- Home

- »

- Animal Health

- »

-

Livestock Insurance Market Size, Industry Report, 2033GVR Report cover

![Livestock Insurance Market Size, Share & Trends Report]()

Livestock Insurance Market (2025 - 2033) Size, Share & Trends Analysis Report By Coverage (Mortality, Disease, Disability, Revenue), By Animal Type (Bovine, Swine, Sheep & Goats, Poultry), By Provider, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-076-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Livestock Insurance Market Summary

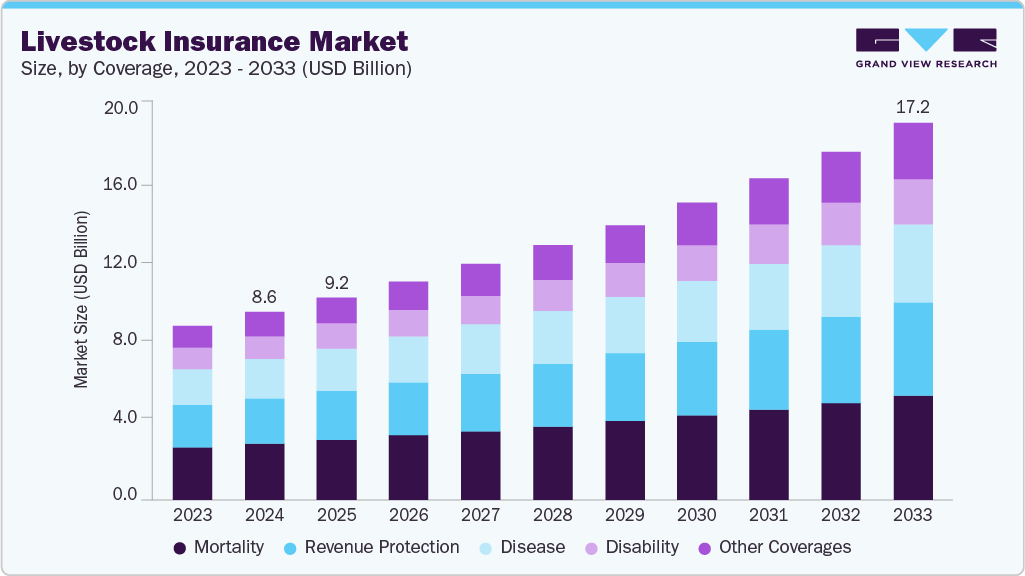

The global livestock insurance market size was estimated at USD 8.58 billion in 2024 and is projected to reach USD 17.22 billion by 2033, growing at a CAGR of 8.09% from 2025 to 2033. The market is driven by higher demand for animal-based products, the increasing economic value of livestock, and a growing vulnerability to climate-related events and disease outbreaks.

Key Market Trends & Insights

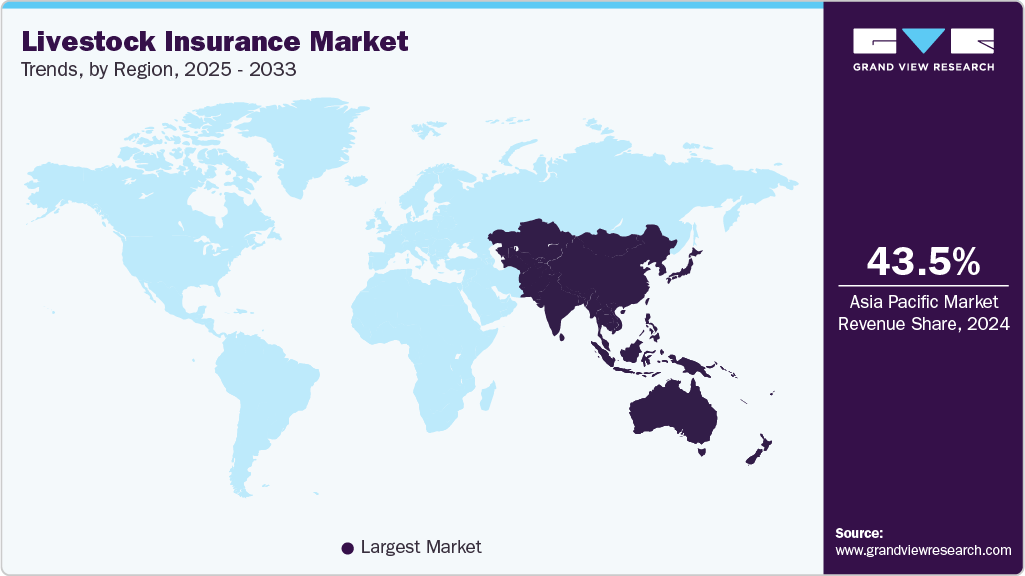

- Asia Pacific livestock insurance market held the largest revenue share of 43.53% in 2024.

- China dominated the Asia Pacific region with largest revenue share in 2024.

- By coverage, the mortality segment held the largest share of 29.95% of the market in 2024

- By animals type, bovine segment held largest in the market in 2024.

- Based on providers, private segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 8.58 Billion

- 2033 Projected Market Size: USD 17.22 Billion

- CAGR (2025-2033): 8.09%

- Asia Pacific region: Largest market in 2024

- Latin America region: Fastest growing market

In addition, the sector is seeing improvements such as the use of AI and digital tools for risk assessment and claims processing, the rise of parametric and mobile-based insurance models, and more partnerships with fintech and agritech firms. The livestock insurance market is gaining rapid momentum internationally as livestock populations increase, the value of livestock assets rises, and the reliance on animal agriculture grows, prompting an increased need for financial protection against deaths, epidemics, and losses from climate-related events. The extensive growth of commercial livestock farming for milk, beef, poultry, and small ruminants has inevitably increased the financial risk factor for producers to a point that structured insurance programs are becoming a commonplace means to manage risk from diseases, accidents, and natural disasters. In some transitional markets, livestock is invariably the primary economic asset for millions of smallholder farmers, underscoring the importance of livestock insurance in enhancing rural income stability and resilience.

The increasing variability in climate, including more frequent drought, floods, heat stress and pasture degradation is increasing the potential markets for index based and parametric livestock insurance solutions. Governments and development agencies are introducing climate-linked risk financing instruments to protect vulnerable pastoral and dairy populations from adverse climate events, leading to catastrophic losses. At the same time, the increase in the incidence of infectious and zoonotic diseases such as Foot and Mouth Disease, Avian Influenza, and African Swine Fever is shaping the demand for livestock insurance as farmers, cooperatives, and policymakers emphasize disease risk-management strategies to uphold herd health and uninterrupted food supply chains.

Support programs from the government and partnerships with private industry are valuable tools to accelerate adoption in regions such as Asia and Africa. Many countries are offering premium subsidies and tying livestock insurance to access credit and government-supported cattle schemes for farmers to encourage coverage of valuable livestock. Established markets such as the US and Europe have begun to see increased uptake of established mortality and revenue-based programs primarily because of commercial decisions around livestock investments, biosecurity protocols, and across-farm risk management.

Technologies are increasingly changing the insurance landscape for livestock, resulting in speedy onboarding still relatively well controlled, automated claims processing, and on-time ground-truth validation of risks. Insurers are increasingly using satellite-based drought monitoring, GPS-durable livestock tracking, veterinary data repositories, mobile payments, and AI-based mortality analytics. New ecosystems are emerging in public and private sectors (e.g., agritech, fintech) to facilitate micro-insurance in rural and under-resourced settings for better access and affordability.

Overall, the livestock insurance market is seeing sustained growth due to the emphasis by stakeholders throughout the livestock value chain (farmers, dairy cooperatives, commercial meat producers, government, insurers, and development organizations) on financial risk-protection tools, which serve to support livestock productivity, resilience to climate shocks, and ultimately, the longevity of the animal agriculture industry.

Hurdles in Cattle Insurance Adoption:

Reason

Description

High loss & claim ratios

Cattle portfolios often record very high loss ratios (e.g., above 80-90%), making them financially unattractive for insurers.

Difficult risk assessment & poor data

Lack of reliable data on breeds, mortality, and identification limits accurate risk pricing and underwriting.

High administrative and transaction costs

Managing large, dispersed herds and handling claims is costly and logistically challenging.

Moral hazard and adverse selection

Farmers may insure only high-risk animals or neglect preventive care, increasing claim frequency.

Low premium volumes

Small premium collections relative to servicing and claim costs make the business difficult to scale profitably.

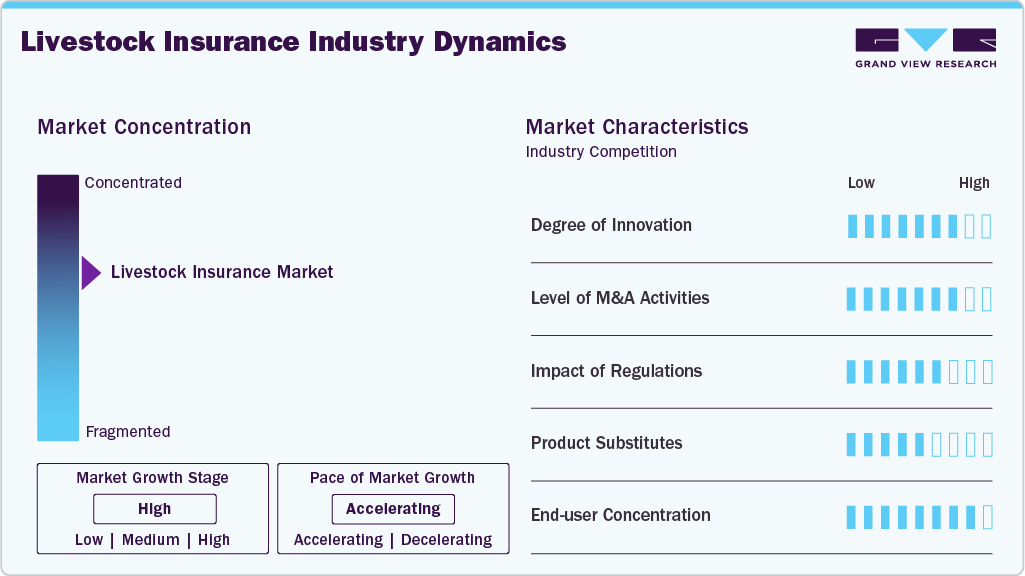

Market Concentration & Characteristics

The Livestock Insurance market is moderately concentrated, with an increasing number of insurers, re-insurers, government incentive programs, and agri-fintech entering the sector. The structure of the sector varies by geographies; in developed markets few major insurers and reinsurers can sustain a meaningful share of the market because of established distribution networks, actuarial systems, and underwriting expertise. In emerging markets, the market structure is varied among traditional insurers, cooperatives, and government subsidized livestock insurance schemes.

Digital-first agri-insurance startups and technology providers are carving their share of the market by offering mobile-based policy issuance, satellite-based loss assessments, and parametric risk-cover models. Despite the efforts of large insurers to establish product standards, pricing, and product offerings, localized livestock risk coverage, claims support, and farmer engagement is influenced significantly by regional niche players and cooperative programs.

The livestock insurance industry is rapidly adopting digital and data-driven technologies that materially change underwriting, distribution, and claims settlement. Parametric and index-based products that use satellite vegetation indices (NDVI), weather data, and other remote-sensing triggers are expanding across Africa and Asia, enabling faster, lower-cost payouts for drought and pasture-loss events. Mobile enrolment and digital wallets are making micro-policies viable for smallholders, while AI and telemetry (GPS/wearables) are beginning to inform risk-scoring and fraud detection all of which reduce operating costs and improve product suitability for pastoral and smallholder contexts.

Direct M&A activity specifically labelled “livestock-insurance” is modest, but strategic partnerships and bolt-on acquisitions are increasingly evident: insurers and reinsurers are partnering with agritech firms, satellite/analytics providers, and fintech platforms to obtain distribution, data and payout infrastructure rather than buying traditional insurers outright. Reinsurers and development financiers are also underwriting index pilots and scaling agreements that functionally consolidate capacity and risk-sharing in the value chain. This trend points to collaboration-led consolidation more than headline M&A in mainstream insurance markets.

Government policy and public finance are major market shapers: premium subsidies, national livestock insurance schemes, and regulatory approvals for parametric products accelerate uptake in many countries. Recent regulatory and programmatic changes in major markets for example, USDA-RMA updates that expand and refine U.S. livestock insurance programs and government-supported pilots in Africa and South Asia demonstrate how policy can broaden product availability and improve farmer protections. Public disaster compensation schemes also interact with commercial insurance, sometimes crowding in adoption (via subsidies) and sometimes acting as crowding-out fallback cover.

Insurance increasingly operates alongside (not simply instead of) preventive and community risk mechanisms. Vaccination drives, veterinary extension, cooperative mutual funds, and government compensation schemes reduce risk exposure and thus can lower insurance demand per se yet they also raise the attractiveness of complementary insurance for residual, catastrophic events. Parametric insurance and micro-insurance are emerging as practical complements to community risk pools rather than direct substitutes.

Growth is uneven, but accelerating, across regions. East Africa and parts of West Africa are scaling index-based models for pastoralists; South Asia (India) is seeing increasing interest in parametric pilots and commercialization tied to cooperatives and public subsidy schemes; North America's updates to Livestock Risk Protection reflect the evolution of products in mature markets; and new pilots in Latin America and Nigeria show greater geographic diffusion. Recent launches (e.g., Nigeria’s index-based livestock insurance pilots) and increased disease shocks (e.g., ASF outbreaks in northeast India) are practical drivers of both product innovation and geographic diffusion.

Coverage Insights

On the basis of insurance coverage, in mortality insurance segment dominated the market with largest revenue share of 29.95% in 2024. The segment is driven by its growing uptake among smallholder farmers and commercial livestock producers because of its simple policy framework, ease of underwriting, and various government-backed initiatives in developing countries, mortality cover continues to be the most universally applicable and understood type of insurance. In settings where livestock is a major asset for sustaining livelihoods, and as financial risk transfer mechanisms become normalized, mortality cover, which provides coverage against animal deaths (such as through accidents, predation, disease and natural disasters), is even more relevant.

On the other hand, revenue protection insurance is expected to witness the fastest growth over the forecast period. This trend is largely attributed to the rising commercialization of dairy and meat production systems, increasing exposure to market price fluctuations, and growing awareness of income-linked protection products. Advancements in digital claim validation, satellite-based yield and weather models, and integration of actuarial data with farm-level productivity metrics are further supporting accelerated adoption. Higher emphasis on income stability among progressive farmers and the expansion of parametric and hybrid insurance products by private insurers and agri-fintech platforms also contribute to the segment’s rapid growth outlook.

Animal Insights

In 2024, Bovine continues to dominate the market , and this segment also accounted for the biggest share of revenue generation due to the high economic importance of dairy and beef cattle around the world, the very high replacement cost for cattle, as well as a large number of cattle producers participating in government-supported insurance programs. In addition, dairy cooperatives, micro-insurance programs, and rural lending organizations bolster the uptake of bovine insurance, especially in milk-producing economies where cattle are a considerable income and asset class for farmers.

Poultry is expected to witness the fastest growth during the forecast period. Key drivers of this segment include the rapid growth of integrated commercial-level poultry farming, growing susceptibility to disease outbreaks including avian influenza, and increased awareness by integrated poultry producers of insurance-based structured risk protection. The poultry insurance market also benefits from participant investment in high-density intensive production systems, acceptance of farm biosecurity benchmarks in premium calculations, and increasing numbers of affordable group-based insurance offerings to alleviate risks. Increased global demand for poultry, particularly among emerging economies, will contribute to growth in the poultry insurance market as producers utilize insurance to protect against mortality, disease, and income loss.

Provider Insights

The livestock insurance market operates through two main providers which include private insurers and public insurers. The private insurance sector emerged as the dominant market leader in 2024 because it continues to develop its operations for managing livestock business risks. The commercial insurance sector expanded rapidly because agri-fintech solutions and digital underwriting and claims automation tools enabled private companies to increase their operational efficiency and reach more farmers. The combination of real-time livestock health data with satellite-based monitoring and predictive analytics enables private insurers to create flexible coverage options which perform better for contemporary large-scale farming operations. Private insurers are expected to achieve the highest growth rate during the forecast period because customers now want personalized insurance solutions while companies form new partnerships with reinsurers and digital finance platforms and technology providers.

Public insurers maintain their essential function to deliver affordable livestock insurance coverage to all people especially in developing nations because livestock serves as the main source of income for many families. The program focuses on making insurance affordable while providing social protection and working with government agricultural financing programs to maintain rural and smallholder participation as the private sector grows into commercial and technology-based insurance markets.

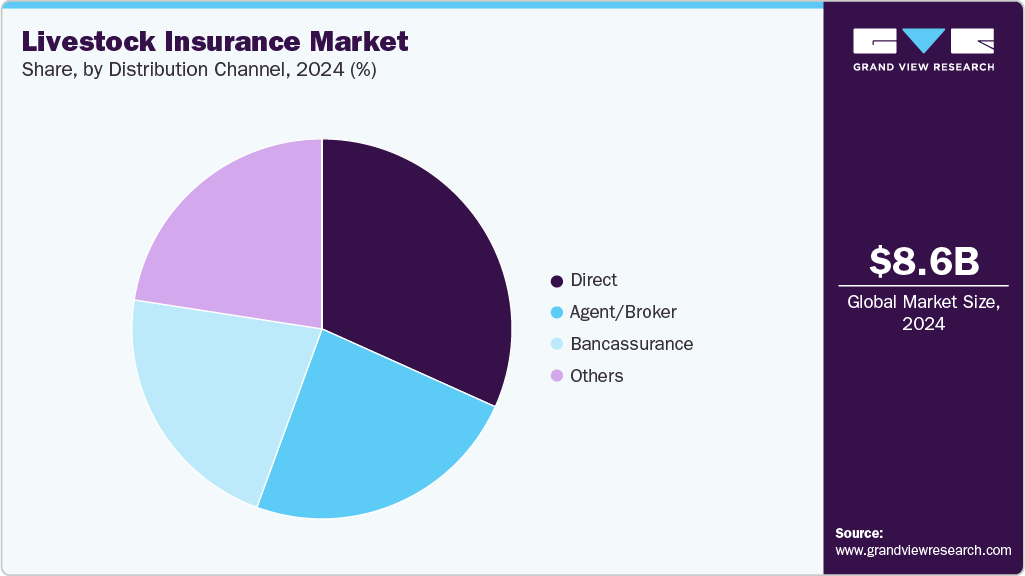

Distribution Channel Insights

The livestock insurance market is divided by distribution channel into direct, agency/broker, bancassurance, and others. The largest market share in 2024 was held by the direct channel, which was made possible by the increasing use of digital platforms and mobile-based enrollment systems that make insurance services more accessible to farmers. The growing connection of livestock insurance with agri-tech and e-commerce platforms, coupled with government policies aimed at digital financial inclusion, has made it easier for insurers to own the customers directly. On the other hand, rural areas with rising digital literacy and improved connectivity continue to prefer direct distribution due to simplified claim processing, online premium payment, and increased transparency.

The others segment which includes cooperative societies, dairy unions, producer groups, self-help groups, and microfinance institutions is expected to grow at the fastest rate. This is because these channels help farmers enroll in livestock insurance at the rural level. This segment also involves veterinary clinics, feed and input suppliers, and community-based livestock development organizations that offer insurance as part of farmer support and extension services. These networks play a particularly important role in rural areas where formal banking and agency infrastructure is limited, helping build awareness, support documentation, and facilitate claims. Although smaller in scale compared to traditional channels, this segment continues to grow as livestock cluster programs and cooperative-led service models expand in developing regions.

Regional Insights

In 2024, the Asia Pacific is expected to hold a dominant role in the global livestock insurance market, with the largest share. This is attributed to the region's large livestock population, growing understanding of risk mitigation practices, and increasing availability of government-supported insurance programs, all of which contribute to this trend. India, China, and Australia are the major contributors to this growth as they are facing more animal diseases, losses due to changing climate, and the need for protecting smallholder farmers' income becoming more and more important.

China Livestock Insurance Market Trends

China holds the largest share of the livestock insurance market, driven by its large commercial swine and poultry industries, strong government subsidies, and increased biosecurity focus post-African swine fever. Digital loss-assessment pilots and wider insurer participation are improving accessibility across rural regions. On March 3, 2025, China’s National Financial Regulatory Administration (NFRA) stated that agricultural insurance premiums reached CNY 150 billion (~USD 20.6 billion) in 2024 including livestock, making China the world’s largest agricultural insurance market by premium size. In addition, targeted schemes continue to support high-risk pastoral communities; a 2025 study reported up to 90% premium subsidies for yak and sheep insurance in Qinghai-Tibet Plateau regions, reflecting strong government prioritization of climate- and disease-exposed herds.

The Livestock Insurance market in India is experiencing rapid growthsupported by livestock-centric rural livelihoods, expanding dairy cooperatives, and national/state-level livestock insurance programs. Digital farmer-service platforms, rising dairy productivity initiatives, and priority lending requirements tied to livestock assets are strengthening product adoption among smallholders. India has been expanding livestock protection through national and state measures: Tripura rolled out a state livestock insurance scheme in 2024, and the Agriculture Insurance Company of India announced plans to scale parametric livestock products (2024-25), reflecting a policy push to increase coverage for dairy, cattle and allied workers.

North America Livestock Insurance Market Trends

In 2024, North America held a significant share of the global livestock insurance market, driven by a strong risk management framework, high awareness, and participation from both public and private insurers. Widespread use of USDA-backed programs such as LRP and LGM, along with digital claim systems and satellite monitoring, has enhanced efficiency and precision in underwriting. The region’s mature dairy and beef industries, supported by early adoption of parametric and index-based insurance, continue to position North America as a leader in structured livestock coverage.

The livestock insurance market in the U.S. accounted for the highest market share in the North America market, due to large-scale cattle and poultry operations, federal livestock insurance subsidies under USDA-RMA, and well-developed digital extension channels. For instance, in 2025 the USDA’s Risk Management Agency (RMA) continued to refine livestock insurance options (Livestock Risk Protection and related programs), updating guidance and product parameters to help producers manage price and mortality risks. These RMA updates reflect ongoing federal support for farm risk management and encourage complementary private solutions.

Canada’s livestock insurance market is expanding, supported by provincial programs, rising climate-risk exposure, and increasing producer demand for income protection. The segment is transitioning from niche to mainstream as dairy and beef farmers adopt structured risk-transfer solutions. Momentum is reflected in recent developments for instance in October 2025 , HUB launched a livestock insurance program in Canada, signaling deeper commercial focus on agribusiness risk. In addition, the June 2024 Maritime Livestock Price Insurance Program gained industry support, reinforcing government commitment to livestock-risk tools. Growing interest across Western Canada further highlights strengthening adoption and market maturity.

Europe Livestock Insurance Market Trends

Europe's livestock insurance market expansion is supported by strong farm-support policies under CAP (Common Agricultural Policy), established livestock health systems, and increasing focus on disease outbreak preparedness. Farmers in the region benefit from structured subsidy frameworks, risk-pooling initiatives, and partnerships between insurers and cooperatives.

The livestock insurance market in UK is expected to grow significantly over the forecast period. The UK market is gaining traction due to UK brokers and specialty carriers reported increased demand in 2025 for livestock mortality and disease cover as producers face higher biosecurity costs and climate variability. Industry commentary highlights insurer product adaptation and advisory services targeted at dairy and beef sectors.

The Germany Livestock Insurance market held significant share in 2024. Germany’s livestock sector experienced heightened focus on biosecurity and contingency arrangements in 2025 following regional disease responses; such events underline the role of insurance in funding rapid response, culling compensation and farm business continuity.

Latin America Livestock Insurance Market Trends

Latin America shows steady adoption of livestock insurance as commercial animal farming intensifies, and producers look to safeguard income against weather shocks, disease outbreaks, and mortality risks. Beef and poultry export momentum, climate volatility, and gradual improvements in agricultural financing structures are shaping demand. While penetration remains modest, ongoing policy support, expanding commercial dairy and feedlot operations, and digitization of farm services are fostering interest in structured risk management solutions.

Brazil Livestock Insurance market leads regional growth as large-scale cattle and poultry producers seek protection against disease and weather-driven losses. Brazil’s federal rural-insurance subsidy framework (PSR) continues to support livestock coverage uptake among commercial beef and poultry producers; public subsidy mechanisms and growing use of geo-referenced monitoring are helping insurers underwrite livestock risk in climate-exposed regions.

Middle East & Africa Livestock Insurance Market Trends

The livestock insurance market in the Middle East & Africa is at an emerging but rapidly evolving stage, driven by growing exposure to droughts, infectious diseases, and food-security imperatives. Governments and reinsurers are increasingly piloting innovative products such as index-based insurance, as seen with Africa Re’s satellite-triggered drought cover in Nigeria. In the Gulf, livestock-risk solutions are gaining attention within broader food-security strategies, while African markets such as South Africa and Rwanda are expanding vaccination and subsidized insurance programs to mitigate animal-loss risks. Overall, policy support, disease outbreaks, and advancing risk-financing mechanisms are accelerating regional adoption.

The UAE livestock insurance market isexpanding steadily, supported by rising investment in commercial dairy, poultry, and camel farming, along with national food-security initiatives. Growth is driven by increasing adoption of structured livestock management systems, wider availability of veterinary services, and initiatives to mitigate climate-related risks such as heat stress and disease outbreaks

Key Livestock Insurance Company Insights

The livestock insurance market is witnessing steady global expansion as major insurers and reinsurers strengthen agricultural risk portfolios through specialized livestock protection products. Companies such as AXA SA and Nationwide Mutual Insurance Company are collaborating with governments and agritech firms to design solutions covering mortality, disease, and climate-related risks. AXA integrates digital monitoring and remote risk assessment to enhance underwriting accuracy, while Nationwide offers bundled farm risk packages. In emerging markets, innovation is driving adoption; Africa Re’s index-based livestock insurance in Nigeria exemplifies this trend. Overall, the industry is shifting toward data-driven, climate-resilient, and technology-enabled insurance models, improving inclusivity and sustainability for livestock producers globally.

Key Livestock Insurance Companies:

The following are the leading companies in the livestock insurance market. These companies collectively hold the largest market share and dictate industry trends.

- Nationwide Mutual Insurance Company

- AXA SA

- Lloyd's

- Allianz Global Corporate & Specialty (AGCS)

- The Hartford

- HUB International Limited

- ICICI Lombard General Insurance

- HDFC ERGO General Insurance Company Limited

- QBE Insurance Group

- Amwins

- ProAg (Tokio Marine HCC group of companies)

- FBL Financial Group, Inc

Recent Developments

-

In October 2025, Agriculture Insurance Company of India (AIC) announced expansion into parametric livestock insurance, leveraging weather and mortality indices to improve payout efficiency for dairy and cattle farmers — strengthening India's national livestock protection scheme.

-

In September 2025, HUB International launched "HUB Livestock Insurance" across Canada, offering specialized protection for equine, dairy, poultry, and beef operations including mortality, disease, theft, and transit coverage, strengthening its agricultural risk specialty portfolio.

-

In August 2025, Africa Re introduced an index-based livestock insurance program in Nigeria using satellite vegetation monitoring to protect ~20,000 pastoral farmers against drought-related livestock loss — supporting climate-resilient livestock production across Africa.

-

In 2024, ICICI Lombard partnered with state-level livestock departments to expand digital livestock protection platforms under government-supported schemes, offering disease, mortality, and accident coverage to rural dairy clusters in India, reinforcing public-private insurance delivery in emerging markets. (Govt notifications & insurer press updates)

Livestock Insurance Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 9.24 billion

Revenue forecast in 2033

USD 17.22 billion

Growth rate

CAGR of 8.09% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Coverage, animal, provider, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Thailand; South Korea; Australia; Brazil; Argentina; South Africa; UAE; Saudi Arabia; Kuwait; Qatar; Oman

Key companies profiled

Nationwide Mutual Insurance Company; AXA SA; Lloyd's; Allianz Global Corporate & Specialty (AGCS); The Hartford; HUB International Limited; ICICI Lombard General Insurance; HDFC ERGO General Insurance Company Limited; QBE Insurance Group; Amwins; ProAg (Tokio Marine HCC group of companies); FBL Financial Group, Inc.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Livestock Insurance Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global livestock insurance market report based on coverage, animal, provider, distribution channel and region.

-

Coverage Outlook (Revenue, USD Million, 2021 - 2033)

-

Mortality

-

Disability

-

Disease

-

Revenue Protection

-

Other Coverages (liability, natural calamity, travel, index-based, theft protection, etc.)

-

-

Animal Outlook (Revenue, USD Million, 2021 - 2033)

-

Bovine

-

Swine

-

Sheep & Goats

-

Poultry

-

Other Animals (aquaculture, llama, mule, donkey, alpaca, etc.)

-

-

Provider Outlook (Revenue, USD Million, 2021 - 2033)

-

Private Insurer

-

Public Insurer

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Direct

-

Agency/Broker

-

Bancassurance

-

Others

-

-

Region Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

Saudi Arabia

-

Kuwait

-

Qatar

-

Oman

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.