- Home

- »

- Homecare & Decor

- »

-

Living And Dining Room Market Size, Industry Report, 2033GVR Report cover

![Living And Dining Room Market Size, Share & Trends Report]()

Living And Dining Room Market (2026 - 2033) Size, Share & Trends Analysis Report By Type (Coffee, Dining & Other Tables, Living & Dining Room Cabinets & Storage), By Distribution Channel (Offline, Online), By Region, and Segment Forecasts

- Report ID: GVR-4-68039-927-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Living & Dining Room Market Summary

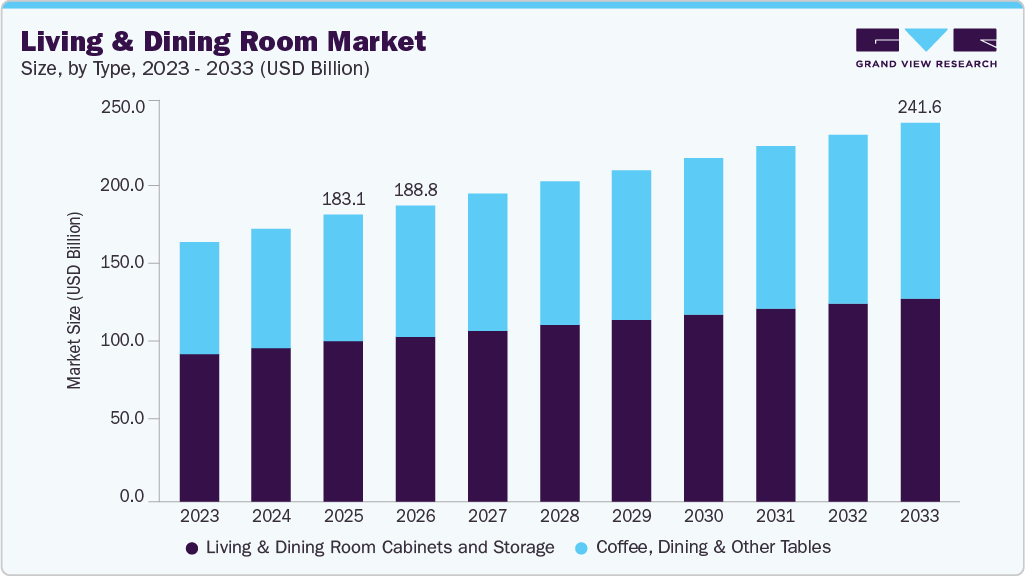

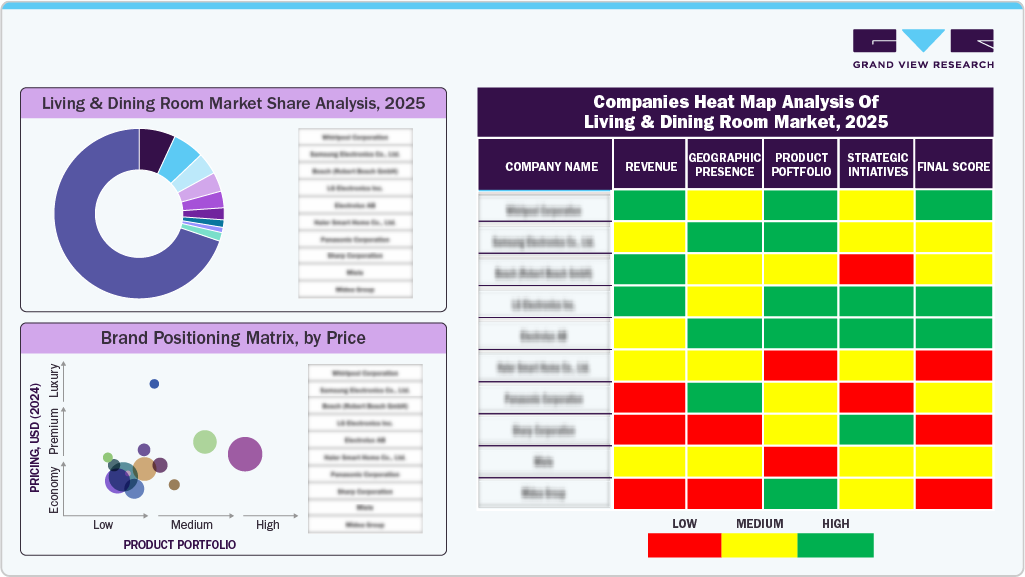

The global living & dining room market size was valued at USD 183.09 billion in 2025 and is expected to reach USD 241.61 billion by 2033, growing at a CAGR of 3.6% from 2026 to 2033. The market for living and dining room cabinets and storage solutions is witnessing growth due to changing consumer lifestyles and an increasing focus on home organization and interior aesthetics.

Key Market Trends & Insights

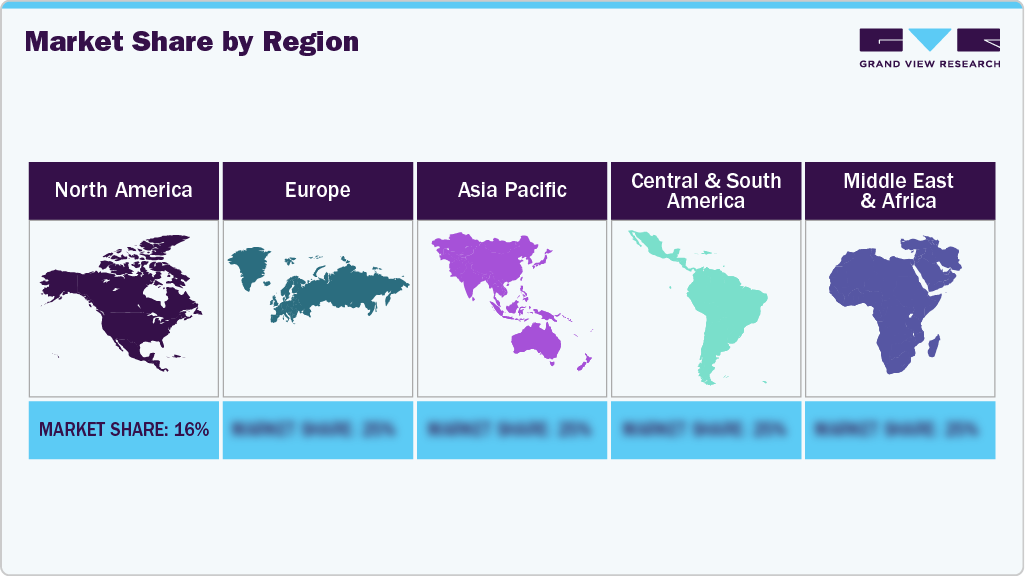

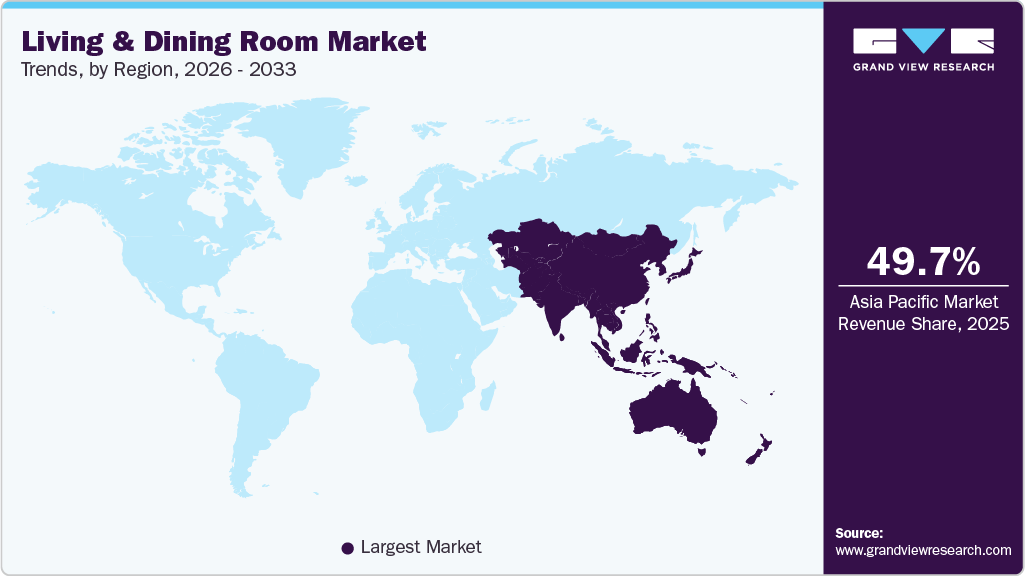

- By region, Asia Pacific led the market with a share of 49.7% in 2025.

- The living and dining room in China is expected to register significant CAGR over the forecast period.

- By type, living and dining room cabinets and storage segment led the market and accounted for a share of 56.2% in 2025.

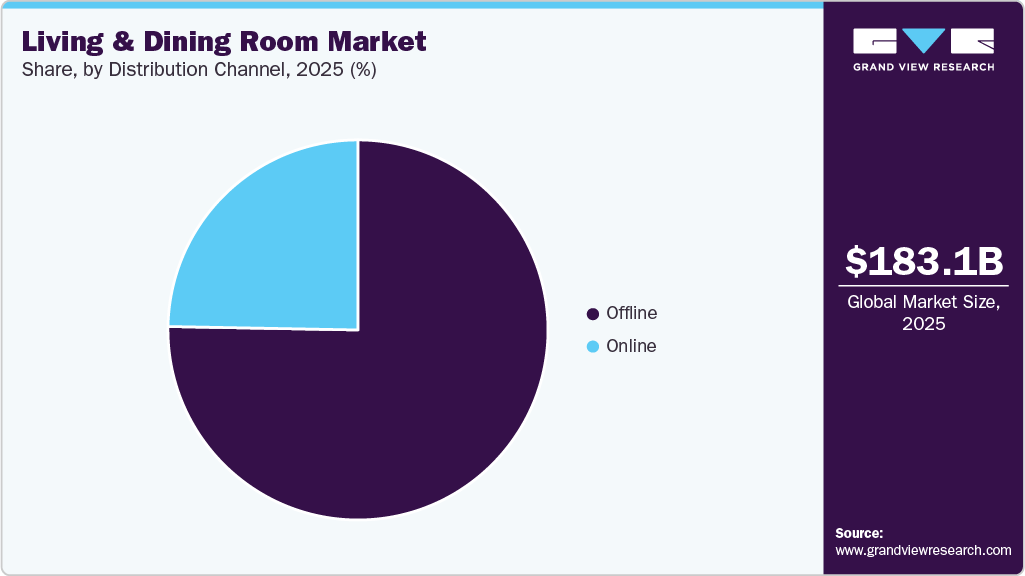

- By distribution channel, the offline segment led the market and accounted for a share of 75.3% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 183.09 Billion

- 2033 Projected Market Size: USD 241.61 Billion

- CAGR (2026-2033): 3.6%

- Asia Pacific: Largest market in 2025

As households place greater emphasis on creating well-structured and visually appealing living spaces, demand for functional storage furniture that integrates seamlessly with home décor has risen. Cabinets and storage units are increasingly viewed as essential components of living and dining areas rather than supplementary furniture.Urbanization and the prevalence of smaller residential spaces have further reinforced the need for efficient storage solutions. Consumers are seeking cabinets that optimize space use while maintaining a clean, uncluttered appearance. This has led to growing interest in modular, built-in, and multifunctional storage furniture that can accommodate dining essentials, electronics, décor items, and household accessories within limited floor space.

In addition, rising home renovation and remodeling activity is supporting market expansion. Homeowners are increasingly investing in durable, well-designed cabinets and storage units as part of long-term interior upgrades. The availability of customizable designs, improved material quality, and a wider range of styles through both offline and online channels has made such furniture more accessible, further contributing to sustained demand across living and dining room storage categories.

Sustainability is also influencing purchasing decisions through design and lifecycle considerations. Consumers are favoring long-lasting, modular storage units that can adapt to changing household needs, thereby reducing the need for frequent replacement. Manufacturers are responding by introducing eco-designed cabinets with minimal waste production, water-based coatings, and transparent sourcing practices. This aligns with broader consumer values around ethical consumption and responsible home furnishing.

Type Insights

The living and dining room cabinets and storage dominated the market, accounting for 56.2% in 2025. As more individuals and families spend increased time at home, there is a greater emphasis on creating organized, multifunctional living spaces that blend aesthetics with utility. Additionally, the growth of e-commerce and easily accessible custom cabinetry options has expanded consumer choice, enabling buyers to select tailored designs that fit specific spatial and stylistic requirements. This demand is further supported by a broader home renovation cycle, in which investments in quality furniture and storage solutions are seen as long-term value-adds that enhance functionality, comfort, and the overall living experience.

The coffee, dining, and other tables are expected to grow at a CAGR of 4.3% from 2026 to 2033. The market for coffee, dining, and other tables is rising due to a combination of lifestyle shifts, evolving interior design preferences, and changes in how consumers use residential and commercial spaces. In residential settings, increased time spent at home has led consumers to invest in functional, aesthetically appealing furniture that supports multiple uses, such as dining, working, and socializing. Tables are increasingly viewed as central lifestyle pieces rather than purely utilitarian items, driving demand for well-designed, durable, and space-efficient options. Additionally, growing interest in home renovation, interior décor personalization, and flexible living spaces has encouraged replacement and upgrade purchases.

Distribution Channel Insights

Sales of living & dining room through the offline channel accounted for 75.3% in 2025. Sales of living and dining room furniture through offline channels are rising as consumers increasingly value tactile evaluation, in-store visualization, and personalized assistance when purchasing high-involvement home furnishings. Physical retail allows shoppers to assess comfort, material quality, finishes, and scale in real settings, factors that are particularly important for sofas, dining tables, and chairs. In addition, the return of in-store shopping following pandemic-related disruptions, combined with the availability of design consultations, customization options, and immediate delivery or installation services, has reinforced the relevance of brick-and-mortar stores

In terms of revenue, the online distribution channel is expected to grow at a CAGR of 4.4% from 2026 to 2033. E-commerce platforms allow shoppers to explore a wide range of styles, materials, and price points, supported by detailed product descriptions, reviews, and visualization tools such as room planners and augmented reality. Improvements in last-mile logistics, flexible delivery options, and hassle-free return policies have further reduced barriers to purchasing large furniture items online. Additionally, urban lifestyles, time-constrained households, and the growing influence of digital-first furniture brands are reinforcing online channels as a preferred route for purchasing living and dining room furniture.

Regional Insights

The North American living & dining room market is expected to register the highest CAGR of 3.5% from 2026 to 2033. Increased time spent at home has led consumers to place greater emphasis on creating comfortable, multifunctional living spaces that support both relaxation and social interaction. Living and dining rooms are increasingly being designed as flexible areas for work, entertainment, and gatherings, driving demand for versatile furniture such as modular sofas, extendable dining tables, and space-efficient storage solutions. Additionally, higher homeownership activity in suburban and secondary urban markets, along with renovation and remodeling projects, is encouraging replacement purchases and style upgrades.

The U.S. market for living and dining room furniture is growing as consumers increasingly prioritize home comfort, functionality, and aesthetics, driven by lifestyle shifts that have led to more time spent at home. Remote and hybrid work patterns have encouraged households to invest in multifunctional living spaces that support work, relaxation, and socializing, leading to higher demand for updated sofas, seating, dining tables, and storage furniture.

Europe Living & Dining Room Market Trends

The European living & dining room market is expected to grow at a CAGR of 2.7% from 2026 to 2033. The market for living and dining room furniture in Europe is rising due to a combination of changing lifestyles, housing trends, and evolving consumer priorities. Increased time spent at home has elevated the importance of living and dining spaces as multifunctional areas for work, socializing, and leisure, prompting consumers to invest in comfort-oriented and aesthetically cohesive furniture. Urbanization and a steady pace of residential renovations, particularly in Western Europe, are also supporting replacement demand as households upgrade interiors to reflect modern design preferences.

Asia Pacific Living & Dining Room Market Trends

The Asia Pacific living & dining room market accounted for 49.7% of the market share in 2025. A growing middle class in countries such as China, India, Indonesia, and Vietnam is increasingly investing in better-quality home interiors as home ownership and apartment living expand in urban and semi-urban areas. Additionally, the influence of Western-style living, smaller family units, and the growing preference for organized, multifunctional living spaces has increased demand for aesthetically designed, space-efficient living and dining room furniture. The continued growth of e-commerce furniture platforms, greater exposure to interior design trends through social media, and higher spending on home upgrades following extended work-from-home adoption have further supported market growth among Asia Pacific consumers.

Key Living & Dining Room Company Insights

The presence of a few established players and new entrants characterizes the market. Many big players are increasing their focus on the growing trend of the living & dining room market. Players in the market are diversifying their service offerings in order to maintain market share.

Key Living & Dining Room Companies:

The following key companies have been profiled for this study on the living & dining room market.

- KOKUYO Co., Ltd.

- Okamura Corporation

- Godrej & Boyce Manufacturing Company Limited

- Inter IKEA Systems B.V.

- HNI Corporation

- Kimball International, Inc.

- Herman Miller, Inc.

- AFC Systems

- Ashley Furniture Industries, Inc.

- Berco Design

Recent Developments

-

In January 2025, Kutchenhaus expanded its 2025 kitchen offer with a new nBOX drawer system, seven anti-fingerprint lacquer front colours, and minimalist full-height continuous fronts to boost personalisation and storage efficiency. New vertical wood décors, Nordic lacquer finishes, plus 3D digital prints and mirror décors are designed to let customers create highly tailored, contemporary kitchen spaces without compromising on German build quality.

Living & Dining Room Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 188.83 billion

Revenue forecast in 2033

USD 241.61 billion

Growth rate

CAGR of 3.6% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

KOKUYO Co., Ltd.; Okamura Corporation; Godrej & Boyce Manufacturing Company Limited; Inter IKEA Systems B.V.; HNI Corporation, Kimball International, Inc.; Herman Miller, Inc.; AFC Systems; Ashley Furniture Industries, Inc.; Berco Design

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

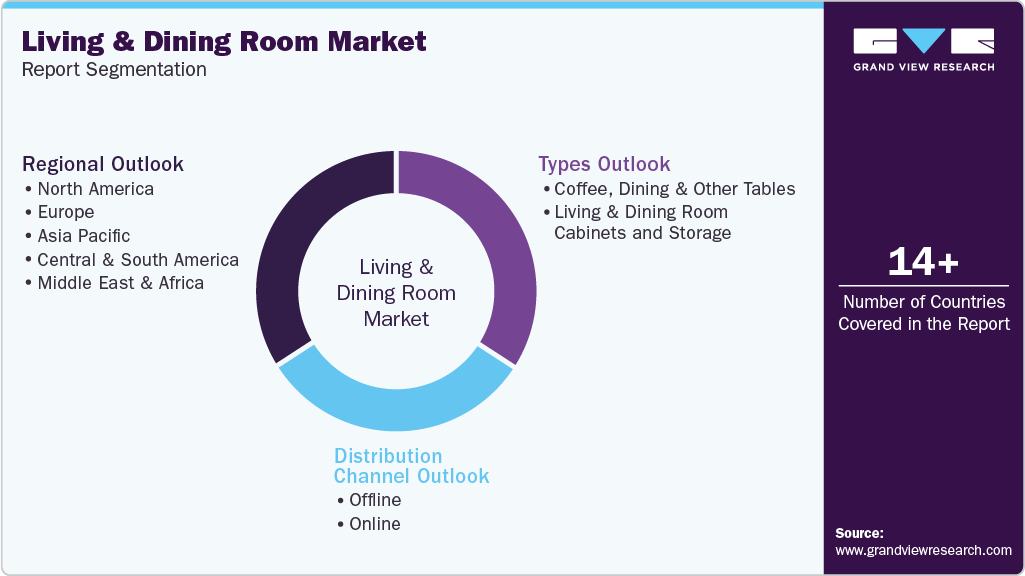

Global Living & Dining Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the living & dining room market report on the basis of types, distribution channel and region.

-

Types Outlook (Revenue, USD Million, 2021 - 2033)

-

Coffee, Dining and Other Tables

-

Living and Dining Room Cabinets and Storage

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global living & dining room market size was estimated at USD 183.09 billion in 2025 and is expected to reach USD 188.83 billion in 2026.

b. The global living & dining room market is expected to grow at a compound annual growth rate of 3.6% from 2026 to 2033 to reach USD 241.61 billion by 2033.

b. The living and dining room cabinets and storage dominated the market with a share of 56.2% in 2025. As more individuals and families spend increased time at home, there is a greater emphasis on creating organized, multifunctional living spaces that blend aesthetics with utility. Additionally, the growth of e-commerce and easily accessible custom cabinetry options has expanded consumer choice, enabling buyers to select tailored designs that fit specific spatial and stylistic requirements.

b. Some key players operating in the living & dining room market include KOKUYO Co., Ltd.; Okamura Corporation; Godrej & Boyce Manufacturing Company Limited; Inter IKEA Systems B.V.; HNI Corporation; Kimball International, Inc.; Herman Miller, Inc.; AFC Systems; Ashley Furniture Industries, Inc.; and Berco Design.

b. Key factors that are driving the living & dining room market growth include growing demand for coffee table products in the developed economies, escalating the sales of living & dining room cabinets products, and consumer inclination towards easy to assemble and manage furniture products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.