- Home

- »

- Distribution & Utilities

- »

-

LNG Storage Tank Market Size, Share, Industry Report, 2030GVR Report cover

![LNG Storage Tank Market Size, Share & Trends Report]()

LNG Storage Tank Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Self-Supportive, Non-self Supportive), By Material (Steel, 9% Nickel Steel, Aluminum Alloy, Others (7% Nickel Steel, Concrete)), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-346-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

LNG Storage Tank Market Summary

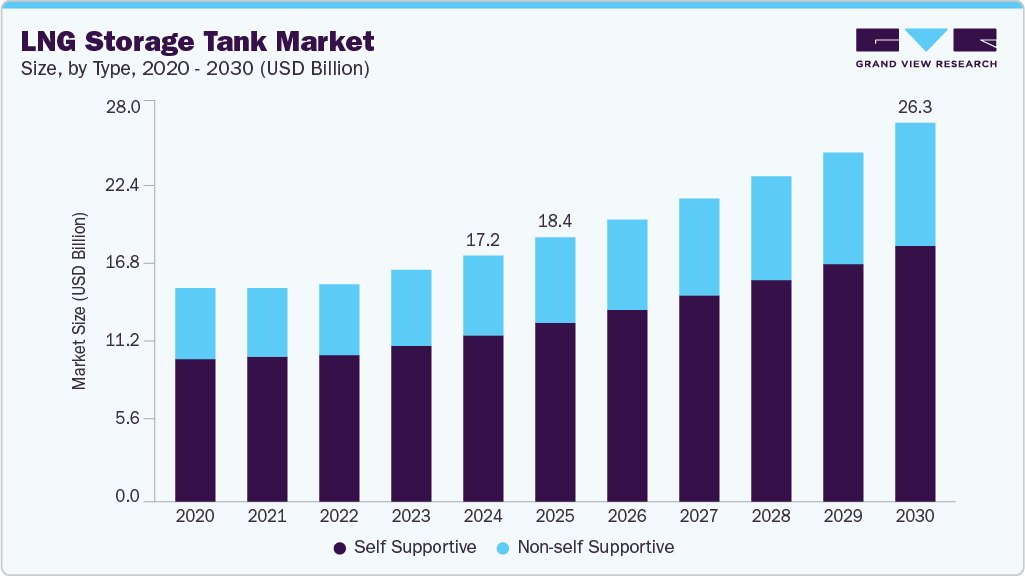

The global LNG storage tank market size was valued at USD 17.20 billion in 2024 and is projected to reach USD 26.28 billion by 2030, growing at a CAGR of 7.4% from 2025 to 2030. This growth can be attributed to the rising global demand for Liquefied Natural Gas (LNG) as a cleaner energy alternative, especially in power generation, transportation, and industrial sectors.

Key Market Trends & Insights

- North America LNG storage tank market is expected to be the fastest-growing region at a CAGR of 8.2% in the global LNG storage tank industry.

- The U.S. LNG storage tank market plays a pivotal role in driving North America’s rapid growth.

- By type, the self supportive segment led the market and accounted for 67.8% of revenue share in 2024.

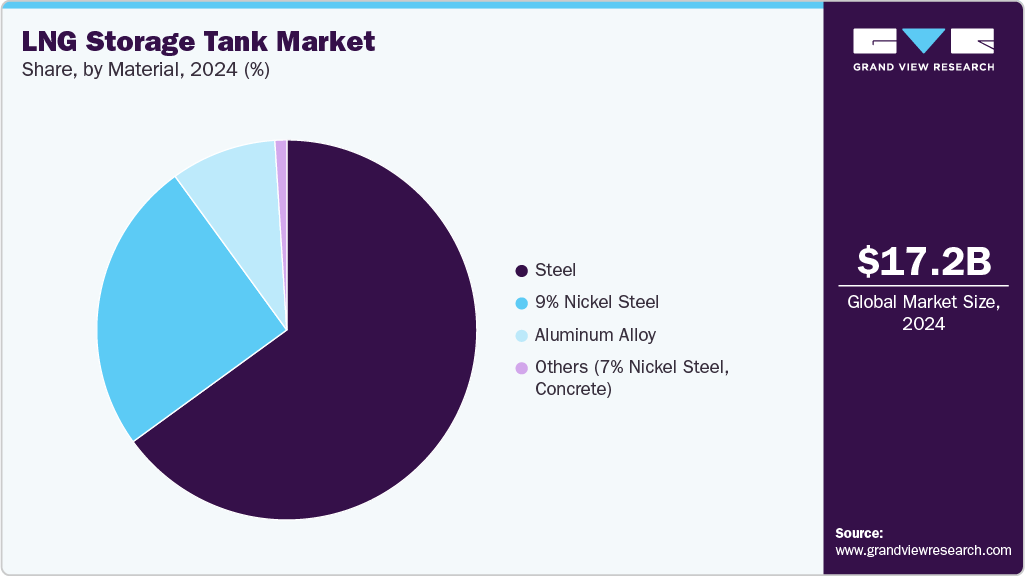

- By material, the steel segment dominated the lng storage tank industry in 2024.

Market Size & Forecast

- 2024 Market Size: USD 17.20 Billion

- 2030 Projected Market Size: USD 26.28 Billion

- CAGR (2025-2030): 7.4%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

The expansion of LNG production capacities, increased investments in liquefaction and regasification facilities, and the steady growth in international LNG trade are collectively fueling the demand for enhanced storage infrastructure.The global LNG storage tank industry is experiencing significant growth, driven by several key trends and opportunities, including the rising global demand for cleaner energy alternatives. As governments and industries seek to reduce their carbon footprints and transition away from coal and oil, natural gas has emerged as a key transitional fuel due to its lower greenhouse gas emissions. This shift fuels investments in LNG infrastructure, including storage facilities that ensure stable supply chains and energy security. Emerging economies, particularly in Asia Pacific, are increasingly importing LNG to meet growing energy needs, further stimulating the demand for storage capacity both at import terminals and inland distribution hubs.

Technological advancements and innovations in cryogenic storage have also emerged as significant market drivers. Modern LNG storage tanks, typically double-walled and designed with high-performance insulation materials, enable safer and more efficient long-term storage of LNG. These technological improvements enhance storage efficiency and safety and reduce operational costs, making large-scale storage economically viable. The emergence of modular tank design and prefabricated systems allows for quicker installation and scalability, which is particularly beneficial for rapidly developing regions and offshore applications.

Furthermore, government policies, subsidies, and international agreements to promote natural gas as a cleaner energy source support infrastructure investment across the LNG value chain. Strategic energy diversification initiatives, particularly in Europe and Asia, result in the expansion of LNG import terminals and the development of new regasification and storage facilities. In parallel, the growing adoption of LNG as a marine and heavy-duty transport fuel generates new demand for small-scale storage tanks and satellite distribution terminals. These combined factors create a favorable environment for continued growth in the LNG storage tank market.

Industry Concentration & Characteristics

The market growth stage is medium, and the pace of market growth is accelerating. The market is characterized by a moderate degree of innovation, driven by the need for enhanced safety, efficiency, and environmental compliance. Companies are investing in advanced materials and designs to improve tank performance. High-manganese and 9% nickel steel offer enhanced alternatives to traditional steel, providing superior strength and resistance to low temperatures. Moreover, high-manganese steel offers a cost-effective solution compared to other alternatives. Modular construction techniques and improved insulation systems are being developed to reduce boil-off gas losses and enhance thermal efficiency. These advancements improve operational efficiency and align with global sustainability goals.

The LNG storage tank industry is experiencing a surge in M&A activities as companies seek to expand their global footprint and technological capabilities. A notable example is Chart Industries' acquisition of Howden in March 2023, which enhanced its LNG storage and cryogenic equipment portfolio. Similarly, McDermott International's CB&I division secured a significant contract to develop an LNG storage tank in Oman's Port of Sohar, reflecting strategic expansion efforts. These transactions underscore a broader trend of consolidation aimed at achieving economies of scale, accessing new markets, and integrating advanced technologies.

The market exhibits a high degree of end-use concentration, primarily dominated by the energy and power sector. The global shift toward cleaner energy sources and the need for reliable energy storage solutions fuel market demand. The transportation and logistics sector is emerging as a significant end user, driven by the adoption of LNG as a cleaner fuel alternative for shipping and heavy-duty vehicles. The industrial sector also contributes to the demand, utilizing LNG for various processes requiring high energy input.

Type Insights

The self supportive segment led the market and accounted for 67.8% of revenue share in 2024. Self-supporting tanks, which do not rely on the container structure for support, are preferred for their enhanced safety, reliability, and versatility. These tanks can withstand extreme temperatures and pressures required for LNG storage, making them suitable for a wide range of applications, including onshore, offshore, and marine environments.

The non-self-supporting LNG storage tanks segment is expected to grow at a significant CAGR of 7.3% over the forecast period. These tanks require external support structures to maintain their shape and integrity. They are preferred for small-scale LNG storage applications, such as on-site storage for small-scale LNG users or temporary storage during LNG transportation.

Material Insights

The steel segment dominated the LNG storage tank industry in 2024. This dominance is attributable to steel's exceptional mechanical properties, including high tensile strength, durability, and the ability to withstand extreme cryogenic temperatures (-162°C). These characteristics are crucial for ensuring safe and efficient LNG storage, resulting in the extensive application in large-scale onshore storage facilities and LNG carriers. Steel’s ability to maintain structural integrity and safety standards in LNG storage applications is one of the key driving forces.

Aluminum alloy is expected to emerge as the fastest-growing segment over the forecast years. This growth is driven by aluminum's inherent properties, such as lightweight, excellent corrosion resistance, and ease of fabrication. These attributes make aluminum alloys suitable for applications requiring mobility and modularity, including ISO containers and small-scale LNG storage solutions in remote or offshore locations. The increasing demand for flexible and efficient LNG storage options has led to a surge in the adoption of aluminum-based tanks.

Regional Insights

The North America LNG storage tank market is expected to be the fastest-growing region at a CAGR of 8.2% in the global LNG storage tank industry. This growth can be attributed to expanding LNG production, increased exports, and high investment in infrastructure. The surge in shale gas extraction has transformed the region into a global LNG powerhouse. The effect of this increase is seen in the rising number of liquefaction and storage terminals being commissioned. For instance, the Calcasieu Pass and Sabine Pass facilities in the U.S. have significantly boosted storage and export capacity, enabling North America to respond to growing energy demand in Europe and Asia. This expanding export capability directly increases the need for new and upgraded LNG storage tanks across the continent.

U.S. LNG Storage Tank Market Trends

The U.S. LNG storage tank market plays a pivotal role in driving North America’s rapid growth. As one of the world's top LNG exporters, the U.S. has seen a surge in demand for LNG storage facilities, supporting its expansion of liquefaction and regasification terminals. This demand stems from the country’s abundant shale gas reserves and its strategic push to dominate global LNG supply chains. The effect of this trend is evident in federal approvals and private investments in projects. These developments are expanding the export capabilities and reinforcing the need for advanced LNG storage infrastructure in the U.S.

Europe LNG Storage Tank Market Trends

Europe LNG storage tank market is expected to grow at a notable rate, driven by strategic investments aimed at enhancing energy security and transitioning to cleaner energy sources. Germany is at the forefront of this expansion, rapidly developing Floating Storage and Regasification Units (FSRUs) and onshore terminals to diversify its energy sources and reduce reliance on pipeline gas. Key projects include the Wilhelmshaven and Brunsbüttel terminals, which are integral to Germany's strategy of integrating LNG into its energy mix while exploring future conversions to green hydrogen and ammonia facilities.

Asia Pacific LNG Storage Tank Market Trends

Asia Pacific LNG storage tank market dominated the global market with the highest revenue share of 45.0% in 2024. This dominance is fueled by rising energy consumption, insufficient domestic gas production, and a shift from coal. The region’s reliance on LNG imports has led to robust investment in storage infrastructure at coastal terminals and inland facilities. The effect is a widespread expansion of regasification and storage capacities across countries with high urbanization and industrial growth. Major projects in South Korea and Japan, as well as regional cooperation agreements for LNG supply, illustrate the broad scope of storage development efforts in the region. South Korea is investing significantly in LNG infrastructure, with projects such as the expansion of the Hibiki LNG Terminal, which includes constructing a third storage tank to enhance domestic supply reliability.

LNG storage tank market of China accounted for the largest share in 2024. The growing demand for LNG in China is a key driver of the market. The country has been expanding its LNG liquefaction capacity and regasification facilities, fueling the need for more storage infrastructure to support the growing LNG trade volumes and the increasing adoption of LNG as a cleaner energy source in power generation, transportation, and industrial applications.

India LNG storage tank market is expected to grow at the fastest rate over the forecast period. India is a major importer of LNG and has been inclined toward expanding its LNG import and storage infrastructure to meet the rising energy demand, particularly in the power generation sector. As per an article in Reuters in May 2025, the Dahej terminal, India's largest LNG import facility, is set to expand capacity with the addition of new storage tanks and regasification units.

Key LNG Storage Tank Company Insights

Some key companies in the LNG storage tank industry include McDermott, Chart Industries, IHI Corporation, and Cryolor. Companies are adopting expansion strategies with increased mergers & acquisitions and focusing on developing innovative tank designs with improved insulation and safety features. They also focus on offering full-service solutions, encompassing tank construction, maintenance, and financing, catering to the diverse needs of LNG terminal operators and energy companies.

-

Chart Industries, Inc. holds a leading position in the small-to-midscale LNG storage segment and specializes in standardized, factory-built tanks and ISO containerized LNG solutions. The company caters to emerging markets in Asia and Africa, where rapid deployment and cost efficiency are critical.

-

McDermott International, Ltd. is a global Engineering, Procurement, Construction, and Installation (EPCI) company specializing in energy infrastructure. Its CB&I Storage Solutions division is a world leader in LNG storage tank design and construction. McDermott operates across more than 50 countries, delivering complex energy projects that support the global transition to cleaner fuels.

Key LNG Storage Tank Companies:

The following are the leading companies in the LNG storage tank market. These companies collectively hold the largest market share and dictate industry trends.

- Linde plc

- McDermott.

- Wärtsilä

- IHI Corporation

- AIR WATER INC.

- CIMC Enric Holdings Limited

- Chart Industries

- ISISAN A.Ş.

- Cryolor

- Inox India Limited

Recent Developments

-

In May 2024, CB&I secured a significant contract from TotalEnergies and OQ for the engineering, procurement, and construction of a 165,000 cubic meter full containment LNG storage tank in Oman's Port of Sohar. This project underscores CB&I's capability to deliver complex LNG storage solutions and its commitment to supporting the global energy transition by contributing to one of the lowest greenhouse gas emissions intensity LNG plants ever built.

-

In November 2023, Sinopec completed the installation and commissioning of the world’s largest 270,000 cubic meter LNG storage tank. The tank will increase LNG storage capacity of Qingdao LNG Receiving Terminal located in China by 165 million m3.

LNG Storage Tank Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 18.39 billion

Revenue forecast in 2030

USD 26.28 billion

Growth rate

CAGR of 7.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, material, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Norway, Russia, China, Japan, India, Australia, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait.

Key companies profiled

Linde plc; McDermott International, Ltd.; Wärtsilä Oyj Abp; IHI Corporation; Air Water, Inc.; CIMC Enric Holdings Limited; Chart Industries, Inc.; Isisan A.S.; Cryolor SA; Inox India Limited.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global LNG Storage Tank Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the LNG storage tank market report based on type, material, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Self Supportive

-

Non-self Supportive

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Steel

-

9% Nickel Steel

-

Aluminum Alloy

-

Others (7% Nickel Steel, Concrete)

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Norway

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.