- Home

- »

- Next Generation Technologies

- »

-

Load Balancer Market Size, Share & Growth Report, 2030GVR Report cover

![Load Balancer Market Size, Share & Trends Report]()

Load Balancer Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software), By Service (Training & Consulting, Integration & Deployment), By Type, By Deployment, By Enterprise Size, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-987-8

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Load Balancer Market Summary

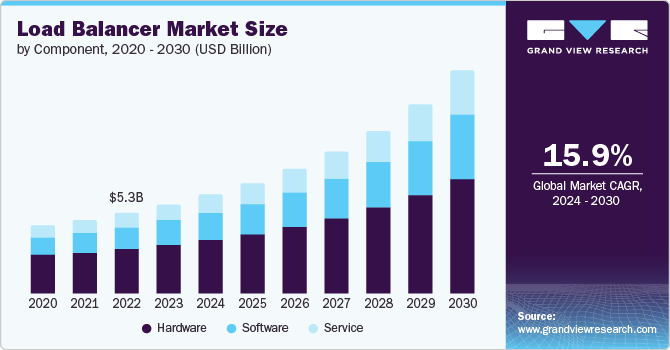

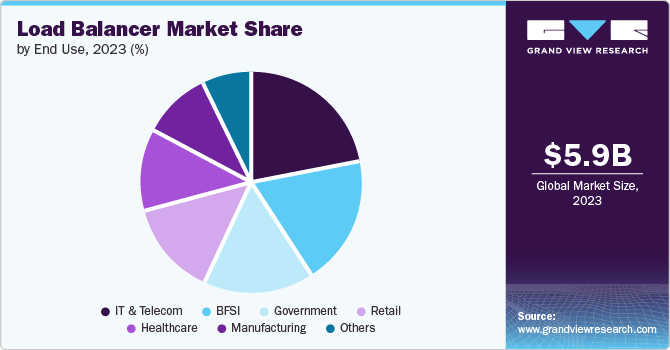

The global load balancer market size was estimated at USD 5.9 billion in 2023 and is projected to reach USD 16.14 billion by 2030, growing at a CAGR of 15.9% from 2024 to 2030. The current momentum in the market growth is fueled by a surge in the adoption of cloud load balancing services, driven by a growing awareness among enterprises regarding the advantages of cloud and networking technologies.

Key Market Trends & Insights

- North America held a market share of 32% in 2023 and is expected to dominate the market by 2030.

- The load balancer market in the U.S. is growing significantly at a CAGR of 14.0% from 2024 to 2030.

- By component, the hardware segment accounted for the largest market share of 55.6% in 2023.

- By service, the integration and deployment segment accounted for the largest market share of 46.4% in 2023.

- By type, the global load balancing segment accounted for the largest market share of 69.6% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 5.94 Billion

- 2030 Projected Market Size: USD 16.14 Billion

- CAGR (2024-2030): 15.9%

- North America: Largest market in 2023

Furthermore, the increasing adoption of connected devices and remote working models is amplifying the need for efficient load balancing solutions.

Amid the COVID-19 pandemic, the market experienced a moderate impact as businesses worldwide adjusted to remote work and online operations. However, this disruption also spurred an acceleration in digital transformation efforts as companies sought to adapt to the changing landscape. Heightened government spending on network infrastructure further fueled this shift, indicating a broader commitment to enhancing digital capabilities and ensuring robust connectivity for businesses and individuals alike. As organizations prioritize agility, scalability, and reliability in their digital infrastructure, load balancers play a crucial role in optimizing performance and distributing network traffic efficiently, thus facilitating seamless digital experiences for users.

The increasing spread of internet access, server virtualization, the growing use of connected devices, and the shift towards remote work are all expected to drive market growth. Reflecting these trends, in May 2024, VMware, now part of Broadcom, announced significant advancements in its Avi Load Balancer technology. The new features introduced are designed to enhance the scalability and management of cloud workloads, addressing the needs of modern IT environments. The Avi Load Balancer, a software-defined solution, is specifically optimized for hybrid cloud environments, making it highly effective in private cloud settings such as VMware Cloud Foundation. It also supports Kubernetes workloads through VMware Tanzu and is well-suited for mobile and 5G applications, ensuring robust performance and flexibility across diverse use cases.

The rise in network traffic has the potential to impact server performance and productivity, but load balancing offers a solution by enabling the seamless addition of extra servers to handle the influx of incoming requests. Instead of undergoing the complex process of migrating to a completely new environment, users can simply integrate additional load balancers as necessary. Furthermore, server configurations can be dynamically adjusted in accordance with business requirements and fluctuating traffic levels. For instance, a retail website experiencing heightened traffic during a sales event can mitigate latency issues by deploying additional load-balanced web servers. In the event of one server becoming unresponsive, other backend servers can seamlessly take over, ensuring uninterrupted management of incoming traffic and the continuous provision of services.

The increasing adoption of Internet of Things (IoT) devices necessitates robust request processing capabilities, fueling the widespread utilization of load balancers. These devices generate vast amounts of data, requiring efficient distribution and management to ensure smooth operation. Load balancers play a crucial role in this ecosystem by evenly distributing incoming requests across multiple servers or computing resources, optimizing performance, and preventing bottlenecks. Moreover, with numerous companies implementing global sensor deployment programs and embracing the multi-access edge computing revolution, the demand for load balancers continues to surge.

Load balancing solutions are being seamlessly integrated into business ecosystems with the aid of tools like Azure Application Gateway, enhancing structured communication accessibility while ensuring robust security measures across network levels. The significance of load balancing services has surged notably due to the escalating threat of cyberattacks, encompassing malware, phishing attempts, and Denial of Service (DoS) attacks targeting organizational networks. Nevertheless, the market's growth trajectory is anticipated to face constraints owing to the persistent challenge of cyber threats and the considerable expenses associated with implementing load balancing network solutions. Various nations, including China, are proactively addressing data security concerns; for instance, the Cyberspace Administration of China (CAC) unveiled a draft regulation on network data security management in January 2022.

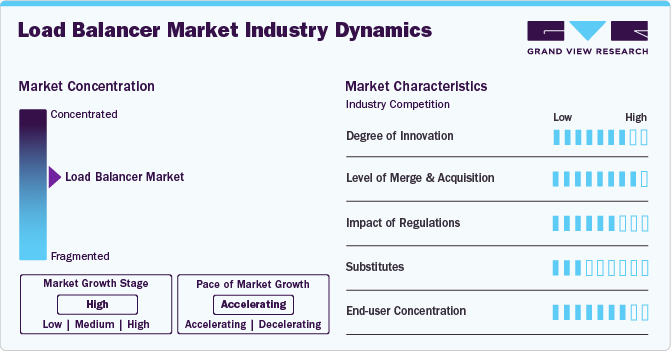

Market Characteristics & Concentration

One of the key innovative aspects of contemporary load balancers is their ability to leverage machine learning to predict traffic patterns and optimize resource allocation dynamically. This predictive capability ensures minimal latency and maximizes server utilization by intelligently distributing the load based on real-time analysis of incoming requests and historical data trends.

Key players in the load balancer market are taking strategic decisions such as mergers and acquisitions to strengthen their market positioning and increase their market share. For instance, in April 2024, Commvault, a prominent supplier of hybrid cloud data protection solutions and cyber resilience, announced the acquisition of Appranix, a company specializing in cloud cyber resilience. With the integration of Appranix's expertise, Commvault aims to offer enhanced protection and resilience, ensuring seamless operations and data security for organizations navigating the complexities of the hybrid cloud environment.

Regulations significantly impact the deployment and utilization of load balancers in various industries. For instance, in the healthcare sector, compliance with regulations such as the Health Insurance Portability and Accountability Act (HIPAA) in the United States and the General Data Protection Regulation (GDPR) in the European Union necessitates robust data security measures, including load balancing, to ensure the protection of sensitive patient information across distributed systems.

With reference to the load balancer, the threat of substitutes remains relatively low due to the specialized nature of load balancing technology and its essential role in optimizing network performance and reliability. While alternative approaches to distributing traffic across servers exist, such as DNS-based load balancing or software-defined networking solutions, these substitutes often lack the sophistication, scalability, and fine-grained control offered by dedicated load balancer appliances or software.

End User concentration in load balancer usage is indicative of a growing need for scalability, reliability, and performance optimization in modern digital infrastructures. With the rising demand for online services and applications, end users expect seamless experiences, regardless of fluctuations in traffic volume or system loads. Load balancers play a pivotal role in meeting these expectations by efficiently distributing incoming requests across multiple servers, ensuring optimal resource utilization, and preventing service disruptions.

Component Insights

The hardware segment accounted for the largest market share of 55.6% in 2023. The expansion of this segment can be credited to its capacity to manage highly demanding tasks, including Secure Sockets Layer (SSL) offload, processing of User Datagram Protocol (UDP) traffic, and the distributed denial of service (DDoS) protection. Hardware load balancers provide notable benefits, particularly for large enterprises seeking to share a multitenant device among various business units. Application Delivery Controllers (ADCs) based on hardware enable enterprises to achieve compliance on a broad scale, a critical requirement for sectors such as local and state government. These factors are expected to drive market growth significantly during the forecast period.

The software segment is expected to grow at a CAGR of 16.8% during the forecast period. The increasing complexity of network traffic and the escalating threat of cybercrime are key drivers behind the surging demand for load balancers in the market. Ensuring transparent communication at both device and system levels is a critical necessity, further propelling market growth. Software load balancers offer scalability, flexibility, ease of deployment, and enhanced security, all of which contribute to their growing adoption. These advantages enable swift responses to fluctuations in network traffic by dynamically adding or removing virtual servers as required. Additionally, the utilization of load-balancing software between servers and clients serves to intercept suspicious signals before they reach the server, thereby augmenting security measures. This trend is expected to drive the increased usage of software load balancers in the forecast period.

Service Insights

The integration and deployment segment accounted for the largest market share of 46.4% in 2023. The growth of this segment can be attributed to the increasing adoption of load balancing techniques across diverse business sectors. Moreover, the market is experiencing a boost due to its straightforward approach to decrypting data, which is particularly valuable for security professionals. In today's rapidly evolving corporate landscape, data security holds paramount importance for every company, and load balancing plays a pivotal role in facilitating threat analysis for end users. Additionally, centralized management simplifies the control of website congestion and provides a platform for consolidating insights from various environments and geographies, thereby enhancing analytics capabilities. The integration and deployment services that offer these benefits are expected to further fuel the growth of this segment.

The support and maintenance segment are expected to grow at a CAGR of 19.3% during the forecast period. n-house IT professionals play a crucial role in delivering ongoing support and maintenance to ensure the regular updating of solutions aimed at enhancing management and minimizing network downtime for load balancers. These internal IT staff members are responsible for overseeing a wide range of tasks, including managing network devices, implementing security defenses, monitoring traffic, handling database storage and retrieval, ensuring hardware quality, enforcing user controls, maintaining compliance standards, and facilitating scalability. Collaborating with original equipment manufacturers, they manage these responsibilities onsite at the company premises. These capabilities are expected to bolster the growth of the segment throughout the forecast period.

Type Insights

The global load balancing segment accounted for the largest market share of 69.6% in 2023. The growth of this segment can be attributed to its ability to provide support for disruptions at site or regional levels, ensuring the continuity of mission-critical operations and facilitating global catastrophe recovery. Moreover, it enables network architects to cater to a global user base while adhering to governmental regulations, particularly in highly regulated industries such as defense, telecommunications, and healthcare. For instance, a global load balancer can be configured to route requests only to data centers located in Canada if they originate from Canadian customers, thus ensuring compliance with regional requirements. With the increasing prevalence of interconnected data center architectures necessitating efficient load balancing for optimal performance, the adoption of global load balancers is expected to be pivotal.

The local load balancers segment is expected to grow at a CAGR of 14.8% during the forecast period. The rapid response times and swift performance of local load balancers significantly enhance user experiences by ensuring optimal speed and reliability, regardless of users' location or time of access. By distributing incoming traffic across servers, load balancing effectively prevents server overload, thereby maintaining network speed and stability. It enables the dynamic addition or removal of servers in response to traffic surges without causing downtime or disrupting existing systems. Moreover, local load balancers enhance the efficiency and availability of programs, websites, databases, and other computing resources. They facilitate the seamless and precise processing of customer requests, presenting lucrative opportunities for the growth of this segment.

Deployment Insights

The on-premise segment accounted for the largest market share of 52.2% in 2023. Software-based load balancers deployed on-premises are utilized to deliver load balancing for applications operating within the data center on-site. Businesses prefer deploying load balancers within the same environment as the resources they manage to optimize application performance effectively. Having on-site workers enables access to storage even in areas with weak internet connectivity. However, consolidating all data onto a server restricts access solely to those present in the office, thus limiting server accessibility for remote workers. These factors are poised to bolster the growth of this segment throughout the forecast period.

The cloud segment is expected to grow at a CAGR of 18.0% over the forecast period. The growth of this segment is fueled by increasingly advantageous factors, such as cost-effectiveness and the flexibility to scale up according to demand. With the proliferation of global interconnections facilitated by digital platforms and cloud computing, industries are gravitating towards multi-cloud environments. This shift towards cloud usage has led to the proliferation of data silos, necessitating efficient communication and data exchange across networks. Consequently, numerous software companies are bolstering their investment capital to support large-scale network technologies and infrastructure. For example, in March 2022, Kyndryl announced a partnership with Cloudera to establish a collaborative innovation center aimed at expediting customers' transitions to cloud platforms such as Amazon Web Services, Google Cloud, and Microsoft Azure. These benefits offered by cloud computing are poised to further augment the growth of the market throughout the forecast period.

Enterprise size Insights

The large enterprises segment accounted for the largest market share of 65.4% in 2023. In recent years, numerous large businesses have fallen victim to cyberattacks orchestrated by hackers. Moreover, the widespread adoption of remote work following the onset of the COVID-19 pandemic has exacerbated the risks of cyber threats and data breaches. Consequently, companies across various industries and verticals are actively embracing load balancing solutions as a proactive measure against potential security vulnerabilities. This surge in adoption is driven by the imperative need to safeguard sensitive data and critical infrastructure in the face of evolving cyber threats. As organizations prioritize cybersecurity measures to protect their operations and remote workforce, load balancing solutions emerge as essential components of comprehensive defense strategies.

The small and medium-sized enterprises segment is expected to grow at a CAGR of 16.2% during the forecast period. The growth of this segment stems from the growing flexibility in managing website traffic, facilitated by the availability of multiple server load balancers. With the ability to conduct various server maintenance procedures without impacting the website's uptime, organizations can ensure continuous availability and optimal performance. For small and medium-sized enterprises (SMEs), maintaining uptime and monitoring process performance are critical to ensuring that systems and websites operate seamlessly. Therefore, database load balancing emerges as a pivotal component in guaranteeing the correct functioning of these systems and websites. SMEs rely on efficient load balancing to distribute incoming traffic evenly across servers, thereby optimizing resource utilization and enhancing overall user experience. This capability not only improves website performance but also reinforces the reliability and stability of the organization's digital infrastructure, driving the growth of this segment.

End Use Insights

The IT & telecom segment held a market share of 21.7% in 2023 and is expected to dominate the market by 2030. The IT and telecommunications sectors form the backbone of operations across all industry verticals. In the realm of workload management, efficient resource allocation is paramount within the IT sector, where load balancers play an integral role. Similarly, networking stands as a critical aspect of the telecommunications industry, with load balancers serving as essential tools for traffic distribution. Both public and corporate entities play regulatory roles in overseeing the telecommunications infrastructure on national and international scales. International bodies like the World Trade Organization (WTO) have played pivotal roles in global telecommunications market liberalization, while the International Telecommunication Union (ITU) establishes regulations for collaboration among national telecommunications systems, manages the distribution of wireless spectrum, and oversees satellite positioning.

The healthcare segment is expected to grow at a CAGR of 17.7% over the forecast period. The sensitive nature of healthcare records, which encompass personal health information, financial details, and patients' social security numbers, underscores the imperative to safeguard them, considering the impact of COVID 19 pandemic. Consequently, stakeholders within the healthcare industry are anticipated to embrace load balancing solutions more vigorously as part of their initiatives to fortify the security of confidential patient data. Moreover, as leading players in the healthcare sector increasingly integrate cutting-edge technologies like Internet of Things (IoT), cloud computing, Artificial Intelligence (AI), and natural language processing to streamline operations and elevate healthcare services, they grapple with the challenges of managing the resulting intricate network infrastructure. This underscores the growing demand for efficient solutions for analyzing and managing data traffic.

Regional Insights

North America held a market share of 32% in 2023 and is expected to dominate the market by 2030. The market in North America is growing significantly at a CAGR of 14.5% from 2024 to 2030. All major sectors in the North America region have embraced cloud-based solutions, positioning the region as a leader in the early adoption of cloud computing services. Many companies are incorporating load balancers into their infrastructure to maintain performance and flexibility, which is expected to drive market growth. Similarly, early adoption of advanced technologies and significant ICT expenditure are key factors fueling the expansion of the load balancer in the North America market. For instance, Amazon Web Services (AWS) offers the Gateway Load Balancer, a service that facilitates the scalable and cost-effective management of third-party virtual appliances, including firewalls, intrusion detection and prevention systems, and deep packet inspection systems. Such innovations are contributing to the market's growth in the region.

U.S. Load Balancer Market Trends

The load balancer market in the U.S. is growing significantly at a CAGR of 14.0% from 2024 to 2030. The key factor contributing to the growth of the market in the U.S. is the rapid increase in data center traffic. With the proliferation of digital services and the exponential growth of data generation, data centers are under immense pressure to handle vast amounts of traffic efficiently.

Asia Pacific Load Balancer Market Trends

The market in Asia Pacific is growing significantly at a CAGR of 17.9% from 2024 to 2030. The Asia Pacific region is witnessing significant growth in the market, driven by several key factors. Rapid digital transformation across countries such as China, India, and Singapore have led to an increased demand for efficient network management solutions. Businesses in these rapidly developing economies are expanding their online presence and digital services, necessitating the adoption of load balancing technologies to manage and optimize network traffic effectively.

The load balancer market in China is growing significantly at a CAGR of 17.5% from 2024 to 2030. The adoption of load balancers in China is being driven by several key factors, reflecting the country's dynamic technological landscape and evolving business needs. As the country is emerging as a global leader in e-commerce, fintech, and other digital industries, businesses in China are experiencing unprecedented levels of online traffic. This surge in digital activity necessitates robust load balancing solutions to optimize resource allocation, ensure efficient data delivery, and maintain smooth user experiences.

The load balancer market in India is growing significantly at a CAGR of 19.4% from 2024 to 2030. The key factors driving the growth of load balancers in India are the exponential growth of internet usage and digital services in the country. Further, the rising government initiatives to boost the adoption of digital payments applications, social media, and online buying and selling platformshave heightened the need for robust load balancing solutions in the country.

The load balancer market in Japan is growing significantly at a CAGR of 16.6% from 2024 to 2030. Japan's commitment to technological innovation and its substantial investments in information and communication technology (ICT) infrastructure are driving the adoption of load balancers. As Japanese companies strive to stay competitive in the global market, they are leveraging advanced networking solutions to enhance efficiency, scalability, and reliability.

Europe Load Balancer Market Trends

The market in Europe is growing significantly at a CAGR of 15.1% from 2024 to 2030. The adoption of load balancers is steadily increasing in Europe, driven by several key factors that are shaping the market landscape. One significant driver is the growing reliance on digital technologies across various sectors, including finance, healthcare, retail, and manufacturing. As European businesses increasingly transition to cloud-based solutions and expand their digital footprints, the demand for efficient load balancing solutions to manage network traffic and optimize performance has surged.

The load balancer market in the U.K. is growing significantly at a CAGR of 14.3% from 2024 to 2030. The business sector in the U.K. emphasis on scalability and adaptability is propelling the integration of load balancers into infrastructure systems. Companies are recognizing the importance of maintaining consistent performance levels, particularly during peak usage periods or sudden spikes in demand. Load balancers offer the flexibility to scale resources up or down as needed, enabling businesses to efficiently manage fluctuations in network activity without compromising user experience.

The load balancer market in Germany is growing significantly at a CAGR of 13.5% from 2024 to 2030. The stringent data privacy regulations in Germany, such as the General Data Protection Regulation (GDPR), have compelled organizations to prioritize the security and integrity of their data processing systems. Load balancers offer enhanced security features, such as distributed denial-of-service (DDoS) protection and SSL offloading, which help safeguard sensitive information and ensure compliance with regulatory requirements.

The load balancer market in France is growing significantly at a CAGR of 14.7% from 2024 to 2030. The growing emphasis on digital transformation and the increasing complexity of IT infrastructures are contributing to the expansion of the market in France. As businesses modernize their operations and embrace emerging technologies such as IoT (Internet of Things) and AI (Artificial Intelligence), the need for scalable and resilient network infrastructure becomes paramount.

Middle East & Africa Load Balancer Market Trends

The market in the Middle East & Africa region is growing significantly at a CAGR of 16.9% from 2024 to 2030. The rapid expansion of digital infrastructure and connectivity initiatives is driving the adoption of load balancers in the MEA region. Governments and businesses in countries such as Saudi Arabia and UAE are investing heavily in upgrading their IT infrastructure to support the growing demand for digital services. As a result, there is a heightened need for load balancers to ensure efficient distribution of network traffic and optimal performance across servers and data centers.

Key Load Balancer Company Insights

Some of the key players operating in the market include F5 Networks; Citrix Systems, Inc.; and Radware among others.

-

F5 Networks is a leading provider of application delivery and security solutions, including load balancers. Their products help optimize the delivery of applications and services across networks while enhancing security and ensuring high availability.

-

Citrix Systems offers a range of networking and virtualization solutions, including load balancers under their NetScaler brand. Their load balancing products help organizations improve application performance, scalability, and reliability across distributed environments.

-

Radware is among the key players in the market, offering application delivery and cybersecurity solutions. Their load balancing products provide advanced traffic management capabilities, ensuring optimized application delivery and protection against cyber threats.

Avi Networks and Kemp Technologies are some of the emerging market participants in the market.

-

Avi Networks, now part of VMware, offers innovative software-defined application delivery services that include load balancing, application analytics, and security features. To further its growth, Avi Networks is focusing on expanding its product portfolio to address the evolving needs of modern applications and cloud-native architectures.

-

Kemp Technologies is a leading provider of application delivery and load balancing solutions, offering both hardware and software-based load balancer products. To fuel its growth, Kemp Technologies is concentrating on enhancing its product offerings to cater to the increasing demand for cloud-native and hybrid cloud deployments. This involves developing load balancing solutions that are optimized for modern application architectures, microservices, and containerized environments.

Key Load Balancer Companies:

The following are the leading companies in the load balancer market. These companies collectively hold the largest market share and dictate industry trends.

- A10Networks, Inc.

- Amazon web services, Inc.

- ARRAY NETWORKS, INC

- Cloudflare, Inc.

- Cisco Systems, Inc.

- Citrix Systems, Inc.

- F5 Networks, Inc.

- Avi Networks

- Google LLC

- Hewlett Packard Enterprise Development LP

- Kemp Technologies

- IBM Corporation

- Microsoft Corporation

- Palo Alto Networks Inc.

- Radware

Recent Developments

-

In March 2024, Kyndryl Inc. infrastructure services provider and Cloudflare, Inc.a connectivity cloud company announced an extension of their collaboration, aimed at empowering enterprises to migrate and oversee networks for multi-cloud connectivity alongside comprehensive network security. This partnership merges Kyndryl's comprehensive consulting services and proficiency in enterprise networking, security, and resilience with Cloudflare's resilient cloud connectivity, providing a unified solution for security, performance, and cloud adaptability.

-

In March 2024, Citrix, a business unit of Cloud Software Group, Inc., unveiled new incentive initiatives tailored for customers and partners looking to shift their current non-Citrix deployments to the recently introduced Citrix platform, particularly in relation to load balancer solutions. These programs include discounted rates and expand usage privileges, serving as compelling incentives for both prospective and existing users. The strategic framework of these incentives is crafted to streamline the transition of workloads from existing providers like VMWare or F5, to environments that can leverage the advanced capabilities of the Citrix platform, including load balancing functionalities.

-

In May 2024, Microsoft Corporation and Broadcom expanded their partnership to support VMware Cloud Foundation (VCF) subscriptions on Azure VMware Solution, offering customers enhanced flexibility. Azure VMware Solution delivers a fully managed VMware environment, allowing seamless migration of workloads with minimal refactoring. Load balancer integration ensures optimized performance as organizations leverage Azure's scalable cloud infrastructure.

Load Balancer Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.65 billion

Market Value forecast in 2030

USD 16.14 billion

Growth rate

CAGR of 15.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

July 2024

Quantitative units

Market Value in USD million/billion and CAGR from 2024 to 2030

Report coverage

Market value forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, service, type, deployment, enterprise size, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, U.K., Germany, France, Italy, Spain, China, India, Japan, Australia, South Korea, Brazil, Saudi Arabia, UAE, South Africa

Key companies profiled

A10Networkss, Inc.; Amazon Web Services, Inc.; ARRAY NETWORKS, INC; Cloudflare, Inc.; Cisco Systems, Inc.; Citrix Systems, Inc.; F5 Networks, Inc.; Avi Networks; Google LLC; Hewlett Packard Enterprise Development LP; Kemp Technologies; IBM Corporation; Microsoft Corporation; Palo Alto Networks Inc.; Radware

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Load Balancer Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends from 2018 to 2030 in each of the sub-segments. For this study, Grand View Research has segmented the global load balancer market report based on component, service, type, deployment, enterprise size, end use, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

Software

-

Service

-

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Training and Consulting

-

Integration and Deployment

-

Support and Maintenance

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Local Load Balancer

-

Global Load Balancer

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises (SMEs)

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Retail

-

Government

-

Manufacturing

-

IT & Telecom

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global load balancer market size was estimated at USD 5.94 billion in 2023 and is expected to reach USD 6.65 billion in 2024.

b. The global load balancer market is expected to grow at a compound annual growth rate of 15.9% from 2024 to 2030 to reach USD 16.14 billion by 2030.

b. The hardware segment had the largest market share, 55.6%, in 2023. This expansion can be credited to its capacity to manage highly demanding tasks, including Secure Sockets Layer (SSL) offload, processing of User Datagram Protocol (UDP) traffic, and distributed denial of service (DDoS) protection.

b. Some key players operating in the load balancer market include A10Networkss, Inc.; Amazon Web Services, Inc.; ARRAY NETWORKS, INC; Cloudflare, Inc.; Cisco Systems, Inc.; Citrix Systems, Inc.; F5 Networks, Inc.; Avi Networks; Google LLC; Hewlett Packard Enterprise Development LP; Kemp Technologies; IBM Corporation; Microsoft Corporation; Palo Alto Networks Inc.; and Radware.

b. The current momentum in the market growth is fueled by a surge in the adoption of cloud load balancing services, driven by a growing awareness among enterprises regarding the advantages of cloud and networking technologies. Furthermore, the increasing adoption of connected devices and remote working models is amplifying the need for efficient load balancing solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.