- Home

- »

- Sensors & Controls

- »

-

Location Based Services Market Size, Industry Report, 2033GVR Report cover

![Location Based Services Market Size, Share, & Trend Report]()

Location Based Services Market (2025 - 2033) Size, Share, & Trend Analysis By Component (Hardware, Software, Services), By Location Type, By Technology, By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-687-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Location Based Services Market Summary

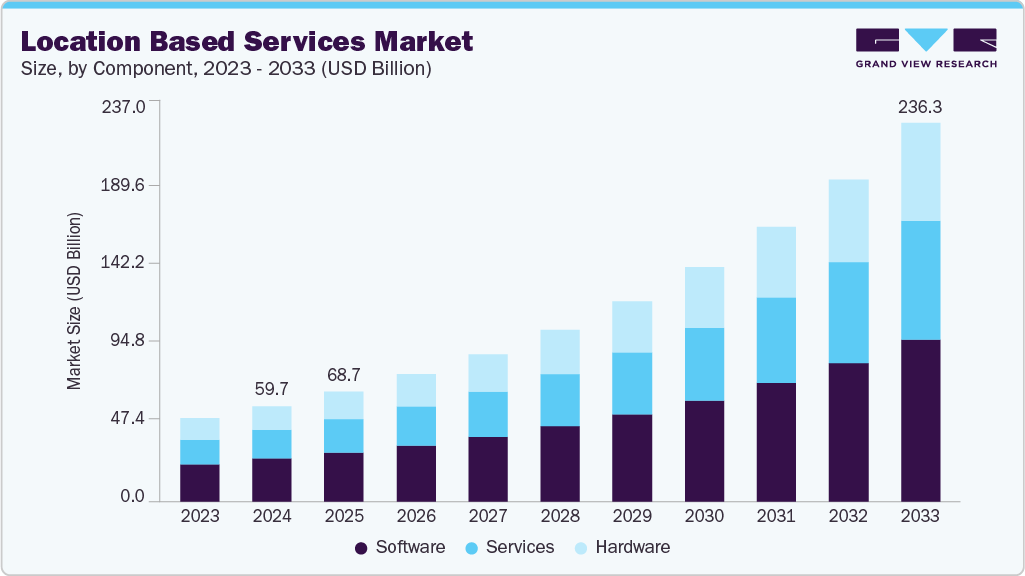

The global location based services market size was estimated at USD 59.65 billion in 2024 and is projected to reach USD 236.34 billion by 2033, growing at a CAGR of 16.7% from 2025 to 2033. The rapid rise in smartphone adoption and IoT device proliferation is a key driver of the location-based services (LBS) market.

Key Market Trends & Insights

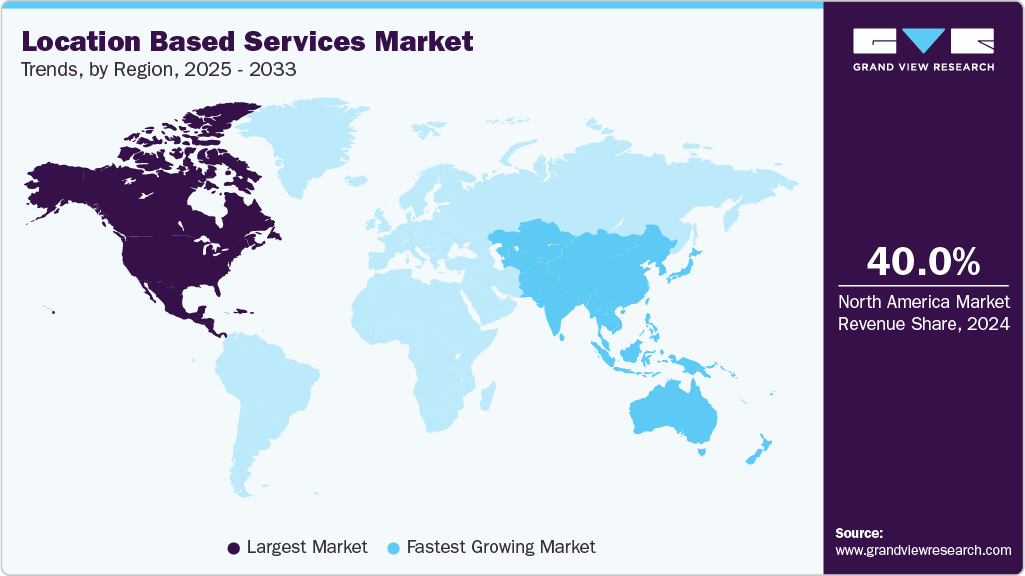

- North America location based services (LBS) dominated the global market with the largest revenue share of over 40.0% in 2024.

- The location based services (LBS) industry in U.S. is expected to grow significantly over the forecast period.

- By component, software led the market and held the largest revenue share of 44.50% in 2024.

- By location type, the outdoor LBS segment dominated the market and accounted for the largest revenue share in 2024.

- By technology, the GPS (Global Positioning System) segment dominated the market and accounted for the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 59.65 Billion

- 2033 Projected Market Size: USD 236.34 Billion

- CAGR (2025-2033): 16.7%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Most modern devices now feature integrated GPS, Wi-Fi, Bluetooth Low Energy (BLE), and sensors, enabling constant location tracking. This widespread connectivity allows businesses to deliver real-time, personalized, and context-aware services, fueling demand across sectors like navigation, advertising, logistics, and smart city applications. The rising adoption of location based services (LBS) in retail and advertising is transforming how businesses interact with consumers. Retailers are leveraging LBS technologies such as geofencing, BLE beacons, and Wi-Fi tracking to deliver personalized, hyperlocal advertising and promotions.By targeting users based on their real-time location, businesses can engage customers with context-aware offers, increasing the likelihood of immediate action and purchase. In-store navigation powered by LBS helps enhance the shopping experience, guiding customers to products or departments efficiently.

Moreover, behavioral analytics derived from location data allows retailers to understand foot traffic patterns, optimize store layouts, and tailor marketing strategies. In dense urban areas, these technologies are particularly effective, enabling brands to capture consumer attention at the right place and time. Overall, the integration of LBS into retail and advertising is driving higher customer engagement, improving conversion rates, and offering valuable insights that help retailers stay competitive in a digital-first landscape.

Smart city initiatives around the world are increasingly leveraging location-based services (LBS) to enhance urban living and operational efficiency. Governments are integrating LBS into traffic management systems to monitor congestion and optimize flow in real time. Public safety is improved through location-aware emergency response and surveillance. LBS also supports efficient waste collection by tracking routes and bin statuses. Urban mobility apps, such as public transport trackers and shared mobility platforms, rely on LBS to provide accurate navigation and arrival times. In addition, parking systems use location data to guide drivers to available spaces. These applications collectively improve service delivery, reduce costs, and enhance the overall quality of life for citizens.

Privacy and data security concerns are among the most significant barriers to the adoption of location-based services (LBS). Location data is inherently sensitive, revealing personal habits, travel patterns, and behavioral trends. When mishandled, it can lead to serious issues such as unauthorized tracking, data breaches, or surveillance abuse. High-profile incidents of location data leaks have heightened consumer awareness and skepticism, prompting many to disable location permissions or opt out of tracking altogether. Furthermore, stringent regulations such as GDPR and CCPA impose strict requirements on how businesses collect, store, and use location data. As a result, organizations must prioritize transparent practices and robust data protection to maintain user trust and regulatory compliance.

Component Insights

The software segment dominated the market and accounted for the revenue share of 44.5% in 2024. The growth of smart cities is accelerating the adoption of location-based services (LBS) software as governments and urban planners seek to enhance public safety, traffic management, and citizen services. LBS enables real-time monitoring of vehicles, crowds, and infrastructure, helping cities respond quickly to incidents and optimize operations. These systems are increasingly integrated through APIs and cloud platforms, allowing seamless data sharing across departments and services. From smart parking to emergency response apps, LBS plays a crucial role in building efficient, connected, and responsive urban environments

The services segment is anticipated to grow at the highest CAGR of 17.5% during the forecast period. As location-based services (LBS) evolve beyond simple navigation to include indoor tracking, geofencing, real-time analytics, and IoT integration, their deployment is becoming increasingly complex. Organizations are facing challenges in system architecture, data management, and multi-platform integration, prompting the need for expert guidance. This drives demand for professional services such as consulting, system design, and implementation support. Service providers help tailor LBS solutions to specific industry needs, ensuring scalability, accuracy, and compliance making them essential partners in deploying effective and future-ready location-aware systems.

Location Type Insights

The outdoor LBS segment dominated the market and accounted for the largest revenue share in 2024. The rapid growth of ride-hailing and delivery services such as Uber, Lyft, Swiggy, and DoorDash is significantly fueling demand for outdoor location-based services (LBS). These platforms rely on real-time GPS tracking to match users with nearby drivers, optimize delivery routes, and ensure timely service. As the gig economy expands and consumers increasingly expect on-demand convenience, precise outdoor location data becomes critical for operational efficiency and customer satisfaction. This dependence on accurate geolocation for outdoor LBS across urban mobility and last-mile logistics will help market growth.

The indoor LBS segment is expected to grow at a significant CAGR during the forecast period. The demand for indoor LBS is rising as hospitals, factories, and warehouses increasingly rely on real-time asset and personnel tracking. These systems help monitor the location of high-value equipment, critical supplies, and staff within complex indoor environments. By improving visibility and reducing search time, organizations can enhance safety, streamline operations, and prevent loss or theft. In addition, indoor tracking supports regulatory compliance, especially in healthcare and manufacturing, where traceability and accountability are essential. This efficiency boost makes indoor LBS a valuable tool across various high-impact industries.

Technology Insights

The GPS (Global Positioning System) segment dominated the market and accounted for the largest revenue share in 2024. The rapid growth of navigation and mobility applications such as Google Maps, Waze, and Apple Maps has significantly boosted demand for GPS-based location-based services (LBS). These apps use GPS to provide real-time traffic updates, turn-by-turn directions, and geofencing features, making them essential tools for daily commuting, logistics, and tourism. As consumers and businesses increasingly rely on accurate, real-time navigation for efficiency and convenience, GPS continues to serve as the foundational technology enabling these critical mobility services across sectors.

The Bluetooth low energy (BLE) segment is expected to grow at a significant CAGR during the forecast period. Bluetooth Low Energy (BLE) is in high demand for indoor positioning due to its ability to deliver accurate, real-time location tracking where GPS fails. Widely used in malls, airports, hospitals, and industrial facilities, BLE beacons offer a cost-effective and energy-efficient solution for identifying the location of people or assets within a defined area. With room-level accuracy and minimal infrastructure requirements, BLE enables navigation, monitoring, and operational efficiency indoors making it a preferred choice for location-based services (LBS) in complex, enclosed environments.

Application Insights

The mapping & navigation segment dominated the market and accounted for the largest revenue share in 2024. The rapid expansion of transportation, logistics, and delivery services is significantly driving demand for mapping and navigation in the location-based services (LBS) market. Accurate location data is essential for fleet tracking, route optimization, and real-time delivery updates. E-commerce and last-mile delivery companies use navigation tools to reduce fuel consumption, minimize delays, and improve estimated time of arrival (ETA) accuracy. These efficiencies not only lower operational costs but also enhance customer satisfaction through timely and transparent deliveries, making mapping and navigation a core component of logistics operations

The location-based advertising segment is expected to grow at a significant CAGR during the forecast period. The global rise in smartphone adoption has led to continuous user connectivity and frequent location data sharing through mobile apps. This trend empowers advertisers to deliver real-time, location-specific ads directly to users’ devices, targeting them based on where they are or have been. Such precision allows brands to reach consumers at moments of high relevance near stores, events, or points of interest significantly boosting engagement and click-through rates. As mobile usage grows, location-based advertising becomes increasingly effective for driving personalized, timely interactions and influencing purchase decisions.

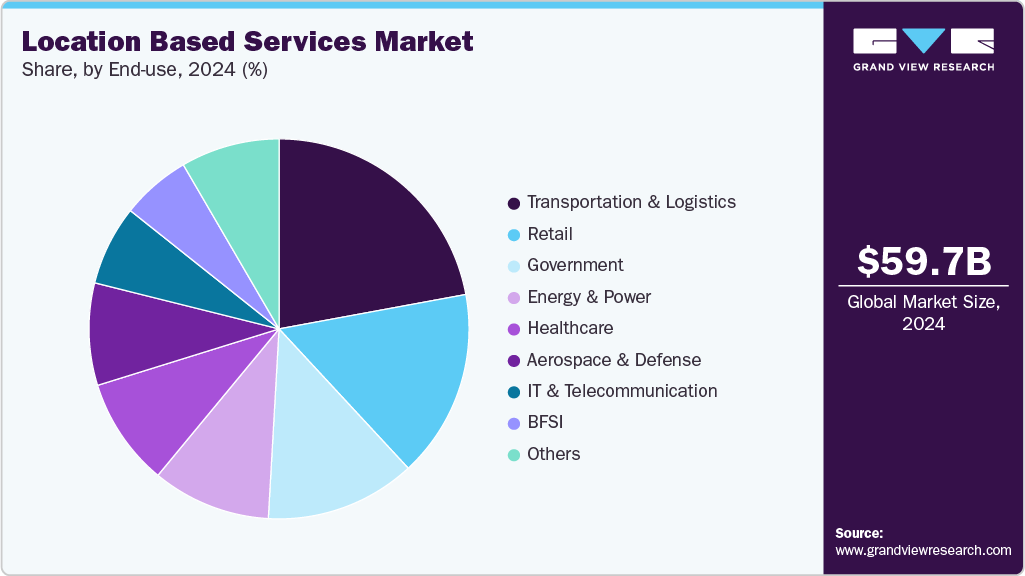

End Use Insights

The transportation & logistics segment dominated the market and accounted for the largest revenue share in 2024. Real-time fleet tracking is essential for logistics and transportation companies to monitor vehicle routes, delivery status, and driver behavior. Location-Based Services (LBS), powered by GPS and cellular networks, provide continuous visibility into the movement of trucks and delivery vehicles. This enables fleet managers to respond quickly to delays, optimize routes, reduce fuel consumption, and improve overall efficiency. Real-time tracking also enhances security, ensures compliance with delivery schedules, and allows for proactive customer communication making it a critical tool for modern fleet operations an supply chain management.

The retail segment is expected to grow at a significant CAGR over the forecast period. The rise of hyperlocal advertising and proximity marketing is transforming retail engagement through location-based services (LBS). Retailers deploy geofencing and Bluetooth Low Energy (BLE) beacons to deliver personalized offers, alerts, and promotions to shoppers' smartphones when they enter or are near a store. This location-triggered approach captures customer attention at the point of decision-making, increasing footfall, dwell time, and purchase likelihood. By targeting users based on real-time proximity, retailers enhance conversion rates and foster more relevant, timely interactions, making LBS a powerful tool for modern retail marketing.

Regional Insights

North America dominated the global market with the largest revenue share of 40.0% in 2024. North America benefits from the strong presence of tech giants like Google, Apple, Amazon, Uber, and Meta, which are heavily investing in location-based services (LBS) technologies. Their continuous innovation in navigation, delivery, advertising, and mobility apps drives early adoption and advances in LBS infrastructure. These companies influence global trends, set high performance standards, and accelerate the development of new, location-aware services across industries, solidifying the region’s market leadership.

U.S. Location Based Services Market Trends

The location based services (LBS) market in the U.S. is expected to grow significantly at a CAGR of 15.6% from 2025 to 2033. The U.S. is home to major LBS-driven platforms like Google Maps, Apple Maps, Uber, and Waze. Their ongoing innovation, frequent updates, and localized features enhance user experience and drive widespread adoption. This ecosystem leadership positions the U.S. at the forefront of global LBS market growth and application usage.

Europe Location Based Services Market Trends

The location based services (LBS) market in Europe is anticipated to register considerable growth from 2025 to 2033. European governments are actively investing in smart city projects to enhance urban mobility, environmental monitoring, and public safety. LBS technologies are central to traffic management, waste collection optimization, and citizen services in cities like Amsterdam, Barcelona, and Vienna.

The UK location based services (LBS) market is expected to grow rapidly in the coming years. Retailers and logistics firms are increasingly using LBS to enhance delivery efficiency, optimize routes, and provide real-time tracking. Companies such as Royal Mail, DPD, and Ocado leverage geolocation to meet high consumer expectations for fast, trackable deliveries.

The Germany location based services (LBS) market held a substantial market share in 2024. Germany’s globally recognized automotive and manufacturing sectors are rapidly adopting LBS for real-time asset tracking, fleet management, and location-aware logistics. Automotive OEMs such as BMW, Daimler, and Volkswagen are integrating LBS into connected vehicle systems, fueling demand for navigation, telematics, and geofencing solutions

Asia Pacific Location Based Services Market Trends

Asia Pacific location based services (LBS) held a significant share in the global market in 2024. Asia Pacific is home to the largest number of smartphone users globally, led by countries such as China, India, Indonesia, and Southeast Asian nations. This expanding mobile base drives massive adoption of LBS-based applications across navigation, social media, retail, and mobility.

The Japan location based services (LBS) market is expected to grow rapidly in the coming years. Japan’s highly efficient public transit systems (railways, metros, buses) are deeply integrated with LBS for real-time updates, route optimization, and mobile navigation apps. Commuters rely on LBS-powered apps such as NAVITIME and Yahoo! Transit, driving demand for high-precision location services.

The China location based services (LBS) market held a substantial market share in 2024, due to the exponential growth of platforms such as JD.com and Alibaba's Cainiao Network which has increased demand for LBS in last-mile delivery, smart warehousing, and real-time shipment tracking. LBS supports more efficient and transparent logistics operations at scale.

Key Location Based Services Company Insights

Key players operating in the location based services (LBS) industry are Google LLC, ALE International, Microsoft Corporation, IBM Corporation, Cisco Systems, Inc., Qualcomm Technologies, Inc., Oracle Corporation, HERE Technologies, TomTom N.V., Zebra Technologies, Ericsson, Foursquare Labs Inc., MapmyIndia (C.E. Info Systems), Esri, and Sensewhere Ltd. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In January 2025, TomTom N.V. and Esri have partnered to integrate TomTom’s real-time mapping and traffic data with Esri’s GIS platform. This collaboration aims to enhance location analytics capabilities for businesses and governments, enabling smarter decision-making in areas such as urban planning, transportation, and infrastructure management through improved geospatial insights and visualization tools.

-

In January 2024, HERE Technologies expanded its partnership with what3words to integrate precise location addressing into its mapping platform. This collaboration enables users and businesses to find and navigate to exact 3-meter-square locations globally, enhancing logistics, emergency response, and delivery accuracy especially in areas lacking formal addresses or clear navigation points.

-

In April 2023, Qualcomm and Xiaomi jointly demonstrated a mobile meter-level positioning system using Qualcomm’s Snapdragon technology. The solution enhances location accuracy to within one meter, improving navigation, augmented reality, and location-based services. This breakthrough supports high-precision applications in urban environments where traditional GPS accuracy is often limited.

Key Location Based Services Companies:

The following are the leading companies in the location based services (LBS) market. These companies collectively hold the largest market share and dictate industry trends.

- Google LLC

- ALE International

- Microsoft Corporation

- IBM Corporation

- Cisco Systems, Inc.

- Qualcomm Technologies, Inc.

- Oracle Corporation

- HERE Technologies

- TomTom N.V.

- Zebra Technologies

- Ericsson

- Foursquare Labs Inc.

- MapmyIndia (C.E. Info Systems)

- Esri

- Sensewhere Ltd.

Location Based Services Market Report Scope

Report Attribute

Details

Market size in 2025

USD 68.71 billion

Revenue forecast in 2033

USD 236.34 billion

Growth rate

CAGR of 16.7% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report scope

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, location type, technology, application, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

Google LLC; ALE International; Microsoft Corporation; IBM Corporation; Cisco Systems, Inc.; Qualcomm Technologies, Inc.; Oracle Corporation; HERE Technologies; TomTom N.V.; Zebra Technologies; Ericsson; Foursquare Labs Inc.; MapmyIndia (C.E. Info Systems); Esri; Sensewhere Ltd.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Location Based Services Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the location based services (LBS) market report based on component, location type, technology, application, end use, and region:

-

Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

Hardware

-

Software

-

Services

-

-

Location Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Indoor

-

Outdoor

-

-

Technology Outlook (Revenue, USD Billion, 2021 - 2033)

-

GPS (Global Positioning System)

-

Wi-Fi

-

RFID & NFC

-

Bluetooth Low Energy (BLE)

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Mapping & Navigation

-

Location-Based Advertising

-

Asset & Fleet Tracking

-

Social Networking & Entertainment

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Aerospace & Defense

-

BFSI

-

IT and Telecommunications

-

Energy & Power

-

Government

-

Healthcare

-

Retail

-

Transportation & Logistics

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global location based software market size was estimated at USD 59.65 billion in 2024 and is expected to reach USD 68.71 billion in 2025.

b. The global location based software market is expected to grow at a compound annual growth rate of 16.7% from 2025 to 2033 to reach USD 236.34 billion by 2033.

b. North America dominated the global market with the largest revenue share of 40.09% in 2024. North America benefits from the strong presence of tech giants like Google, Apple, Amazon, Uber, and Meta, which are heavily investing in location-based services (LBS) technologies.

b. Some key players operating in the location based software (LBS) market include Google LLC, ALE International, Microsoft Corporation, IBM Corporation, Cisco Systems, Inc., Qualcomm Technologies, Inc., Oracle Corporation, HERE Technologies, TomTom N.V., Zebra Technologies, Ericsson, Foursquare Labs Inc., MapmyIndia (C.E. Info Systems), Esri, Sensewhere Ltd.

b. The rapid rise in smartphone adoption and IoT device proliferation is a key driver of the location-based services (LBS) market. Most modern devices now feature integrated GPS, Wi-Fi, Bluetooth Low Energy (BLE), and sensors, enabling constant location tracking.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.