- Home

- »

- Medical Devices

- »

-

Lower Limb Prosthetics Market Size & Share Report, 2030GVR Report cover

![Lower Limb Prosthetics Market Size, Share & Trends Report]()

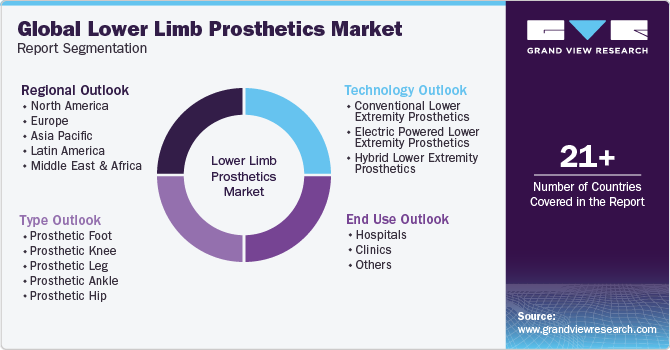

Lower Limb Prosthetics Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Prosthetics Foot, Prosthetics Knee, Prosthetics Leg, Prosthetics Ankle), By Technology, By End-use (Hospitals, Clinics, Others), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-156-4

- Number of Report Pages: 118

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Lower Limb Prosthetics Market Summary

The global lower limb prosthetics market size was estimated at USD 1,184.5 million in 2023 and is projected to reach USD 1,625.4 million by 2030, growing at a CAGR of 4.6% from 2024 to 2030. The growing prevalence of diabetes has led to rising incidences of lower limbs, driving market demand for prosthetic implants.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2023.

- Country-wise, Germany is expected to register the highest CAGR from 2024 to 2030.

- In terms of segment, prosthetic leg accounted for a revenue of USD 368.2 million in 2023.

- Prosthetic Hip is the most lucrative type segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 1,184.5 Million

- 2030 Projected Market Size: USD 1,625.4 Million

- CAGR (2024-2030): 4.6%

- North America: Largest market in 2023

As per the International Diabetes Federation's statistics from 2021, 1 in 10 adults aged between 20-79 years (537 million people) live with diabetes. This number is expected to rise to 643 million and 783 million by 2030 and 2045 respectively. Moreover, the increasing geriatric population globally and a rising prevalence of vascular disease, particularly among the aging population, are expected to open profitable market expansion avenues over the coming years.

The COVID-19 pandemic had notable repercussions on the market. Supply chain disruptions were among the first and most prominent effects, impeding the production and distribution of essential prosthetics components and materials. Moreover, the pandemic prompted innovation in the healthcare sector, including the development of new technologies and approaches for prosthetics care. this could lead to advancements in lower limb prosthetics. Furthermore, increased focus on healthcare research and innovation during the pandemic is expected to drive the development of more advanced prosthetic technologies. The pandemic emphasized the importance of resilient healthcare systems and highlighted the need for continued investment in the market to ensure patients' access to essential medical devices, even during challenging times.

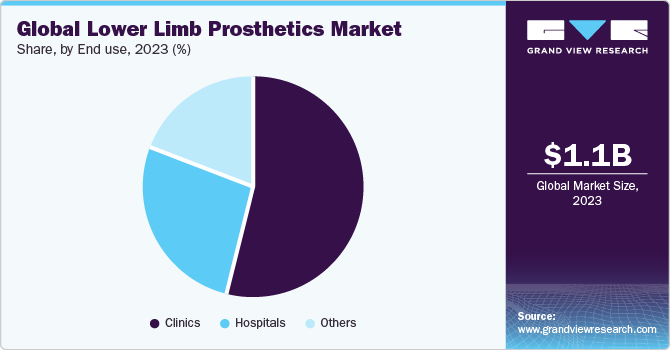

End-use Insights

Based on end-use, the market is segmented into hospitals, clinics, and others. The clinics segment held the largest market share of 53.98% in 2023. The rising incidence of limb amputation primarily driven by factors such as vascular diseases, diabetes, and accidents drives the demand for clinical services specialized in the field. In addition, some clinics offer personalized and customized prosthetic solutions through skilled prosthetists who can provide expert evaluation, fitting, and ongoing care for prosthetic limbs. Such clinics tend to attract more patients and foster industry growth.

The hospitals segment is expected to grow at a significant CAGR of 4.81% over the forecast period. Hospitals are often at the forefront of adopting and offering the latest prosthetic technologies and devices, attracting patients seeking advanced and innovative solutions. Such factors are expected to drive the segment growth.

Market Dynamics

The rising number of road accidents is a significant driving factor in the market. Road accidents often result in severe injuries, including lower limb amputations and loss or irreparable damage to lower limbs. This can lead to heightened demand for lower limb prosthetic equipment. Prompt medical care following road accidents involves amputation and limb-saving surgeries. Subsequently, patients often undergo rehabilitation, which includes the provision of prosthetic limbs to restore mobility and functionality. Also, the rising occurrence of conditions such as osteosarcoma and an increasing rate of sports injuries are factors expected to drive market expansion. According to John Hopkins University, more than 3.5 million children in the United States sustain sports-related injuries annually. During the assessment period, sports-related injuries are anticipated to drive industry demand and support its expansion.

The technological advancements in prosthetics technology such as 3D printing, digital design tools, device implants, sense of touch, neural interfaces, adaptive learning, AI in prosthetics, and more serve as a driving force behind the growth of the market. These technological innovations bring about substantial improvements in mobility, comfort, and functionality of prosthetic devices, significantly enhancing the lives of individuals with lower limb amputations. Further, several companies are actively investing in research and development to create innovative lower limb prosthetics devices. These companies aim to improve mobility, comfort, and quality of life for individuals with lower limb amputations. For instance, in 2022, Össur unveiled the POWER KNEE, which is an actively powered microprocessor prosthetics knee intended for individuals with above-knee amputations or limb differences.

Regional Insights

North America dominated the market for and accounted for the largest revenue share of 45.75% in 2023. The concentration of prosthetics research and development, as well as manufacturing expertise, is prominent in North America. Many leading market companies as well as innovators are based in the U.S. and Canada, thus boosting regional influence and presence in the prosthetics industry. Moreover, North America has a substantial aging population along with a relatively high prevalence of conditions such as vascular diseases and diabetes, which can result in lower limb amputations. This demographic trend, coupled with a strong focus on patient care and rehabilitation, drives a consistent demand for lower limb Prosthetics devices.

Asia Pacific is expected to exhibit lucrative growth in the lower limb prosthetics market over the forecast period. This is attributed to improving healthcare infrastructure and rising geriatric population. Moreover, significant economic development in the region is one of the pioneering factors responsible for attracting international investments. The presence of major players along with the constantly developing technologies is further encouraging market growth.

Type Insights

Based on type, the market is segmented into prosthetic foot, prosthetic knee, prosthetic leg, prosthetic ankle, and prosthetic hip. The prosthetic leg segment held the largest market share of 30.92% in 2023. This growth is primarily attributed to the fact that prosthetic legs are more prevalent and provide comprehensive mobility solutions for individuals with above-the-knee or below-the-knee amputations. Moreover, increasing war activities in various regions also drive demand for prosthetic legs. For instance, as per ABC News in July 2022, according to one of the top medical specialists in Ukraine focused on creating limbs for amputees, the demand for prosthetic legs and arms increased drastically due to the Russia-Ukraine warfare.

The prosthetic hip segment is expected to grow at the fastest CAGR of 5.07% over the forecast period. The increasing prevalence of arthritis among the population and technological advancements in prosthetic hip surgeries will drive segment growth over the coming years. For instance, as per the Center For Disease Control and Prevention (CDC) June 2023 statistics, an estimated 78.4 million (25.9%) of U.S. individuals who are 18 years of age or older are expected to have arthritis by 2040, according to a diagnosis performed by Behavioral Risk Factor Surveillance System (BRFSS).

Technology Insights

Based on technology, the market is segmented into conventional lower extremity prosthetics, electric-powered lower extremity prosthetics, and hybrid lower extremity prosthetics. The conventional lower extremity prosthetics segment held the largest market revenue share of 41.91% in 2023. Conventional lower extremity prosthetics systems have a long-established track record of reliability and durability. Many prosthetists and patients are well aware of their design and functionality, enabling a sense of trust and confidence. Furthermore, conventional prosthetics are generally more economical than their advanced counterparts, improving their accessibility for a broader range of patients, particularly in regions that have limited healthcare resources or those facing budget constraints.

The electric-powered lower extremity prosthetics segment is expected to grow at the fastest CAGR of 4.89% over the forecast period. Electric-powered lower extremity prosthetics characterize a significant advancement in the field of prosthetic technology. These prosthetic devices incorporate electrical components and sensors to enhance the mobility, functionality, and comfort of individuals who have undergone lower limb amputations. Such factors are expected to fuel the segment growth in the coming years.

Key Companies & Market Share Insights

Key players operating in the market are undertaking strategic initiatives to address the growing demand for clinical services. Major players are involved in the acquisition of small players to enhance their services portfolio and improve their geographical presence, also launching new products to enhance users' functionality and mobility significantly. Thus, there is significant competition among market players. For instance, in March 2023, Steeper Group introduced a new S-Charge System. The S-Charge System combines a magnetic charging port, a visual display, and flexible, low-profile S-Cell batteries. This technology was created to replace outdated switch mechanism, which was cumbersome to operate and frequently caught by mistake by the user. It also puts extra strain on the forearm. Similarly, in February 2022, Ossur (Touch Bionics)introduced an advanced Power Knee Microprocessor Prosthetics Knee System, representing the next generation in Prosthetics technology. This system integrates motor technology and aims to enhance users' functionality and mobility significantly.

Key Lower Limb Prosthetics Companies:

- Enovis

- Fillauer

- Ossur (Touch Bionics)

- Ottobock SE

- Endolite

- College Park Industries

- Steeper Group

- TRS Inc

- Naked Prosthetics

- DePuy Synthes

Lower Limb Prosthetics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.23 billion

Revenue forecast in 2030

USD 1.63 billion

Growth Rate

CAGR of 4.70% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, technology, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Enovis; Fillauer; Ossur (Touch Bionics); Ottobock SE; Endolite; College Park Industries; Steeper Group; TRS Inc; Naked Prosthetics; DePuy Synthes

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Lower Limb Prosthetics Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global lower limb prosthetics market report based on type, technology, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Prosthetic Foot

-

Prosthetic Knee

-

Prosthetic Leg

-

Prosthetic Ankle

-

Prosthetic Hip

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Conventional Lower Extremity Prosthetics

-

Electric Powered Lower Extremity Prosthetics

-

Hybrid Lower Extremity Prosthetics

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global lower limb prosthetics market size was estimated at USD 1.1 billion in 2023 and is expected to reach USD 1.23 billion in 2024.

b. The global lower limb prosthetics market is expected to grow at a compound annual growth rate of 4.6% from 2024 to 2030 to reach USD 1.63 billion by 2030.

b. North America dominated the lower limb prosthetics market with a share of 45.75% in 2023. The concentration of prosthetics research and development, as well as manufacturing expertise, is prominent in North America. Many industry's leading companies and innovators are headquartered in U.S. and Canada, which significantly bolsters region's influence and presence in the prosthetics market.

b. Some key players operating in the lower limb prosthetics market include Enovis, Fillauer, Ossur (Touch Bionics), Ottobock SE, Endolite, College Park Industries, Steeper Group, TRS Inc, Naked Prosthetics, DePuy Synthes;

b. Key factors that are driving the market growth include growing geriatric population and increasing incidence of vascular disease, especially among the aging population, would likely open profitable opportunities for the market over the coming years.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.