- Home

- »

- Medical Devices

- »

-

Lumbar Spine Cages Market Size, Industry Report, 2033GVR Report cover

![Lumbar Spine Cages Market Size, Share & Trends Report]()

Lumbar Spine Cages Market (2025 - 2033) Size, Share & Trends Analysis Report By Cage Design (Static Cages), By Fusion Type, By Reconstruction Type, By Material, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-684-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Lumbar Spine Cages Market Summary

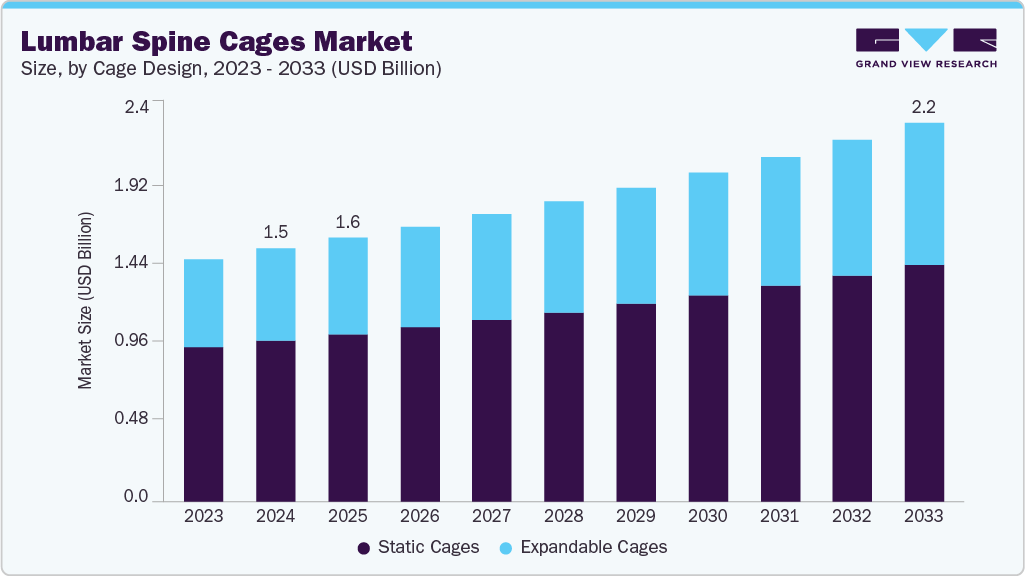

The global lumbar spine cages market size was estimated at USD 1.49 billion in 2024 and is projected to reach USD 2.24 billion by 2033, growing at a CAGR of 4.63% from 2025 to 2033. The market is driven by the growing prevalence of degenerative spine disorders and rising demand for minimally invasive fusion techniques.

Key Market Trends & Insights

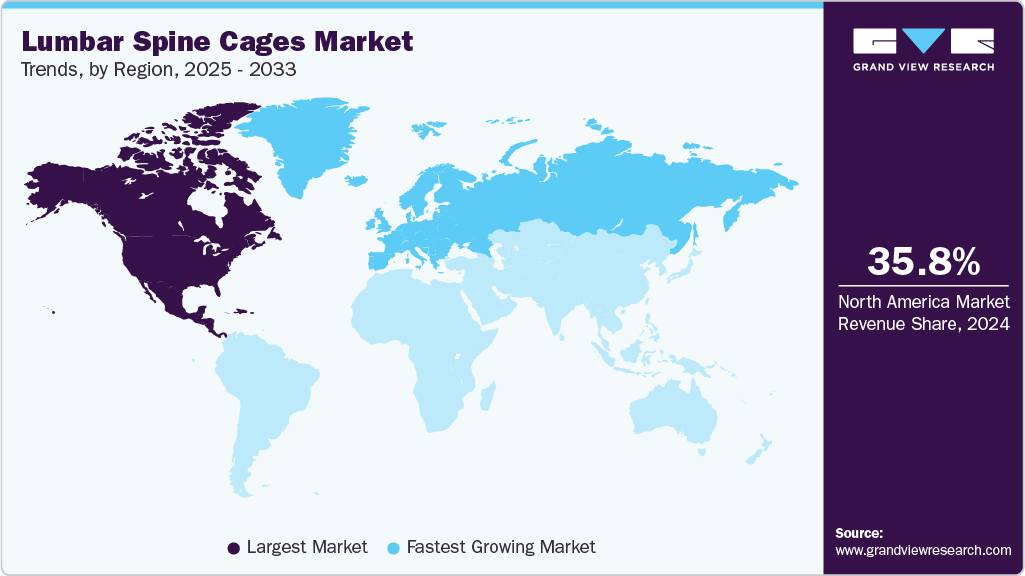

- North America lumbar spine cages market held the largest share of 35.84% of the global market in 2024.

- The lumbar spine cages industry in the U.S. is expected to grow significantly over the forecast period.

- By cage design, the static cages segment held the highest market share of 63.58% in 2024.

- Based on approach/technique (fusion type), the TLIF (Transforaminal lumbar interbody fusion) cages segment held the highest market share 51.92% in 2024.

- Based on reconstruction type, the corpectomy cages segment held the highest market share of 56.50% in 2024.

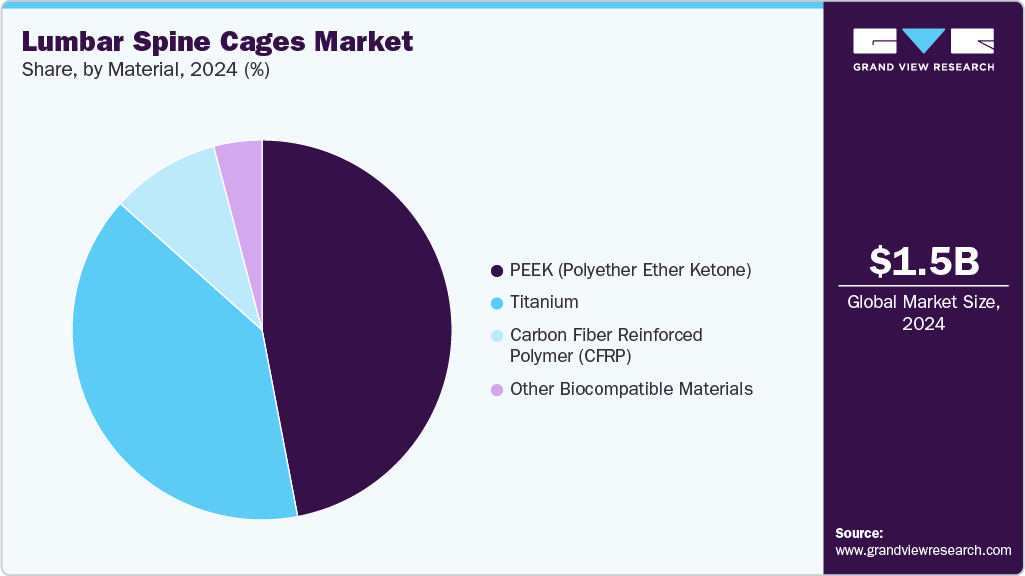

- By material, the PEEK (Polyether ether ketone) segment held the highest market share 46.99% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.49 Billion

- 2033 Projected Market Size: USD 2.24 Billion

- CAGR (2025-2033): 4.63%

- North America: Largest market in 2024

The market is primarily driven by the rising global burden of degenerative spinal conditions, particularly among the aging population. Disorders such as lumbar spondylosis, disc herniation, and spinal stenosis are increasingly prevalent, contributing to higher surgical intervention rates. As conservative treatments often fail in advanced cases, spinal fusion becomes a preferred option, with interbody cages playing a central role in restoring disc height and stabilizing the affected segments. In November 2024, a BMC study projected that global DALYs due to low back pain in middle-aged adults will exceed 11.6 million by 2050, with females disproportionately affected. Although age-specific rates declined slightly since 1990, the total burden rose due to aging populations and obesity. The findings highlight growing demand for interventions such as lumbar spine cages, especially in high-SDI regions.

Technological advancements are a key growth driver, with innovations in cage design, materials, and surgical techniques enhancing procedural outcomes. The development of radiolucent, porous, and bioactive materials, especially PEEK and titanium-coated variants, improves bone integration and visibility during imaging. Adopting minimally invasive fusion techniques, including MIS-TLIF and ALIF, is boosting demand for anatomically optimized and expandable cages tailored for precise placement and reduced recovery times. In July 2024, Spectrum Spine Inc. began clinical use of its first anterior cervical cage featuring BioBraille, a nano-engineered surface that induces rapid, maturing bone formation. The subtractive nanostructure mimics bone anatomy across macro to nanoscales, triggering robust osteoblast and osteocyte activity within 14 days.

The growing availability of advanced surgical infrastructure and improved reimbursement for spinal procedures in emerging economies is fueling market expansion. Countries in Asia Pacific and Latin America are witnessing increased surgeon training, better access to spinal implants, and rising patient awareness about surgical options. In March 2024, NovApproach Spine announced the first implantation of its OneLIF interbody fusion cage with the patient in a lateral position. The device enables anterior lumbar fusion through multiple approaches using a single implant, offering surgeons flexibility in complex spinal procedures. This marks a notable advancement in the market, particularly for minimally invasive and anatomy-adaptive surgeries.

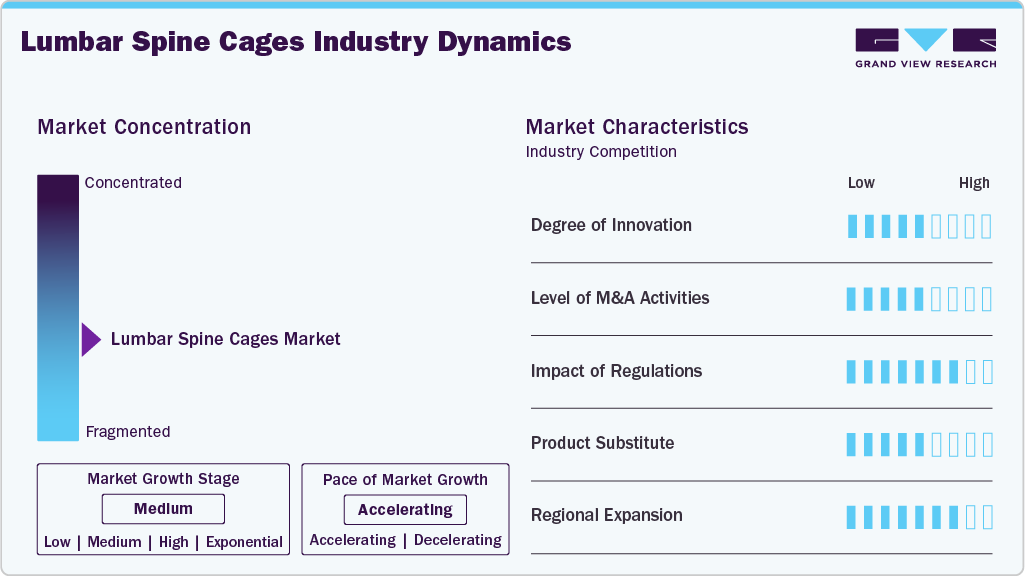

Market Concentration & Characteristics

Innovation in the lumbar spine cages industry is moderate, with a steady stream of improvements focused on materials such as PEEK composites and titanium alloys and cage design features like expandability and surface texturing. However, the pace remains incremental rather than disruptive, largely driven by surgeon preferences and clinical safety requirements. Emerging technologies such as bioactive coatings and 3D printing are promising but not widespread.

The level of mergers and acquisitions in the lumbar spine cages industry is moderate, reflecting a strategic focus by mid- to large-sized orthopedic firms to consolidate technology portfolios and expand access to key hospital systems. While major deals occur, the market remains fragmented, with several niche players retaining independent operations. Most transactions aim to boost product differentiation or secure regional distribution.

Regulatory influence on the lumbar spine cages industry is high, given the critical nature of spinal implants and the long-term patient safety considerations. Regulatory bodies such as the FDA and CE authorities require rigorous clinical and biomechanical data for device approval, slows time-to-market and increases development costs. Variations in global approval timelines and standards further complicate market access strategies.

The presence of product or service substitutes in the lumbar spine cages industry is moderate, with alternatives including traditional bone grafts, non-fusion devices, and motion-preserving implants such as disc replacements. While these options serve select patient groups, they do not match the widespread clinical acceptance or long-term evidence of fusion cages, particularly in degenerative lumbar pathologies.

Regional expansion in the lumbar spine cages industry is high, with manufacturers aggressively entering emerging markets in Asia-Pacific, Latin America, and the Middle East. Rising surgical volumes drive this expansion, improving reimbursement frameworks, and growing investments in spine care infrastructure. Local partnerships and tailored regulatory strategies are helping global players establish an early advantage.

Cage Design Insights

The static cages segment held the largest market share in 2024, accounting for approximately 63.58% of total revenue. Static cages are non-adjustable interbody fusion devices used in spinal fusion procedures to maintain disc height and promote osseointegration between vertebral bodies. These cages are typically manufactured in a range of predefined sizes and shapes, requiring careful preoperative planning to select the optimal implant size for each patient. In March 2023, the Journal of Spine Surgery discussed the performance of static interbody cages in minimally invasive transforaminal lumbar interbody fusion (MIS-TLIF). Once the gold standard, Static PEEK cages restored disc and foraminal height and supported spinal fusion. However, their fixed height and need for distraction during insertion posed risks, including endplate violation and subsidence.

The expandable cages segment is projected to grow at the fastest CAGR over the forecast period, driven by increasing adoption of minimally invasive spinal fusion procedures and the need for intraoperative adjustability. These devices allow surgeons to restore disc height and lordosis with greater precision, reducing the need for excessive tissue disruption. In May 2024, the Journal of Clinical Medicine published a narrative review titled Expandable Cages for Lumbar Interbody Fusion, analyzing their clinical performance, advantages, limitations, and future role in minimally invasive spinal surgery. The article found that expandable cages offer better disc height restoration, foraminal decompression, and sagittal alignment than static cages, although some studies reported higher subsidence rates and questioned cost-effectiveness.

Approach/Technique (Fusion Type) Insights

The TLIF (Transforaminal Lumbar Interbody Fusion) cages segment held the largest market share of 51.92% in 2024, driven by its favorable surgical profile, combining posterior access with reduced neural retraction. TLIF allows for efficient disc removal, cage placement, and stabilization through a single incision, making it a preferred technique among spine surgeons. Its compatibility with minimally invasive approaches and consistent fusion outcomes has further reinforced its dominance in elective and complex lumbar procedures. In April 2023, Life Spine published a retrospective study comparing expandable and static lordotic interbody implants in minimally invasive TLIF procedures in the Journal of Spine Surgery. The ProLift Expandable Spacer System showed significantly greater improvements in disc height, foraminal height, and patient-reported outcomes over two years. Benefits included reduced disability, pain, shorter hospital stays, and lower blood loss.

The OLIF (Oblique Lumbar Interbody Fusion) cages segment is projected to grow at the fastest CAGR over the forecast period, fueled by the rising preference for less invasive lateral approaches that minimize muscle disruption and reduce recovery time. OLIF enables anterior disc access without repositioning the patient, offering favorable alignment correction and larger graft placement. A July 2025 Scientific Reports study on 63 OLIF patients found that restoring posterior disc height (PDH) by over 3.0 mm is key for successful indirect decompression and lasting symptom relief. OLIF effectively increased disc, foraminal height, and spinal canal area up to one year post-surgery. However, over-distraction raises subsidence risks, stressing the need for precise surgical technique to balance decompression and implant stability.

Reconstruction Type Insights

The corpectomy cages segment held the largest market share of 56.50% in 2024 and is anticipated to grow at the fastest CAGR over the forecast period, driven by their critical role in managing vertebral body collapse, trauma, and tumor-related spinal instability. These cages offer structural support following vertebral resection and are designed to restore anterior column integrity with high load-bearing capacity. In December 2024, McGill University Health Centre introduced a novel post-corpectomy spinal reconstruction technique using cages filled with allograft/autograft bone and secured by pedicle screws to spinal rods. Applied in cervical and lumbar cases, it showed improved stability and fusion without needing cage endcaps, offering a promising alternative to traditional grafts.

The vertebrectomy cages segment is projected to grow at a significant rate over the forecast period, driven by the increasing incidence of complex spinal pathologies such as metastatic disease, severe trauma, and osteoporotic fractures requiring complete vertebral body removal. These cages provide robust anterior column reconstruction following vertebrectomy, enabling spinal stability and height restoration. In January 2024, the University of Pittsburgh secured USD 557K in NIH funding to develop next-generation spinal fusion cages using metamaterials. These novel implants aim to overcome the limitations of traditional titanium or PEEK vertebrectomy cages by enhancing stiffness, load-sharing, and bone integration. The initiative marks the first in vivo trial of metamaterial orthopedic implants and could reshape spinal fusion outcomes.

Material Insights

PEEK (Polyether ether ketone) held the largest revenue market share of 46.99% in 2024 and is projected to grow at the fastest CAGR over the forecast period, supported by its favorable biomechanical properties and widespread clinical acceptance. The material's radiolucency allows clear post-operative imaging, while its elastic modulus closely mimics natural bone, reducing stress shielding and promoting fusion. In December 2023, Asian Spine Journal published a comprehensive review on material and design advancements in lumbar interbody fusion cages. The article highlighted a shift from static to expandable cage systems, alongside innovations in 3D printing, surface modifications, and emerging biomaterials such as tantalum and biodegradable polymers. PEEK was emphasized for its biomechanical compatibility and imaging advantages, though its bioinert surface remains a limitation being addressed through coatings and composites.

Titanium is the second largest segment in the market, driven by its superior strength, biocompatibility, and proven osseointegration capabilities. Surgeons prefer titanium cages in cases requiring robust structural support, particularly in patients with poor bone quality or multilevel fusion. Recent advancements in surface texturing and 3D-printed porous designs have improved bone in-growth and fusion rates, reinforcing titanium’s role in complex, high-load-bearing spinal procedures. In July 2023, Evolution Spine announced the first implantation of its E3D-A Integrated ALIF cage, a 3D-printed titanium device with a double lattice structure designed to promote bone ingrowth and ongrowth. The cage, used for anterior lumbar interbody fusion, offers multiple sizes and lordotic angles to match patient anatomy.

Regional Insights

North America dominated the lumbar spine cages market with the largest market share of 35.84% in 2024, driven by high procedural volumes, advanced spinal surgery infrastructure, and early adoption of minimally invasive fusion techniques. The National Spinal Cord Injury Statistical Center reported approximately 54 cases of TSCI per million people in 2023, resulting in around 18,000 new cases annually in the U.S. This increases the burden on the healthcare organization for the treatment, creating new opportunities for industry players and leading to substantial market growth in the country.

U.S. Lumbar Spine Cages Market Trends

The lumbar spine cages market in the U.S. continues to drive regional growth, supported by a high prevalence of degenerative spine disorders, strong clinical adoption of advanced cage technologies, and robust reimbursement frameworks. In August 2024, New York-Presbyterian performed New York’s first MIS lumbar fusion using AI-designed, 3D-printed interbody cages tailored to individual patient anatomy. The personalized implants aimed to improve fusion rates, reduce subsidence, and optimize spinal alignment.

Europe Lumbar Spine Cages Market Trends

The lumbar spine cages market in Europe held the second-largest market share in 2024 and is expected to grow at the fastest CAGR over the forecast period, supported by well-established healthcare systems, growing adoption of minimally invasive spinal fusion techniques, and an aging population with a rising incidence of lumbar spine conditions. In February 2024, a study published in Heliyon introduced a trigonometric model to predict neuroforaminal height following lumbar reconstruction with hyperlordotic cages. The research in Switzerland validated the model in four patients and showed that proper cage sizing can restore lordosis while preventing nerve root impingement.

Germany lumbar spine cages marketis growing steadily due to its strong orthopedic surgical infrastructure, high volume of spinal fusion procedures, and early clinical adoption of advanced cage materials such as PEEK and titanium. In July 2025, Paradigm Spine GmbH, a subsidiary of Xtant Medical, celebrated 20 years in spinal care innovation. The company announced two new lumbar spine cage products: the Fortilink-SC stand-alone interbody fusion device and a MIS extension for the HPS 2.0 System.

The lumbar spine cages market in the UK maintained a significant market share in 2024, driven by the increasing demand for minimally invasive spinal procedures, growing awareness of lumbar spine disorders, and strong integration of spinal implants within NHS and private healthcare settings. In July 2025, Paradigm Spine GmbH partnered with RIWOspine UK to distribute eFuse expandable interbody cages across the UK. The titanium cages are designed for TLIF, PLIF, and endoscopic lumbar procedures and offer in situ expansion, multiple lordotic angles, and surface technology.

Asia Pacific Lumbar Spine Cages Market Trends

The lumbar spine cages market in Asia Pacific is expected to grow at a significant CAGR over the forecast period, led by the rising incidence of degenerative spine conditions, expanding access to surgical care, and increasing adoption of advanced spinal implants in countries like China, India, and Japan. In June 2025, an article published in Applied Sciences focused on a study from Korea that introduced a novel expandable spinal cage for lumbar fusion. Designed to enable independent and continuous height and angle adjustments, the cage aims to improve surgical precision in minimally invasive procedures.

China lumbar spine cages marketaccounted for a significant share in Asia Pacific in 2024, fueled by a high volume of spinal procedures, increasing urban healthcare access, and strong government support for domestic medical device innovation. In June 2022, Beijing Fule received China NMPA clearance for its POHAE interbody fusion cage, marking the first such device in China made with PEEK-OPTIMA HA Enhanced polymer. Developed with Invibio, the cage incorporates hydroxyapatite for improved bone integration and fusion outcomes.

The lumbar spine cages market in Japanis anticipated to grow at a significant rate in the region, supported by its aging population, advanced surgical infrastructure, and early adoption of precision-guided and expandable cage technologies. In August 2022, according to Medicina, Japan introduced the concept of Minimally Invasive Spinal Treatment (MIST) as a broader framework beyond surgery, encompassing conservative care and advanced technologies. The review highlighted how Japan and other Asia-Pacific regions have advanced MISt procedures such as TLIF, PLIF, XLIF, and OLIF using lumbar spine cages to address spinal instability with reduced surgical trauma.

Latin America Lumbar Spine Cages Market Trends

The lumbar spine cages market in Latin America is expected to grow at a lucrative CAGR over the forecast period, supported by improving access to spinal care in urban centers, increasing adoption of fusion procedures, and gradual enhancement of clinical infrastructure in countries like Brazil and Argentina. In February 2025, according to Accelus, the FlareHawk Interbody Fusion System received regulatory approval in Brazil from ANVISA. The approval covers FlareHawk7 and FlareHawk9 expandable implants, designed to reduce subsidence and restore spinal alignment. This milestone expands Accelus’s footprint in Latin America's minimally invasive spine surgery market.

Brazil lumbar spine cages market is expanding due to a high concentration of spine specialists, rising procedural volumes in major cities, and government support for local production of medical devices. In November 2024, NovApproach Spine co-sponsored an international spine surgery training event in Orlando, focused on the OneLIF interbody fusion cage. The program included cadaveric labs and technique sessions on anterior lumbar approaches. Participating surgeons included attendees from Brazil.

Middle East & Africa Lumbar Spine Cages Market Trends

The lumbar spine cages market in the Middle East and Africa is witnessing rising demand due to an increasing incidence of spinal disorders, expanding healthcare infrastructure, and greater availability of advanced fusion technologies in high-income countries. In January 2025, Spineway marked its return to Arab Health by showcasing its ESP disc prosthesis and VEOS fixation systems while expanding distributor outreach across the Middle East and Asia. The company finalized two distribution agreements in the UAE and Saudi Arabia, reinforcing its presence in key spine surgery markets.

Saudi Arabia lumbar spine cages marketis expected to grow at a strong CAGR due to national investments in specialized surgical centers, rising awareness of spinal care, and strategic partnerships with global device manufacturers. In March 2024, an article published in Cureus discussed public understanding of back pain and spinal disorders in Western Saudi Arabia. Fewer than half of respondents could accurately define acute or chronic low back pain, and only 19.2% were aware of proper diagnostic approaches.

Key Lumbar Spine Cages Company Insights

Some of the major participants in the market include Medtronic, Stryker, and DePuy Synthes, which continue to lead through investments in expandable cage systems and navigation-enabled fusion platforms. Globus Medical and ATEC Spine are gaining traction by focusing on procedure-specific innovation and integrated surgical ecosystems. Meanwhile, Xenco Medical and Aurora Spine are carving out space with lightweight, single-use implants and disruptive delivery models for outpatient and ambulatory settings.

Key Lumbar Spine Cages Companies:

The following are the leading companies in the lumbar spine cages market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic

- DePuy Synthes (J&J)

- Stryker

- Zimmer Biomet

- Globus Medical

- ATEC Spine

- Aurora Spine

- Medacta International

- ORTHOFIX MEDICAL INC.

- XTANT MEDICAL HOLDINGS, INC.

- Xenco Medical

Recent Developments

-

In November 2024, Spineart announced reaching 100,000 sales of its Ti-LIFE Technology cages worldwide, marking a significant milestone in spine surgery innovation. These 3D-printed titanium cages, used in posterior, lateral, and cervical spinal fusion surgeries, promote rapid osseointegration without additional bone grafts.

-

In March 2024, Bioretec secured FDA Breakthrough Device designation for its RemeOs spinal interbody cage intended for cervical fusion procedures. The cage supports intervertebral height restoration using a proprietary magnesium-based hybrid material. The recognition underscores its potential to improve outcomes over traditional implant options.

-

In January 2023, Weill Cornell Medicine performed the first 3D-navigation-guided endoscopic lumbar fusion (TLIF) in New York City. This ultra-minimally invasive procedure uses a small incision and precise navigation to place expandable spinal cages, reducing tissue damage and recovery time. The surgery marks a significant advancement in spine surgery, offering safer, faster recovery options compared to traditional methods.

Lumbar Spine Cages Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.56 billion

Revenue forecast in 2033

USD 2.24 billion

Growth rate

CAGR of 4.63% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Case design, approach/technique (fusion type), reconstruction type, material, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Medtronic; DePuy Synthes (J&J); Stryker; Zimmer Biomet; Globus Medical; ATEC Spine; Aurora Spine; Medacta International; ORTHOFIX MEDICAL INC.; XTANT MEDICAL HOLDINGS, INC.; Xenco Medical

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Lumbar Spine Cages Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global lumbar spine cages market report based on cage design, approach/technique (fusion type), reconstruction type, material, and region:

-

Cage Design Outlook (Revenue, USD Million, 2021 - 2033)

-

Static Cages

-

Expandable Cages

-

-

Approach/Technique (Fusion Type) Outlook (Revenue, USD Million, 2021 - 2033)

-

TLIF (Transforaminal Lumbar Interbody Fusion) Cages

-

PLIF (Posterior Lumbar Interbody Fusion) Cages

-

ALIF (Anterior Lumbar Interbody Fusion) Cages

-

XLIF (Extreme Lateral Interbody Fusion) Cages

-

OLIF (Oblique Lumbar Interbody Fusion) Cages

-

-

Reconstruction Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Vertebrectomy Cages

-

Corpectomy Cages

-

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

PEEK (Polyether ether ketone)

-

Titanium

-

Carbon Fiber Reinforced Polymer (CFRP)

-

Other Biocompatible Materials

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global lumbar spine cages market size was estimated at USD 1.49 billion in 2024 and is expected to reach USD 1.56 billion in 2025.

b. The global lumbar spine cages market is expected to grow at a compound annual growth rate of 4.63% from 2025 to 2033 to reach USD 2.24 billion by 2033.

b. North America dominated the lumbar spine cages market, with a 35.84% market share in 2024, driven by high procedural volumes, advanced spinal surgery infrastructure, and early adoption of minimally invasive fusion techniques.

b. Some key players operating in the lumbar spine cages market include Medtronic, DePuy Synthes (J&J), Stryker, Zimmer Biomet, Globus Medical, ATEC Spine, Aurora Spine, Medacta International, ORTHOFIX MEDICAL INC., XTANT MEDICAL HOLDINGS, INC., and Xenco Medical.

b. Key factors driving the growth of lumbar spine cages include the growing prevalence of degenerative spine disorders and rising demand for minimally invasive fusion techniques.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.