- Home

- »

- Consumer F&B

- »

-

Global Macadamia Nut Market Share & Growth Report, 2030GVR Report cover

![Macadamia Nut Market Size, Share & Trends Report]()

Macadamia Nut Market (2023 - 2030) Size, Share & Trends Analysis Report By Processing (Organic, Conventional), By Product (Raw, Roasted, Coated), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-484-0

- Number of Report Pages: 81

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Macadamia Nut Market Summary

The global macadamia nut market size was estimated at USD 1.58 billion in 2022 and is projected to reach USD 3.57 billion by 2030, growing at a CAGR of 9.3% from 2023 to 2030. Growing public knowledge of the health advantages of nuts and dried fruits has been a key driver in the macadamia market's expansion.

Key Market Trends & Insights

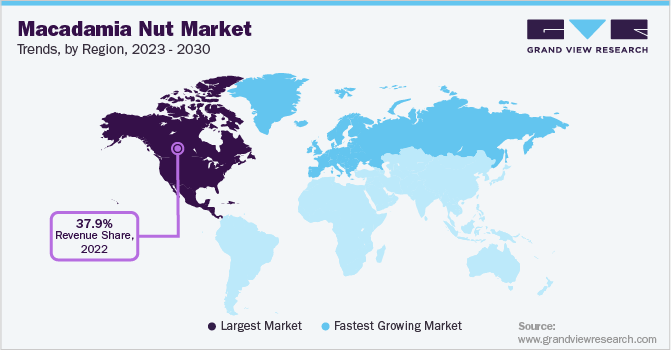

- North America dominated the market with a share of 37.9% in 2022.

- Europe is anticipated to have the largest CAGR of 10.3% over the forecast period of 2023 -2030.

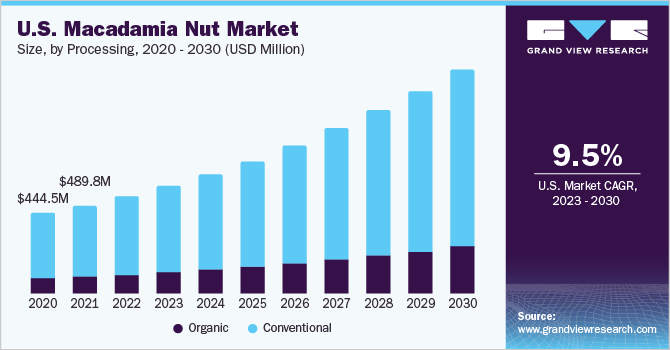

- By processing, the conventional macadamia nuts segment dominated the market in 2022 with a share of 80.2%.

- By distribution channel, the online distribution channel segment is expected to expand at a faster CAGR of 10.1% over the forecast period of 2023 - 2030.

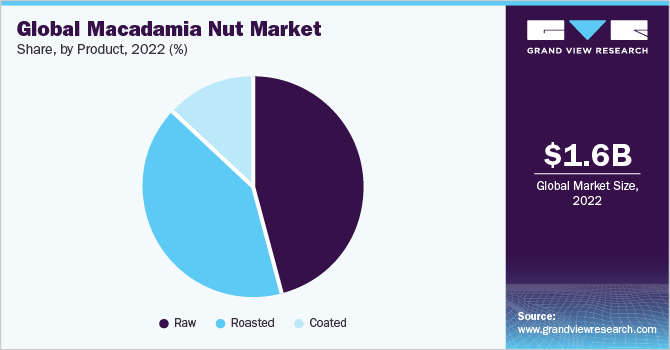

- By product, raw macadamia nut segment consumption dominated the market with a share of 46.2% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 1.58 Billion

- 2030 Projected Market Size: USD 3.57 Billion

- CAGR (2023-2030): 9.3%

- North America: Largest market in 2022

Macadamia nuts are also used to make macadamia oil, which has become popular among both businesses and consumers. In recent years, there has been a considerable increase in global demand for healthy and nutritious snacks, particularly among the younger generation and the working-class population. People are also migrating away from non-vegetarian protein sources and toward plant-based protein sources.

Without incorporating any animal protein, macadamia nuts are the greatest way to meet one's daily protein and fat requirements. This helps customers to stick to their vegan diets while avoiding lactose discomfort. For instance, according to a poll by Beijing-based think tank EO Intelligence in 2019, up to 71% of surveyed consumers stated snacks are equally important to their physical and psychological health. Freshness and healthy qualities are the top priorities for almost 85% of millennials, who are the primary buyers of healthy snacks in the market.

Macadamia kernels can be consumed fresh, cooked with, or processed into a number of goods. Roasted, roasted and salted, chocolate coated, honey-roasted, and wasabi-flavored are all popular options. They're also used in biscuits, pastries, and ice cream, and they're ground into a paste and cold pressed to make an oil. Consumers like oil-roasted macadamia nut kernels, but dry-roasted nuts are more popular because they only contain endogenous macadamia oil.

Processing Insights

The conventional macadamia nuts segment dominated the market in 2022 with a share of 80.2%.Conventional macadamia nuts are more affordable and widely available than organic or sustainably grown nuts, they also contain higher levels of pesticide residues and other chemical additives. They also have a longer shelf life than the sustainably grown nuts because they are treated with preservatives or other chemicals to prevent spoilage

The organic processing of the macadamia nuts is anticipated to dominate the market with a CAGR of 9.9% over the forecast period of 2023 - 2030. Organic macadamia nuts contain higher levels of certain nutrients, such as vitamin E, magnesium, and antioxidants, because organic farming practices can help promote healthier soil, which can lead to higher nutrient content in the nuts. Owing of this, consumers increasingly favor these nuts.

Distribution Channel Insights

The online distribution channel is expected to expand at a faster CAGR of 10.1% over the forecast period of 2023 - 2030. Walmart, Kroger, Amazon, Alibaba Group, Instacart, FreshDirect, ShopFoodEx, Tesco, Sainsbury's, and Asda Stores Limited are just a few of the major e-commerce portals that sell macadamia nuts.Several value-added services given by e-retailers, such as discounted prices, cash-on-delivery, and cash backs, are predicted to boost the online channel's growth in the future years.

The offline sector is dominating the market with a share of 80.1% in 2022. People prefer to buy consumer goods, supermarkets, food products, and nuts offline where they can directly verify the product quality. Also, the segment expansion over the past few years is probably being driven by simple access to and searching for different nuts items through stores. Due to expanded global distribution channel networks, offline channels are anticipated to continue to dominate during the forecast period.

Product Insights

Raw macadamia nut consumption dominated the market with a share of 46.2% in 2022. The health benefits of macadamia nuts are propelling their widespread adoption as of their high fat content, macadamias have become increasingly popular. Macadamia nuts have the highest fat content of any nut, at 20.9 grams per pound, which is why they were once thought to be unhealthy. In actuality, the bulk of that fat is cholesterol-free and contains palmitoleic acid, which can assist your body maintain appropriate insulin levels and enhance your metabolism.

The coated macadamia nuts segment is anticipated to have the highest CAGR of 9.9% over the forecast period of 2023 - 2030. The coated macadamia nuts preferred as they are coated with a variety of different ingredients to add flavor and texture. Some common coatings for macadamia nuts include chocolate, caramel, honey, coconut, and spices such as cinnamon or ginger.

Regional Insights

North America dominated the market with a share of 37.9% in 2022. The rising concern about health among consumers is boosting the industry's growth over the upcoming years. Moreover, the region is expected to grow with the most accelerated growth rate in the regional segment of the market in the forecast period owing to the growing disposable income of the people and rising population.

Europe is anticipated to have the largest CAGR of 10.3% over the forecast period of 2023 -2030. The nuts are increasingly used as ice cream topping in the region. The increase in the consumption is linked to the health benefits and appealing & distinctive flavour of macadamia nuts. Also, the market expansion in Europe is attributed to the increasing use of macadamia nuts in the food processing sector.

Key Companies & Market Share Insights

The market for macadamia nuts is highly competitive, with a range of companies offering various products and solutions for pet anxiety and stress. Many big players are increasing their focus towards new product launches, partnerships, and expansion into new markets to compete in the effectively.

-

For instance, in April 2022, Golden Macadamias South African cooperative business invested in TOMRA 5C sorting machine with Biometric Signature Identification technology. It machine is a high-end optical sorting device for nut and dried fruit applications which helps in attaining the highest product quality with large production volumes of macadamias.

-

For instance, in March 2022, Milkadamia Company launched a new macadamia nut oil milk product at Natural Products Expo West. This milk is available in salted caramel and pumpkin pie varieties.

Some of the key players in the macadamia nut market include:

-

Hawaiian Host Group

-

Health and Plant Protein Group Limited

-

Hamakua Macadamia Nut Company

-

Mac's Nut Co. of Hawaii

-

North Shore Macadamia Nut Company

-

Superior Nut Company, Inc

-

Macadamia.US

-

Makua Coffee

-

T.M. Ward Coffee Company

Macadamia Nut Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.75 billion

Revenue forecast in 2030

USD 3.57 billion

Growth rate

CAGR of 9.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Processing, product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Rest of the World

Country scope

U.S.; Canada; U.K.; Germany; France; China; India; Japan; Brazil

Key companies profiled

Hawaiian Host Group; Health and Plant Protein Group Limited; Hamakua Macadamia Nut Company; Mac's Nut Co. of Hawaii; North Shore Macadamia Nut Company; Superior Nut Company, Inc.; Macadamia.US; Makua Coffee; T.M. Ward Coffee Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, ands segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Macadamia Nut Market Report Segmentation

This report forecasts revenue growth at global, regional, country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global macadamia nut market report on the basis of processing, product, distribution channel, and region:

-

Processing Outlook (Revenue, USD Million, 2017 - 2030)

-

Conventional

-

Organic

-

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Raw

-

Roasted

-

Coated

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

Australia

-

-

Rest of the world

-

Brazil

-

-

Frequently Asked Questions About This Report

b. The global macadamia nuts market was estimated at USD 1.58 billion in 2022 and is expected to reach USD 1.75 billion in 2023.

b. The global macadamia nuts market is expected to grow at a compound annual growth rate of 9.3% from 2023 to 2030 to reach USD 3.57 billion by 2030.

b. North America dominated the macadamia nuts market with a share of around 37.9% in 2022. This is owing to the people becoming more aware of the benefits of healthy snacks.

b. Some of the key players operating in the macadamia nuts market include Hawaiian Host Group, Health and Plant Protein Group Limited, Hamakua Macadamia Nut Company, Mac's Nut Co. of Hawaii, North Shore Macadamia Nut Company, Superior Nut Company, Inc, Macadamia.US, Makua Coffee, T.M. Ward Coffee Company.

b. Key factors that are driving the macadamia nuts market growth are the government initiatives in supporting the macadamia protection and trade and its widespread application in various sectors like, health, desserts, cosmetics and more.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.