- Home

- »

- Advanced Interior Materials

- »

-

Machine Tools Market Size, Share & Trends Report, 2030GVR Report cover

![Machine Tools Market Size, Share & Trends Report]()

Machine Tools Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Metal Cutting, Metal Forming), By Technology (Computer Numerical Control (CNC), Conventional), By End Use (Automotive, Mechanical Engineering), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-841-1

- Number of Report Pages: 152

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Machine Tools Market Summary

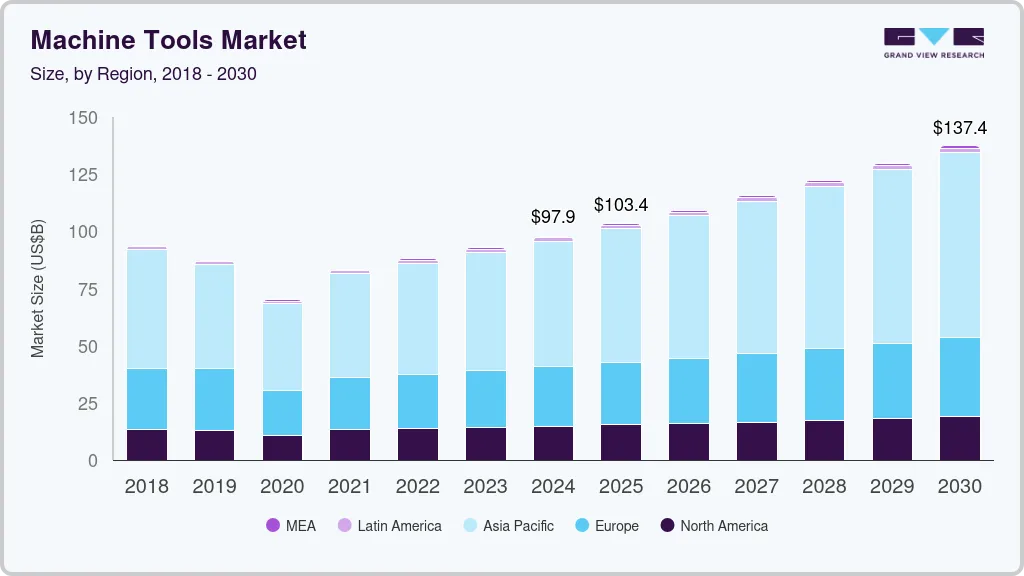

The global machine tools market size was estimated at USD 97,927.5 million in 2024 and is projected to reach USD 137,426.8 million by 2030, growing at a CAGR of 7.0% from 2025 to 2030. The driving factory for the industry includes advancements in technologies for machine tools, such as multi-axis arms & robotics, as well as the growth in the manufacturing industry.

Key Market Trends & Insights

- The machine tools market in the Asia Pacific region dominated the market and accounted for the largest revenue share, over 56.0%, in 2024.

- China machine tools market dominated the global market in 2024 accounting for 59.3% of the market share.

- Based on type, the metal cutting segment is expected to grow at a significant CAGR of 7.2% from 2025 to 2030 in terms of revenue.

- Based on technology, the Computer Numerical Control (CNC) segment is expected to grow at a rapid CAGR of 7.2% from 2025 to 2030 in terms of revenue.

- Based on end use, the electrical industry segment is expected to grow at a significant CAGR of 8.9% from 2025 to 2030 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 97,927.5 Million

- 2030 Projected Market Size: USD 137,426.8 Million

- CAGR (2025-2030): 7.0%

- Asia Pacific: Largest market in 2024

Apart from this, the growing focus on augmenting productivity and reducing downtime are further fueling the market’s growth. Reducing operating costs has been a major challenge for business owners worldwide. Moreover, it has been observed that it is relatively easy to lower the manufacturing costs than to increase the price of the end product to increase profit margins in the manufacturing industry.

Time is one of the key factors considered during manufacturing, and the number of jobs produced in the stipulated amount of time determines the productivity of the plant. The strong emphasis on reducing operating costs is driving the demand for machine tools.

Drivers, Opportunities & Restraints

Machine tools are used across various industries and industry verticals, including automobile, aerospace, and others, to manufacture various components with precision and speed while ensuring adequate flexibility. Aerospace companies use CNC machine tools to manufacture parts, such as fuel access panels, landing gears, engine mounts, turbines, and wheels, among others, as well as lightweight parts with tight tolerance.Growing demand for air travel, which is subsequently driving the need for producing more efficient aircraft, bodes well for the growth of the machine tools market.

A new CNC machinery often demands higher initial capital investments. The capital cost of new CNC machinery varies from hundreds of thousands of dollars to millions of dollars. Moreover, these machines can be high-risk, high-value investments that often require decision-makers to access numerous criteria before purchasing. Thus, the upper management in the CNC machine in the organization market considers the total cost of ownership (TCO) before making the purchase decision, a factor restraining market growth.

Industry 4.0 is actively promoting digital transformation across the automotive sector, involving OEMs, dealers, and suppliers, which positively influences the increasing demand for CNC machine tools. The motorsport industry, in particular, is utilizing CNC machine tools to shorten manufacturing times and ensure flawless component production. As a result, various racing car manufacturers are collaborating with CNC machine tool providers to produce precision-engineered parts. These trends create valuable opportunities for market growth in the forecast period.

Type Insights

“The metal cutting segment is expected to grow at a significant CAGR of 7.2% from 2025 to 2030 in terms of revenue”

Metal cutting machines are widely utilized in many end-use sectors such as automotive, mechanical engineering, metal working, and aerospace, to produce completed products with the necessary geometry by cutting various types of ferrous and non-ferrous metals. It offers the finished goods a variety of benefits, such as surface texture or finish, greater dimensional precision, complex shape, and needed size. Market expansion is expected to be benefitted by the increasing demand for sophisticated automated metal-cutting equipment.

The metal forming segment accounted for market share of 22.7% of the market share in 2024. Metal forming machines are used in a variety of industries including aerospace, automobile, appliance, energy, construction, metal building products, electronics, and others. Metal forming machines are used in a variety of procedures, including shearing, bending, pressing, shaping, and forming. The use of press brake machinery is expected to drive the segment. This is due to the widespread usage of press brake metal forming machines as sheet bending tools in industries, such as agriculture, aerospace, shipbuilding, automotive, and petroleum machinery.

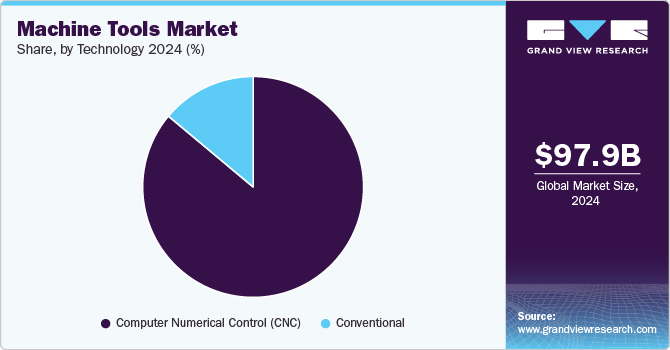

Technology Insights

"The demand for the Computer Numerical Control (CNC) segment is expected to grow at a rapid CAGR of 7.2% from 2025 to 2030 in terms of revenue”

The use of CNCs as milling machines, lathes, abrasive jet cutters, laser cutters, press brakes, punch presses, and other industrial instruments has been expanding quickly with the development of computers. Various technological advancements are taking place in the manufacturing industry to meet the rising demand from various end-user industries such as the automobile, aerospace, and electrical industry, among others. Manufacturers are adopting AI and advanced robotics along with other technologies, to streamline their operations. These factors associated with CNC machines are expected to bolster the segment.

The conventional segment held a 13.9% market share in 2024. For uncertain operations, conventional machining is typically more affordable, effective, and efficient. Conventional machining is highly suitable for single parts since it is challenging to guarantee a high level of part consistency when human intervention is involved. These factors are expected to drive the segment’s growth.

End Use Insights

“The electrical industry segment is expected to grow at a significant CAGR of 8.9% from 2025 to 2030 in terms of revenue”

The electrical and electronics industry is one of the world’s largest industries. It includes a broad range of goods, from bulky consumer electronics to tiny electrical parts. The increasingly fierce competition in the semiconductor industry demands for smaller, more precise package designs, thereby driving up the demand for machine tools market over the forecast period.

The automotive segment dominated the market in 2024, accounting for a market share of 41.7%. The usage of machine tools in the production of automotive components has increased significantly. Although the automotive industry employs a variety of manufacturing methods, machine tools are frequently utilized for metal cutting and the production of small machine parts owing to advantages including increased accuracy, dependability, and efficiency. Thereby, the increased production of more efficient auto parts has increased the demand for machine tools.

Regional Insights

North America is the third-largest electric vehicle market in the world. Factors such as the presence of well-established automobile manufacturers such as General Motors, Nissan, Tesla, and Ford, suitable infrastructures for producing electric vehicles, and high disposable income are expected to fuel the growth of the electric vehicle market in North America over the forecast period, which in turn is likely to augment the growth of machine tools market during the projected timeframe.

U.S. Machine Tools Market Trends

The machine market in the U.S. accounted for 76.6% of the North America market share in 2024. Factors such as easy access to new and advanced technologies in the EV industry, presence of innovative processing capabilities, availability of a highly skilled workforce, and increased R&D initiatives have boosted the penetration of electric vehicles in the U.S. which is likely to anticipate machine tools market growth. Moreover, favorable government regulations and initiatives in the form of tax rebates and subsidies have further fueled the demand for electric vehicles in the U.S. Growing automotive sector in the country is projected to have a positive impact on the machine tools market over the forecast period.

Asia Pacific Machine Tools Market Trends

Emerging economies such as China, India, and Japan are the key countries driving the development of the oil & gas, automotive, aviation, and building & construction industries in this region. The competition among Chinese capital markets and a few other Asian economies is generating lucrative growth opportunities for the industries, which has, in turn, created a favorable environment for investments in the machine tools market.

The machine tools market in India is expected to expand at a rapid CAGR of 8.9% over the forecast period. Expanding population and urbanization are likely to drive infrastructural development projects in India. Continuing economic development in the country is expected to trigger the growth of the construction market. The Indian construction industry is expected to exhibit significant growth owing to the high level of investments in energy projects under programs such as the National Skill Development Mission (NMSD), Atal Mission for Rejuvenation and Urban Transformation (AMRUT), 100 Smart Cities Mission, Make in India, and Power for all (PFA), which, in turn, are anticipated to have a positive impact on the machine tools demand.

China machine tools market dominated the global market in 2024 accounting for 59.3% of the market share. China is anticipated to emerge as one of the most promising markets in Asia Pacific due to favorable government support to promote investments in manufacturing sectors. Population growth, rapid urbanization, and rising disposable incomes of the population have played an important role in developing the automobile and construction sectors in the country. The economy is driven by significant investments in infrastructure, evolving business models, and a growing middle-class population. Hence, growth opportunities for the aerospace industry in the country are expected to positively influence the demand for machine tools.

Europe Machine Tools Market Trends

Europe is one of the largest producers of automobiles across the globe and attracts maximum foreign direct investment (FDI) in the automotive sector. Process innovation, improving R&D, and expansion of automobile production in countries such as Germany, the UK, and France are expected to fuel the growth of the automotive sector over the forecast period. Furthermore, the region is marked by the presence of global automobile manufacturers including Volkswagen, BMW, and Mercedes, which focus on increasing the production volume yearly, thereby strengthening the demand for machine tools in the region.

The machine tools market in Germany is expected to expand at a considerable CAGR of 6.3% over the forecast period. Automotive industry in Germany is one of the largest in Europe, in terms of revenue as well as volume, due to the specific and innovative nature of car manufacturers and suppliers. The country is marked by the presence of over 41 OEMs, which account for the largest concentration of OEM plants in the region. The growing automotive industry in Germany will drive the demand for machine tools in this region.

Italy machine tools market accounted for 20.2% of the market share in 2024. Increasing measures to propel the French electrical industry will raise demand for machine tools in the region. For instance, the French government published its electronics strategy as part of the France 2030 investment plan, with the goal of giving a greater dimension to the development of local technology and manufacturing locations. These factors are expected to augment market growth over the forecast period.

Middle East Machine Tools Market Trends

Major oil-producing economies such as the UAE and Saudi Arabia are shifting their focus toward the manufacturing of electrical & electronic goods, packaging products, and automobiles and their components. Under Vision 2030, Saudi Arabia plans to make substantial investments in clean energy plants and infrastructural development projects to create a favorable environment for the growth of electric vehicles market in the country, thereby driving market growth.

Latin America Machine Tools Market Trends

The governments of different countries in Latin America are focusing on the development of sustainable infrastructure related to railways, urban mass transits, energy and oil and gas production, renewable energy generation, etc. to meet the growing population's demand. This, in turn, fuels the demand for machine tools, which are used in end use industry applications in the region.

Key Machine Tools Company Insights

Some of the key players operating in the market include ENTACT and WSP among Massaging & Marinating.

-

Amada Machine Tools Co., Ltd. operates in North America, Latin America, Europe, the Middle East & Africa, and Asia Pacific. The company operates through its four major divisions, namely sheet metal, cutting and grinding, micro welding, and press automation solutions. Sheet Metal division is an integration of cutting, drilling, bending, and welding processes and provides sheet metal fabrication machines. It has a production system with production bases in Japan, China, North America, and Europe. The company offers engineering and manufacturing of advanced metalworking solutions.

-

CHIRON GROUP SE operates through brands such as CHIRON, STAMA, retrofit brand CMS, and FACTORY5 associated with the new machines. The company has a global presence, with development and production sites, service and sales subsidiaries, and sales agencies across the world.The company serves key customers from sectors such as automotive, aerospace, medical technology, medical engineering, precision technology, and tool manufacturing.

Key Machine Tools Companies:

The following are the leading companies in the machine tools market. These companies collectively hold the largest market share and dictate industry trends.

- Amada Machine Tools Co., Ltd.

- CHIRON GROUP SE

- DMG MORI. CO., LTD.

- DN Solutions

- Georg Fischer Ltd.

- HYUNDAI WIA CORP

- JTEKT Corporation

- Komatsu Ltd

- Makino Inc.

- Okuma Corporation

- Hurco Companies, Inc.

- Dalian Machine Tool Group (DMTG) Corporation

- Amera Seiki

- Haas Automation, Inc

- Datron AG

Recent Developments

-

In September 2022, Makino Inc. unveiled the Slim3n three-axis vertical machining center, a compact and high-performance solution for part and component processes needing turnkey & automation solutions. With this project, Slim3n broadens the range of machines that Makinuses as the basis for its turnkey and automation solutions for industries like automotive, die casting, and medical, among others.

-

In November 2023, Amada Machine Tools Co., Ltd. announced it is launching a new entity, AMADA Service Europe, as part of its strategic business plans, effective April 2024. This initiative aims to enhance customer service across Europe by providing consistent, high-quality support for sheet metal machinery. Headquartered in Paris, the new company will not alter existing local services but plans to unify and elevate service standards throughout the continent. Key objectives include improving technician skills, spare parts delivery, and integrating advanced digital services.

Machine Tools Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,03,416.5 million

Revenue forecast in 2030

USD 137,426.8 million

Growth rate

CAGR of 7.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Type, technology, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; Italy; Switzerland; Spain; China; India; Japan; South Korea; Taiwan; Brazil; Argentina; South Africa; and Saudi Arabia.

Key companies profiled

Amada Machine Tools Co., Ltd.; CHIRON GROUP SE; DMG MORI. CO., LTD.; DN Solutions; Georg Fischer Ltd.; HYUNDAI WIA CORP; JTEKT Corporation; Komatsu Ltd; Makino Inc.; Okuma Corporation; Hurco Companies, Inc. ; Dalian Machine Tool Group (DMTG) Corporation; Amera Seiki; Haas Automation, Inc; and Datron AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Machine Tools Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global machine tools market based on type, technology, end use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Metal Cutting

-

Machining Centers

-

Turning Machines

-

Grinding Machines

-

Milling Machines

-

Eroding machines

-

Others

-

-

Metal Forming

-

Bending Machines

-

Presses

-

Punching Machines

-

Others

-

-

-

Technology (Revenue, USD Million, 2018 - 2030)

-

Computer Numerical Control (CNC)

-

Conventional

-

-

End Use (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Mechanical Engineering

-

Metal Working

-

Aerospace

-

Electrical industry

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Switzerland

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Taiwan

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global machine tools market size was estimated at USD 97,927.5 million in 2024 and is expected to reach USD 103,416.5 million in 2025.

b. The global machine tools market, in terms of revenue, is expected to grow at a compound annual growth rate of 7.0% from 2025 to 2030 to reach USD 137,426.8 million by 2030.

b. The automotive segment dominated the market in 2024 accounting for 41.9% of overall revenue share. The usage of machine tools in the production of automotive components has increased significantly. Machine tools are frequently utilized for metal cutting and the production of small machine parts owing to advantages including increased accuracy, dependability, and efficiency.

b. Some of the key players operating in the machine tools market are Amada Machine Tools Co., Ltd., CHIRON GROUP SE, DMG MORI. CO., LTD., DN Solutions, Georg Fischer Ltd., HYUNDAI WIA CORP, JTEKT Corporation, Komatsu Ltd, Makino Inc., Okuma Corporation, Hurco Companies, Inc. , Dalian Machine Tool Group (DMTG) Corporation, Amera Seiki, Haas Automation, Inc, and Datron AG.

b. The machine tools market is experiencing significant growth driven by increasing demand from end-use industries, technological advancements, and the necessity to reduce operational costs. Industries are seeking more efficient manufacturing processes, leading to higher investments in advanced machine tools that enhance precision and productivity. Additionally, innovations in automation and smart technologies are enabling businesses to streamline operations, further propelling market expansion.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.