- Home

- »

- Advanced Interior Materials

- »

-

Magnetic Materials Market Size, Industry Report, 2030GVR Report cover

![Magnetic Materials Market Size, Share & Trends Report]()

Magnetic Materials Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Hard/Permanent, Semi-hard, Soft), By Application (Automotive & Transportation, Electronics, Energy), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-972-2

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Magnetic Materials Market Summary

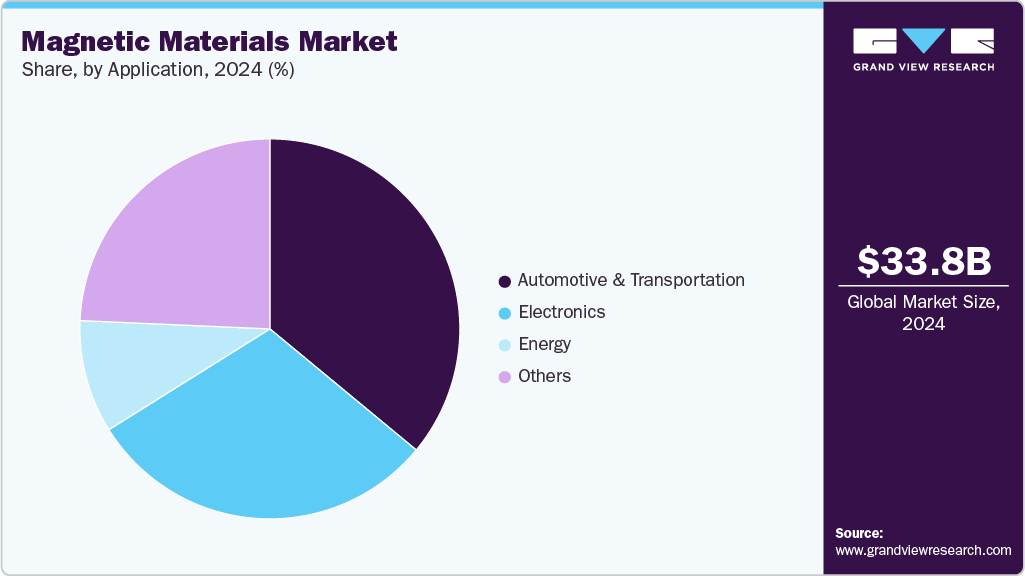

The global magnetic materials market size was estimated at USD 33.78 billion in 2024 and is projected reach USD 48.17 billion by 2030, growing at a CAGR of 6.3% from 2025 to 2030. The growth of the global magnetic materials industry is predominantly driven by the automotive sector, particularly the surge in electric vehicle (EV) production and adoption.

Key Market Trends & Insights

- Asia Pacific dominated the magnetic materials market with the largest revenue share, 66.3% in 2024.

- The magnetic materials market in the U.S. accounted for the largest market revenue share in North America in 2024.

- By type, the hard or permanent segment accounted for the largest market revenue share in 2024.

- By application, the automotive and transportation segment led the market with the largest revenue share of 36.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 33.78 Billion

- 2030 Projected Market Size: USD 48.17 Billion

- CAGR (2025-2030): 6.3%

- Asia Pacific: Largest market in 2024

The development is anticipated to be driven by increasing demand for magnetic materials in the automotive and electronic industries. Magnetic materials are used in motors, transformer cores, electromagnets, generators, microphones, speakers, and magnetic separators. These products further find applications in power conversion from electrical to mechanical, signal transfer, power adaptation, magnetic field screening, data storage, analog & digital, permanent magnets, and quantum devices.Permanent magnets like neodymium-iron-boron (NdFeB) are essential components in EV motors, sensors, actuators, and powertrains, and they are integral to electric vehicles' performance and efficiency. Stringent emission regulations and the automotive industry's transition towards electrification and advanced driver-assistance systems (ADAS) further fuel this trend.

The U.S. government's target to achieve net-zero carbon emissions by 2050 is expected to boost the market growth for permanent magnets. Demand for these magnets is projected to increase in the U.S. and globally, as they are widely used in industrial and consumer electronics, particularly in drive systems and advanced motors.

With rising investments in the energy sector, the need for permanent magnets is anticipated to grow strongly. They play a crucial role in clean energy applications, including wind turbine generators, hybrid electric vehicles, and traction motors in batteries. However, the heavy reliance on imports for these materials outside the U.S. is likely to limit market growth in the short term.

The U.S. energy sector has faced significant challenges recently, including cancellations and delays in installation projects due to the global health crisis and retroactive rent bills. This situation has resulted in multi-million-dollar losses for the industry.

Drivers, Opportunities & Restraints

The magnetic materials industry is witnessing accelerated growth, primarily propelled by the expanding electric vehicle (EV) sector, where permanent magnets serve as essential components in high-efficiency motors and powertrains. Concurrently, increasing investments in renewable energy infrastructure, particularly wind and solar, are driving demand for advanced magnetic materials utilized in generators, inverters, and related technologies. The burgeoning electronics industry, underpinned by rising demand for consumer devices, data storage solutions, and industrial automation, also plays a pivotal role in market expansion. Moreover, stringent environmental regulations to reduce emissions foster the integration of magnetic materials into sustainable and energy-efficient applications.

Emerging markets present substantial growth opportunities, supported by government-led initiatives and subsidies that encourage domestic production of electronic components and the development of clean energy systems. The industry is also being shaped by the growing emphasis on miniaturization and the need for high-performance materials in sectors such as consumer electronics and medical devices, which create fertile ground for innovation. In addition, technological advancements, such as developing rare-earth-free magnetic materials, address critical challenges related to supply chain security and cost efficiency. The potential for application in high-growth fields like aerospace, advanced robotics, and next-generation computing further underscores the market's strategic importance and future potential.

The magnetic materials industry faces restraints primarily from fluctuating prices and limited availability of rare-earth elements, which are essential for high-performance permanent magnets. Environmental concerns and regulatory restrictions related to the mining and processing of these materials pose challenges. Moreover, high manufacturing costs and complex processing techniques can limit adoption, especially in cost-sensitive applications. Competition from alternative technologies and materials that offer similar performance without reliance on rare-earth elements also restrains market growth.

Type Insights & Trends

The hard or permanent segment accounted for the largest market revenue share in 2024. These materials have smaller areas enclosed by their hysteric loop. These materials have low coercivity and remnant magnetization and high initial permeability. Also, eddy current and hysteresis losses are low in these materials.

The soft segment is anticipated to grow at the fastest CAGR from 2025 to 2030. These materials have high coercively, high anisotropy, large magnetic fields, and large hysteresis loop areas. They cannot be easily magnetized and can be manufactured by heating and sudden cooling. Some of these materials are NdFeB, SmCo 2:17, SmCo 1.:5, Ferrite, Alnico 8, and Alnico 5-7, among others.

The demand for permanent magnets is projected to be driven by rising penetration of renewable energy, including wind & solar, growing needs for power distribution, and thus demanding motors in various applications. These magnets are used in turbine generators for wind energy to improve their efficiency and reliability and reduce maintenance costs.

Application Insights & Trends

The automotive and transportation segment led the market with the largest revenue share of 36.0% in 2024, and the trend is expected to continue during the forecast period. Investments in this sector will likely fuel the demand for it over the coming years. The push for cleaner, more energy-efficient transportation solutions is prompting automakers to increase investments in research and development, further accelerating demand for these critical components.

For instance, in January 2025, Tata Motors is set to launch Avinya as an all-electric luxury brand positioned above its existing Tata lineup and below Land Rover. The connection to iron casting lies in the manufacturing and structural requirements of premium electric vehicles like Avinya. While the EMA platform emphasizes lightweight materials and advanced battery integration, iron casting remains crucial for specific components that require high strength and durability, such as subframes, suspension mounts, and specific drivetrain elements.

The industrial segment, including factories and manufacturing plants, is expected to grow strongly due to the increasing adoption of automation and the need for a reliable power supply to support continuous operations. The residential segment also expands, particularly in emerging markets where electrification initiatives drive demand for low-voltage AIS to support household power needs.

The global clean energy investment surpassed USD 2 trillion in 2024, with substantial allocations directed towards wind and solar energy projects. For instance, the United States Senate's clean energy investment bill, passed in July 2021, allocated USD 500 billion to modernize energy infrastructure, including investments in energy generation and electric vehicles. This initiative is projected to significantly boost the demand for magnetic materials, essential components in wind turbines and electric vehicle motors.

India's electronics manufacturing sector has witnessed remarkable growth, with projections indicating a 15% increase, reaching a value of USD 115 billion in 2024. This expansion is attributed to enhanced local value addition and product development. The government's Production-Linked Incentive (PLI) schemes and initiatives like 'Make in India' have attracted significant investments, further bolstering the sector's growth .

Regional Insights

The magnetic materials market in North America is experiencing robust growth, driven by technological, economic, and policy-related factors. A major catalyst is the rapid expansion of the electric vehicle (EV) industry, which relies heavily on high-performance magnetic materials for motors and drivetrains. In addition, the increasing shift toward renewable energy sources, particularly wind power, has intensified the demand for magnetic materials in turbines and generators.

U.S. Magnetic Materials Market Trends

The magnetic materials market in the U.S. accounted for the largest market revenue share in North America in 2024, driven by several key factors. The increasing demand for electric vehicles (EVs) and renewable energy sources, such as wind and solar power, has led to a surge in the need for high-performance magnetic materials like neodymium-iron-boron (NdFeB) magnets. These materials are essential in applications ranging from EV motors to wind turbine generators. In addition, advancements in electronics and consumer goods, including smartphones and medical devices, fuel the demand for compact and efficient magnetic components.

Asia Pacific Magnetic Materials Market Trends

Asia Pacific dominated the magnetic materials market with the largest revenue share, 66.3% in 2024. The high-volume production of the automotive and electronics industries in China, India, and Japan is projected to push the demand for magnetic materials in the region. For instance, in 2024, as per the International Organization of Motor Vehicle Manufacturers (OICA), China produced 33.5% of the world's automotive production.

Europe Magnetic Materials Market Trends

The magnetic materials market in Europe is likely to observe lucrative growth over the coming years. As reported by the government, in 2024, Europe invested approximately USD 46,130 million in the wind energy sector, enabling the addition of 25 gigawatts (GW) of new energy capacity. This substantial investment reflects Europe's strong dedication to expanding its renewable energy infrastructure and advancing toward its climate and sustainability objectives.

Key Magnetic Materials Company Insights

Some of the key players operating in the market include Daido Steel Co. Ltd., Hitachi Metals Ltd., and TDK Corp.

-

Daido Steel Co. Ltd. is a prominent Japanese manufacturer known for its high-performance steel products, including advanced magnetic materials such as bonded magnets and permalloy foils. These materials are widely used in electric vehicle motors, transformers, and magnetic sensors, showcasing Daido Steel’s commitment to innovation in magnetic alloys.

-

Hitachi Metals Ltd., now operating under Proterial Ltd., specializes in producing high-grade magnetic materials like Neodymium-Iron-Boron (NdFeB) magnets under its Neomax brand, essential for electric vehicles and industrial applications. The company also develops soft magnetic materials such as Finemet and magnetic slot wedges to enhance motor efficiency.

-

TDK Corporation, a leading global electronics company, offers a broad portfolio of magnetic materials, including ferrite magnets and magnetic sensors used across automotive, industrial, and consumer electronics sectors. TDK is known for cutting-edge innovations like its magnetic tunnel junction (MTJ) spin photo detectors and next-generation solid-state batteries, positioning itself at the forefront of magnetic and electronic component technology.

Key Magnetic Materials Companies:

The following are the leading companies in the magnetic material market. These companies collectively hold the largest market share and dictate industry trends.

- Daido Steel Co. Ltd.

- Hitachi Metals Ltd.

- TDK Corp

- Shin-Etsu Chemical Co. Ltd.

- Molycorp Magnequench

- Lynas Corporation Ltd.

- Arnold Magnetic Technologies Corporation

- Electron Energy Corporation

- Tengam Engineering, Inc

Recent Developments

-

In October 2024, Arnold inaugurated a 26,250-square-foot manufacturing facility in Amata City, Chonburi, Thailand. This facility produces permanent magnet assemblies, including rotors, stators, and motors, to meet growing demand in the Asia-Pacific region.

-

Shin-Etsu Chemical announced plans to build a new semiconductor materials plant in Isesaki, Gunma Prefecture, Japan, with an investment of approximately ¥83 billion (about USD 545 million). The facility will produce photoresists and other semiconductor materials, with operations expected to commence by 2026.

-

TDK is doubling the production capacity of its Tunnel Magneto-Resistance (TMR) magnetic sensors at the Asama Techno Factory in Saku-shi, Nagano, Japan. This expansion will be completed by mid-2025, addressing the increasing demand from the automotive, consumer, and industrial sectors.

Magnetic Materials Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 35.51 billion

Revenue forecast in 2030

USD 48.17 billion

Growth rate

CAGR of 6.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative Units

Volume in Kilotons, Revenue in USD million/billion, CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South Africa; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; Italy; Russia; Turkey; India; China; Japan; South Korea; Brazil; South Africa

Key companies profiled

Daido Steel Co. Ltd.; Hitachi Metals Ltd.; TDK Corp; Shin-Etsu Chemical Co. Ltd.; Molycorp Magnequench; Lynas Corporation Ltd.; Arnold Magnetic Technologies Corporation; Electron Energy Corporation; Tengam Engineering, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

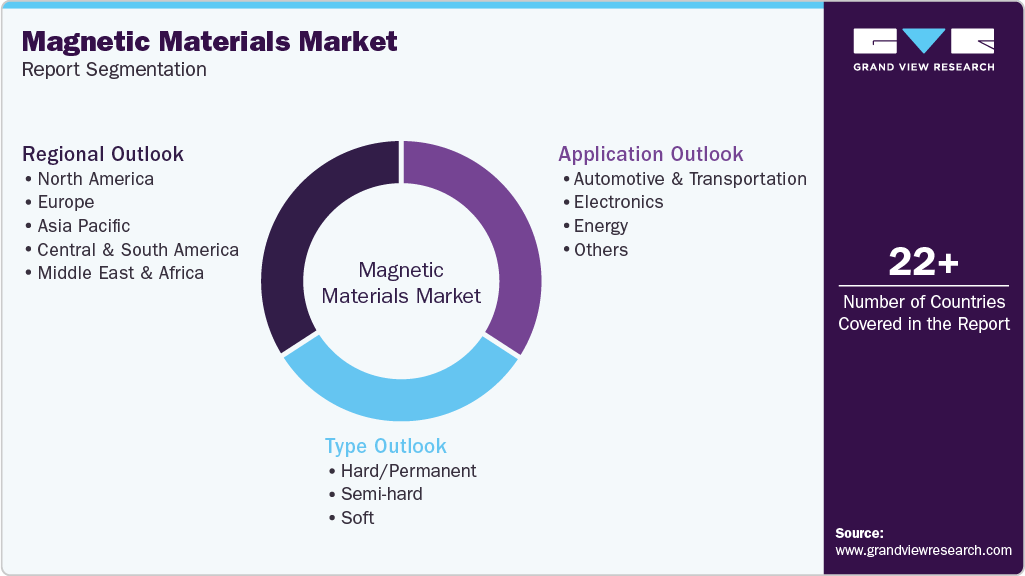

Global Magnetic Materials Market Report Segmentation

This report forecasts revenue growth at the global, country, and regional levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global magnetic materials market report based on the type, application, and region.

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Hard/Permanent

-

Semi-hard

-

Soft

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Automotive & Transportation

-

Electronics

-

Energy

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Italy

-

Russia

-

Turkey

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global magnetic materials market size was estimated at USD 33.78 billion in 2024 and is expected to reach USD 35.51 billion in 2025.

b. The global magnetic materials market is expected to grow at a compound annual growth rate of 6.3% from 2025 to 2030 to reach USD 48.17 billion by 2030.

b. Soft magnetic materials dominated the magnetic materials market in 2024 with a volume share of more than 46.0%, and this trend is expected to continue during the forecast period.

b. Some of the key vendors in the global magnetic materials market are Daido Steel Co. Ltd., Hitachi Metals Ltd., TDK Corp, Shin-Etsu Chemical Co. Ltd., Molycorp Magnequench, Lynas Corporation Ltd., Arnold Magnetic Technologies Corporation, Electron Energy Corporation, and Tengam Engineering, Inc.

b. The key factor driving the growth of the global magnetic materials market is the significant growth driven by the rapid growth in the electric vehicle (EV) industry, where permanent magnets are critical components in high-efficiency motors and powertrains.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.