- Home

- »

- Digital Media

- »

-

Manga Market Size, Share & Trends, Industry Report, 2033GVR Report cover

![Manga Market Size, Share & Trends Report]()

Manga Market (2026 - 2033) Size, Share & Trends Analysis Report By Content (Printed, Digital), By Gender (Male, Female), By Distribution Channel (Online, Offline), By Genre (Action And Adventure, Sci-Fi And Fantasy), By Audience, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-013-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Manga Market Summary

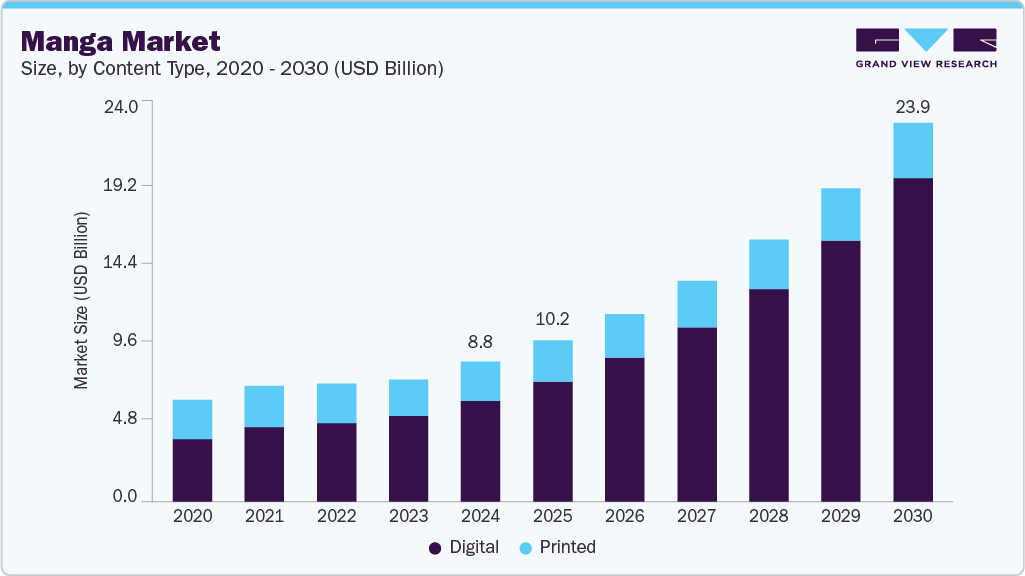

The global manga market size was estimated at USD 10,193.3 million in 2025 and is projected to reach USD 43,856.1 million by 2033, growing at a CAGR of 20.5% from 2026 to 2033. The market growth is driven by the surging adoption of digital platforms, including e-books and streaming apps, as well as the explosive demand for anime adaptations and cross-media expansions.

Key Market Trends & Insights

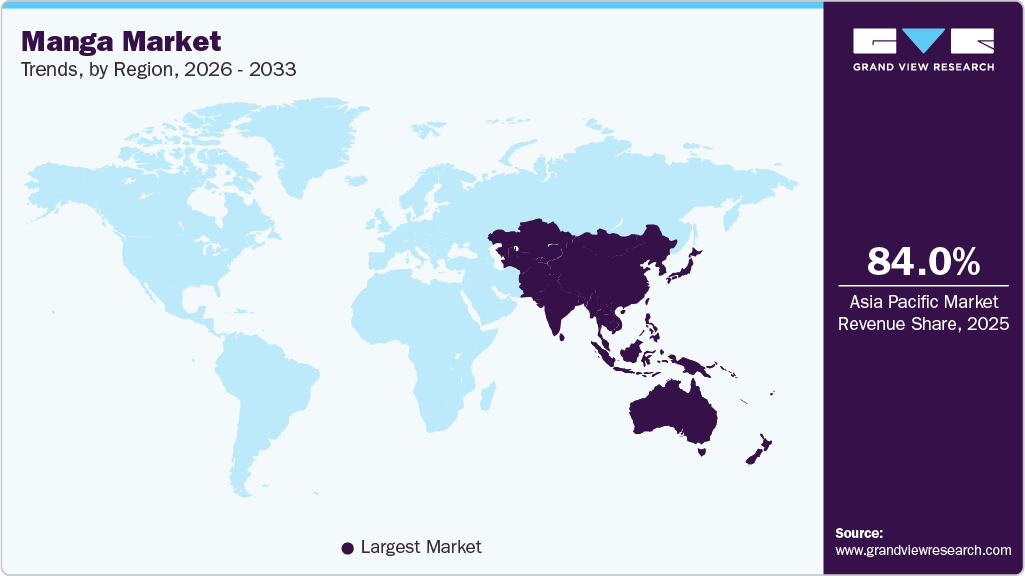

- The Asia Pacific manga market accounted for the largest revenue share of over 84% in 2025.

- Based on content, the digital segment accounted for the largest revenue share of over 66% in 2025.

- Based on the distribution channel, the online segment is expected to grow at the fastest CAGR of over 22% in 2025.

- Based on genre, the action and adventure segment accounted for the largest market share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 10,193.3 Million

- 2033 Projected Market Size: USD 43,856.1 Million

- CAGR (2026-2033): 20.5%

- Asia Pacific: Largest market in 2025

In addition, rising social media engagement, growing proliferation of e-commerce, and diverse genre appeal spanning romance, fantasy, and sci-fi that attracts broader demographics amid cultural exports are other crucial factors driving the market growth. The growing popularity of webtoons, particularly in South Korea and China, is having a significant impact on the manga sector. Webtoons, which are typically published on digital platforms in a vertical scroll format, cater to the preferences of mobile-first readers. As the demand for webtoons continues to rise, many manga publishers are adapting their works to this format, either to expand their existing portfolios or tap into the expanding webtoon audience. With webtoons gaining traction worldwide, they are presenting new opportunities for manga creators and publishers to reach a broader and more diverse readership, further shaping the future of the manga industry.The demand for a wider variety of genres within the manga industry is growing as readers increasingly seek stories that transcend traditional action and fantasy. Niche genres such as slice-of-life, romance, LGBTQ+, and horror are gaining popularity, catering to a broad range of tastes and demographics. Publishers are responding to this shift by diversifying their portfolios, creating manga that resonates with underrepresented audiences. This trend is contributing to the growth of the manga sector by attracting new readers and offering more inclusive and varied storytelling.

The role of manga as an educational tool is becoming increasingly important, especially in Japan and other parts of Asia. Educational manga, which integrates subjects such as history, science, and economics, is gaining recognition among students and educators for its ability to present complex topics in an engaging and accessible format. This genre’s use in classrooms and study programs highlights manga's growing influence in modern education, which is expected to further drive the market expansion in the coming years.

The increasing demand for manga adaptations across various media formats, including anime, video games, and live-action movies, is a key driver of the growth within the manga industry. Successful manga series such as Demon Slayer and Attack on Titan have demonstrated the potential for adaptations to broaden their reach, leading to significant increases in manga sales and audience engagement. Publishers and creators are actively exploring partnerships with anime studios and gaming companies to create cross-media content that enhances the visibility of manga. This cross-platform approach is helping to drive revenue across multiple entertainment channels, reinforcing the interconnected nature of the manga industry.

The rise of digital manga platforms is also reshaping how readers engage with the manga industry. Digital distribution offers readers the convenience of accessing manga anywhere and anytime, contributing to an increase in global readership. Digital platforms are making it easier for publishers to reach international audiences, expanding the accessibility of manga beyond traditional print formats. This shift is helping the manga industry grow its international presence and reach a new generation of readers who prefer digital content.

The increasing integration of manga into pop culture is influencing the broader entertainment industry. Manga’s influence on fashion, music, and social media is creating a deeper connection with younger audiences, particularly those in Generation Z. This cultural crossover is driving a surge in the demand for manga-related content, leading to greater investments from publishers and entertainment companies. Manga's prominent role in shaping modern pop culture is likely to expand its influence on global entertainment trends, further solidifying its position within the industry.

Content Insights

The digital segment recorded the largest revenue share of over 66% in 2025. Digital manga is experiencing rapid growth in international markets, driven by the increasing accessibility of digital platforms. Non-Japanese regions, particularly North America and Europe, are experiencing a strong demand for translated manga, with local publishers utilizing digital platforms to offer content in multiple languages. This expansion is facilitated by the ability to access manga instantly on smartphones, tablets, and computers, providing readers with a more convenient and flexible reading experience. As digital platforms continue to localize and adapt content for different cultural markets, global demand for digital manga is expected to rise steadily.

The printed segment is projected to register a significant CAGR of over 8% from 2026 to 2033. The popularity of high-quality printed editions is another key trend in the printed manga market. Fans are increasingly seeking out manga with superior print quality, including hardcover volumes, premium paper, and high-definition artwork. These editions offer a more luxurious reading experience and often become prized possessions for collectors. As publishers focus on quality production, the market for premium printed manga continues to grow, reflecting consumers’ desire for high-end, collectible products.

Distribution Channel Insights

The online segment accounted for the largest revenue share in 2025. The popularity of webtoons and vertical scroll formats is reshaping the online manga market. Webtoons, which originated in South Korea, are optimized for mobile devices and are gaining significant traction in global markets, particularly in North America and Southeast Asia. Manga publishers are increasingly adapting their works to the webtoon format, capitalizing on the growing preference for easily consumable, mobile-friendly content. This trend is helping bridge the gap between traditional manga and the rapidly growing webcomic market, further expanding the reach of online manga.

The offline segment is anticipated to record the significant CAGR from 2026 to 2033. The growth of manga in non-traditional retail channels is another trend driving the offline market. Retailers such as convenience stores, drugstores, and supermarkets in Japan are increasingly carrying manga, making it more accessible to a wider audience. This expansion into everyday retail outlets allows manga to reach consumers who may not typically visit bookstores, broadening its reach and appeal. As manga continues to be integrated into these diverse retail channels, its availability increases, thereby fostering further growth in the offline market.

Genre Insights

The action & adventure segment held the largest market share in 2025. A growing trend within action-adventure manga is the focus on strong, diverse protagonists who challenge traditional tropes. Readers are increasingly drawn to characters with unique abilities, backgrounds, and perspectives, reflecting broader societal shifts towards inclusivity. These protagonists often embody values such as resilience, leadership, and self-discovery, which resonate with a global audience. As a result, manga series that feature diverse characters are gaining more recognition, both within Japan and internationally, contributing to the evolution of the action-adventure genre.

The romance & drama segment is expected to grow at the fastest CAGR from 2026 to 2033. The rising popularity of slice-of-life romance manga is a prominent trend in the market. These stories, which focus on the everyday lives and emotional growth of characters, have captured the hearts of readers, particularly those seeking relatable narratives. The genre appeals to a wide audience, offering a break from the action-packed titles while focusing on personal connections, love, and drama. As readers continue to gravitate towards more emotionally-driven stories, the demand for slice-of-life romance manga is expected to rise, further strengthening its presence in the market.

Gender Insights

The male segment held the largest revenue share in 2025. The increasing popularity of manga adaptations of popular video games and anime is a growing trend in the male manga market. Many successful franchises are expanding their universes by adapting their video game or anime storylines into manga formats, which allow for deeper exploration of characters and plotlines. Male readers who are fans of these original games and shows are often keen to follow the manga versions to gain additional insights into their favorite worlds. This trend underscores the continued integration of manga with other forms of entertainment, appealing to male fans who are already invested in these broader multimedia franchises.

The female segment is anticipated to witness the fastest CAGR from 2026 to 2033. There is a noticeable shift toward manga series featuring empowering female protagonists who are strong, independent, and often challenge traditional gender roles. Female readers are increasingly gravitating towards stories where the main characters are not just love interests but also complex and multidimensional individuals. These characters often engage in self-improvement, take charge of their destinies, and challenge societal norms, making them more relatable and inspiring to readers. This trend is leading to the creation of more stories where women are portrayed as active agents in their own narratives, reflecting broader societal movements towards gender equality and empowerment.

Audience Insights

The adults segment held the largest revenue share in 2025. The demand for mature romance & drama manga targeted at adult readers has seen a significant uptick. These titles often explore the complexities of relationships, including themes of unrequited love, betrayal, personal growth, and reconciliation, making them more relatable to an older audience. Unlike traditional romance genres, adult romance and drama manga offer a more grounded, real-world perspective on emotional conflicts and relationships. With the success of these stories in both domestic and international markets, publishers are increasingly focusing on producing content that caters to adult readers seeking deeply resonant, emotionally charged narratives.

The children and kids segment is estimated to grow at the fastest CAGR from 2026 to 2033, owing to the increasing support from parents who view manga as both an educational and entertaining medium for young readers. The rise of digital manga platforms enhances accessibility and convenience, providing children with easier access to a diverse range of manga titles. Furthermore, the growing global interest in Japanese pop culture, anime adaptations, and interactive digital content continues to captivate younger audiences. The merchandising and licensing of popular manga characters also enrich the engagement experience for kids, making manga an appealing and multifaceted entertainment option within this demographic.

Regional Insights

The manga industry in North America is expected to grow at the fastest CAGR of over 23% from 2026 to 2033. North America has witnessed a significant expansion of manga in libraries and educational settings. Schools and libraries are increasingly incorporating manga into their collections due to its ability to engage reluctant readers and attract younger audiences. This trend has created a niche for manga in education, particularly in promoting literacy among younger readers. As a result, publishers are adapting their releases to cater to both educational institutions and the broader general audience.

U.S. Manga Market Trends

The U.S. manga industry held a dominant position in 2025, driven by its deep integration into the broader anime and gaming culture. The surge in anime’s popularity through platforms like Crunchyroll, Netflix, and Funimation has fueled demand for manga, as fans seek original storylines and extended narratives. Conventions such as Comic-Con are increasingly highlighting manga through dedicated panels and events, reflecting its growing cultural significance. Additionally, publishers are tapping into the gaming community, with manga adaptations of popular video games attracting strong readership and further strengthening the market’s growth.

Europe Manga Market Trends

The manga industry in Europe is expected to grow at a significant CAGR of over 22% from 2026 to 2033. In Europe, publishers are experiencing strong demand for high-quality manga translations, particularly in countries with a rich comic book culture, such as France and Italy. As the European market matures, more titles are being localized to appeal to a diverse range of readers across the continent, including those interested in niche or experimental genres. Notably, there is a growing interest in adapting Japanese works to suit European tastes while maintaining the original essence of the stories. As a result, Europe has become an increasingly important market for Japanese manga publishers.

The UK manga industry is expected to grow rapidly in the coming years. The market's expansion is further supported by the increasing popularity of manga content, with retailers and publishers responding by broadening their manga offerings. This trend is helping to drive market growth, as manga's unique blend of art and narrative appeals to a wide demographic, leading to increased sales across various genres. The growth is also fueled by the increasing localization of manga and the availability of official streaming services that offer English subtitles, making content more accessible to a global audience.

The manga industry in Germany held a significant market share in 2025. This growth can be attributed to the increasing popularity of manga in the country, driven by its unique storylines and the availability of translated versions. Additionally, the strong presence of renowned distributors, such as Tokyopop, Carlsen Manga, and Egmont Manga, is creating lucrative opportunities for the market. The rising popularity of anime conventions, such as DoKomi – Anime & Japan Expo, which attracted over 150,000 visitors in July 2023, is also contributing to the growing demand for manga and anime content in the country.

Asia Pacific Manga Market Trends

The manga industry in the Asia Pacific dominated the global market with a share of 84% in 2025. The demand for digital manga is rapidly increasing, fueled by the widespread use of smartphones and digital platforms. Readers across countries like Japan, China, South Korea, and Southeast Asia are turning to digital platforms for easier access to a diverse range of manga content. This trend is supported by the growth of e-commerce and online subscription services, which offer a more convenient and cost-effective way for readers to enjoy manga. As a result, digital manga is set to become an even more significant driver of market growth in the region.

The Japan manga industry is expected to grow rapidly in the coming years. Japan remains the epicenter of anime and manga, with a strong presence of major publishers and a vast range of content available across genres, appealing to various age groups and interests. This diversity helps keep readers engaged and attracts a broad demographic, further driving the growth of manga in Japan. Beyond entertainment, manga has become an increasingly popular medium for education, with notable examples such as Ishinomori Shōtarō’s educational manga, which introduces Japanese economics to readers.

The manga market in China is expected to grow significantly in the coming years. The increased readership for manga, driven by the availability of content from renowned publishers, online platforms, and streaming services, is contributing to market growth in the region. Large-scale conventions in China, which bring together anime and manga fans from around the world, further support this trend. These events often feature a wide range of publications and merchandise, which bodes well for the continued growth of the manga industry.

Key Manga Company Insights

Some of the key players operating in the market include Kodansha Ltd. and Shueisha Inc., among others.

-

Kodansha Ltd. is a leading Japanese publisher known for its extensive catalog of iconic manga titles, such as Attack on Titan and Akira. The company publishes both print and digital manga, reaching a global audience through its international division, Kodansha Manga, as well as platforms like ComiXology and Manga Plus. Kodansha also plays a central role in anime production, often working alongside manga adaptations to expand its intellectual properties. With its vast licensing agreements and collaborations with other media companies, Kodansha has firmly established itself as a powerhouse in the manga industry.

-

Shueisha is one of the top manga publishers, renowned for producing some of the most well-known manga series, including One Piece, My Hero Academia, and Demon Slayer. The company is deeply integrated into the manga-to-anime pipeline, ensuring simultaneous releases of manga and their anime adaptations. Shueisha also operates digital platforms such as MANGA Plus and Shonen Jump+, catering to a global audience. The publisher has firmly established itself as a key player in both the domestic and international manga industry.

Some of the emerging market players in the manga market include Seven Seas Entertainment, Inc. and Bilibili Comics Pte. Ltd., among others.

-

Seven Seas Entertainment is a rapidly expanding manga publisher, best known for licensing and distributing Japanese manga titles in North America. The company specializes in publishing both well-established and lesser-known manga, with a focus on niche genres such as yaoi, yuri, and slice-of-life. Seven Seas has earned recognition for its high-quality English translations and its commitment to bringing diverse manga content to a broader audience. The company's portfolio includes popular manga and light novel series, appealing to both mainstream and niche markets.

-

Bilibili Comics is an emerging force in the manga industry, primarily known for its digital manga platform. The company focuses on publishing Chinese webcomics and making them available in multiple languages to global audiences, often in collaboration with international publishers. Bilibili places significant emphasis on fan engagement and interactive features, positioning itself as a key player in the expansion of the Chinese manga industry. With its growing presence in anime production, Bilibili is expanding its influence across both the manga and anime industries.

Key Manga Companies:

The following are the leading companies in the manga market. These companies collectively hold the largest market share and dictate industry trends.

- Akita Publishing Co., Ltd.

- Bilibili Comics Pte. Ltd.

- Bungeishunjū Ltd.

- Good Smile Company, Inc.

- Hitotsubashi Group

- Houbunsha Co., Ltd.

- Kadokawa Corporation

- Kodansha Ltd.

- Nihon Bungeisha Co., Ltd.

- Seven Seas Entertainment, Inc.

- Shogakukan Inc.

- Shueisha Inc.

- VIZ, Inc.

- Yen Press LLC

Recent Developments

-

In October 2025, Kodansha unveiled its Fall 2026 new print manga licensing announcements at New York Comic Con (NYCC), revealing an exciting slate of upcoming series, premium editions, picture books, and box sets debuting in print and digital formats.

-

In July 2025, Seven Seas Entertainment, Inc. acquired licenses for several new manga series, including 'I Have a Secret' by Yoru Sumino and Zui Nieki, 'DOGGO' by Ryuki Onuma and Hikari Komaru, and 'The Babe at My Back Has Her Eye on Me,' showcasing a variety of genres from coming-of-age supernatural drama to lighthearted romance, strengthening their catalog diversity.

-

In July 2025, VIZ Media LLC announced an anime co-production of the critically acclaimed manga Hirayasumi, in partnership with Shogakukan-Shueisha Productions Co., Ltd.

Manga Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 11,876.9 million

Revenue forecast in 2033

USD 43,856.1 million

Growth rate

CAGR of 20.5% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Content, distribution channel, genre, gender, audience, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; China; Japan; India; South Korea; Australia; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

Akita Publishing Co., Ltd.; Bilibili Comics Pte. Ltd.; Bungeishunjū Ltd.; GOOD SMILE COMPANY, INC.; Hitotsubashi Group; Houbunsha Co., Ltd.; Kadokawa Corporation; Kodansha Ltd.; Nihon Bungeisha Co.; Ltd.; Seven Seas Entertainment, Inc.; Shogakukan Inc.; Shueisha, Inc.; VIZ Media LLC; Yen Press LLC

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Manga Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technology trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global manga market report based on content, distribution channel, genre, gender, audience, and region:

-

Content Outlook (Revenue, USD Million, 2021 - 2033)

-

Printed

-

Digital

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Online

-

Offline

-

-

Genre Outlook (Revenue, USD Million, 2021 - 2033)

-

Action and Adventure

-

Sci-Fi and Fantasy

-

Sports

-

Romance and Drama

-

Others

-

-

Gender Outlook (Revenue, USD Million, 2021 - 2033)

-

Male

-

Female

-

-

Audience Outlook (Revenue, USD Million, 2021 - 2033)

-

Children and Kids

-

Teenagers

-

Adults

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global manga market size was estimated at USD 10,193.3 million in 2025 and is expected to reach USD 11,879.6 million in 2026.

b. The global manga market is expected to grow at a compound annual growth rate of 20.5% from 2025 to 2033 and to reach USD 43,856.1 million by 2033.

b. The Asia Pacific dominated the manga market, accounting for a share of over 84% in 2025. This is attributable to the highest concentration of manga production studios across countries, including Japan, China, and South Korea in the Asia Pacific region.

b. Some key players operating in the manga market include Kadokawa Corporation; Bilibili Comics Pte. Ltd.; Houbunsha Co., Ltd.; Shogakukan Inc.; Shueisha Inc.; GOOD SMILE COMPANY, INC. and Akita Publishing Co., Ltd. among others.

b. Key factors that are driving the manga market growth include the growing popularity of graphic reading content with intriguing narratives and appealing images, as well as an increase in the number of manga readers among the Millennial Generation and Generation Z.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.