- Home

- »

- Next Generation Technologies

- »

-

Maritime Artificial Intelligence Market, Industry Report, 2030GVR Report cover

![Maritime Artificial Intelligence Market Size, Share & Trends Report]()

Maritime Artificial Intelligence Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software), By Technology, By Application, By Deployment, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-570-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Maritime Artificial Intelligence Market Trends

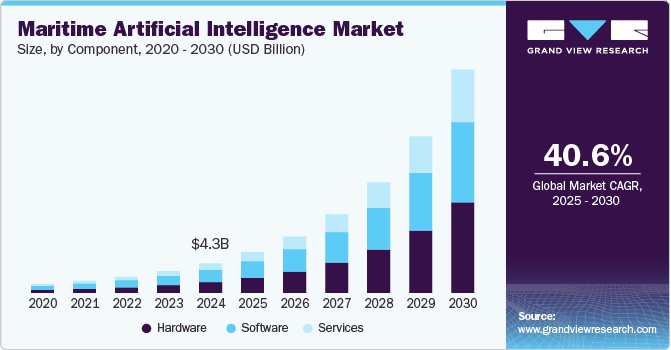

The global maritime artificial intelligence market size was estimated at USD 4,321.1 million in 2024 and is projected to grow at a CAGR of 40.6% from 2025 to 2030.This growth is driven by the increasing need for operational efficiency, improved safety, and environmental sustainability. AI applications in maritime are diverse and impactful.

For instance, autonomous vessels like the Yara Birkeland, the world’s first fully electric autonomous container ship, and the Mayflower Autonomous Ship demonstrate how AI enables ships to navigate complex routes with minimal human intervention, significantly reducing human error, which is a leading cause of maritime accidents.

Predictive maintenance is another key application where AI analyzes sensor data to forecast equipment failures before they occur, allowing for proactive maintenance that reduces downtime and costs. Industry leaders such as Rolls-Royce and Wärtsilä have implemented AI-driven systems to monitor ship components and optimize maintenance schedules, thereby extending vessel lifespans. In addition, AI-powered route optimization models analyze weather, traffic, and fuel consumption data to identify the most efficient and safest routes, reducing fuel use and emissions while accelerating delivery times.

In port operations, AI enhances efficiency by coordinating automated cranes and vehicles, optimizing cargo handling, and improving communication among maritime stakeholders. Platforms like MagicPort exemplify how AI streamlines port operations and collaboration. Furthermore, AI-based safety and risk management systems provide real-time monitoring and predictive insights to reduce collisions and accidents, especially in congested waters. Overall, maritime artificial intelligence is driving a technological revolution that promises smarter, safer, and more sustainable shipping operations, with significant growth and widespread adoption expected in the forecast years.

Component Insights

The hardware segment led the market with the largest revenue share of 42.1% in 2024. Hardware advancements are significantly driving growth in the maritime artificial intelligence industry by enabling faster, more efficient data processing and real-time decision-making at sea. The integration of high-performance edge computing systems, AI-enabled sensors, and advanced navigation hardware is transforming operations across shipping, offshore energy, and naval sectors.

Major initiatives by key players, for instance, in February 2025, Siemens Digital Industries Software and Compute Maritime have partnered to transform ship design by integrating Compute Maritime’s NeuralShipper platform with Siemens’ Simcenter STAR-CCM+ CFD software. This collaboration leverages generative AI and advanced simulation to accelerate vessel design, optimize performance, and enable innovative, fuel-efficient ship concepts.

The services segment is anticipated to exhibit at the fastest CAGR over the forecast period. These services, such as predictive maintenance, real-time vessel tracking, automated navigation, and route optimization, enhance operational efficiency, safety, and cost-effectiveness. Shipping companies increasingly rely on AI-as-a-Service (AIaaS) models to access advanced analytics and decision-making tools without heavy upfront investments in infrastructure. In addition, regulatory pressures around sustainability are prompting maritime firms to adopt AI services for emissions monitoring and compliance.

Moreover, significant development by key players, for instance, in March 2025, Saildrone and Palantir Technologies announced a strategic partnership to advance AI-powered maritime intelligence by integrating Palantir’s AI cloud infrastructure with Saildrone’s autonomous surface vehicles. This collaboration aims to enhance maritime security, surveillance, and operational scalability amid growing global threats and limited naval assets. Leveraging AI and extensive maritime data, the partnership will deliver unprecedented insights for defense and maritime domain awareness.

Technology Insights

The machine learning (ML) segment accounted for the largest market revenue share in 2024. ML enhances maritime operations by analyzing vast amounts of sensor and environmental data to optimize routes, reduce fuel consumption, and improve arrival time predictions, directly boosting operational efficiency and sustainability. Predictive maintenance powered by ML analyzes equipment sensor data to foresee failures, minimizing costly downtime and repair expenses. Major initiatives, for instance, in February 2025, Cyprus and Digital Energy AI collaborated to launch to boost fuel efficiency and reduce emissions across the shipping industry. By leveraging advanced artificial intelligence solutions, the partnership aims to help operators optimize voyages and minimize environmental impact. This initiative marks a significant

The computer vision segment is anticipated to exhibit at the fastest CAGR over the forecast period. Computer vision technology is significantly propelling growth in the maritime artificial intelligence industry by enabling real-time monitoring, navigation, and automation. Its integration into shipboard systems supports advanced functionalities such as automated vessel inspection, anomaly detection, and object recognition, enhancing safety and operational efficiency. Ports are leveraging computer vision for traffic management, cargo handling, and berth allocation, reducing turnaround times and human error. In addition, AI-powered surveillance systems using computer vision improve maritime security by detecting unauthorized activities and potential threats. Environmental monitoring is also enhanced through automated detection of oil spills and waste discharge.

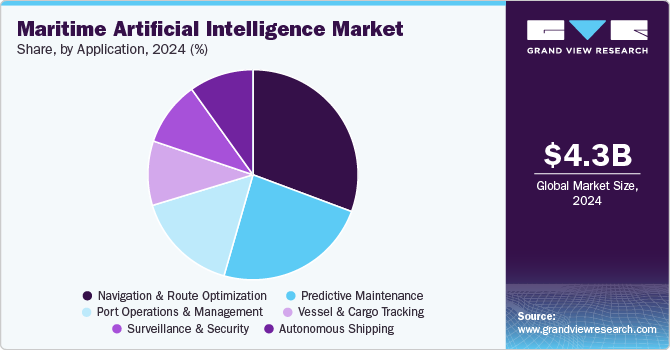

Application Insights

The navigation & route optimization segment accounted for the largest market revenue share in 2024. These applications are significantly enhancing operational efficiency, safety, and sustainability. AI-powered route optimization leverages real-time data-such as weather, ocean currents, port congestion, and vessel performance dynamically calculate the most efficient and safest routes, reducing fuel consumption and travel time. This leads to lower operational costs and decreased greenhouse gas emissions, aligning with increasing environmental regulations. In addition, AI integration in navigation supports autonomous and semi-autonomous vessels, enabling safer and more reliable voyages with minimal human intervention. The ability of AI to process vast maritime data in real time also improves predictive maintenance and decision-making, further boosting efficiency and reducing downtime.

The vessel & cargo tracking segment is anticipated to exhibit at the fastest CAGR over the forecast period. As global trade intensifies, real-time tracking solutions powered by AI are becoming essential for enhancing supply chain visibility, optimizing routes, and ensuring cargo safety. AI-driven analytics enable predictive maintenance, anomaly detection, and ETA forecasting, reducing downtime and operational costs. Port operators and shipping companies are increasingly adopting these solutions to comply with tightening regulations, improve efficiency, and gain a competitive advantage. The rise of smart ports and the integration of AIS (Automatic Identification System) and IoT sensors further accelerate AI adoption. In addition, the demand for sustainability and fuel efficiency pushes stakeholders to leverage AI for voyage optimization. With the surge in maritime data, AI’s ability to process and extract actionable insights is transforming decision-making, thereby driving market expansion. This trend is expected to continue.

Deployment Insights

The onboard systems segment accounted for the largest market revenue share in 2024. These systems integrate advanced sensors, edge computing, and AI algorithms to optimize navigation, fuel efficiency, and maintenance, reducing operational costs and enhancing safety. As global shipping companies face increasing pressure to improve efficiency and comply with environmental regulations, onboard AI systems offer scalable, vessel-level intelligence without relying on constant connectivity.

Major initiatives, for instance, in November 2024, NautilusLog, in collaboration with industry leaders and standardization bodies DIN and JSTRA, launched ISO 4891, an innovative international standard for the interoperability of smart applications onboard ships. This new standard enables seamless integration and communication between maritime digital systems, enhancing operational efficiency, safety, and real-time data sharing. ISO 4891 marks a significant step forward in the digital transformation of the maritime industry, supporting smarter, safer, and more sustainable shipping operations worldwide.

The cloud-based solutions segment is anticipated to exhibit at the fastest CAGR over the forecast period. Cloud technologies offer scalability, flexibility, and real-time data access, enabling maritime companies to integrate diverse data streams from global operations efficiently. This facilitates advanced AI applications such as predictive maintenance, route optimization, and fleet management, which reduce operational costs and downtime while enhancing safety and decision-making. Cloud deployment also minimizes the need for on-site IT infrastructure, cutting costs and simplifying maintenance through automated updates.

Moreover, cloud platforms support regulatory compliance and crew welfare management by centralizing operations and ensuring up-to-date standards are met. As maritime digitalization accelerates, cloud-based AI solutions are pivotal in driving automation, operational efficiency, and sustainability efforts, positioning them as essential to the future of maritime artificial intelligence innovation and market expansion.

End Use Insights

The commercial shipping segment accounted for the largest market revenue share in 2024. AI technologies enable real-time route optimization, fuel consumption monitoring, and predictive maintenance, significantly reducing operational costs and improving vessel performance. In high-traffic routes and long-haul operations, AI systems support dynamic decision-making, helping ships avoid delays, congestion, and adverse weather.

Furthermore, AI-powered cargo tracking and automated documentation are streamlining logistics and boosting supply chain transparency. As environmental regulations tighten, commercial fleets are also using AI to monitor emissions and improve sustainability efforts. The demand for smart shipping solutions is rising as global trade volumes increase and competition intensifies, pushing shipping companies to modernize their fleets with intelligent systems. This digital transformation across the commercial shipping sector is directly fueling investment and innovation in the maritime artificial intelligence industry, positioning AI as a critical enabler of next-generation shipping operations.

The naval defense segment is projected to register at the fastest CAGR over the forecast period. Naval defense leverages artificial intelligence to enhance situational awareness, threat detection, and decision-making in real-time. AI-powered systems analyze sensor data from ships, drones, and satellites to identify potential threats such as enemy vessels, submarines, or unmanned systems.

Autonomous navigation and predictive analytics support mission planning, route optimization, and collision avoidance. In addition, AI improves cybersecurity resilience and electronic warfare capabilities in naval operations. These advancements significantly strengthen maritime domain awareness and national defense readiness. Moreover, AI also enables intelligent control of unmanned surface and underwater vehicles for reconnaissance and mine detection. Machine learning models help distinguish between false alarms and real threats, reducing cognitive load on operators.

Regional Insights

North America dominated the maritime artificial intelligence market with the largest revenue share of 36.3% in 2024. Driven by increasing demand for autonomous vessels, enhanced safety and security measures, and the need for fuel efficiency and environmental sustainability. The integration of AI with IoT, big data analytics, and machine learning is optimizing navigation, predictive maintenance, and port automation. Regulatory support and investments in smart port technologies further accelerate this growth. In addition, the push for decarbonization and emission reduction in maritime transport fuels AI adoption in the region.

U.S. Maritime Artificial Intelligence Market Trends

The maritime artificial Intelligence market in the U.S. is anticipated to exhibit at a significant CAGR over the forecast period. Significant demand for operational efficiency, fuel optimization, and real-time monitoring in both commercial and defense vessels. The adoption of autonomous and remotely operated vessels, regulatory compliance for carbon emissions, and advancements in AI, IoT, and big data analytics are also significant growth drivers unique to the U.S. market. Furthermore, substantial investments by leading companies in integrated marine automation systems contribute to this growth trajectory.

Europe Maritime Artificial Intelligence Market Trends

The maritime artificial intelligence market in Europe is expected to witness at a significant CAGR over the forecast period. The market growth in Europe is primarily driven by stringent environmental regulations like the EU's FuelEU Maritime Regulation, which mandates significant reductions in greenhouse gas emissions, pushing the adoption of AI for fuel efficiency and emissions monitoring. Increasing investments in smart port technologies and AI-driven automation enhance operational efficiency and safety. The rising demand for autonomous vessels and advanced navigation systems also fuels growth.

Asia Pacific Maritime Artificial Intelligence Market Trends

The maritime artificial intelligence market in the Asia Pacific is expected to register at the fastest CAGR over the forecast period. The market is driven by rapid growth in shipbuilding and port infrastructure, especially in China, Japan, South Korea, and India, which are major contributors to fleet value and technological innovation. The surge in international trade and container throughput through some of the world's busiest ports fuels demand for AI-powered analytics and automation. Strong government initiatives and Industry 4.0 adoption, including IoT, big data, and AI integration, are accelerating digital transformation in maritime operations.

Key Maritime AI Company Insights

Key maritime artificial intelligence companies include Windward, Orca AI, Sea Machines Robotics, Rovco, and Nautilus Labs. Companies active in the maritime artificial intelligence industry are focusing aggressively on expanding their customer base and gaining a competitive edge over their rivals. Hence, they pursue various strategic initiatives, including partnerships, mergers & acquisitions, collaborations, and new product/ technology development. For instance, in April 2025, CMA CGM Group announced a major investment of US$110 million in next-generation artificial intelligence technologies. This strategic move underscores the company’s commitment to digital transformation and innovation within the shipping and logistics sector. The investment aims to enhance operational efficiency, optimize supply chain management, and deliver greater value to customers worldwide.

-

Anduril Industries develops a family of autonomous systems powered by its proprietary Lattice AI platform, delivering integrated and persistent awareness and security across land, sea, and air at the tactical edge. In the maritime domain, Anduril offers highly reliable and flexible autonomous underwater vehicles (AUVs) specifically designed for littoral and deep-water survey, inspection, and intelligence, surveillance, and reconnaissance (ISR) missions. These maritime artificial intelligence systems support a wide range of defense and commercial applications, enhancing situation awareness and operational effectiveness in complex maritime environments. Combining cutting-edge AI with veteran expertise, Anduril drives innovation in autonomous defense technologies.

-

Blue Visby offers an innovative, multilateral platform aimed at reducing greenhouse gas (GHG) emissions in the maritime industry by approximately 15%. The company addresses the inefficiency of the "Sail Fast, Then Wait" practice by leveraging advanced data analytics and AI to optimize vessel arrival times and voyage speeds. Their solution enables ships to coordinate and adjust their speeds dynamically, minimizing fuel consumption and emissions while maintaining operational efficiency. Blue Visby’s operations are centered on transforming maritime logistics with AI-driven insights for a more sustainable shipping industry.

Key Maritime AI Companies:

The following are the leading companies in the maritime artificial intelligence market. These companies collectively hold the largest market share and dictate industry trends.

- Anduril Industries

- Awake.AI

- Blue Visby Services Ltd.

- Blue Water Autonomy

- Domino Data Lab

- EyeROV

- Nautilus Labs

- OrbitMI

- Orca AI

- Rovco

- Saildrone

- Sea Machines Robotics

- Spire Global

- ThayerMahan

- Windward

Recent Developments

-

In July 2024, Bearing AI unveiled an enhanced AI-powered Deployment Planner specifically designed for tramp shipping companies, addressing their unique operational challenges. The tool leverages advanced AI to analyze historical and real-time data, enabling operators to optimize vessel deployment, improve fuel efficiency, and manage emissions effectively. By predicting end-of-year vessel performance and supporting strategic decision-making, the Deployment Planner helps balance commercial goals with environmental compliance. This innovation marks a significant step toward smarter, more sustainable tramp shipping operations.

-

In June 2024, Windward and Dataminr joined forces to deliver AI-driven, real-time alerting solutions for the maritime industry. This partnership enables rapid response to maritime threats and operational risks by combining Windward’s advanced maritime analytics with Dataminr’s real-time event detection. The collaboration aims to improve situational awareness and decision-making for maritime stakeholders worldwide.

Maritime Artificial Intelligence Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5,949.6 million

Revenue forecast in 2030

USD 32,733.3 million

Growth rate

CAGR of 40.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2017 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, technology, application, deployment, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

Anduril Industries; Awake.AI; Blue Visby; Blue Water Autonomy; Domino Data Lab; EyeROV; Nautilus Labs; OrbitMI; Orca AI; Rovco; Saildrone; Sea Machines Robotics; Spire Global; ThayerMahan; Windward

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Maritime Artificial Intelligence Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global maritime artificial intelligence market report based on the component, technology, application, deployment, end use, and region.

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Software

-

Services

-

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Natural Language Processing

-

Machine Learning

-

Computer Vision

-

Robotics & Autonomous Systems

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Navigation & Route Optimization

-

Predictive Maintenance

-

Port Operations & Management

-

Vessel & Cargo Tracking

-

Surveillance & Security

-

Autonomous Shipping

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

Onboard Systems

-

Cloud-Based Solutions

-

-

End Use Outlook (Revenue, USD Million, 2017 - 2030)

-

Commercial Shipping

-

Energy & Utilities

-

Warehouse & Logistics

-

Port Authorities

-

Fishing Industry

-

Offshore Energy

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global maritime artificial intelligence market size was estimated at USD 4,321.1 million in 2024 and is expected to reach USD 5,949.6 million in 2025.

b. The global maritime artificial intelligence market is expected to grow at a compound annual growth rate of 40.6% from 2025 to 2030 to reach USD 32,733.3 million by 2030.

b. North America dominated the maritime artificial intelligence market with a share of 36.3% in 2024. Driven by increasing demand for autonomous vessels, enhanced safety and security measures, and the need for fuel efficiency and environmental sustainability. The integration of AI with IoT, big data analytics, and machine learning is optimizing navigation, predictive maintenance, and port automation.

b. Some key players operating in the maritime artificial intelligence market includeAnduril Industries, Awake.AI; Blue Visby; Blue Water Autonomy; Domino Data Lab; EyeROV; Nautilus Labs; OrbitMI; Orca AI; Rovco; Saildrone; Sea Machines Robotics; Spire Global; ThayerMahan; and Windward

b. Key factors that are driving the market growth include the increasing need for operational efficiency, improved safety, and environmental sustainability. AI applications in maritime are diverse and impactful.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.