- Home

- »

- Medical Devices

- »

-

Mastopexy Market Size, Share & Trends Report, 2030GVR Report cover

![Mastopexy Market Size, Share & Trends Report]()

Mastopexy Market (2024 - 2030) Size, Share & Trends Analysis Report By Technique (Crescent Breast Lift, Benelli Lift, Benelli-Lollipop Lift, Full Mastopexy), By End-use (Hospitals, Specialty Clinics), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-936-5

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global mastopexy market size was valued at USD 1.44 billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 5.8% from 2024 to 2030. The market growth can be attributed to the growing demand for improved aesthetic appearance among women. The key market players have introduced high-tech devices for better surgeries and ultimate customer satisfaction. In addition, the increasing medical tourism in some countries such as Thailand, Malaysia, and Mexico is enhancing the demand for cosmetic breast augmentation surgeries.

In the initial phase of the COVID-19 pandemic, the growth of the mastopexy market was affected as there was a significant decrease in elective procedures, especially cosmetic surgeries. The pandemic posed distinctive challenges for breast enhancement or reconstruction surgeries. Many organizations placed restrictions initially on these surgeries, resulting in surgeons and cosmetic clinics conceiving innovative protocols. Although these procedures were halted initially by most cosmetic surgeons, they were resumed in later stages of the pandemic.

The growth of the healthcare infrastructure and rising income levels in developing countries such as China, India, and Brazil are contributing to the rising demand for cosmetic breast lifting procedures. A breast lift procedure can be costlier than a breast implant. The cost of breast lifting surgeries ranges between USD 9,000 to USD 16,000. On the other hand, the cost of breast implants ranges from USD 6,000 to USD 12,000. Silicone implants had been utilized in 84% and saline implants in 16% of all the breast augmentations in 2020 (declined 33% from 2019).

Considering age as one of the segments in breast lift surgical procedures, it has been noted that around 40% of the total procedure is performed for age 40-54, followed by 27% of total procedure for age 30-39. The breast lift in teenagers has gone down to 23% compared to 2019 (in 2020 the total surgeries performed were 1,006) in the U.S. Breast lift is also performed for those who lose weight suddenly. The number of people who performed mastopexy after sudden weight loss declined 16% from 13,050 in 2019 to 10,972 in 2020.

Technique Insights

Based on technique, the full mastopexy segment held a majority of the market share of around 37% in 2021 in terms of revenue. The full mastopexy procedure is performed in cases of breast sagginess, which is mainly observed in older women. Mastopexy is also performed in breast cancer patients, to remove the excessively growing tissues. During the procedure, the surgeons tend to remove excess or extra tissues present around the breast to enhance the aesthetic appearance of the patients.

The Benelli-lollipop lift segment is anticipated to witness the fastest CAGR of 7.2% during the forecast period from 2022 to 2030. It is also known as vertical lift or vertical mastopexy. Vertical incisions are particularly used to remove excess skin horizontally, to the sides of the nipple. This procedure allows the reshaping of areolas. This procedure uses the natural tissue that is already present and reshapes and tightens it to form a more balanced contour.

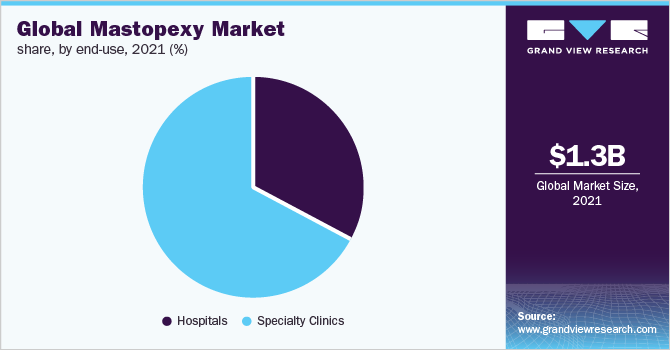

End-use Insights

Based on End-use, the specialty clinics segment held the largest market share of around 67% in terms of revenue in 2021. The segment is also expected to witness the fastest CAGR of around 6.0% during the forecast period from 2022 to 2030. The growing adoption and rise in the awareness of breast enhancement surgeries are resulting in the rise of cosmetic professionals and practices offering these surgical procedures.

In addition, the rising affordability and less recovery time have resulted in the higher adoption of independent practices, thereby leading to the growth in the number of cosmetic clinics. On the other hand, very few hospitals have the facility to perform cosmetic surgeries, as it requires highly qualified doctors with special skills and high-tech devices and equipment.

Regional Insights

In 2021, North America held the largest market share in terms of revenue. As per the American Society of Plastic Surgeons, surgical breast lifts increased by over 70% since 2000. Breast enhancement is one of the top cosmetic surgical procedures performed in the region. The surgeries performed to remove tumors including, skin cancer, and breast cancer, among others, have been the top reconstructive procedures performed annually. In 2020, around 87,000 breast lift surgeries were performed. Due to rising per capita healthcare costs and increased aesthetic demands, Europe is the second-largest market for mastopexy.

Asia Pacific is expected to witness the fastest CAGR of around 7.0% over the forecast period. The key drivers contributing to market expansion in the region include the rising awareness of women's health, developing healthcare infrastructure, and changing lifestyle patterns. Moreover, the presence of economies such as Australia and China, which are characterized by an increase in the number of cosmetic treatments further stimulates market expansion.

Key Companies & Market Share Insights

The increasing population concerned about the aesthetic appearance drives the manufacturing of mastopexy devices. Some market players are undertaking strategic initiatives such as mergers and partnerships to strengthen their market presence and expand their product portfolio. For instance, Allergan merged with AbbVie in June 2019 to form Allergan AbbVie. The company's product range includes Acular, Asacol, Betagan, and Alphagan. Allergan's products are manufactured, researched, and utilized commercially in over 100 countries, including India, Australia, Austria, Chile, Brazil, and Germany. Allergan acquired ZELTIQ Aesthetics, a medical device firm, in April 2017. Some prominent players in the global mastopexy market include:

-

Cynosure

-

Allergan

-

Lumenis

-

Mentor Worldwide

-

SOLTA Medical

-

Syneron Medical

-

Galderma

Mastopexy Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.52 billion

Revenue forecast in 2030

USD 2.14 billion

Growth rate

CAGR of 5.8% from 2024 to 2030

Base year for estimation

2023

Actual estimates/Historic data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million & CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors & trends

Segments covered

Technique, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Japan; China; India; Brazil; Mexico; South Africa

Key Companies profiled

Cynosure; Allergan; Lumenis; Mentor Worldwide; SOLTA Medical; Syneron Medical; Galderma

15% free customization scope (equivalent to 5 analyst working days)

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global mastopexy market report based on technique, end-use, and region:

-

Technique Outlook (Revenue, USD Million, 2018 - 2030)

-

Crescent Breast Lift

-

Benelli Lift

-

Benelli-Lollipop Lift

-

Full Mastopexy

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Specialty Clinics

-

-

Regional Outlook (USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The full mastopexy segment held a majority of the market share of around 37% in 2021 in terms of revenue share.

b. Some of the key players operating in the mastopexy market are Cynosure; Allergan; Lumenis; Mentor Worldwide; SOLTA Medical; Syneron Medical; and Galderma; among others.

b. The market growth can be attributed to the growing demand for improved aesthetic appearance among women. The key market players have introduced high-tech devices for better surgeries and ultimate customer satisfaction.

b. The global mastopexy market is expected to grow at a compound annual growth rate of 5.7% from 2022 to 2030 to reach USD 2.14 billion by 2030.

b. The global mastopexy market size was estimated at USD 1.3 billion in 2021 and is expected to reach USD 1.37 billion in 2022.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.