- Home

- »

- Communications Infrastructure

- »

-

MEA Cloud Infrastructure Services Market, Report, 2030GVR Report cover

![MEA Cloud Infrastructure Services Market Size, Share & Trends Report]()

MEA Cloud Infrastructure Services Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (PaaS, IaaS, CDN/AND, Managed Hosting, Colocation, DRaaS), By Deployment, By Organization, By Vertical, And Segment Forecasts

- Report ID: GVR-2-68038-195-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

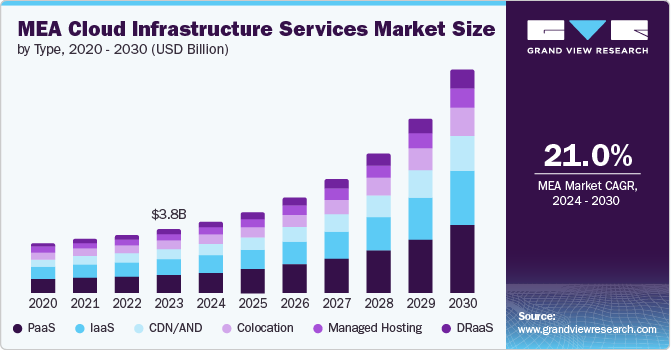

The MEA cloud infrastructure services market size was valued at USD 3.79 billion in 2023 and is projected to grow at a CAGR of 21.0% from 2024 to 2030. Cloud infrastructure refers to hardware and software components that facilitate cloud computing services. These components include storage devices, servers, software, interface components, networking devices, and other related instruments. Businesses across the MEA region increasingly embrace digital transformation initiatives to modernize operations, enhance productivity, and remain competitive globally.

Governments in the region are actively promoting cloud adoption as part of their national digital agendas. For instance, digital transformation has been highlighted as essential to Saudi Arabia’s Vision 2030 program. These initiatives involve investments in cloud infrastructure, fostering regulatory frameworks that encourage cloud usage, and promoting the use of cloud-based solutions for public service delivery. This government support creates a more favorable environment for businesses to adopt cloud technology.

The proliferation of smartphones, social media usage, and e-commerce platforms has led to a surge in data traffic across the region. Cloud infrastructure services offer a secure and scalable data processing, management, and storage platform, allowing businesses to handle this data growth effectively. Additionally, the region is witnessing a growing market for data analytics, artificial intelligence (AI), and the Internet of Things (IoT), which requires an equally efficient cloud infrastructure in the back end, which is a significant factor for market growth.

Type Insights

Platform as a Service (PaaS) dominated the market accounting for a market revenue share of 27.1% in 2023. PaaS offers a cloud-based development environment that eliminates the need for capital investment and ongoing maintenance of physical IT infrastructure. Cloud service providers manage the entire infrastructure stack, including data storage, network connectivity, servers, and virtualization. By leveraging PaaS, organizations can save significantly and avoid the complexities associated with on-premise IT infrastructure management. This comprehensive approach leads to rising demand for PaaS.

DRaaS segment is expected to grow at significant CAGR of 22.8% over forecast period. Disaster Recovery as a Service (DRaaS) has become increasingly important for organizations seeking robust protection against increasing cyber threats. This service enables businesses to swiftly recover critical data and applications in scenarios ranging from ransomware attacks to system failures. By leveraging automated backup, real-time data replication, and seamless failover capabilities to secondary environments, DRaaS minimizes downtime. Its scalability and cost-effectiveness offer a compelling alternative to conventional disaster recovery methods, ensuring continuity of operations amidst evolving cyber risks. As organizations prioritize resilience in their operational strategies, DRaaS stands as a crucial safeguard, facilitating uninterrupted service delivery and mitigating the impact of unforeseen incidents on business continuity.

Deployment Insights

Public cloud accounted for the highest market share in 2023. Public cloud is a computing service offered to customers by third-party providers. These services can be availed by any user or organization by paying certain charges. Public cloud eliminates the upfront capital expenditure required to build and maintain on-premises IT infrastructure. Organizations pay only for the resources they consume, leading to improved cost efficiency and reduced risk. These factors along with improved security measures make public clouds a popular option among several organizations.

Hybrid cloud segment is projected to grow at the fastest CAGR during the forecast period. This is due to the convenience and flexibility offered by hybrid cloud for organizations managing sensitive data and Personally Identifiable Information (PII). This model allows for the segregation of critical data within secure private cloud environments while leveraging the cost-effectiveness and scalability of public clouds for less sensitive workloads and data storage. By adopting a hybrid approach, organizations can maintain control over their most sensitive information while benefiting from the flexibility offered by public cloud services. This best of both worlds approach is expected to attract more users during the forecast period.

Organization Insights

Large organizations dominated the MEA cloud infrastructure services market in 2023. This is owing to their ability to spend and changing needs. For instance, they possess the financial resources to invest in cloud infrastructure and associated expertise. They can absorb costs of cloud migration and leverage economies of scale for potentially lower service costs. Organizations in MEA are increasingly seeking digital transformation initiatives and cloud infrastructure plays a critical role in these initiatives, enabling rapid innovation, improved agility, and faster market deployment for new products and services. In March 2024, Amazon Web Services (AWS) announced a substantial investment of $5.3 billion to establish a new cloud infrastructure region in Saudi Arabia. This significant financial commitment underscores AWS's strategy to expand its cloud services in the Middle East. The new region, expected to be operational by 2026, will feature three Availability Zones, enhancing the capacity for high-availability and fault-tolerant applications. Additionally, AWS will establish two innovation centers focused on upskilling local talent, including a dedicated initiative to train 4,000 women in cloud computing.

Small and medium enterprises (SMEs) segment is anticipated to grow at a fastest CAGR during the forecast period. SMEs are particularly sensitive to IT-related costs. Public cloud services offer a pay-as-you-go model, eliminating the need for huge capital expenditure required for on-premises infrastructure. This allows SMEs to scale their IT resources efficiently and avoid overprovisioning, leading to significant cost savings. Moreover, emergence of several SMEs and their need for cloud infrastructure services pose significant growth prospects in market.

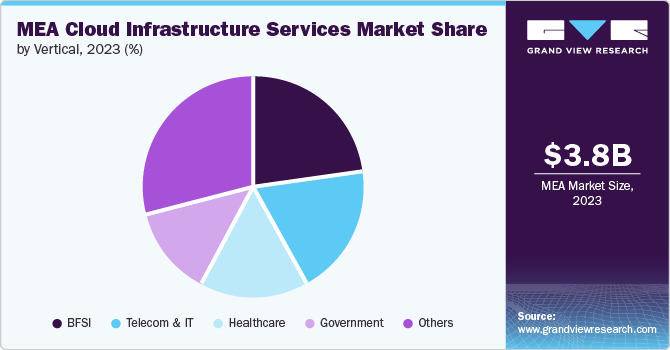

Vertical Insights

BFSI accounted for the highest market revenue share in 2023. Cloud infrastructure enables BFSI institutions to automate manual processes, streamline operations, and achieve greater agility. This results in significant cost savings, faster deployment of new financial products and services, and improved customer experience. With increasing economic activities in the region, a huge amount of data is being generated, which is efficiently managed by leveraging cloud infrastructure.

The healthcare sector is expected to register the fastest CAGR during the forecast period. Cloud adoption facilitates the storage and access of vast amounts of patient data, enabling improved data-driven decision-making for diagnoses, treatment plans, and personalized medicine. Many MEA governments are actively promoting healthcare IT adoption through funding and regulatory frameworks that encourage cloud-based solutions such as electronic health record (EHR). This leads to a supportive environment for cloud infrastructure services in the healthcare sector, enabling faster segment growth.

Country Insights

KSA Cloud Infrastructure Services Market Trends

KSA accounted for the highest market share at 26.4% in 2023. The country is rapidly developing its digital infrastructure. For instance, in July 2024, Aramco Digital and World Wide Technology entered into a strategic partnership to change the digital artificial intelligence landscape in Saudi Arabia. The partnership is expected to transform the AI infrastructure in the country by integrating the industrial sector with world-class AI solutions. Furthermore, Saudi Arabia's ambitious Vision 2030 plan emphasizes economic diversification and technological advancement. Cloud adoption is seen as a critical driver for achieving these goals, leading to increased investments in cloud infrastructure and services.

South Africa Cloud Infrastructure Services Market Trends

South Africa is expected to register the fastest growth rate during the forecast period. The need for robust cybersecurity measures and compliance with data protection regulations, such as the Protection of Personal Information Act (POPIA), is a major driver for organizations to adopt secure cloud solutions. POPIA, which mandates stringent protection of personal data, necessitates that businesses implement advanced security protocols to safeguard sensitive information from breaches and unauthorized access. By leveraging secure cloud services, organizations can ensure adherence to these regulations through built-in security features, such as encryption, identity and access management, and continuous monitoring. These cloud solutions not only enhance data protection but also provide scalable and cost-effective ways to maintain compliance, thereby reducing the risk of legal penalties and reputational damage associated with data breaches.

Key MEA Cloud Infrastructure Services Company Insights:

Some key companies involved in the MEA cloud infrastructure services market include Microsoft, Google, and IBM.

-

Google is an American multinational company offering internet search engines, cloud computing, computer software, computer hardware, artificial intelligence, and online advertising services. Google Cloud Platform (GCP) is a cloud computing service offered by Google across various industries, such as retail, media, manufacturing, healthcare, and financial services. GCP offers over 100 products, such as a compute engine, Google Kubernetes engine, cloud SQL, cloud storage, vertex AI, and cloud CDN.

-

Microsoft is an American multinational company known for its software products, such as MS Office, Microsoft 365, and Windows operating systems, such as Windows 11. Microsoft offers cloud computing solutions under its Azure platform, serving a wide range of users, such as private individuals, governments, and small and large organizations. The platform supports several programming languages and offers IaaS, PaaS, and SaaS to choose from its range of delivery models.

Key MEA Cloud Infrastructure Services Companies:

- Alibaba Cloud

- Amazon Web Services (AWS)

- Cisco Systems Inc.

- Dell Inc.

- Hewlett Packard Enterprise Development LP

- IBM

- Microsoft

- Oracle

- Red Hat, Inc.

- Salesforce, Inc

- SAP

- ServiceNow

- Tencent Cloud

- Broadcom

Recent Developments

-

In March 2024, Alibaba Cloud opened a new training center in Dubai, aiming to train 5,000 people in the next five years. The center is directed toward developing the workforce's competence in advanced technologies such as cloud computing, artificial intelligence, database management, and related areas.

-

In January 2024, Google launched its first African cloud region in Johannesburg, South Africa, expanding its global network to 40 cloud regions with 121 zones spanning over 200 countries and territories. This new cloud region is integrated into Google's secure network, which includes the Equiano subsea cable system, enhancing connectivity and service delivery across multiple countries. This strategic expansion aims to offer African businesses high-performance, secure, and low-latency cloud services, thereby driving the continent's digital transformation.

MEA Cloud Infrastructure Services Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.25 billion

Revenue Forecast in 2030

USD 13.33 billion

Growth Rate

CAGR of 21.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

August 2024

Quantitative units

Revenue in USD Billion and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Type, deployment, organization, vertical

Country scope

Saudi Arabia, Qatar, UAE, South Africa

Key companies profiled

Alibaba Cloud; Amazon Web Services (AWS); Cisco Systems Inc.; Dell Inc.; Google; Hewlett Packard Enterprise Development LP; IBM; Microsoft; Oracle; Red Hat, Inc.; Salesforce, Inc.; SAP; ServiceNow; Tencent Cloud; Broadcom

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

MEA Cloud Infrastructure Services Market Report Segmentation

This report forecasts revenue growth at the MEA and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the MEA cloud infrastructure services market report based on type, deployment, organization, and vertical.

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

PaaS

-

IaaS

-

CDN/AND

-

Managed Hosting

-

Colocation

-

DRaaS

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Public Cloud

-

Private Cloud

-

Hybrid Cloud

-

-

Organization Outlook (Revenue, USD Billion, 2018 - 2030)

-

SME

-

Large Organization

-

-

Vertical Outlook (Revenue, USD Billion, 2018 - 2030)

-

Telecom and IT

-

BFSI

-

Healthcare

-

Government

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

Middle East & Africa

-

Saudi Arabia

-

Qatar

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.