MEA Cold Chain Market Size & Trends

The Middle East & Africa cold chain market size was valued at USD 35.93 billion in 2024 and is projected to grow at a CAGR of 20.6% from 2025 to 2030. The market growth can be credited to the increasing demand for perishable goods, such as fruits, vegetables, dairy products, and pharmaceuticals. As urbanization accelerates and consumer preferences shift towards fresh and high-quality products, efficient cold chain solutions have become more critical. This demand is further amplified by the rising disposable incomes in the region, which enable consumers to spend more on premium and perishable goods.

Furthermore, the expansion of the food and beverage industry in the MEA region has driven the market. With a growing population and changing dietary habits, the market witnessed a heightened need for reliable cold chain logistics to ensure food products' safe and timely delivery. The growing food industry is supported by the increasing number of organized retail stores and supermarkets, which require robust cold chain infrastructure to maintain the quality and safety of their perishable inventory.

Moreover, technological advancements in refrigeration technologies, temperature monitoring systems, and data analytics have enhanced the efficiency and reliability of cold chain operations. These technologies help maintain the required temperature levels throughout the supply chain, reducing the risk of spoilage and ensuring product integrity. Additionally, integrating Internet of Things (IoT) devices and blockchain technology has improved traceability and transparency, allowing stakeholders to monitor and manage the cold chain more effectively.

Type Insights

The storage segment dominated the market with a revenue share of 76.1% in 2024. The pharmaceutical sector has majorly contributed to the growth of the storage segment. The demand for temperature-sensitive pharmaceuticals, such as vaccines, biologics, and blood products, has surged, especially in the wake of the pandemic. Therefore, ensuring the safe storage of these products became increasingly crucial to maintain their efficacy and safety. As a result, pharmaceutical companies have invested heavily in cold storage facilities to meet regulatory requirements and ensure the timely delivery of critical medical supplies.

The monitoring components segment is expected to grow at the fastest CAGR during the forecast period owing to the increased demand for real-time monitoring and data analytics capabilities. With the cold chain market expanding, the market has witnessed a heightened need for advanced monitoring systems that can ensure the integrity and safety of temperature-sensitive products throughout the supply chain. Technologies such as Internet of Things (IoT) devices, RFID tags, and advanced sensor systems have been widely adopted to provide real-time data on temperature, humidity, and other critical parameters.

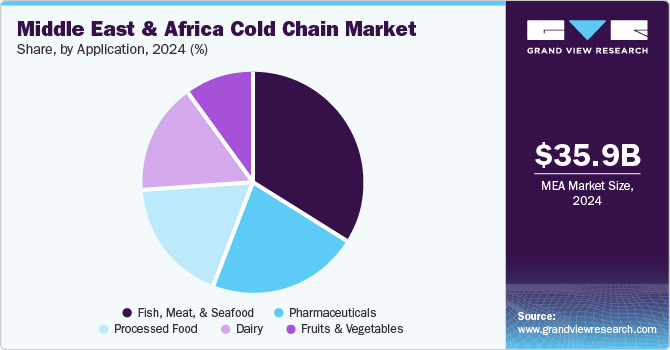

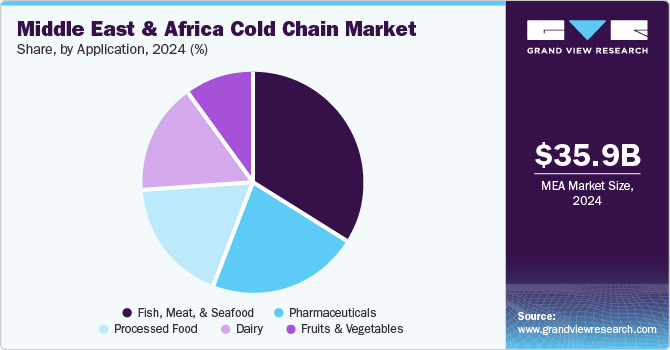

Application Insights

The fish, meat, and seafood segment accounted for the largest market revenue share in 2024 owing to the increasing demand for high-quality, fresh, and safe food products. As urbanization continues and consumer preferences shift towards protein-rich diets, the market witnessed a heightened need for efficient cold chain solutions to ensure the freshness and safety of fish, meat, and seafood products. This demand is further amplified by the rising disposable incomes in the region, enabling consumers to spend more on premium and perishable goods.

The processed food industry is expected to grow at the fastest CAGR over the forecast period due to the growing demand for convenience foods. With the increasingly fast-paced lifestyles, consumers have increasingly sought ready-to-eat and easy-to-prepare food options. This shift in consumer preferences has led to a surge in demand for processed foods, which require efficient cold-chain logistics to maintain their quality and safety. Moreover, technological advancements in packaging and processing have significantly enhanced the efficiency and reliability of cold chain operations. These advancements help maintain the required temperature levels, reduce spoilage, and ensure product integrity throughout the supply chain.

Country Insights

Saudi Arabia Cold Chain Market Trends

The Saudi Arabia cold chain market in 2024 was driven by the increasing demand for temperature-sensitive goods, such as pharmaceuticals and perishable foods. The demand was further fueled by population growth and changing consumer preferences. Moreover, the expansion of the healthcare sector, particularly the pharmaceutical industry has necessitated efficient cold chain solutions to ensure the safe storage and transportation of medications and vaccines.

UAE Cold Chain Market Trends

UAE accounted for a significant revenue share in the regional market in 2024 owing to country’s strategic location as a global trade hub that enhances the demand for efficient cold chain logistics to support international trade. In addition, the increasing urbanization and changes in consumer preferences towards fresh, frozen, and imported food products fueled the demand for these solutions. The food and beverage sector, including dairy, seafood, and meat, relied heavily on cold chain logistics.

Key MEA Cold Chain Company Insights

The MEA cold chain market is consolidated featuring key participants such as Logistica Group, Able Logistics Group FZCO, Barloworld Limited, and others. These companies have increasingly focused on R&D activities, product launches, acquisitions & mergers to continue their market dominance.

-

Logistics Group offers a wide range of services, including freight forwarding, warehousing, and transportation management. It specializes in providing customized logistics solutions to meet the unique needs of its clients across various industries.

-

Able Logistics Group FZCO offers services such as air and sea freight, customs clearance, warehousing, and distribution. Its location in the UAE allows it to serve as a critical hub for international trade, connecting businesses across the globe.

Key MEA Cold Chain Companies:

- Logistica Group

- Able Logistics Group FZCO (A subsidiary of Kerry Logistics Network)

- Barloworld Limited

- Brothers General Transport LLC (A subsidiary of Jamal Al Ghurair Group)

- Global Shipping & Logistics

- gulfdrug

- Oceana Group Limited

- RSA

- Wared Logistics

Recent Developments

-

In January 2024, GulfDrug opened a cutting-edge supply chain, management, and training facility in the Industrial City of Abu Dhabi (ICAD). This new facility aims to enhance the robustness and connectivity of its pharmaceutical and medical distribution and management across the country.

-

In November 2023, RSA Cold Chain leased an agreement with DP World to establish a cutting-edge cold chain facility at Jebel Ali’s premier logistics hub. RSA Cold Chain is a joint venture between Dubai-based supply chain firm RSA Global and Americold, an Atlanta-based leader in temperature-controlled warehousing and logistics.

MEA Cold Chain Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 42.67 billion

|

|

Revenue forecast in 2030

|

USD 108.98 billion

|

|

Growth rate

|

CAGR of 20.6% from 2025 to 2030

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2018 - 2023

|

|

Forecast period

|

2025 - 2030

|

|

Quantitative units

|

Revenue in USD billion, and CAGR from 2025 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Type, application, region

|

|

Country scope

|

Saudi Arabia, UAE

|

|

Key companies profiled

|

Logistica Group; Able Logistics Group FZCO (A subsidiary of Kerry Logistics Network); Barloworld Limited; Brothers General Transport LLC (A subsidiary of Jamal Al Ghurair Group); Global Shipping & Logistics; gulfdrug; Oceana Group Limited; RSA; Wared Logistics

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

MEA Cold Chain Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Middle East & Africa cold chain market report based on type, application, and country.

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Storage

-

Warehouse

-

Refrigerated Containers

-

Transportation

-

Monitoring Components

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Fruits & Vegetables

-

Dairy

-

Fish, Meat, & Seafood

-

Processed Food

-

Pharmaceuticals

-

Country Outlook (Revenue, USD Billion, 2018 - 2030)