- Home

- »

- Renewable Chemicals

- »

-

MEA Specialty Chemicals Market Size, Industry Report 2030GVR Report cover

![MEA Specialty Chemicals Market Size, Share & Trends Report]()

MEA Specialty Chemicals Market Size, Share & Trends Analysis Report By Product (Institutional & Industrial Cleaners, Flavor & Fragrances, Food & Feed Additives), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-213-3

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

MEA Specialty Chemicals Market Trends

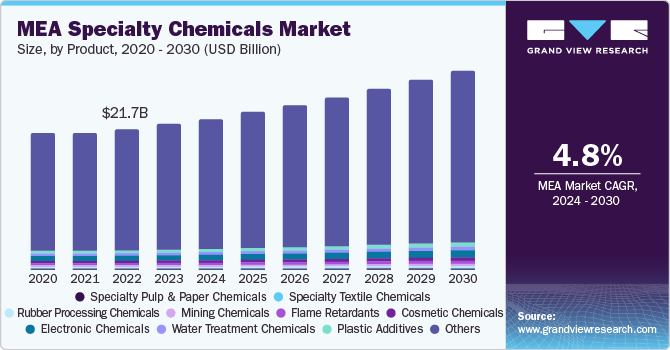

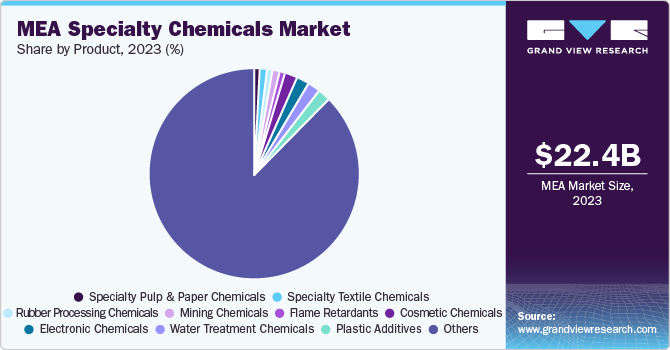

The MEA specialty chemicals market size was valued at USD 22.43 billion in 2023 and is anticipated to witness a compound annual growth rate (CAGR) of 4.8% from 2024 to 2030. The market growth is attributed to growing demand of specialty chemicals in the cosmetic industry in countries including the U.A.E., Kuwait, and Saudi Arabia. Additionally, the food & beverage sector in the Middle East & Africa region is seeing several growth opportunities for international investors. Reliance on food trade, international tastes, changing consumer preferences & lifestyles, strategic geographic position, and gulf food programs have substantially contributed to the development of the food & beverages industry in the region, which is further estimated to fuel the demand for specialty chemicals during the forecast years.

Another driving factor for the market is the growth of textile industry in the region. Middle East was known as a trading hub for textiles products, however with changing times along with growing consumer preference regarding choice and variety of clothing and increasing investment coupled with increasing demand for textiles goods the region has started itself to transform into a manufacturing hub. Moreover, the government's push to boost the textile sector is another major factor driving the textile industry established in the region. Various policies like Special Investment Trade and Manufacturing Business Policy have been initiated to benefit the manufacturers of textiles especially in Kuwait, Oman, Qatar, Bahrain, UAE, and Saudi Arabia countries. Thus, the growing textile industry in the region provides ample opportunities for the specialty chemicals manufacturers to tap this upcoming market.

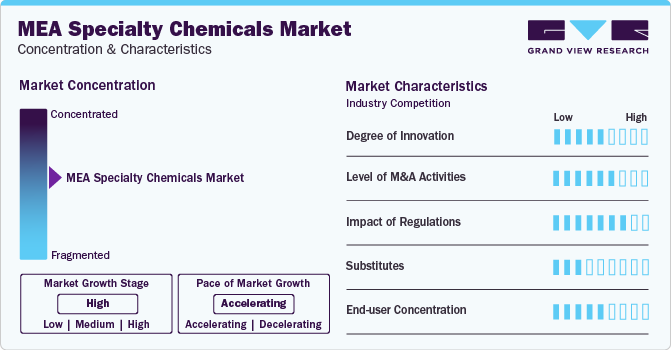

Market Concentration & Characteristic

Market growth stage is high, and pace of the market growth is accelerating. Innovation in the MEA specialty chemicals market is highly affected by the end-use industries. Since the end-use industries are developing new & innovative products which require specialty chemicals, the degree of innovation in the market is at moderate to high level.

The level of merger & acquisition activities is moderate in the market. This is because the market is concentrated with leading participants focusing on collaborations with other companies, universities, and research institutions to develop new products. The top organizations in the market are strategically acquiring small companies to broaden their own product portfolio and increase their client base.

Government regulations in the market are still in a nascent stage, however, seeing the global awareness towards environmental safety and sustainability, UAE government has taken strict measures to regulate the use of pesticides. The manufacturers must register virtually for all end uses.

Buyers tend to have specific performance, and functional requirements, as a result the formulated specialty chemical products have no direct substitute for a specific chemical requirement. Therefore, the threat of substitutes is expected to be low in the near future.

Market Dynamics

MEA specialty chemicals market is highly consumer-driven. The growth of the market is led by categories such as electronics chemicals, cosmetic chemicals, petroleum chemicals, among others. Rising demand for flavoring agents in food & beverages industry in Middle Easte & Africa countries are positively affecting the market growth.

Chemicals such as sodium hypochlorite, hydrochloric acid, and others are widely employed in the manufacturing of industrial and institutional cleaners. These chemicals are widely used for cleaning in various industries. This application is expected to have a positive impact on the market growth over the forecast period. Pharmaceutical additives are employed in Over the Counter (OTC) drug production, and other pharmaceutical products to impart specific qualities in the productions. They find application in various end-use industries such as personal care products, cosmetics, and others. Continuous growth in these sectors is expected to benefit industry participants.

Product Insights

The specialty polymers segment dominated the market with a revenue share of 13% in 2023. The segment is also the fastest growing segment for the market during the forecast period. Specialty polymers include products such as high-performance thermoplastics, specialty films, water soluble polymers, and engineering thermoplastics that are designed to meet the critical requirements engineers face in industrial practices in key industries including automobile, pharmaceutical, aeronautics, plastic, smart devices, healthcare, and storage of food products.

Plastic is highly favored for the manufacture of numerous fast-moving products and goods in the world. This has resulted in an increasing demand for specialty polymers as they have similar properties. Most plastic manufacturers prefer manufacturing a multi-functional product that has widespread industrial applications. Various specialty polymers are used for various industrial applications such as transportation, healthcare, textile, food processing & manufacturing, food & beverage packaging, pharmaceutical, and others. This is expected to push forward the demand for specialty polymers with increased product penetration in major applications over the forecast period.

Key MEA Specialty Chemicals Companies Insights

The key market players often chose to supply directly to the end-use industries. The end-users such as oil & mining, catalyst, consumer chemicals and other are an important part of the MEA specialty chemicals ecosystem. The strategic movements of key players involve capacity/regional expansions, partnerships, new product launches, and mergers & acquisitions in order to gain a higher stake in the market share.

Key MEA Specialty Chemicals Companies:

- Solvay

- Evonik Industries AG

- Clariant AG

- Akzo Nobel N.V.

- DuPont

- Lanxess

- Croda International Plc

- Huntsman International LL

- The Lubrizol Corporation

- Albemarle Corporation

Recent Development

-

In September 2021, the Solvay launched new portfolio of additive manufacturing (AM) build sheets under its Ajedium brand.

-

In February 2021, Clariant expanded a new pigment laboratory in Johannesburg, Africa. This new facility will service the emerging African and Middle East paints and coatings market. The new facility will also offer increased employment opportunities, value-added services for coating across countries in Africa, and skill development in color technologies.

MEA Specialty Chemicals Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 23.29 billion

Revenue forecast in 2030

USD 30.78 billion

Growth Rate

CAGR of 4.8% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product

Key Companies

Solvay; Evonik Industries AG; Clariant AG; Akzo Nobel N.V.; DuPont; Lanxess; Croda International Plc; Huntsman International LL; The Lubrizol Corporation; Albemarle Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

MEA Specialty Chemicals Market Report Segmentation

This report forecasts revenue growth at regional level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the MEA specialty chemicals market report based on product:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Specialty Polymers

-

Institutional & Industrial Cleaners

-

General Purpose Cleaners

-

Disinfectants and Sanitizers

-

Laundry Care Products

-

Vehicle Wash Products

-

Others

-

-

Electronic Chemicals

-

Rubber Processing Chemicals

-

Anti-degradants

-

Accelerators

-

Flame Retardants

-

Processing Aid/ Promoters

-

Others

-

-

Flavors & Fragrances

-

Construction Chemicals

-

Food & Feed Additives

-

Flavors & Enhancers

-

Sweeteners

-

Enzymes

-

Emulsifiers

-

Preservatives

-

Fat Replacers

-

Others

-

-

Cosmetic Chemicals

-

Surfactants

-

Emollients & Moisturizers

-

Film-Formers

-

Colorants & Pigments

-

Preservatives

-

Emulsifying & Thickening Agents

-

Single-Use Additives

-

Others

-

-

Oilfield Chemicals

-

Inhibitors

-

Demulsifiers

-

Rheology Modifiers

-

Friction Reducers

-

Biocides

-

Surfactants

-

Foamers

-

Others

-

-

Mining Chemicals

-

CASE (Coatings, Adhesives, Sealants & Elastomers)

-

Pharmaceutical & Nutraceutical Additives

-

Plastic Additives

-

Printing Inks

-

Specialty Pulp & Paper Chemicals

-

Basic Chemicals

-

Functional Chemicals

-

Bleaching Chemicals

-

Process Chemicals

-

-

Specialty Textile Chemicals

-

Coating & Sizing Chemicals

-

Colorants & Auxiliaries

-

Finishing Agents

-

Surfactants

-

Denim Finishing Agents

-

-

Catalysts

-

Water Treatment Chemicals

-

Coagulants & Flocculants

-

Biocide & Disinfectant

-

Defoamer & Defoaming Agent

-

pH & Adjuster & Softener

-

Scale & Corrosion Inhibitor

-

Others

-

-

Corrosion Inhibitors

-

Flame Retardants

-

Other Products

-

Frequently Asked Questions About This Report

b. The MEA specialty chemicals market size was valued at USD 22.43 billion in 2023 and is expected to reach USD 23.29 billion in 2024

b. The MEA specialty chemicals market is anticipated to witness a CAGR of 4.8% from 2024 to 2030 and reach USD 30.78 billion by 2030

b. The specialty polymers segment dominated the market with a revenue share of 13% in 2023 due to high demand for high-performance thermoplastics, specialty films, water soluble polymers, and engineering thermoplastics across wide range of industries.

b. Some of the prominent players in the MEA specialty chemicals market are Solvay; Evonik Industries AG; Clariant AG; Akzo Nobel N.V.; DuPont; Lanxess; Croda International Plc; Huntsman International LL; The Lubrizol Corporation; Albemarle Corporation

b. The MEA specialty chemicals market growth is attributed to growing demand from the cosmetics and food & beverages industry in countries including the U.A.E., Kuwait, and Saudi Arabia.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."