- Home

- »

- Healthcare IT

- »

-

Medical Animation Market Size, Share, Industry Report 2030GVR Report cover

![Medical Animation Market Size, Share & Trends Report]()

Medical Animation Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (3D Animation, Flash Animation), By Therapeutic Area (Oncology, Cardiology), By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-913-2

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Medical Animation Market Summary

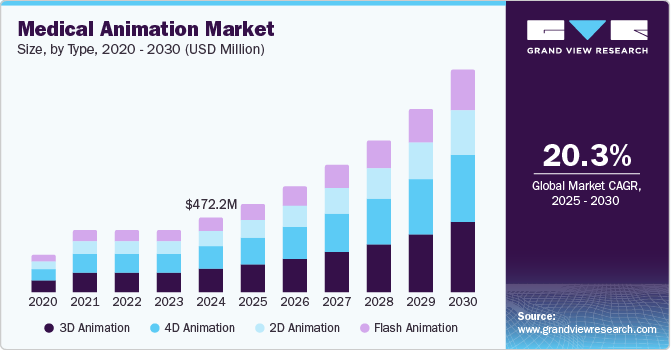

The global medical animation market size was valued at USD 472.22 million in 2024 and is projected to grow at a CAGR of 20.3% from 2025 to 2030. The medical animation market is growing due to increased pharmaceutical marketing, patient education, and advanced research use.

Key Market Trends & Insights

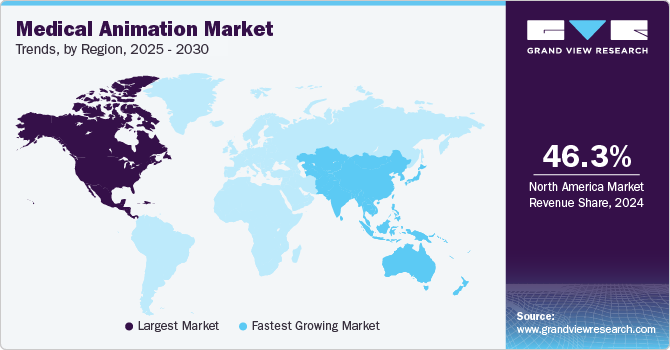

- North America medical animation market dominated the global market with a revenue share of 46.3% in 2024.

- By type, the 3D animation segment dominated the market and accounted for a share of 31.6% in 2024.

- By therapeutic area, the oncology segment dominated the market and accounted for a share of 24.8% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 472.22 Million

- 2030 Projected Market Size: 1,418.67 Million

- CAGR (2025-2030): 20.3%

- North America: Largest market in 2024

The demand for sophisticated animation techniques and the growing trend of patient involvement in healthcare drive market growth. Medical animations are effectively used to educate patients and promote disease management programs. In addition, their application in oncology and cardiac research and the development of new cellular and molecular research tools propel market expansion.

The medical animation market is expanding due to the increasing use of 3D animations in healthcare product promotion. These animations are crucial in training pharmaceutical sales representatives to understand complex medical concepts. Medical animations enhance sales teams' comprehension, confidence, and efficiency by visually representing disease mechanisms, treatment processes, and drug actions. For instance, in March 2024, the Paediatric Neuroimaging Group launched "My Baby's Brain" animations to help parents understand their premature baby's brain development and its link to breathing issues. These animations explain why premature babies experience apnoea, the treatments used, and the equipment involved, providing valuable support and knowledge to parents.

Developing novel medical animations is expected to drive the market in the forecast period. For instance, in October 2022, Random42 Scientific Communication announced the release of a medical animation. The released medical animation featured some of the most powerful and intense scientific visuals, depicting various diseases and cellular pathways in 3D.

The medical animation market is projected to grow due to supportive government organizations providing information and guidelines for advanced medical animation software, leading to increased technology adoption. For instance, the American Association of Medical Illustrators provides resources such as books, business tools, client guides, and expert techniques to promote scientific visualization through medical animation.

Type Insights

The 3D animation segment dominated the market and accounted for a share of 31.6% in 2024. The widespread use of 3D animation in healthcare is due to its effectiveness in communication and explaining medical procedures. The increasing digitalization and its use in medical device manufacturing and forensic science drive its growth. This technology is also crucial for sharing health information among medical professionals. For instance, in November 2022, ANIMA RES GmbH partnered with GigXR to offer hyper-realistic 3D anatomy learning through the Insight Series. This holographic healthcare training is available globally for healthcare providers, nursing schools, medical schools, and government and defense agencies.

The 4D Animation segment is expected to grow at the fastest CAGR over the forecast period owing to increased usage of 4D animations in medical simulation. Medical professionals can benefit from 4D animations illustrating surgical procedures or demonstrating intricate physiological processes. This aids in educating and improving comprehension of medical concepts.

Therapeutic Area Insights

The oncology segment dominated the market and accounted for a share of 24.8% in 2024 owing to the increase in cancer cases and research and development for novel drugs, which resulted in a high demand for animated drug mechanism studies, contributing to the industry's growth. Rising awareness levels, increased presence in research and academic institutions, and improvements in surgical training methods are also responsible for the market's growth. For instance, in October 2023, Apollo Proton Cancer Centre and the Social Welfare & Women Empowerment Department launched a self-breast examination chart and an animated video. These tools aim to increase awareness about early breast cancer detection and its significance in successful treatment.

The plastic surgery segment is expected to grow at the fastest CAGR of 20.4% over the forecast period driven by the increase in minimally invasive procedures and the aging population. These animations aid plastic surgeons in communicating complex procedures and are essential for medical student education. They also boost patient confidence by providing clear information about treatments and expected outcomes. For instance,

Application Insights

The drug mechanism of action (MoA) segment dominated the market and accounted for a share of 30.4% in 2024 attributed to the high usage of medical animation in drug interaction studies. The mechanism of action of a drug is difficult to understand theoretically, but the application of 3D medical animation can easily understand it. Rising drug-drug interaction studies in the coming years are expected to drive the market. For instance, Microverse Studios is a medical animation studio specializing in cellular and molecular functions. Its team of experts creates high-quality animations from scriptwriting to final delivery. They excel at understanding complex scientific concepts such as AI-driven drug discovery, PCR technologies, and drug MOA.

The patient education segment is expected to grow at the fastest CAGR of 20.9% over the forecast period, owing to the increasing demand for medical animations to educate patients regarding the basic aspects of diseases. Patients require education in the healthcare industry to grasp their medical conditions comprehensively. Nevertheless, even a few doctors need help explaining complex medical ideas to individuals with low health literacy. For instance, in December 2023, the National Kidney Foundation launched an animated video series to educate patients about the connection between systemic lupus erythematosus (SLE) and lupus nephritis (LN). This series aims to improve understanding of these diseases among patients with varying health literacy levels. The goal was to reduce the increased mortality risk associated with SLE and LN compared to the general population.

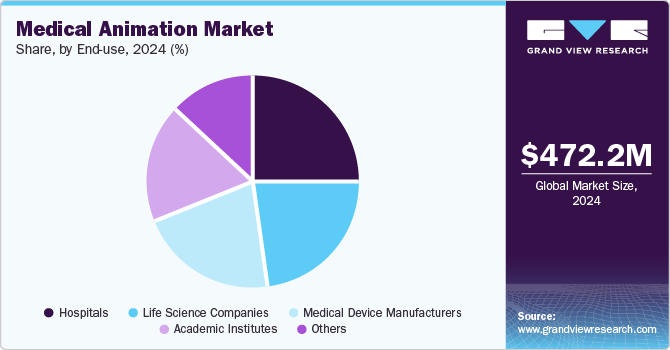

End-use Insights

Hospitals segment dominated the market and accounted for a share of 25.4% in 2024. Medical animations are increasingly used in hospitals to simplify complex patient medical information. These animations improve patient understanding, leading to better treatment compliance. Medical animations enhance patient education and memory retention by bridging the communication gap between medical professionals and patients with varying health literacy levels.

The life science companies segment is expected to grow at the fastest CAGR of 20.7% over the forecast period. The emergence of biological illustration and 3D computer graphics in healthcare marketing drives the segment's growth. Owing to a rise in research activities for inventing new products and awareness about different health issues. For instance, in May 2022, Random42 Scientific Communication released its first educational virtual reality (VR) intercellular experience. This new VR experience aims to educate users about the human body using cinematic storytelling techniques.

Regional Insights

North America medical animation market dominated the global market with a revenue share of 46.3% in 2024 owing to favorable government initiatives to encourage the adoption of medical animation across various regions. The increasing usage of 3D animations in oncological, cardiac, and other regional studies drives the market. For instance, in September 2020, Sketchy Group LLC secured a USD 30 million investment from TCG CAPITAL MANAGEMENT, LP. for a majority stake in the company.

U.S. Medical Animation Market Trends

The U.S. medical animation market dominated North America in 2024 due to the high utilization of 3D animations for drug interaction and drug MoA studies. The increasing adoption of medical animation by various pharmaceutical and life science companies is also driving the U.S. medical animation market.

Europe Medical Animation Market Trends

Europe medical animation market was identified as a lucrative region in this industry. The market is growing rapidly due to the introduction of novel medical animations that demonstrate complex cellular and molecular studies understandably. For instance, in March 2021, Disney and Koninklijke Philips N.V. collaborated to test the impact of custom-made Disney animations within Philips Ambient Experience. This solution created a relaxing atmosphere for patients and staff by personalizing the environment through dynamic lighting, video projections, and sound.

The UK medical animation market is expected to grow rapidly in the coming years due to various academic and research institutes' acceptance of 3D and 4D animations for docking studies of different drugs and biomolecules.

Germany medical animation market held a substantial market share in 2024 due to the country's high demand for 2D and 3D medical animations. The market is expected to witness exponential growth in the forecast period owing to the increasing adoption of medical animations in E-learning courses with 3D visuals by various e-learning platforms.

Asia Pacific Medical Animation Market Trends

Asia Pacific medical animation market is expected to grow at the fastest CAGR over the forecast period. Increasing applications of medical animations, specifically the rising usage of 3D animations in disease management or disease awareness programs conducted by hospitals, are expected to contribute to the rapid growth of the market in the region. For instance, in March 2020, Fresenius Medical Care expanded its CSR initiative, The Kidney Kid Superhero, globally after its success in the Asia Pacific. This character-based program teaches children about kidney health through engaging adventures and aims to promote kidney health awareness worldwide.

The China medical animation market held a substantial market share in 2024 owing to high adoption of medical animations in clinical surgical practices. Medical animations assist surgeons in clinical practice by helping in procedure planning, demonstrating surgical techniques, and educating patients on available treatments and expected outcomes. For instance, in February 2022, Lanarkshire Chinese Association launched an animation promoting oral hygiene for children. The animation debuted at the LCA's Annual General Meeting and Chinese New Year celebrations, aiming to encourage good oral hygiene and healthy eating habits among children.

Latin America Medical Animation Market Trends

Latin America medical animation market is expected to grow significantly over the forecast period. The growth can be attributed to the use of medical animations in rehabilitation programs to inform patients about disease recovery. Thus, increasing rehabilitation programs are expected to drive the market.

The Brazil medical animation market is expected to experience exponential growth due to the adoption of animations in medical simulations. Medical simulations train professionals by creating a realistic training environment and anatomy animations.

Middle East & Africa Medical Animation Market Trends

The Middle East and Africa medical animation market is anticipated to grow significantly over the forecast period. Advancements in developing novel medical animations and education software integrated with Artificial Intelligence (AI) have increased regional market engagement.

Key Medical Animation Company Insights

Some of the key companies in the medical animation market include INFUSE MEDIA GROUP, LLC., Medmovie.com, Nucleus Medical Media, Radius Digital Science, Scientific Animations, Trinsic Animation, Viscira, Epic Systems Corporation, XVIVO, Ghost Productions, Inc., Intervoke, and DG INTERACTIVE, LLC. Organizations in the market are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

-

Ghost Productions, Inc. is a 3D medical animation studio and firm. It offers medical illustrations, animations, virtual reality surgery simulations, website design, and interactive software. Many clients, such as pharmaceutical companies, medical device manufacturers, hospitals, and medical schools, utilize its products for device sales, medical marketing, surgical training, and patient education.

-

XVIVO is a company specializing in 3D medical animations. It produces elaborate and visually captivating medical visuals, animations, and interactive experiences that depict advanced scientific discoveries. XVIVO operates across various scientific fields to produce customized medical animations for biotech, pharmaceutical, and educational institutions.

Key Medical Animation Companies:

The following are the leading companies in the medical animation market. These companies collectively hold the largest market share and dictate industry trends.

- INFUSE MEDIA GROUP, LLC.

- Medmovie.com

- Nucleus Medical Media

- Radius Digital Science

- Scientific Animations

- Trinsic Animation

- Viscira

- Epic Systems Corporation

- XVIVO

- Ghost Productions, Inc.

- Intervoke

- DG INTERACTIVE, LLC

Recent Developments

-

In August 2021, Ghost Productions Inc. collaborated with MicroAire Surgical to develop a visually striking animation featuring the SmartRelease product in a Plantar Fascia release. The SmartRelease is a surgical instrument used to cut the transverse carpal ligament and cubital tunnel fascia and releasing the plantar fascia and gastrocnemius aponeurosis.

-

In May 2021, Ghost Productions Inc. partnered with Spineology to offer cutting-edge VR training to sales representatives for the new OptiLIF spinal fixation procedure. Spineology has received final approval from the FDA for its procedure. It is created to improve overall patient results, as the medical instrument used to join the spine can be inserted through a smaller cut than other fusion systems.

Medical Animation Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 564.10 million

Revenue forecast in 2030

USD 1,418.67 Million

Growth rate

CAGR of 20.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, Therapeutic Area, Application, End Use, Region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

INFUSE MEDIA GROUP, LLC.; Medmovie.com; Nucleus Medical Media; Radius Digital Science; Scientific Animations; Trinsic Animation; Viscira; Epic Systems Corporation; XVIVO; Ghost Productions, Inc.; Intervoke; DG INTERACTIVE, LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Animation Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global medical animation market report based on type, therapeutic area, application, end use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

3D Animation

-

2D Animation

-

4D Animation

-

Flash Animation

-

-

Therapeutic Area Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Cardiology

-

Plastic Surgery

-

Dental

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Drug MoA

-

Patient Education

-

Surgical Training & Planning

-

Cellular & Molecular Studies

-

Others

-

-

End-Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Life Science Companies

-

Academic Institutes

-

Medical Device Manufacturers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.