- Home

- »

- Medical Devices

- »

-

Medical Billing Outsourcing Market Size, Share Report, 2030GVR Report cover

![Medical Billing Outsourcing Market Size, Share & Trends Report]()

Medical Billing Outsourcing Market Size, Share & Trends Analysis Report By Component (In-house, Outsourced), By Service (Front-End, Middle-End, Back-End), By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-261-7

- Number of Report Pages: 108

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Market Size & Trends

The global medical billing outsourcing market size was valued at USD 12.2 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 12.26% from 2023 to 2030. Emerging new trends mainly due to bad debts, new technological solutions, & bills, and changing regulatory guidelines, are contributing to the increasing impact of healthcare claim outsourcing. Medical billing outsourcing can help in lowering equipment and software expenses, improving cash flow, and reducing employee size and costs.

Due to the rising use of IT resources in the healthcare business and steady government support, the market is growing at a substantial rate. The increased cost of healthcare, particularly in developed countries, has led to continuous advancements, allowing for the high adoption of modern technology devices and equipment, such as RCM software. The rising patient load and the need to address the ever-growing record and bills are creating a burden on health practitioners. To counter such a situation, hospitals are outsourcing the clinical billing process which is expected to drive the growth of the market.

Medical billing involves revenue cycle management, which is the most complex and important component of the healthcare IT business. Due to a lack of expertise in dealing with new payment models and revenue management tools, current revenue management systems are becoming obsolete. In addition, the increasing use of billing and medical coding techniques in revenue cycle management is estimated to spur market growth.

The medical coding classification is subject to various changes, which is favoring the market growth. Billing for surgeries can be a daunting task for many health professionals and businesses, who may not have access to qualified personnel to undertake their duties. As a result, healthcare providers, hospitals, clinicians, and physicians prefer to outsource their healthcare financing needs to third-party providers.

The advent of advanced technology, money, labor, and time savings are rising the preference for healthcare billing outsourcing among healthcare providers. The need for medical billing outsourcing services is increasing due to the efforts of healthcare providers to reduce errors and internal procurement costs. It increases organization revenue by substantial cost savings and time on infrastructure, payroll, maintenance, purchase, and software updates. Well-established outsourcing companies offer a very transparent process.

The spread of the novel coronavirus has adversely affected the sector. New codes were created for COVID-19. For instance, the World Health Organization created the International Classification of Diseases (ICD-11) codes, which came into effect in January 2022. The advent of new technological solutions, increasing and changing government requirements, uncollectible accounts, and bad debt have boosted the preference for medical billing outsourcing by several healthcare providers.

Component Insights

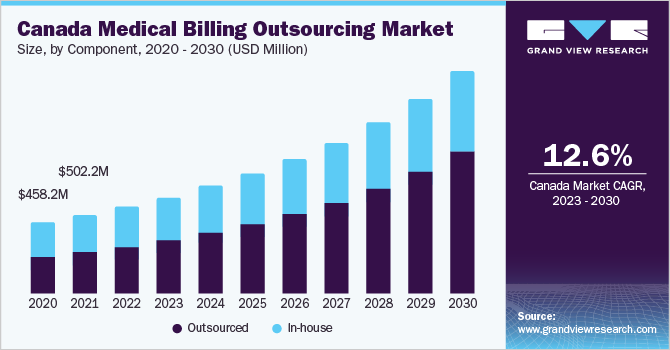

By component, the market is bifurcated into in-house and outsourced. The outsourced segment held the largest revenue share of 53.2% in 2022 and is expected to register the highest CAGR from 2023 to 2030. Outsourcing service significantly reduces costs and have proven to be a good fit for small and medium operations. Physician health operations at clinics and acute care hospitals are faced with challenging times as reimbursements have declined and costs are rising, and the newly introduced regulations have made business more complex. As per a survey conducted by the Medical Group Management Association (MGMA), a medical practice loses around 5-10% of its revenue due to errors in billing. This is boosting the segment’s growth.

Many companies are adopting or launching innovative cloud-based medical billing capabilities for superior security of patient data. For example, eClinicalWorks, a provider of medical billing services, launched a cloud-based revenue cycle management platform in 2018. In addition, outsourcing reduces labor costs by eliminating the need to hire an accounting team. Also, the company does not have to train or stay up to date, saving additional training costs.

Service Insights

Based on service, the market is segmented into front-end services, middle-end services, and back-end services. The front-end services segment dominated the market and accounted for a revenue share of 38.7% in 2022. Front-end services consist of processes, such as scheduling, preregistration, registration, pre-authorization, and insurance verification. It involves the major functions of medical billing. Managing front-end services well is key to reducing repetitive work and improving the patient experience with faster service. Therefore, the demand for outsourcing these services is strong.

However, the segment is estimated to witness a decline in revenue share owing to increased competition and saturation in the market. On the other hand, the middle-end services segment is projected to witness lucrative growth over the coming years because of new entrants in the sector as well as the rising awareness of the middle-end service among practitioners. These services have become the most popular function that healthcare providers outsource due to the critical nature of data and the significant challenges involved in managing the transfer internally in an efficient and cost-effective manner.

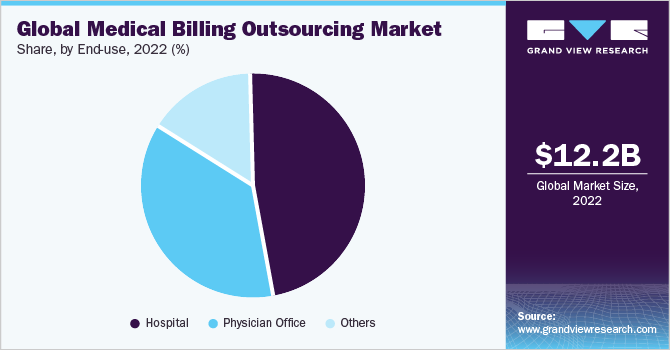

End-use Insights

The hospital segment with a share of 47.0%, held the maximum portion of the market in 2022. The segment is expected to maintain its dominance throughout the forecast period. This is primarily due to the increasing demand for financing services in healthcare facilities. In addition, the consolidation of hospitals adds to the complexity of the reimbursement and billing process. This is driving the demand for medical billing outsourcing services in the hospital sector.

The newly introduced International Classification of Diseases-10th revision (ICD-11) has made the medical billing business even more complex. Owing to this, the demand for Revenue Cycle Management (RCM) solutions has increased drastically. In addition, providers are choosing the companies having the right combination of RCM with electronic medical records for improving patient outcomes.

The physician office segment is expected to grow at the fastest rate over the forecast period. Rising expenditure on healthcare services provided by small and midsized providers due to the growing emphasis on risk management and regulatory compliance and complex technology and staffing requirements is expected to drive the segment in the years to come. As the number of services provided by physicians is increasing and government regulations are changing, a significant number of physicians have begun using RCM services at their medical facilities.

Regional Insights

North America dominated the market with a share of 47.3% in 2022. The presence of numerous healthcare providers in the U.S. and the shift in their focus on end-to-end outsourcing solutions for managing billing processes is augmenting the market in North America. Due to the increased awareness about the benefits offered by outsourcing, providers are preferring outsourced services to maximize profits and manage high-value transactions.

The market in Asia Pacific is anticipated to witness remarkable growth during the forecast period. Emerging countries such as Australia, India, and China are anticipated to register high growth owing to increasing patient populations and improving healthcare infrastructure. Increasing awareness about clinical billing software and the rising adoption of the latest technology is expected to boost the market. The increasing need to reduce healthcare delivery costs is favoring the growth of the market in Europe. In Latin America and the Middle East and Africa, the market is expected to grow owing to rising investment in healthcare by the government and an increasing number of private hospitals.

Key Companies & Market Share Insights

The market is highly fragmented, with many small, medium, and large-sized companies competing with one another. Partnerships, technological advancements, mergers, and acquisitions are key strategies undertaken by major companies to strengthen their market position. For instance, in March 2022, Omega Healthcare acquired Reventics, an RCM solution developer that provides solutions for provider engagement to improve compliance and physician reimbursement. Furthermore, in May 2023, Aspirion, a leading RCM provider announced the acquisition of FIRM Revenue Cycle Management Services, Inc. Some prominent players in the global medical billing outsourcing market include:

-

R1RCM Inc.

-

Veradigm, LLC

-

eClinicalWorks

-

Oracle

-

Kareo, Inc.

-

Quest Diagnostics Incorporated

-

AdvancedMD, Inc.

-

Promantra Inc.

-

McKesson Corporation

Medical Billing Outsourcing Market Report Scope

Report Attribute

Details

The market size value in 2023

USD 13.4 billion

The revenue forecast in 2030

USD 30.2 billion

Growth rate

CAGR of 12.26% from 2023 to 2030

The base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

June 2023

Quantitative units

Revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Component, service, end-use, region

Country scope

U.S.; Canada; Germany; UK; Spain; France; Italy; Sweden; Norway; Denmark; Japan; China; India; Australia; Thailand, South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; Kuwait; UAE

Key companies profiled

R1RCM Inc.; Veradigm, LLC; Oracle; eClinicalWorks; Kareo, Inc.; McKesson Corporation; Quest Diagnostics Incorporated; Promantra Inc.; AdvancedMD, Inc.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Billing Outsourcing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global medical billing outsourcing Market report based on component, service, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

In-house

-

Outsourced

-

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Front-end Services

-

Middle-end Services

-

Back-end Services

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital

-

Physician Office

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global medical billing outsourcing market size was estimated at USD 12.2 billion in 2022 and is expected to reach USD 13.4 billion in 2023.

b. The global medical billing outsourcing market is expected to grow at a compound annual growth rate of 12.26 from 2023 to 2030 to reach USD 30.2 billion by 2030.

b. North America held the largest revenue share of 47.3% in the medical billing outsourcing market in 2022. A number of healthcare providers in the U.S. has turned their focus on end-to-end outsourcing firms for managing their billing processes which is boosting the market in the region

b. Some key players operating in the medical billing outsourcing market include R1RCM Inc., Veradigm, LLC, Oracle, eClinicalWorks, Kareo, Inc., McKesson Corporation, Quest Diagnostics Incorporated, Promantra Inc., AdvancedMD, Inc.

b. Key factors that are driving the medical billing outsourcing market growth include growing emphasis on compliance and risk management, increasing need to make the medical billing process efficient, and efforts to decrease in-house processing costs.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."