- Home

- »

- Medical Devices

- »

-

Medical Devices Reimbursement Market Size Report, 2030GVR Report cover

![Medical Devices Reimbursement Market Size, Share & Trends Report]()

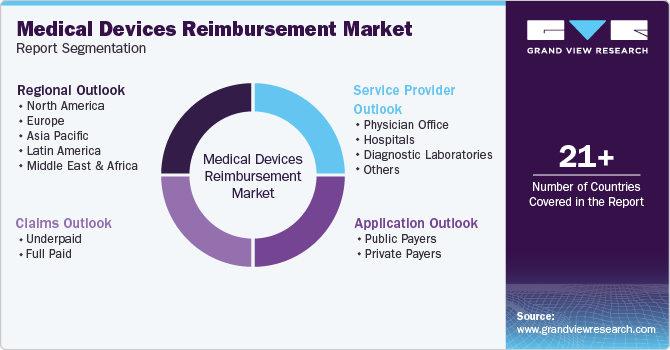

Medical Devices Reimbursement Market (2025 - 2030) Size, Share & Trends Analysis Report By Claim (Underpaid, Full Paid), By Payer (Public, Private), By Service Provider (Hospitals), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-835-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Medical Devices Reimbursement Market Summary

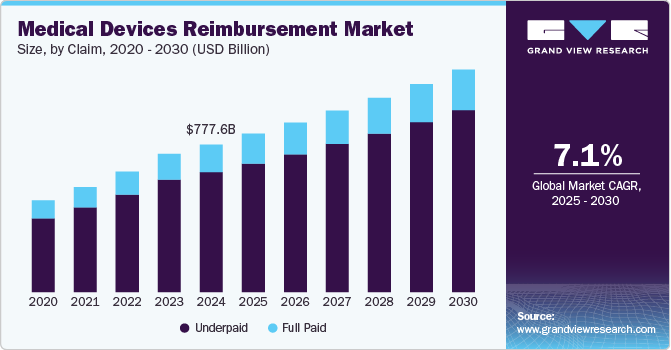

The global medical devices reimbursement market size was estimated at USD 777.64 billion in 2024 and is projected to reach USD 1171.72 billion by 2030, growing at a CAGR of 7.1% from 2025 to 2030. Increasing prevalence of cardiovascular diseases and technological advancements in the field of medical devices reimbursement are factors anticipated to boost market growth.

Key Market Trends & Insights

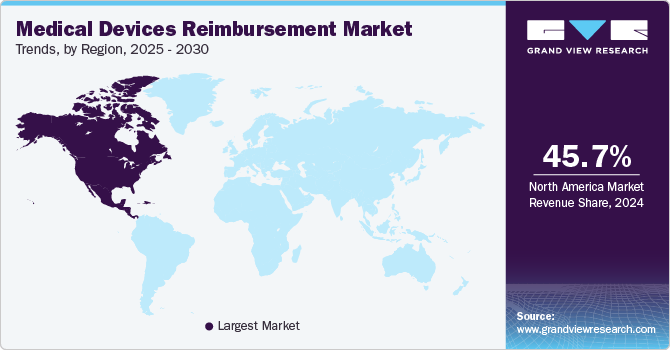

- North America dominated the medical devices reimbursement industry in 2024 with a share of 45.71% and is expected to maintain its position during the forecast period.

- The U.S. accounted for the largest share of 93.87% in North America

- By claim, the underpaid segment dominated the market in 2024 with a share of 81.24% and is expected to grow at the fastest CAGR over the forecast period.

- By payer, the public payers segment dominated the market in 2024 with a share of 66.30%.

Market Size & Forecast

- 2024 Market Size: USD 777.64 Billion

- 2030 Projected Market Size: USD 1171.72 Billion

- CAGR (2025-2030): 7.1%

- North America: Largest market in 2024

According to the World Health Organization's World Health Statistics 2024 report, Noncommunicable Diseases (NCDs) account for approximately 71% of all deaths worldwide, with cardiovascular diseases alone responsible for 17.9 million deaths annually. The rising prevalence of these conditions has led to an increased demand for medical devices such as insulin pumps, cardiac monitors, and dialysis machines. This surge necessitates comprehensive reimbursement strategies to ensure patient access to essential technologies. This is likely to add to market growth.

In addition, healthcare industry is experiencing a paradigm shift from traditional Fee-for-Service (FFS) models to Value-based Care (VBC) frameworks. This transition emphasizes patient outcomes and cost-efficiency, rewarding healthcare providers based on the quality rather than the quantity of care delivered. In 2022, nearly 70% of Medicare Advantage enrollees opted for providers participating in VBC models, reflecting a growing patient preference for such approaches. For medical device manufacturers, the shift to VBC necessitates the demonstration that their products contribute to improved patient outcomes and cost savings. Devices that can provide measurable improvements in health metrics are more likely to be favored in reimbursement decisions within VBC frameworks.

The Centers for Medicare & Medicaid Services (CMS) has established comprehensive policies governing the reimbursement of medical devices under the Medicare program. These policies are designed to ensure that beneficiaries have access to necessary medical technologies while maintaining fiscal responsibility. For instance, medicare provides coverage for DMEPOS, which includes items such as wheelchairs, prosthetic limbs, orthotic braces, and other medically necessary equipment. Payment for most DMEPOS items is determined by a fee schedule, where Medicare typically covers 80% of the approved amount and the beneficiary is responsible for the remaining 20%, along with any unmet Part B deductible. Payment amounts are established for items under the DMEPOS Competitive Bidding Program through a bidding process among suppliers.

Moreover, the U.S. Affordable Care Act (ACA) focuses on decreasing the costs of healthcare for patients. The main purpose of this Act is to reduce medical device costs and make affordable healthcare insurance available to every person in the country. In addition, the Center for Medicaid and Medicare is working toward providing high-quality medical devices and making health insurance available for billions of people. Medicaid spending in the U.S. increased by 9.2% in 2021. In addition, according to a report published by the American Medical Association, USD 4.3 trillion is estimated to have been spent on healthcare reimbursement in 2021 in the U.S.

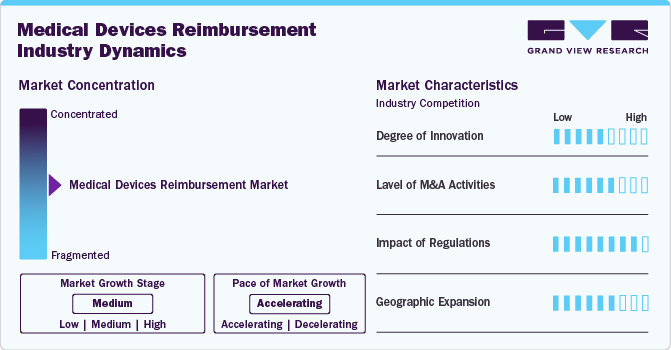

Market Concentration & Characteristics

The medical devices reimbursement industry is experiencing a medium level of degree of innovation driven by the development of emerging technologies, such as 3D-printed implants and digital therapeutics, are driving new coverage considerations. Various regulatory initiatives are undertaken aimed at improving access to medical technologies, which can influence reimbursement policies and practices globally. In July 2024, the World Health Organization (WHO) launched the Medical Devices Information System (MeDevIS), an online platform designed to enhance global access to medical technologies and devices. MeDevIS serves as the first global open-access clearinghouse for information on medical devices, aiming to standardize data and improve transparency in the medical device sector.

The level of M&A activities is moderate in the market. Mature players are acquiring emerging players to strengthen their position. For instance, in August 2024, IQVIA acquired MCRA, a prominent medical device advisory firm. This strategic acquisition enhanced IQVIA's capabilities in the medical device sector by integrating MCRA's expertise in regulatory affairs, clinical research, reimbursement, and quality assurance. MCRA, now operating as an IQVIA business, continues to offer comprehensive support to clients, assisting them throughout the entire technology lifecycle from research and development to commercialization.

Government initiatives play a vital role in boosting medical reimbursement market growth. For instance, the Affordable Care Act (ACA), implemented in the U.S., focuses on expanding health insurance coverage to low-income individuals. The act aims to improve the quality of healthcare services and reduce the cost of care. The expanding insurance coverage is expected to increase the number of reimbursements as well as denials.

Several market players are expanding their business by introducing new services. For instance, in June 2024, Endotronix, Inc. received FDA Premarket Approval (PMA) for its Cordella Pulmonary Artery (PA) Sensor System designed to treat patients with New York Heart Association (NYHA) Class III heart failure. The Cordella System includes an implantable PA sensor that remotely monitors pulmonary artery pressure, a key indicator of heart failure status. It also enables reimbursement for implantation and ongoing management through existing reimbursement pathways.

Claim Insights

The underpaid segment dominated the market in 2024 with a share of 81.24% and is expected to grow at the fastest CAGR over the forecast period. Underpaid claims occur when healthcare providers receive lower reimbursements than expected for medical devices due to coding errors, policy changes, or administrative delays. This issue affects hospitals, clinics, and manufacturers, leading to financial strain and disputes with payers. Many providers struggle to recover lost revenue, as the appeals process can be complex and time-consuming. In the U.S., a significant portion of medical device claims are underpaid due to discrepancies in billing codes and shifting insurance policies. Recent data suggests that automation and AI-driven claim review systems are helping providers identify and challenge underpaid claims more efficiently.

The full paid segment is expected to grow significantly over the forecast period. Full paid claims represent successful reimbursement transactions where healthcare providers receive the due amount for medical devices. These claims indicate a well-functioning reimbursement system, allowing hospitals and device manufacturers to maintain financial stability. In the U.S., the Centers for Medicare & Medicaid Services (CMS) has introduced new policies to streamline reimbursements for innovative medical devices, ensuring full payments for eligible products. The FDA’s approval of new breakthrough medical devices has recently led to increased reimbursement approvals, benefiting manufacturers and healthcare providers.

Payer Insights

The public payers segment dominated the market in 2024 with a share of 66.30%. The demand for public payers is increasing due to the rising prevalence rate of chronic diseases globally and the need for cost-effective procedures in healthcare settings. An increase in the adoption of public payer services in emerging & developed markets and the introduction of advanced medical devices along with reimbursement facilities are further driving segment growth. For instance, in July 2024, the Centers for Medicare & Medicaid Services (CMS) introduced the Transitional Coverage for Emerging Technologies (TCET) program. This initiative aims to expedite Medicare coverage for FDA-designated breakthrough medical devices, enhancing patient access to innovative technologies. The TCET program seeks to streamline the coverage process, balancing the need for rapid access with patient safety and clinical effectiveness

The private payer segment is expected to grow at the fastest CAGR over the forecast period owing to the presence of a large number of private players in the market. The rising prevalence of cancer & diabetes and increasing demand for better treatment are factors expected to drive segment growth over the forecast period. Private players reimburse a medical device that has been approved by the FDA. In addition, with the increasing prevalence of respiratory diseases, the demand for expensive medical devices, such as ventilators, is increasing. Therefore, the demand for private payer services is expected to grow over the forecast period.

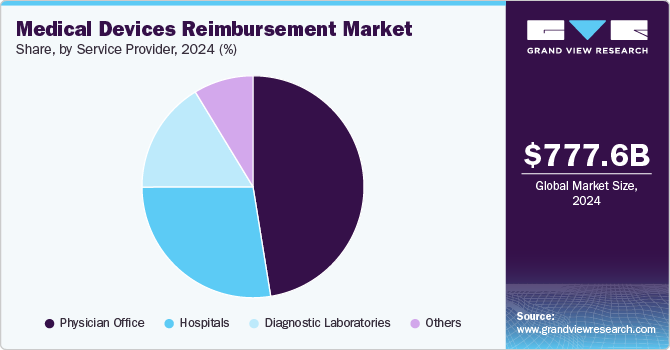

Service Provider Insights

The physician offices segment accounted for the largest share of 47.45% in 2024 owing to the frequent use of various medical devices for diagnosis, treatment, and patient management. Devices such as diagnostic tools, monitoring equipment, and therapeutic devices are commonly used in outpatient settings. Reimbursement for these devices is typically processed through private insurance providers, Medicare, or Medicaid, depending on the country’s healthcare system.

Hospitals are expected to grow at the fastest CAGR over the forecast period, serving as primary end-users that rely on reimbursement policies to manage costs and ensure patient access to advanced medical technologies. Reimbursement frameworks directly impact hospitals' purchasing decisions, particularly for high-cost devices such as implantable cardiac devices, surgical robotics, diagnostic imaging equipment, and AI-driven monitoring systems. Many hospitals operate under Diagnosis-Related Groups (DRGs), bundled payments, or fee-for-service models, where reimbursement rates determine the financial feasibility of adopting new medical technologies.

Regional Insights

North America dominated the medical devices reimbursement industry in 2024 with a share of 45.71% and is expected to maintain its position during the forecast period. owing to favorable regulatory policies and robust reimbursement structure. Provisions for medical device reimbursement are also well-established in the region. The rising prevalence of chronic diseases, coupled with increasing demand for medical devices, is expected to augment market growth in this region over the forecast period.

U.S. Medical Devices Reimbursement Market Trends

The U.S. accounted for the largest share of 93.87% in North America due to technological advancements and the recent reimbursement approvals of many medical devices. The U.S. Affordable Care Act helps regulate and reduce healthcare expenses by distributing the cost of specific services across a broad patient base. This legislation has made healthcare more accessible to a larger population by promoting innovative approaches to delivering medical care at lower costs. In addition, the Centers for Medicare & Medicaid Services (CMS) implements effective strategies to enhance the healthcare system by ensuring the provision of high-quality, reliable care and expanding health insurance coverage nationwide. These supportive policies contribute significantly to the dominant share of the medical device reimbursement market.

Europe Medical Devices Reimbursement Market Trends

Europe held a substantial revenue share of the global medical devices reimbursement industry. The UK, France, Germany, Italy, and Spain are the main markets in this region. Growing R&D activities in the pharma and biotech sector in developed countries, such as the UK, Germany, Italy, & France, and the presence of high unmet needs in Eastern Europe are some of the factors anticipated to drive growth over the forecast period. The increasing prevalence of chronic diseases due to lifestyle changes is a major factor likely to drive the market. Other factors contributing to the growth of this region are the local presence of major market players, technological advancements, and growth in business activities, such as the launch of new products and mergers & acquisitions.

Germany dominated the Europe medical devices reimbursement market owing to the presence of advanced healthcare system. The country has around 100 statutory health insurers, with the National Association of Statutory Health Insurance Funds (GKV) being the largest payer institution. However, on the basis of the number of persons insured, Techniker Krankenkasse (TK) is the largest single health insurance funding entity in Germany; it provided insurance to around 11.3 million individuals in 2023.

The UK is one of the largest markets for medical devices reimbursement in Europe and is expected to witness lucrative growth. Rising incidence & prevalence of chronic diseases are some of the major factors contributing to this growth. In addition, the geriatric population in the UK has significantly increased in the past five decades, which is further likely to add to the market demand. For instance, according to a report by the UK parliament, over one-fifth of the people in the country are above 65 years of age.

Asia Pacific Medical Devices Reimbursement Market Trends

The medical devices reimbursement market in Asia Pacific is expected to register significant growth over the forecast period. The evolving business landscape and the increasing costs of medical devices are key factors driving the demand for medical device reimbursement services in countries such as India and China.

China dominated the Asia Pacific medical devices reimbursement market. China is a major medical device reimbursement market due to its cost-effectiveness and the growing pharmaceutical industry. Due to cost-efficient services provided by the Chinese healthcare industry as compared to the U.S. and European countries, there is an increasing demand for medical device reimbursement market services. Increasing awareness regarding medical devices reimbursement process is further expected to boost the market during the forecast period.

India is expected to register significant growth over the forecast period in Asia Pacific medical devices reimbursement market. India faces significant healthcare challenges, particularly with the rising incidence of cancer. It is projected that one in nine Indians will receive a cancer diagnosis in their lifetime, making it imperative to enhance access to effective medical care. The limited availability of medical equipment, especially in Tier 2 and Tier 3 cities, has severely impacted on the quality of healthcare services. This situation necessitates innovative solutions to bridge the gap in healthcare infrastructure.

Latin America Medical Devices Reimbursement Market Trends

The medical devices reimbursement market in Latin America is expected to register considerable growth over the forecast period owing to its proximity to the U.S., which reduces monitoring costs associated with reimbursement services. Presence of medical devices reimbursement rise in investments in R&D research and increase in regulatory guidelines are among factors expected to drive the medical devices reimbursement industry in the region.

Middle East & Africa Medical Devices Reimbursement Market Trends

The medical device reimbursement market in the Middle East & Africa (MEA) is driven by rising healthcare expenditure, government initiatives, and expanding insurance coverage. Several Gulf Cooperation Council (GCC) countries, such as Saudi Arabia, the UAE, and Kuwait, have universal healthcare schemes that support the reimbursement of medical devices. In addition, increasing private health insurance penetration in these countries is improving access to advanced medical technologies. Countries such as South Africa are implementing National Health Insurance (NHI) programs, aiming to expand coverage and integrate medical device reimbursement into their healthcare frameworks.

Key Medical Devices Reimbursement Company Insights

Key companies in the market are engaged in adopting strategies such as mergers and acquisitions, new service launches, partnerships, collaborations, and expansion to strengthen their position in the market.

Key Medical Devices Reimbursement Companies:

The following are the leading companies in the medical devices reimbursement market. These companies collectively hold the largest market share and dictate industry trends.

- MCRA (IQVIA)

- WellCare Health Plans, Inc.

- BNP Paribas

- Boston Scientific

- Humana

- Cigna Healthcare

- Anthem Insurance Companies, Inc. (Elevance Health)

- Abbott Laboratories

- Ethicon (J & J Medtech)

- AdvaMed

Recent Developments

-

In August 2025, The Centers for Medicare and Medicaid Services (CMS) issued a National Coverage Determination (NCD) to provide reimbursement for Implantable Pulmonary Artery Pressure Sensors (IPAPS) used in heart failure management. The decision falls under the Coverage with Evidence Development (CED) framework. As part of this NCD, the CardioMEMS CED study received CMS approval, ensuring that all Medicare beneficiaries, including those who were previously denied under Medicare Advantage plans, can access the CardioMEMS HF System, provided they meet the NCD criteria.

-

In February 2025, The French National Authority for Health released seven recommendations regarding the add-on reimbursement of medical devices and medical aids. These recommendations, developed by the National Commission for Evaluation of Medical Devices and Health Technologies (CNEDiMTS), pertain to the inclusion or modification of devices in the List of Reimbursable Products and Services (LPPR). The devices evaluated span various medical fields, including neurovascular, neuromodulation, endocrine, ophthalmology, orthopedics, and medical aid.

-

In May 2023, Humana announced partnerships with two national DME providers, AdaptHealth Corp. and Rotech Healthcare Inc., to enhance access to DME for its Medicare Advantage HMO members. These partnerships operate under a value-based structure, with each provider serving specific regions. This initiative aimed to streamline the DME acquisition process, improve service quality, and contribute to better health outcomes for members. It also simplified the ordering process for healthcare providers, ensuring timely delivery of necessary equipment.

Medical Devices Reimbursement Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 832.75 billion

Revenue forecast in 2030

USD 1,171.72 billion

Growth Rate

CAGR of 7.1% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Report updated

April 2025

Quantitative units

Revenue in USD Billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Claim, Payer, Service Provider, Region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; Spain; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

MCRA (IQVIA); WellCare Health Plans, Inc.; BNP Paribas; Boston Scientific; Humana; Cigna Healthcare; Anthem Insurance Companies, Inc. (Elevance Health); Abbott Laboratories; Ethicon (J & J Medtech); AdvaMed

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Devices Reimbursement Market Report Segmentation

This report forecasts revenue growth and provides at global, regional, and country levels an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global medical devices reimbursement market report-based on claim, payer, service provider, and region:

-

Claims Outlook (Revenue, USD Billion; 2018 - 2030)

-

Underpaid

-

Full Paid

-

-

Application Outlook (Revenue, USD Billion; 2018 - 2030)

-

Public payers

-

Private payers

-

-

Service Provider Outlook (Revenue, USD Billion; 2018 - 2030)

-

Physician Office

-

Hospitals

-

Diagnostic Laboratories

-

Others

-

-

Regional Outlook (Revenue, USD Billion; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global medical devices reimbursement market size was estimated at USD 777.64 billion in 2024 and is expected to reach USD 832.75 billion in 2025.

b. The global medical devices reimbursement market is expected to grow at a compound annual growth rate of 7.07% from 2025 to 2030 to reach USD 1,171.72 billion by 2030.

b. The underpaid segment dominated the market in 2024 with a share of 81.24%. Underpaid claims occur when healthcare providers receive lower reimbursements than expected for medical devices due to coding errors, policy changes, or administrative delays. Recent data suggests that automation and AI-driven claim review systems are helping providers identify and challenge underpaid claims more efficiently.

b. Some key players operating in the medical devices reimbursement market include MCRA (IQVIA), WellCare Health Plans, Inc., BNP Paribas, Boston Scientific, Humana, Cigna Healthcare, Anthem Insurance Companies, Inc. (Elevance Health), Abbott Laboratories, Ethicon (J & J Medtech), AdvaMed.

b. Key factors driving the medical devices reimbursement market growth include increased cost of devices, enhanced strategic planning on part of medical device manufacturers, the introduction of reforms and new bills by governments, and shift of healthcare providers to form accountable care organizations (ACOs).

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.