- Home

- »

- Medical Devices

- »

-

Medical Digital Imaging System Market, Industry Report 2030GVR Report cover

![Medical Digital Imaging System Market Size, Share & Trends Report]()

Medical Digital Imaging System Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software), By Modality (CT, MRI), By Deployment Mode, By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-054-5

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

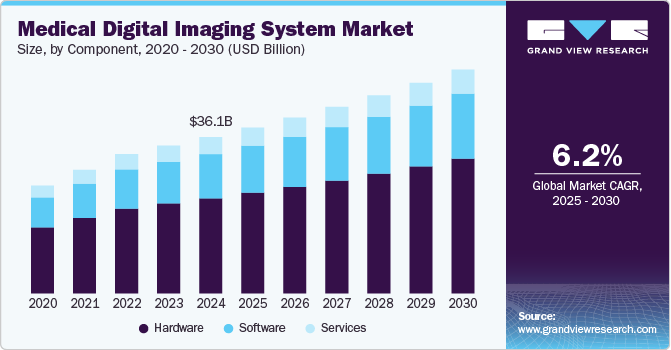

The global medical digital imaging system market size was estimated at USD 36.1 billion in 2024 and is expected to grow at a CAGR of 6.2% from 2025 to 2030. The growth of the medical digital imaging system industry can be attributed to technological advancements, the rising prevalence of chronic diseases, an aging population, increased awareness of preventive care and early diagnosis, government and private sector investments in healthcare infrastructure, expanding adoption of cloud-based PACS and teleradiology, and increasing healthcare access in emerging markets. For instance, in November 2024, China took a significant step toward enhancing its healthcare system by expanding access to wholly foreign-owned hospitals, signaling an openness to greater international investment. The National Health Commission (NHC), in collaboration with three other key government departments, announced a detailed plan for establishing such hospitals in nine major cities: Beijing, Tianjin, Shanghai, Nanjing, Suzhou, Fuzhou, Guangzhou, Shenzhen, and across the entire island of Hainan.

The medical digital imaging system industry is driven by advancements in imaging technologies and the increasing adoption of complementary systems like Picture Archiving and Communication Systems (PACS), Radiology Information Systems (RIS), and advanced visualization software. PACS and RIS streamline the storage, retrieval, and sharing of imaging data, enabling seamless integration with hospital information systems and electronic health records, which enhances workflow efficiency and diagnostic accuracy. The rise of advanced visualization software further boosts this growth, as these tools enhance diagnostic precision through features like 3D and 4D imaging, artificial intelligence-based analysis, and interactive anatomical modeling. These technologies are transforming medical diagnostics, combined with advancements in imaging modalities such as MRI, CT, and ultrasound, which continue to deliver improved image quality and lower radiation exposure.

Furthermore, the surge in telemedicine has accelerated the adoption of digital imaging systems, as remote consultations and teleradiology rely heavily on efficient image sharing and analysis. These factors collectively position the industry for continuous expansion as healthcare providers increasingly prioritize digital and interconnected solutions to improve patient outcomes. According to a report published by Harvard Medical School, telemedicine services resulted in improved quality of care, enhanced accessibility, and only a modest rise in healthcare spending.

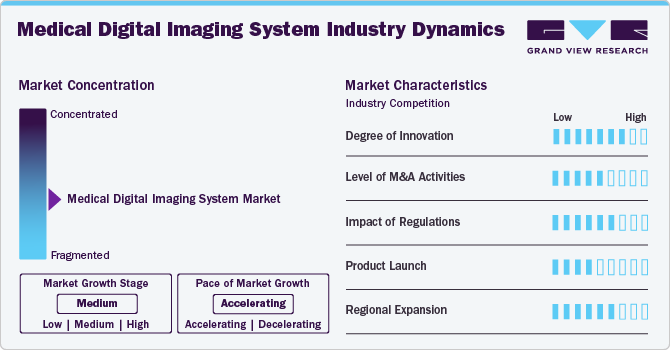

Market Concentration & Characteristics

The medical digital imaging system industry is growing at a significant rate. This growth is owing to advancements across various aspects of medical imaging, including software, imaging modalities, and associated services. These technological improvements enhance the accuracy, efficiency, and accessibility of imaging systems, enabling healthcare providers to deliver better diagnostic and treatment outcomes. The rising prevalence of chronic diseases and other medical conditions globally has also fueled the demand for innovative imaging solutions. The industry is expected to expand as healthcare systems increasingly adopt digital imaging technologies to improve patient care and streamline workflows.

Companies in the medical digital imaging industry are strategically focusing on product launches to strengthen their industry position and meet the growing demand for advanced imaging solutions. For instance, in November 2024, United Imaging announced the installation of the world's first uMI Panvivo PET/CT system at Pueblo Medical Imaging in Nevada, U.S. This groundbreaking platform builds upon United Imaging's fully digital PET/CT portfolio, offering exceptional performance with an industry-leading NEMA spatial resolution of 2.9 mm. The uMI Panvivo is designed to deliver highly precise imaging capabilities, enabling clinicians to achieve superior diagnostic accuracy. This launch highlights United Imaging's commitment to advancing medical imaging technology and addressing the evolving needs of healthcare providers and patients.

The degree of innovation in the medical digital imaging system industry is remarkably high, reflecting a dynamic landscape shaped by technological advancements and evolving clinical demands. In November 2024, GE Healthcare unveiled the Pristina Via mammography system, specifically designed to improve the screening experience for both patients and technologists.

Industry players are increasingly adopting mergers and acquisitions as a strategic move to strengthen their industry position, broaden their product offerings, and accelerate growth. For instance, in September 2023, Varian Medical Systems, Inc. acquired Aspekt Solutions, a company specializing in medical physics, strategic consulting, and dosimetry services. This acquisition enhances Varian's Advanced Oncology Solutions (AOS) portfolio and boosts its ability to address the growing demand for customized services and standardized care delivery.

Regulations play a pivotal role in shaping the medical digital imaging system industry, influencing product development, manufacturing, and industry entry. Regulatory bodies, such as the FDA in the United States and the European Medicines Agency (EMA) in the EU, establish stringent guidelines to ensure imaging systems' safety, efficacy, and quality.

Manufacturers actively launch new products to meet evolving industry demands and technological advancements. In May 2024, Shimadzu Corporation released the RADspeed Pro SR5 Version, an X-ray General Imaging System designed to enhance usability with console upgrades and an optical camera that detects patient movements. These innovations improve examination efficiency and reduce the burden on healthcare workers and patients.

The geographical reach of the medical digital imaging system industry is expanding as manufacturers strategically extend their presence into emerging and established industries. For instance, in July 2024, Siemens Healthineers AG announced that its Multix Impact E digital radiography X-ray machine would now be manufactured in India. This milestone reflects the company’s commitment to improving access to advanced medical imaging technologies for regional patients while supporting local healthcare infrastructure development. Such initiatives highlight the industry's efforts to enhance global accessibility and meet the growing demand for innovative imaging solutions across diverse industries.

Component Insights

The hardware system segment dominated the market in 2024 by capturing a share of 60.8%. This segment is further divided into workstations, servers, and storage systems. The growth of this segment is driven by the increasing era of digitization and the widespread adoption of advanced technologies in healthcare. As medical facilities transition to digital platforms, the demand for high-performance hardware systems to manage, store, and process large volumes of imaging data has surged. Integrating advanced technologies, such as cloud computing and AI, into these hardware systems further accelerates their market growth, enabling enhanced efficiency, better image quality, and more accurate diagnoses.

The software segment is expected to grow at the fastest CAGR of 6.6% over the forecast period. This is owing to the rising adoption and enhanced efficiency of various software solutions within the medical imaging industry. As healthcare systems increasingly grow to digital platforms, the demand for advanced software tools, such as Picture Archiving and Communication Systems (PACS), Radiology Information Systems (RIS), and AI/ML-based image analysis tools, is accelerating. These software solutions streamline workflows, improve diagnostic accuracy, and facilitate seamless data sharing across different healthcare providers. The continuous development of AI-driven technologies, advanced visualization software, and vendor-neutral archives further bolstered the segment's growth, offering more precise, efficient, and accessible imaging solutions that meet the evolving needs of the healthcare industry.

Modality Insights

The computed tomography segment dominated the market and accounted for the largest revenue share of 26.2% in 2024. This is driven by the growing demand for non-invasive diagnostic tools, the increasing prevalence of chronic diseases, and advancements in CT technology, such as higher-resolution imaging, faster scanning times, and improved accuracy. CT scans are widely used in various medical fields, including oncology, cardiology, and emergency care, making them essential for early disease detection and treatment planning.

The nuclear imaging (PET/SPECT) segment is expected to grow at the fastest CAGR of over 7.3% during the forecast period. This is due to the increasing prevalence of cancer worldwide and the growing demand for more precise, non-invasive diagnostic techniques. The International Agency for Research on Cancer reported that in 2022, approximately 19,976,499 new cancer cases were diagnosed globally, and 9,743,832 cancer-related deaths occurred in the same year. Positron Emission Tomography (PET) and Single Photon Emission Computed Tomography (SPECT) are crucial in oncology for detecting and staging cancer, monitoring treatment response, and assessing tumor recurrence. The advancements in PET/SPECT imaging technologies, including better resolution and improved tracer agents, also contribute to the segment’s growth.

Deployment Mode Insights

The on-premises segment dominated the market and accounted for the largest revenue share of 41.9% in 2024. This is driven by the healthcare industry's preference for having direct control over their imaging systems, particularly in large medical institutions such as hospitals and specialized diagnostic centers. On-premises solutions offer enhanced security, control over data, and the ability to customize the systems to meet specific organizational needs. In addition, on-premises deployment ensures faster access to imaging data and better integration with existing IT infrastructure, which is crucial for maintaining the efficiency of workflows in time-sensitive environments like radiology departments.

The cloud-based segment is expected to grow at the fastest CAGR of over 6.7% during the forecast period. Cloud-based solutions offer several advantages, including remote access to imaging data, reduced infrastructure costs, and the ability to easily scale storage and processing capabilities. These benefits are particularly attractive to healthcare providers looking to improve operational efficiency, facilitate collaboration across multiple locations, and enhance data sharing between departments or institutions. Moreover, the cloud's ability to integrate advanced technologies such as artificial intelligence (AI) and machine learning (ML) for image analysis further contributes to its growth, enabling more efficient and accurate diagnostics.

Application Insights

The diagnostic imaging segment dominated the market and accounted for the largest revenue share of 59.2% in 2024; this segment is expected to grow at the fastest CAGR over the forecast period. This is driven bythe increasing demand for early and accurate disease detection and the rising prevalence of chronic diseases such as cancer, cardiovascular conditions, and neurological disorders. Diagnostic imaging technologies, including CT, MRI, ultrasound, and X-ray, are essential for identifying health issues early, enabling timely interventions, and improving patient outcomes.

The therapeutic imaging segment is also expected to grow at a significant CAGR of over 6.3% during the forecast period. Advanced imaging techniques are increasingly used in treatment planning and monitoring, particularly in fields like oncology, cardiology, and neurology. Therapeutic imaging is crucial in guiding precise treatments, such as radiation therapy for cancer patients, by providing detailed images of the targeted area, ensuring that radiation is delivered accurately while minimizing damage to surrounding healthy tissues. Furthermore, the integration of imaging with other treatment modalities, such as image-guided surgery and interventional procedures, further accelerates the segment's growth.

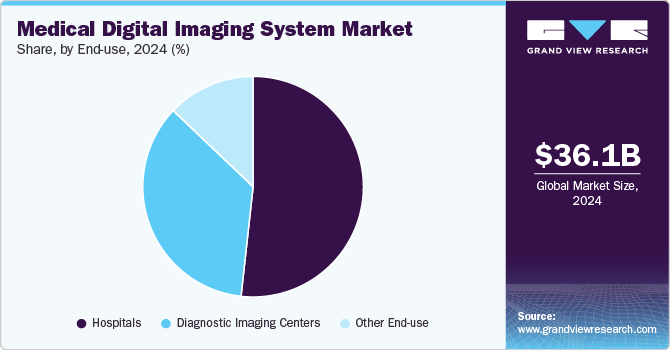

End Use Insights

The hospitals segment held the largest revenue share of 51.8% in 2024. Hospitals are key adopters of advanced medical digital imaging systems due to their need for comprehensive diagnostic and therapeutic capabilities. The growing demand for efficient, high-quality imaging systems in hospitals is driven by the increasing prevalence of chronic diseases, the need for accurate diagnosis, and the emphasis on improving patient outcomes.

The diagnostic imaging centers segment is expected to witness the fastest CAGR of 6.5% during the forecast period. This growth is primarily driven by the increasing demand for specialized imaging services and the growing preference for outpatient care. Diagnostic imaging centers offer patients quicker access to imaging procedures, such as CT scans, MRIs, and X-rays, at lower costs compared to hospitals, making them an attractive option for routine and specialized diagnostic needs. As the healthcare industry shifts toward more accessible and affordable care settings, these centers benefit from the rising demand for non-invasive diagnostic solutions.

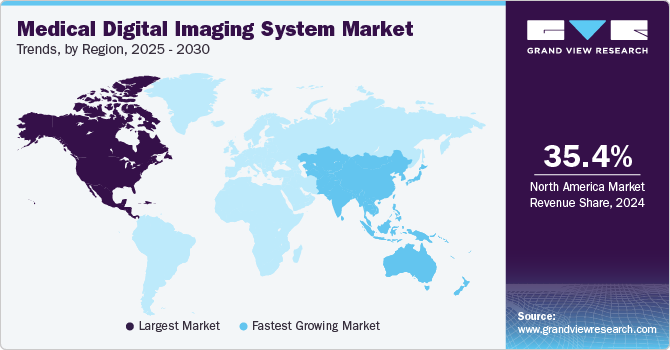

Regional Insights

North America medical digital imaging system market held the largest share of 35.4% in 2024. Key factors driving market growth in this region include its advanced healthcare infrastructure, the presence of major market players, the growing prevalence of chronic disorders, and the adoption of advanced technologies. The region's strong investment in research and development has led to the innovation and implementation of advanced imaging modalities, such as AI-driven systems, which further enhance diagnostic capabilities. The high demand for healthcare services, coupled with a rising aging population and increasing rates of conditions like cancer, cardiovascular diseases, and neurological disorders, also contribute to market growth.

U.S. Medical Digital Imaging System Market Trends

The medical digital imaging system market in the U.S. held the largest market share in 2024 in the North American region. This is primarily attributed to end users' growing adoption of advanced healthcare technologies and the continuous initiatives undertaken by market players to drive innovation and meet the increasing demand for diagnostic imaging solutions. For instance, in June 2024, Siemens Healthineers announced the FDA clearance of the Biograph Trinion, a high-performance, energy-efficient positron emission tomography/computed tomography (PET/CT) scanner.

Europe Medical Digital Imaging System Market Trends

The medical digital imaging system market in Europe held a significant market share in 2024. This is owing to theregion's well-established healthcare infrastructure, strong focus on improving patient outcomes, and increasing demand for advanced imaging technologies. The growing adoption of innovative solutions and the shift toward more personalized and precise medical care further contribute to the market's expansion. For instance, in October 2024, United Imaging launched the uMI Panvivo, the uMI Panorama GS, and a Nuclear Medicine AI Solution at the European Association of Nuclear Medicine (EANM) conference. This launch and strategic partnerships highlight the company's commitment to advancing molecular imaging technologies in Europe and beyond.

The UK medical digital imaging system market is experiencing significant growth, driven by technological advancements and the expanding presence of market players. In May 2024, Siemens Healthineers announced a new facility in North Oxfordshire. This facility will design and manufacture superconducting magnets for MRI patient scans in healthcare facilities worldwide. With an investment of £250 million, the site will feature novel technology to minimize the use of helium, making MRI scanners lighter, easier to install, and more sustainable. This investment underscores the UK's role as a hub for innovation in the medical imaging industry, contributing to the sector's overall growth by advancing MRI technology, improving operational efficiency, and reducing environmental impact .

The medical digital imaging system market in France is expected to grow over the forecast period. This is driven by the increasing prevalence of chronic disorders and the growing demand for advanced diagnostic technologies. As chronic diseases such as cancer, cardiovascular conditions, and neurological disorders continue to rise, the need for accurate and early diagnostic imaging becomes more critical.

Germany medical digital imaging system market is experiencing significant growth, driven by advancements in medical technology, strategic initiatives by market players, and the rising prevalence of chronic diseases in the country. In October 2024, GE HealthCare (GEHC) announced a collaboration with the University of Medicine Essen in Germany to establish a new Theranostics Centre of Excellence. This center will focus on supporting the use of theranostics-an emerging field that combines therapy and diagnostics-in clinical practice. It aims to advance research on more personalized approaches to cancer care, enhancing the precision and effectiveness of treatments.

Asia Pacific Medical Digital Imaging System Market Trends

The medical digital imaging system marketinAsia Pacific is expected to witness the fastest growth of CAGR of 6.8% over the forecast period. This growth is primarily driven by the increasing demand for advanced healthcare technologies, improving healthcare infrastructure, and rising awareness about early disease detection. In addition, the growing expansion of market players in the region further contributes to market growth. For instance, in June 2024, Esaote Group, a leading Italian innovator in medical imaging, strengthened its presence in India by establishing a new manufacturing site in New Delhi. This facility will produce advanced ultrasound systems for the Indian market, including My Lab A, My Lab E series, and compact portable ultrasounds, which will significantly move toward localized production and further support the region's healthcare development.

China medical digital imaging system marketis expected to grow owing to the rapid expansion of healthcare infrastructure, increasing adoption of advanced imaging technologies, and a growing focus on early disease detection. The rise in the prevalence of chronic diseases, such as cancer, cardiovascular disorders, and neurological conditions, is fueling the demand for more accurate and efficient diagnostic tools. Moreover, government initiatives aimed at improving healthcare access and quality and ongoing investments in digital healthcare technologies are expected to support the market's growth.

The medical digital imaging system market in Japan is significantly driven by technological advancements, the growing adoption of advanced medical devices, and initiatives undertaken by market players in the country. In December 2024, GE HealthCare announced its acquisition of the remaining 50% stake in Nihon Medi-Physics (NMP), a leading radiopharmaceutical company in Japan, from Sumitomo Chemical. This strategic acquisition is expected to enhance GE HealthCare's position in the Japanese market by expanding its molecular imaging and theranostics capabilities, further supporting the growing demand for advanced imaging solutions.

Latin America Medical Digital Imaging System Market Trends

The medical digital imaging system market in Latin America is expectedto grow due to the increasing prevalence of chronic diseases, rising healthcare investments, and improvements in healthcare infrastructure across the region. As conditions such as cancer, cardiovascular diseases, and neurological disorders become more common, the demand for accurate diagnostic tools like medical imaging systems continues to rise. Furthermore, the adoption of advanced technologies, such as AI-powered imaging and cloud-based solutions, is enhancing the efficiency and accessibility of diagnostic imaging in healthcare facilities.

Middle East & Africa Medical Digital Imaging System Market Trends

The medical digital imaging system marketinthe Middle East & Africa is experiencing notable growth, driven by increasing healthcare investments, advancements in medical technology, and rising demand for diagnostic imaging due to the growing prevalence of chronic diseases. The region is witnessing improvements in healthcare infrastructure, particularly in countries such as the UAE, Saudi Arabia, and South Africa, which are investing heavily in modernizing their healthcare systems. In addition, the rising awareness of the benefits of early disease detection and the adoption of advanced technologies, such as AI and machine learning in imaging systems, are contributing to market growth.

Key Medical Digital Imaging System Company Insights

The leading medical digital imaging system industry players are undertaking various strategic initiatives to enhance their market position. These include investing in technological innovations such as AI-powered imaging and advanced diagnostics and engaging in mergers and acquisitions to expand their product portfolios. Companies are forming strategic partnerships with healthcare providers and research institutions to drive the development and adoption of new technologies. They are also expanding their presence in emerging markets, particularly in Asia Pacific, Latin America, and the Middle East, while focusing on regulatory compliance and quality assurance.

Key Medical Digital Imaging System Companies:

The following are the leading companies in the medical digital imaging system market. These companies collectively hold the largest market share and dictate industry trends.

- GE Healthcare

- Koninklijke Philips N.V.

- Siemens Healthineers

- Canon Medical Systems Corporation

- Mindray Medical International

- FUJIFILM VisualSonics Inc.

- Carestream Health

- Hitachi

- Samsung Medison Co., Ltd.

- Koning Corporation

- Agfa-Gevaert Group

- MIM Software, Inc.

- DeepHealth

- Epic Systems Corporation

Recent Developments

-

In November 2024, GE HealthCare and DeepHealth, Inc., an AI-powered health informatics company and a wholly owned subsidiary of RadNet, Inc., announced a strategic partnership aimed at advancing the innovation, commercialization, and adoption of AI in medical imaging. The collaboration seeks to develop SmartTechnology solutions that leverage AI's transformative capabilities to tackle key challenges throughout the imaging value chain.

-

In June 2024, Koninklijke Philips N.V.announced the launch of the Philips Image Guided Therapy Mobile C-arm System 9000 - Zenition 90 Motorized, developed to support clinicians in providing high-quality care to a greater number of patients.

-

In March 2024, Siemens Healthineers AG announced the FDA clearance of the CIARTIC Move, a mobile C-arm with self-driving capabilities. This system accelerates and standardizes 2D fluoroscopic and 3D cone-beam computed tomography (CT) imaging for surgeons and operating room teams in hospitals and outpatient facilities, bringing consistency to automated workflows and reducing imaging time during procedures.

Medical Digital Imaging System Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 38.3 billion

Revenue forecast in 2030

USD 51.7 billion

Growth rate

CAGR of 6.2% from 2025 to 2030

Actual period

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, modality, deployment mode, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

GE Healthcare; Koninklijke Philips N.V.; Siemens Healthineers; Canon Medical Systems Corporation; Mindray Medical International; FUJIFILM VisualSonics Inc.; Carestream Health; Hitachi; Samsung Medison Co., Ltd.; Koning Corporation; Agfa-Gevaert Group; MIM Software, Inc.; DeepHealth; Epic Systems Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Digital Imaging System Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global medical digital imaging system market report based on component, modality, deployment mode, application, end use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Workstations

-

Servers

-

Storage Systems

-

-

Software

-

Picture Archiving and Communication Systems (PACS)

-

Radiology Information Systems (RIS)

-

Vendor Neutral Archives (VNA)

-

Advanced Visualization Software

-

AI/ML-based Tools for Image Analysis

-

-

Services

-

-

Modality Outlook (Revenue, USD Million, 2018 - 2030)

-

X-ray

-

Computed Tomography (CT)

-

Magnetic Resonance Imaging (MRI)

-

Ultrasound

-

Nuclear Imaging (PET/SPECT)

-

Mammography

-

-

Deployment Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

On-Premises

-

Cloud-Based

-

Hybrid

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Diagnostic Imaging

-

Therapeutic Imaging

-

Research and Training

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostic Imaging Centers

-

Other End Use

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global medical digital imaging system market size was estimated at USD 36.1 billion in 2024 and is expected to reach USD 38.3 billion in 2025.

b. The global medical digital imaging system market is expected to grow at a compound annual growth rate of 6.2% from 2025 to 2030 to reach USD 51.7 billion by 2030.

b. CT dominated the medical digital imaging systems market with a share of 26.2% in 2024. This is attributable to the frequent introduction of advanced products.

b. Some key players operating in the medical digital imaging system market include GE Healthcare; Koninklijke Philips N.V.; Siemens Healthineers; Canon Medical Systems Corporation; Mindray Medical International; FUJIFILM VisualSonics Inc.; Carestream Health; Hitachi; Samsung Medison Co., Ltd.; Koning Corporation; Agfa-Gevaert Group; MIM Software, Inc.; DeepHealth; Epic Systems Corporation

b. Key factors that are driving the medical digital imaging system market growth include surging demand for effective early diagnostic methods and a widening base of the aging population.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.