Medical Electronics Market Summary

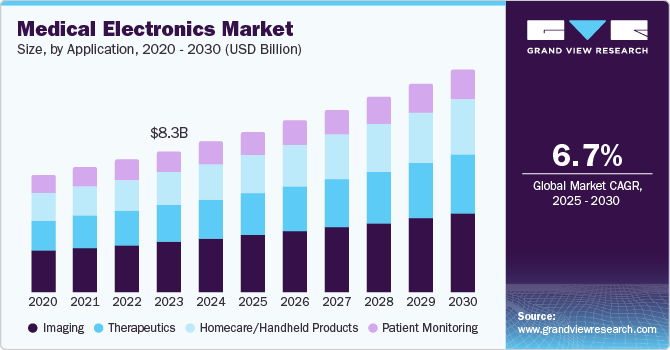

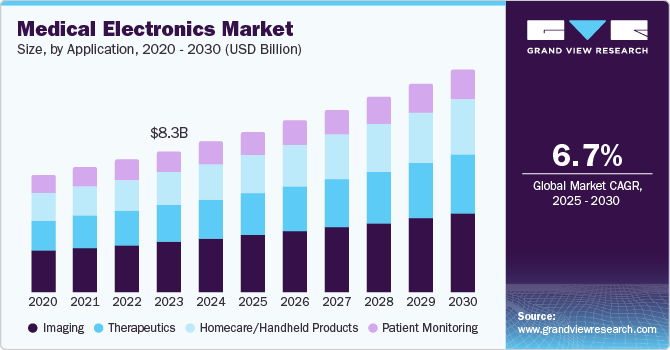

The global medical electronics market size was estimated at USD 8.25 billion in 2024 and is projected to reach USD 12.21 billion by 2030, growing at a CAGR of 6.7% from 2025 to 2030. The aging population and rising incidence of chronic diseases, such as diabetes, cardiovascular diseases, and cancer, are driving demand for advanced medical devices.

Key Market Trends & Insights

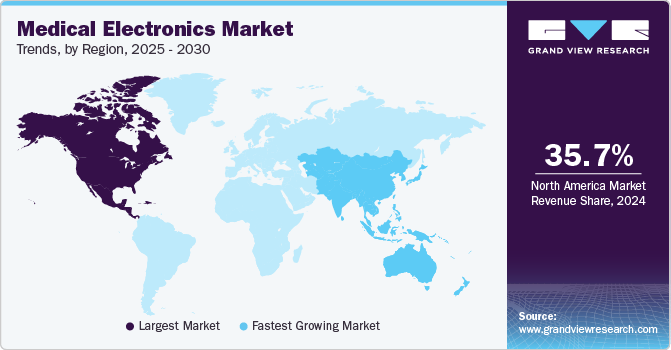

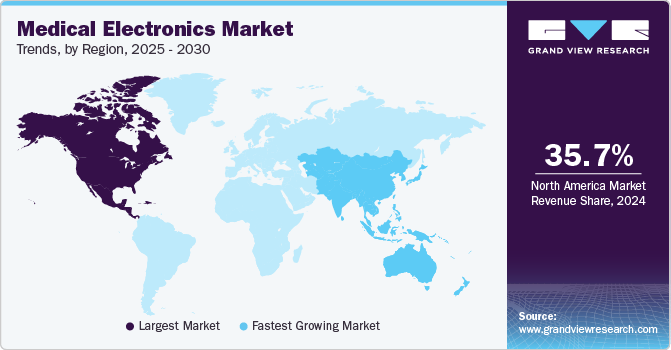

- North America medical electronics market dominated the global market with a revenue share of 35.7% in 2024.

- The medical electronics market in the U.S. dominated North America, with a significant revenue share in 2024.

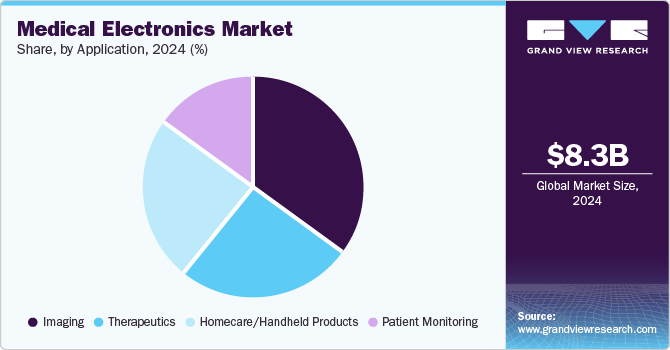

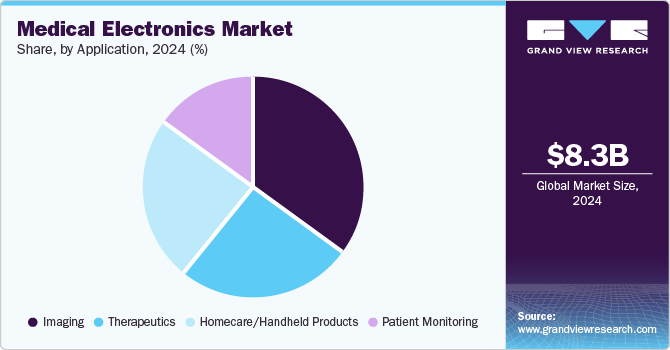

- By application, imaging applications segment led the market with a revenue share of 35.3% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 8.25 Billion

- 2030 Projected Market Size: USD 12.21 Billion

- CAGR (2025-2030): 6.7%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

This trend is expected to continue, necessitating a higher demand for electronic health monitoring tools, including oximeters, heart rate monitors, and other diagnostic devices.

Technological advancements drive the medical electronics market, enabled by innovations such as wearable health trackers, telemedicine solutions, and AI-driven diagnostics. Semiconductors have improved device functionality and miniaturization, making them more user-friendly. The COVID-19 pandemic accelerated telehealth and remote monitoring adoption, creating a growing market for electronic health solutions.

The expansion of healthcare infrastructure, particularly in emerging markets, drives demand for advanced medical equipment with electronic technologies. Increased disposable incomes and insurance coverage enable individuals to invest in personal health management through electronic devices. The growing preference for homecare solutions is fueling demand for portable, user-friendly medical devices that facilitate care at home.

Emerging regions, such as India and China, offer significant market opportunities for medical electronics. Global players are investing in local healthcare infrastructure, driven by the rapidly aging population and expanding healthcare markets. These regions are attractive destinations for manufacturers seeking growth.

Application Insights

Imaging applications of medical electronics led the market with a revenue share of 35.3% in 2024, driven by the increasing prevalence of chronic diseases such as cancer and neurological disorders. Advanced diagnostic tools, including AI-integrated and portable devices, enhance accuracy and accessibility, appealing to healthcare providers and patients seeking early disease detection.

Homecare/handheld products are projected to witness the fastest CAGR of 7.8% over the forecast period. The increasing prevalence of chronic diseases and an aging population are driving segment growth further. Portable devices enable continuous monitoring, meeting consumer preferences for convenient and comfortable home healthcare, and are further fueled by technological advancements, growing disposable incomes, and health awareness.

Regional Insights

North America medical electronics market dominated the global market with a revenue share of 35.7% in 2024, fueled by its advanced healthcare infrastructure and high spending on medical technologies, leading the global market in healthcare expenditures. The region’s strong presence of key manufacturers and innovators fuels continuous advancements while the growing demand for chronic disease management and the aging population's needs solidify its position as a global leader.

U.S. Medical Electronics Market Trends

The medical electronics market in the U.S. dominated North America, with a significant revenue share in 2024. The presence of leading medical technology companies drives innovation and rapid adoption of advanced medical devices. Favorable regulatory conditions, the growing prevalence of chronic diseases, and the aging population create a strong demand for sophisticated medical electronics, enhancing patient care in the U.S.

Europe Medical Electronics Market Trends

Europe medical electronics market held a substantial market share in 2024, owing to a strong regulatory framework and well-established healthcare systems, fostering innovation and investment in advanced technologies. Countries such as Germany and France are experiencing growth driven by demand for innovative devices in hospitals and home care and favorable reimbursement policies.

The medical electronics market in Germany is expected to grow in the forecast period. Germany benefits from significant R&D investments, driving the development of advanced medical devices that meet increasing healthcare demands. The aging population fuels the need for effective diagnostic and therapeutic solutions, while a well-established regulatory framework ensures high-quality standards, attracting domestic and international manufacturers.

Asia Pacific Medical Electronics Market Trends

Asia Pacific medical electronics market is expected to register the fastest CAGR of 7.9% over the forecast period attributed to significant investments in healthcare infrastructure, a large population base, and rapid economic growth. Increasing disposable incomes and the prevalence of chronic diseases are driving demand for affordable and advanced medical devices, including telemedicine and home healthcare solutions.

The medical electronics market in China is projected to grow significantly over the forecast period, aided by significant investments in healthcare infrastructure and a large population driving demand for medical devices. The government’s focus on improving healthcare access and quality has increased funding for hospitals and clinics, driving the adoption of advanced medical technologies.

Key Medical Electronics Company Insights

Some key companies operating in the market include FUJIFILM Holdings Corporation, CANON MEDICAL SYSTEMS CORPORATION, and Koninklijke Philips N.V., among others. Companies are implementing strategic initiatives, including mergers, acquisitions, and product launches, to expand their market presence and address evolving healthcare demands through portable and wearable devices.

-

FUJIFILM Holdings Corporation offers advanced imaging solutions, including digital X-ray systems, ultrasound devices, and endoscopy equipment, to enhance diagnostic accuracy and efficiency through innovative technologies, such as AI integration, significantly contributing to the healthcare sector’s diagnostic capabilities.

-

Koninklijke Philips N.V. offers advanced imaging systems, patient monitoring solutions, and telehealth services to enhance patient outcomes and streamline healthcare processes. The company prioritizes innovation and sustainability to drive healthcare improvements across various settings.

Key Medical Electronics Companies:

The following are the leading companies in the medical electronics market. These companies collectively hold the largest market share and dictate industry trends.

- FUJIFILM Holdings Corporation

- CANON MEDICAL SYSTEMS CORPORATION

- Koninklijke Philips N.V.

- MCKESSON CORPORATION

- iCAD, Inc.

- Siemens Healthineers AG

- GE Healthcare

- Analog Devices, Inc.

- Texas Instruments Incorporated

- Biotronik

- STMicroelectronics

Recent Developments

-

In July 2024, Fujifilm Holdings Corporation launched APERTO Lucent, a 0.4T open MRI system, featuring permanent magnet technology and enhanced workflow capabilities.

-

In May 2024, Canon installed the first Aquilion Serve SP CT scanner in the U.S. with INSTINX workflow automation, integrating top-tier imaging capabilities with enhanced efficiency and consistency.

Medical Electronics Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 8.81 billion

|

|

Revenue forecast in 2030

|

USD 12.21 billion

|

|

Growth rate

|

CAGR of 6.7% from 2025 to 2030

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2018 - 2023

|

|

Forecast period

|

2025 - 2030

|

|

Quantitative units

|

Revenue in USD million/billion and CAGR from 2025 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, trends

|

|

Segments covered

|

Application, region

|

|

Regional scope

|

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

|

|

Country scope

|

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

|

|

Key companies profiled

|

FUJIFILM Holdings Corporation; CANON MEDICAL SYSTEMS CORPORATION; Koninklijke Philips N.V.; MCKESSON CORPORATION; iCAD, Inc.; Siemens Healthineers AG; GE Healthcare; Analog Devices, Inc.; Texas Instruments Incorporated; Biotronik; STMicroelectronics

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Global Medical Electronics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global medical electronics market report based on application and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

Latin America

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait