- Home

- »

- Plastics, Polymers & Resins

- »

-

Medical Foam Market Size & Share, Industry Report, 2033GVR Report cover

![Medical Foam Market Size, Share & Trends Report]()

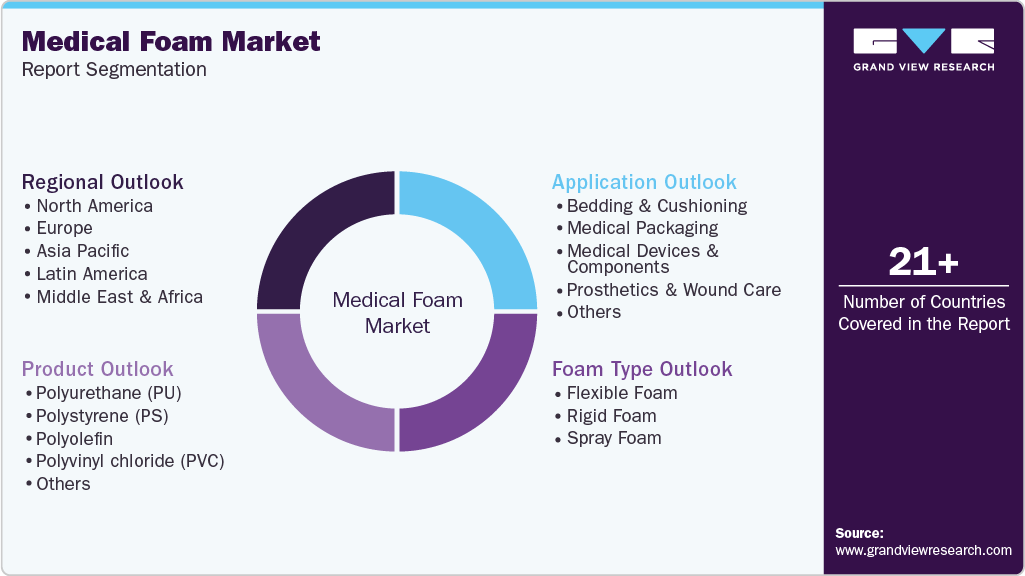

Medical Foam Market (2026 - 2033) Size, Share & Trends Analysis Report By Foam Type (Flexible, Spray, Rigid), By Product (Polyurethane, Polyolefin, Polystyrene, PVC), By Application (Bedding & Cushioning, Medical Packaging), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-808-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Medical Foam Market Summary

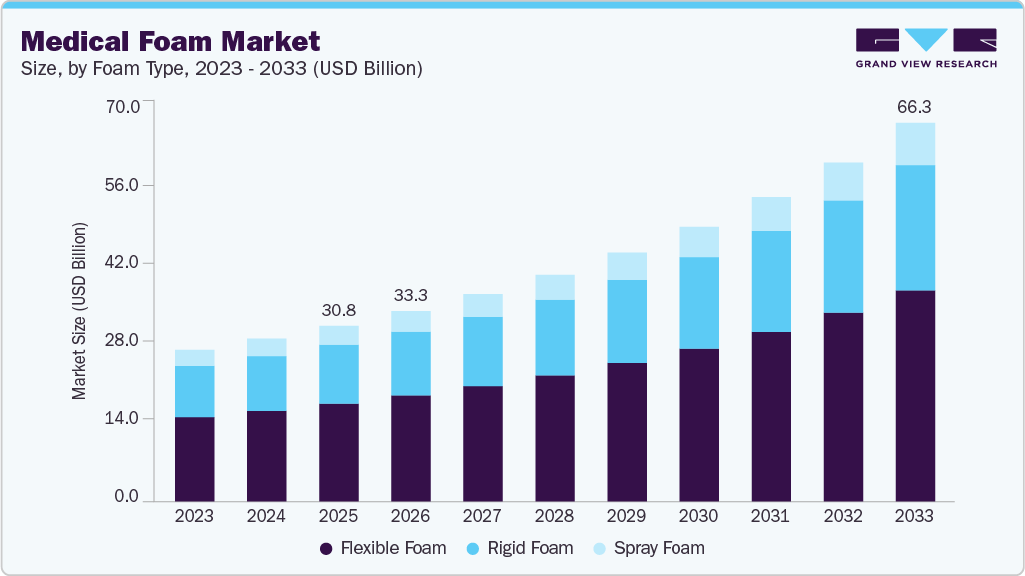

The global medical foam market size was estimated at USD 30.77 billion in 2025 and is projected to reach USD 66.34 billion by 2033, growing at a CAGR of 10.3% from 2026 to 2033. This growth can be attributed to the rising geriatric population is increasing the demand for healthcare services and products that utilize medical foam.

Key Market Trends & Insights

- North America dominated the global medical foam market with the largest revenue share of 33.92% in 2025.

- The medical foam market in the U.S. accounted for the largest market revenue share in North America in 2025.

- By foam type, the flexible foam segment led the market with the largest revenue share of 55.60% in 2025.

- By product, polyurethane (PU) segment led the market with the largest revenue share of 43.03% in 2025.

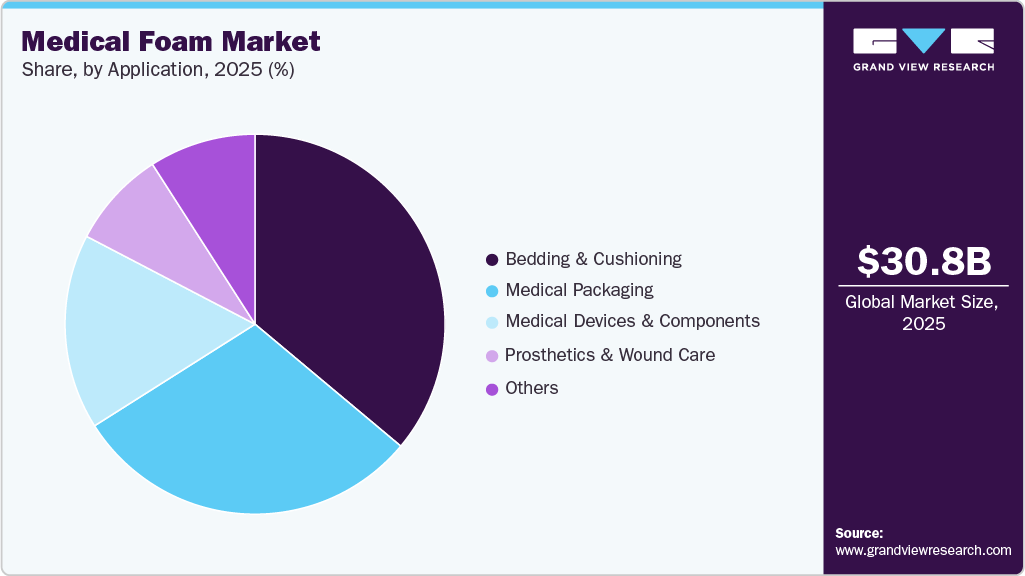

- By application, the bedding & cushioning segment led the market with the largest revenue share of 36.09% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 30.77 Billion

- 2033 Projected Market Size: USD 66.34 Billion

- CAGR (2026-2033): 10.3%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Medical foam is a specialized material designed for use in healthcare applications. It is characterized by its biocompatibility, durability, and versatility. It is extensively utilized in various medical products, including hydrophilic dressings, orthopedic supports, and braces. The properties of medical foam such as being lightweight, water-resistant, and adaptable-make it ideal for protective packaging and patient care solutions. Moreover, it plays a crucial role in customized orthotics, pressure relief devices for the feet, prosthetic padding, and ostomy sealing.Furthermore, medical foams play a crucial role in advanced medical equipment, facilitating heat and moisture exchange in breathing apparatuses and enhancing wound healing through specialized dressings. Despite its widespread application, the growth of the medical foam industry faces challenges due to stringent regulations aimed at ensuring high standards for packaging and labeling in the healthcare sector.

Moreover, fluctuations in raw material costs, particularly for polyurethane and polyvinyl chloride, pose significant hurdles for manufacturers. The volatility in prices can adversely affect the supply chain of medical goods and impact the overall profitability of companies within this sector.

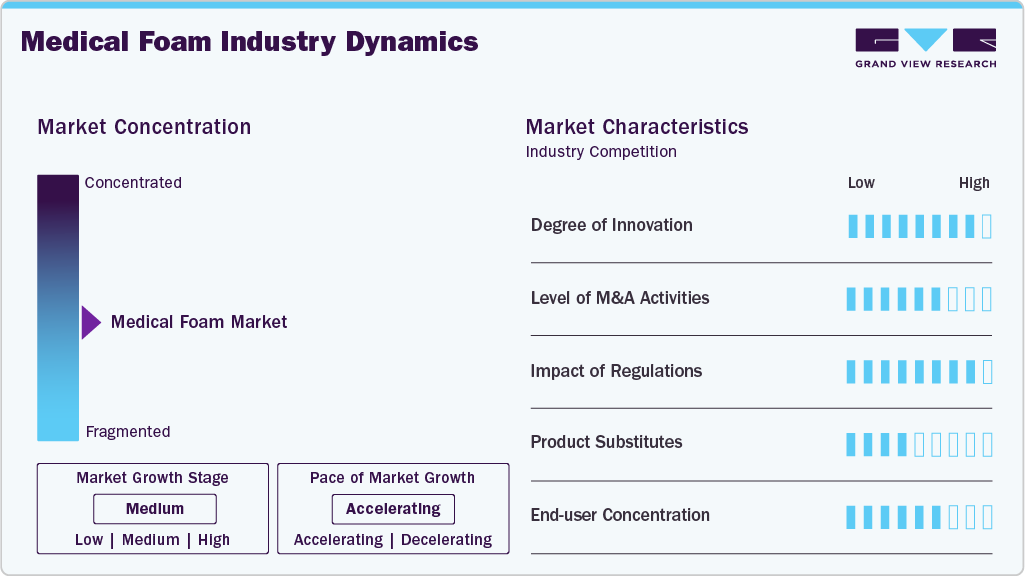

Market Concentration & Characteristics

The global medical forms industry is currently in a stage of moderate growth, with momentum accelerating as healthcare infrastructure expands and demand for advanced, compliant medical solutions increases. While the market is mature in terms of core applications, it continues to evolve through material innovation, enhanced safety features, and increasing adoption across emerging healthcare systems. Growth is being reinforced by rising surgical volumes, stricter regulatory standards, and the shift toward higher-value, precision-engineered medical components rather than commoditized products.

The global medical forms industry exhibits a high level of concentration, with a relatively small group of global players accounting for a substantial share of total revenues and technological leadership. Manufacturing in the medical form industry is technology, quality, and process-intensive, often requiring cleanroom environments, controlled material handling, and rigorous quality management systems. Raw materials, such as medical-grade plastics, nonwovens, paper composites, and high-performance films, must meet stringent specifications for biocompatibility, barrier protection, and sterilization compatibility.

Production processes may involve advanced lamination, sealing, and cut-and-fold systems, as well as the integration of features such as peelability, tear resistance, and microbial barrier properties. Because these products are integral to sterile supply chains, even minor defects can pose significant clinical risks, driving a high reliance on automated inspection, statistical quality control, and certification audits. As a result, capital intensity is high, and technological expertise is a key entry barrier compared to conventional flexible packaging markets.

Another defining characteristic of the global medical form industry is the high integration with sterilization and supply chain logistics, which creates elevated switching costs and encourages long-term supplier relationships. Medical forms are often validated with specific sterilization processes and integrated into inventory management, labeling, and traceability systems. Any change in form type, material, or supplier typically necessitates revalidation, regulatory notification, and adjustments to clinical workflow, which can be time-consuming and costly.

Consequently, established manufacturers with strong quality credentials, global distribution footprints, and regulatory expertise hold significant advantages. This dynamic also encourages innovation in features such as tamper evidence, barcoding, and compatibility with automated sterilization/handling systems, further differentiating leading suppliers from smaller competitors.

Market Drivers, Restraints, And Opportunities

One of the primary drivers of growth in the global medical forms industry is the rising demand for injectable drugs, biologics, and advanced pharmaceutical therapies. The increasing prevalence of chronic diseases such as diabetes, cancer, cardiovascular disorders, and autoimmune conditions has significantly expanded the use of injectable treatments that require high-quality, sterile, and chemically inert medical forms. Biologics and biosimilars, in particular, are highly sensitive to contamination and material interaction, driving demand for precision-engineered primary packaging and delivery components. As pharmaceutical pipelines increasingly shift toward complex formulations, manufacturers are placing greater emphasis on reliable medical forms that ensure drug stability, sterility assurance, and patient safety throughout the product lifecycle.

Another major driver is the tightening global regulatory environment and growing focus on patient safety and quality compliance. Regulatory authorities across North America, Europe, and Asia are imposing stricter requirements related to extractables and leachables, particulate contamination, traceability, and sterility validation. These regulations compel pharmaceutical and medical device companies to adopt higher-performance medical forms that meet evolving international standards. As a result, demand is shifting away from low-cost, commoditized products toward premium, certified solutions supplied by established manufacturers with strong quality systems and regulatory expertise. This trend not only supports market growth but also raises entry barriers, reinforcing long-term demand for compliant, high-value medical forms.

The key opportunity in the global medical forms industry lies in the rapid growth of biologics, personalized medicine, and advanced drug delivery systems, which are reshaping pharmaceutical development and packaging requirements. As therapies become more complex, such as high-viscosity injectables, cell and gene therapies, and combination products, there is rising demand for customized medical forms with enhanced barrier properties, ultra-low extractables, and compatibility with novel delivery devices. This creates strong opportunities for manufacturers to develop differentiated, value-added solutions, including pre-filled systems, ready-to-use components, and digitally enabled forms with traceability features. Companies that can collaborate closely with pharmaceutical innovators early in the drug development lifecycle stand to secure long-term supply contracts and strengthen their strategic positioning.

A major restraint affecting the market is the high cost and complexity associated with regulatory compliance and validation processes. Medical forms must undergo extensive testing, certification, and revalidation whenever materials, suppliers, or manufacturing processes change. These requirements increase development timelines, capital expenditure, and operational costs, particularly for smaller or new entrants. Additionally, prolonged regulatory approval cycles can delay product launches and limit the speed at which manufacturers can respond to evolving market needs. This compliance burden not only constrains market flexibility but also reinforces dependence on established suppliers, reducing competitive intensity and slowing the pace of disruptive innovation.

Foam Type Insights

The flexible foam segment led the market with the largest revenue share of 55.60% in 2025. This growth can be attributed to its affordability and versatility. Due to its softness, moisture resistance, and excellent mechanical properties, flexible foam is widely utilized in applications such as bedding, cushioning, and wound care dressings. Furthermore, these characteristics enhance patient comfort and ensure effective packaging for medical devices. As healthcare demands increase, the cost-effectiveness and adaptability of flexible foam make it an attractive option for manufacturers and healthcare providers alike.

The spray foam segment is expected to grow at the fastest CAGR of 10.8% over the forecast period, driven by its unique properties that support advanced medical applications. In addition, spray foam offers excellent insulation, sound absorption, and moisture resistance, making it ideal for use in various medical devices and equipment. Its ability to conform to complex shapes ensures a secure fit in applications such as prosthetics and cushioning. Furthermore, the growing emphasis on patient safety and comfort drives the demand for spray foam solutions in healthcare settings, further contributing to its market growth.

Product Insights

The polyurethane (PU) segment accounted for the largest market revenue share in 2025, owing to its exceptional biocompatibility and versatility. PU foams are widely used in medical applications such as wound dressings, cushioning, and prosthetics as they provide comfort and support while promoting healing. Furthermore, increasing investments in the healthcare sector and the rising demand for advanced medical devices further propel the adoption of PU foams, making them a preferred choice for manufacturers aiming to enhance patient care.

The polyolefin foams segment is expected to grow at the fastest CAGR from 2026 to 2033, owing to their lightweight nature and excellent chemical resistance. These properties make polyolefin foams suitable for various applications, including packaging for medical devices and protective cushioning. In addition, the growing emphasis on hygiene and safety in healthcare settings drives demand for polyolefin materials, which are easy to sterilize and dispose of. Furthermore, advancements in manufacturing processes are enhancing the performance characteristics of polyolefin foams, contributing to their increased usage in medical applications.

Application Insights

The bedding & cushioning application segment led the market with the largest revenue share of 36.09% in 2025, primarily driven by an increasing demand for patient comfort and support. As healthcare facilities expand and more hospital beds are needed, the demand for high-quality bedding and cushioning products increases. Additionally, medical foams play a crucial role in creating comfortable mattresses, pillows, and seat cushions that help prevent pressure ulcers and facilitate patient recovery. Furthermore, the growing focus on improving healthcare infrastructure further drives the demand for these products.

The medical devices and components segment is expected to grow at the fastest CAGR of 10.8% over the forecast period, driven by the increasing demand for advanced medical equipment and components that utilize medical foam. In addition, the increasing prevalence of chronic diseases and a growing geriatric population necessitate innovative medical devices that provide better patient care. Furthermore, medical foams are favored for their biocompatibility, lightweight nature, and cost-effectiveness, making them ideal for various applications, including protective packaging and cushioning for medical devices.

Regional Insights

North America dominated the global medical foam marketwith the largest revenue share of 33.92% in 2025. This growth can be attributed to increasing healthcare expenditures and advancements in medical technology, significant investments in healthcare infrastructure, and a growing demand for innovative medical devices. In addition, the aging population further contributes to the rising need for medical foam products, particularly in wound care and patient support applications.

U.S. Medical Foam Market Trends

The medical foam market in the U.S. accounted for the largest market revenue share in North America in 2025, driven by high per capita health spending and a robust healthcare system. In addition, the demand for advanced medical devices and components is on the rise, fueled by innovations in healthcare technology. Furthermore, an increasing geriatric population necessitates more healthcare services, leading to greater utilization of medical foam in various applications, including wound care and cushioning products. Moreover, enhanced health insurance coverage also plays a crucial role in driving market growth by expanding access to essential medical services.

Asia Pacific Medical Foam Market Trends

The medical foam market in the Asia Pacific is expected to grow at the fastest CAGR of 11.4% over the forecast period, owing to rising investments in healthcare infrastructure and increasing demand for medical devices. Furthermore, countries like India and Japan are enhancing their healthcare systems, leading to greater adoption of advanced medical technologies that utilize medical foam. Moreover, the growing awareness of health and hygiene, coupled with a rising population, is further propelling the demand for medical foam products across various applications, including packaging and wound care solutions.

The China medical foam marketheld a significant share in Asia Pacific in 2025, due to government initiatives aimed at improving healthcare services and infrastructure. In addition, the country's focus on enhancing its pharmaceutical industry drives demand for high-quality medical foams used in packaging and device manufacturing. Furthermore, the increasing prevalence of chronic diseases among its large population necessitates advanced medical solutions that incorporate medical foam, thereby contributing to market growth.

Europe Medical Foam Market Trends

The medical foam market in Europeis expected to grow at a significant CAGR over the forecast period, driven by stringent regulations ensuring high-quality healthcare products and an emphasis on patient safety. In addition, the region's aging population generates an increased demand for specialized medical devices that utilize medical foam for comfort and support. Furthermore, advancements in technology and materials science are leading to innovative applications of medical foam across various sectors, including wound care and surgical procedures, enhancing overall market growth.

The Germany medical foam marketis expected to be driven by its strong healthcare system and commitment to research and development. In addition, the country’s focus on innovation drives the adoption of advanced medical technologies that incorporate high-performance medical foams. Furthermore, Germany's robust manufacturing sector supports the production of diverse medical devices requiring specialized foams for cushioning and protection. Moreover, the increasing emphasis on quality healthcare services further fuels the demand for effective solutions involving medical foam across various applications.

Key Medical Foam Market Company Insights

Key companies in the global medical foam industry include Sekisui Chemical Co., Ltd., UFP Technologies, Inc., Zotefoams plc, and others. These companies are adopting various strategies to enhance their competitive edge. These include focusing on product innovation and development, expanding production capacities, and forming strategic partnerships or collaborations.

Furthermore, companies are investing in research and development to create advanced medical foam solutions that meet evolving healthcare needs while exploring sustainable practices to align with environmental regulations and consumer preferences. These strategies aim to strengthen market presence and ensure long-term growth in the industry.

Key Medical Foam Companies:

The following are the leading companies in the medical foam market. These companies collectively hold the largest market share and dictate industry trends.

- Robert Bosch GmbH

- 3M

- General Plastics Manufacturing Company, Inc.

- Huntsman International LLC.

- Sekisui Chemical Co., Ltd.

- UFP Technologies, Inc.

- Zotefoams plc.

- Probo Medical

- Avery Dennison Corp.

- Rogers Corp.

- Foamtec Medical

Recent Developments

-

In May 2023, Probo Medical successfully acquired the MRI coil repair operation from Creative Foam, enhancing its diagnostic imaging division. This strategic move allows Probo to perform complex MRI coil repairs in-house, while Creative Foam will continue to provide medical foam re-foaming services for MRI coils. The partnership aims to enhance customer satisfaction and streamline the repair process. Probo Medical will relocate the repair operations to its headquarters in Tampa, Florida, while Creative Foam will maintain its facility in Indiana.

-

In June 2022, Mitsui Chemicals and Microwave Chemical launched a new initiative aimed at commercializing chemical recycling of flexible polyurethane (PU) foam via microwave technology. The project involves the direct synthesis of PU raw materials by decomposing offcuts of the foam used to manufacture mattresses and similar items.

Medical Foam Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 33.34 billion

Revenue forecast in 2033

USD 66.34 billion

Growth rate

CAGR of 10.3% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Volume in Kilotons, Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Foam type, product, application, region.

Regional scope

North America; Asia Pacific; Europe; Latin America; Middle East & Africa.

Country scope

U.S.; Canada; Mexico; China; India; Japan; Germany; UK; France; Italy; Brazil; Argentina; Saudi Arabia.

Key companies profiled

3M; General Plastics Manufacturing Company, Inc.; Huntsman International LLC.; Sekisui Chemical Co., Ltd.; UFP Technologies, Inc.; Zotefoams plc; Avery Dennison Corp.; Rogers Corp.; Foamtec Medical.; Robert Bosch GmbH

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Foam Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the global medical foam market report based on foam type, product, application, and region.

-

Foam Type Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Flexible Foam

-

Rigid Foam

-

Spray Foam

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Polyurethane (PU)

-

Polystyrene (PS)

-

Polyolefin

-

Polyvinyl chloride (PVC)

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Bedding & Cushioning

-

Medical Packaging

-

Medical Devices & Components

-

Prosthetics & Wound Care

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the medical foam market include S3M, General Plastics Manufacturing Company, Inc., Huntsman International LLC., Sekisui Chemical Co., Ltd., UFP Technologies, Inc., Zotefoams plc, Avery Dennison Corporation, Rogers Corporation, and Foamtec Medical.

b. Key factors that are driving the market growth include rising applications of medical foam in the packaging of medical devices, bedding & cushioning applications, and foam dressing in wound care applications, among others.

b. The global medical foam market size was estimated at USD 30.77 billion in 2025 and is expected to reach USD 33.34 billion in 2026.

b. The global medical foam market is projected to grow at a compound annual growth rate (CAGR) of 10.3% from 2026 to 2033, reaching USD 66.34 billion by 2033.

b. North America dominated the medical foam market, accounting for a 33.92% share in 2025. This is attributable to rising per capita health expenditure in the U.S.; the demand for medical devices would, in turn, boost the growth of medical foam.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.