- Home

- »

- Organic Chemicals

- »

-

Nitrogen Gas Market Size, Share & Trends Report, 2030GVR Report cover

![Nitrogen Gas Market Size, Share & Trends Report]()

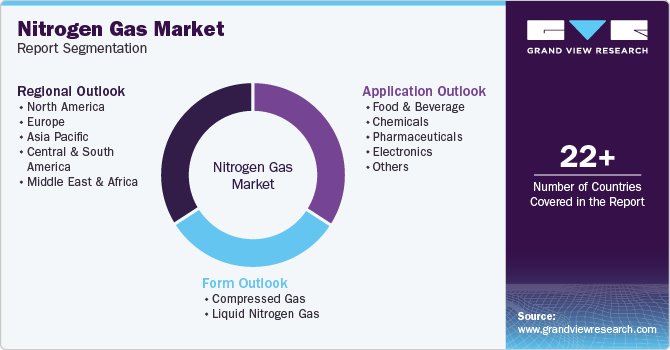

Nitrogen Gas Market (2024 - 2030) Size, Share & Trends Analysis Report By Form (Compressed Gas, Liquid Nitrogen Gas), By Application (Food & Beverages, Chemicals), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-116-6

- Number of Report Pages: 116

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Nitrogen Gas Market Summary

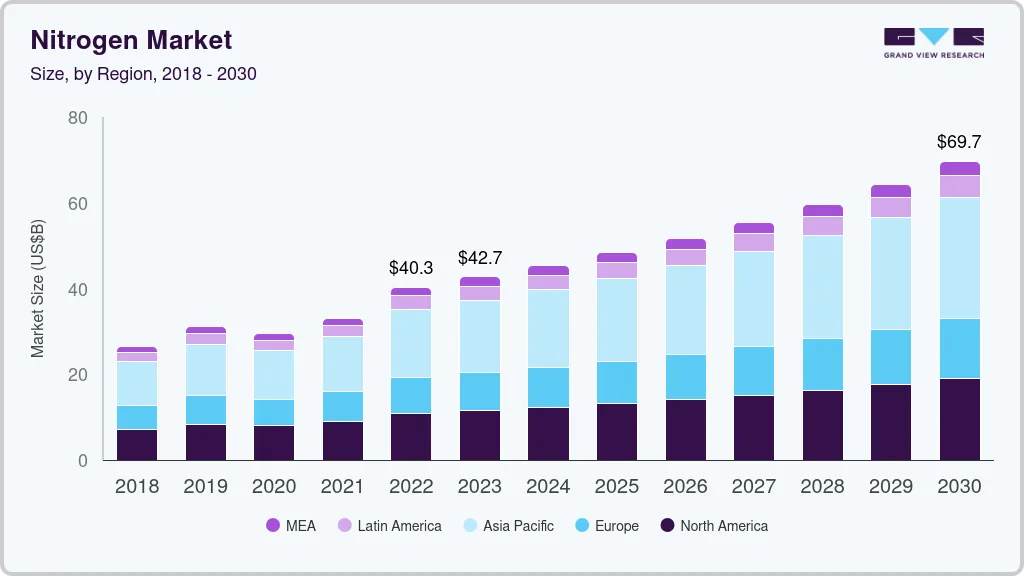

The global nitrogen market size was estimated at USD 30.4 billion in 2023 and is projected to reach USD 44.28 billion by 2030, growing at a CAGR of 6.4% from 2024 to 2030. This is attributable to ongoing urbanization and industrialization and the increasing application of nitrogen in various industries such as healthcare, manufacturing, metals and mining, and food & beverages.

Key Market Trends & Insights

- The North America nitrogen gas market held a substantial share of 34.9% by volume in 2023.

- By form, the liquid nitrogen gas segment dominated the market with a revenue share of 59.3% in 2023.

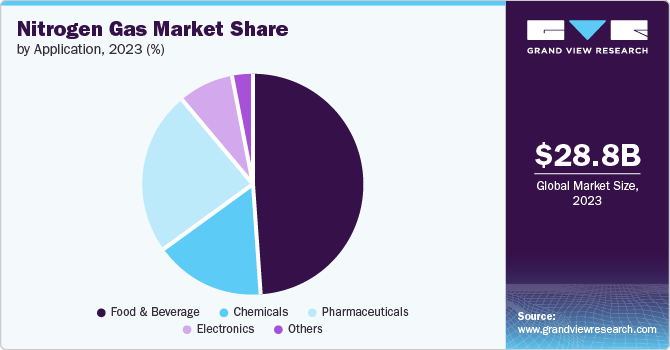

- By application, the food and beverage segment held a revenue share of 49.8% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 30.4 Billion

- 2030 Projected Market Size: USD 44.28 Billion

- CAGR (2024-2030): 6.4%

- North America: Largest market in 2023

Furthermore, increased manufacturing of packaged food, medicines & pharmaceuticals, and electronic devices is likely to be a key growth driver. Nitrogen (N2) is a colorless, odorless, and tasteless gas that constitutes 78.09% (by volume) of our air. It is nonflammable and does not support combustion. Industries prepare commercial nitrogen through the fractional distillation of liquefied air. It is slightly lighter than air and has slight solubility in water. Furthermore, it is used as a fertilizer, typically in ammonia or ammonia-based compounds.The demand for packaged foods has increased due to evolving eating habits and a more accelerated pace of life. This trend has significantly impacted the food packaging industry, leading to substantial growth. Packaged foods offer benefits such as extended shelf life, stability, and high protective properties, prompting considerable investments from companies aiming to capture a larger market share in this rapidly expanding industry. Nitrogen is utilized to replace oxygen in packaging, creating a Modified Atmosphere Packaging (MAP) environment that prolongs the shelf life of various foods. As consumers increasingly seek options with extended shelf life akin to fresh food, food manufacturers are turning to nitrogen to meet these demands.

Nitrogen plays a critical role in pharmaceutical products' preservation and quality assurance. By displacing oxygen from packaging, nitrogen extends the shelf life of medications, ensuring that their efficacy and integrity remain uncompromised. The rising prevalence of chronic diseases, advancements in medical technology, and a growing emphasis on personalized medicine are all contributing to the rise in medical expenditure globally. This, in turn, fuels the product demand in various medical applications.

However, the market faces challenges due to environmental regulations such as the Clean Air Act (CAA), EPA Regulations, and the Kyoto Protocol. Production methods, particularly cryogenic distillation, can contribute to emissions. Manufacturers may need cleaner technologies or carbon capture to comply, but these investments may raise production costs, hindering market expansion.

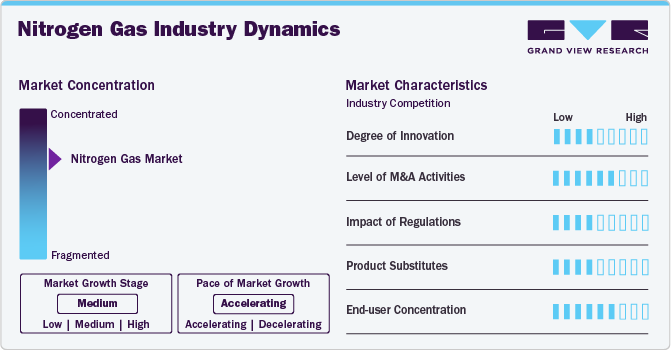

Market Concentration & Characteristics

The global market demonstrates characteristics akin to a moderately consolidated landscape, with the presence of a large number of medium-and large-scale producers, including Linde plc, Air Products and Chemicals, Inc., Taiyo Nippon Sanso Corporation, and Praxair Technology, Inc.

The market growth stage is medium, at an accelerating pace. The product market is characterized by a high degree of M&A activities along with high end-user concentration. With increasing acquisition activities, the key players are focusing on consolidating operations to benefit from higher customer reach and optimize sales efforts, thereby bolstering the industry's growth in the coming years.

Major key players operating in the nitrogen gas industry have high end-use concentrations, specifically in the food and beverages and pharmaceutical sectors. The staggering growth of food packaging, coupled with the increasing product usage of preservation in food packaging to inhibit the growth of spoilage-causing microorganisms, further proliferates the industry's growth.

Nitrogen gas itself is not a significant contributor to greenhouse emissions. However, its production process, especially when reliant on fossil fuels like natural gas, results in emissions that worsen climate change. This situation has heightened environmental concerns and necessitated a shift toward more sustainable practices within the industry. The nitrogen gas industry needs to embrace innovation to navigate these regulations effectively. R&D efforts are crucial for creating cleaner production methods. This could involve exploring alternative energy sources like solar or wind power to run production facilities.

An increasing emphasis on CSR initiatives is compelling nitrogen manufacturers to prioritize sustainability. Adopting environment-friendly production practices and reducing carbon footprints aids in regulatory compliance and also enhances corporate brand image, potentially attracting a segment of environmentally conscious consumers.

Form Insights

The liquid nitrogen gas segment dominated the market with a revenue share of 59.3% in 2023. Liquid nitrogen gas, obtained through commercial fractional distillation of liquid air, represents its liquefied state. It is extensively used in cooling and cryogenic applications. Due to its non-toxic, odorless, colorless, chemically inert, and non-flammable properties, liquid nitrogen is commonly used in the chemical and pharmaceutical industry.

It is frequently used during pharmaceutical manufacturing to facilitate the safe transfer of reaction mixtures from one container to another. Using a secure and inert gas is crucial when handling and delivering liquid or powdered medications, as exposure to oxygen or water vapor can lead to potential hazards. Furthermore, certain pharmaceutical chemicals can be compromised or undergo explosive reactions if they encounter oxygen or water vapor.

Application Insights

The food and beverage segment held a revenue share of 49.8% in 2023. This is attributed to the growing use of nitrogen in numerous applications in industry. This gas is primarily used for preservation in food packaging to create a nitrogen-rich environment that inhibits the growth of spoilage-causing microorganisms. The product is further employed in the packaging of perishable food products to maintain freshness and extend shelf life.

Nitrogen gas further finds usage in pharmaceuticals. It is mainly used in medicine production to create an inert atmosphere and eliminate the risk of unwanted reactions in sensitive pharmaceutical compounds. It is further used for packaging and storing medications to protect them from moisture, oxidation, and degradation. As a result, the growth of the pharmaceuticals industry worldwide is anticipated to surge the demand for nitrogen gas, thereby leading to market growth in the coming years.

In the chemical sector, nitrogen gas is extensively used as a preventive against oxidation owing to its non-reactive nature, inhibiting fires and explosions. The growing need for chemicals propels investments in chemical production, thus boosting the need for nitrogen gas. Further, it is widely used in the production of ammonia, a building block for various chemical compounds, including fertilizers, explosives, and plastics. Population growth also boosts crop production, thus propelling the need for fertilizers. Increasing production of fertilizers is anticipated to augment the demand for nitrogen.

In the electronics industry, nitrogen gas provides an oxygen- and moisture-free environment during various manufacturing processes. It is used to produce semiconductors, printed circuit boards (PCBs), and other electronic components. This gas helps minimize the oxidation of sensitive materials, enhances the quality and reliability of electronic devices, and prevents the formation of defects.

Regional Insights

The North America nitrogen gas market held a substantial share of 34.9% by volume in 2023. This is characterized by increasing product demand from pharmaceuticals, food and beverage, oil and gas, and petrochemicals. These industries require nitrogen gas for preservation, packaging, and manufacturing processes, significantly contributing to the market expansion.

U.S. Nitrogen Gas Market Trends

The nitrogen gas market in the U.S. is driven by the surging demand for quality health services, the increasing elderly population, and rising chronic ailments. According to the U.S. Census Bureau, over 17.3% of people were aged 65 years and above in 2023, which has fueled the demand for advanced healthcare facilities in the U.S. Thus, the high demand for healthcare services is expected to drive the consumption of nitrogen gas in medical applications in the coming years.

Europe Nitrogen Gas Market

The nitrogen gas market in Europe is anticipated to grow at a significant rate as Europe aims to lessen its reliance on imports from Asia and enhance its self-sufficiency in semiconductor production. This shift comes in response to the trade tensions between the U.S. and China, as well as the sanctions imposed on China, which have restricted the export of specialized chips and semiconductors. As a result, countries in the region are exploring alternative, cost-effective sources for these products. This is expected to lead to an expansion of raw material capacity, such as nitrogen gas, in the region, as well as an increase in new investments, thereby bolstering the regional market growth.

The Germany nitrogen gas market is anticipated to grow at a significant rate over the forecast period. Germany is the largest pharmaceutical market in Europe, growing faster than its economy. It is primarily driven by an increase in chronic diseases and a growing emphasis on prevention and self-medication. In 2022, sales in the pharmaceutical industry in Germany increased by 5.4%, reaching a total of EUR 56.5 billion. Rising demand for pharmaceuticals is expected to propel the demand for nitrogen gas over the forecast period.

Asia Pacific Nitrogen Gas Market

The Asia Pacific nitrogen gas market is anticipated to grow at a lucrative rate over the forecast period. As the region is currently experiencing significant industrial growth, particularly in nations such as China, India, and Southeast Asia, the respective country governments have been instrumental in fostering the expansion of the semiconductor industry, resulting in a substantial pipeline of investments driving the demand for nitrogen gas. For example, companies in Taiwan are planning to invest over USD 107 billion in semiconductor production by 2025.

The nitrogen gas market in China is anticipated to grow at a significant CAGR over the forecast period. China is a central manufacturing hub for electronic products, with a growing electronics industry driven by government support, domestic demand, and international market opportunities. This growth is expected to increase the demand for nitrogen. In August 2023, China launched a new $40 billion investment fund focusing on semiconductor manufacturing in response to U.S. sanctions imposed in August 2022, further boosting the product demand.

Middle East & Africa Nitrogen Gas Market

The nitrogen gas market in the Middle East is expected to grow in the coming years. The MEA region is a major producer and exporter of crude oil and natural gas. As a result, there is a high demand for nitrogen gas in this region, as it is extensively used in the oil and gas industry. The increasing investments by countries in the region to enhance their oil and gas production are expected to drive up the demand for nitrogen gas in the MEA region over the review period.

The nitrogen gas market in South Africa is expected to experience significant growth in the coming years. South Africa is Africa's largest chemical producer, and the country is exploring advanced technologies such as AI and IoT, which rely on semiconductor components, which is anticipated to increase the demand for nitrogen gas.

Central & South America Nitrogen Gas Market

The Central and South American nitrogen gas market is expected to grow due to increased foreign and government investments in the oil and gas industry. Furthermore, the development of the healthcare sector in countries like Brazil and Argentina is predicted to boost the use of cryogenic liquid for medical purposes, leading to further market growth.

The nitrogen gas market in Brazil is anticipated to grow as Brazil has significant oil reserves and there is ongoing development in its oil and gas sector. Therefore, there is a growing need for nitrogen for applications such as inerting pipelines and enhancing oil recovery. Thus, the favorable policies formulated by the Brazilian government to increase oil and gas exploration and production activities are expected to drive product demand in the country.

Key Nitrogen Gas Company Insights

The global nitrogen gas industry is consolidated with several tier-1 and tier-2 players, such as Linde plc, Air Products and Chemicals, Inc., Taiyo Nippon Sanso Corporation, and Praxair Technology, Inc. The players face intense competition from each other and regional players, who have strong distribution networks and good knowledge of suppliers and regulations.

-

Air Products and Chemicals, Inc. was formed in 1940 and is headquartered in Pennsylvania, U.S. It targets critical industries such as energy & environment, refining, chemicals, metals, and food. It also builds, operates, and owns (BOO) global large-scale clean hydrogen projects. Its reporting business units are segmented into i) Regional & industrial gases and ii) Corporate & others. The company has a J.V. with Jazan Integrated Gasification and Power Company, Saudi Arabia.

-

Linde Plc was established in 2018 and is headquartered in Surrey, UK. It produces gases (N2, O2, argon, and rare gases) and processes gases (CO2, hydrogen, helium, electronic, specialty, and acetylene). The company has 45 subsidiaries worldwide and caters to various markets such as chemicals and energy, manufacturing, food and beverages, healthcare, electronics, metals, and mining.

Gulf Cryo, NEXAIR, Omega Air, and Axcel Gases are some of the emerging market participants in the market.

-

NEXAIR was established in 1940 and is headquartered in Tennessee, U.S. The company produces various industrial gases, including N2. It caters to aerospace, automotive, chemical, food & beverage, welding, and metal fabrication industries. The company has several branches located in the Northeast of the U.S.

-

Axcel Gases was founded in 2000 and is headquartered in Haryana, India. The company mainly produces commercial and pure gases, gas mixtures, calibration and reference gases, high-pressure gas cylinders, acetylene cylinders, cylinder quads/ cascades, and other associated equipment. N2 gas and liquid N2 are produced in its plant located in the Delhi-NCR region and cater to the Indian market.

Key Nitrogen Gas Companies:

The following are the leading companies in the nitrogen gas market. These companies collectively hold the largest market share and dictate industry trends.

- Air Products and Chemicals, Inc.

- Gulfcryo

- Universal Industrial Gases, Inc.

- NEXAIR

- Southern Industrial Gas Sdn Bhd

- Praxair Technology, Inc.

- Taiyo Nippon Sanso Corporation

- Axcel Gases

- Linde Plc

- Omega Air

- Ellenbarrie Industrial Gases

- Messer Group

- Parker Hannifin

- Dubai Industrial Gas

- Yingde Gases Group

Recent Developments

-

In August 2023, Air Water America, the U.S. subsidiary of Japan-based Air Water Inc., announced its plans to construct the first air separation unit in Rochester, New York. Thus, the former intends to successfully focus on sales of industrial gases in addition to production.

-

In May 2023, Air Products signed an investment agreement with the Government of the Republic of Uzbekistan and Uzbekneftegaz JSC to acquire, own, and operate a natural gas-to-syngas processing facility in Qashqadaryo Province, Uzbekistan for a value of USD 1 billion.

Nitrogen Gas Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 30,441.8 million

Revenue forecast in 2030

USD 44.28 billion

Growth rate

CAGR of 6.4% from 2024 to 2030

Base year for estimation

2023

Historic data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in Kilotons, Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Volume and revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Form, application, region

Country scope

U.S., Canada, Mexico, Germany, UK, Switzerland, France, Italy, Spain, The Netherlands, Russia, China, India, Japan, South Korea, Malaysia, Indonesia, Vietnam, Australia, New Zealand, Brazil, Argentina, Chile, Colombia, Iran, Oman, UAE, Qatar, Kuwait, South Africa, Saudi Arabia, Angola, Nigeria

Key companies profiled

Air Products and Chemicals, Inc., Gulfcryo, Universal Industrial Gases, Inc., NEXAIR, Southern Industrial Gas Sdn Bhd, Praxair Technology, Inc., Taiyo Nippon Sanso Corporation, Axcel Gases, Linde Plc, Omega Air, Ellenbarrie Industrial Gases, Messer Group, Parker Hannifin, Dubai Industrial Gas, Yingde Gases Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Nitrogen Gas Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global nitrogen gas market report on form, application, and country.

-

Form Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Compressed Gas

-

Liquid Nitrogen Gas

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food & Beverage

-

Chemicals

-

Pharmaceuticals

-

Electronics

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Switzerland

-

France

-

Italy

-

Spain

-

The Netherlands

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Malaysia

-

Indonesia

-

Vietnam

-

Australia

-

New Zealand

-

-

Middle East & Africa

-

Iran

-

Oman

-

UAE

-

Qatar

-

Kuwait

-

Saudi Arabia

-

South Africa

-

Angola

-

Nigeria

-

-

Central & South America

-

Brazil

-

Argentina

-

Chile

-

Colombia

-

-

Frequently Asked Questions About This Report

b. The global nitrogen gas market size was estimated at USD 28.8 billion in 2023 and is expected to reach USD 30.4 billion in 2024.

b. The global nitrogen gas market is expected to grow at a compound annual growth rate of 6.4% from 2024 to 2030 to reach USD 44.28 billion by 2030.

b. North America region dominated the market with a volume share of 34.9% in 2023. This is attributable to increasing product demand from pharmaceuticals, food and beverage, oil and gas, and petrochemicals as nitrogen gas is inert in nature.

b. Some key players operating in the nitrogen gas market include Linde plc, Air Products and Chemicals, Inc., Taiyo Nippon Sanso Corporation, and Praxair Technology, Inc.

b. The growth of the nitrogen gas market is driven by ongoing urbanization and industrialization and the increasing application of nitrogen in various industries such as healthcare, manufacturing, metals and mining, and food & beverages.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.