- Home

- »

- Medical Devices

- »

-

Medical Imaging Phantoms Market Size, Share Report, 2030GVR Report cover

![Medical Imaging Phantoms Market Size, Share & Trends Report]()

Medical Imaging Phantoms Market (2025 - 2030) Size, Share & Trends Analysis Report By Product, By Application (Calibration & Quality Assurance, Diagnostic Imaging, R&D), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-153-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Medical Imaging Phantoms Market Trends

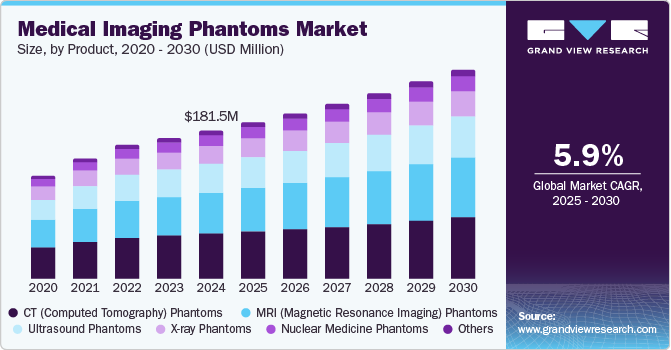

The global medical imaging phantoms market size was estimated at USD 181.5 million in 2024 and is projected to grow at a CAGR of 5.9% from 2025 to 2030. The rising demand for accurate diagnostic imaging techniques and the increasing burden of chronic diseases drive market growth. The WHO reported that chronic diseases such as cardiac failure and chronic obstructive pulmonary disease (COPD) affected millions globally, with approximately 251 million cases of COPD recorded in 2023. This growing incidence drives the necessity for effective diagnostic imaging solutions, which ultimately rely on medical imaging phantoms to calibrate and test imaging systems.

Hospitals are recognizing the importance of investing in advanced imaging technologies to enhance diagnostic accuracy. A survey conducted in early 2024 indicated significant investments in the U.S. healthcare market, with over 20% of healthcare facilities upgrading their imaging equipment to improve patient care. This trend reflects a broader shift toward adopting sophisticated imaging techniques, thus increasing reliance on medical imaging phantoms to assure the precision and performance of these systems.

Technological advancements in the design and materials of medical imaging phantoms further underscore their growing importance in the healthcare landscape. In 2023, innovations led to the development of sophisticated phantoms tailored for modalities such as MRI and CT imaging. Key organizations have introduced new phantoms that enhance calibration accuracy, catering to the increasing demand for precision in imaging techniques. These advancements improve the reliability of imaging systems and facilitate better quality assurance protocols, thus optimizing overall patient outcomes.

Stricter regulations implemented by entities such as the FDA have mandated routine testing and quality assurance for medical imaging devices. Consequently, healthcare providers are increasingly procuring imaging phantoms to comply with established safety standards, further boosting market demand. In the context of expanding healthcare infrastructure in countries such as Japan, India, and China, which are witnessing substantial investments in new diagnostic centers, the demand for medical imaging phantoms is anticipated to grow as these facilities implement stringent quality assurance protocols. For instance, in December 2024, China announced a detailed plan for wholly foreign-owned hospitals in nine cities, demonstrating commitment to healthcare reform and foreign investment following a pilot policy initiated in September.

Product Insights

CT (Computed Tomography) phantoms dominated the market and accounted for a share of 30.6% in 2024, driven by their essential function in facilitating accurate calibration and quality assurance of imaging systems. As healthcare facilities adopt advanced imaging technologies, the necessity for dependable phantoms to improve diagnostic accuracy and enhance patient safety has significantly increased.

MRI (Magnetic Resonance Imaging) phantoms are expected to grow at the fastest CAGR of 6.7% over the forecast period, owing to their essential function in quality assurance and research for magnetic resonance imaging. The rising necessity for precise diagnostic tools, combined with advancements in imaging technology, significantly enhances this demand, particularly among hospitals and research institutions.

Application Insights

Calibration & quality assurance led the market with a revenue share of 38.3% in 2024, fueled by their crucial role in maintaining accurate imaging and diagnostic reliability. As healthcare facilities emphasize standardized performance and regulatory compliance, these phantoms enable effective evaluation and upkeep of imaging equipment, thereby supporting the overall quality of diagnostic services.

Diagnostic imaging is expected to register the fastest growth of 6.5% over the forecast period. The increasing requirement for precise imaging in clinical environments drives segment growth significantly. Moreover, a rise in chronic diseases, advancements in imaging technologies, and the imperative for quality assurance in diagnostic procedures are aiding innovation and development, all aimed at improving patient outcomes and enhancing the overall efficacy of healthcare services.

End-use Insights

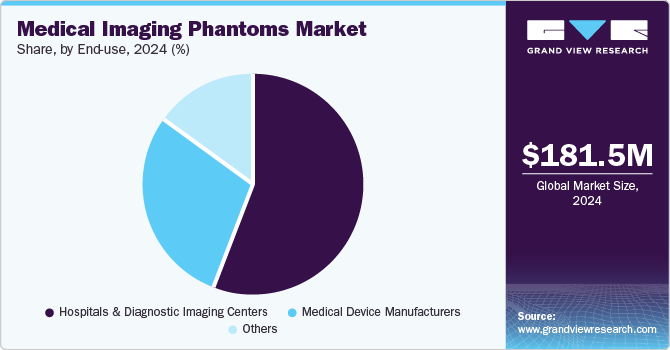

Hospitals & diagnostic imaging centers held the largest market share of 56.3% in 2024, aided by the rising prevalence of chronic diseases and the necessity for accurate diagnostic imaging. These facilities rely on phantoms for quality assurance, training, and compliance with regulatory standards, ultimately contributing to their widespread adoption and integration into clinical practices.

Medical device manufacturers are projected to grow at the fastest rate of 6.4% over the forecast period. These manufacturers employ phantoms to develop and test new devices, ensuring compliance with industry standards and improving the reliability of diagnostic imaging technologies. This trend underscores the importance of phantoms in advancing medical device innovation.

Regional Insights

North America medical imaging phantoms market dominated the global market with a revenue share of 36.4% in 2024. North America is supported by advanced healthcare infrastructure, substantial investments in research and development, and a high prevalence of chronic diseases. The region’s focus on early diagnosis and the adoption of innovative imaging technologies significantly enhance the demand for medical imaging phantoms, ensuring quality assurance in diagnostic procedures.

U.S. Medical Imaging Phantoms Market Trends

The medical imaging phantoms market in the U.S. dominated North America with the largest revenue share in 2024. The country’s emphasis on regulatory compliance and quality assurance in medical imaging practices drives the demand for phantoms vital for effective diagnostics and patient safety. Furthermore, the nation boasts a robust healthcare system, substantial healthcare expenditure, and a growing installation of advanced imaging devices, further contributing to the increasing need for medical imaging phantoms in clinical settings.

Europe Medical Imaging Phantoms Market Trends

Europe medical imaging phantoms market held a substantial market share in 2024 due to the heightened demand for precise diagnostic imaging linked to an increase in chronic diseases. The region’s dedication to research and innovation, coupled with stringent regulations pertaining to imaging quality, fosters the utilization of phantoms in hospitals and diagnostic centers, thereby ensuring reliable imaging outcomes and enhancing patient care.

The medical imaging phantoms market in Germany is expected to grow in the forecast period, aided by the country’s robust focus on medical technology innovation and high healthcare standards. The extensive network of hospitals and research institutions promotes the development and application of advanced phantoms for quality assurance, thereby enhancing diagnostic accuracy and significantly improving patient care across the healthcare system.

Asia Pacific Medical Imaging Phantoms Market Trends

Asia Pacific medical imaging phantoms market is expected to register the fastest CAGR of 6.6% in the forecast period. Enhanced focus on medical research and rising investments in advanced imaging technologies further fuel demand for phantoms, which are critical for ensuring accurate diagnostics in healthcare settings. For instance, in August 2024, Fischer Medical Ventures announced the launch of domestically produced, affordable CT scan machines, expanding its portfolio following the introduction of India’s first indigenous MRI system earlier that year, underscoring this trend.

The medical imaging phantoms market in Japan is expected to grow at the fastest rate in the Asia Pacific market over the forecast period. Japan’s leadership in medical technology innovations and a strong focus on patient safety are key factors driving market growth in the country. The nation’s robust healthcare system and dedication to high-quality diagnostic practices significantly drive the demand for phantoms, which are essential for calibration, testing, and adherence to stringent regulatory standards within the industry.

Key Medical Imaging Phantoms Company Insights

Some key companies operating in the market include BARTEC Top Holding GmbH, Gold Standard Phantoms, IBA Worldwide, and Kyoto Kagaku Co., Ltd., among others. Strategic initiatives encompass the creation of advanced 3D-printed phantoms, partnerships for cost-effective imaging solutions, and heightened R&D investment, all aimed at improving diagnostic accuracy and expanding access in underserved areas.

-

BARTEC Top Holding GmbH is dedicated to providing safety solutions and products for hazardous environments, including healthcare settings. The company develops innovative phantoms that promote safe operations and enhance diagnostic imaging reliability.

-

IBA Worldwide offers an extensive array of medical imaging phantoms through its Dosimetry Services, aimed at ensuring quality assurance in radiation therapy and diagnostic imaging. The company’s phantoms are essential for verifying machine performance and ensuring patient safety.

Key Medical Imaging Phantoms Companies:

The following are the leading companies in the medical imaging phantoms market. These companies collectively hold the largest market share and dictate industry trends.

- BARTEC Top Holding GmbH

- Gold Standard Phantoms

- IBA Worldwide

- Kyoto Kagaku Co., Ltd.

- Leeds Test Objects

- Mirion Technologies, Inc.

- PTW Freiburg GmbH

- Pure Imaging Phantoms

- RSD Radiology Support Devices

Recent Developments

-

In December 2024, Siemens Healthineers expanded the 1.5 Tesla Magnetom Flow MRI platform, introducing a 70-centimeter bore scanner designed for patient comfort, sustainability, enhanced image quality, and automated workflows.

-

In July 2024, RSD Radiology Support Devices announced the upcoming launch of Multimodality Phantoms, enhancing precision and reliability in medical diagnostics across various imaging modalities, including CT, MRI, and X-ray.

-

In June 2024, Festo acquired Carville’s process technologies and production facilities for multilayer plastic manifolds, with production set to commence in 2025, enhancing our innovative solutions in laboratory automation and medical technology.

-

In February 2024, Philips launched the AI-enabled CT 5300 at #ECR2024, enhancing diagnostic capabilities and efficiency and prompting advancements in medical imaging phantoms for accurate patient assessments and complex cardiac cases.

Medical Imaging Phantoms Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 191.6 million

Revenue forecast in 2030

USD 255.7 million

Growth rate

CAGR of 5.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

BARTEC Top Holding GmbH; Gold Standard Phantoms; IBA Worldwide; Kyoto Kagaku Co., Ltd.; Leeds Test Objects; Mirion Technologies, Inc.; PTW Freiburg GmbH; Pure Imaging Phantoms; RSD Radiology Support Devices

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Imaging Phantoms Market Report Segmentation

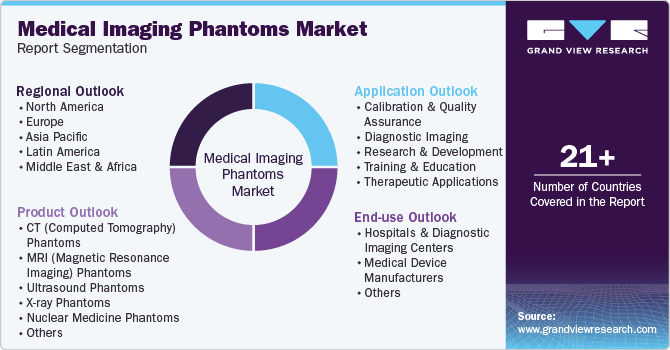

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global medical imaging phantoms market report based on product, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

CT (Computed Tomography) Phantoms

-

MRI (Magnetic Resonance Imaging) Phantoms

-

Ultrasound Phantoms

-

X-ray Phantoms

-

Nuclear Medicine Phantoms

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Calibration & Quality Assurance

-

Diagnostic Imaging

-

Research & Development

-

Training & Education

-

Therapeutic Applications

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Diagnostic Imaging Centers

-

Medical Device Manufacturers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.