- Home

- »

- Plastics, Polymers & Resins

- »

-

Medical Packaging Films Market Size, Industry Report, 2033GVR Report cover

![Medical Packaging Films Market Size, Share & Trends Report]()

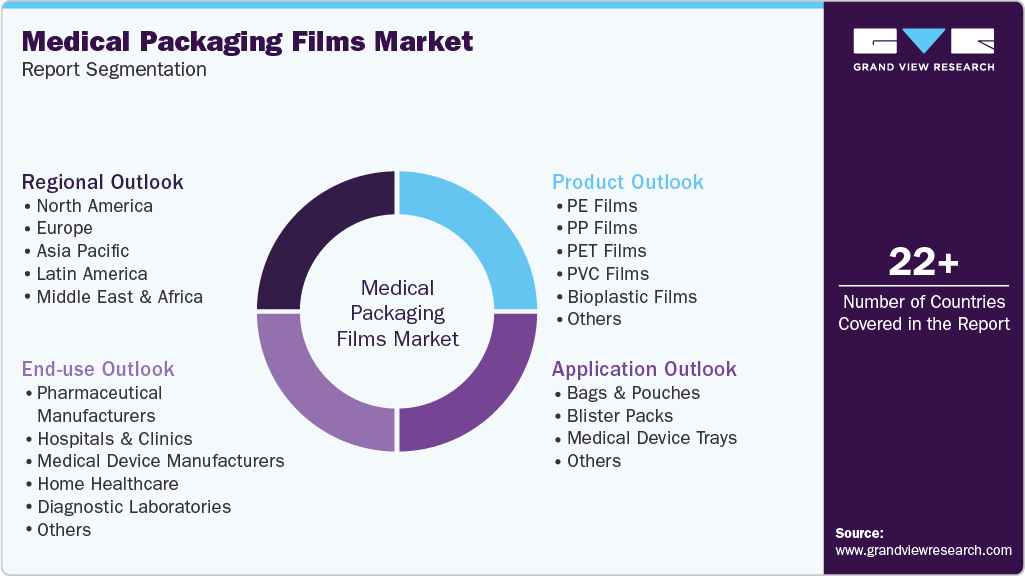

Medical Packaging Films Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (PE Films, PP Films, PET Films, PVC Films, Bioplastic Films), By Application (Bags & Pouches, Blister Packs, Medical Device Trays), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-844-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Medical Packaging Films Market Summary

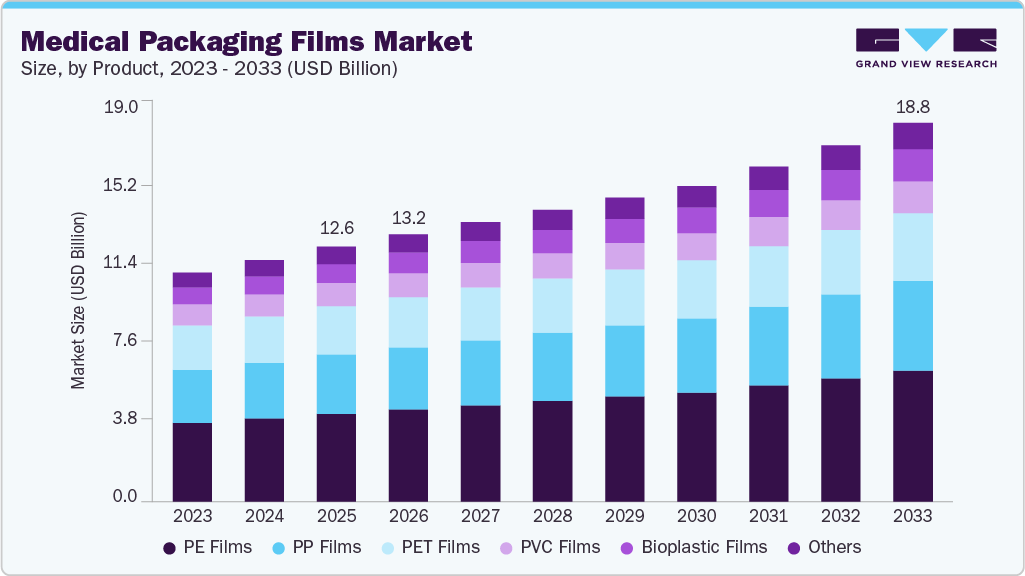

The global medical packaging films market size was estimated at USD 12.62 billion in 2025 and is projected to reach USD 18.78 billion by 2033, growing at a CAGR of 5.1% from 2026 to 2033. Rising pharmaceutical and medical device production, driven by aging populations and the prevalence of chronic diseases, is increasing demand for high-barrier, sterile, and contamination-resistant medical packaging films.

Key Market Trends & Insights

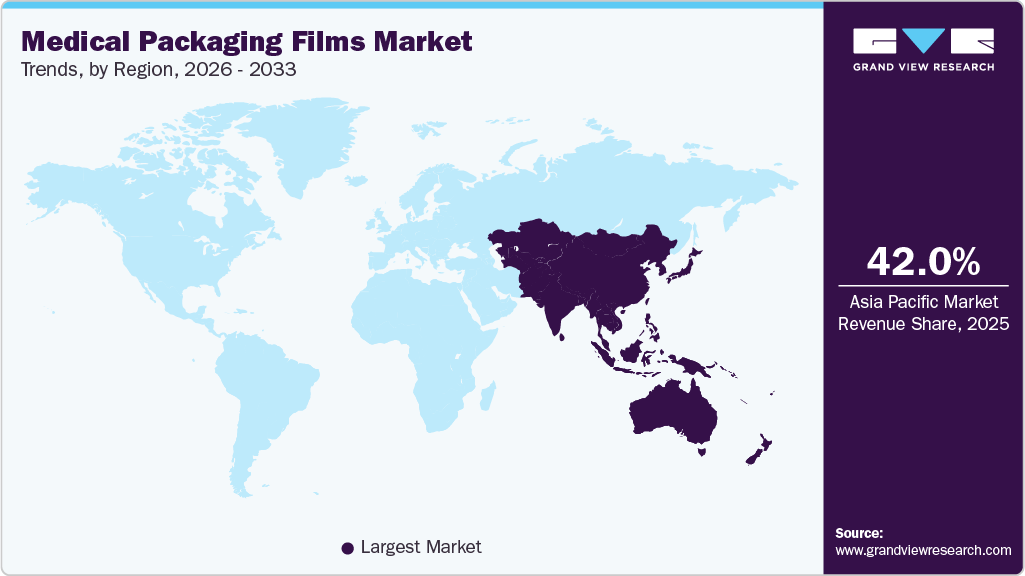

- Asia Pacific dominated the global medical packaging films market with the largest revenue share of 42.0% in 2025.

- The medical packaging films industry in China accounted for the largest market revenue share in the Asia Pacific in 2025.

- By product, the bioplastic films segment is expected to grow at the fastest CAGR of 6.7% from 2025 to 2033.

- By application, the blister packs segment is expected to grow at the fastest CAGR of 5.8% from 2025 to 2033.

- By end use, the home healthcare segment is expected to grow at the fastest CAGR of 5.7% from 2025 to 2033.

Market Size & Forecast

- 2025 Market Size: USD 12.62 Billion

- 2033 Projected Market Size: USD 18.78 Billion

- CAGR (2026-2033): 5.1%

- Asia Pacific: Largest market in 2025

Stricter regulatory requirements, growth in single-use medical products, and adoption of advanced multilayer and sustainable film technologies are further accelerating market expansion. Aging populations, increasing prevalence of chronic diseases, and higher surgical procedure rates are directly translating into greater demand for sterile, high-barrier packaging solutions. Medical films play a critical role in maintaining product integrity, sterility, and shelf life across applications such as blister packs, IV bags, wound care products, and diagnostic kits, making them indispensable as healthcare delivery scales in both developed and emerging markets.Regulatory emphasis on patient safety and contamination control is another major growth driver shaping the medical packaging films industry. Stringent standards imposed by regulatory bodies such as the FDA, EMA, and ISO require packaging materials to demonstrate high chemical resistance, puncture strength, seal integrity, and compatibility with sterilization methods, including ethylene oxide, gamma radiation, and steam. This regulatory pressure is accelerating the adoption of advanced multilayer and specialty films, including high-performance polyethylene, polypropylene, PET, and co-extruded structures, thereby increasing the value per unit of medical packaging films.

Technological advancements in medical devices and pharmaceutical formulations are also fueling demand for sophisticated packaging films. The growing use of minimally invasive devices, combination drug-device products, and biologics requires packaging materials with precise barrier properties, transparency, and peelability. In addition, the shift toward home healthcare, self-administration devices, and point-of-care diagnostics is driving demand for lightweight, flexible, and user-friendly packaging formats, where medical films offer superior design flexibility compared to rigid alternatives.

Finally, sustainability and supply chain efficiency are emerging as influential demand drivers. Healthcare companies are increasingly seeking downgauged, recyclable, and mono-material film structures to meet environmental targets without compromising safety or compliance. At the same time, medical packaging films enable cost-effective high-speed manufacturing, reduced transportation weight, and improved inventory efficiency, which is particularly critical in a healthcare environment focused on cost containment and resilience. These economic and sustainability benefits are reinforcing the long-term adoption of medical packaging films across global healthcare value chains.

Market Concentration & Characteristics

The medical packaging films industry is characterized by a value-over-volume pricing structure. Medical packaging films command higher margins compared to commodity flexible films due to stringent quality requirements, lower tolerance for defects, and the critical nature of end-use applications. Demand is relatively resilient to economic cycles, as healthcare consumption is non-discretionary. However, pricing is influenced by raw material volatility and the ability of suppliers to pass through costs while maintaining long-term contracts with healthcare customers.

The medical packaging films industry operates within a highly integrated and risk-averse value chain. Close collaboration between resin suppliers, film extruders, converters, sterilization service providers, and end users is essential to ensure compliance and performance throughout the product lifecycle. Supply chain resilience, traceability, and geographic diversification have become increasingly important characteristics, particularly after recent global disruptions. As a result, scale, technical credibility, and regulatory expertise are key competitive advantages shaping industry structure and consolidation trends.

Product Insights

The PE films segment led the market with the largest revenue share of 34.4% in 2025, due to its excellent chemical resistance, sealability, and compatibility with multiple sterilization methods. Its versatility across applications such as pouches, bags, blister lidding, and medical device packaging supports widespread adoption. In addition, PE films offer a favorable balance of cost efficiency, processability, and regulatory acceptance, reinforcing their leading market position.

The bioplastic films segment is expected to register at the fastest CAGR of 6.7% during the forecast period, driven by increasing sustainability commitments across the healthcare value chain. Medical device and pharmaceutical companies are actively adopting bio-based and recyclable film solutions to meet regulatory, ESG, and corporate decarbonization targets. Advances in bio-based PE, PLA blends, and compostable barrier films that maintain medical-grade performance are accelerating adoption without compromising safety or compliance.

Application Insights

The bags and pouches segment led the market with the largest revenue share of 37.7% in 2025, supported by their extensive use in sterile medical devices, pharmaceutical products, and IV solutions. Their flexibility, strong barrier performance, and compatibility with multiple sterilization techniques make them a preferred packaging format. In addition, cost efficiency, ease of handling, and suitability for high-volume healthcare applications reinforced their dominant market position.

The blister packs segment is projected to grow at the fastest CAGR of 5.8% over the forecast period, driven by rising demand for unit-dose pharmaceutical packaging and enhanced product protection. Blister packs offer superior barrier properties, tamper evidence, and dosing accuracy, which are critical for patient safety and regulatory compliance. Increasing adoption in solid oral drugs, diagnostic kits, and home healthcare applications is further accelerating segment growth.

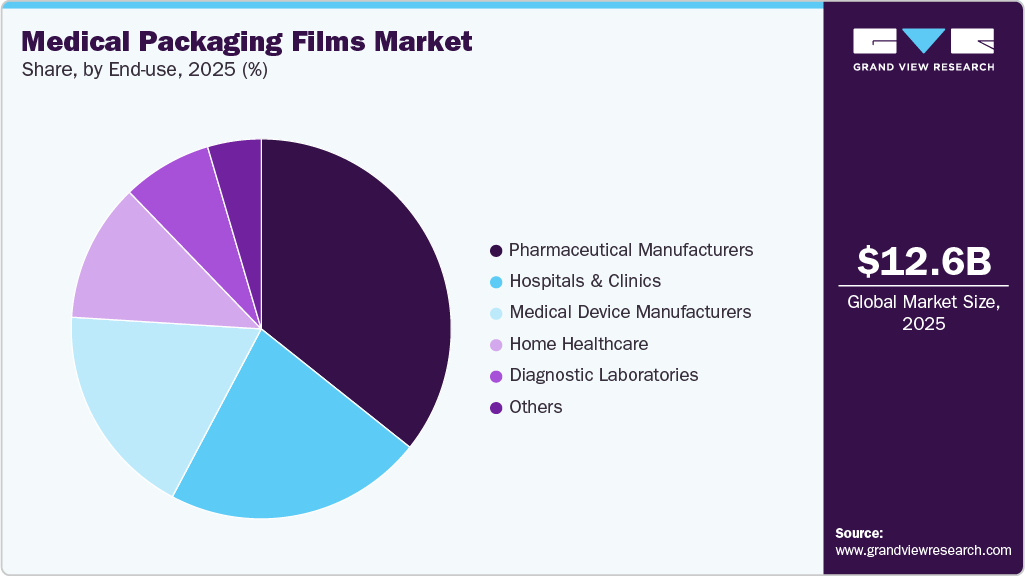

End Use Insights

The pharmaceutical manufacturers segment led the market with the largest revenue share of 35.7% in 2025, due to high volumes of oral solids, injectables, and sterile formulations. Strict regulatory requirements for moisture, oxygen, and contamination protection drive sustained demand for high-performance film structures. In addition, growth in chronic therapies, generics, and contract pharmaceutical manufacturing continues to reinforce this segment’s leadership.

The home healthcare segment is expected to register at the fastest CAGR of 5.7% over the forecast period, driven by the shift toward outpatient care, self-administered therapies, and remote patient monitoring. The growing use of disposable medical devices, diagnostic kits, and drug-delivery systems increases demand for lightweight, flexible, and user-friendly packaging films. Aging populations and cost pressures on hospital systems are further accelerating the adoption of home-based care solutions.

Regional Insights

The medical packaging films market in North America is a mature yet high-value region in the medical packaging films industry, driven by advanced healthcare infrastructure and strong demand for premium, compliant packaging solutions. The presence of leading pharmaceutical and medical device manufacturers, coupled with strict FDA and USP regulatory requirements, sustains demand for high-performance, multilayer, and specialty films. In addition, growth in biologics, combination devices, and home healthcare continues to support steady market expansion despite overall market maturity.

U.S. Medical Packaging Films Market Trends

The medical packaging films market in the U.S. represents the largest and most technologically advanced market for medical packaging films within North America, supported by its dominant pharmaceutical and medical device manufacturing base. Stringent FDA regulations and a strong focus on patient safety drive high demand for premium multilayer films with superior barrier properties, seal integrity, and sterilization compatibility. In addition, rapid growth in biologics, specialty drugs, and home healthcare products continues to reinforce the U.S. market’s high value and innovation-led demand profile.

Asia Pacific Medical Packaging Films Market Trends

Asia Pacific dominated the global medical packaging films market with the largest revenue share in 42.0% in 2025 and is also expected to register at the fastest CAGR of 5.4% during the forecast period. This leadership is driven by expanding pharmaceutical manufacturing, rising healthcare expenditure, and strong growth in generic drugs and medical device production across China, India, and Southeast Asia. In addition, cost-competitive manufacturing, improving regulatory frameworks, and increasing demand for affordable healthcare packaging solutions continue to accelerate regional growth.

The medical packaging films market in China accounted for the largest market revenue share in the Asia Pacific in 2025, driven by its massive pharmaceutical manufacturing base and rapidly expanding medical device sector. Strong government support for domestic drug production, rising exports of generics and APIs, and increasing demand for compliant primary packaging are fueling sustained consumption of high-barrier PE, PP, and multilayer films. In parallel, growing healthcare access, hospital expansion, and accelerated adoption of home healthcare and diagnostic products are strengthening China’s role as both a high-volume consumer and a strategic manufacturing hub for medical packaging films.

Europe Medical Packaging Films Market Trends

The medical packaging films market in Europe is a key value-driven industry, characterized by strict regulatory oversight under the EU MDR and a strong emphasis on patient safety and sustainability. The region’s well-established pharmaceutical and medical device industries in countries such as Germany, France, and Switzerland drive consistent demand for high-barrier and specialty film solutions. In parallel, the growing adoption of recyclable and mono-material packaging structures is shaping product innovation and reinforcing Europe’s role as a leader in compliant, sustainable medical packaging.

Key Medical Packaging Films Company Insights

The medical packaging films industry operates in a concentrated, highly regulated competitive environment, dominated by a mix of global packaging majors and specialized film manufacturers with strong technical and regulatory expertise. Competition is driven less by price and more by product performance, regulatory compliance, supply reliability, and long-term partnerships with pharmaceutical and medical device companies.

High entry barriers, lengthy qualification cycles, and strict change-control requirements limit new entrants and favor established players with validated manufacturing processes and global footprints. As a result, the market is characterized by stable customer relationships, selective innovation, and targeted M&A focused on expanding healthcare portfolios and advanced film capabilities.

Key Medical Packaging Films Companies:

The following key companies have been profiled for this study on the medical packaging films market.

- Amcor plc

- Sealed Air

- Klöckner Pentaplast

- UFlex Limited

- TOPPAN Inc.

- ACG

- Tekni-Plex, Inc.

- Neelam Global Pvt. Ltd.

- WEIFU Films

- DUNMORE

- SIGMA Medical Supplies Corp.

Recent Developments

-

In April 2025, Amcor plc completed construction of a cutting-edge coating facility for healthcare packaging in Selangor, Malaysia, marking a significant milestone as the first in Asia to utilize advanced air knife coating technology and to produce both top and bottom substrates for medical packaging. This state-of-the-art facility, integrated with Amcor’s existing healthcare packaging plant, enhances supply chain security, reduces lead times, and supports the growing demand for high-quality, sterile packaging in the Asia Pacific region.

-

In October 2024, Klöckner Pentaplast launched kpNext MDR1, a sustainable medical device packaging film that extends its kpNext brand from pharmaceutical blister films into the medical device sector. The film is recyclable in the RIC 1 stream and halogen-free, reinforcing the company’s commitment to sustainability and innovation in healthcare packaging.

-

In January 2024, Tekni-Plex, Inc. partnered with Alpek Polyester to launch the world’s first pharmaceutical-grade polyethylene terephthalate (PET) blister film featuring 30% post-consumer recycled (PCR) monomers. This innovative film, produced through a chemical recycling process that depolymerizes post-consumer plastic waste back into monomers and repolymerizes them into PET, matches the quality of virgin material and meets stringent pharmaceutical standards outlined in the U.S. and European Pharmacopoeias.

Medical Packaging Films Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 13.24 billion

Revenue forecast in 2033

USD 18.78 billion

Growth rate

CAGR of 5.1% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Amcor plc; Sealed Air; Klöckner Pentaplast; UFlex Limited; TOPPAN Inc.; ACG; Tekni-Plex, Inc.; Neelam Global Pvt. Ltd.; WEIFU Films; DUNMORE; SIGMA Medical Supplies Corp.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Packaging Films Market Report Segmentation

This report forecasts revenue growth at the regional, and country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global medical packaging films market report based on the product, application, end use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

PE Films

-

PP Films

-

PET Films

-

PVC Films

-

Bioplastic Films

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Bags & Pouches

-

Blister Packs

-

Medical Device Trays

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmaceutical Manufacturers

-

Hospitals & Clinics

-

Medical Device Manufacturers

-

Home Healthcare

-

Diagnostic Laboratories

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global medical packaging films market is expected to grow at a compound annual growth rate of 5.1% from 2026 to 2033 to reach around USD 18.78 million by 2033.

b. The global medical packaging films market was estimated at around USD 12.62 billion in the year 2025 and is expected to reach around USD 13.24 million in 2026.

b. The pharmaceutical manufacturers segment dominated the medical packaging films market due to the high volume production of solid, liquid, and injectable drugs requiring strict moisture, oxygen, and contamination protection.

b. The key players in the medical packaging films market include Amcor plc; Sealed Air; Klöckner Pentaplast; UFlex Limited; TOPPAN Inc.; ACG; Tekni-Plex, Inc.; Neelam Global Pvt. Ltd.; WEIFU Films; DUNMORE; and SIGMA Medical Supplies Corp.

b. The medical packaging films industry is primarily driven by the sustained expansion of the global healthcare sector, particularly the rising volume of medical devices, pharmaceuticals, and diagnostic consumables.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.