- Home

- »

- Medical Devices

- »

-

Medical Service Robots Market Size & Share Report, 2030GVR Report cover

![Medical Service Robots Market Size, Share & Trends Report]()

Medical Service Robots Market Size, Share & Trends Analysis Report By Product (Disinfection Robots, Robotics Nurse Assistant, Medical Telepresence Robots, Delivery Robots), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-961-1

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Medical Service Robots Market Size & Trends

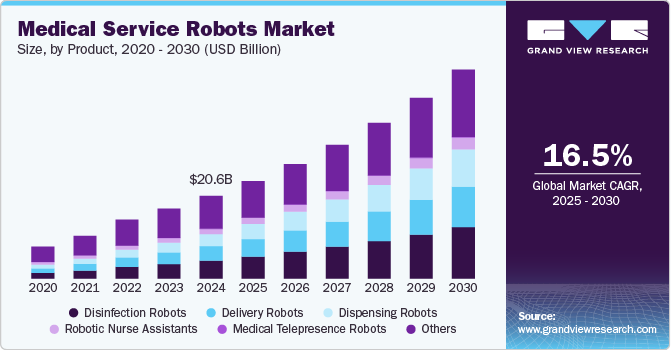

The global medical service robots market size was estimated at USD 20.59 billion in 2024 and is projected to grow at a CAGR of 16.5% from 2025 to 2030. The growth can be attributed to the introduction of technologically advanced robotic equipment in the healthcare sector and the rise in per capita healthcare spending. Continuous advancements in technology, such as robotic catheter control systems (CCS), data recorders, data analytics, remote navigation, motion sensors, 3D-Imaging, and HD surgical microscopic cameras, are projected to drive industry growth. Furthermore, the introduction of swarm robotics is opening new opportunities for industry. It is a new approach to coordinating multi-robotic systems through swarm intelligence.

Swarm robotics finishes the task faster and identifies pathology with higher efficiency. Growing adoption of AR/VR, AI, and IoT along with the introduction of a 5G network is further expected to boost industry growth over the forecast period since these technologies along with a strong network are expected to enhance the experience of remote patient monitoring and improve the workflow process across the medical sector. These robotics services are used to provide a higher level of patient care by providing patient-centric, customized, frequent, and/or constant monitoring for patients dealing with debilitating health conditions and chronic diseases, introducing intelligent therapeutics, and also providing social engagement to elderly patients.

These systems reduce the workload on the shoulder of healthcare providers by streamlining the clinical workflow. Robots can be used to deal with staff shortages as these are beneficial in keeping track of the inventory and making sure medication, supplies and equipment are in stock. In addition, these systems are also used for cleaning and disinfecting the area, and the automatic sterilization process also reduces the labor. In April 2024, Avidbots, a company in the robotics industry, launched Kas, their latest autonomous floor-scrubbing robot designed to cater to the spaces of retail, transportation, healthcare, and educational sectors. Kas offers businesses a way to modernize their workforce approach, achieve cost savings from the outset, and transform their approach to cleaning. These advantages are driving the industry's growth.

Supportive government initiatives to establish medical facilities in remote areas through telepresence-based robotic systems are fueling the industry's growth. As the demand for drugs and medicines is growing, the pharmaceutical sector is continuously looking for automated equipment and robotics to increase productivity. The introduction of robotic systems in the pharmaceutical sector has many advantages in terms of speed and precision. Robots can perform a task 3 or 4 times faster than humans. Thus, it can be used for producing a large number of products in a shorter span of time.

In March 2022, Omnicell launched IVX Station, it is an enhanced version of IV robotics technology, which has the capability of improving workflow, automating operations, and enhancing patient care in a complete regulatory environment. Furthermore, these robots are also used for medicine management. The growing geriatric population and increasing cases of chronic diseases are further surging the adoption of robotic systems for medical management, as they provide better ways for elderly patients to manage their medications and monitor their treatment. For instance, in July 2024, a 16-year-old from Vadodara, India, has created an innovative mini robot named Meditel, intended to assist the elderly in taking their medications punctually.

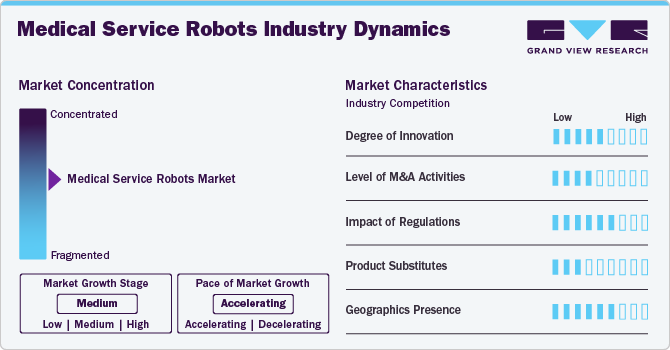

Market Concentration & Characteristics

Innovations in robotics technology, including artificial intelligence, machine learning, and sensor technology, are enhancing the capabilities of medical robots. These advancements enable more precise surgical procedures, improved rehabilitation processes, and efficient hospital logistics, thus attracting more healthcare facilities to adopt robotic solutions.

The market is characterized by a moderate level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including the desire to expand the business to cater to the growing demand for medical service robots. In September 2024, Hitachi Ltd. successfully finalized the purchase of MA micro automation GmbH, a prominent company specializing in robotic and automation solutions.

Regulatory bodies, such as the FDA in the United States and the EMA in Europe, establish rigorous guidelines for the design, testing, and deployment of these technologies. These regulations help to standardize quality controls, ensuring that robots meet safety requirements and perform as intended in clinical settings.

Traditional methods of patient care, such as manual procedures performed by healthcare professionals, can be seen as substitutes for robotic systems. Telehealth services and wearable health technologies also serve as alternatives, providing remote patient management and data collection without the need for physical robots.

Several market players are expanding their business by entering new geographical regions to strengthen their market position and expand their product portfolio. Rising product approvals and funding create more opportunities for market players to enter new regions. In July 2024, Haystack Robotics, a startup from Portland, Oregon, focused on creating robotics solutions for disinfection applications, secured USD 2.7 million from an investment group linked to healthcare IT firm Agadia Systems.

Product Insights

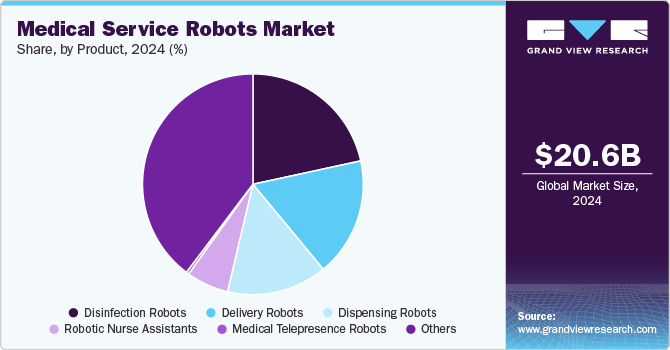

The disinfection robots segment led the market with the largest revenue share of 21.6% in 2024. The rising utilization of technologically advanced disinfection systems in healthcare institutions is one of the major factors contributing to the higher share of this segment. In addition, these robotic systems are beneficial to overcome shortages in the healthcare workforce. Furthermore, increasing Hospital-Acquired Infections (HAIs) are fostering segmental growth. As per the WHO report, more than 24% of individuals affected with healthcare-associated sepsis and 52.3% of those receiving care in an ICU die annually. Moreover, growing automation and increasing adoption of machine learning-based products & solutions are supplementing market growth.

The dispensing robots segment is anticipated to witness at the fastest CAGR over the forecast period. This growth can be attributed to an increasing demand for efficiency and accuracy in medication management. In addition, the rising pressure to optimize operational costs and streamline workflows in hospitals and pharmacies further fuels the adoption of these technologies.Moreover, the growing emphasis on personalized medicine and the need for scalable solutions in response to aging populations and chronic disease management also contribute to the market's expansion.

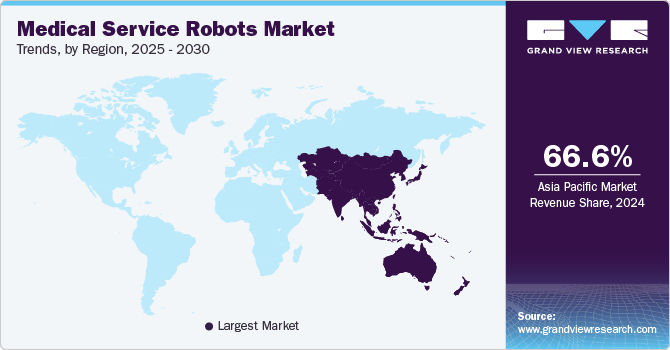

Regional Insights

The medical service robots market in North America is anticipated to register at the fastest CAGR during the forecast period.The presence of key players, along with favorable government initiatives for the adoption of robotic technologies in healthcare, is a key factor boosting the region’s growth.

U.S. Medical Service Robots Market Trends

The medical service robots market in the U.S. held the largest share in North America in 2024. The growing geriatric population in the country is fostering market growth owing to advancements in healthcare technology and increasing investment in research and development. Regulatory support and favorable reimbursement policies for robotic-assisted surgeries also contribute to the market's expansion.

The Canada medical service robots market is anticipated to register at a considerable CAGR during the forecast period owing to improving healthcare delivery and adopting technological innovation. Furthermore, the increasing prevalence of hospital-acquired infections is boosting market growth.

Asia Pacific Medical Service Robots Market Trends

Asia Pacific medical service robots market dominated with the largest revenue share of 66.6% in 2024. The increasing number of installations of healthcare service robots and the growing geriatric population across major countries requiring assistance are some of the key factors responsible for the higher revenue of the Asia Pacific region. In August 2024, Gleneagles Hospital Hong Kong implemented uniBOT, an entirely automated robotic system for cutting and repacking unit doses of medication.

The medical service robots market in China held the largest share of Asia Pacific market in 2024. The rapidly aging population and increasing healthcare demands are fostering the demand of medical service robots in the region. Government data indicates that in 2023, approximately 297 million individuals in China are aged 60 and older, representing 21.1% of the total population, which classifies the nation as a “super-aged society” according to World Bank criteria. This age group is projected to exceed half a billion by the year 2050.

The Japan medical service robots market is anticipated to register at the fastest CAGR during the forecast period. The Japanese government actively supports research and development in robotics, considering these technologies essential for addressing labor shortages in the healthcare sector. In addition, advanced healthcare infrastructure further accelerates regional growth.

Europe Medical Service Robots Market Trends

The medical service robots market in Europe is anticipated to register at a significant CAGR during the forecast period. European countries are increasingly adopting robotic technologies to address challenges such as an aging population and a rising burden of chronic diseases.Regulatory frameworks across the EU are becoming more supportive of innovative medical devices, facilitating the approval and integration of robotic solutions in clinical settings. In September 2023, an Estonian firm called Grab2Go has created a 24/7 robotic pharmacy, which could revolutionize healthcare access in Europe.

The Germany medical service robots market is anticipated to register at a considerable CAGR during the forecast period, due to its strong emphasis on innovation and advanced healthcare technology. In addition, public and private sector collaborations are promoting research initiatives, thereby escalating market growth.

The medical service robots market in UK is anticipated to register at a considerable CAGR during the forecast period. The increasing focus on reducing waiting times and improving patient outcomes has led to the adoption of robotic technologies for surgeries and patient care management. Furthermore, advancements in artificial intelligence and machine learning are driving the development of smarter robotic systems capable of providing personalized treatment.

Latin America Medical Service Robots Market Trends

The medical service robots market in Latin America is anticipated to grow at a lucrative CAGR during the forecast period. Government initiatives and regulatory frameworks supporting the integration of robotics in healthcare also contribute to market growth. The increasing incidence of mobility disorders, such as strokes and spinal cord injuries, is driving the demand for rehabilitation robots.

The Brazil medical service robots market is anticipated to register at a considerable CAGR during the forecast period. The increasing elderly population contributes to a higher demand for healthcare services, including surgical and rehabilitation procedures.

MEA Medical Service Robots Market Trends

Themedical service robots market in MEA is anticipated to register at the fastest CAGR during the forecast period. Rapid advancements in healthcare infrastructure and an increasing focus on improving patient care are accelerating regional growth. In July 2020, the Dubai Health Authority (DHA) launched eight "smart" robots designed to disinfect its hospitals and clinics operated by the government.

The South Africa medical service robots market is anticipated to register at a considerable CAGR during the forecast period. The South African government and private sector are increasingly investing in healthcare infrastructure, promoting the adoption of robotic technologies.

Key Medical Service Robots Company Insights

Key participants in the global market are focusing on devising innovative business growth strategies in the form of product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions.

Key Medical Service Robots Companies:

The following are the leading companies in the medical service robots market. These companies collectively hold the largest market share and dictate industry trends.

- Toyota Motor Corp.

- Panasonic

- Aethon

- Nordson Corp.

- Blue Ocean Robotics

- InTouch Health

- Nuro, Inc.

- Ateago Technology

- VGo Communications, Inc.

- Techcon

- Xenex Disinfection Services, LLC

View a comprehensive list of companies in the Medical Service Robots Market

Recent Developments

-

In May 2024, Richtech Robotics Inc., a Nevada-based company specializing in AI-powered service robots, introduced its newest innovation, Medbot. This robot, designed specifically for elevator delivery, aims to revolutionize pharmacy operations by ensuring seamless, round-the-clock medication delivery.

-

In May 2023, the world's top producer of automated guided vehicles (AGVs) enhancing its product line for global healthcare with the MEDI MOVE series. This new transport robot is engineered for exceptional transport efficiency in round-the-clock operations and fulfills the most rigorous transport standards in hospital settings.

-

In June 2022, Nevoa Inc., introduced their next-generation, automated disinfecting robot called Nimbus. The disinfectant spreads throughout the surface of the room and also decontaminates the air. The quick dehumidification process of Nimbus spontaneously eliminates any remaining disinfectant solution, thus, allowing for immediate room reentry.

Medical Service Robots Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 24.26 billion

Revenue forecast in 2030

USD 52.00 billion

Growth rate

CAGR of 16.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast data

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; Italy; France; Norway; Denmark; Sweden; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Toyota Motor Corp.; Panasonic; Aethon; Nordson Corp.; Blue Ocean Robotics; InTouch Health; Nuro, Inc.; Ateago Technology; VGo Communications, Inc.; Techcon; Xenex Disinfection Services, LLC

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Service Robots Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the global medical service robots market report based on the product, and region:

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Disinfection Robots

-

Robotic Nurse Assistants

-

Medical Telepresence Robots

-

Delivery Robots

-

Dispensing Robots

-

Others

-

-

Regional Outlook Revenue USD Million, 2018 - 2030)

-

NorthAmerica

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global medical service robots market size was estimated at USD 20.59 billion in 2024 and is expected to reach USD 24.26 billion in 2025.

b. The global medical service robots market is expected to grow at a compound annual growth rate of 16.5% from 2025 to 2030 to reach USD 52.00 billion by 2030.

b. The Asia Pacific dominated the medical service robots market in 2024 and accounted for the largest revenue share of 66.6%. The increasing rate of installation of medical service robots, along with the growing geriatric population requiring assistance are some of the major factors contributing to higher market share.

b. Some of the major market players are Toyota Motor Corporation, Panasonic, Aethon, Nordson Corporation, Blue Ocean Robotics, InTouch Health, Nuro, Inc., Ateago Technology, VGo Communications, Inc., Techcon, Xenex Disinfection Services, LLC

b. Continuous advancements in technology such as robotic catheter control systems (CCS), data recorders, data analytics, remote navigation, motion sensors, 3D-Imaging, and HD surgical microscopic cameras are projected to drive the market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."