- Home

- »

- Medical Devices

- »

-

Disinfection Robots Market Size, Share, Growth Report, 2030GVR Report cover

![Disinfection Robots Market Size, Share & Trends Report]()

Disinfection Robots Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (HPV Robots, Ultraviolet Light Robots, Disinfectant Spraying Robots), By Technology (Semi-autonomous, Fully-autonomous), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-127-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Disinfection Robots Market Size & Trends

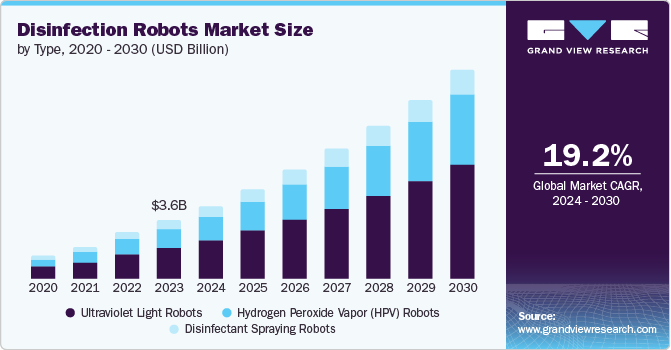

The global disinfection robots market size was valued at USD 3.60 billion in 2023 and is projected to grow at a CAGR of 19.2% from 2024 to 2030. The market’s growth is attributed to the increasing awareness and emphasis on hygiene and infection control in healthcare settings and labor and time savings offered by disinfection robots. In addition, advancements in robotics and AI technologies have enabled the development of sophisticated disinfection robots that can navigate complex environments, adapt to various surfaces, and employ multiple disinfection methods, such as UV-C light or chemical spraying.

For instance, in February 2021, Badger Technologies launched the UV Disinfect robot, a cutting-edge autonomous robot designed to combat high-risk pathogens typically found in food service establishments and retail settings. The latest addition to Badger Technologies' lineup of autonomous robots, the Disinfect robot, is integrated with advanced UV-C technology developed by UltraViolet Devices Inc. Moreover, the challenges of infectious diseases, such as COVID-19, have accelerated the need for advanced disinfection methods. Disinfection robots provide an efficient way to cover large areas quickly, aiding in reducing pathogen transmission.

The growing need for disinfection robots in hospitals to effectively control the spread of infectious diseases is a major driving force behind the rapid growth of the market. Hospitals and healthcare facilities have recognized the significant role of these robots in maintaining a safe and sanitized environment for patients, staff, and visitors. Disinfection robots offer a reliable and efficient solution, capable of covering extensive areas and reaching surfaces that might be difficult for manual cleaning to address. Their ability to deploy various disinfection techniques, such as UV-C light or chemical sprays, improves their effectiveness in eliminating pathogens. As hospitals prioritize infection prevention, the demand for disinfection robots continues to rise, creating a robust market growth trajectory driven by the imperative to ensure health and safety within medical settings.

Moreover, hospital-acquired infections contribute to approximately 37,000 deaths annually in Europe and nearly 100,000 in the U.S. The financial burden of treating these infections amounts to about USD 7.5 billion in Europe and USD 6.5 billion in the U.S. Ultraviolet disinfection robots present a promising solution, capable of eradicating up to 99.9% of microorganisms within 10 minutes in a hospital room. The shortage of workforce in hospitals is another significant factor driving the market growth. With increasing demands, hospitals often need help allocating sufficient staff to perform meticulous cleaning and disinfection tasks. Disinfection robots step in to fill this gap by offering an automated and efficient solution.

These robots can work tirelessly and consistently, reducing the reliance on manual labor for disinfection procedures. By addressing the workforce shortage issue, disinfection robots ensure that hospitals can maintain optimal cleanliness and infection control measures, ultimately contributing to patient safety and operational efficiency. The COVID-19 pandemic has swiftly propelled the acceptance of disinfection robots, extending their application beyond healthcare settings like hospitals to spaces such as hotels, airports, and public transport. Simultaneously, the rise in antibiotic-resistant infections highlights the importance of infection prevention, especially within medical facilities.

However, regardless of the potential benefits of disinfection robots, there are some challenges to overcome. One of the major concerns is the cost of maintaining and implementing these advanced robots. Despite high initial costs, supporters contend that long-term patient care and efficiency gains will surpass expenses. In addition, there are concerns about the possibility of losing jobs for the human workforce as robots take on more tasks. However, experts anticipate that integrating mobile robotics will lead to new roles in system development, maintenance, and operation, countering potential job losses.

Market Concentration & Characteristics

The disinfection robots industry is composed of numerous small and medium-sized companies alongside a few dominant players. This market participation is driven by rapid technological advancements, diverse application areas (hospitals, airports, etc.), and varying regional demands. The market's innovative nature favors startups and specialized ventures to make an entry into the market without barriers that are associated with established industries, leading to a competitive environment with many players offering unique solutions and technologies.

The disinfection robots industry is characterized by a high degree of innovation driven by continuous technological advancements. Innovations include enhanced AI for navigation, improved UV-C & hydrogen peroxide vapor technologies, and integration with IoT for remote monitoring and control. These advancements enable more efficient and effective disinfection processes, catering to the increasing demand for automated hygiene solutions across various sectors such as healthcare, transportation, and public spaces.

Regulations significantly impact the disinfection robots industry by ensuring safety, efficacy, and compliance with health standards. Strict guidelines from health authorities and regulatory bodies drive the development of high-quality, reliable products. Compliance with these regulations can increase market entry barriers, favoring established players with resources to meet stringent standards while also fostering consumer trust and wider adoption of disinfection robots in critical environments like hospitals and public transport.

The industry is witnessing a moderate level of mergers, acquisitions, and partnerships. Companies collaborate to leverage complementary technologies, expand market reach, and enhance product offerings. Strategic partnerships often focus on integrating advanced AI, IoT, and sensor technologies. For instance, in January 2022, UVD Robots became part of Ecolab's global infection prevention offerings to combat hospital-acquired infections. This consolidation helps firms improve their competitive edge, streamline research and development efforts, and accelerate market penetration, fostering innovation and growth within the industry.

The market is experiencing significant product expansion. Companies are continuously developing new models with advanced features such as enhanced mobility, better disinfection efficiency, and integration with AI and IoT for smarter operation. This expansion includes tailoring robots for diverse settings like hospitals, airports, schools, and commercial spaces. The ongoing innovation and diversification of products are meeting the growing global demand for automated disinfection solutions.

The market is undergoing considerable global expansion, driven by the increasing need for automated hygiene solutions across various regions. Companies are extending their reach by entering new international markets, forming strategic partnerships, and establishing local distribution networks. This global expansion is fueled by the heightened awareness of infection control, the COVID-19 pandemic's impact, and the demand for innovative disinfection technologies in sectors such as healthcare, transportation, and public spaces.

Type Insights

The ultraviolet light robots segment held the largest revenue share of 52.3% in 2023 and is expected to register the fastest CAGR over the forecast period. These robots use ultraviolet (UV) light, specifically UV-C light, to eliminate a wide range of pathogens, including bacteria, viruses, and other harmful microorganisms. UV-C light has been extensively studied for its germicidal properties and ability to break down the DNA and RNA of pathogens, rendering them inactive. They provide consistent and thorough disinfection without the use of chemicals, reducing the risk of human error and potential exposure to harmful substances. Moreover, UV robots can quickly disinfect large areas and surfaces, significantly reducing the time required for manual cleaning and disinfection.

In addition, hospitals are increasingly acquiring disinfection robots to enhance infection control and reduce hospital-acquired infections. This surge in adoption is driving significant market growth for ultraviolet (UV) light robots. For instance, in October 2023, the Texas A&M Veterinary Hospital incorporated a disinfecting robot utilizing ultraviolet C (UVC) technology for enhanced sanitation. This advanced robot technology is now employed for disinfection purposes at the Texas A&M Veterinary Medical Teaching Hospital (VMTH) located in College Station, Texas. UV disinfection robots are particularly favored for their effectiveness in eliminating pathogens, ease of integration into existing cleaning protocols, and ability to operate autonomously.

The hydrogen peroxide vapor (HPV) robots segment is anticipated to have a significant CAGR in the coming years. The development and launch of technologically advanced disinfection robots by key players to maintain their competitive edge is boosting the market growth. For instance, The TMiRob, developed by a Chinese company, Taimi Robotics Technology, offers a versatile solution for disinfection with three distinct methods: UV, hydrogen peroxide, and plasma air filtration. These methods can be employed individually or combined based on specific disinfection requirements. Notably, some disinfection robots, like those from Indian manufacturer Milagrow and the collaboration between Siemens and Chinese partner Aucma, feature caterpillar tracks for enhanced mobility, allowing them to navigate challenging terrains and inclines. This innovation expands the operational versatility of disinfection robots beyond traditional wheeled models.

Technology Insights

The fully autonomous robots segment held the largest revenue share in 2023 and is also anticipated to grow at the fastest CAGR of 19.8% over the forecast period. This growth can be attributed to its ability to operate with minimal human intervention. These robots are equipped with advanced sensors, AI algorithms, and cameras that enable them to navigate and disinfect spaces independently. This level of autonomy ensures consistent and efficient disinfection, reducing the risk of human error and ensuring thorough coverage.

Fully autonomous robots can map and adapt to their environment, avoiding obstacles and adjusting their cleaning patterns. This technological advancement not only enhances the effectiveness of disinfection but also contributes to operational cost savings and time efficiency. As a result, the demand for fully autonomous disinfection robots has increased, making them a prominent choice for various industries seeking reliable and hands-free disinfection solutions.

The semi-autonomous segment is experiencing robust growth due to several key factors. These robots offer a balance between manual control and full automation, making them versatile and easier to integrate into existing workflows. Driving factors include the rising demand for efficient infection control, labor shortages in cleaning staff, and the need for consistent and thorough disinfection. Technological advancements, such as improved sensors and AI capabilities, further enhance their effectiveness and appeal, contributing to their increasing adoption in various sectors like healthcare, hospitality, and transportation.

End Use Insights

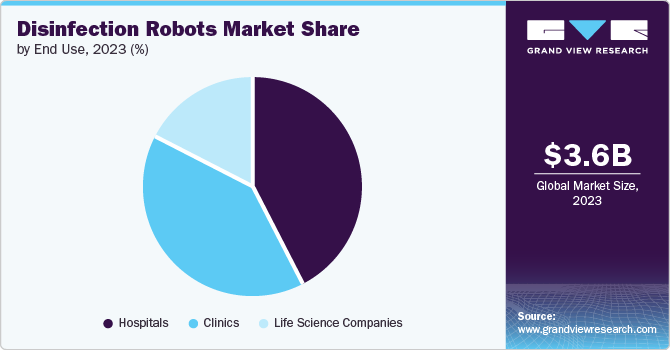

The hospital segment dominated the market in 2023 with the largest revenue share of 42.4%. Hospitals often have complex layouts with various rooms and surfaces that require frequent and thorough disinfection. Disinfection robots offer a systematic and efficient approach to covering large areas, including hard-to-reach spaces, which can be challenging for manual cleaning methods. Moreover, the challenges posed by healthcare-associated infections (HAIs) and the need to minimize the risk of cross-contamination have further accelerated the adoption of disinfection robots in hospitals. These robots provide a consistent and standardized disinfection process, reducing the potential for human error and enhancing overall hygiene levels.

The clinics segment is expected to witness the fastest CAGR over the forecast period. Clinics often need more staff resources, and healthcare professionals are occupied with patient care and other critical tasks. Disinfection robots offer an automated solution that complements existing cleaning practices, freeing up staff to focus on patient care. In addition, clinics, especially those specializing in specific medical treatments or procedures, require a high level of cleanliness and hygiene to prevent post-treatment infections. Disinfection robots provide consistent and thorough disinfection, reducing the potential for cross-contamination and enhancing the overall quality of care provided.

Regional Insights

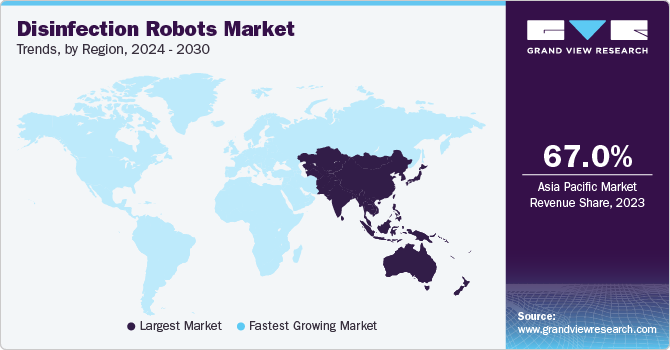

The North America disinfection robots market is expected to witness the fastest CAGR of 22.1% over the forecast period, largely driven by stringent regulations imposed by regulatory bodies such as the FDA and CDC. These regulations ensure high standards of hygiene and infection control, prompting healthcare facilities and other sectors to adopt advanced disinfection technologies. For instance, in January 2024, the U.S. Food and Drug Administration announced that it now recognizes vaporized hydrogen peroxide as an established method of sterilization for medical devices, citing VHP’s long history of safety. The push for compliance with these rigorous standards accelerates the adoption of disinfection robots, which offer consistent, effective sanitization solutions. This regulatory environment fosters innovation and boosts market expansion across the region.

U.S. Disinfection Robots Market Trends

The disinfection robots market in the U.S. is witnessing significant growth, driven by several key factors. The increasing focus on infection control in healthcare facilities, especially due to the COVID-19 pandemic, has accelerated the adoption of these robots. In addition, technological advancements in robotics and automation, combined with strong regulatory support from bodies like the FDA, enhance market expansion. The rising demand for efficient, consistent, and labor-saving disinfection solutions in various sectors, including healthcare, hospitality, and transportation, further fuels this growth.

Europe Disinfection Robots Market Trends

The disinfection robot market in Europe is experiencing robust growth, driven by several factors. Increasing awareness of infection control, heightened by the COVID-19 pandemic, has led to greater adoption of these robots in healthcare and public spaces. Technological advancements, such as improved AI, navigation systems, and more effective disinfection methods like UV-C light and vaporized hydrogen peroxide, are enhancing robot efficiency and reliability. In addition, supportive government regulations and initiatives to promote automation in healthcare further stimulate market expansion in the region.

The UK disinfection robots market is growing rapidly, particularly in the healthcare sector. Hospitals are increasingly adopting these robots to enhance sterilization processes and ensure a higher standard of hygiene. The demand is driven by the need to reduce hospital-acquired infections, improve patient safety, and comply with stringent health regulations. Advanced technologies like UV-C and automated navigation systems are further boosting their adoption in UK hospitals.

The disinfection robots market in Germany is expanding significantly, spurred by the introduction of new products from market players. These innovative robots, equipped with advanced technologies like UV-C light and AI-driven navigation, are meeting the rising demand for effective sterilization solutions. For instance, in December 2021, researchers at Fraunhofer developed a new robot designed for wipe disinfection of surfaces. German hospitals and public facilities are increasingly adopting these robots to enhance hygiene standards, reduce infection rates, and comply with stringent health regulations, driving market growth.

Asia Pacific Disinfection Robots Market Trends

Asia Pacific disinfection robots market dominated globally and held the largest revenue share in 2023. The introduction of advanced disinfection robots by key players in the region and increasing government initiatives in the robotics market are the major factors driving the industry's growth. In January 2021, Korean robotics manufacturer ZetaBank unveiled a new lineup of autonomous mobile disinfection robots at CES 2021. The company has established agreements with several partners in China and Japan, paving the way for its North American launch.

The disinfection robots market in China is expected to grow at the fastest rate during the forecast period. For instance, as per the news article published by Cutting Tool Engineering in January 2023, China undeniably leads as the world's fastest-expanding robot market. With the highest count of annual installations and an unbroken streak since 2016 of maintaining the largest operational robot stock annually, China's high technological adoption holds the potential to significantly fuel the market growth within the Asia Pacific region.

The Japan disinfection robots market is experiencing rapid growth, propelled by increasing awareness of the importance of maintaining high hygiene standards, particularly in response to the COVID-19 pandemic. This heightened awareness has led to the widespread deployment of these robots throughout the region as businesses and healthcare facilities seek effective solutions to enhance sanitation and reduce the risk of infection.

Latin America Disinfection Robots Market Trends

The Latin America disinfection robots market is witnessing growth, buoyed by ongoing research and advancements in robotics technology. As research in robotics continues to evolve, innovative solutions are emerging to address the region's sanitation needs. This includes the development of disinfection robots equipped with advanced features such as AI-driven navigation and UV-C light technology. These robots are increasingly sought after by healthcare facilities, commercial spaces, and public venues to enhance cleanliness and combat the spread of infections.

The disinfection robots market in Brazil is gaining traction, driven by the pressing needs of hospitals for advanced sanitation solutions. With the increasing demand for efficient infection control and the rising awareness of the importance of hygiene, hospitals in Brazil are seeking innovative technologies like disinfection robots. These robots offer automated and thorough cleaning, helping hospitals maintain a safe environment for patients, staff, and visitors amidst growing health concerns.

Middle East and Africa (MEA) Disinfection Robots Market Trends

The disinfection robots market in the Middle East and Africa (MEA) is flourishing, primarily driven by the region's emphasis on hygiene and sanitation. With a growing awareness of the importance of cleanliness in preventing infections, various industries, including healthcare, hospitality, and transportation, are turning to disinfection robots.

The Saudi Arabia disinfection robots market is witnessing significant growth, particularly in hospital settings, where cleanliness is paramount. These robots play a crucial role in maintaining high levels of hygiene by efficiently and effectively disinfecting hospital environments. With advanced features such as UV-C light and autonomous navigation, they ensure thorough cleaning, reducing the risk of infections and promoting a safer healthcare environment for patients and healthcare professionals alike.

Key Disinfection Robots Company Insights

The competitive scenario in the market is highly competitive, with key players such as Blue Ocean Robotics; Xenex Disinfectant Systems; Finsen Technologies (Thor UV-C); Skytron (Infection Prevention Technologies); Tru-D SmartUVC LLC; Akara Robotics Ltd.; Mediland Enterprise Corp.; Tmirob Technology; OTSAW Digital Pte. Ltd.; Bioquell PLC (Ecolab Inc.); Bridgeport Magnetics; Ateago Technology holding significant positions. The major companies are undertaking various strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion to serve the unmet needs of their customers.

Key Disinfection Robots Companies:

The following are the leading companies in the disinfection robots market. These companies collectively hold the largest market share and dictate industry trends.

- Blue Ocean Robotics

- Xenex Disinfectant Systems

- Finsen Technologies (Thor UV-C)

- Skytron (Infection Prevention Technologies)

- Tru-D SmartUVC LLC

- Akara Robotics Ltd.

- Mediland Enterprise Corp.

- Tmirob Technology

- OTSAW Digital Pte. Ltd.

- Bioquell PLC (Ecolab Inc.)

- Bridgeport Magnetics

- Ateago Technology

Recent Developments

-

In April 2024, RobotLAB announced its partnership with LionsBot International, a global robotics innovator, aiming to broaden the accessibility of its cleaning robots to hospitality enterprises.

-

In October 2023, the Texas A&M Veterinary Hospital incorporated a disinfecting robot utilizing ultraviolet C (UVC) technology for enhanced sanitation. This advanced robot technology is now employed for disinfection purposes at the Texas A&M Veterinary Medical Teaching Hospital (VMTH) located in College Station, Texas.

-

In January 2022, UVD Robots became part of Ecolab's global infection prevention offerings to combat hospital-acquired infections. This consolidation helps firms improve their competitive edge

Disinfection Robots Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.45 billion

Revenue forecast in 2030

USD 12.79 billion

Growth Rate

CAGR of 19.2% from 2024 to 2030

Actual Data

2018 - 2023

Forecast Data

2024 - 2030

Report updated

July 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, technology, End Use

Regional scope

North America, Europe, Asia Pacific, Latin America, and MEA

Country scope

U.S., Canada, Mexico; UK, Germany, France, Italy, Spain, Norway, Denmark, Sweden, China, Japan, India, Australia, Thailand, South Korea, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Blue Ocean Robotics; Xenex Disinfectant Systems; Finsen Technologies (Thor UV-C); Skytron (Infection Prevention Technologies); Tru-D SmartUVC LLC; Akara Robotics Ltd.; Mediland Enterprise Corp.; Tmirob Technology; OTSAW Digital Pte. Ltd.; Bioquell PLC (Ecolab Inc.); Bridgeport Magnetics; Ateago Technology

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Disinfection Robots Market Report Segmentation

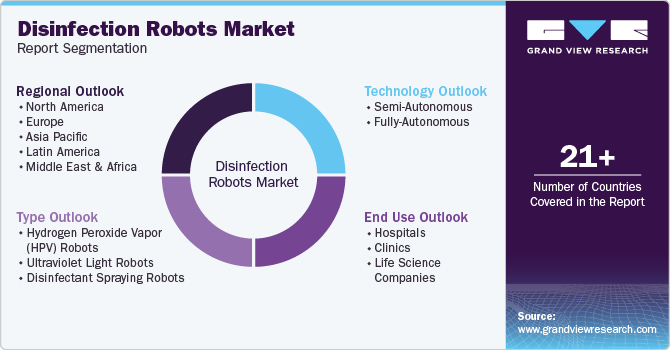

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global disinfection robots market report by type, technology, end use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Hydrogen Peroxide Vapor (HPV) Robots

-

Ultraviolet Light Robots

-

Disinfectant Spraying Robots

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Semi-Autonomous

-

Fully-Autonomous

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

Life Science Companies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global disinfection robots market was valued at USD 3.6 billion in 2023 and is estimated to reach USD 4.45 billion in 2024.

b. The global disinfection robots market is estimated to grow at a compound annual growth rate (CAGR) of 19.2% from 2024 to 2030 to reach USD 12.79 billion in 2030.

b. The hospital segment has dominated the disinfection robots market and held the largest revenue share of 42.4% in 2023. Hospitals often have complex layouts with various rooms and surfaces that require frequent and thorough disinfection.

b. Some of the major players in the disinfection robots market are: o Blue Ocean Robotics o Xenex Disinfectant Systems o Finsen Technologies (Thor UV-C) o Skytron (Infection Prevention Technologies) o Tru-D SmartUVC LLC o Akara Robotics Ltd o Mediland Enterprise Corporation o Tmirob Technology o OTSAW Digital Pte Ltd o Bioquell PLC (Ecolab Inc.) o Bridgeport Magnetics o Ateago Technology

b. The market’s growth is attributed to the increasing awareness and emphasis on hygiene and infection control in healthcare settings and labor and time savings offered by disinfection robots.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.