- Home

- »

- Pharmaceuticals

- »

-

Men’s Health Supplements Market, Industry Report, 2030GVR Report cover

![Men’s Health Supplements Market Size, Share & Trends Report]()

Men’s Health Supplements Market (2025 - 2030) Size, Share & Trends Analysis Report, By Type (Sports Supplements, Reproductive Health Supplements), By Age Group, By Formulation, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-095-8

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Men’s Health Supplements Market Summary

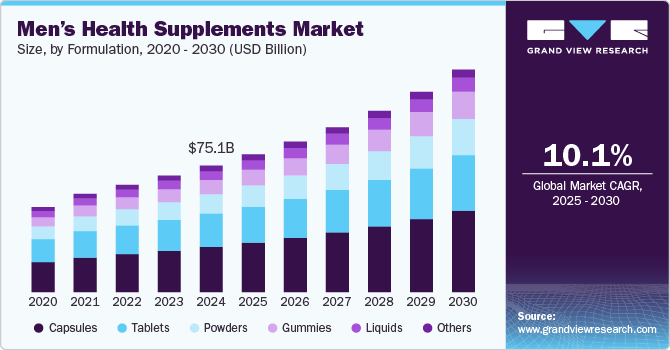

The global men’s health supplements market size was estimated at USD 75.09 billion in 2024 and is projected to reach USD 132.13 billion by 2030, growing at a CAGR of 10.07% from 2025 to 2030. The growth of the men’s health supplements market can be attributed to the increasing attention towards maintaining health, and rising trend of preventive healthcare.

Key Market Trends & Insights

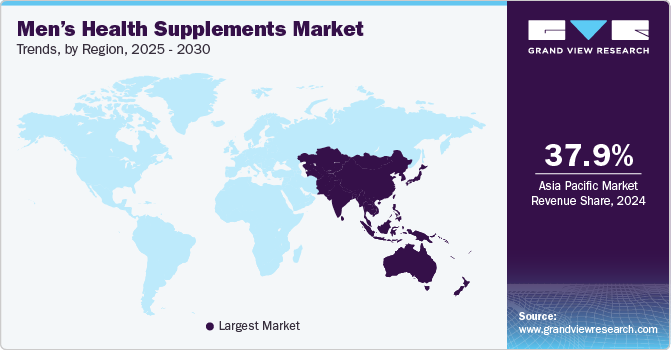

- Asia Pacific dominated the men’s health supplements market with a share of 37.98% in 2024 and the region is projected to register the fastest growth during 2025-2030.

- China’s men’s health supplements market is expanding due to a growing middle-class population and increasing concern over aging and lifestyle-related diseases.

- By type, weight management supplements segment accounted for the largest market share of 36.16% in 2024.

- By age group, the 31-45 segment dominated the age group segment with a market share of 30.53% in 2024.

- By formulation, the capsules segment dominated the market with a revenue share of 35.70% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 75.09 Billion

- 2030 Projected Market Size: USD 132.13 Billion

- CAGR (2025-2030): 10.07%

- Asia Pacific: Largest Market in 2024

Moreover, increasing nutritional deficiencies among men is another factor influencing the demand for heath supplements for men. For instance, according to Fullscript, more than 40% of U.S. adults are vitamin D deficient. The COVID-19 pandemic had a positive impact on men’s health supplements market as people became more conscious about their health and wellbeing. Moreover, it has shifted the paradigm towards preventive healthcare and thus the demand for men’s health supplements has increased. Traditionally the marketers have focused on female consumers, but in past times the men’s health supplements have gained popularity to help men maintain their fitness levels and energy. According to report of Council for Responsible Nutrition, around 73% of men use health supplements to support overall wellbeing and 42% of men’s supplement users are interested in supplements that offer complete health and wellness benefits. Thus, the changing consumption pattern of these products across men is likely to create momentum for the global men’s health supplements industry in coming years.

Moreover, rising inclination towards personalized nutrition for better catering health needs is projected to offer significant growth opportunities for the industry. In addition, presence of several risk factors, comorbidities, genetics, lifestyle factors have also contributed to high demand for personalized supplementation. Thus, the higher demand for customized supplementation is pushing market players to introduce novel products. For instance, in January 2023, Nourished and Neutrogena partnered to develop personalized 3D printed skin dietary supplements for men and women. Similarly, in July 2022 Healthycell launched next generation customized supplement products in partnership with Panaceutics.

Furthermore, convenient accessibility of men’s health supplements owing to growing number of e-pharmacies and high penetration e-commerce platforms is likely to facilitate market expansion. E-commerce platforms have started to gain traction in developing economies such as China, India, and Mexico. In addition, large number of market players are introducing their offerings on e-commerce platforms to strengthen their business avenues. For instance, in March 2022 Cymbiotika launched its e-commerce store in the UK for natural supplements.

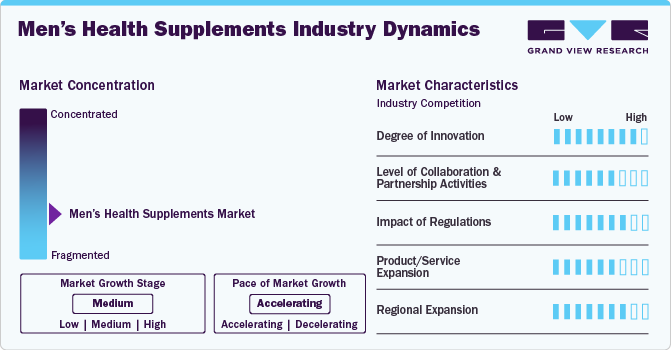

Market Concentration & Characteristics

Innovation in men’s health supplements is driven by advancements in ingredient formulation, bioavailability, and personalized nutrition. Companies are leveraging AI and genetic insights to create tailored supplement regimens, while research into adaptogens, probiotics, and plant-based alternatives is reshaping product offerings. Functional beverages and gummies are gaining traction, reflecting a shift toward convenient and palatable supplement formats.

Strategic collaborations between supplement brands, biotechnology firms, and research institutions are increasing, fostering scientific validation and product credibility. Partnerships with fitness influencers, professional athletes, and healthcare providers are also shaping marketing strategies. Additionally, acquisitions of smaller wellness brands by major players are accelerating market consolidation and innovation.

The regulatory landscape significantly impacts product development and marketing strategies. Strict guidelines from the FDA (U.S.), EFSA (Europe), and other health authorities require brands to substantiate health claims, leading to increased investment in clinical trials. Regulatory scrutiny over ingredients such as testosterone boosters and herbal extracts has also influenced product formulations and labeling practices.

The market is witnessing a surge in product diversification, with companies expanding beyond traditional vitamin and mineral supplements to offer functional foods, meal replacements, and subscription-based personalized nutrition plans. There is also a growing focus on holistic wellness, incorporating mental health and stress management supplements alongside traditional categories such as muscle growth and sexual health.

North America remains the dominant market, driven by high consumer awareness and disposable income. However, Asia Pacific is emerging as a lucrative region due to increasing health consciousness, urbanization, and rising middle-class spending on wellness products. Companies are localizing formulations to cater to regional dietary preferences and regulatory requirements, further fueling global men’s health supplements industry growth.

Type Insights

Weight management supplements accounted for the largest market share of 36.16% in 2024 and is expected to witness significant growth during the forecast period. Factors such as the rising cases of obesity and related health ailments, such as diabetes, cardiovascular diseases (CVDs), and hypertension are projected to drive product demand. For instance, as per the National Institute of Diabetes and Digestive and Kidney Diseases obesity is a serious concern among adults and around 1 in 3 men (34.1%) are overweight. Thus, surging obese population have propelled the demand for low calorie diet and weight management products. In addition, growing trend of fitness, social media penetration and growing inclination towards aesthetics are other factors propelling men’s health supplements industry growth.

Anti-aging supplements is projected to grow at the fastest CAGR of 11.72% from 2025 to 2030. Factors such as rising elderly population, high desire for youthful appearance, and increasing disposable income are projected to drive high growth rate of the segment. Moreover, changing lifestyles, and growing inclination towards aesthetics are further supporting segment expansion. The higher demand for anti-aging products among consumers is pushing manufacturers to introduce new products with enhanced safety and less side effects. In May 2022, Wonderfeel announced the U.S. patent application for the launch of Yongr, a revolutionary formulation to address signs of aging.

Age Group Insights

The 31-45 segment dominated the age group segment with a market share of 30.53% in 2024. The higher revenue share of the segment is attributed to the higher awareness about supplement-based products in this age group, potential buying power, and larger adoption of supplements. In addition, men in age group of 31-45 are the largest consumer pool for companies to target their products as these consumers often demand for various supplementation to support their lifestyle. Moreover, the majority portion of this consumer group is highly influenced by social media, and thus, companies use social media platforms to promote their products in a more appealing manner. For instance, wellness and sports supplements companies are using social media platforms like Instagram, Facebook, and others to maximize their product reach.

The above 60 age group is projected to register the fastest CAGR of 11.16% from 2025 to 2030. Increasing life expectancy, rising awareness about wellbeing, and increasing disposable income are anticipated to support higher growth rate of the segment. Moreover, rising consumer interests towards natural products owing to higher safety profile than synthetic ones is another factor contributing to industry expansion.

Formulation Insights

The capsules segment dominated the market with a revenue share of 35.70% in 2024. High number of products available in capsule form owing to its lower cost, high convenience, high shelf life and greater patient compliance are projected to drive the segment growth. Capsules appear to be more feasible in the case of smaller formulations. Furthermore, they require minimal excipients (such as binders), which increases their appeal to the end user. Manufacturing advancements have provided capsule manufacturers with a wide range of options to offer brand owners, including various shell colors, designs, shapes, and imprints. Moreover, various strategic initiatives undertaken by market players is another factor fueling market growth. For instance, for instance, in February 2023 Capillus launched scientifically proven hair wellness supplement in capsule form for both women and men. Thus, rising product launches is further anticipated to support men’s health supplements industry expansion.

The gummies segment is projected to exhibit the fastest growth at a CAGR of 11.77% from 2025 to 2030. The rising demand from young and middle-aged population, rising preferences over tablets and capsules and surging interest of manufacturers to develop gummies based supplementations are fueling segment uptake. For instance, in January 2023, Modicare expanded its offerings with the launch of its Well Gummies product range to support skin, nail and hair health.

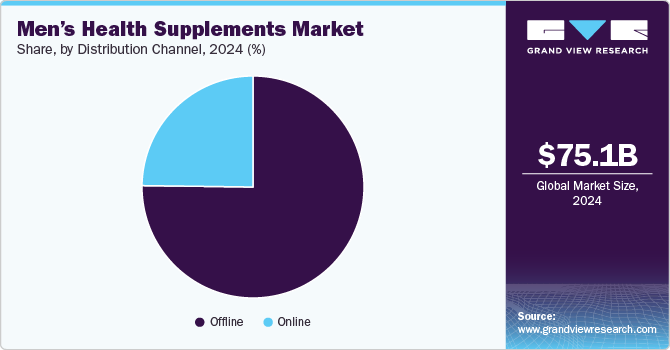

Distribution Channel Insights

The offline segment captured the largest market share in 2024. The presence of established supermarkets/ pharmacies chains such as Walgreen’s, Walmart, Boots, CVS Pharmacy among others significantly contribute to the segment expansion. In addition, offline shopping offers personalized guidance from pharmacists/ doctors, and it also offer wide variety of products to choose for the customers.

On the contrary, the online segment is projected to register fastest CAGR from 2025 to 2030. Increase in the number of self-directed consumers is one of the important factors driving the online pharmacies segment. In addition, various discounts offered by online pharmacies in the form of coupons and cashbacks are another factor fueling segment uptake. Moreover, many key participants in the men’s health supplements and wellness space are launching their businesses on e-commerce platforms to serve a large consumer base and acquire a larger market share.

Regional Insights

The men's health supplements market in North America is driven by rising health consciousness, increasing awareness of preventive healthcare, and the growing popularity of fitness and bodybuilding trends. The region's high disposable income and strong presence of major nutraceutical brands encourage continuous product innovation and marketing strategies targeting men’s specific health needs, such as testosterone support, cardiovascular health, and cognitive function.

U.S. Men’s Health Supplements Market Trends

In the U.S., the market is fueled by the strong demand for personalized nutrition, fueled by advancements in biotechnology and AI-driven supplement plans. The increasing prevalence of lifestyle-related diseases, such as obesity, diabetes, and heart conditions, has led to a surge in demand for dietary supplements tailored to men’s health. In addition, the influence of social media, fitness influencers, and the rise of e-commerce platforms have further boosted product accessibility and sales.

Europe Men’s Health Supplements Market Trends

The European market is experiencing steady growth due to an aging male population seeking supplements for vitality, joint health, and cognitive support. Regulatory backing for scientifically proven supplements has enhanced consumer trust, while the trend toward natural and organic ingredients is pushing manufacturers to focus on clean-label formulations. Increased awareness about mental health and stress management has also driven demand for adaptogenic and nootropic supplements.

The UK market is benefiting from a strong shift toward plant-based and vegan supplements, reflecting changing dietary preferences and sustainability concerns. Government initiatives promoting preventive healthcare, coupled with an aging population seeking longevity-focused supplements, have further accelerated growth. The rise of online health retailers and subscription-based supplement services has also expanded consumer access to tailored men’s health products.

French consumers are increasingly favoring high-quality, science-backed supplements, with a strong preference for natural and organic formulations. The emphasis on holistic wellness, including gut health, immunity, and hormonal balance, has driven innovation in probiotic-based and botanical supplements. In addition, a growing fitness culture and demand for muscle recovery and performance-enhancing supplements contribute to market expansion.

Germany's men’s health supplements market is characterized by a high level of consumer trust in pharmaceutical-grade products and stringent regulatory oversight. The demand for clinically tested, functional supplements-especially those targeting cardiovascular health, stress reduction, and cognitive function-is rising. The strong presence of pharmacy-led supplement sales channels also ensures credibility and sustained consumer interest.

Asia Pacific Men’s Health Supplements Market Trends

Asia Pacific dominated the men’s health supplements market with a share of 37.98% in 2024 and the region is projected to register the fastest growth during 2025-2030. The large patient pool and robust demand for supplement among population is likely to contribute higher revenue share of the region. In addition, rising investments by companies in the region to strengthen their presence and distribution networks is also fueling regional industry. For instance, in June 2023 European Wellness Biomedical Group signed a MoU for exclusive distribution of skincare supplementation products in China.

China’s men’s health supplements market is expanding due to a growing middle-class population and increasing concern over aging and lifestyle-related diseases. The demand for traditional Chinese medicine-based supplements, such as ginseng and deer antler extract, remains strong, while international brands are capitalizing on the premiumization trend. E-commerce and social media-driven sales channels have significantly boosted product visibility and accessibility.

In Japan, the market is driven by a cultural emphasis on longevity and preventive healthcare. The preference for functional foods and supplements that support energy, metabolism, and prostate health is growing, particularly among the aging male demographic. Technological advancements in supplement formulations, such as fermented probiotics and bioavailable vitamins, are further fueling innovation and consumer interest.

MEA Men’s Health Supplements Market Trends

The Middle Eastern market is growing due to increasing health awareness, rising disposable income, and a greater focus on fitness and bodybuilding trends among younger male consumers. Halal-certified supplements and clean-label formulations are in high demand, while government initiatives promoting healthier lifestyles contribute to market expansion. Online retail channels are also playing a key role in driving product accessibility.

Saudi Arabia's market is benefiting from the government's Vision 2030 initiative, which encourages healthier lifestyles and wellness practices. The demand for sports nutrition, energy-boosting supplements, and products targeting testosterone and reproductive health is rising. The increasing penetration of international supplement brands and growing consumer interest in premium, imported products are also fueling men’s health supplements industry growth.

In Kuwait, the men’s health supplements market is expanding due to the increasing prevalence of lifestyle-related diseases such as obesity and diabetes. The demand for weight management and metabolic health supplements is particularly strong. A growing gym culture and higher awareness of dietary supplements through social media and fitness influencers are also driving consumer interest and sales.

Men’s Health Supplements Market Share Insights

The key players in the men’s health supplements are undertaking various strategic initiatives to maintain their market presence. In addition, various strategic initiatives help market players to bolster their business avenues. The expansion of e-commerce and subscription-based models has improved accessibility, fostering competition among key players. However, stringent regulatory requirements and evolving consumer preferences for transparency and sustainability pose challenges. Overall, these developments are pushing companies to invest in research, strategic partnerships, and product diversification, shaping a more dynamic and consumer-driven market.

Key Men’s Health Supplements Companies:

The following are the leading companies in the men’s health supplements market. These companies collectively hold the largest market share and dictate industry trends.

- Nature's Lab

- Nordic Naturals

- NOW Foods

- Irwin Naturals

- GNC

- The Vitamin Shopee

- Amway

- Life Extension

- New Chapter, Inc.

- Metagenics LLC

Recent Developments

-

In June 2023, Token Communities, Ltd launched its two naturopathic supplements in the Asia market. The newly launched supplement is for type-2 diabetes and blood pressure.

-

In January 2023, Nourished and Neutrogena partnered to develop personalized 3D-printed skin dietary supplements for men and women.

-

In February 2023, Capillus launched a scientifically proven hair wellness supplement in capsule form for both women and men. Thus, rising product launches are further anticipated to support segment expansion.

Men’s Health Supplements Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 81.79 billion

Revenue forecast in 2030

USD 132.13 billion

Growth rate

CAGR of 10.07% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Report updated

February 2025

Quantitative units

Revenue in USD million, CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, Age Group, Formulation, Distribution Channel, Region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Nature's Lab; Nordic Naturals; NOW Foods; Irwin Naturals; GNC; The Vitamin Shopee; Amway; Life Extension; New Chapter, Inc.; Metagenics LLC

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Men’s Health Supplements Market Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the global market on the basis of type, age group, formulation, distribution channel, and region.

-

Type Scope Outlook (Revenue, USD Million, 2018 - 2030)

-

Sports Supplements

-

Reproductive Health Supplements

-

Bone & Joint Health Supplements

-

Cardiovascular Health Supplements

-

Probiotic Supplements

-

Anti-Aging Supplements

-

Hair Growth Supplements

-

Weight Management Supplements

-

Immune Health Supplements

-

Others

-

-

Age Group Scope Outlook (Revenue, USD Million, 2018 - 2030)

-

20-30

-

31-45

-

46-60

-

Above 60

-

-

Formulation Outlook (Revenue, USD Million, 2018 - 2030)

-

Tablets

-

Capsules

-

Liquids

-

Powders

-

Gummies

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2018- 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global men’s health supplements market size was estimated at USD 75.09 billion in 2024 and is expected to reach USD 81.79 billion in 2025.

b. The global men’s health supplements market is expected to grow at a compound annual growth rate of 10.07% from 2025 to 2030 to reach USD 132.13 billion by 2030

b. Asia Pacific dominated the men’s health supplements market with a share of 37.98% in 2024 and the region is projected to register the fastest growth during 2025-2030. The large patient pool and robust demand for supplement among population is likely to contribute higher revenue share of the region. In addition, rising investments by companies in the region to strengthen their presence and distribution networks is also fueling regional industry

b. Some key players operating in the men’s health supplements market include Nature's Lab; Nordic Naturals; NOW Foods; Irwin Naturals; GNC; The Vitamin Shopee; Amway; Life Extension; New Chapter, Inc.; Metagenics LLC.

b. The growth of the men’s health supplements market can be attributed to the increasing attention towards maintaining health, and rising trend of preventive healthcare. Moreover, increasing nutritional deficiencies among men is another factor influencing the demand for heath supplements for men

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.