- Home

- »

- Next Generation Technologies

- »

-

Metadata Management Tools Market Size Report, 2030GVR Report cover

![Metadata Management Tools Market Size, Share & Trends Report]()

Metadata Management Tools Market (2025 - 2030) Size, Share & Trends Analysis Report By Metadata Type, By Deployment (On-Premises, Cloud), By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-954-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Metadata Management Tools Market Summary

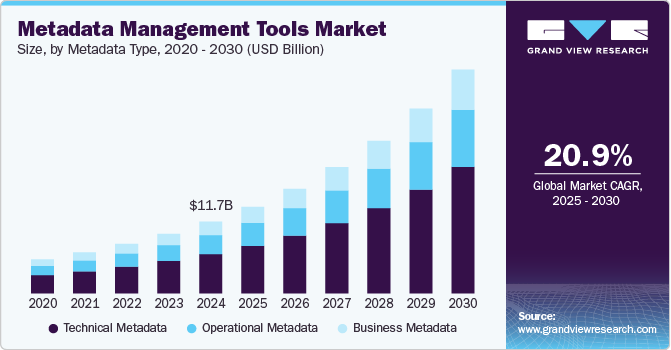

The global metadata management tools market size was estimated at USD 11.69 billion in 2024 and is projected to reach USD 36.44 billion by 2030, growing at a CAGR of 20.9% from 2025 to 2030. The increasing necessity for centralized data administration, the growing value of metadata management in data security, and the growing requirement for greater data quality and trustworthy analytics are the primary factors driving the market growth.

Key Market Trends & Insights

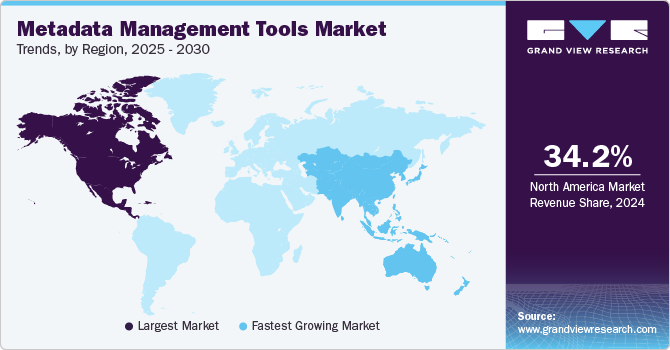

- In terms of region, North America was the largest revenue generating market in 2024.

- The metadata management tools market in the U.S. held a dominant position in 2024.

- Based on metadata types, the technical metadata segment led the market with the largest revenue share of 54.7% in 2024.

- Based on deployment, the cloud segment led the market with the largest revenue share of 61.9% in 2024.

- Based on application, the data governance segment led the market with the largest revenue share of 41.4% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 11.69 Billion

- 2030 Projected Market Size: USD 36.44 Billion

- CAGR (2025-2030): 20.9%

- North America: Largest market in 2024

Furthermore, the implementation of metadata management tools and applications is likely to be driven by sales volume increase for SMEs in a variety of industries across the globe.

Metadata increases the usefulness and discoverability of data, hence increasing its worth. It's easier to discover and use data while using metadata management and giving business and IT teams the required and important data context. In the developed countries from North America and Europe, metadata management tools have seen a rise in implementation as they serve variety of purposes, such as information retrieval and strict non-compliance fines on the violation of any private information that may be internal or external to the company. The increasing adoption of metadata management tools across retail, industrial, IT & telecommunication, and BFSI industry verticals is fostering market expansion. Many firms have spent a lot of time and money developing Data Warehouse projects that use tools to collect, load, and convert data into useful information for end uses all around the company.

Most businesses have already adopted cloud-based metadata management tools for storing their data in the cloud and it is more used in organizations because they are easily available and scalable. Metadata is managed independently of actual files in the cloud-based metadata management.

The metadata management tools industry also faces challenges like the selection of poor technology, costly implementation of tools and maintenance, missing metadata relationships, and applications built by Non-Metadata Professionals. The volume of data is also a big challenge as the tools must be able to manage large amounts of data effectively with the data being increased. Security and privacy is also a huge concern that needs to be handled, tools must be able to ensure that the data is protected and remains confidential.

Metadata Types Insights

Based on metadata types, the technical metadata segment led the market with the largest revenue share of 54.7% in 2024. The segment is also projected to lead in terms of growth rate owing to the significant implementation of data governance and management. Technical metadata refers to physical characteristics that aid in the loading of information from primary articles and technical attributes that are important for the presentation of data. It involves structural information like foreign key attributes, and its primary focus is on organizing the various data sources and their attributes, including data source, location, credentials, mapping, etc. Some of examples of technical metadata include physical database tables, backup rules, access permission, mapping documentation, and many more.

The operational metadata segment is also expected to witness at a prominent CAGR during the forecast period, owing to substantial applications in the retail and logistics industry. Operational metadata handles data generation and management processes, as well as proper data measurement and analysis. Some examples of operational metadata include audit results, error logs, archive and retention rules, job execution logs, etc.

Deployment Insights

Based on deployment, the cloud segment led the market with the largest revenue share of 61.9% in 2024. The developments in cloud computing have transformed and enabled the creation of cloud-based metadata management Applications. In Asia Pacific, the cloud segment is projected to witness at a prominent CAGR over the forecast period. In 2024, the segment acquired the leading market revenue share in North America, ascending the growth of cloud-based applications in the region.

The capability of cloud-based solutions to handle large data sets along with providing an improved experience has promoted several companies to choose cloud-based deployment over On-Premises. Since most enterprises don’t have the networks and infrastructure capable of handling large datasets, there is a huge demand for cloud-based deployment in the global market.

Application Insights

Based on application, the data governance segment led the market with the largest revenue share of 41.4% in 2024. Data governance plays a prominent role in data management strategy. It includes a governing body, a set of standards and policies, and a plan to implement those standards and policies by making sure that data standards and policies are created and implemented consistently across the organization. Data governance is witnessing increased adoption in industries like government, healthcare, and finance.

The product and process management segment is expected to witness at a substantial CAGR during the forecast period. It is implemented by the companies for storing and managing all related information of a product and processes. The information includes information ranging from raw materials to constructing the product including the data required across several business processes from design to marketing. An ideal product and process data management system is accessible by multiple applications and teams across an organization and supports business-specific needs.

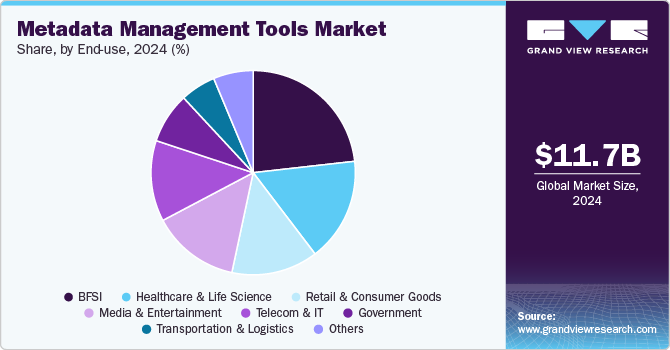

End Use Insights

Based on end use, the BFSI segment led the market with the largest revenue share of 23.2% in 2024. BFSI industries use metadata management tools for improved customer experience in the market. The increasing prominence of cloud-based metadata management tools helps in easy deployment and reduced operational costs for businesses.

The media & entertainment segment is anticipated to witness at a substantial CAGR during the forecast period. Vendors are focusing on data enrichment, automated reporting, analyzing, metadata insights, etc., for improved customer experience and operations. Moreover, the rising number of client dealings outside of the branch through various channels, including mobile, web, chat, and social media, is expected to drive the adoption of corporate metadata management tools.

Regional Insights

North America dominated the metadata management tools market with the largest revenue share of 34.2% in 2024. The leading share is attributable to the prevalence of the majority of the organizations and vendors, with extensive operations and client base, in North America. In addition, being early adopters of technology along with the established economic structures, the region has witnessed extensive implementation of cloud-based security Applications, primarily among large businesses.

U.S. Metadata Management Tools Market Trends

The metadata management tools market in the U.S. held a dominant position in 2024; organizations are prioritizing data governance to ensure compliance with regulations like GDPR and CCPA. This drives demand for robust metadata management tools that facilitate data lineage, data quality, and regulatory reporting. Moreover, the significant integration of AI and ML is augmenting the market expansion in the U.S. Tools that leverage AI and ML for automated metadata tagging, data discovery, and classification are gaining traction. These technologies help organizations efficiently manage and utilize their data assets.

Europe Metadata Management Tools Market Trends

The metadata management tools market in Europe is also growing. As in Europe, the growth of metadata management tools is largely driven by the increasing emphasis on data governance and compliance with stringent regulations such as the General Data Protection Regulation (GDPR). Organizations are prioritizing tools that enhance data lineage, quality, and accessibility to ensure adherence to these regulations. In addition, European organizations are focusing on collaboration features that enable cross-departmental cooperation on data initiatives, thereby enhancing productivity. The demand for robust data catalogs is also increasing, as organizations look to create comprehensive inventories of their data assets for better usability.

Asia Pacific Metadata Management Tools Market Trends

The metadata management tools market in Asia Pacific is anticipated to grow at the fastest CAGR of 22.7% from 2025 to 2030. In the Asia-Pacific region, the growth of metadata management tools is significantly influenced by the rapid digital transformation and data-driven initiatives undertaken by businesses. Organizations are increasingly recognizing the importance of effective metadata management to navigate the complexities of diverse data sources and ensure compliance with evolving local regulations, such as the Personal Data Protection Act (PDPA) in several countries. The data governance Deployments and management are considered as highly effective by most of the organizations.

Key Metadata Management Tools Company Insights

Some of the key companies in the global market include Collibra, IBM, Microsoft, Oracle, SAP; ASG Technologies, Informatica, Adaptive, Cambridge Semantics; Data Advantage Group; and others. Organizations are prioritizing the expansion of their customer base to secure a competitive advantage in the industry. As a result, key players are implementing various strategic initiatives, including mergers and acquisitions, as well as forming partnerships with other major companies.

-

IBM stands out as a comprehensive technology provider with a rich history of innovation and a strong commitment to helping organizations leverage technology for business transformation. Its diverse offerings in cloud computing, AI, and consulting services position it as a key player in the global technology landscape. IBM is actively engaged in research related to metadata management, focusing on enhancing capabilities like metadata discovery, enrichment, governance, and lineage tracking. The company aims to improve how organizations utilize metadata for better decision-making and compliance

-

SAP is a global leader in enterprise software, recognized for its comprehensive suite of solutions that support various business functions, including finance, supply chain, and human resources. In the realm of metadata management, SAP offers several specialized tools designed to help organizations effectively manage their data assets

Key Metadata Management Tools Companies:

The following are the leading companies in the Metadata Management Tools Market. These companies collectively hold the largest market share and dictate industry trends.

- IBM

- Oracle

- SAP

- ASG Technologies

- Adaptive

- Cambridge Semantics

- Data Advantage Group

- Erwin

- Alex Deployments

- Natuvion

- Immuta

- CentricMinds

- Syniti

Recent Developments

-

In June 2024, Immuta, the data security specialists, today unveiled new data governance and audit features for Retrieval Augmented Generation (RAG)-based GenAI solutions across various cloud platforms. This release positions Immuta as the first to offer a multi-layer architecture designed to secure, monitor, and audit sensitive data accessed by RAG-based AI applications

-

In March 2024, SAP has unveiled the SAP Datasphere solution, the latest addition to its data management portfolio, designed to provide customers with easy access to business-ready data across their data landscape. Additionally, SAP announced strategic partnerships with leading data and AI companies—Collibra NV, Confluent Inc., Databricks Inc., and DataRobot Inc.—to enhance SAP Datasphere. These collaborations will enable organizations to develop a unified data architecture that securely integrates data from both SAP software and non-SAP sources

-

In September 2024 HCLBusiness Metadata, the software division of HCLTech, announced the completion of its acquisition of Zeenea, a Paris-based innovator in data catalog and governance solutions. This acquisition allows Actian, a division of HCLBusiness Metadata, to provide a unified data intelligence and governance solution that empowers customers to effortlessly discover, manage, and maximize the value of their data assets. Additionally, it enhances Actian's presence, workforce, and customer base in Europe.

Metadata Management Tools Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 14.11 billion

Revenue forecast in 2030

USD 36.44 billion

Growth rate

CAGR of 20.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segment scope

Metadata type, deployment, application, end use, region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Brazil

Key companies profiled

Collibra; IBM; Microsoft; Oracle; SAP; ASG Technologies;Informatica; Adaptive; Cambridge Semantics; Data Advantage Group; Erwin; Alex Deployments; Natuvion; Immuta; CentricMinds; Syniti

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country; regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Metadata Management Tools Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global metadata management tools market report based on metadata type, deployment, application, end use, and region:

-

Metadata Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Business Metadata

-

Technical Metadata

-

Operational Metadata

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cloud

-

On Premises

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Data Governance

-

Risk and compliance management

-

Incident Management

-

Product and process management

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Retail and consumer good

-

Government

-

Telecom and IT

-

Healthcare and life sciences

-

Media & Entertainment

-

Transportation and logistics

-

Others (Manufacturing, Energy & Utilities, etc.)

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global metadata management tools market size was estimated at USD 11.69 billion in 2023 and is expected to reach USD 14.11 billion in 2024.

b. The global metadata management tools market is expected to grow at a compound annual growth rate of 20.9% from 2025 to 2030 to reach USD 36.44 billion by 2030.

b. North America dominated the metadata management tools market with a share of 34.1 % in 2024. This is attributable to the prevalence of the majority of the organizations and vendors with extensive operations and client bases in North America.

b. Some key players operating in the metadata management tools market include Collibra; IBM; Microsoft, Oracle; SAP; ASG Technologies; Informatica; Adaptive; Cambridge Semantics; Data Advantage Group; Erwin; Alex Deployments; Natuvion; Immuta; CentricMinds; Syniti.

b. Key factors that are driving the metadata management tools market growth include the rising importance of centralized data management and metadata growth opportunities in the electric vehicle industry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.