- Home

- »

- Advanced Interior Materials

- »

-

Metal Abrasives Market Size & Share, Industry Report, 2030GVR Report cover

![Metal Abrasives Market Size, Share & Trends Report]()

Metal Abrasives Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (Steel, Others), By Application (Automotive, Metalworking, Construction, Machinery & Equipment), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-968-7

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Metal Abrasives Market Size & Trends

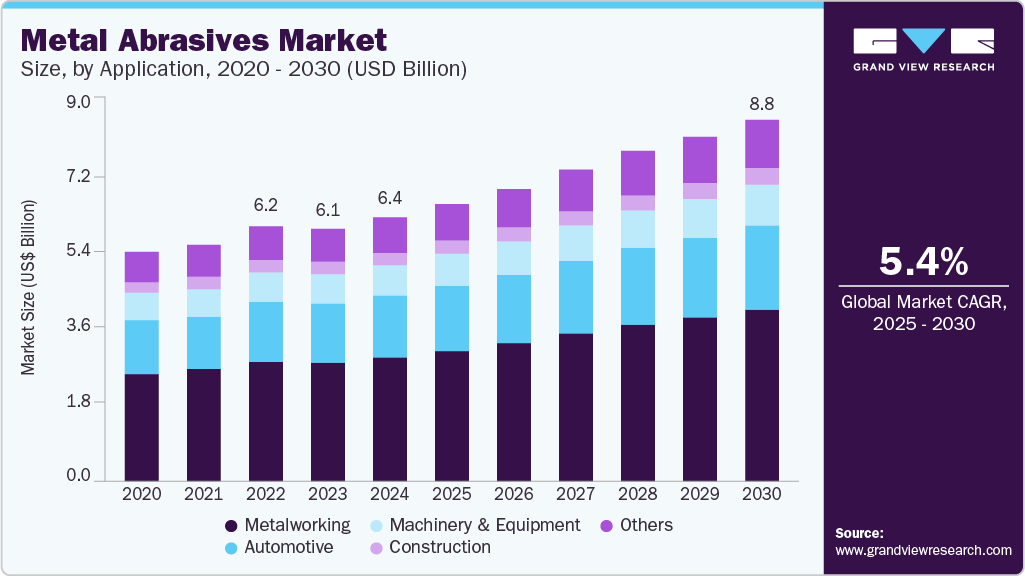

The global metal abrasives market size was estimated at USD 6.39 billion in 2024 and is projected to grow at a CAGR of 5.4% from 2025 to 2030. The market is driven by moderate-to-high demand from the automotive industry.

Key Highlights:

- Asia Pacific metal abrasives industry held the largest global revenue share of over 55% in 2024.

- The U.S. metal abrasives industry is expected to maintain a steady growth trajectory through the decade's end.

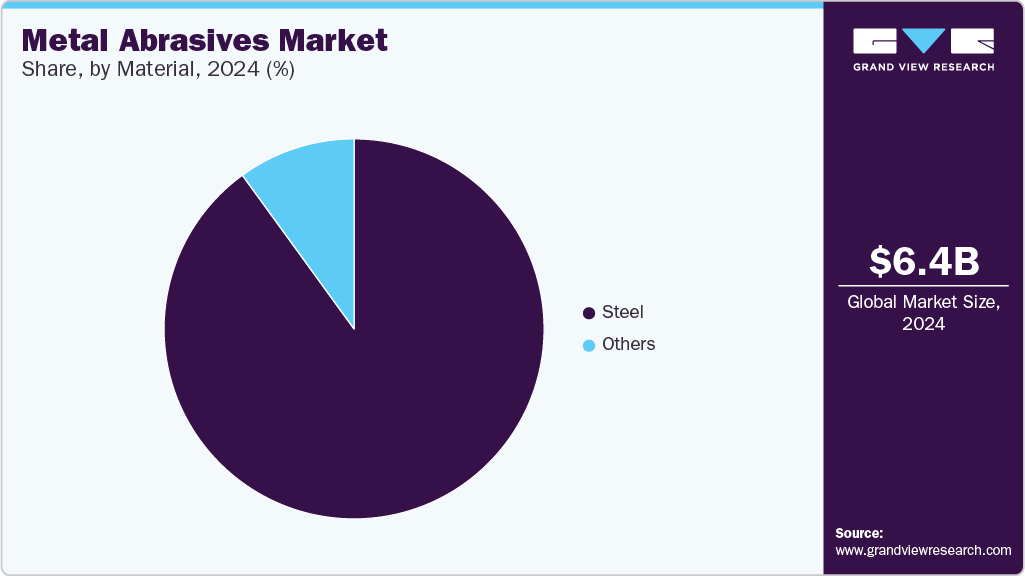

- Based on material, the steel segment dominated the market in 2024 with a revenue share of 90%.

- Based on application, metalworking held the largest revenue share of 47.0% in 2024.

Metal abrasives are used in applications such as cleaning, descaling, shot peening, and desanding of different parts produced in various production industries such as casting, forging, aluminum die casting, auto components, and investment casting, among others. Increasing investments in the automotive sector are projected to augment demand for metal abrasives throughout the forecast period.

In October 2023, Tyrolit Group, a leading abrasives manufacturer, acquired Acme Holding Company, a Michigan-based manufacturer. This acquisition strengthens Tyrolit's portfolio by integrating grinding and specialty abrasives solutions, expanding its presence in key industries such as foundry, steel, and rail.

Considering the rising spending in the automotive sector, the U.S. is one of the major consumers of metal abrasives. For instance, Hyundai Motor Group established its USD 7.6 billion electric vehicle (EV) manufacturing facility in Bryan County, Georgia. This facility, known as Hyundai Motor Group Metaplant America (HMGMA), commenced production in October 2024, less than two years after groundbreaking. The plant aims to produce up to 300,000 EVs annually, including models like the Hyundai Ioniq 5 and the Ioniq 9, with plans to expand capacity to 500,000 units in the coming years.

In addition, continuing investments in machinery & equipment manufacturing plants are likely to boost demand for metal abrasives during the forecast period. For instance, in June 2022, KUBOTA Corporation, an equipment manufacturer based in Japan, invested USD 140 million in setting up a new facility to produce front-end loaders in Northeast Georgia, U.S.

Furthermore, operations were commenced at Reliance Industries' Polypropylene Plant-3 in Jamnagar, India, in 2025. This facility, with a production capacity of 5.2 million tonnes per annum (mtpa), is among Asia's most significant polypropylene projects. The plant's establishment is part of a broader trend in India, where 281 petrochemical projects are expected to start operations by 2025, contributing to a substantial increase in regional production capacity.

Drivers, Opportunities & Restraints

The global metal abrasives industry is experiencing robust growth, primarily driven by expanding industrial sectors such as automotive, construction, metal fabrication, and petrochemicals. A key contributor is the accelerating shift toward electric vehicles (EVs), where metal abrasives play a critical role in the manufacturing and finishing of precision components such as battery housings, drivetrains, and body panels. Leading automakers like Hyundai and Tesla are investing billions into EV production facilities, significantly increasing the demand for high-performance metal abrasives in cutting, grinding, and surface finishing processes.

Similarly, the ongoing boom in construction and infrastructure, particularly in rapidly urbanizing regions such as Asia-Pacific and the Middle East, is fueling the need for abrasives in activities like concrete surface preparation, metal structure fabrication, and welding. As infrastructure spending rises, so does the requirement for metal abrasives to prepare and maintain tools and equipment. The metal fabrication and machinery industry remains a vital end user of metal abrasives, driven by global demand for industrial equipment, heavy machinery, and precision tools.

The global metal abrasives industry is witnessing significant growth opportunities as industries increasingly focus on enhancing efficiency, precision, and sustainability in their manufacturing operations. A key area of potential is in the expanding use of automated and robotic metalworking systems, particularly within the automotive, aerospace, and heavy equipment sectors. These advanced systems rely on high-performance abrasives for grinding, polishing, and surface finishing processes critical for improving product quality and reducing production time.

One major challenge facing the global metal abrasives industry is fluctuating raw material prices, especially for key materials such as aluminum oxide, silicon carbide, and synthetic diamonds. Changes in the cost of these materials, caused by factors such as supply and demand imbalances, political tensions, and natural disasters, can increase production costs and cause price instability, which affects manufacturers' profitability.

Material Insights

Based on material, the steel segment dominated the market in 2024 with a revenue share of 90%, which is expected to continue during the forecast period. Steel abrasives are preferred for their hardness, cleanliness, grain size, and toughness. Due to these properties, they are widely used in various industries, including automotive, construction, and petrochemical industries.

Steel mainly includes steel shots and grits, which are used in metalworking industries such as forging, casting, die casting, investment casting, fabrication, and others. Investments in these industries are expected to benefit from the demand for steel shots and grits in air-blasting applications. For instance, in February 2025, according to Huatong Abrasives, steel shot and steel grit exports saw a 12% year-on-year increase in January and February 2025, reaching a total volume of 85,000 metric tons. This growth is attributed to heightened demand from North America, Europe, and Southeast Asia, driven by increased activity in the shipbuilding, automotive, and construction sectors.

Iron abrasives are also extensively used by several end use industries. The wide demand for abrasives makes its manufacturers engage in acquisitions to further their business. For instance, in September 2023, Saint-Gobain, a global leader in building and high-performance materials, partnered with Dedeco Abrasive Products to market Dedeco's Sunburst abrasive line.

Application Insights

Based on application, metalworking held the largest revenue share of 47.0% in 2024, and the trend is expected to continue during the forecast period. Investment in fabrication plants will likely fuel market growth throughout the forecast period. For instance, in October 2021, Ramakrishna Forgings, a supplier of forged, rolled, and machined products, began producing fabrications in its facility in Jamshedpur, India. The plant mainly manufactures fabrications for excavator parts.

Rising EV production by automotive manufacturers is projected to boost the demand for metal abrasives such as steel shots and grits for the different types of components produced from casting, forging, fabrication, etc. For instance, in March 2024, Stellantis, a global automotive manufacturer, entered into a joint venture with Contemporary Amperex Technology Co. Ltd. to invest ~USD 4.61 billion (€4.1 billion) in building a large-scale lithium iron phosphate (LFP) battery plant in Zaragoza, Spain. This initiative is part of Stellantis' strategy to enhance its EV production capabilities, necessitating advanced metal abrasives for the precision manufacturing of battery components and other EV parts.

In addition, the construction sector is one of the primary end users of metal abrasives, and various investments in construction activities are likely to positively influence demand for the commodity during the forecast period positively. In 2024, Mexico's government, under President Claudia Sheinbaum, announced significant infrastructure investments to modernize the country's transportation and energy sectors. These initiatives are expected to stimulate demand for metal abrasives, particularly in automotive manufacturing, construction, and energy infrastructure sectors.

Regional Insights

North America metal abrasives industry is projected to register a revenue growth rate of 5.1% from 2025 to 2030. The growth rate is expected to be driven by the rising shortage of funds for setting up machinery and equipment manufacturing hubs in the country. In November 2023, Siemens invested USD 140 million in two electrical products manufacturing plants in Grand Prairie, Texas, and Pomona, California. These facilities aim to meet the growing demand for electrification in critical infrastructure sectors.

U.S. Metal Abrasives Market Trends

The U.S. metal abrasives industry is expected to maintain a steady growth trajectory through the decade's end. The market has gained momentum due to strong demand from core industries such as metalworking, automotive, machinery, and construction. With rising investments in electric vehicle production, infrastructure development, and precision manufacturing, the use of metal abrasives for grinding, cutting, and surface finishing is projected to increase steadily.

The metalworking segment remains the most significant and fastest-growing segment, driven by advancements in industrial automation, fabrication, and machine technologies. The automotive sector is supported by growing electric vehicle (EV) production and demand for lightweight metal components.

Asia Pacific Metal Abrasives Market Trends

Asia Pacific metal abrasives industry held the largest global revenue share of over 55% in 2024. The high volume of die-cast components supported by vehicle production will likely boost demand for metal abrasives within the region in the coming years. For instance, in 2025, Maruti Suzuki India Limited commenced commercial production at its new manufacturing facility in Kharkhoda, Haryana. This plant has a capacity of 250,000 units and is currently focused on producing the SUV. The plant plans to increase the total production capacity at the site to 750,000 vehicles per year by 2029.

Europe Metal Abrasives Market Trends

The European metal abrasives industry witnessed steady growth in 2024, with Germany holding the largest market share in the region. Germany's dominance is primarily attributed to its strong industrial base, particularly in the automotive, machinery, and manufacturing sectors, significantly contributing to the demand for metal abrasives.

Among various applications, metalworking holds the largest share of the market in 2024. The metalworking sector's robust demand for abrasives is driven by the ongoing need for precision machining, grinding, and polishing in automotive, aerospace, and industrial equipment manufacturing industries.

Key Metal Abrasives Company Insights

Some of the key players operating in the market include Abrasives Inc., Vulkan INOX GmbH, and Ervin Industries.

-

Abrasives Inc., founded in 1990 in North Dakota, is a leading supplier in the metal abrasives industry, known for its flagship product Black Magic, a coal slag abrasive used widely in industrial blasting. The company also offers a range of metallic and non-metallic abrasives, including steel grit, steel shot, aluminum oxide, garnet, and crushed glass.

-

VULKAN INOX GmbH, established in 1985 and headquartered in Hattingen, Germany, specializes in stainless steel abrasives tailored for treating metallic and mineral surfaces. Its key products, CHRONITAL and GRITTAL, serve critical roles in deburring, descaling, and cleaning in sectors like automotive, aerospace, and foundry.

Key Metal Abrasives Companies:

The following are the leading companies in the metal abrasives market. These companies collectively hold the largest market share and dictate industry trends.

- Abrasives Inc.

- Vulkan INOX GmbH

- Abrasive Shot

- 3M India Ltd.

- Macro Group International

- Metaltec Steel Abrasive

- W Abrasives

- Grind well, Norton Ltd

- Silcal Metallurgic Ltd.

- Ervin Industries

- Siambrator Co., Ltd.

- Air blast-Abrasives B.V.

Recent Developments

-

In January 2024, Vulkan INOX expanded its presence in North America by opening a new branch in Santiago de Querétaro, Mexico. This strategic move aims to strengthen customer relationships and provide exceptional service in the growing automotive and machinery industries.

-

In September 2024, Carborundum Universal Limited (CUMI), a Murugappa Group company, made significant strides in expanding its global footprint within the abrasives sector. In September 2024, CUMI acquired a 100% stake in Silicon Carbide Products, Inc. (SCP), a U.S.-based manufacturer specializing in Nitride Bonded Silicon Carbide (NBSiC) products. The acquisition, valued at approximately USD 6.66 million (INR 56 crore), was finalized through a Type-F reorganization under the U.S. Internal Revenue Code.

Metal Abrasives Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.72 billion

Revenue forecast in 2030

USD 8.76 billion

Growth rate

CAGR of 5.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative Units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue Forecast, Competitive Landscape, Growth Factors, Trends

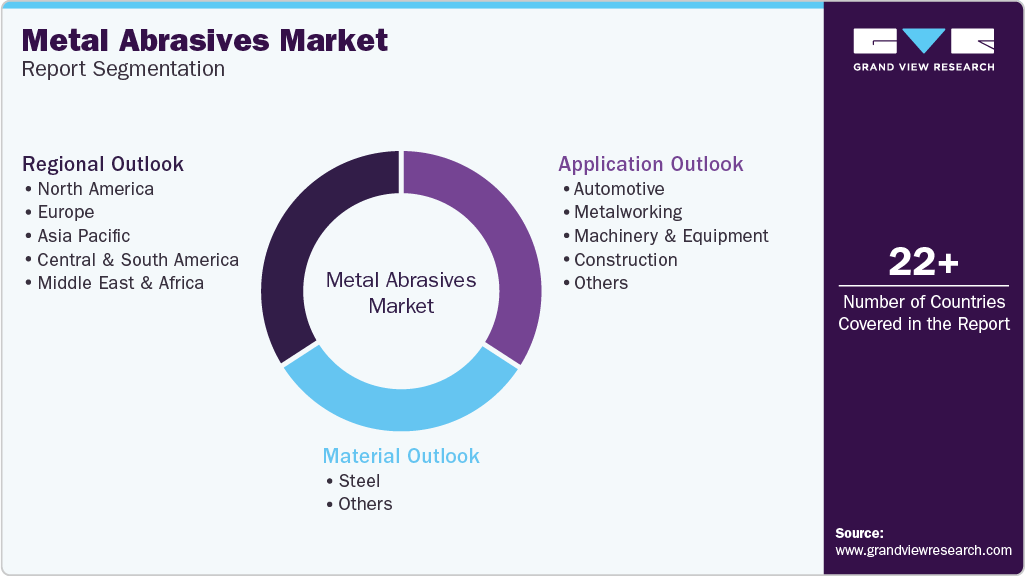

Segments covered

Material, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S; Canada; Mexico; Germany; UK; Russia; France; Italy; India; China; Japan; Australia; Brazil; South Africa

Key companies profiled

Abrasives Inc.; Vulkan INOX GmbH; 3M India Ltd.; Grind well Norton Ltd; Ervin Industries; Siambrator Co., Ltd.; Air blast-Abrasives B.V.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Metal Abrasives Market Report Segmentation

This report forecasts revenue growth at the global, country, and regional levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global metal abrasives market report based on material, application, and region.

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Steel

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Metalworking

-

Machinery & Equipment

-

Construction

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Russia

-

France

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global metal abrasives market size was estimated at USD 6.39 billion in 2024 and is expected to reach USD 6.72 billion in 2025.

b. The global metal abrasives market is expected to grow at a compound annual growth rate of 5.4% from 2025 to 2030 to reach USD 8.76 billion by 2030.

b. Based on application, metalworking accounted for the largest revenue share of more than 47.0% in 2024 of the overall market. The rising flow of investments towards setting up of metalworking facilities is expected to boost the market growth over the forecast period.

b. Some of the key vendors in the global metal abrasives market are Abrasives Inc.; Vulkan INOX GmbH; 3M India Ltd.; Grind well Norton Ltd; Ervin Industries; Siambrator Co., Ltd.; Air blast-Abrasives B.V.

b. The global abrasives market is experiencing robust growth, largely driven by expanding industrial sectors such as automotive, construction, metal fabrication, and petrochemicals. A key contributor is the accelerating shift toward electric vehicles (EVs), where metal abrasives play a critical role in the manufacturing and finishing of precision components such as battery housings, drivetrains, and body panels.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.