- Home

- »

- Advanced Interior Materials

- »

-

Metal Recycling Market Size, Share & Growth Report, 2030GVR Report cover

![Metal Recycling Market Size, Share & Trends Report]()

Metal Recycling Market (2024 - 2030) Size, Share & Trends Analysis Report By Metal (Steel, Copper, Aluminum), By Sector (Construction, Automotive, Consumer Goods, Industrial Goods), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-810-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Metal Recycling Market Summary

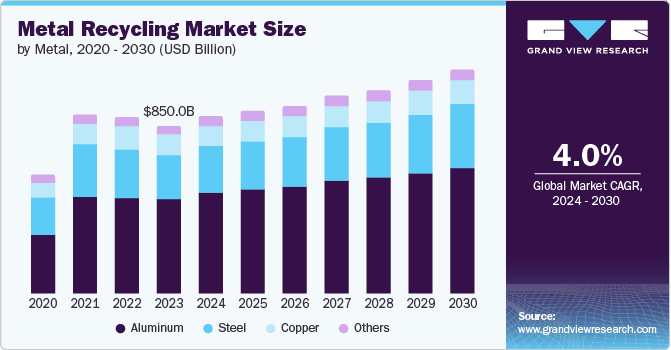

The global metal recycling market size was estimated at USD 850.04 billion in 2023 and is projected to reach USD 1,135.28 billion by 2030, growing at a CAGR of 4.0% from 2024 to 2030. Increasing demand for metals coupled with a rising focus on the conservation of natural resources and reduction in greenhouse gas emissions is augmenting scrap generation activities worldwide.

Key Market Trends & Insights

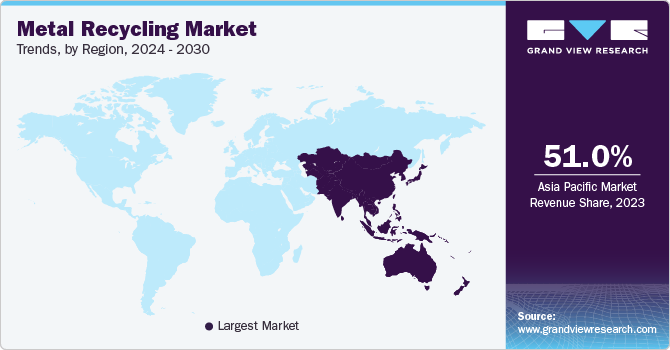

- The metal recycling market in the Asia Pacific region dominated the market and accounted for the largest revenue share, over 51.0%, in 2023.

- The North America metal recycling market held a significant revenue share in the global market, owing to the presence of scrap suppliers in the U.S.

- Based on metal, the aluminum segment dominated the market and accounted for the largest revenue share of over 56.0% in 2023.

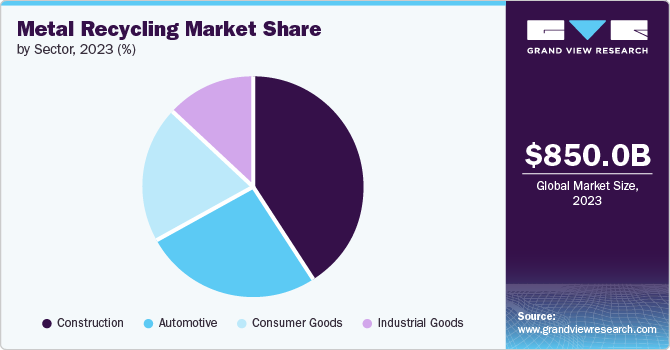

- Based on sector, the construction sector led the market and accounted for more than 40.0% of revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 850.04 Billion

- 2030 Projected Market Size: USD 1,135.28 Billion

- CAGR (2024-2030): 4.0%

- Asia Pacific: Largest market in 2023

Metal recycling allows manufacturers to procure raw materials to produce finished goods without degrading their properties. Furthermore, it is cheaper than the primary production of metal. In addition, environmental importance also plays a significant role in driving industry growth.

China emerged as the largest player in the global industry in 2023. As reported by World Steel, China leads global steel production, having manufactured 1,019.1 million tons in 2023, representing roughly 55% of worldwide crude steel output. Global Energy Monitor data indicates China's annual crude steel production via electric arc furnaces (EAFs), utilizing steel scrap as a primary resource, and stands at 151 million tons as of January 2024.

China has set a strategic goal to increase its EAF production to at least 15% by 2025. The number of scrap processing plants and local collection centers in China is estimated to increase significantly over the coming years. The ban on the operation of small induction furnaces in China placed a significant requirement on EAFs.

Metal Scrap Price Trends

Metal scrap prices have shown an upward trend over the past few years. In 2021, aluminum scrap prices surged owing to growth in demand for aluminum-based products in applications like packaging during the post-pandemic era. From 2022 onwards, the dynamics of ferrous scrap prices changed due to the impact of the Russia-Ukraine war on raw material availability and the supply chain. This caused prices of steel products and scrap to soar. Additionally, an increase in construction activities and lightweight vehicle production boosted the demand and production of steel, leading to a high demand and price surge for steel scrap.

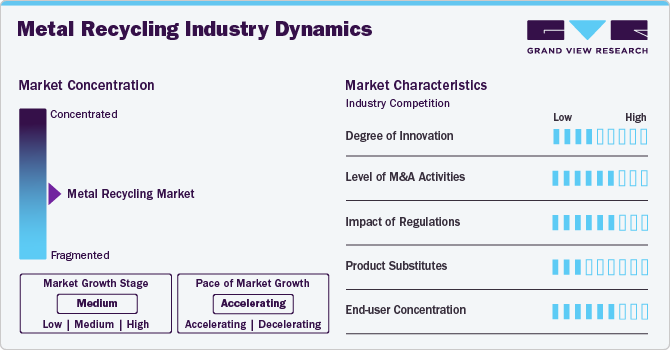

Industry Dynamics

The metal recycling market is at a medium stage of growth, with an accelerated pace. The market is relatively fragmented, characterized by the presence of a mix of medium and small-scale recycling across various regions. There is a high level of competition within the industry as these entities cater to local demand.

The market scenario exhibits a moderate level of innovation, primarily directed toward refining manufacturing processes to yield superior-quality recycled metals. In pursuit of this objective, corporations have substantially escalated their investment in R&D activities. This strategic allocation of resources aims to integrate advanced technological solutions to augment the efficiency of the metal recycling process.

The market observed moderately high levels of merger and acquisition (M&A) activity as key industry players tried to consolidate their market share. Investors are targeting small-scale firms leveraging advanced technology, streamlining operations, and controlling significant regional market presence.

The market is also subject to moderately high levels of regulatory scrutiny. Regulatory norm provides benefits and safety to the production and worker safety in the facility. In recent times, metal waste is no longer deemed as mere refuse, given its potential for recycling through appropriate disposal methods, contributing to sustainable practices.

Metal Insights

The aluminum segment dominated the market and accounted for the largest revenue share of over 56.0% in 2023. A surge in demand for recycled aluminum across construction, automotive, and packaging industries has substantially boosted the aluminum scrap market.

Aluminum profiles are the most commonly available source of scrap presently and are obtained from building & construction and demolition projects. Several demolition projects are planned in the U.S. In September 2023, in Pennsylvania, properties of Grille, Sandbar, Manor Motel, and the back side of Bel Aire Hotel are planned for demolition by the end of March 2024.

The production of steel scrap has been constantly increasing because of increasing industrialization. Increasing urbanization and space constraints have resulted in higher demolition activities across cities in the world. Combined with the need for sustainability in new construction, older buildings with reduced energy savings are queued to be demolished to be replaced with newer green buildings.

Sector Insights

The construction sector led the market and accounted for more than 40.0% of revenue share in 2023. There is a considerable demand for steel and aluminum from the global construction industry. Rising urbanization owing to increasing disposable income levels in emerging economies is likely to contribute to the growth of the construction industry, thereby driving demand for construction metal products. This, in turn, is expected to drive the market growth.

The construction sector is expected to experience a lower growth rate relative to other industries. This is attributed to the durability of metal materials and the extended service life of infrastructures before their eligibility for recycling.

The automotive industry also uses a considerable amount of metal. For instance, engine components and various other auto components, such as hoods, mufflers, basic vehicle frames for doors, and fuel tanks, are made of steel. According to the World Steel Association, about 70% of an automobile’s weight consists of iron and steel. This represents a lucrative opportunity for industry growth.

Regional Insights

The North America metal recycling market held a significant revenue share in the global market, owing to the presence of scrap suppliers in the U.S. The market is competitive, and there is a high concentration of medium-to small-scale foundries and secondary smelters in the region. Market players benefit from metal recycling exports to other countries.

U.S. Metal Recycling Market Trends

The U.S. metal recycling market is one of the largest in North America. According to the latest statistics released by World Integrated Trade Solution, World Bank, it is one of the largest scrap suppliers globally. Hence, it is one of the largest net exporters of metal recycling in the world.

Asia Pacific Metal Recycling Market Trends

The metal recycling market in the Asia Pacific region dominated the market and accounted for the largest revenue share, over 51.0%, in 2023. This region's dominance in the sector is attributed to its robust metal production capabilities and established recycling industry, complemented by government regulations and policies that encourage recycling and sustainable practices.

China metal recycling market held a maximum revenue share in 2023 and is expected to continue its growth from 2024 to 2030. China is the largest producer and consumer of metals in the world. It relies on the secondary metals market to meet the existing demand-supply gap for metals in its industries.

Europe Metal Recycling Market Trends

The metal recycling market in Europe accounted for the third-largest revenue share of the global market in 2023 and is projected to witness continuous growth from 2024 to 2030. Metal production in Europe is considerably smaller than in the Asia Pacific. However, recycled scrap usage for secondary metal production in Europe is relatively higher. Rising emphasis on a circular economy in Europe, coupled with stricter government regulations on energy usage, plays a major role in promoting market growth in Europe.

Central & South America Metal Recycling Market Trends

The Central & South America metal recycling market held a significant market share in 2023. Growth of the market is positively influenced by its increasing demand across various sectors such as automotive and construction in the region. In addition, governments of countries have been directing their focus toward the adoption of EVs to achieve carbon emission goals which is anticipated boost demand for metal recycling. For instance, in April 2022, government of Chile announced its target of achieving 100% electricity-driven new vehicles in Chile by 2035.

Middle East & Africa Metal Recycling Market Trends

The metal recycling market in the Middle East & Africa is expected to grow at a notable CAGR from 2024 to 2030. Countries in the region are developing at a fast pace owing to ongoing industrialization and urbanization. Moreover, the Government of UAE plans to increase the contribution of manufacturing industry to its economy by diversifying its investments in other industries. Implementation of large-scale projects is expected to increase requirement for metals in various construction projects in the region. This is subsequently expected to impact growth of the market in MEA.

Key Metal Recycling Company Insights

Some key players operating in the market include Norsk Hydro ASA, Novelis, and Tata Steel.

-

Norsk Hydro ASA is primarily engaged in the aluminum industry with fully integrated operations from mining to primary aluminum production. This is present at 140 locations across 40 countries. It operates in energy, metal recycling, renewables & batteries, and aluminum markets. In 2023, it recycled 443,760 tons of post-consumer scrap.

-

Novelis is the world's largest aluminum recycler. With a well-established network of advanced recycling and rolling facilities across North America, South America, Europe, and Asia, Novelis has a strong global presence. Its four major business segments are aerospace, automotive, beverage packaging, and specialty purpose aluminum products. It further purchases aluminum beverage cans for recycling and offers competitive prices for purchased scrap.

- Tata Steel is the tenth-largest steel producer in the world with an annual crude steel production capacity of 34 million tons per annum. It supplies steel to end-use industries such as construction, general engineering, and automotive. The company has started manufacturing crude metal from recycled scrap. It has introduced FerroHaat, a digital platform for procuring steel scrap from scrapyards. This platform has penetrated deeply into the value chain, brought transparency, and facilitated efficient business transactions.

Key Metal Recycling Companies:

The following are the leading companies in the metal recycling market. These companies collectively hold the largest market share and dictate industry trends.

- European Metal Recycling

- CMC

- GFG Alliance

- Norsk Hydro ASA

- Kimmel Scrap Iron & Metal Co., Inc.

- Schnitzer Steel Industries, Inc.

- Novelis

- Tata Steel

- Sims Metal

- Utah Metal Works

Recent Developments

-

In February 2024, Germany-based Hydro announced its plans to invest EUR 180 million to construct a new aluminum recycling plant in Torija, Spain. The new facility is expected to have a capacity of 120,000 tons, with the ability to recycle about 70,000 tons of old scrap in a year. It is anticipated to supply secondary aluminum billet to the automotive, transportation, building & construction, renewable energy installations, and consumer durable markets in Europe.

-

In January 2024, Bonlon Industries Limited, an India-based copper wire manufacturer, announced its plans to establish a secondary aluminum plant that produces aluminum rods and ingots, in Taloja, Maharashtra. The plant is anticipated to have a capacity of 75,000 tons per annum and is expected to be commissioned in FY 2024-2025.

-

In December 2023, Novelis collaborated with U.S.-based Ball Corporation to decarbonize aluminum recycling in all their locations and achieve a closed-loop economy. This aims at improving recycling rates and streamlining aluminum scrap for recycling, hence furthering both their sustainability and social governance goals.

-

In March 2023, Sims Limited, an Australian-origin company, acquired Northeast Metal Traders (NEMT) in Pennsylvania, U.S., to expand its regional operating and commercial assets. NEMT is among the largest copper recyclers in the U.S., with extensive supply connections across eastern states.

Metal Recycling Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 898.99 billion

Revenue forecast in 2030

USD 1,135.28 billion

Growth rate

CAGR of 4.0% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion, volume in million tons, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Metal, sector, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Russia; Turkey; China; India; Japan; Brazil

Key companies profiled

CMC; European Metal Recycling; Novelis; Norsk Hydro ASA; Tata Steel; GFG Alliance; Kimmel Scrap Iron & Metal Co., Inc; Schnitzer Steel Industries, Inc., Sims Metal, Utah Metal Works

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Metal Recycling Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global metal recycling market report based on metal, sector, and region:

-

Metal Outlook (Volume, Million Tons; Revenue, USD Billion, 2018 - 2030)

-

Aluminum

-

Copper

-

Steel

-

Others

-

-

Sector Outlook (Volume, Million Tons; Revenue, USD Billion, 2018 - 2030)

-

Construction

-

Automotive

-

Consumer Goods

-

Industrial Goods

-

-

Regional Outlook (Volume, Million Tons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Russia

-

Turkey

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global metal recycling market size was estimated at USD 850.04 billion in 2023 and is expected to reach USD 898.99 billion in 2024.

b. The global metal recycling market is expected to grow at a compound annual growth rate of 4.0% from 2024 to 2030 to reach USD 1,135.28 billion by 2030.

b. Aluminum dominated the metal recycling market and accounted for a revenue share of over 56.0% in 2023, owing to a surge in demand for recycled aluminum across construction, automotive, and packaging industries.

b. Some of the key players operating in the metal recycling market include CMC, European Metal Recycling, Novelis, Norsk Hydro ASA, and Tata Steel.

b. The key factors driving the metal recycling market include rising environmental awareness and increasing demand for metal from end-use industries such as automotive and construction.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.