- Home

- »

- Advanced Interior Materials

- »

-

Metal Stamping Market Size, Share & Growth Report, 2030GVR Report cover

![Metal Stamping Market Size, Share & Trends Report]()

Metal Stamping Market Size, Share & Trends Analysis Report By Process (Blanking, Embossing), By Application (Automotive, Industrial Machinery), By Press Type, By Thickness, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-615-8

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Metal Stamping Market Size & Trends

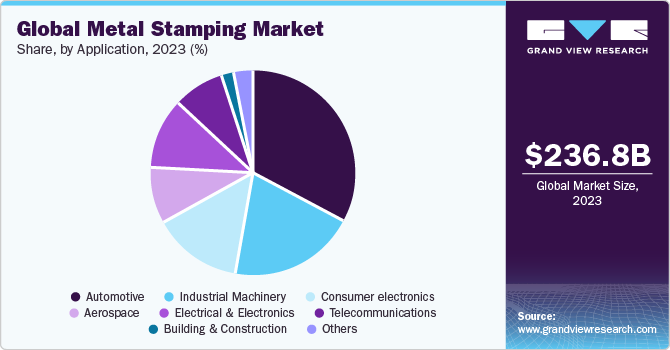

The global metal stamping market size was estimated at USD 236.83 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 4.2% from 2024 to 2030. Growing consumer electronics industry is likely to remain a key driving factor based on application of metal frames in mobile phones, headphones, speakers, and gamepads & controllers. In mobile phones, metal stamping is used in manufacturing antennas, chassis, and camera lens holders as it offers high tolerance, corrosion resistance, electrical conductivity, and a smooth finish. According to GSM Association, the global number of unique mobile subscribers was 5.31 billion in January 2021 and this number is growing at a rate of 1.8% per annum. This is likely to propel the demand for mobile phones and eventually metal stamping in coming years.

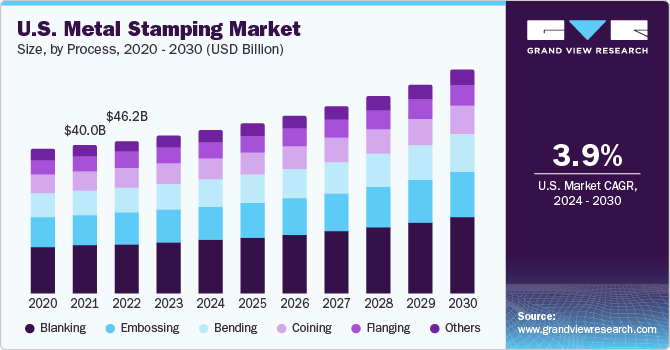

The U.S. is one of the prominent player in the industry. However, emergence of COVID-19 and subsequent temporary lockdown measures countrywide impacted operations of the industry. Downstream demand from key sectors including automotive, aerospace, industrial machinery, and others was largely disrupted owing to challenges in supply chain and dried-up demand from end-use customers. The situation has normalized as rate of vaccination has picked up pace. Growing demand for metal stamping in the U.S. has compelled manufacturers to expand their facilities.

For instance, in December 2020, General Motors Co. announced its plans about investing USD 6 million in its metal stamping facility in Parma, Ohio, U.S. The investment will be used to construct four new metal assembly cells to support increasing production of Chevrolet Silverado and GMC Sierra pickup trucks.

According to International Energy Agency (IEA), global EV sales surpassed 3.4 million, out of which, China accounted for over 50% in 2021. Government initiatives, such as electric car subsidies to local manufacturers to support growth of EVs are major factors responsible for increased production. This is likely to boost the usage of sheet metal during production of auto components.

These components include chassis, interior and exterior structural, and transmission components. This, in turn, is expected to drive market growth during the forecast period. Market growth can be hindered as automobile manufacturers are replacing metals with plastic and carbon fiber as they assist in weight reduction of vehicles. A 10% reduction in weight of the vehicle results in a 5% to 7% increase in fuel efficiency.

Increasing production of lightweight vehicles owing to stringent government regulations in various countries is anticipated to drive demand for substitute products. For instance, in the U.S., developments in the Corporate Average Fuel Economy (CAFE) regulations to enhance fuel efficiency are encouraging use of these substitute products in automobiles, which, in turn, is likely to hamper the market for metal stamping.

Market Concentration & Characteristics

The global metal stamping market is fragmented in nature, witnessing a stage of accelerating, medium-paced growth with the presence of numerous small- and large-scale players in the industry. Domestic players compete with the companies catering at global level based on services and customized products. They have the ability to provide personalized customization services to customers. They have the capability of providing standardized products to major industrial machinery producers, automotive OEMs, and consumer electronics manufacturers.

The market is characterized by moderate levels of innovation. The industry has been focusing its efforts into improvising the production process, to achieve cost effectiveness with minimal wastage. The market is also characterized by fairly moderate levels of merger and acquisition (M&A) activity owing to high competitive rivalry amongst key players in the market. The common growth expansion strategy observed is plant expansion and investment into machinery upgrades.

The market is also subject to regulatory scrutiny. Various regulatory authorities such as the U.S. Environmental Protection Agency (EPA) and several building codes across the world regulate the specifications of metal stamped parts used for construction. Also, a number of substitutes for metal stamped parts such as high-grade plastic are being explored in end-user industries.

End user concentration is a significant factor in the market, since metal stamped parts are commonly used across end-user industries. The growing penetration of new grades of metal parts in high-performance applications are being used in industries such as telecommunications, military, and aerospace. The performance of each end use industry is influenced by macro-economic trends and seasonal variations in each industry.Application Insights

Automotive & transportation segment held a revenue share of more than 34.0% in 2023. Automotive industry, including passenger vehicles, light commercial vehicles (LCVs), heavy trucks, buses, and coaches use metal stamping parts in manufacturing body panels to maintain safety standards and control end costs. According to the International Organization of Motor Vehicle Manufacturers, the global production of vehicles rose by 6% in 2022 from 2021. High-volume production is expected to foster growth of the market for metal stamping in automotive applications in coming years.

In aerospace industry, metal stamping is used to produce aircraft parts, such as channels and frames, for obtaining ultra-lightweight airplanes that consume less fuel. The use of metal stamping in aircraft parts manufacturing provides durability and is a cost-effective solution, which is expected to propel its demand.

In addition, growing production of commercial and fighter aircraft is expected to drive market in coming years. Industrial machinery segment is expected to witness significant growth over the coming years on account of growing industrialization in developing and emerging economies, such as India, China, Brazil, and South Africa.

In agricultural industry, stamped components are used to manufacture automated processing equipment. Metal stamping companies, such as D&H industries, are investing in R&D to provide advanced stamping technology for agricultural equipment. Developments in agricultural industry are anticipated to boost market growth over the forecast period.

In telecommunications, metal parts are used in manufacturing of antennas and outer body of telecom products. Demand for metal stamping parts is witnessing growth in telecommunications industry as they enhance durability of telecom products. The availability of advanced technology along with high demand for premium telecom products is anticipated to augment market growth over the coming years.

Market Dynamics

Growing investments in construction industry especially in Asia Pacific is propelling the demand for stamped metal parts. For instance, in January 2022, Government of China announced plans to develop 6.5 million units of government-subsidized homes country wide by 2025. This project anticipates helping 13 million people.

The metal stamping industry, however, faces hindrances with volatility in raw material prices. For instance, in H1 2022, primary aluminum prices rose to USD 3,077.2 per ton from USD 2,500.4 per ton in 2021. Rise in raw material costs impacts manufacturing process and affects end product prices.

Regional Insights

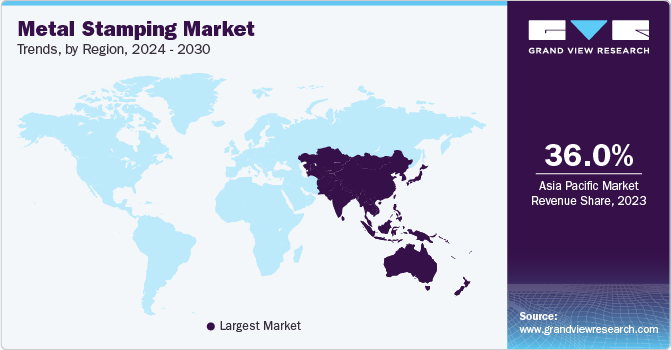

Asia Pacific held the largest revenue share of more than 36.0% in 2023owing to increasing demand for cars and consumer electronics in the region and is anticipated to witness fastest CAGR over the forecast period. Growth is majorly driven by developing countries, such as China, India, Bangladesh, Indonesia, and Pakistan, where increasing demand for phones along with other consumer electronics is anticipated to augment the market growth. Growing industrialization coupled with infrastructure development and growth in defense industry is expected to have a positive impact on the demand for machinery and equipment in Asia Pacific.

Countries, such as China and India, are increasing their investments in defense industry. For instance, China increased its defense budget by 41% in 2022 from 2021 to reach USD 292 billion. Rising demand for defense equipment is anticipated to drive the market for stamped products in coming years. India is another lucrative market for metal stamping where growing production of components is anticipated to positively influence market growth.

Increasing production of aluminum hoods is anticipated to drive demand for stamped products over the coming years. Europe held a significant revenue share in 2023 owing to established automotive industry and growing consumer electronics industry. The region has stringent regulations on enhancing fuel economy, increasing demand for EVs. According to the IEA, global sale of EVs is anticipated to reach 44 million vehicles per year by 2030. Growing demand for electric vehicles is anticipated to augment market growth over the coming years.

Process Insights

Blanking segment held the largest revenue share of more than 32.0% in 2023. Blanking is an integral part of manufacturing automobiles on account of its precise and superior stamping ability. This technique involves use of a die to obtain desired shape. Growing use of blanking in automobile industry on account of its ability to cater to mass production lines is expected to augment segment growth over the coming years.

Embossing was second-largest segment in 2023 owing to its advantages, such as the ability to produce different patterns and sizes, depending on roll dies. This is done by passing a metal sheet or strip between rolls of desired pattern. Embossing a sheet metal reduces friction, increases stiffness and rigidity, and enhances traction.

Bending process refers to pressuring a metal onto a plane surface to provide the desired shape. It is cost-effective when used for low or medium quantities of metals. Bent parts are utilized in several applications, such as wheels, door hinges, and engine assembly, in automobiles.

Coining is a cold working process that uses extreme force to plastically deform a metal workpiece such that it conforms to a die. A gear-driven press, a mechanical press, or a hydraulically actuated press are used in this process. It was earlier used in minting of coins but with growing complexity in designing of automobiles, coining process is now being used in metal stamping as well.

Press Type Insights

Mechanical press segment held a revenue share of almost 50.0% of the global market, in 2023. Mechanical presses are frequently used for sheet metal processing and are characterized by the fast and continuous application of pressure over a constrained distance. When compared to hydraulic press machines, mechanical press machines exhibit a higher speed and are well suited for stamping applications.

Servo press is gaining prominence in the market. Servo presses are utilized in metalworking industry for precision metal forming processes, specifically in metal stamping. With servo motors and controllers, press rams can be controlled more precisely, resulting in more accurate and flexible stamping operations. This is an improvement over traditional mechanical or hydraulic presses.

Thickness Insights

Based on thickness, less than & up to 2.5 mm thickness segment held over 65.0% market share in 2023. Sheet metal less than 2.5 mm thick is commonly used in metal stamping applications. It is ideal for producing small, precise components for electronic devices such as battery and circuit board components and is found in laptops, smartphones, and tablets. In addition, it is in demand for interior components in automotive industry, such as door panels, dashboard trim, and decorative elements.

Sheet metal comes in different gauges, with medium gauges falling within the range of 3 mm to 6 mm. This gauge is commonly used for applications that demand a good balance between strength and formability. However, heavy gauge sheet metal is thicker, ranging from 6 mm to 12 mm or even more. It is used for applications that require high strength and durability, such as structural components in construction and heavy machinery.

Key Companies & Market Share Insights

Some of the key players operating in the market include CAPARO, Nissan Motor Co., Ltd and Goshen Stamping Company.

-

CAPARO is mainly engaged in the designing, manufacturing, marketing, and distribution of value-added steel and niche emerging products. The group operates in North America, the UK, the Middle East, and India with its various subsidiaries such as Bull Moose Engineering Livonia, Caparo Engineering India Ltd – Chennai, and Caparo Middle East, among others.

-

Nissan Motor Co., Ltd is engaged in the manufacturing, sales, and related business of automotive products. The company has several subsidiaries, dealers, and joint ventures, which are involved in R&D, design, production, automobile finance, and digital operations.

-

Goshen Stamping Company specializes in producing high volumes with a combination of medium to high-speed presses with progressive dies. The company operates 36 presses ranging from 30-ton OBIs up to 400-ton SSDC. Its press bed sizes are up to 84" x 48" with stroke ranges from 2" to 8" for stamping. It offers a wide range of stampings in various materials such as carbon based steel, stainless steel, aluminum, or other metals.

-

AAPICO Hitech Public Company Limited and Gestamp are some of the emerging market participants.

-

AAPICO Hitech Public Company Limite is engaged in OEM auto parts manufacturing, car dealerships, and IoT connectivity and mobility. OEM auto parts manufacturing is further segmented into stamped or pressed parts, forged & machined parts, and plastic parts & plastic fuel tanks.

-

Maoming Xingli Kaolin Co., Ltd. has a high-quality mine named acicular kaolin mine that spreads across 800 acres. The company offers several products such as bone china clay, clay for porcelain, kaolin clay, porcelain clay, and others. Its key focus is on washed kaolin (without acid), 90-degree ball clay, and 90- degree kaolin.

Key Metal Stamping Companies:

- Acro Metal Stamping

- Manor Tool & Manufacturing Company

- D&H Industries, Inc.

- Kenmode, Inc.

- Klesk Metal Stamping Co

- Clow Stamping Company

- Goshen Stamping Company

- Tempco Manufacturing Company, Inc

- Interplex Holdings Pte. Ltd.

- CAPARO

- Nissan Motor Co., Ltd

- AAPICO Hitech Public Company Limited

- Gestamp

- Ford Motor Company

Recent Developments

-

In November 2023, Generational Growth Capital, an equity firm based in Milwaukee, U.S. acquired Federal Tool & Engineering, BP Metals, and Rockford Specialties based in Wisconsin, Minnesota and Illinois, U.S. respectively. The three manufacturers are metal stamping and structural steel manufacturers. This will enable the new entity to tap into various benefits such as expanding its manufacturing capacity, and support customers with interrupted delivery through a strong logistics supply chain.

-

In October 2023, Ryerson acquired Norlen Inc., a metal stamping fabricator based Wisconsin, U.S. for an undisclosed sum. The latter mainly caters to the agricultural and defense markets.

-

In June 2023, General Motors announced that it would be investing more than USD 500 million into its Arlington, Texas, U.S. assembly plant to produce the next generation SUVs. It intends to purchase new equipment for metal stamping, the body shop and other assembly parts.

Metal Stamping Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 243.93 billion

Revenue forecast in 2030

USD 316.72 billion

Growth Rate

CAGR of 4.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report Updated

November 2023

Quantitative Units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Process, press type, thickness, application, region

Regional scope

North America, Europe, Asia Pacific, Central & South Africa, Middle East & Africa

Country scope

U.S., Germany, UK, Italy, China, India, Japan

Key companies profiled

Acro Metal Stamping; Manor Tool & Manufacturing Company; D&H Industries, Inc.; Kenmode, Inc.; Klesk Metal Stamping Co; Clow Stamping Company; Goshen Stamping Company; Tempco Manufacturing Company, Inc.; Interplex Holdings Pte. Ltd.; CAPARO; Nissan Motor Co., Ltd; AAPICO Hitech Public Company Limited; Gestamp; Ford Motor Company

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Metal Stamping Market Report Segmentation

This report forecasts revenue growth at global, country & regional levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global metal stamping market report based on process, press type, thickness, application, and region:

-

Process Outlook (Revenue, USD Million, 2018 - 2030)

-

Blanking

-

Embossing

-

Bending

-

Coining

-

Flanging

-

Others

-

-

Press Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Mechanical Press

-

Hydraulic Press

-

Servo Press

-

Others

-

-

Thickness Outlook (Revenue, USD Million, 2018 - 2030)

-

Less than & up to 2.5 mm

-

More than 2.5 mm

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Industrial Machinery

-

Consumer electronics

-

Aerospace

-

Electrical & Electronics

-

Building & Construction

-

Telecommunications

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

UK

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global metal stamping market size was estimated at USD 236.83 billion in 2023 and is expected to reach USD 243.93 billion in 2024.

b. The global metal stamping market is expected to grow at a compound annual growth rate of 4.2% from 2024 to 2030 to reach USD 316.72 billion in 2030.

b. The Asia Pacific dominated the metal stamping market with a revenue share of over 36.0% in 2023. This is attributable to developing countries such as China, India, Bangladesh, Indonesia, and Pakistan, where there is increasing demand for mobile phones along with other consumer electronics.

b. Some of the key players operating in the metal stamping market include Acro Metal Stamping, Manor Tool & Manufacturing Company, D&H Industries, Inc., Kenmode, Inc., Klesk Metal Stamping Co, Clow Stamping Company, Goshen Stamping Company, Tempco Manufacturing Company, Inc, Interplex Holdings Pte. Ltd., CAPARO, Nissan Motor Co., Ltd, AAPICO Hitech Public Company Limited, Gestamp, and Ford Motor Company.

b. Key factors that are driving the metal stamping market growth include the application of metal frames in mobile phones, headphones, speakers, and gamepads and controllers.

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Market Definition

1.3. Information Procurement

1.3.1. Information Analysis

1.3.2. Data Analysis Models

1.3.3. Market Formulation & Data Visualization

1.3.4. Data Validation & Publishing

1.4. Research Scope and Assumptions

1.4.1. List of Data Sources

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segmental Outlook

2.3. Competitive Outlook

Chapter 3. Market Variables, Trends, and Scope

3.1. Market Lineage Outlook

3.1.1. Global Metal Stamping Market

3.2. Industry Value Chain Analysis

3.2.1. Raw Material Trends

3.3. Technology Overview

3.4. Regulatory Framework

3.5. Market Dynamics

3.5.1. Market Driver Analysis

3.5.2. Market Restraint Analysis

3.5.3. Market Opportunity Analysis

3.5.4. Market Challenges

3.6. Porter’s Five Forces Analysis

3.6.1. Bargaining Power of Suppliers

3.6.2. Bargaining Power of Buyers

3.6.3. Threat of Substitution

3.6.4. Threat of New Entrants

3.6.5. Competitive Rivalry

3.7. PESTLE Analysis

3.7.1. Political

3.7.2. Economic

3.7.3. Social Landscape

3.7.4. Technology

3.7.5. Environmental

3.7.6. Legal

Chapter 4. Metal Stamping Market: Process Estimates & Trend Analysis

4.1. Metal Stamping Market: Process Movement Analysis, 2023 & 2030

4.2. Blanking

4.2.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

4.3. Embossing

4.3.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

4.4. Bending

4.4.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

4.5. Coining

4.5.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

4.6. Flanging

4.6.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

4.7. Others

4.7.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

Chapter 5. Metal Stamping Market: Press Type Estimates & Trend Analysis

5.1. Metal Stamping Market: Press Type Movement Analysis, 2023 & 2030

5.2. Mechanical Press

5.2.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

5.3. Hydraulic Press

5.3.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

5.4. Servo Press

5.4.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

5.5. Others

5.5.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

Chapter 6. Metal Stamping Market: Thickness Estimates & Trend Analysis

6.1. Metal Stamping Market: Thickness Movement Analysis, 2023 & 2030

6.2. Less than and up to 2.5 mm

6.2.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

6.3. More than 2.5 mm

6.3.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

Chapter 7. Metal Stamping Market: Application Estimates & Trend Analysis

7.1. Metal Stamping Market: Application Movement Analysis, 2023 & 2030

7.2. Automotive

7.2.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

7.3. Industrial Machinery

7.3.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

7.4. Consumer Electronics

7.4.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

7.5. Aerospace

7.5.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

7.6. Electrical & Electronics

7.6.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

7.7. Telecommunications

7.7.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

7.8. Building & Construction

7.8.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

7.9. Others

7.9.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

Chapter 8. Metal Stamping Market: Regional Estimates & Trend Analysis

8.1. Regional Analysis, 2023 & 2030

8.2. North America

8.2.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

8.2.2. Market estimates and forecasts, by process, 2018 - 2030 (USD Million)

8.2.3. Market estimates and forecasts, by press type, 2018 - 2030 (USD Million)

8.2.4. Market estimates and forecasts, by thickness, 2018 - 2030 (USD Million)

8.2.5. Market estimates and forecasts, by application, 2018 - 2030 (USD Million)

8.2.6. U.S.

8.2.6.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

8.2.6.2. Market estimates and forecasts, by process, 2018 - 2030 (USD Million)

8.2.6.3. Market estimates and forecasts, by press type, 2018 - 2030 (USD Million)

8.2.6.4. Market estimates and forecasts, by thickness, 2018 - 2030 (USD Million)

8.2.6.5. Market estimates and forecasts, by application, 2018 - 2030 (USD Million)

8.3. Europe

8.3.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

8.3.2. Market estimates and forecasts, by process, 2018 - 2030 (USD Million)

8.3.3. Market estimates and forecasts, by press type, 2018 - 2030 (USD Million)

8.3.4. Market estimates and forecasts, by thickness, 2018 - 2030 (USD Million)

8.3.5. Market estimates and forecasts, by application, 2018 - 2030 (USD Million)

8.3.6. Germany

8.3.6.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

8.3.6.2. Market estimates and forecasts, by process, 2018 - 2030 (USD Million)

8.3.6.3. Market estimates and forecasts, by press type, 2018 - 2030 (USD Million)

8.3.6.4. Market estimates and forecasts, by thickness, 2018 - 2030 (USD Million)

8.3.6.5. Market estimates and forecasts, by application, 2018 - 2030 (USD Million)

8.3.7. U.K.

8.3.7.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

8.3.7.2. Market estimates and forecasts, by process, 2018 - 2030 (USD Million)

8.3.7.3. Market estimates and forecasts, by press type, 2018 - 2030 (USD Million)

8.3.7.4. Market estimates and forecasts, by thickness, 2018 - 2030 (USD Million)

8.3.7.5. Market estimates and forecasts, by application, 2018 - 2030 (USD Million)

8.3.8. Italy

8.3.8.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

8.3.8.2. Market estimates and forecasts, by process, 2018 - 2030 (USD Million)

8.3.8.3. Market estimates and forecasts, by press type, 2018 - 2030 (USD Million)

8.3.8.4. Market estimates and forecasts, by thickness, 2018 - 2030 (USD Million)

8.3.8.5. Market estimates and forecasts, by application, 2018 - 2030 (USD Million)

8.4. Asia Pacific

8.4.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

8.4.2. Market estimates and forecasts, by process, 2018 - 2030 (USD Million)

8.4.3. Market estimates and forecasts, by press type, 2018 - 2030 (USD Million)

8.4.4. Market estimates and forecasts, by thickness, 2018 - 2030 (USD Million)

8.4.5. Market estimates and forecasts, by application, 2018 - 2030 (USD Million)

8.4.6. China

8.4.6.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

8.4.6.2. Market estimates and forecasts, by process, 2018 - 2030 (USD Million)

8.4.6.3. Market estimates and forecasts, by press type, 2018 - 2030 (USD Million)

8.4.6.4. Market estimates and forecasts, by thickness, 2018 - 2030 (USD Million)

8.4.6.5. Market estimates and forecasts, by application, 2018 - 2030 (USD Million)

8.4.7. India

8.4.7.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

8.4.7.2. Market estimates and forecasts, by process, 2018 - 2030 (USD Million)

8.4.7.3. Market estimates and forecasts, by press type, 2018 - 2030 (USD Million)

8.4.7.4. Market estimates and forecasts, by thickness, 2018 - 2030 (USD Million)

8.4.7.5. Market estimates and forecasts, by application, 2018 - 2030 (USD Million)

8.4.8. Japan

8.4.8.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

8.4.8.2. Market estimates and forecasts, by process, 2018 - 2030 (USD Million)

8.4.8.3. Market estimates and forecasts, by press type, 2018 - 2030 (USD Million)

8.4.8.4. Market estimates and forecasts, by thickness, 2018 - 2030 (USD Million)

8.4.8.5. Market estimates and forecasts, by application, 2018 - 2030 (USD Million)

8.5. Central & South America

8.5.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

8.5.2. Market estimates and forecasts, by process, 2018 - 2030 (USD Million)

8.5.3. Market estimates and forecasts, by press type, 2018 - 2030 (USD Million)

8.5.4. Market estimates and forecasts, by thickness, 2018 - 2030 (USD Million)

8.5.5. Market estimates and forecasts, by application, 2018 - 2030 (USD Million)

8.6. Middle East & Africa

8.6.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

8.6.2. Market estimates and forecasts, by process, 2018 - 2030 (USD Million)

8.6.3. Market estimates and forecasts, by press type, 2018 - 2030 (USD Million)

8.6.4. Market estimates and forecasts, by thickness, 2018 - 2030 (USD Million)

8.6.5. Market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Chapter 9. Competitive Landscape

9.1. Recent Developments & Impact Analysis, By Key Market Participants

9.2. Company Categorization

9.3. Company Ranking

9.4. Heat Map Analysis

9.5. Vendor Landscape

9.5.1. List of raw material suppliers, prominent manufacturers, and distributors

9.5.2. List of prospective end-users

9.6. Strategy Mapping

9.7. Company Profiles/Listing

9.7.1. Acro Metal Stamping

9.7.1.1. Company overview

9.7.1.2. Financial performance

9.7.1.3. Product benchmarking

9.7.2. Manor Tool & Manufacturing Company

9.7.2.1. Company overview

9.7.2.2. Financial performance

9.7.2.3. Product benchmarking

9.7.3. D&H Industries, Inc.

9.7.3.1. Company overview

9.7.3.2. Financial performance

9.7.3.3. Product benchmarking

9.7.4. Kenmode, Inc.

9.7.4.1. Company overview

9.7.4.2. Product benchmarking

9.7.5. Klesk Metal Stamping Co

9.7.5.1. Company overview

9.7.5.2. Product benchmarking

9.7.6. Clow Stamping Company

9.7.6.1. Company overview

9.7.6.2. Product benchmarking

9.7.7. Goshen Stamping Company

9.7.7.1. Company overview

9.7.7.2. Product benchmarking

9.7.8. Tempco Manufacturing Company, Inc

9.7.8.1. Company overview

9.7.8.2. Product benchmarking

9.7.9. Interplex Holdings Pte. Ltd

9.7.9.1. Company overview

9.7.9.2. Product benchmarking

9.7.10. CAPARO

9.7.10.1. Company overview

9.7.10.2. Financial performance

9.7.10.3. Product benchmarking

9.7.11. Nissan Motor Co., Ltd

9.7.11.1. Company overview

9.7.11.2. Financial performance

9.7.11.3. Product benchmarking

9.7.12. AAPICO Hitech Public Company Limited

v9.7.12.1. Company overview

9.7.12.2. Financial performance

9.7.12.3. Product benchmarking

9.7.13. Gestamp

9.7.13.1. Company overview

9.7.13.2. Financial performance

9.7.13.3. Product benchmarking

9.7.14. Ford Motor Company

9.7.14.1. Company overview

9.7.14.2. Financial performance

9.7.14.3. Product benchmarking

List of Tables

Table 1 Metal Stamping - Market snapshot

Table 2 Metal stamping market estimates and forecast, 2018 - 2030 (USD Billion)

Table 3 Metal stamping market estimates and forecast, by blanking, 2018 - 2030 (USD Billion)

Table 4 Metal stamping market estimates and forecast, by embossing, 2018 - 2030 (USD Billion)

Table 5 Metal stamping market estimates and forecast, by bending, 2018 - 2030 (USD Billion)

Table 6 Metal stamping market estimates and forecast, by coining, 2018 - 2030 (USD Billion)

Table 7 Metal stamping market estimates and forecast, by flanging, 2018 - 2030 (USD Billion)

Table 8 Metal stamping market estimates and forecast, by other processes, 2018 - 2030 (USD Billion)

Table 9 Metal stamping market estimates and forecast, by automotive & transportation, 2018 - 2030 (USD Billion)

Table 10 Metal stamping market estimates and forecast, by industrial machinery, 2018 - 2030 (USD Billion)

Table 11 Metal stamping market estimates and forecast, by consumer electronics, 2018 - 2030 (USD Billion)

Table 12 Metal stamping market estimates and forecast, by aerospace, 2018 - 2030 (USD Billion)

Table 13 Metal stamping market estimates and forecast, by electrical & electronics, 2018 - 2030 (USD Billion)

Table 14 Metal stamping market estimates and forecast, by telecommunication, 2018 - 2030 (USD Billion)

Table 15 Metal stamping market estimates and forecast, by building & construction, 2018 - 2030 (USD Billion)

Table 16 Metal stamping market estimates and forecast, by other applications, 2018 - 2030 (USD Billion)

Table 17 North America metal stamping market estimates and forecast, 2018 - 2030 (USD Billion)

Table 18 North America metal stamping market, by process, 2018 - 2030 (USD Billion)

Table 19 North America metal stamping market, by application, 2018 - 2030 (USD Billion)

Table 20 US metal stamping market estimates and forecasts, 2018 - 2030 (USD Billion)

Table 21 US metal stamping market, by process, 2018 - 2030 (USD Billion)

Table 22 US metal stamping market, by application, 2018 - 2030 (USD Billion)

Table 23 Europe metal stamping market estimates and forecast, 2018 - 2030 (USD Billion)

Table 24 Europe metal stamping market, by process, 2018 - 2030 (USD Billion)

Table 25 Europe metal stamping market, by application, 2018 - 2030 (USD Billion)

Table 26 Germany metal stamping market estimates and forecast, 2018 - 2030 (USD Billion)

Table 27 Germany metal stamping market, by process, 2018 - 2030 (USD Billion)

Table 28 Germany metal stamping market, by application, 2018 - 2030 (USD Billion)

Table 29 UK metal stamping market estimates and forecasts, 2018 - 2030 (USD Billion)

Table 30 UK metal stamping market, by process, 2018 - 2030 (USD Billion)

Table 31 UK metal stamping market, by application, 2018 - 2030 (USD Billion)

Table 32 Italy metal stamping market estimates and forecasts, 2018 - 2030 (USD Billion)

Table 33 Italy metal stamping market, by process, 2018 - 2030 (USD Billion)

Table 34 Italy metal stamping market, by application, 2018 - 2030 (USD Billion)

Table 35 Asia Pacific metal stamping market estimates and forecasts, 2018 - 2030 (USD Billion)

Table 36 Asia Pacific metal stamping market, by process, 2018 - 2030 (USD Billion)

Table 37 Asia Pacific metal stamping market, by application, 2018 - 2030 (USD Billion)

Table 38 China metal stamping market estimates and forecasts, 2018 - 2030 (USD Billion)

Table 39 China metal stamping market, by process, 2018 - 2030 (USD Billion)

Table 40 China metal stamping market, by application, 2018 - 2030 (USD Billion)

Table 41 India metal stamping market estimates and forecasts, 2018 - 2030 (USD Billion)

Table 42 India metal stamping market, by process, 2018 - 2030 (USD Billion)

Table 43 India metal stamping market, by application, 2018 - 2030 (USD Billion)

Table 44 Japan metal stamping market estimates and forecasts, 2018 - 2030 (USD Billion)

Table 45 Japan metal stamping market, by process, 2018 - 2030 (USD Billion)

Table 46 Japan metal stamping market, by application, 2018 - 2030 (USD Billion)

Table 47 Central & South America metal stamping market estimates and forecasts, 2018 - 2030 (USD Billion)

Table 48 Central & South America metal stamping market, by process, 2018 - 2030 (USD Billion)

Table 49 Central & South America metal stamping market, by application, 2018 - 2030 (USD Billion)

Table 50 Middle East & Africa metal stamping market estimates and forecasts, 2018 - 2030 (USD Billion)

Table 51 Middle East & Africa metal stamping market, by process, 2018 - 2030 (USD Billion)

Table 52 Middle East & Africa metal stamping market, by application, 2018 - 2030 (USD Billion)

List of Figures

Fig. 1 Market segmentation

Fig. 2 Information procurement

Fig. 3 Data Analysis Models

Fig. 4 Market Formulation and Validation

Fig. 5 Market snapshot

Fig. 6 Segmental outlook - Process & Application

Fig. 7 Segmental outlook - Press Type & Thickness

Fig. 8 Competitive Outlook

Fig. 9 Metal stamping market outlook, 2018-2030 (USD Million) (Kilotons)

Fig. 10 Value chain analysis

Fig. 11 Market dynamics

Fig. 12 Porter’s Analysis

Fig. 13 PESTEL Analysis

Fig. 14 Metal stamping market, by process: Key takeaways

Fig. 15 Metal stamping market, by process: Market share, 2023 & 2030

Fig. 16 Metal stamping market, by press type: Key takeaways

Fig. 17 Metal stamping market, by press type: Market share, 2023 & 2030

Fig. 18 Metal stamping market, by thickness: Key takeaways

Fig. 19 Metal stamping market, by thickness: Market share, 2023 & 2030

Fig. 20 Metal stamping market, by application: Key takeaways

Fig. 21 Metal stamping market, by application: Market share, 2023 & 2030

Fig. 22 Metal stamping market: Regional analysis, 2023

Fig. 23 Metal stamping market, by region: Key takeawaysWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Metal Stamping Process Outlook (Revenue, USD Million, 2018 - 2030)

- Blanking

- Embossing

- Bending

- Coining

- Flanging

- Others

- Metal Stamping Press Type Outlook (Revenue, USD Million, 2018 - 2030)

- Mechanical Press

- Hydraulic Press

- Servo Press

- Others

- Metal Stamping Thickness Outlook (Revenue, USD Million, 2018 - 2030)

- Less than & up to 2.5 mm

- More than 2.5 mm

- Metal Stamping Application Outlook (Revenue, USD Million, 2018 - 2030)

- Automotive

- Industrial machinery

- Consumer electronics

- Aerospace

- Electrical & Electronics

- Telecommunications

- Building & Construction

- Others

- Metal Stamping Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- North America Metal Stamping Market, By Process

- Blanking

- Embossing

- Bending

- Coining

- Flanging

- Others

- North America Metal Stamping Market, By Press Type

- Mechanical Press

- Hydraulic Press

- Servo Press

- Others

- North America Metal Stamping Market, By Thickness

- Less than & up to 2.5 mm

- More than 2.5 mm

- North America Metal Stamping Market, By Application

- Automotive

- Industrial Machinery

- Consumer Electronics

- Aerospace

- Electrical & Electronics

- Telecommunications

- Building & Construction

- Others

- U.S.

- U.S. Metal Stamping Market, By Process

- Blanking

- Embossing

- Bending

- Coining

- Flanging

- Others

- U.S. Metal Stamping Market, By Press Type

- Mechanical Press

- Hydraulic Press

- Servo Press

- Others

- U.S. Metal Stamping Market, By Thickness

- Less than & up to 2.5 mm

- More than 2.5 mm

- U.S. Metal Stamping Market, By Application

- Automotive

- Industrial Machinery

- Consumer Electronics

- Aerospace

- Electrical & Electronics

- Telecommunications

- Building & Construction

- Others

- U.S. Metal Stamping Market, By Process

- North America Metal Stamping Market, By Process

- Europe

- Europe Metal Stamping Market, By Process

- Blanking

- Embossing

- Bending

- Coining

- Flanging

- Others

- Europe Metal Stamping Market, By Press Type

- Mechanical Press

- Hydraulic Press

- Servo Press

- Others

- Europe Metal Stamping Market, By Thickness

- Less than & up to 2.5 mm

- More than 2.5 mm

- Europe Metal Stamping Market, By Application

- Automotive

- Industrial Machinery

- Consumer Electronics

- Aerospace

- Electrical & Electronics

- Telecommunications

- Building & Construction

- Others

- Germany

- Germany Metal Stamping Market, By Process

- Blanking

- Embossing

- Bending

- Coining

- Flanging

- Others

- Germany Metal Stamping Market, By Press Type

- Mechanical Press

- Hydraulic Press

- Servo Press

- Others

- Germany Metal Stamping Market, By Thickness

- Less than & up to 2.5 mm

- More than 2.5 mm

- Germany Metal Stamping Market, By Application

- Automotive

- Industrial Machinery

- Consumer Electronics

- Aerospace

- Electrical & Electronics

- Telecommunications

- Building & Construction

- Others

- Germany Metal Stamping Market, By Process

- UK

- UK Metal Stamping Market, By Process

- Blanking

- Embossing

- Bending

- Coining

- Flanging

- Others

- UK Metal Stamping Market, By Press Type

- Mechanical Press

- Hydraulic Press

- Servo Press

- Others

- UK Metal Stamping Market, By Thickness

- Less than & up to 2.5 mm

- More than 2.5 mm

- UK Metal Stamping Market, By Application

- Automotive

- Industrial Machinery

- Consumer Electronics

- Aerospace

- Electrical & Electronics

- Telecommunications

- Building & Construction

- Others

- UK Metal Stamping Market, By Process

- Italy

- Italy Metal Stamping Market, By Process

- Blanking

- Embossing

- Bending

- Coining

- Flanging

- Others

- Italy Metal Stamping Market, By Press Type

- Mechanical Press

- Hydraulic Press

- Servo Press

- Others

- Italy Metal Stamping Market, By Thickness

- Less than & up to 2.5 mm

- More than 2.5 mm

- Italy Metal Stamping Market, By Application

- Automotive

- Industrial Machinery

- Consumer Electronics

- Aerospace

- Electrical & Electronics

- Telecommunications

- Building & Construction

- Others

- Italy Metal Stamping Market, By Process

- Europe Metal Stamping Market, By Process

- Asia Pacific

- Asia Pacific Metal Stamping Market, By Process

- Blanking

- Embossing

- Bending

- Coining

- Flanging

- Others

- Asia Pacific Metal Stamping Market, By Press Type

- Mechanical Press

- Hydraulic Press

- Servo Press

- Others

- Asia Pacific Metal Stamping Market, By Thickness

- Less than & up to 2.5 mm

- More than 2.5 mm

- Asia Pacific Metal Stamping Market, By Application

- Automotive

- Industrial Machinery

- Consumer Electronics

- Aerospace

- Electrical & Electronics

- Telecommunications

- Building & Construction

- Others

- China

- China Metal Stamping Market, By Process

- Blanking

- Embossing

- Bending

- Coining

- Flanging

- Others

- China Metal Stamping Market, By Press Type

- Mechanical Press

- Hydraulic Press

- Servo Press

- Others

- China Metal Stamping Market, By Thickness

- Less than & up to 2.5 mm

- More than 2.5 mm

- China Metal Stamping Market, By Application

- Automotive

- Industrial Machinery

- Consumer Electronics

- Aerospace

- Electrical & Electronics

- Telecommunications

- Building & Construction

- Others

- China Metal Stamping Market, By Process

- India

- India Metal Stamping Market, By Process

- Blanking

- Embossing

- Bending

- Coining

- Flanging

- Others

- India Metal Stamping Market, By Press Type

- Mechanical Press

- Hydraulic Press

- Servo Press

- Others

- India Metal Stamping Market, By Thickness

- Less than & up to 2.5 mm

- More than 2.5 mm

- India Metal Stamping Market, By Application

- Automotive

- Industrial Machinery

- Consumer Electronics

- Aerospace

- Electrical & Electronics

- Telecommunications

- Building & Construction

- Others

- India Metal Stamping Market, By Process

- Japan

- Japan Metal Stamping Market, By Process

- Blanking

- Embossing

- Bending

- Coining

- Flanging

- Others

- Japan Metal Stamping Market, By Press Type

- Mechanical Press

- Hydraulic Press

- Servo Press

- Others

- Japan Metal Stamping Market, By Thickness

- Less than & up to 2.5 mm

- More than 2.5 mm

- Japan Metal Stamping Market, By Application

- Automotive

- Industrial Machinery

- Consumer Electronics

- Aerospace

- Electrical & Electronics

- Telecommunications

- Building & Construction

- Others

- Japan Metal Stamping Market, By Process

- Asia Pacific Metal Stamping Market, By Process

- Central & South America

- Central & South America Metal Stamping Market, By Process

- Blanking

- Embossing

- Bending

- Coining

- Flanging

- Others

- Central & South America Metal Stamping Market, By Press Type

- Mechanical Press

- Hydraulic Press

- Servo Press

- Others

- Central & South America Metal Stamping Market, By Thickness

- Less than & up to 2.5 mm

- More than 2.5 mm

- Central & South America Metal Stamping Market, By Application

- Automotive

- Industrial Machinery

- Consumer Electronics

- Aerospace

- Electrical & Electronics

- Telecommunications

- Building & Construction

- Others

- Central & South America Metal Stamping Market, By Process

- Middle East & Africa

- Middle East & Africa Metal Stamping Market, By Process

- Blanking

- Embossing

- Bending

- Coining

- Flanging

- Others

- Middle East & Africa Metal Stamping Market, By Press Type

- Mechanical Press

- Hydraulic Press

- Servo Press

- Others

- Middle East & Africa Metal Stamping Market, By Thickness

- Less than & up to 2.5 mm

- More than 2.5 mm

- Middle East Africa Metal Stamping Market, By Application

- Automotive

- Industrial Machinery

- Consumer Electronics

- Aerospace

- Electrical & Electronics

- Telecommunications

- Building & Construction

- Others

- Middle East & Africa Metal Stamping Market, By Process

- North America

Metal Stamping Market Dynamics

Driver: Long-term growth prospects of the automotive industry

The automotive industry is an important end-user of the metal stamping market and is a major contributor to the market revenue. Metal stamping finds application in the production of automobile chassis, interior and transmission components, and exterior structural parts. Rapid advancements in automobile production are expected to drive market growth. China and India are anticipated to emerge as the most lucrative automobile markets over the next 20 years. Rising population and increasing disposable income in these emerging economies are the significant factors boosting automobile production. In addition, these countries have significant cost advantages, which facilitate increased vehicle production. For instance, Indian auto firms save 10% to 25% on operations as compared to those in Europe and South America. significant rise in the production of EVs is expected to provide a lucrative opportunity for the metal stamping market. The global sales of EVs are surging rapidly. The recorded sales in 2020, 2021, and 2022 are 3.2 million, 6.7 million, and 10.5 million, respectively. China accounted for over 58.0% of global EV sales in 2022, with more than 6 million units sold in the country.

Driver: Rising demand for metal stamping from aerospace & defense industries

The metal stamping market has been witnessing significant growth in terms of volume and revenue over the past few years owing to a surge in demand for stamped metal components from the global aerospace & defense industries. The stainless steel, steel, and aluminum components used in these industries are offered by a few well-established global companies that make significant financial investments to provide their clients with the most cutting-edge products.

Metal stamping parts are used in aircraft engines, missile and defense components, aircraft panels, and various other high-precision equipment in these industries. Aluminum and stainless steel are the preferred metals for application in the aerospace industry owing to their lightweight, effective cost, and high-strength characteristics. This is because the reduction in aircraft weight allows aviation companies to accommodate a large number of air passengers in their planes. It also increases fuel efficiency, thereby enhancing the profitability of airlines. Over the past few years, several governments and airlines have invested significant amounts in the purchase of advanced aircraft owing to the surging number of global air passengers.

Restraint: Availability of substitute

Although the automotive industry forms an integral part of the metal stamping market, the growing usage of polymers in producing vehicle parts is anticipated to impact the consumption of metal-stamped components across the forecast period. The shifting trend toward replacing metals with polymers to reduce weight and, in turn, increase the fuel efficiency of vehicles is presumed to critically impact the market. Developments in the Corporate Average Fuel Economy (CAFE) regulations have resulted in automobile manufacturers following these trends diligently in a bid to reduce automobile weight and increase fuel efficiency.

Polymer usage in automobiles has witnessed an increase in recent years and the trend is expected to continue over the forecast period. Technological advancements have made it possible for automobile manufacturers to replace metals like steel with high-performance polymers such as thermoplastics for numerous applications. This has led to automobile weight reduction, resulting in higher fuel efficiency. The use of polymers results in an almost 40% reduction in overall vehicle weight.

Opportunity: Penetration of additive manufacturing

Additive manufacturing offers a lucrative growth opportunity for the metal stamping industry. The technology provides various benefits such as minimized waste, reduced energy and labor costs, and the potential for the production of smaller & complex geometries. Research across the world has been putting impetus into developing additive manufacturing and adopting it to produce metal-stamped products. 3D printing is becoming more reliable and less expensive, offering a new method for producing industrial tooling such as dies. It is an attractive option for low-volume metal-forming projects. This method is being gradually adopted across industries due to its various benefits.

For instance, in the automotive industry, the 2022 manual transmission models of the Cadillac Blackwing V-series are expected to implement 3D printing for ducts and brackets produced through multi-jet fusion, powder bed fusion, and binder jetting methods. 3D printing applications in the automotive industry are slowly progressing and 3D printing is being used in prototype vehicles.

What Does This Report Include?

This section will provide insights into the contents included in this metal stamping market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.

Metal stamping market qualitative analysis

-

Industry overview

-

Industry trends

-

Market drivers and restraints

-

Market size

-

Growth prospects

-

Porter’s analysis

-

PESTEL analysis

-

Key market opportunities prioritized

-

Competitive landscape

-

Company overview

-

Financial performance

-

Product benchmarking

-

Latest strategic developments

-

Metal stamping market quantitative analysis

-

Market size, estimates, and forecast from 2018 to 2030

-

Market estimates and forecast for product segments up to 2030

-

Regional market size and forecast for product segments up to 2030

-

Market estimates and forecast for application segments up to 2030

-

Regional market size and forecast for application segments up to 2030

-

Company financial performance

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationResearch Methodology

A three-pronged approach was followed for deducing the metal stamping market estimates and forecasts. The process has three steps: information procurement, analysis, and validation. The whole process is cyclical, and steps repeat until the estimates are validated. The three steps are explained in detail below:

Information procurement: Information procurement is one of the most extensive and important stages in our research process, and quality data is critical for accurate analysis. We followed a multi-channel data collection process for metal stamping market to gather the most reliable and current information possible.

- We buy access to paid databases such as Hoover’s and Factiva for company financials, industry information, white papers, industry journals, SME journals, and more.

- We tap into Grand View’s proprietary database of data points and insights from active and archived monitoring and reporting.

- We conduct primary research with industry experts through questionnaires and one-on-one phone interviews.

- We pull from reliable secondary sources such as white papers and government statistics, published by organizations like WHO, NGOs, World Bank, etc., Key Opinion Leaders (KoL) publications, company filings, investor documents, and more.

- We purchase and review investor analyst reports, broker reports, academic commentary, government quotes, and wealth management publications for insightful third-party perspectives.

Analysis: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilized different methods of metal stamping market data depending on the type of information we’re trying to uncover in our research.

-

Market Research Efforts: Bottom-up Approach for estimating and forecasting demand size and opportunity, top-down Approach for new product forecasting and penetration, and combined approach of both Bottom-up and Top-down for full coverage analysis.

-

Value-Chain-Based Sizing & Forecasting: Supply-side estimates for understanding potential revenue through competitive benchmarking, forecasting, and penetration modeling.

-

Demand-side estimates for identifying parent and ancillary markets, segment modeling, and heuristic forecasting.

-

Qualitative Functional Deployment (QFD) Modelling for market share assessment.

Market formulation and validation: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilize different methods of data analysis depending on the type of information we’re trying to uncover in our research.

-

Market Formulation: This step involves the finalization of market numbers. This step on an internal level is designed to manage outputs from the Data Analysis step.

-

Data Normalization: The final market estimates and forecasts are then aligned and sent to industry experts, in-panel quality control managers for validation.

-

This step also entails the finalization of the report scope and data representation pattern.

-

Validation: The process entails multiple levels of validation. All these steps run in parallel, and the study is forwarded for publishing only if all three levels render validated results.

Metal Stamping Market Categorization:

The metal stamping market was categorized into five segments, namely process (Blanking, Embossing, Bending, Coining, Flanging), press type (Mechanical Press, Hydraulic Press, Servo Press), thickness (Less than & up to 2.5 mm, More than 2.5 mm), application (Automotive, Industrial Machinery, Consumer electronics, Aerospace, Electrical & Electronics, Building & Construction, Telecommunications), and regions (North America, Europe, Asia Pacific, Central & South America, Middle East & Africa).

Segment Market Methodology:

The metal stamping market was segmented into process, press type, thickness, application, and regions. The demand at a segment level was deduced using a funnel method. Concepts like the TAM, SAM, SOM, etc., were put into practice to understand the demand. We at GVR deploy three methods to deduce market estimates and determine forecasts. These methods are explained below:

Market research approaches: Bottom-up

-

Demand estimation of each product across countries/regions summed up to from the total market.

-

Variable analysis for demand forecast.

-

Demand estimation via analyzing paid database, and company financials either via annual reports or paid database.

-

Primary interviews for data revalidation and insight collection.

Market research approaches: Top-down

-

Used extensively for new product forecasting or analyzing penetration levels.

-

Tool used invoice product flow and penetration models Use of regression multi-variant analysis for forecasting Involves extensive use of paid and public databases.

-

Primary interviews and vendor-based primary research for variable impact analysis.

Market research approaches: Combined

- This is the most common method. We apply concepts from both the top-down and bottom-up approaches to arrive at a viable conclusion.

Regional Market Methodology:

The metal stamping market was analyzed at a regional level. The globe was divided into North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa, keeping in focus variables like consumption patterns, export-import regulations, consumer expectations, etc. These regions were further divided into seven countries, namely, the U.S., Germany, the UK, Italy, China, India, Japan.

All three above-mentioned market research methodologies were applied to arrive at regional-level conclusions. The regions were then summed up to form the global market.

Metal stamping market companies & financials:

The metal stamping market was analyzed via companies operating in the sector. Analyzing these companies and cross-referencing them to the demand equation helped us validate our assumptions and conclusions. Key market players analyzed include:

-

Gestamp: Gestamp was founded in 1997 as a spin-off of Gonvarri and is headquartered in Madrid, Spain. It is an international group dedicated to the design, development, and manufacturing of metal automotive components, with special emphasis on developing innovatively designed products to achieve increasingly safer and lighter vehicles, thereby reducing energy consumption and environmental impact. The group has numerous subsidiaries and all of them are dedicated to the development and manufacturing of metal components for the automotive industry through stamping, assembly, welding, tailor-welded blanks, and construction of tools, and machinery. It has service companies as well, which are engaged in the R&D of innovative technologies.

-

Interplex Holdings Pte. Ltd: Interplex. is headquartered in Singapore. The group has several subsidiaries such as AE Technology Sdn Bhd., AE Rubber Sdn Bhd, Interplex Hungary KFT, Lian Jun Industrial PTE Ltd., and Amtek International Pte Ltd., among others. The group’s multi-technology expertise enables it to provide top-notch customized solutions across a wide range of applications. It offers various solutions in power & signals, connectors, high-precision engineering, interconnect technology, and mechanical. Its products and solutions are catered to various markets including automotive, datacom, telecom, industrial & infrastructure, medical & life sciences, and aerospace. The group’s global footprint is flanked by 2 power teams, Interplex Product Development (IPD) and Interplex Tech Innovation Centers (TICs). The group has numerous quality registrations, including ISO 9001, IATF 16949, ISO 14001, ISO 13485 certifications, and FDA registration in Design Control. The group has its presence across 14 countries with 6 development sites, 10 R&D centers, 29 manufacturing sites, with around 13,000 employees, and provides over 39,000 products.

-

Kenmode, Inc.: Kenmode Inc. was founded in 1960 and is headquartered in Illinois, U.S. The company is engaged in manufacturing custom metal stampings and assemblies for automotive, electronics, medical devices, and insert molding industries. The metal stamping products offered by the company are manufactured using various materials such as stainless steel, aluminum-clad copper, aluminum, titanium, noble metals, Mylar, and other ferrous & non-ferrous metals. It also provides comprehensive metal stamping services such as 3D tool design, in-house tool building, precision metal stamping, 3D high-speed hard milling, and EDM machining. The company offers insulin pumps, implantable devices, and surgical devices including endoscopic, laparoscopic, and micro-miniature parts for the medical sector.

-

AAPICO Hitech Public Company Limited: AAPICO Hitech was established in 1996 and is headquartered in Ayutthaya, Thailand. It was listed on The Stock Exchange of Thailand in 2002. The company’s main businesses are OEM auto parts manufacturing, car dealerships, and IoT connectivity and mobility. OEM auto parts manufacturing is further segmented into stamped or pressed parts, forged & machined parts, and plastic parts & plastic fuel tanks. The company has numerous subsidiaries engaged in various operations. Its subsidiaries such as AAPICO Hitech PLC, AAPICO Mitsuike (Thailand) Co., Ltd., AAPICO Amata Co., Ltd., Sumino AAPICO (Thailand) Co., Ltd., and AAPICO Hitech Parts Co., Ltd. provide metal stamping parts. The company’s other subsidiaries including AAPICO Hitech Tooling Co., Ltd. provide stamping die and AAPICO Lemtech (Thailand) Co., Ltd. provides stamping parts for automotive and electronic components.

-

Acro Metal Stamping: The company was founded in 1936 and incorporated in 1942. The company is headquartered in Wisconsin, U.S. It is engaged in metal stamping and specializes in producing progressive and compound dies. The company provides metal stamping sheets made of various materials including copper, plastic, and brass; deep-drawn enclosures & cans made from a variety of materials including steel, aluminum, brass, nickel alloys, copper, and stainless steel; electrical components; and washers. It also offers engineering design solutions for dies and individual parts and tight tolerance medium- and small-size parts such as shims & washers, connectors, and electrical components.

-

CAPARO: The group is mainly engaged in the designing, manufacturing, marketing, and distribution of value-added steel and niche emerging products. The group operates in North America, the UK, the Middle East, and India with its various subsidiaries such as Bull Moose Engineering Livonia, Caparo Engineering India Ltd – Chennai, and Caparo Middle East, among others. Caparo India, the Indian business arm of Caparo Group, began its operations in 1994, as a joint venture with India's largest car manufacturer- Maruti Suzuki India < Back to Table of Contents Metal Stamping Market Analysis, 2023 ©Grand View Research, Inc., USA. All Rights Reserved 104 Limited. Caparo India leverages its exhaustive capabilities in metal stamping, fastening, tubing, forging, fabrication, and aluminum foundry businesses.

-

Clow Stamping Company: The company was established in 1970 and is headquartered at Merrifield, Minnesota, U.S. The precision stamping and fabrication company is engaged in the fabricating and stamping of metal components for the hydraulic, commercial refrigeration, exercise equipment, light & heavy equipment, and recreational, and agriculture industries. It also offers other services, including weldments, fabrication, assemblies, hardware attachment, parts washing, special packaging, and value-added machining, to its customers. The company serves its products to various industries including agricultural, recreational, light & heavy equipment, exercise equipment, commercial refrigeration, hydraulic, and automotive, among others.

-

Goshen Stamping Company: The company was incorporated in 1923 and is headquartered in Goshen, Indiana, U.S. The company is a renowned manufacturer and supplier of metal stampings with ISO 9001 standards. It specializes in producing high volumes with a combination of medium to high-speed presses with progressive dies. The company operates 36 presses ranging from 30-ton OBIs up to 400-ton SSDC. Its press bed sizes are up to 84" x 48" with stroke ranges from 2" to 8" for stamping. It offers a wide range of stampings in various materials such as carbon-based steel, stainless steel, aluminum, or other metals

-

D&H Industries, Inc.: The company specializes in deep-drawn stampings, progressive stampings, robotic welded assemblies including resistance & MIG/TIG welding, and value-added assemblies. The company also offers various kinds of simple components including metal stamping, deep-drawn parts, welded fabrication, and lasered components. Its metal stamping products are made from stainless steel, cold-rolled steel, draw-quality steel, aluminum, copper, brass, and other high-strength materials. The company offers aluminum magazines for the M-16/AR-15 platform for the U.S. and allied governments. Its products are catered to various industries including agriculture, alternative energy, automotive, defense, engine components, furniture, heavy equipment, lawn & garden, marine, material handling, power transmission, railroad, and transportation.

-

Ford Motor Company: The company, founded on June 16, 1903, and headquartered in Michigan, U.S., is a world-leading automaker. The group operates through three segments, namely automotive, mobility, and Ford credit. Automotive – The segment includes the sale of Ford and Lincoln vehicles, service parts, and accessories, along with the associated costs to develop, manufacture, distribute, and service vehicles, parts, and accessories. In addition, it includes revenues and costs related to the company’s electrification vehicle programs. Mobility – The segment includes development costs related to autonomous vehicles and investments in mobility through Ford Smart Mobility Ford Credit Segment – The segment includes Ford Credit Business, which includes primarily vehicle-related financing and leasing activities. The group has manufacturing and assembly facilities, distribution centers, warehouses, sales or administrative offices, and engineering centers. Its facilities are situated in various parts of the U.S. including assembly plants, engine plants, casting, metal stamping plants, transmission plants, and other component plants. The group has eight stamping plants of which six are in the U.S. and the remaining two are located each in Argentina and Australia. For the automotive industry, the company provides precision metal stamping products for brake components, hose clamps, engine components, brackets, safety-related devices & seat belts, retainer clips, interior & exterior lighting components, windshield wiper arms & system components, and transmission components. The company also offers metal stamping products for various electronic applications such as data communications, computers, terminals, and keyboards, besides catering to consumer goods & appliances and telecommunication sectors.

Value chain-based sizing & forecasting

Supply Side Estimates

-

Company revenue estimation via referring to annual reports, investor presentations, and Hoover’s.

-

Segment revenue determination via variable analysis and penetration modeling.

-

Competitive benchmarking to identify market leaders and their collective revenue shares.

-

Forecasting via analyzing commercialization rates, pipelines, market initiatives, distribution networks, etc.

Demand side estimates

-

Identifying parent markets and ancillary markets

-

Segment penetration analysis to obtain pertinent

-

revenue/volume

-

Heuristic forecasting with the help of subject matter experts

-

Forecasting via variable analysis

Metal Stamping Market Report Objectives:

-

Understanding market dynamics (in terms of drivers, restraints, & opportunities) in the countries.

-

Understanding trends & variables in the individual countries & their impact on growth and using analytical tools to provide high-level insights into the market dynamics and the associated growth pattern.

-

Understanding market estimates and forecasts (with the base year as 2023, historic information from 2018 to 2022, and forecast from 2024 to 2030). Regional estimates & forecasts for each category are available and are summed up to form the global market estimates.

Metal Stamping Market Report Assumptions:

-

The report provides market value for the base year 2023 and a yearly forecast till 2030 in terms of revenue/volume or both. The market for each of the segment outlooks has been provided on region & country basis for the above-mentioned forecast period.

-

The key industry dynamics, major technological trends, and application markets are evaluated to understand their impact on the demand for the forecast period. The growth rates were estimated using correlation, regression, and time-series analysis.

-

We have used the bottom-up approach for market sizing, analyzing key regional markets, dynamics, & trends for various products and end-users. The total market has been estimated by integrating the country markets.

-

All market estimates and forecasts have been validated through primary interviews with the key industry participants.

-

Inflation has not been accounted for to estimate and forecast the market.

-

Numbers may not add up due to rounding off.

-

Europe consists of EU-8, Central & Eastern Europe, along with the Commonwealth of Independent States (CIS).

-

Asia Pacific includes South Asia, East Asia, Southeast Asia, and Oceania (Australia & New Zealand).

-

Latin America includes Central American countries and the South American continent

-

Middle East includes Western Asia (as assigned by the UN Statistics Division) and the African continent.

Primary Research

GVR strives to procure the latest and unique information for reports directly from industry experts, which gives it a competitive edge. Quality is of utmost importance to us, therefore every year we focus on increasing our experts’ panel. Primary interviews are one of the critical steps in identifying recent market trends and scenarios. This process enables us to justify and validate our market estimates and forecasts to our clients. With more than 8,000 reports in our database, we have connected with some key opinion leaders across various domains, including healthcare, technology, consumer goods, and the chemical sector. Our process starts with identifying the right platform for a particular type of report, i.e., emails, LinkedIn, seminars, or telephonic conversation, as every report is unique and requires a differentiated approach.

We send out questionnaires to different experts from various regions/ countries, which is dependent on the following factors:

-

Report/Market scope: If the market study is global, we send questionnaires to industry experts across various regions, including North America, Europe, Asia Pacific, Latin America, and MEA.

-

Market Penetration: If the market is driven by technological advancements, population density, disease prevalence, or other factors, we identify experts and send out questionnaires based on region or country dominance.

The time to start receiving responses from industry experts varies based on how niche or well-penetrated the market is. Our reports include a detailed chapter on the KoL opinion section, which helps our clients understand the perspective of experts already in the market space.

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationShare this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."