- Home

- »

- Advanced Interior Materials

- »

-

Sheet Metal Market Size, Share And Growth Report, 2030GVR Report cover

![Sheet Metal Market Size, Share & Trends Report]()

Sheet Metal Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Steel, Aluminum), By End-use (Building & Construction, Automotive & Transportation), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-775-9

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Sheet Metal Market Summary

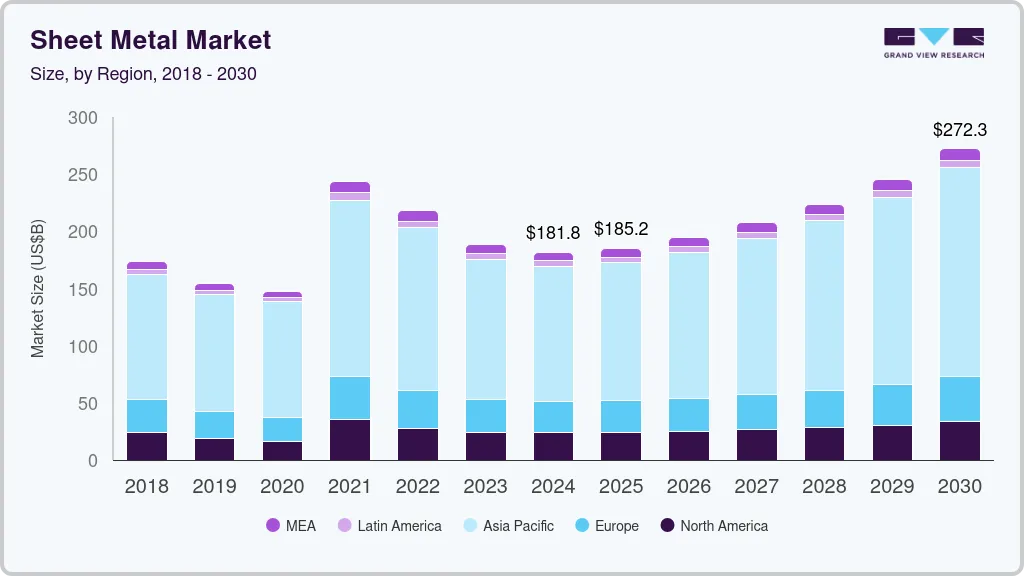

The global sheet metal market size was estimated at USD 181,846.1 million in 2024 and is projected to reach USD 272,261.2 million by 2030, growing at a CAGR of 7% from 2025 to 2030. Sheet metal is one of the common building materials used across the construction sector for various applications. Continuous expansion of the building and construction sector is one of the key drivers for market growth.

Key Market Trends & Insights

- Asia Pacific sheet metal market accounted for the largest global revenue share of 65.0% in 2023.

- The sheet metal market in China accounted for more than 69% of revenue share in 2023 in the Asia Pacific region.

- By product, steel held the largest revenue share of over 81% in 2023.

- By end use, automotive & transportation segment is anticipated to register a revenue CAGR of 7.03% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 181,846.1 Million

- 2030 Projected Market Size: USD 272,261.2 Million

- CAGR (2025-2030): 7.0%

- Asia Pacific: Largest market in 2023

Sheet metal products have high strength and are deployed in sturdy structures. Moreover, these products are thin and lightweight, which makes them easy to transport. They are ideal for use in various weather conditions and provide moisture and corrosion resistance. Other advantages of using sheet metal include durability, recyclability, and widespread availability, thus making it a suitable choice for use in construction applications.

The increasing number of single-family construction projects in the U.S. contributes to economic growth and job creation in the construction industry and also caters to the evolving housing needs of individuals and families across the country. This has resulted in a growing population that prefers renting over homeownership, thereby increasing the demand for well-maintained single-family rental properties. This overall trend is expected to positively impact the market in the U.S.

The use of lightweight materials and alloys with titanium and aluminum is likely to contribute to the growth of the sector. Titanium is a stronger and lighter metal than steel. It is alloyed with iron, aluminum, manganese, and other metals to improve physical and chemical properties. Demand for titanium metal is anticipated to grow on account of its extensive use in the aerospace industry for applications, including aircraft skin, structural parts, engine components, hydraulic systems, missiles, and rockets.

Drivers, Opportunities & Restraints

The rising investments in global construction industry act as a significant driver for the growth of sheet metal industry worldwide owing to surging number of infrastructure development projects and ongoing urbanization. As construction activities rise to meet requirements of a growing global population and ongoing modernization programs, demand for sheet metal increases since it plays a pivotal role in these activities. Sheet metal is essential for roofing and façade cladding applications, as well as for structural components, used in residential and commercial buildings.

Moreover, adoption of green building practices and stringent energy efficiency standards further enhance the demand for sheet metal in construction activities. For instance, use of coated and insulated metal panels helps enhance building envelope performance, thereby contributing to energy savings and environmental sustainability.

The rise in steel prices has compelled companies to halt their construction activities, thus impacting demand for sheet metal products. Since 2022, steel commodities have experienced daily price swings in most countries, along with fluctuations in prices of raw materials such as iron, coal, and steel scrap. The impact of demand and supply dynamics leads to extreme volatility in prices of these raw materials. Production costs also influence steel prices and storage capacity. Steel production cost is impacted by these price fluctuations, which directly influences the cost of sheet metal.

Moreover, geopolitical tensions and trade uncertainties contribute to the challenge of securing a stable supply chain. The dominance of a few countries, notably China, in steel & aluminum production raises concerns about supply chain resilience. Downstream businesses must strategically diversify their sources and explore alternative materials to mitigate risks associated with geopolitical dynamics.

Aluminum Price Trends

Global aluminum prices set records at the end of February 2022 and in the first week of March 2022. This was attributed to the Russia-Ukraine war, which resulted in supply pressure on the aluminum market. A sudden surge in global demand for aluminum from industries such as construction, automotive, and packaging during the post-pandemic recovery phase also constrained the aluminum supply globally.

In July 2023, Chinese exports of aluminum products showed no improvement, indicating subdued global demand for aluminum. The slowdown in commodity-intensive manufacturing sectors outside China reflected weak export demand amid a challenging global economic environment. Furthermore, sluggish demand for primary aluminum in Europe throughout 2023 and tight monetary policies in key economies outweighed supply disruptions in Yunnan province of China.

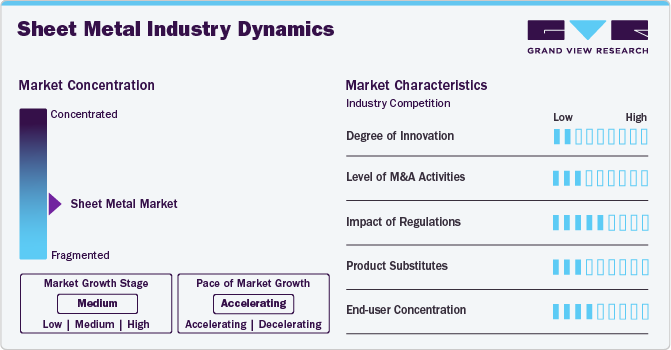

Market Concentration & Characteristics

The global sheet metal industry is moderately fragmented, with a diverse mix of small, medium, and large-scale producers spread across different regions. Moderate fragmentation promotes a competitive environment as companies strive to meet the specific demands of their regional markets.

Innovation activities are at a moderately low level, with a significant focus on enhancing production efficiency and product quality. Companies are increasingly investing in technological advancements and R&D activities aimed at developing more efficient sheet metal production methods. This drive for innovation is fueled by the need to meet stringent environmental regulations and to produce higher-quality sheets that meet evolving requirements of end users, particularly in the steel and aluminum industry.

Merger and acquisition (M&A) activity is moderate, driven by key players aiming to consolidate market positions and achieve economies of scale. Market leaders are acquiring smaller firms with efficient processes, distribution networks, and strong regional presence. The market's end user concentration is on lower side owing to its wide applicability across various end use industries.

The regulatory impact is moderately high, with stringent rules on production processes, environmental standards, quality, and worker safety. Compliance is essential to avoid severe penalties and reputational damage. The sustainability push has heightened focus on green steel and aluminum recyclability, driving the adoption of advanced technologies to minimize the environmental footprint of sheet metal production.

The presence of product substitutes, such as ceramics, plastics, and composites, poses a moderately low threat to the sheet metal industry. Superior performance characteristics of sheet metal ensure its continued preference among end users.

Product Insights

“Steel held the largest revenue share of over 81% in 2023.”

Steel sheet products have a high demand from various end use industries including automotive, construction, and heavy industries such as oil & gas, food processing, and chemicals. Stainless steel sheets are used in manufacturing of kitchenware and cookware such as sinks, grills, cookers, and pots. They are also widely used in dishwashers, countertops, refrigerators, and washing machines.

Rising importance of steel in construction industry coupled with infrastructural developments in developing and developed economies is expected to drive the market growth over the forecast period. Also, demand for steel sheet products is expected to propel over next seven years on account of their properties such as high quality, durability, economic benefits, sustainability, strength, long life, and low maintenance cost.

Properties of aluminum such as strength, lightweight, ductility, reflectivity, electrical & heat conductivity, and corrosion resistance make it suitable for various applications in several end use industries. It is one of the versatile metals and the right fit for use in joining, fabrication, machining, forming, and finishing processes.

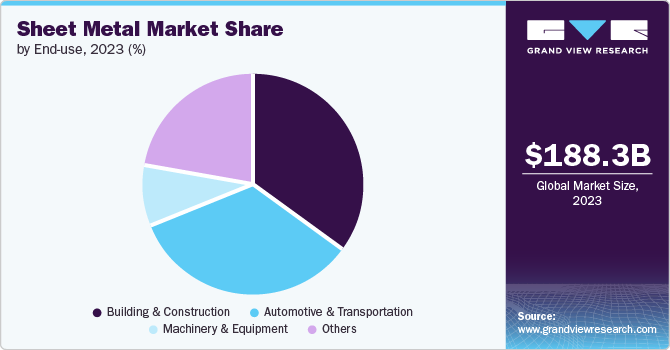

End-use Insights

“Automotive & transportation segment is anticipated to register a revenue CAGR of 7.03% over the forecast period.”

Surface-treated steel sheets, which commonly include electro-galvanized steel sheets and hot-dipped galvanized sheets, are key products used in automobile production. They are used in basic vehicle frames for doors, mufflers, hoods, and fuel tanks. Massive automobile production is a key contributor to the demand for these products.

Building & construction accounted for the highest volume share of 54.9% and is projected to grow at a lucrative pace over the forecast period. Roofing, walling, and cladding are the key applications in construction industry. The increasing use of stainless steel sheets in curtain walls and roofing has influenced the market for sheet metals positively. This can be majorly attributed to functional properties and aesthetic appeal offered by stainless steel. The use of numerous stainless steel alloys in building & construction has witnessed growth in the last few years.

The popularity of aluminum roofing sheets has been increasing in the last few years. Aluminum metal sheets offer several advantages, such as resistance to rust, high insulation, durability, good resale value, longer lifespan, and lightweight. Applications of these products include sheds & halls, roofing for houses & residential buildings, airports, cladding, industrial warehouses, parking bays, and stadiums.

Regional Insights

“China held over 69% revenue share of the overall Asia Pacific sheet metal market.”

North America sheet metal market is the third-largest market in the world, after Asia Pacific and Europe. The transportation industry including automotive, aerospace, and marine sectors is one of the key contributors to the growth of the market in North American region. In this industry, expansion of aerospace sector due to increased demand for new aircraft is anticipated to aid in market growth.

U.S. Sheet Metal Market Trends

The U.S. sheet metal market accounts for the largest revenue share in the North America region in 2023. The establishment of several aircraft companies, along with huge defense spending in the U.S., are propelling regional growth.

Europe Sheet Metal Market Trends

Europe sheet metal market trends highlight the manufacturing sector, particularly the automotive industry, as among the biggest contributors to the economy, especially in Germany and Italy. Moreover, sheet metals such as stainless steel, aluminum, and titanium used in engine components, aircraft skin, door structures, frames for doors, and seat fixtures are likely to observe growing demand due to increasing production of aircraft.

Asia Pacific Sheet Metal Market Trends

Asia Pacific sheet metal market accounted for the largest global revenue share of 65.0% in 2023 and is anticipated to continue its dominance over the forecast period owing to the presence of China. Factors such as availability of skilled and low-cost labor, integration across the industry from raw material to end-product stages, and government policies towards encouraging manufacturing sector in developing nations such as China and India, are propelling regional growth.

The sheet metal market in China accounted for more than 69% of revenue share in 2023 in the Asia Pacific region. China is a manufacturing hub with a widespread presence of mining operations, metal producers, and metal parts manufacturers. Steel is one of the key materials preferred in the sheet metal industry, and China was the largest crude steel producer in the world in 2023. Thus, raw material availability, coupled with a strong manufacturing base, makes it a dominant player in the market.

Central & South America Sheet Metal Market

The sheet metal market in Central and South America is expected to grow due to increasing investments in construction activities. Surging investments by automobile manufacturers in EVs segment and increasing construction activities in the region positively influence market growth.

Middle East & Africa Sheet Metal Market

The Middle East & Africa sheet metal market is witnessing surging investments in resorts, hotels, artificial islands, and luxury residential projects that will support growth of its construction industry. For instance, in May 2024, Radisson Hotel Group accelerated its expansion plans in Saudi Arabia with an increased focus on holy cities. It currently has 26 properties and 18 additional properties under construction. Thus, such expansive construction activities in the Middle East & Africa are anticipated to fuel the demand for sheet metal.

Key Sheet Metal Company Insights

Some of the key players operating in the market include Nippon Steel Corporation, Baosteel Group, and United States Steel Corporation.

-

Nippon Steel Corporation is Japan’s largest steelmaker. It operates through business segments, namely Steelmaking & Steel Fabrication, Engineering, Chemicals, New Materials, and System Solutions. Its core segment is Steelmaking and Steel Fabrication, which includes Engineering & Construction, Chemicals & Materials, and System Solutions. It delivers diverse products and caters to all key end-user industries of steel.

-

Baosteel Group, an integrated steel producer founded by the Shanghai Baosteel Group Corporation, produces various steel products such as HR steel, CR sheets, heavy plates, pipes and tubes, bars and wire rods, and rail and section steel. It has a total manufacturing capacity of 50.95 Mtpa across four plants in China.

-

United States Steel Corporation is an integrated steel producer operating in the U.S. and Central Europe. It produces various types of steel products that cater to diverse industries such as automotive, building & construction, consumer durables, electrical appliances, industrial equipment, and energy.

Key Sheet Metal Companies:

The following are the leading companies in the sheet metal market. These companies collectively hold the largest market share and dictate industry trends.

- JSW Steel Ltd

- Tata BlueScope Steel Private Limited

- Nippon Steel Corporation

- POSCO

- United States Steel Corporation

- JFE Steel

- Baosteel Group

- Howmet Aerospace, Inc.

- Ma’aden

- Hindalco Industries Limited

- Kaiser Aluminum Corporation

- Constellium SE

- Aleris Corporation

- Hulamin Limited

- Norsk Hydro ASA (Speira)

Recent Developments

-

In June 2024, Malaysia-based BWYS Group Bhd announced that it would build a new sheet metal plant to expand its sheet metal business. The transaction value is undisclosed. The new plant is currently under construction adjoining the existing facility in Sungai Bakap.

-

In May 2024, India-based Jindal Stainless announced major expansion and acquisition plans of nearly INR 5,400 crores (~USD 64.7 million) to boost its melting and downstream capacities. This investment is in line with its strategic expansion plans to become the largest stainless steel manufacturer in the world. Its product portfolio includes stainless steel slabs, hot rolled coils, plates and sheets, cold rolled coils and sheets, and ferroalloys.

-

In January 2024, UK-based Lantek, a sheet metal machinery manufacturer, partnered with TECHNOLOGY Italiana, a punching machinery manufacturer, to synergize and collaborate to provide new technology to market.

Sheet Metal Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 185,182.5 million

Revenue forecast in 2030

USD 272,261.2 million

Growth Rate

CAGR of 7.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative Units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America, Europe, Asia Pacific, Central & South Africa, Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, France, Italy, China, Japan, India, Brazil

Key companies profiled

JSW Steel Ltd, Tata BlueScope Steel Private Limited, Nippon Steel Corporation, POSCO, United States Steel Corporation, JFE Steel, Baosteel Group, Howmet Aerospace, Inc., Ma’aden, Hindalco Industries Limited, Kaiser Aluminum Corporation, Constellium SE, Aleris Corporation, Hulamin Limited, Norsk Hydro ASA (Speira)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

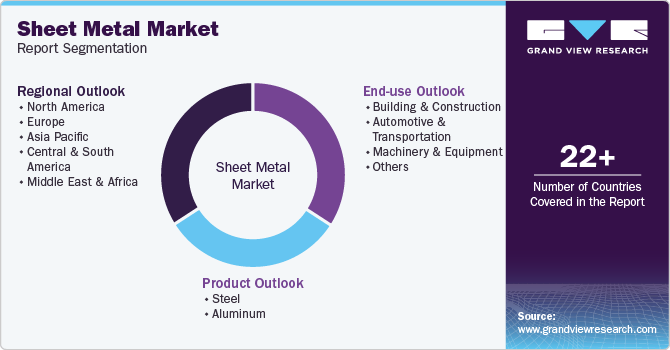

Global Sheet Metal Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global sheet metal market report based on product, end use, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Steel

-

Aluminum

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Building & Construction

-

Automotive & Transportation

-

Machinery & Equipment

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global sheet metal market size was estimated at USD 188.31 billion in 2023 and is expected to reach USD 181.85 billion in 2024.

b. The global sheet metal market is expected to grow at a compound annual growth rate of 7.0% from 2024 to 2030 to reach USD 272.26 billion by 2030.

b. Based on end use segment, building & construction held the largest revenue share of more than 34.0% in 2023 owing to growth of construction activities.

b. Some of the key vendors of the global sheet metal market are JSW Steel Ltd, Tata BlueScope Steel Private Limited, Nippon Steel Corporation, POSCO, United States Steel Corporation, JFE Steel, Baosteel Group, Howmet Aerospace, Inc., Ma’aden, among others.

b. Sheet metal is one of the common building materials used across the construction sector for various applications. Continuous expansion of the building & construction sector is one of the key drivers for the metal market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.