- Home

- »

- Plastics, Polymers & Resins

- »

-

Mexico Bag-in-Box Containers Market Size Report, 2033GVR Report cover

![Mexico Bag-in-Box Containers Market Size, Share & Trends Report]()

Mexico Bag-in-Box Containers Market (2025 - 2033 ) Size, Share & Trends Analysis Report By Application (Food & Beverage, Industrial, Household), By Component (Bag, Box, Fitments), By Tap (With Tap, Without Tap), By Capacity (1-5 Liter, 5-10 Liter), And Segment Forecasts

- Report ID: GVR-4-68040-735-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Mexico Bag-in-Box Containers Market Summary

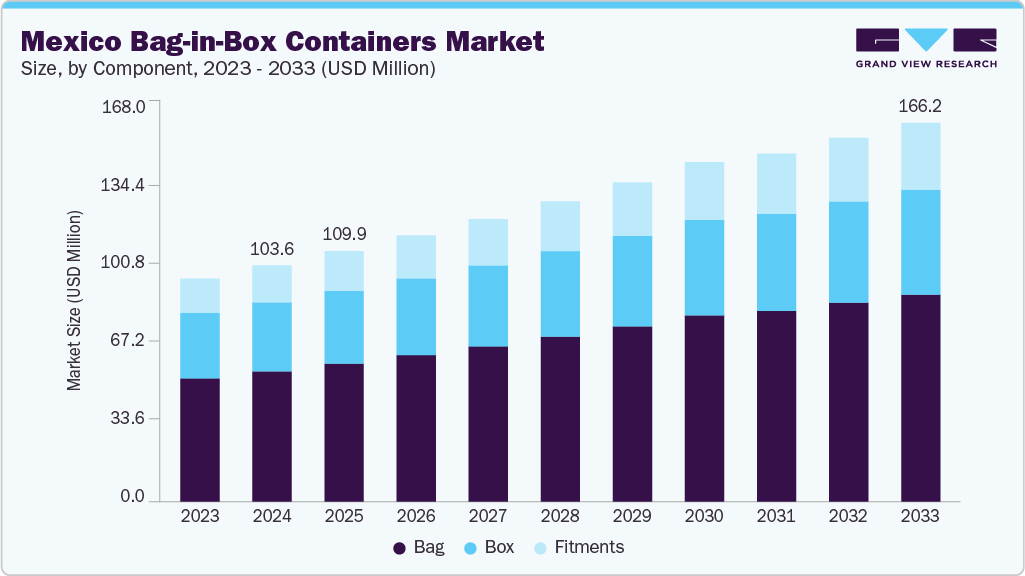

The Mexico bag-in-box containers market size was valued at USD 103.6 million in 2024 and is expected to reach USD 166.2 million by 2033, growing at a CAGR of 6.3% from 2025 to 2033. The industry is primarily driven by the rising demand for convenient, long-shelf-life packaging solutions in the food and beverage sector. Additionally, increasing wine and juice consumption is boosting the adoption of bag-in-box formats.

Key Market Trends & Insights

- By component, the fitments segment is expected to grow at a considerable CAGR of 7.7% from 2025 to 2033 in terms of revenue.

- By tap, the ‘with tap’ segment is expected to grow at a considerable CAGR of 6.5% from 2025 to 2033 in terms of revenue.

- By capacity, the 10-20 liter segment is expected to grow at a considerable CAGR of 6.9% from 2025 to 2033 in terms of revenue.

- By application, the household products segment is expected to grow at a considerable CAGR of 7.3% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 103.6 Million

- 2033 Projected Market Size: USD 166.2 Million

- CAGR (2025-2033): 6.3%

Mexico has witnessed a steady increase in the consumption of packaged beverages, including wine, juices, dairy-based drinks, and ready-to-drink beverages. The bag-in-box packaging format is highly favored in this context due to its convenience, ability to preserve freshness, and longer shelf life compared to traditional bottles. For instance, local wineries and juice manufacturers have increasingly adopted BIB containers for bulk sales and retail distribution, reducing the need for frequent restocking while maintaining product quality. This trend is particularly pronounced in urban centers like Mexico City, Guadalajara, and Monterrey, where demand for packaged beverages is growing with urbanization and changing consumer lifestyles.Bag-in-box packaging offers a cost-effective alternative to glass or PET bottles, both in terms of production and transportation. The lightweight nature of BIB containers reduces shipping costs, while the use of recyclable or partially recyclable materials aligns with sustainability goals, which are increasingly important to Mexican consumers and regulatory bodies. Companies such as Bodegas Santo Tomás and Grupo Jumex are leveraging these advantages, opting for BIB formats to reduce operational costs while catering to environmentally conscious consumers. This dual appeal of economic efficiency and sustainability is a significant driver in the Mexican market.

Mexico’s wine and beverage industry has been expanding steadily, driven by both domestic consumption and export potential. Bag-in-box packaging is particularly advantageous for wine producers because it prevents oxidation, preserves flavor over extended periods, and allows smaller and more affordable portion sizes. Wineries in Baja California, which is the hub of Mexico’s wine production, have increasingly turned to BIB formats to target younger consumers seeking affordable yet quality options. Additionally, the convenience of BIB packaging for foodservice providers and restaurants helps boost adoption within the hospitality sector.

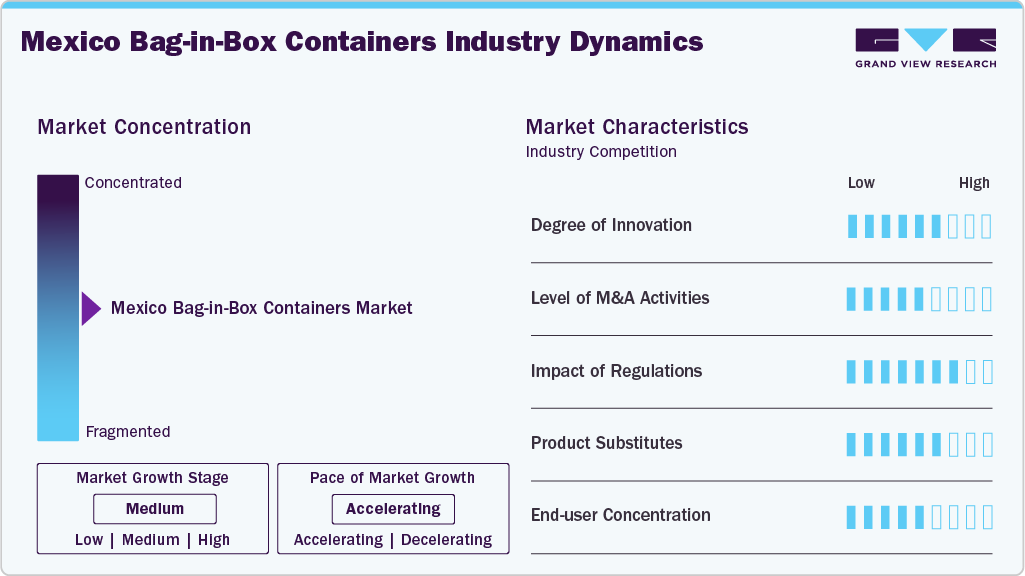

Market Concentration & Characteristics

The Mexico BIB container industry is moderately fragmented, with a mix of local manufacturers, regional suppliers, and international players competing for market share. Key global suppliers such as Smurfit Westrock, Tetra Pak, and SIG operate alongside Mexican producers, catering to domestic demand. Competition is primarily based on product quality, customization options (size, material, and barrier properties), and cost-efficiency. Smaller local manufacturers often focus on flexible production runs and niche beverage segments, while larger companies supply high-volume clients like wineries, juice producers, and dairy companies.

Regulatory compliance and sustainability are increasingly defining characteristics of the market. BIB containers must meet food contact safety standards established by the Mexican Ministry of Health (COFEPRIS), and packaging recyclability is becoming a key selling point. Companies are under pressure to minimize environmental impact, prompting the adoption of recyclable materials and reduced plastic content. Additionally, sustainability-focused brands are leveraging eco-friendly BIB packaging as a marketing tool to appeal to environmentally conscious consumers.

Component Insights

The bag segment recorded the largest revenue share of over 55.0% in 2024. The bag component is typically made from flexible, multi-layered plastic films, designed to hold liquids such as juices, wine, dairy products, and other beverages. It serves as the primary containment unit and is engineered to prevent leakage, preserve freshness, and extend the shelf life of the product. Bags often include barrier layers like EVOH or metallized films to protect against oxygen, moisture, and light, making them suitable for sensitive liquid products. The convenience of lightweight, flexible bags compared to rigid containers, and their ability to maintain product quality over extended periods, support their growth.

The fitments segment is expected to grow at the fastest CAGR of 7.7% during the forecast period. Fitments include the spouts, taps, or valves attached to the bag that allow for controlled dispensing of liquids. They are typically made from plastic materials and are designed for easy operation, hygiene, and preventing spillage. Fitments play a critical role in maintaining the product's integrity, ensuring user convenience, and reducing wastage during dispensing. The growth of the fitments segment is fueled by increasing consumer preference for convenience-oriented packaging solutions.

Tap Insights

The ‘with tap’ segment recorded the largest revenue share of over 69.0% in 2024 and is expected to grow at the fastest CAGR of 6.5% during the forecast period. Bag-in-box containers with taps are designed for easy dispensing of liquids, making them ideal for consumer-facing applications such as beverages (wine, juice), dairy products, and household cleaners. The tap mechanism enhances user experience by providing easy dispensing without the need for additional tools or equipment.

Bag-in-box containers without taps are typically used for bulk storage and industrial applications where precise dispensing is less critical. These containers are often employed in settings such as food processing, institutional kitchens, and chemical industries. The absence of a tap reduces manufacturing complexity and cost, making it an economical choice for large-scale operations. The growth of the bag-in-box market without taps is fueled by its cost-effectiveness and suitability for bulk storage and transportation.

Capacity Insights

The 10-20 liter segment recorded the largest revenue share of over 31.0% in 2024 and is expected to grow at the fastest CAGR of 6.9% during the forecast period. This segment targets high-volume usage in both commercial and industrial applications, including large-scale catering, food production, and beverage manufacturing. The 10-20 liter BiB containers are designed for bulk liquid storage while maintaining product freshness and minimizing spoilage, which is critical in large operations. The main drivers include the expansion of large-scale food and beverage manufacturing and increased demand for bulk packaging in commercial kitchens.

BiB containers in the 5-10 liter range are often used in institutional and commercial settings, including restaurants, cafes, and catering services. This segment caters to users requiring moderate volumes of liquids such as wine, juice, syrups, or cooking oils. The larger capacity allows for fewer packaging changes and efficient inventory management in commercial setups. This segment is driven by the growth of the foodservice and hospitality industries in Mexico. Increased demand from restaurants, bars, and hotels for ready-to-use bulk liquid products encourages adoption.

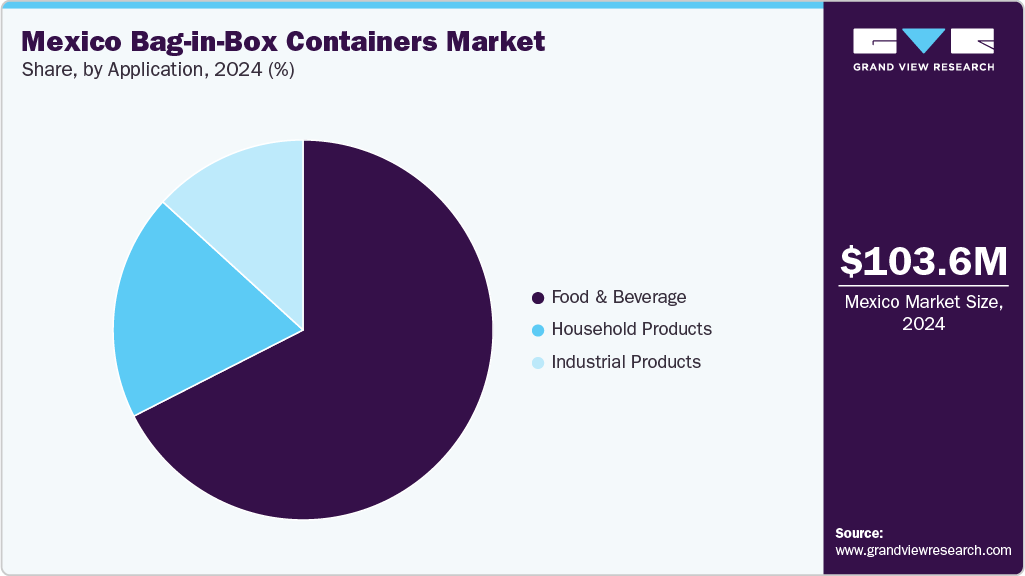

Application Insights

The food & beverage segment recorded the largest market share of over 67.0% in 2024. The food and beverage segment dominates the bag-in-box containers market in Mexico, primarily due to the increasing demand for liquid consumables such as juices, wine, dairy products, sauces, and edible oils. Supermarkets, convenience stores, and foodservice providers increasingly prefer BIB packaging for ready-to-use and bulk liquid products, boosting adoption. Additionally, the growth of organized retail chains and online grocery sales in Mexico has strengthened the demand for convenient, lightweight, and cost-effective liquid packaging solutions.

The household products segment is expected to grow at the fastest CAGR of 7.3% during the forecast period. Household products such as liquid detergents, cleaning agents, and soaps are increasingly being packaged in BiB containers in Mexico. The packaging format is ideal for large-volume household liquids, offering spill-proof storage, ease of dispensing, and reduced shipping costs. Retailers and distributors find BIB packaging attractive because it lowers packaging and transportation costs while maintaining product quality and usability. The main driving factor is the growing urbanization and busy lifestyle of consumers, which has led to increased demand for larger pack sizes and convenience-focused solutions.

Key Mexico Bag-in-Box Containers Company Insights

Key players operating in the Mexico bag-in-box containers market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Mexico Bag-in-Box Containers Companies:

- Amcor plc

- Smurfit Westrock

- Liquibox

- SIG

- Tetra Pak

- CDF Corporation

- ZACROS AMERICA, INC.

- Aran Group

- GNS Packaging Solutions

Recent Developments

-

In April 2025, Amcor plc completed its all-stock combination with Berry Global. This merger positioned Amcor as a stronger global leader in consumer and healthcare packaging solutions, combining material science and innovation capabilities to better meet sustainability goals.

-

In November 2024, Smurfit Westrock plc unveiled its new EasySplit Bag-in-Box innovation to help customers comply with upcoming packaging regulations requiring at least 80% recyclability. The EasySplit design makes it easier to separate the box and bag components, boosting overall recyclability to over 90%. This innovation addresses challenges in recycling mixed materials, where improper separation could reduce recyclability to 75% or less.

-

In January 2024, Liquibox launched the VINIflow Secure dispensing tap with integrated tamper protection as a major step in sustainable packaging for bag-in-box and stand-up pouch products. This new tap design ensures the tamper protection piece stays attached, preventing plastic litter and improving recyclability. The tap is suitable for various liquids like wine, juice, and water, and fits existing filling lines, allowing seamless adoption without extra costs.

Mexico Bag-in-Box Containers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 109.9 million

Revenue forecast in 2033

USD 166.2 million

Growth rate

CAGR of 6.3% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in million units; revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Volume & revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Component, tap, capacity, application

Key companies profiled

Amcor plc; Smurfit Westrock; Liquibox; SIG; Tetra Pak; CDF Corporation; ZACROS AMERICA, INC.; Aran Group; GNS Packaging Solutions

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Mexico Bag-in-Box Containers Market Report Segmentation

This report forecasts volume & revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Mexico bag-in-box containers market report based on component, tap, capacity, and application:

-

Component Outlook (Volume, Million Units; Revenue, USD Million, 2021 - 2033)

-

Bag

-

Box

-

Fitments

-

-

Tap Outlook (Volume, Million Units; Revenue, USD Million, 2021 - 2033)

-

With Tap

-

Without Tap

-

-

Capacity Outlook (Volume, Million Units; Revenue, USD Million, 2021 - 2033)

-

< 1 Liter

-

1-5 Liter

-

5-10 Liter

-

10-20 Liter

-

> 20 Liter

-

-

Application Outlook (Volume, Million Units; Revenue, USD Million, 2021 - 2033)

-

Food & Beverage

-

Alcoholic Beverages

-

Wine

-

Beer

-

Others

-

-

Non-Alcoholic Beverages

-

Soft Drinks

-

Juices & Flavored Drinks

-

Water

-

-

Others

-

Tomato Products

-

Milk & Dairy Products

-

Liquid Eggs

-

Edible Oil

-

Others

-

-

-

Industrial Products

-

Oils

-

Industrial Fluids

-

Petroleum Products

-

-

Household Products

-

Household Cleaners

-

Liquid Detergents

-

Liquid Soaps & Handwash

-

Others

-

-

Frequently Asked Questions About This Report

b. The Mexico bag-in-box containers market was estimated at around USD 103.6 million in the year 2024 and is expected to reach around USD 109.9 million in 2025.

b. The Mexico bag-in-box containers market is expected to grow at a compound annual growth rate of 6.3% from 2025 to 2033 to reach around USD 166.2 million by 2033.

b. The food & beverage segment emerged as the dominating application segment in the Mexico bag-in-box containers market due to rising demand for convenient, cost-effective, and long shelf-life packaging for wine, juices, dairy, and sauces.

b. The key players in the Mexico bag-in-box containers market include Amcor plc; Smurfit Westrock; Liquibox; SIG; Tetra Pak; CDF Corporation; ZACROS AMERICA, INC.; Aran Group; and GNS Packaging Solutions.

b. The market is primarily driven by the rising demand for convenient, long-shelf-life packaging solutions in the food and beverage sector.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.