- Home

- »

- Electronic Devices

- »

-

Mexico Cleanroom Technology Market Size Report, 2030GVR Report cover

![Mexico Cleanroom Technology Market Size, Share & Trends Report]()

Mexico Cleanroom Technology Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Equipment, Consumables), By Cleanroom Type, By Service Type, By Industry Vertical Competitive Strategies, And Segment Forecasts

- Report ID: GVR-4-68040-062-0

- Number of Report Pages: 96

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

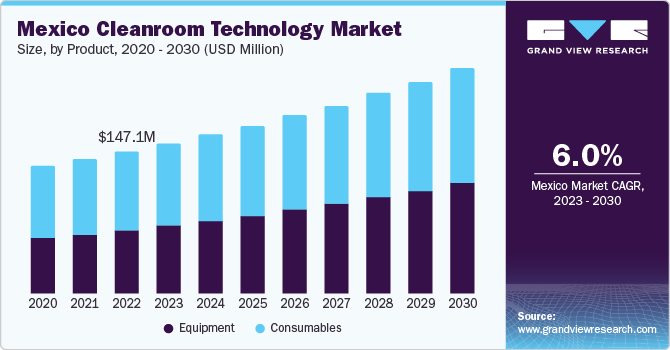

The Mexico cleanroom technology market size was valued at USD 147.1 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.0% from 2023 to 2030. The country’s favorable manufacturing environment, thanks to factors such as free trade agreements and the availability of low-cost labor, is one of the key factors driving the adoption of cleanroom technology. Moreover, notable growth observed in the healthcare and automotive manufacturing sectors further boosts the market's growth prospects. Stringent international and local regulations about manufacturing and production of goods across industries are also likely to boost the use of cleanroom technology solutions and services.

In Mexico, the cleanroom technology market is experiencing growth due to the expansion of pharmaceutical and biotechnology industries, increased investments in healthcare infrastructure, and a rising demand for quality electronic components. Cleanrooms are vital for research, manufacturing, and testing processes in these sectors, ensuring compliance with industry regulations and standards.

Companies in Mexico are investing in advanced cleanroom technologies to meet stringent quality requirements, enhance productivity, and minimize contamination risks during production. Additionally, government initiatives and regulations promoting quality and safety standards are further driving the growth of the cleanroom technology market in the country.

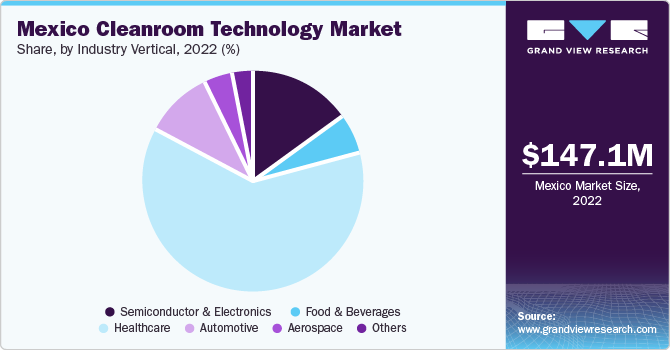

Industry Vertical Insights

In terms of industry vertical, the market is classified into semiconductor & electronics, food & beverages, healthcare, automotive, aerospace, and others. The healthcare segment has dominated the market, gaining a market share of more than 61% in 2022 and witnessing the highest CAGR of 6.6% during the forecast period. Cleanroom solutions are highly adopted in Mexico’s pharmaceutical & healthcare industry due to the stringent regulations concerning pharmaceutical production drafted by the nation’s Federal Committee for Protection from Sanitary Risks (COFEPRIS). The U.S. Department of Commerce’s International Trade Administration (ITA) estimated pharmaceutical sales in Mexico in 2022 at USD 10.12 billion. Moreover, there are about 400 laboratories manufacturing pharmaceuticals in Mexico, and all of them need to abide by the established high standards applicable to healthcare manufacturing activities in Mexico.

The semiconductor & electronics segment is anticipated to witness a CAGR of 5.4% throughout the forecast period. Semiconductors are used in most electronic devices, from consumer devices such as smartphones and laptops to complex defense equipment and automobiles. They are produced with highly sensitive material and can be easily affected by environmental contaminants such as airborne particles and pollutants. Hence, semiconductor manufacturers use cleanrooms to maintain quality and reduce semiconductor failures. Moreover, the presence of leading semiconductor manufacturing companies such as U.S.-based Intel Corporation and Texas Instruments Incorporated contribute to the growth of semiconductor manufacturing in the country. Improving technological infrastructure and nearshoring are likely to further boost the country's semiconductor manufacturing sector.

COVID-19 Impact on the Mexico Cleanroom Technology Market

The Mexican economy encountered significant challenges in the wake of the outbreak of the COVID-19 pandemic. Mexico’s first confirmed COVID-19 case was reported in February 2020, which led to the shutdown of non-essential activities as part of the social distancing norms and restrictions on the movement of people. According to the Federal Reserve Bank of Dallas, while total employment in Mexico dropped 3.7% from March 2020 to December 2020, the total employment in Mexico’s manufacturing sector dropped 4.3% during the same period.

The Mexican economy shrank by 4.5% in 2020, and the output of goods-producing industries, such as manufacturing, fell by 0.5%, which lowered the demand for cleanroom solutions and services in the short term, as the overall manufacturing activity dropped in the country. However, as restrictions were lifted, manufacturing and exports returned to pre-pandemic levels. The pharmaceutical products and local medical device and equipment manufacturing market also grew between 2019 and 2020. According to the U.S. Department of Commerce’s International Trade Administration (ITA), the total local production of medical devices and equipment grew from USD 15.27 billion in 2019 to USD 16.80 billion in 2020 in Mexico.

Product Insights

In terms of product, the market is classified into equipment and consumables. The consumables segment has dominated the market, gaining a significant market share of more than 55% in 2022. The consumables are divided into safety consumables & cleaning consumables. The consumables play a vital role in maintaining cleanliness, sterility, and controlled conditions within cleanrooms. They include items like gloves, wipes, apparel, disinfectants, and other disposable products essential for daily operations in cleanroom environments. The demand for consumables in the market is propelled by various industries, such as pharmaceuticals, biotechnology, electronics, and healthcare, which extensively use cleanrooms for their operations. The consistent need to maintain high levels of hygiene and control contamination within these industries drives the consumption of consumables.

The equipment segment is anticipated to grow at the fastest CAGR of 7.3% throughout the forecast period. The equipment segment has been further segmented into HEPA Filters, HVAC Systems, Fan Filter Unit (FFU), Laminar Air Flow Systems and Biosafety Cabinets, and others. The adoption of cleanroom equipment in Mexico is growing in line with the strong emphasis manufacturing entities are putting on contamination control and regulatory compliance. At the same time, the efforts being pursued aggressively by the incumbents of the industries and industry verticals relying meticulously on clean and controlled environments also bode well for the growth of the market as these industry incumbents would continue adopting cutting-edge cleanroom equipment and technology as they continue to expand their manufacturing operations and transform digitally.

Cleanroom Type Insights

In terms of cleanroom type, the market is classified into softwall cleanroom, hardwall cleanroom, rigidwall cleanroom, others. The hardwall cleanroom type segment dominated the Mexico cleanroom technology market, gaining a more than 44% market share in 2022. The high durability and greater security of hardwall cleanrooms are driving the segment's growth. Moreover, hardwall cleanrooms are easy to maintain as the hardwall panels can be easily cleaned. Hardwall cleanrooms are designed to meet all the standards specified by the ISO cleanroom classification. A hardwall cleanroom provides a stable structure to protect individuals or products, with the hardwall panels making it easier to regulate pressure within the contained environment. Moreover, hardwall cleanrooms are soundproof and offer greater security than softwall cleanrooms.

The rigidwall cleanroom type segment is expected to grow at the fastest CAGR of 6.9% during the forecast period. Rigidwall cleanrooms offer a professional aesthetic due to their nature of construction. They enable easy in-room activity monitoring and display work to visitors, inspectors, and executives. The benefits of rigidwall cleanrooms, such as durability similar to hardwall cleanroom at a price similar to that of a softwall cleanroom, drives the segment’s growth. In addition, they can easily be modified or stored if more space is needed. The panels are suspended from a sturdy ceiling grid, ensuring they retain shape and integrity over time.

Service Type Insights

In terms of service type, the market is classified into professional services, and managed services. The professional services segment has dominated the market, gaining a market share of more than 67% in 2022 and witnessing a CAGR of 5.2% during the forecast period. The professional services segment is further segmented into consultation services, budgeting and planning services, design and engineering services, construction and assembly services, testing and certification services, and preventative maintenance services. Professional services offer customers the expertise required to make the most of cleanroom technology solutions and services. The facilities are complex, and various factors must be considered while investing in them. Moreover, the need for custom cleanroom solutions across industries, depending on the product type, requires expert guidance. Many Mexico technology market players offer professional services for cleanrooms. The need for expertise due to the complexity of cleanrooms and the wide availability of professional services is driving the segment's growth.

The managed service segment is anticipated to witness the fastest CAGR of 7.4% throughout the forecast period. Managed services help manage day-to-day operations or activities of a cleanroom environment. They include services such as 24/7 technical support. Managed services actively help customers achieve business goals. Tools such as Building Management System (BMS) are used to monitor equipment and facilities. In addition, it provides a filtration system monitoring solution through its data management system called Viledon Process View. The need to ensure the functioning of the equipment and the growing use of digital tools in cleanroom monitoring are driving the growth of this segment.

Key Companies & Market Share Insights

The market is fragmented with numerous local and international players and is likely to witness high competition in the market. These players are adopting strategies such as acquisition to gain a competitive edge. In September 2022, American Air Filter Company, Inc. announced the acquisition of National Air Filter, a U.S.-based air filtration management company. National Air Filter offered controlled environments and cleanroom services to ensure consistent operation. With this acquisition, American Air Filter Company, Inc. aimed to improve its offerings and customer experience.

Key Mexico Cleanroom Technology Companies:

- Aeris Clean Room Solutions

- American Air Filter Company, Inc.

- KCWW

- 3M

- Freudenberg Filtration Technologies GmbH & Co. KG

- Camfil

- Hermosillo

- Sapphire Cleanrooms

- TÜV SÜD

- Weiss Technik

Mexico Cleanroom Technology Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 232.9 million

Growth rate

CAGR of 6.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

December 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Country scope

Mexico

Key companies profiled

Aeris Clean Room Solutions; American Air Filter Company, Inc; KCWW; 3M; Freudenberg Filtration Technologies GmbH & Co. KG; Camfil; Hermosillo; Sapphire Cleanrooms; TÜV SÜD; Weiss Technik

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Mexico Cleanroom Technology Market Report Segmentation

This report forecasts revenue growth at a country level and offers a qualitative and quantitative analysis of the market trends for each of the segments and sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the Mexico cleanroom technology market report based on product, cleanroom type, service type, industry vertical:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Equipment

-

Fan Filter Units (FFU)

-

HVAC Systems

-

Laminar Air Flow Systems & Biosafety Cabinets

-

HEPA Filters

-

Others

-

-

Consumables

-

Safety Consumables

-

Gloves

-

Apparel

-

Other Safety Consumables

-

-

Cleaning Consumables

-

Wipes

-

Disinfectants

-

Other Cleaning Consumables

-

-

-

-

Cleanroom Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Softwall Cleanroom

-

Hardwall Cleanroom

-

Rigidwall Cleanroom

-

Others

-

-

Service Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Professional Services

-

Consultation Services

-

Budgeting & Planning Services

-

Design & Engineering Services

-

Construction & Assembly Services

-

Testing & Certification Services

-

Preventative Maintenance Services

-

-

Managed Services

-

-

Industry Vertical Outlook (Revenue, USD Million, 2017 - 2030)

-

Semiconductor & Electronics

-

Food & Beverages

-

Healthcare

-

Automotive

-

Aerospace

-

Others

-

Frequently Asked Questions About This Report

b. The Mexico cleanroom technology market size was estimated at USD 147.1 million in 2022 and is expected to reach USD 155.3 million in 2023.

b. The Mexico cleanroom technology market is expected to grow at a compound annual growth rate of 6.0% from 2023 to 2030 to reach USD 232.9 million by 2030.

b. The consumables segment dominated the Mexico cleanroom technology market with a share of over 55.0% in 2022. This is attributable to increased demand for products such as gloves, disinfectants, and wipes to combat the COVID-19 situation in health facilities.

b. The key players in the market includes Aeris Clean Room Solutions, American Air Filter Company, Inc, KCWW, 3M, Freudenberg Filtration Technologies GmbH & Co. KG, Camfil, Hermosillo, Sapphire Cleanrooms, TÜV SÜD, and Weiss Technik among others.

b. Key factors that are driving the market growth include the country’s favorable manufacturing environment, thanks to factors such as free trade agreements and the availability of low-cost labor, which is one of the key factors driving the adoption of cleanroom technology.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.