- Home

- »

- Consumer F&B

- »

-

Mezcal Market Size, Share & Trends, Industry Report, 2030GVR Report cover

![Mezcal Market Size, Share & Trends Report]()

Mezcal Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Joven, Reposado, Añejo), By Category (100% Agave, Blend), By Distribution (Specialty Stores, Online), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-548-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Mezcal Market Summary

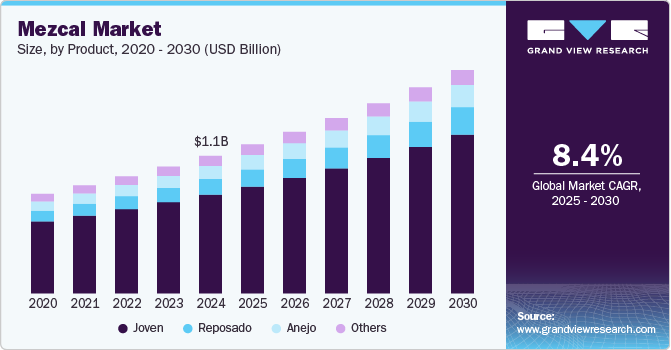

The global mezcal market size was estimated at USD 1,140 million in 2024 and is projected to reach USD 1,852.5 million by 2030, growing at a CAGR of 8.4% from 2025 to 2030. A growing consumer preference for premium alcoholic beverages has had a significant impact on the market growth.

Key Market Trends & Insights

- North America dominated the mezcal market with the largest revenue share of 61.90% in 2024.

- The mezcal market in the U.S. accounted for the largest market revenue share in North America in 2024.

- Based on product, the Joven mescal segment led the market with the largest revenue share of 71.77% in 2024.

- Based on application, the 100% agave mezcal segment accounted for the largest revenue share in 2024.

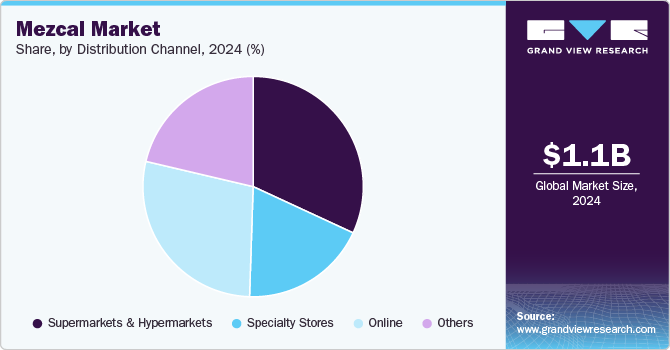

- Based on distribution channel, the supermarkets and hypermarkets segment led the market with the largest revenue share of 31.90% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1,140 Million

- 2030 Projected Market Size: USD 1,852.5 Million

- CAGR (2025-2030): 8.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

As consumers increasingly seek high-quality, artisanal products, mezcal has emerged as a favored choice due to its unique flavor profiles and traditional production methods. This trend is particularly strong among wealthier demographics, who are willing to invest in niche products that offer authenticity and craftsmanship. Another critical factor driving the mezcal industry is the growing interest in agave distillates, mainly influenced by the popularity of tequila. Mezcal, which can be produced from over 36 different agave species, offers a diverse range of flavors compared to tequila, which is typically made from blue agave. This diversity appeals to consumers looking for new and exciting drinking experiences.

The demand for authentic and sustainably produced beverages has also contributed to the rising popularity of mezcal. Consumers today are increasingly aware of the origins of their drinks and prefer products made with natural ingredients and adhering to ethical sourcing practices. This shift toward sustainability aligns with mezcal's traditional production methods, which often emphasize local ingredients and artisanal techniques. The increasing appreciation for craftsmanship in beverage production has led to a growing segment of consumers who value the historical and cultural significance of mezcal.

The expansion of mezcal into international markets further fuels its growth. As global interest in unique alcoholic beverages rises, more consumers are exploring mezcal beyond its Mexican roots. The cocktail culture has embraced mezcal, with mixologists incorporating it into various cocktails, thereby enhancing its visibility and appeal. Regions such as North America and Europe have become significant markets for mezcal, with increasing imports and consumer interest driving demand.

Innovation within the mezcal sector has also played a vital role in its market growth. The introduction of ready-to-drink (RTD) mezcal cocktails and flavored variations caters to contemporary consumer preferences for convenience without sacrificing quality. These innovations not only attract new consumers but also help maintain the traditional characteristics of mezcal while adapting to modern drinking habits. As a result, brands are increasingly focusing on creating unique flavor profiles that resonate with diverse consumer tastes.

The competitive landscape of the mezcal industry is evolving as major players invest in sustainable practices and expand their brands. Companies like Diageo PLC and Pernod Ricard SA are actively acquiring smaller brands and forming partnerships to enhance their market presence while promoting authentic production methods. This competitive drive ensures that mezcal remains relevant in an ever-changing beverage landscape, appealing to both traditional enthusiasts and new consumers alike.

The mezcal industry faces several challenges that impact its growth and expansion. One of the primary challenges is competition from other well-established spirits like tequila, whiskey, and rum, which can lead to price wars and marketing challenges, making it difficult for mezcal brands to establish a unique identity. In addition, quality control and authenticity concerns arise due to inconsistencies in quality standards and a lack of uniform regulations among producers, which can reduce consumer trust and affect brand reputation and sales. Regulatory hurdles also pose a significant challenge, as complex frameworks governing production, labeling, and certification can be costly and difficult for producers, especially smaller operations, to comply with. Furthermore, supply chain disruptions due to fluctuations in agave supply caused by weather, disease, or market factors can disrupt production and increase costs.

Product Insights

The Joven mescal segment led the market with the largest revenue share of 71.77% in 2024. Joven Mezcal has experienced significant growth due to its affordability and versatility. This unaged or minimally aged spirit offers a pure and vibrant agave flavor, making it ideal for cocktails such as Mezcal Margaritas and Palomas. The wide range of flavors, including citrus, green apple, and white pepper, further enhances its popularity. Younger consumers and mixologists are particularly drawn to Joven Mezcal because it provides an authentic agave experience that is both bold and refreshing. In addition, its lower price point compared to aged mezcals makes it more accessible to a broader audience, contributing to its rapid growth in the global market.

The appeal of Joven mezcal is also driven by its adaptability in modern mixology. Bartenders appreciate its ability to add depth and smokiness to a variety of drinks, while consumers enjoy its unique flavor profile that sets it apart from other spirits. As interest in craft cocktails continues to rise, Joven mezcal is well-positioned to remain a staple in bars and restaurants. Furthermore, its connection to traditional Mexican culture and artisanal production methods resonates with consumers seeking authentic and sustainable products, further fueling its growth.

Reposado Mezcal has seen steady growth due to its balanced profile, which appeals to a wide range of consumers. Aged for 2 to 12 months in oak barrels, Reposado offers a smoother and more refined flavor compared to Joven, with hints of vanilla and caramel. This makes it an excellent choice for those transitioning from other aged spirits like tequila or whiskey. The increasing demand for approachable yet refined spirits has contributed to the steady growth of this category. Reposado mezcal's ability to bridge the gap between the boldness of Joven and the complexity of Añejo has made it a favorite among consumers seeking a versatile and enjoyable drinking experience.

The growth of Reposado mezcal is also driven by its appeal to consumers looking for a more mature flavor without the high price tag of Añejo. Its moderate aging process allows it to retain some of the agave's natural characteristics while acquiring subtle oak notes, making it a great introduction to aged mezcals. In addition, Reposado's smoothness has led to its inclusion in various cocktails and sipping occasions, further expanding its market reach. As consumers become more adventurous in their spirits choices, Reposado mezcal's balanced profile positions it well for continued growth in both traditional and emerging markets.

Añejo Mezcal represents the premium segment of the market and is expected to grow at a CAGR of 9.1% from 2025 to 2030 due to its rich and complex flavors. Aged for over a year in wooden barrels, Añejo mezcal offers notes of honey, dark chocolate, and spices, making it a favorite among connoisseurs and affluent consumers seeking luxury beverages. The rising trend of premiumization in the spirits market has fueled demand for Añejo mezcal, aligning with the preferences of those who value craftsmanship and exclusivity. Its high-end positioning and limited production volumes contribute to its allure, making it a sought-after choice for special occasions and sophisticated gatherings.

The growth of Añejo mezcal is also driven by its appeal to consumers who appreciate artisanal craftsmanship and unique flavor profiles. The lengthy aging process and careful selection of agave varieties result in a sophisticated spirit that is both refined and complex. As consumers become more educated about spirits and seek unique experiences, Añejo mezcal's exclusivity and craftsmanship have positioned it as a leader in the premium spirits category. Furthermore, its pairing potential with fine cuisine and its use in high-end cocktails have expanded its reach beyond traditional mezcal enthusiasts, contributing to its continued growth in the luxury market.

Application Insights

Based on application, the 100% agave mezcal segment accounted for the largest revenue share in 2024. 100% Agave Mezcal has experienced significant growth due to its authenticity and premium positioning in the spirits market. Made entirely from agave, it offers a pure and distinctive flavor profile that highlights the natural essence of the plant, appealing to consumers who value artisanal and high-quality products. The increasing global demand for authentic craft beverages has driven its popularity, particularly among affluent consumers seeking culturally rich and sustainable spirits. In addition, the health-conscious trend has contributed to its growth, as agave-based spirits are perceived to have lower glycemic indices compared to other alcoholic beverages. The premiumization trend in the spirits industry further supports the rise of 100% agave mezcal, with manufacturers introducing limited-edition and organic varieties to cater to niche markets.

Blended Mezcal, which combines agave with other sugars or ingredients during production, has also seen growth due to its affordability and accessibility. This category appeals to casual drinkers and new consumers who may find 100% agave mezcal too intense or expensive. Blended mezcal offers a lighter flavor profile that caters to a broader audience, including those new to mezcal. Its lower price point makes it an attractive option for budget-conscious buyers, contributing significantly to its expansion in both domestic and international markets. The versatility of blended mezcal in cocktails further drives its popularity, as it provides an approachable entry point into the world of mezcal without compromising on taste.

Distribution Channel Insights

Based on distribution channel, the supermarkets and hypermarkets segment led the market with the largest revenue share of 31.90% in 2024. Supermarkets and hypermarkets are the dominant channel, offering consumers a tactile shopping experience where they can physically browse products, receive recommendations from knowledgeable staff, and make immediate purchases of their desired mezcal. Liquor shops and specialty stores often provide an extensive selection of brands and varieties, catering to both novice and connoisseur consumers. This channel benefits from its ability to create a personalized shopping experience, which builds consumer trust and loyalty. Moreover, tasting sessions and expert guidance at specialty stores further enhance the appeal of retail outlets, making them a preferred choice for mezcal enthusiasts seeking specific brands or artisanal varieties.

Other distribution channels include direct sales, among others. Direct sales, though smaller in scale compared to other channels, provide a unique value proposition by connecting consumers directly with producers through distillery tours or local events. This channel fosters authenticity by allowing customers to learn about the production process and the story behind each bottle. Direct sales are particularly popular among purists who appreciate artisanal craftsmanship and seek exclusive small-batch mezcals. The personalized experience offered by direct sales strengthens brand loyalty while supporting small-scale producers in mezcal-producing regions, such as Oaxaca, contributing to this channel’s steady growth.

The online segment represents a rapidly growing channel driven by convenience and accessibility. Consumers can shop from the comfort of their homes and access a wider variety of mezcal options that may not be available locally. Competitive pricing and detailed product descriptions also attract buyers looking for value and information. The growth of e-commerce platforms has expanded mezcal’s reach to regions where it is less accessible through physical stores, enabling producers to tap into new markets globally. In addition, the younger demographic’s familiarity with online shopping has further accelerated this channel's expansion as they increasingly seek innovative spirits like mezcal through digital platforms.

Regional Insights

North America dominated the mezcal market with the largest revenue share of 61.90% in 2024. North America, particularly the United States, remains a significant market for mezcal due to its proximity to Mexico and its strong craft spirits culture. The rise of cocktail culture and increasing consumer interest in artisanal and premium beverages have driven demand in this region. Millennials, in particular, are drawn to mezcal's authenticity and unique flavor profiles, aligning with their preference for high-quality and culturally rich products. Furthermore, collaborations between U.S. entrepreneurs and Mexican producers have increased mezcal's availability and visibility, while innovative marketing strategies have amplified its appeal. The region's growing disposable income levels and inclination toward luxury spirits have further fueled the growth of mezcal in North America.

U.S. Mezcal Market Trends

The mezcal market in the U.S. accounted for the largest market revenue share in North America in 2024. The growing number of specialized mezcal establishments and Mexican restaurants in the U.S. has increased consumer exposure to the spirit. According to the National Restaurant Association, Mexican cuisine remains highly popular, with many restaurants adding premium mezcal offerings to their menus. The U.S. market's affinity for luxury spirits, combined with its large millennial population with significant disposable income, further supports the growth of mezcal. Major players are investing in manufacturing facilities in response to the rising popularity of mezcal, indicating a strong future for the market in the U.S.

Asia Pacific Mezcal Market Trends

The mezcal market in Asia Pacific is expected to grow at the fastest CAGR of 9.7% from 2025 to 2030. Asia-Pacific has emerged as a surprising leader in the mezcal industry, holding a significant share due to rising urbanization, increased disposable incomes, and a growing middle class. Consumers in this region are increasingly exploring international and artisanal spirits, with mezcal standing out for its unique flavors and cultural heritage. Strategic marketing efforts by mezcal brands have successfully tapped into the region's expansive consumer base, particularly among younger, affluent individuals eager to try new experiences. The robust e-commerce infrastructure in Asia-Pacific has also played a crucial role in expanding mezcal’s reach across geographically diverse areas. In addition, the integration of mezcal into high-end bars and restaurants has elevated its status as a premium spirit, further driving its growth in this rapidly developing region.

Key Mezcal Company Insights

The competitive landscape is also marked by strong independent brands like Mezcal Amores and Los Danzantes, which maintain a focus on artisanal production methods and high-quality agave sourcing. The market's growth is fueled by premiumization trends, increasing demand for craft spirits, and strategic marketing efforts, including celebrity endorsements and sustainable practices.

Companies such as Dos Hombres, co-founded by Aaron Paul and Bryan Cranston, have reshaped marketing strategies with luxury packaging and storytelling, appealing to consumers seeking authenticity and exclusivity. Overall, the industry competitive landscape is characterized by a blend of large-scale producers and artisanal brands, each driving growth through innovation and strategic positioning

Key Mezcal Companies:

The following are the leading companies in the mezcal market. These companies collectively hold the largest market share and dictate industry trends.

- Pernod Ricard SA

- Ilegal Mezcal SA

- El Silencio Holdings INC

- Rey Campero

- Diageo PLC

- Mezcal Vago

- Lágrimas de Dolores

- Bacardi Limited

- Brown-Forman

- Craft Distillers

- Destileria Tlacolula

- Familia Camarena

- MADRE Mezcal

- Banhez Spirits Company LLC

- Becle SAB de CV (Jose Cuervo)

Mezcal Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1235.8 million

Revenue forecast in 2030

USD 1852.5 million

Growth rate

CAGR of 8.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, category, distribution, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia; South Korea; Brazil; UAE

Key companies profiled

Pernod Ricard SA; Ilegal Mezcal SA; El Silencio Holdings INC; Rey Campero; Diageo PLC; Mezcal Vago; Lágrimas de Dolores; Bacardi Limited; Brown-Forman; Craft Distillers; Destileria Tlacolula; Familia Camarena; MADRE Mezcal; Banhez Spirits Company LLC; Becle SAB de CV (Jose Cuervo)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Mezcal Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and analyzes the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global mezcal market report by product, category, distribution, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Joven

-

Reposado

-

Anejo

-

Others

-

-

Category Outlook (Revenue, USD Million, 2018 - 2030)

-

100% Agave

-

Blend

-

-

Distribution Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Specialty Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global mezcal market was valued at USD 1140 million in 2024 and is expected to reach USD 1235.8 million in 2025.

b. The global mezcal market is expected to grow at a CAGR of 8.4% from 2025 to 2030 to reach USD 1852.5 million by 2030.

b. The Joven mezcal was the most significant mezcal type and had a market revenue of USD 818 million in 2024. Joven Mezcal has experienced significant growth due to its affordability and versatility. This unaged or minimally aged spirit offers a pure and vibrant agave flavor, making it ideal for cocktails such as Mezcal Margaritas and Palomas. The wide range of flavors, including citrus, green apple, and white pepper, further enhances its popularity. Younger consumers and mixologists are particularly drawn to Joven mezcal because it provides an authentic agave experience that is both bold and refreshing. Additionally, its lower price point compared to aged mezcals makes it more accessible to a broader audience, contributing to its rapid growth in the global market.

b. Some of the key players operating in the market include Pernod Ricard SA; Ilegal Mezcal SA; El Silencio Holdings INC; Rey Campero; Diageo PLC; Mezcal Vago; Lágrimas de Dolores; Bacardi Limited; Brown-Forman; Craft Distillers; Destileria Tlacolula; Familia Camarena; MADRE Mezcal; Banhez Spirits Company LLC; Becle SAB de CV (Jose Cuervo)

b. A growing consumer preference for premium alcoholic beverages has had a significant impact on the growth of the mezcal market. As consumers increasingly seek high-quality, artisanal products, mezcal has emerged as a favored choice due to its unique flavor profiles and traditional production methods. This trend is particularly strong among wealthier demographics, who are willing to invest in niche products that offer authenticity and craftsmanship.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.