- Home

- »

- Biotechnology

- »

-

Microbiome Analysis Market Size, Industry Report, 2030GVR Report cover

![Microbiome Report]()

Microbiome Analysis Market (2025 - 2030) Size, Share & Trends Analysis Report, By Product & Services (Instruments, Consumables, Services), By Technology (16S rRNA Sequencing, Shotgun Sequencing), By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-600-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Microbiome Analysis Market Summary

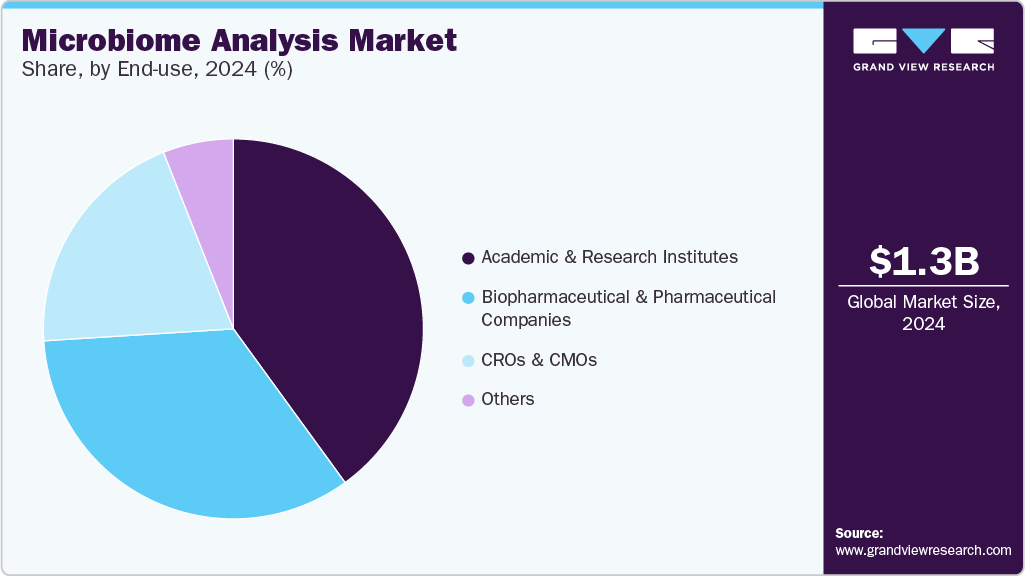

The global microbiome analysis market size was estimated at USD 1.27 billion in 2024 and is projected to reach USD 2.26 billion by 2030, growing at a CAGR of 10.47% from 2025 to 2030. This growth is primarily fueled by the increasing recognition of the microbiome's pivotal role in human health, disease prevention, and personalized medicine.

Key Market Trends & Insights

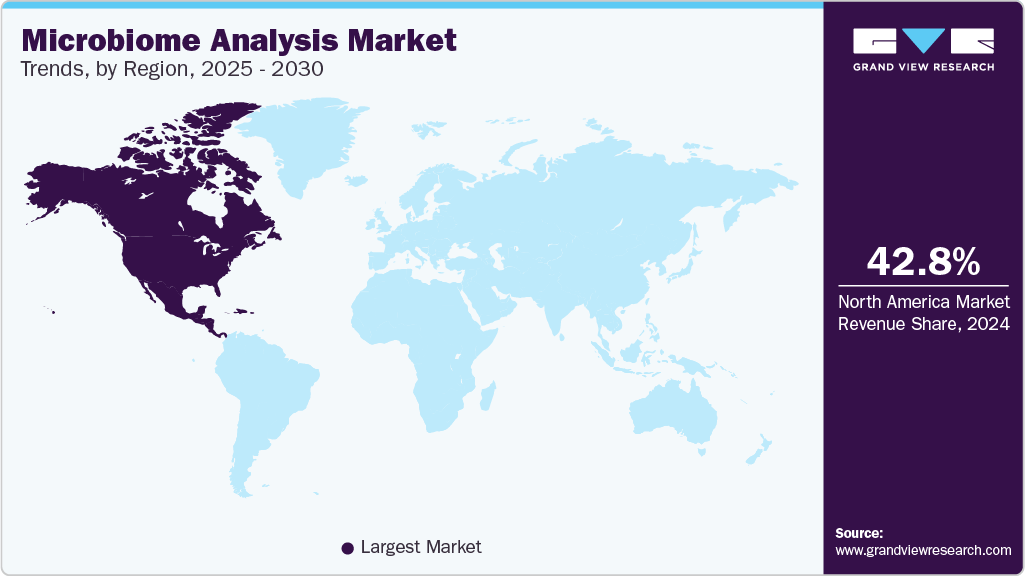

- North America microbiome analysis market dominated the global market with the largest revenue share of 42.81% in 2024.

- The U.S. microbiome analysis market is the largest, due to the presence of major research institutions, healthcare providers.

- In terms of products & service segment, the consumables segment held the largest revenue share of 46.47% in 2024.

- In terms of technology segment, 16S ribosomal RNA (rRNA) sequencing segment held the largest revenue share of 49.38% in 2024.

- In terms of application segment, the research application segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.27 Billion

- 2030 Projected Market Size: USD 2.26 Billion

- CAGR (2025-2030): 10.47%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

For instance, in November 2024, MaaT Pharma advanced its Phase 3 trial for a microbiome-based therapy targeting acute Graft-versus-Host Disease, underscoring its therapeutic potential. As research deepens and technology evolves, the microbiome analysis market is expected to play an increasingly critical role in shaping future diagnostics, therapeutic strategies, and precision healthcare solutions. The growing body of evidence linking microbiome imbalances to a wide range of chronic and complex diseases is a significant driver of the microbiome analysis market. Conditions such as inflammatory bowel disease (IBD), type 2 diabetes, obesity, cardiovascular disorders, and various types of cancer have all been associated with disruptions in the composition and function of the human microbiome.

Expanding Understanding of Disease Linkages Through Microbiome Analysis

As research continues to uncover these connections, there is increasing demand for advanced microbiome profiling tools to aid in early diagnosis, disease monitoring, and the development of targeted therapies. According to the World Health Organization (WHO), 830 million people had diabetes in 2022. This trend is expected to fuel investment in microbiome-based diagnostics and personalized medicine, fueling market growth in the forecast period.

For instance, in November 2024, researchers at McGill University published a narrative review in eGastroenterology, highlighting the gut microbiome's causal role in chronic disease progression. The review emphasized findings from randomized controlled trials and preclinical studies, particularly focusing on Clostridioides difficile infection (CDI). Fecal microbiota transplantation (FMT) was identified as a promising therapy, demonstrating up to a 93% reduction in CDI recurrence rates. Moreover, the study explored the potential of microbiome-based interventions to enhance cancer immunotherapy responses and manage ulcerative colitis.

Advancements in Technology and Research in Microbiome Analysis

Rapid technological progress in genomic sequencing and bioinformatics has significantly enhanced the ability to analyze complex microbial communities with high accuracy and resolution. Next-generation sequencing (NGS), metagenomics, and advanced computational tools now enable comprehensive profiling of the human microbiome, making microbiome analysis faster, more affordable, and scalable. These advancements are expanding both clinical and research applications of microbiome studies, driving market growth.

Moreover, large-scale research initiatives such as the Human Microbiome Project (HMP) and other global collaborations generate vast datasets and deepen our understanding of the microbiome’s role in human health and disease. For instance, in February 2025, researchers published a study in iMeta examining the role of non-differential gut microbes in hypertension. They identified 581 hypertension-related co-abundances in a cohort of 6,999 participants from the Guangdong Gut Microbiome Project.

Findings suggest that microbial interactions, rather than individual species abundance, may be crucial in hypertension development and progression. These research efforts uncover novel therapeutic and diagnostic opportunities and foster public and private investment in microbiome research and product development. Together, these technological and research-driven advances are critical in accelerating the adoption of microbiome analysis tools across healthcare, pharmaceuticals, and nutrition sectors.

Market Concentration & Characteristics

The microbiome industry market is characterized by a high degree of innovation, driven by rapid advancements in sequencing technologies, data analytics, and synthetic biology. Innovations such as shotgun metagenomics, metabolomics integration, and machine learning-based microbiome modeling development are transforming how microbial communities are analyzed and understood. Startups and established biotech firms invest heavily in R&D to develop next-generation microbiome-based diagnostics, therapeutics, and personalized nutrition solutions. For instance, in August 2024, Leucine Rich Bio featured the BugSpeaks2.0, the next generation of their flagship gut microbiome test, and advancements in microbiome science and personalized healthcare.

The microbiome analysis industry is experiencing increasing mergers and acquisitions, as larger biotechnology, pharmaceutical, and diagnostic companies seek to strengthen their capabilities in microbiome-based technologies. These strategic acquisitions aim to expand research portfolios, integrate advanced sequencing platforms, and accelerate the development of microbiome-targeted therapeutics and diagnostics. For instance, in March 2025, Leucine Rich Bio announced a strategic partnership with Medsol Diagnostics to introduce its flagship gut microbiome test, BugSpeaks, to the UAE market. As consolidation continues, it is expected to foster innovation, reduce time and cost barriers for market entry, and position the microbiome analysis market for sustained growth and scalability.

Regulatory frameworks are playing an increasingly influential role in shaping the growth trajectory of the microbiome analysis industry. As microbiome-based diagnostics and therapeutics move closer to clinical application, regulatory oversight from bodies such as the U.S. Food and Drug Administration (FDA), the European Medicines Agency (EMA), and other international health authorities is intensifying. While the evolving regulatory landscape can present hurdles regarding product approvals, compliance requirements, and clinical trial design, it also contributes positively by setting quality standards, ensuring patient safety, and enhancing consumer trust. Regulatory clarity, data privacy in microbiome research, and classifying microbiome-based interventions are expected to drive investment and accelerate market entry.

The microbiome analysis industry is experiencing significant momentum through continuous product expansion, including developing new diagnostic kits, personalized microbiome testing services, microbiome-based therapeutics, and consumer-focused health solutions. Companies increasingly diversify their offerings to address various applications, from gut health and metabolic disorders to skin care, mental health, and immune-related conditions. Innovative products like at-home microbiome testing kits, microbiome-informed nutrition plans, and targeted probiotics make microbiome insights more accessible to consumers and clinicians. Expanding diagnostic platforms that detect dysbiosis-related biomarkers in the clinical space enhance early disease detection and personalized treatment strategies.

Regional expansion is vital in accelerating the growth of the global microbiome analysis industry. North America and Europe are leading due to advanced research infrastructure, strong regulatory support, and high healthcare spending; emerging markets in Asia-Pacific, Latin America, and the Middle East are rapidly gaining traction. Geographic diversification reduces dependence on saturated markets and unlocks new revenue streams and research opportunities, making regional expansion a key strategic driver of the microbiome analysis market’s global growth.

Products & Service Insights

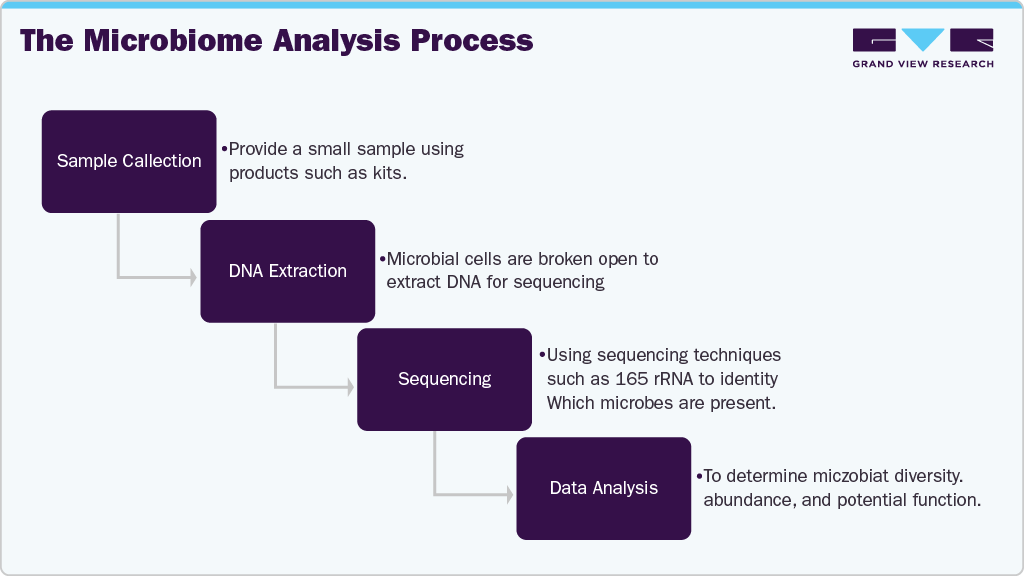

The consumables segment, comprising microbiome analysis kits, reagents, and related laboratory supplies, held the largest revenue share of 46.47% in 2024. These products are essential for sample collection, DNA/RNA extraction, amplification, sequencing preparation, and microbial profiling. With the growing demand for high-throughput and accurate microbiome testing, specialized kits and reagents are steadily increasing across clinical diagnostics, academic research, pharmaceutical development, and personalized nutrition.

The services segment of the microbiome analysis market is expected to grow at the fastest CAGR over the forecast period, encompassing a wide range of offerings such as sample processing, sequencing, bioinformatics analysis, data interpretation, and custom microbiome profiling. This segment caters to academic institutions, research organizations, pharmaceutical companies, and healthcare providers that often outsource microbiome studies due to in-house analysis's complexity and resource intensity. For instance, in November 2024, Cmbio launched a unified brand integrating Clinical Microbiomics, CosmosID, MS-Omics, DNASense, and Microba's Research Services unit. The company provides a comprehensive suite of services, including custom microbiome sample collection kits, microbial DNA sequencing, metatranscriptomics, and targeted metabolite profiling.

Technology Insights

16S ribosomal RNA (rRNA) sequencing segment held the largest revenue share of 49.38% in 2024. It involves the amplification and sequencing of the 16S rRNA gene, a highly conserved component of the bacterial genome that contains variable regions enabling taxonomic identification. This method allows researchers to classify and compare bacterial populations across different environments, such as the human gut, skin, or oral cavity. For instance, in May 2025, researchers published a study in Scientific Reports, comparing RNA- and DNA-based 16S amplicon sequencing methods to analyze the equine uterine microbiome. The study suggests that combining DNA- and RNA-based analyses provides complementary insights into the uterine microbiome, crucial for understanding fertility-related conditions. As demand for microbiome insights grows across healthcare, nutrition, and environmental sectors, the 16S rRNA sequencing segment is expected to maintain a strong presence in the global microbiome analysis industry.

Shotgun metagenomics segment is expected to grow at the fastest CAGR over the forecast period. An advanced sequencing approach enables comprehensive analysis of all genetic material in a microbiome sample, including bacteria, viruses, fungi, and archaea. For instance, in December 2023, researchers published a study in the microbiome investigating the interkingdom interactions between gut bacteria and fungi.

Using shotgun metagenomics and a novel fungal enrichment protocol, they identified competitive relationships between microbial communities, influenced by dietary habits. This method provides insights into which microorganisms are present and what they can do, such as identifying antibiotic resistance genes, metabolic pathways, and virulence factors. These capabilities make shotgun metagenomics valuable in clinical research, infectious disease studies, pharmaceutical R&D, and personalized medicine. As the demand for precision microbiome analysis grows, the shotgun metagenomics segment is expected to expand rapidly, offering substantial growth opportunities within the microbiome analysis market.

Application Insights

The research application segment held the largest revenue share in 2024, driven by increasing scientific interest in understanding the complex interactions between microbial communities and human health, the environment, and agriculture. For instance, in January 2025, researchers introduced PyAMPA, a high-throughput bioinformatics platform for discovering and optimizing antimicrobial peptides (AMPs). PyAMPA comprises five modules: AMPScreen, AMPValidate, AMPSolve, AMPMutate, and AMPOptimize, which facilitate proteome-wide screening, candidate evaluation, and optimization through point mutations and genetic algorithms. PyAMPA aims to accelerate the development of AMPs as viable alternatives to traditional antibiotics, addressing the growing concern of antimicrobial resistance. With continued global investment in life sciences and the increasing emphasis on precision medicine, probiotic development, and microbiome-based therapeutics, the research application segment is expected to remain a major driver of market demand.

The disease application segment is expected to grow at the fastest CAGR throughout the forecast period. This is driven by the increasing understanding of the microbiome’s role in the onset, progression, and management of various human diseases. Research has established strong links between microbiome imbalances (dysbiosis) and a wide range of conditions, including inflammatory bowel disease (IBD), type 2 diabetes, obesity, autoimmune disorders, cardiovascular disease, neurodegenerative conditions, and certain cancers. For instance, in May 2025, researchers conducted a machine learning-based meta-analysis of 4,489 gut microbiome samples from Parkinson’s disease (PD) patients. They found that microbiome-based models accurately classified PD patients within individual studies. Training models on multiple datasets improved their generalizability and disease specificity. This suggests a potential link between environmental exposures and PD risk through gut microbiome modulation. Such findings underscore the growing relevance of microbiome analysis in disease detection and personalized treatment strategies.

End Use Insights

The academic & research institutes segment held the largest revenue share in 2024. Universities, research centers, and government-funded organizations are at the forefront of microbiome research, conducting foundational studies that deepen our understanding of the microbial world. These institutions actively participate in pioneering research, large-scale studies, and collaborative projects that drive scientific discovery and technological advancement. For instance, in May 2024, Rice University engineers developed two advanced AI-driven tools to enhance microbiome analysis: GraSSRep and Rhea. GraSSRep utilizes self-supervised learning and graph neural networks to identify repetitive DNA sequences in metagenomic data without predefined parameters. Rhea detects structural variants in microbial genomes by analyzing long-read coassembly graphs, eliminating the need for reference genomes. These tools aim to improve understanding of microbial evolution and disease mechanisms. With increased funding from government agencies, private research grants, and partnerships with biotechnology companies, academic and research institutes continue to play a key role in advancing the microbiome field, further driving demand for microbiome analysis services, tools, and technologies.

The Contract Research Organization (CROs) and CMOs segment is expected to grow fastest throughout the forecast period, driven by the increasing demand for specialized research, development, and manufacturing services related to microbiome-based diagnostics, therapeutics, and products. As microbiome research accelerates and more microbiome-based products reach clinical and commercial stages, the CRO and CMO segment is positioned for significant growth, offering critical services that bridge the gap between R&D and market-ready solutions.

Regional Insights

North America microbiome analysis market dominated the global market with the largest revenue share of 42.81% in 2024, driven by substantial investment in biotechnology, cutting-edge research, and healthcare infrastructure. The growing demand for personalized medicine, precision diagnostics, and supportive regulatory frameworks is fueling this region’s expansion. Moreover, rising consumer interest in microbiome-based products, such as probiotics and at-home testing kits, contributes to growth in the market.

U.S Microbiome Analysis Market Trends

The U.S. microbiome analysis market is the largest, due to the presence of major research institutions, healthcare providers, and innovative biotech companies. Government-funded initiatives like the Human Microbiome Project (HMP) and partnerships between academia and industry are accelerating breakthroughs in microbiome research. For instance, in February 2023, UCLA launched the Goodman-Luskin Microbiome Center to foster interdisciplinary collaboration across its medical, engineering, public health, and life sciences faculties. The center offers core research facilities, competitive fellowships, and hosts an annual symposium to support cutting-edge microbiome research and training. Such developments underscore the country's key role in shaping the future of microbiome analysis and its applications in health and medicine.

Europe Microbiome Analysis Market Trends

Europe microbiome analysis market holds a significant share of the global market. The region's commitment to advancing precision medicine and personalized healthcare, along with increased investments in microbiome-based therapies, drives the growing demand for microbiome analysis services. Regulatory frameworks, particularly in the UK and Germany, play a key role in fostering innovation while ensuring that microbiome-based products meet safety and efficacy standards. For instance, in March 2025, a review published in npj Biofilms and Microbiomes examined the evolving regulatory landscape for microbiome-based therapies in Europe. The review highlighted the critical role of a product's intended use in determining its regulatory status, noting that even identical substances could be classified differently depending on their applications. This regulatory clarity is essential to developing and safely deploying microbiome-based solutions in the region.

The UK microbiome analysis market is experiencing strong growth with prominent research institutions driving advancements in microbiome-related studies. For instance, in September 2024, a collaborative study involving the Wellcome Sanger Institute, University College London (UCL), and the University of Birmingham identified a naturally occurring probiotic bacterium in the gut microbiomes of UK newborns. This bacterium, Bifidobacterium breve, was found to be genetically adapted to efficiently metabolize breast milk nutrients and inhibit the colonization of harmful pathogens, suggesting its potential as a therapeutic probiotic for infants. These findings could inform the development of personalized infant probiotics and underscore the importance of early-life microbiome composition in long-term health outcomes. Such research underscores the growing potential of microbiome-based therapies in improving infant health and advancing personalized medicine.

Germany microbiome analysis market is experiencing significant growth, driven by its robust healthcare infrastructure and a strong biotechnology sector. The country's emphasis on personalized medicine and precision healthcare, coupled with its highly developed pharmaceutical and biotech industries, fosters the development of microbiome-based diagnostics and therapeutics. Moreover, Germany benefits from clear and supportive regulatory frameworks under the EU, enhancing the market's growth and enabling the commercialization of microbiome-based products. As the demand for microbiome-based solutions continues to rise, Germany remains a central hub for research, product development, and clinical applications in the microbiome space.

Asia Pacific Microbiome Analysis Market Trends

Asia-Pacific microbiome analysis market is expected to grow significantly during the forecast period owing to increasing healthcare awareness, expanding research capabilities, and the rise of personalized healthcare. The region is home to large, diverse populations and has witnessed a surge in studies investigating the microbiome's role in diseases like diabetes, cancer, and gastrointestinal conditions. For instance, in January 2025, a study published in Nature Communications investigated the impact of fermented foods on the seasonal stability of gut microbiota in rural Indian populations. The findings highlight the influence of fermented food intake on gut microbiota composition and its seasonal dynamics, suggesting potential implications for dietary interventions to maintain a healthy and resilient gut microbiota. s. Research or studies like this highlight the growing importance of nutritional factors in shaping gut health and underscore the potential of microbiome-based interventions in improving overall well-being in diverse populations, further driving the market demand in the region.

China microbiome analysis market is set to grow significantly, fueled by substantial investments in biotechnology and life sciences. The country's large and diverse population provides a unique opportunity for extensive microbiome studies, particularly in chronic diseases, gastrointestinal disorders, and diabetes. For instance, in February 2025, researchers in Southwest China conducted a large-scale metagenomic gut survey of microbiomes, analyzing fecal samples. The study revealed novel links between gut microbiota and common metabolic disorders, including obesity, type 2 diabetes mellitus, non-alcoholic fatty liver disease, and cardio-metabolic diseases. These findings underscore the importance of considering population-specific factors when translating microbiome research into clinical applications. The increasing focus on precision medicine and personalized healthcare has increased demand for microbiome-based diagnostics and therapeutic solutions.

Japan microbiome analysis market is growing rapidly, with a highly developed healthcare system and a growing emphasis on medical research, particularly in areas like gut health and age-related diseases. The country’s aging population has accelerated the demand for microbiome-based solutions, especially those that target digestive health and immune function. Japan’s focus on innovation and robust clinical research in microbiome-related therapies makes it an important region for the growth of microbiome diagnostics, probiotics, and therapeutics. As country’s healthcare increasingly adopts personalized approaches, microbiome analysis is expected to become integral to precision medicine strategies.

Middle East and Africa Microbiome Analysis Market Trends

The Middle East and Africa microbiome analysis market is projected to drive the demand for microbiome analysis and grow considerably due to their growing investment in healthcare research and biotechnology. The increasing prevalence of lifestyle-related diseases, such as diabetes and obesity, drives demand for microbiome analysis in the region. As healthcare systems in the Middle East continue to modernize, microbiome analysis and related products are expected to see greater adoption.

The Kuwait microbiome analysis market is projected to grow steadily, with initiatives to improve healthcare outcomes and research funding directed towards novel technologies such as microbiome-based diagnostics. There is a growing recognition of the microbiome's role in chronic diseases, and the government's focus on enhancing healthcare services is expected to stimulate demand for microbiome analysis-based solutions.

Key Microbiome Analysis Company Insights

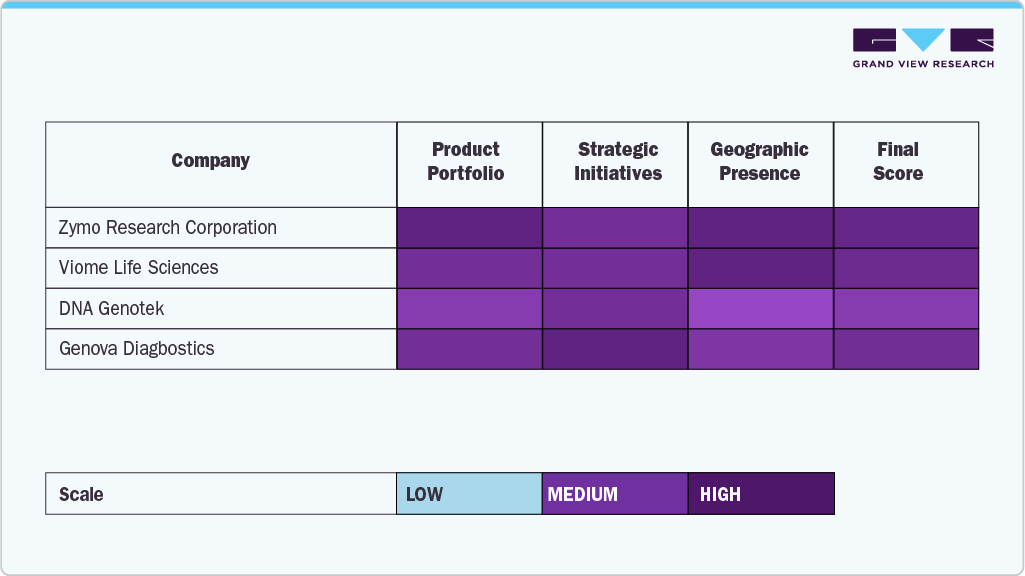

The microbiome analysis market is characterized by several established players who dominate through strong product portfolios, strategic collaborations, and consistent R&D investments. Leading companies such as Genetic Analysis AS, Zymo Research Corporation, Microbiome Insights, and Viome Life Sciences, Inc. have maintained significant market share due to their global presence and integrated solutions spanning diagnostics, drug discovery, and genomics.

Leading companies-including Zymo Research Corporation, Viome Life Sciences, Inc., DNA Genotek, and Genova Diagnostics. -continue to dominate the landscape through comprehensive product portfolios, robust global distribution networks, and sustained investment in R&D. These players leverage their scale, integrated platforms, and strategic acquisitions to maintain a competitive edge across clinical diagnostics, genomics, and life sciences.

Firms like Microbiome Insights, Microba Life Science, and Sun Genomics are expanding their footprint by focusing on advanced microfluidic applications in molecular diagnostics, infectious disease testing, and personalized medicine. Through innovation, partnerships, and geographic expansion, these players continue to shape the competitive dynamics of the microbiome analysis market.

Companies such as Microba Life Science, Viome Life Sciences, and Zymo Research Corporation are leading the charge by providing advanced microbiome sequencing technologies, diagnostic tools, and personalized health insights. These organizations are capitalizing on the growing demand for personalized healthcare solutions, integrating the latest in genomics, bioinformatics, and AI-driven analytics to offer more accurate and actionable insights into gut health and overall wellness.

Overall, the microbiome analysis market is witnessing a dynamic blend of legacy strength and startup agility, with increasing mergers and acquisitions (M&A) activity, strategic partnerships, and breakthrough product innovations set to intensify competition in the coming years. Companies that effectively combine scientific rigor with consumer-driven trends, particularly in personalized health and wellness, are likely to secure long-term value in this rapidly evolving space. As the demand for microbiome-based solutions grows, a strong focus on accessibility, affordability, and ethical sourcing will play a critical role in shaping the future market landscape.

Key Microbiome Analysis Companies:

The following are the leading companies in the microbiome analysis market. These companies collectively hold the largest market share and dictate industry trends.

- Genetic Analysis AS

- Zymo Research Corporation

- Microbiome Insights

- Viome Life Sciences, Inc.

- Microba Life Science

- Luxia Scientific

- DNA Genotek

- Sun Genomics

- CosmosID

- MaaT Pharma

Recent Developments

-

In October 2024, Zymo Research Corporation and BluMaiden Biosciences announced a strategic partnership to offer comprehensive clinical trial analytics and reporting services focused on the human microbiome. This collaboration integrates Zymo Research's expertise in sample preparation and next-generation sequencing with BluMaiden's advanced bioinformatics capabilities via the proprietary KEYSTONE AI analytical platform. The joint service aims to provide pharmaceutical companies with insights into endpoint optimization, drug responder prediction, and patient stratification across all clinical trial phases and disease indications.

-

In August 2024, Kihealth, a life sciences company specializing in preventive diagnostics, partnered with Genova Diagnostics, a leader in gut health and nutritional laboratory testing, to make comprehensive gut health testing more accessible to consumers. This collaboration enables individuals to access advanced gut health tests directly through retail pharmacies or online. By offering these tests directly to consumers, the partnership aims to empower individuals to take proactive steps in managing their gut health and overall well-being.

Microbiome Analysis Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.37 billion

Revenue forecast in 2030

USD 2.26 billion

Growth rate

CAGR of 10.47 % from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product & services, technology, application, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Genetic Analysis AS; Zymo Research Corporation; Microbiome Insights; Viome Life Sciences, Inc.; Microba Life Science; Luxia Scientific; DNA Genotek; Sun Genomics; CosmosID,MaaT Pharma

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Microbiome Analysis Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global microbiome analysis market report based on the product & services, technology, application, end use, and region.

-

Product & Services Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

Consumables

-

Services

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

16S rRNA Sequencing

-

Shotgun Metagenomics

-

Metatranscriptomics

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Disease Application

-

Gastrointestinal Disorders

-

Metabolic Disorders

-

Infectious Diseases

-

Oncology

-

Others

-

-

Research Application

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Biopharmaceutical & Pharmaceutical Companies

-

CROs & CMOs

-

Academic & Research Institutes

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global microbiome analysis market size was estimated at USD 1.27 billion in 2024 and is expected to reach USD 1.37 billion in 2025.

b. The global microbiome analysis market is expected to grow at a compound annual growth rate of 10.47% from 2025 to 2030 to reach USD 2.26 billion by 2030.

b. The 16S rRNA sequencing technology dominates the market, with a revenue share of 49.38% in 2024. This is attributed to its cost-effectiveness, ease of use, and suitability for taxonomic profiling. Its widespread adoption in academic and clinical microbiome studies supports its leading position.

b. Some key players operating in the microbiome analysis market include Genetic Analysis AS; Zymo Research Corporation; Microbiome Insights; Viome Life Sciences, Inc.; Microba Life Science; Luxia Scientific; DNA Genotek; Sun Genomics; CosmosID, and MaaT Pharma.

b. The microbiome analysis market is driven by the increasing prevalence of chronic diseases, growing demand for personalized medicine, and significant advancements in sequencing technologies and bioinformatics. The growing research funding and strategic collaborations between pharmaceutical companies and CROs/CMOs further accelerate innovation and adoption.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.