- Home

- »

- Sensors & Controls

- »

-

Microelectromechanical Systems Market Size Report, 2030GVR Report cover

![Microelectromechanical Systems Market Size, Share & Trends Report]()

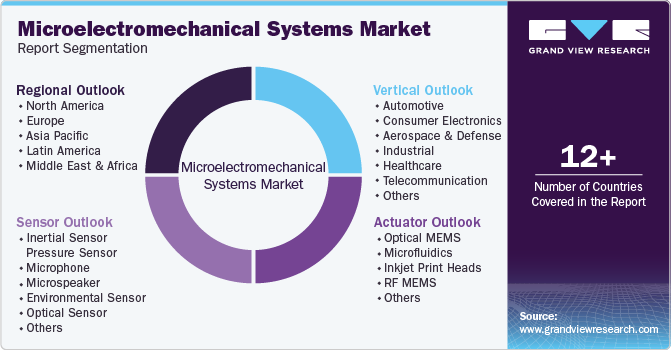

Microelectromechanical Systems Market Size, Share & Trends Analysis Report By Sensor, By Actuator (Optical MEMS, Microfluidics, Inkjet Print Heads, RF MEMS, Others), By Vertical, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-769-8

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

Market Size & Trends

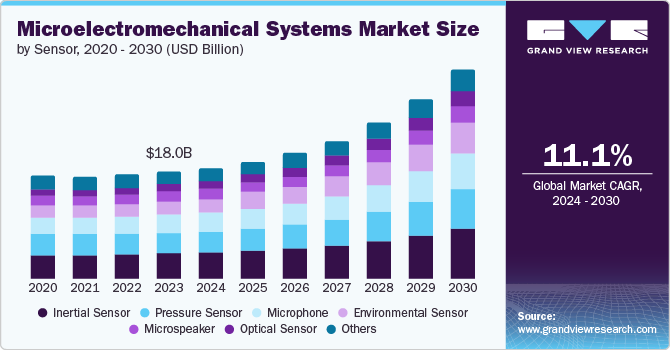

The global microelectromechanical systems market size was valued at USD 18.02 billion in 2023 and is projected to grow at a CAGR of 11.1% from 2024 to 2030. The increasing need for advanced consumer electronics worldwide is driving the expansion of the market. The growing use of the Internet of Things (IoT) by organizations in the semiconductors industry has supplemented the application of technology as it provides advantages to IoT devices, cars, and semiconductor components. Emerging trends in the automotive industry are fueling the growth of this market. These developments involve advancements in safety, connectivity, and autonomous vehicles.

The constant research & development in the technology industry has resulted in the innovation and availability of advanced versions of technologies. MEMS market is no exception to that. The industry has experienced numerous innovations leading to new product developments and enhanced applications in industries such as healthcare, automotive and others.

Over the last few years, MEMS has become part of almost every device that we use in everyday life. This includes pressure sensors, accelerometers, gear, fluid pumps, optical sensors, analyzers, and miniature robots. These systems are widely used in industries such as consumer goods, biomedical, optical displays, wireless and optical communication, aerospace, chemical, fluidics and others. The growing number of applications are expected to drive growth for this market in the approaching years.

Sensor Insights & Trends

Inertial sensor segment dominated the market and accounted for a share of 24.1% in 2023. This segment entails elements such as accelerometer, gyroscope, magnetometer, and combo sensor. There has been a significant growth in the use of MEMS inertial sensors, mainly in consumer electronics and automotive industries. For example, MEMS accelerometers have replaced airbag deployment switches in cars owing to their low energy usage, compact size, and accuracy.

The environmental sensor segment is expected to register the fastest CAGR during the forecast period. This segment serves as the foundation for a wide range of devices including smartphones, wearables, smart home setups, and industrial automation without adding noise. The demand for this segment is fueled by growing adoption due to environmental monitoring and compliance with strict air quality regulations. Growing emphasis on predictive maintenance, industrial automation and remote monitoring in industrial automation is also expected to generate greater demand for this segment in approaching years.

Actuator Insights &Trends

Optical MEMS accounted for the largest revenue share in 2023. Optical switches offer energy efficiency, minimal delay, and protocol flexibility, which are beneficial for future transceivers and modulation types. MEMS optical switches can quickly change the direction of light signals by accurately controlling tiny mirrors or waveguides. Efficient data transmission is guaranteed by their high switching speed. The growing use of optical MEMS in inertial navigation, accelerometers, gyroscopes, and biomedical industry is fueling demand for this segment.

The microfluidics segment is expected to experience the fastest CAGR during the forecast period. Rising point-of-care testing, advancements in microfabrication, emergence of innovative microfluidic devices are the factors generating an increased demand for this segment. These systems can be easily combined with optical detection or sensors, allowing for automated sample preparation and analysis.

Vertical Insights & Trends

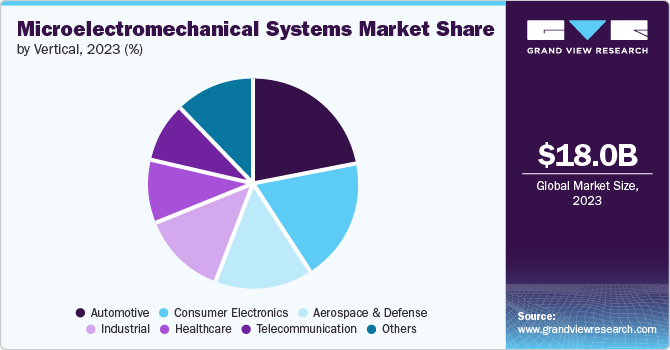

The automotive segment dominated the market in 2023. Factors that are driving the expansion of this segment include growing demand of advanced safety features in modern vehicles, use of MEMS in Airbag deployment sensors, adoption in electronic stability control (ESC) systems, inclusion of MEMS in engine management systems and emission management technology and comfort & convenience systems such as dynamics, suspension, tilt measurement, and alarm systems.

The healthcare sector is projected to grow at the fastest CAGR from 2024 to 2030. Growing use in healthcare, rapid transformations and enhancements in the healthcare industry are generating greater demand for this segment. The emergence of technologies and unceasing adoption of medical devices is developing growth for the MEMS market. The MEMS driven scalpels, diagnostic devices, monitoring meters and other devices have been using different sorts of sensors.

Regional Insights & Trends

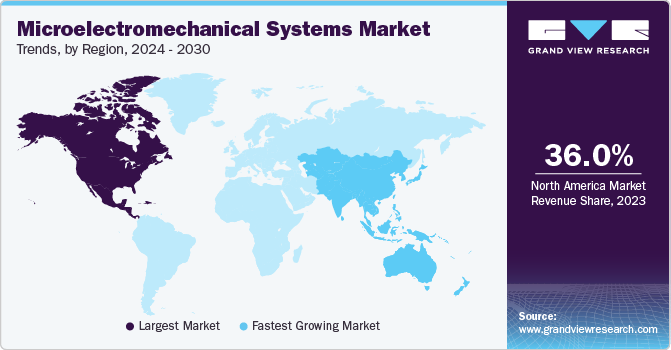

North America MEMS market dominated the market in 2023. The existence of prominent automotive, consumer electronics and healthcare organizations in the region have resulted in the growth for MEMS industry. Technological advancement embraced by the businesses and consumers as well, availability & accessibility of microelectromechanical systems in the region, large number of manufacturing enterprise are some of the factors which have been fueling growth for the regional industry.

U.S. Microelectromechanical Systems Market Trends

The MEMS market in the U.S. dominated the regional industry and accounted for revenue share of 74.0% in 2023. The Insurance Institute for Highway Safety projects the presence of approximately 3.5 million self-driving vehicles in the U.S. by 2025. Such growing application areas, rising use of technology in healthcare industry, and growing dependence on consumer goods devices are expected to produce unceasing growth for the MEMS market in the country.

Europe Microelectromechanical Systems Market Trends

Europe MEMS market was identified as a lucrative region in this industry. Growing embracement of smart technologies in different application areas, rising adoption of connected devices and vehicles as well, and use of advanced technology tools by governments and regulatory authorities are factors generating growth for this industry.

The UK microelectromechanical systems market is anticipated to experience rapid growth rate during forecast period. This market is primarily driven by the factors such as growing adoption of MEMS in healthcare industry in the country, launch of newly invented devices and technologies, rising use in automobile industry, and increasing availability of various medical devices which are empowered by MEMSs. This market is further driven by the presence of multiple organizations operating in application industries for the MEMS industry.

Asia Pacific Microelectromechanical Systems Market Trends

Asia Pacific MEMS market is anticipated to witness significant growth due to growing presence of multiple international brands operating in the application industries such as consumer goods devices, automobile, smart home appliances, smart kitchen appliances and others. Developing economies in the region such as India have experienced an exponential rise in the use of technology-based devices and systems, which has fueled growth for the MEMS market in recent years.

China Microelectromechanical Systems market held the largest revenue share of the regional industry. This market is primarily driven by the presence of large manufacturing enterprises for advanced technology-based vehicles and the electronics industry. Growing embracement of smart medical technology for functions such as diagnosis, surgeries, treatments and follow-up procedures in the country is also expected to generate greater growth for the MEMS market in China.

Key Microelectromechanical Systems Company Insights

Some of the key companies are Broadcom, Goertek, Honeywell International Inc., Texas Instruments Incorporated, Panasonic Corporation, HP Development Company, L.P., and others. Market vendors are expanding their customer base to gain a competitive advantage in the market by adopting various strategic initiatives such as mergers and acquisitions, innovation, new product launches, geographical expansions, and partnerships with other leading firms.

-

Panasonic, a prominent Japanese manufacturing enterprise, operating in the electrical appliances and consumer electronic goods industry, offers MEMS gyro sensors and 6 in 1 inertial sensor.

-

HP Development Company, L.P., one of the prominent companies in the innovation and technology industry, offers MEMS product such as low-power, ultrasensitive MEMS accelerometers, and seismic sensor for oil and gas industry.

Key Microelectromechanical Systems Companies:

The following are the leading companies in the microelectromechanical systems market. These companies collectively hold the largest market share and dictate industry trends.

- Analog Devices, Inc.

- Broadcom

- DENSO CORPORATION

- Goertek

- HP Development Company, L.P.

- Honeywell International Inc.

- Infineon Technologies AG

- Knowles Electronics, LLC

- NXP Semiconductors

- Panasonic Corporation

- Qualcomm Technologies, Inc.

- Robert Bosch GmbH

- STMicroelectronics

- TDK Corporation

- Texas Instruments Incorporated

Recent Developments

-

In May 2024, STMicroelectronics, one of the prominent integrated devices manufacturers, introduced MEMS studio, a one-stop solution for MEMS sensor evaluation and development. The feature offered by the company is connected to STM32 microcontroller ecosystem and it is available for Windows, Linux and MacOS operating systems.

-

In January 2024, Melexis, key company operating in microelectronic solutions, launched MLX90830, MEMS pressure sensor. The newly launched product is equipped with newly patented Triphibian technology and is presented in unprecedented miniaturized version.

Microelectromechanical Systems Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 18.71 billion

Revenue forecast in 2030

USD 35.14 billion

Growth rate

CAGR of 11.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

August 2024

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Sensor, actuator, vertical, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, South Korea, Australia, Brazil, Saudi Arabia, UAE, South Africa

Key companies profiled

Analog Devices Inc.; Broadcom.; DENSO CORPORATION; Goertek; HP Development Company, L.P.; Honeywell International Inc.; Infineon Technologies AG; Knowles Electronics, LLC; NXP Semiconductors; Panasonic Corporation; Qualcomm Technologies, Inc.; Robert Bosch GmbH; STMicroelectronics; TDK Corporation; Texas Instruments Incorporated

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Microelectromechanical Systems Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global microelectromechanical systems market report based on sensor, actuator, vertical, and region:

-

Sensor Outlook (Revenue, USD Billion, 2018 - 2030)

-

Inertial Sensor

-

Accelerometer

-

Gyroscope

-

Magnetometer

-

Combo Sensor

-

-

Pressure Sensor

-

Microphone

-

Microspeaker

-

Environmental Sensor

-

Optical Sensor

-

Microbolometer

-

Pir & Thermophile

-

-

Others

-

-

Actuator Outlook (Revenue, USD Billion, 2018 - 2030)

-

Optical MEMS

-

Microfluidics

-

Inkjet Print Heads

-

RF MEMS

-

Others

-

-

Vertical Outlook (Revenue, USD Billion, 2018 - 2030)

-

Automotive

-

Consumer Electronics

-

Aerospace & Defense

-

Industrial

-

Healthcare

-

Telecommunication

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."