- Home

- »

- Biotechnology

- »

-

MicroRNA Market Size, Share & Trends Analysis Report 2030GVR Report cover

![MicroRNA Market Size, Share & Trends Report]()

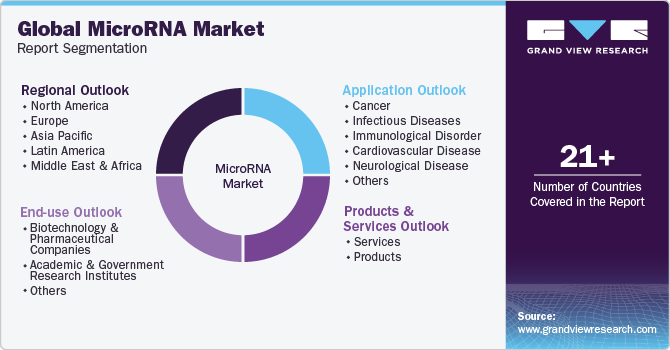

MicroRNA Market Size, Share & Trends Analysis Report By Products & Services (Instruments, Consumables), By Application (Cancer, Infectious Diseases) By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-368-3

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

MicroRNA Market Size & Trends

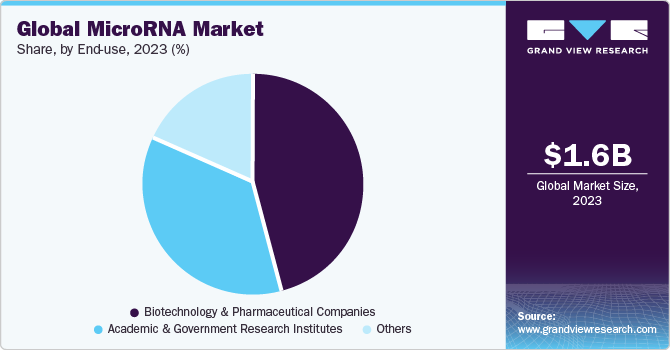

The global microRNA market size was estimated at USD 1.58 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of 12.87% from 2024 to 2030. The increasing prevalence of diseases such as cancer, cardiovascular diseases, and neurological disorders across the globe, as well as growing advancements in genomic technologies, are the prime factors that drive the market growth. According to the American Cancer Society in 2022, about 1.9 million new cancer cases were reported in the U.S. out of which 609,360 recorded cancer-related deaths.

The introduction of MicroRNAs (miRNA) diagnostics into clinics has accelerated the developments in precision medicine in cancer treatment. In addition, miRNAs are ideal candidates as noninvasive biomarkers in cancer. This is due to the secretion of miRNAs by a large number of cells, which can be detected in various body fluids. Thus, microRNA with their roles in gene regulation and disease pathways, creates a substantial market demand, which in turn drives the growth of the market.

The outbreak of COVID-19 pandemic has accelerated microRNA research for the development of vaccines and disease gene expressions. For instance, a study published in April 2020 demonstrated that the use of in vitro-constructed miRNA specific to SARS-CoV-2 RNA genome can be used for vaccine development. In addition, researchers from Medical College of Georgia at Augusta University have found that a group of miRNAs can play a vital role in combating COVID-19. However, their number decreases proportionately to a patient’s age or health conditions. This helps to understand why those with comorbidities and the elderly are more vulnerable to COVID-19 infection. Thus, the surge in COVID-19 studies involving miRNA is anticipated to drive the overall market growth. In addition, a study published in June 2020 suggests that an identified and validated SARS-CoV-2 miRNA signature can be used for differential diagnosis of COVID-19 from other infections with similar symptoms. This contributes to accelerating the use of miRNA analysis in COVID-19 diagnosis.

miRNAs are rapidly being recognized as robust biomarkers of human diseases, as they play a significant role in regulating gene expression at the post-transcriptional level. The stability in serum and plasma has encouraged use of miRNAs from the blood for diagnostic & prognostic biomarker applications. In addition, circulating miRNAs that are within the exosomes act as serum biomarkers to provide information related to immunological status in healthy and diseased conditions. For instance, in people immunized with flu vaccines, the level of microRNA-150 in serum significantly increases post-lymphocyte activation. This supports the potential application of circulating miRNAs as biomarkers for immunological conditions. Therefore, the ability of miRNA to serve as valuable biomarkers in various diseases contributes to the overall market growth.

Partnerships and collaborations play a crucial role in driving the miRNA market by fostering innovation, leveraging expertise, and accelerating the development and commercialization of miRNA-based products. For instance, in 2023, Thermo Fisher Scientific, Inc.announced a collaboration agreement with Pfizer to increase local accessibility to NGS-based testing for breast and lung cancer patients in more than 30 Latin American, African, Middle Eastern, and Asian countries where advanced genomic testing was previously limited or unavailable.

Market Concentration & Characteristics

The market is characterized by a high degree of innovation, with new technologies and methods being developed and introduced at regular intervals. This innovation extends across product formulations, delivery methods, and sustainability practices.

Several market players such as Merck KGaA, Thermo Fisher Scientific, Inc., and QIAGEN are involved in merger and acquisition activities. Through M&A activity, these companies can expand their geographic reach and enter new territories.

Regional expansion in the microRNA market refers to the strategic penetration and growth of market activities, including research, development, and commercialization efforts, into new geographic areas to capitalize on emerging opportunities and address diverse healthcare needs.

Products & Services Insights

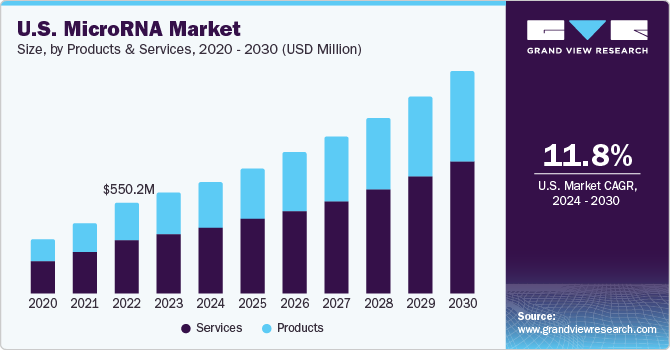

The service segment accounted for the largest revenue share of 58.83% in 2023. The service segment is further divided into isolation & purification,miRNA cDNA synthesis, profiling, localization, & quantification, functional analysis, and others. Adding to it, other service segments including target prediction and validation among others further propel the overall segment growth. For instance, according to a Nature article published in January 2023, a group of researchers developed plant-specific miRNA targets that are correctly predicted by P-TarPmiR. Their findings show that the highest accurate plant-specific miRNA target predictor is obtained by completely excluding animal training data, suggesting that animal-based data may hinder plant miRNA target prediction. All miRNA inside the soybean genome is predicted to have targets using the final P-TarPmiR approach.

The product segment is anticipated to witness significant market growth over the forecast period. Factors such as growing application as a potential biomarker in disease diagnosis and the presence of a substantial number of companies offering consumables such as kits and reagents for miRNA expression studies are chiefly attributed to the growth of the segment.

Application Insights

The cancer segment accounted for the largest revenue share in 2023. The highest revenue share is due to high investments in cancer research adopting miRNA signatures. Furthermore, progress in clinical trials for therapies based on miRNA and clinical diagnostic tests for the differentiation of cancer subtypes and the stage is anticipated to fuel revenue growth. miRNA diagnostics is not only a surplus approach for the diagnosis of differentiated cancer but is also considered a potential breakthrough in cancers of unknown origin.

The infectious disease segment is estimated to register the fastest CAGR over the forecast period. miRNAs are rapidly being recognized as robust biomarkers of human diseases, as they play a significant role in regulating gene expression at the post-transcriptional level. Thus, the aforementioned factors are attributable to the segment growth. Furthermore, the sudden increase in the growth rate of the infectious diseases segment was observed during the pandemic period owing to the COVID-19 outbreak.

End-use Insights

The biotechnology & pharmaceutical companies segment dominated the market in 2023. These companies are at the forefront of establishing collaborations and partnerships with research institutions that allow them to access cutting-edge research and collaborate on large-scale projects to accelerate the pace of miRNA-related advancements.For instance, in August 2022, MiRXES, a biotechnology company based in Singapore, unveiled a range of new capabilities, encompassing an Industry 4.0 (i4.0) manufacturing facility, two additional laboratories, and a collaborative multi-cancer screening research project. These advancements align with MiRXES’ objective to enhance research and production capabilities, with a focus on the development of miRNA-based disease detection tests.

The academic & government research institutes segment is anticipated to show lucrative growth over the forecast period. MiRNA techniques and associated products are being extensively used in numerous research studies that are being conducted by research and academic institutes. Moreover, an increasing number of research studies are likely to boost market growth. For instance, in October 2022, a team of BHU researchers from the School of Biotechnology, Institute of Science, Varanasi, discovered a microRNA that particularly destroys cervical cancer cells. Future research on the study's findings may result in a harmless cervical cancer treatment called micro-RNA therapy.

Regional Insights

North America dominated the market in 2023. Factors such as the local presence of a substantial number of key players such as Thermo Fisher Scientific; NanoString Technologies, Inc.; Merck KGaA.; and others, coupled with an upsurge in research and development spending by key players to develop innovative and advanced products are attributed for the miRNA industry growth in the region.

The U.S. accounted for the largest share of the market in the North America region in 2023. Major market players, such as Thermo Fisher Scientific, Merck KGaA., and QIAGEN, are headquartered in the U.S. These players operate through a well-established distribution network. The miRNA products and services are easily available in the country. Furthermore, these players have a strong focus on R&D that provides robust technological support to customers in the country. For instance, in August 2021, researchers at the Texas Heart Institute unveiled novel insights into disease through miRNA profiling. This underscores the significant role of miRNAs in regulating gene expression and their implications in various biological processes & disease pathogenesis.

The Asia Pacific region is expected to grow at the fastest rate during the forecast period. Factors such as the presence of a significant target population, faster adoption of an array of technologies, several startups coupled with developing healthcare infrastructure, and the existence of high-unmet clinical needs are anticipated to provide growth opportunities to key manufacturers in the region.

China accounted for the largest revenue share of the market in the Asia Pacific region in 2023. Increasing focus on precision medicine and the high potential of miRNAs in developing precision medicine are expected to positively influence market growth. Furthermore, organizations such as the National Science Foundation and the National Nature Science Foundation provide funding and support various omics research. These organizations encourage collaboration of the country's traditional knowledge with scientific advances. For instance, studies are being conducted to investigate the role of miRNAs and Chinese alternative and complementary medicines, such as herbs.

Key Companies & Market Share Insights

Some prominent players operating in the market include Thermo Fisher Scientific, Inc., QIAGEN, and Merck KGaA

-

Thermo Fisher Scientific, Inc. offers a wide range of services that includes miRNA Profiling, miRNA Quantification, and miRNa Functional Analysis. These services are designed to provide comprehensive solutions for studying the role of miRNA molecules in various biological processes and diseases.

-

QIAGEN offers a comprehensive range of services for microRNA (miRNA) analysis that include miRNA Purification, miRNA Localization, and miRNA PCR.

-

Horizon Discovery Group plc., GeneCopoeia, Inc., and NewEngland Biolabs are some of the emerging market players in the microRNA industry.

-

Horizon Discovery Group plc. offers a broad product portfolio of tools and services for applications such as gene function, genetic drivers related to human diseases, gene & cell therapies for precision medicine, and biotherapeutics.

-

GeneCopoeia, Inc.has positioned itself as anemerging player in this expanding market by offering comprehensive tools for miRNA analysis, including plasmid clones, and qPCR Primers & Arrays.

Key MicroRNA Companies:

- Thermo Fisher Scientific, Inc.

- QIAGEN

- Horizon Discovery Group plc.

- NanoString Technologies, Inc.

- Merck KGaA

- Takara Bio, Inc.

- LGC Limited

- BioGenex

- GeneCopoeia, Inc.

- New England Biolabs

Recent Developments

-

In October 2023, Thermo Fisher Scientific planned to invest USD 3.1 billion to acquire Olink Holding AB to expand its life sciences portfolio, which aids in drug discovery.

-

In November 2023, QIAGEN introduced new QIAcuity digital PCR kits & improved software to help biopharma and food safety customers expand their utilization.

MicroRNA Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.76 billion

Revenue forecast in 2030

USD 3.64 billion

Growth rate

CAGR of 12.87% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

December 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Products & services , application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Thermo Fisher Scientific, Inc.; QIAGEN; Horizon Discovery Group plc; NanoString Technologies, Inc.; Merck KGaA; Takara Bio, Inc; LGC Limited; BioGenex; GeneCopoeia, Inc; New England Biolabs

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global MicroRNA Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global microRNA market report based on products & services, application, end-use, and region:

-

Products & Services Outlook (Revenue, USD Million, 2018 - 2030)

-

Services

-

Type

-

Isolation & Purification

-

miRNA cDNA Synthesis

-

Profiling, Localization, & Quantification

-

Functional Analysis

-

Others

-

-

Specimen

-

Whole Blood

-

Serum

-

Plasma

-

FFPE

-

Fresh Frozen Tissue

-

Others

-

-

-

Products

-

Instruments

-

Technology

-

Real Time PCR

-

Microarray

-

NGS

-

Others

-

-

Workflow

-

Isolation & Purification

-

miRNA cDNA Synthesis

-

Profiling, Localization, & Quantification

-

Functional Analysis & Others

-

Others

-

-

-

Consumables

-

Specimen

-

Workflow

-

Isolation & Purification

-

miRNA cDNA Synthesis

-

Profiling, Localization, & Quantification

-

Functional Analysis & Others

-

Others

-

-

Whole Blood

-

Serum

-

Plasma

-

FFPE

-

Fresh Frozen Tissue

-

Others

-

-

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cancer

-

Infectious Diseases

-

Immunological Disorder

-

Cardiovascular Disease

-

Neurological Disease

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Biotechnology & Pharmaceutical Companies

-

Academic & Government Research Institutes

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global microRNA market size was estimated at USD 1.58 billion in 2023 and is expected to reach USD 1.76 billion in 2024.

b. The global microRNA market is expected to grow at a compound annual growth rate of 12.87% from 2024 to 2030 to reach USD 3.64 billion by 2030.

b. microRNA-related profiling, localization, & quantification services dominated the microRNA market with a share of 26.61% in 2023. This is attributable to an increase in functional studies to investigate the role of different miRNAs in various diseases and the increasing adoption of advanced technologies such as NGS for accurate detection and quantification of miRNAs.

b. Some key players operating in the microRNA market include Thermo Fisher Scientific, Inc., QIAGEN, Horizon Discovery Group plc, NanoString Technologies, Inc., Merck KGaA, Takara Bio, Inc, LGC Limited, BioGenex, GeneCopoeia, Inc, and New England Biolabs.

b. The growth of the microRNA market is propelled by substantial investments in research and development initiatives for the development of novel diagnostic tests and therapeutics, coupled with the successful integration of microRNAs in clinical trials.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."