- Home

- »

- Renewable Chemicals

- »

-

Middle East & Africa Palm Oil Market Size & Share ReportGVR Report cover

![Middle East & Africa Palm Oil Market Size, Share & Trends Report]()

Middle East & Africa Palm Oil Market Size, Share & Trends Analysis Report By Product (RBD Palm Oil, Palm Kernel Oil, Crude Palm Oil), By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-069-4

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Specialty & Chemicals

Report Overview

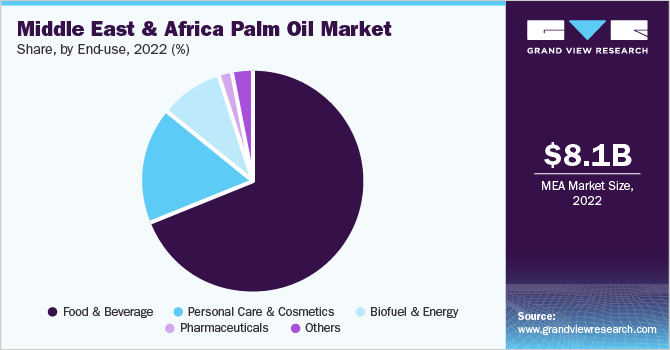

The Middle East & Africa palm oil market size was valued at USD 8.06 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 2.6% from 2023 to 2030. The growth is attributed to the surging consumption of palm oil as a raw material for edible fats, coupled with its increasing utilization in food applications.

The food industry is the largest consumer of the product, accounting for around 70% of the total demand. It is preferred by food manufacturers due to its excellent cooking properties, longer shelf life, and stable texture. It is also a natural source of saturated and unsaturated fats, making it a popular choice for food products such as margarine, chocolate, and baked goods.

Edible oil is one of the prominent end-use segments in the market and is anticipated to positively impact the demand for the product, owing to rising demand from the food & beverage industry. Crude palm oil is widely used as an edible product in the food industry and is expected to continue being an essential part of consumer diets, despite the ban on its use in dairy products in certain countries. It is one of the most prominently consumed products globally and is projected to continue being an essential product.

The prices of the product are likely to remain volatile across the Middle East and Africa region, as it is an importing region and the costs related to exchange rates, food inflation, import & export duty, and changes in trade partners may impact the prices of the product. As the product is an alternative to crude oil in some applications, such as the energy sector, the supply or demand and volatility in the prices of crude oil are also likely to have a direct impact on the prices of palm oil.

Product Insights

The crude palm oil product segment accounted for a substantial revenue share of more than 27% in the Middle East & Africa palm oil market in 2022. The growth is attributed to its increasing adoption over the forecast period as a result of the rapid growth of the food processing industry and its widespread acceptance as an economic and viable alternative to other cooking substances.

RBD palm oil, where RBD refers to refined, bleached, and deodorized, is the liquid fraction obtained after the fractionation and crystallization of the product at controlled temperatures and pressures. This market finds extensive application in domestic cooking, especially for frying. Besides domestic cooking, the product finds industrial applications in the food & beverage sector, such as frying fats of doughnuts, potato chips, and instant noodles, among others.

End-use Insights

The food & beverage end-use segment dominated the market with a revenue share of more than 69% in 2022. The growth is attributed to major food & beverage manufacturers using palm oil to cook potato chips, noodles, and other food products. Additionally, domestic uses include vegetable fats in salad dressing as well as frying oil.It is one of the most consumed products, which is used in several packaged product formulations readily available in supermarkets.

It is used as a raw material in several food items such as margarine, chocolate, fillings, cookies, and ice creams, as well as a cocoa butter substitute. This market is widely utilized in the formulation of ice creams, margarine, chocolates, and cookies as the ingredient imparts a smooth and shiny appearance and creamy taste and texture to the final product.

The others segment includes household cleaners, laundry detergents, chemical intermediaries, and feed. Palm oil is widely used as a lubricant, as such lubricants are known to reduce carbon dioxide emissions compared to mineral lubricants. This is expected to propel the demand for the market as a bio-lubricant. The product also has extensive demand as a lubricant in automotive, industrial, and maintenance applications. Growing environmental concerns and high penetration of petroleum-based surfactants are poised to compel manufacturers to incorporate this product in surfactant production.

Additionally, the market is broadly utilized in several personal care & cosmetic products, including skincare, suntan, and makeup products, owing to its moisturizing, texturizing, softening, foaming, and solubilizing properties. HPO and HPKO are the two major types of products preferred by cosmetic manufacturers, as they can be utilized to increase the viscosity of cosmetic formulations.

Biofuels are renewable sources of energy made from organic waste such as sugar, corn, waste feedstock, and vegetable oils. Ethanol and biodiesel are prominent biofuel types, among which, biodiesel has earned enormous popularity as an effective alternative to diesel. In terms of raw materials, palm oil is considered a traditional feedstock for biodiesel production.

Among all the present raw materials, palm oil possesses a high amount of oleic and palmitic acids, which are considered appropriate sources of biodiesel. Furthermore, increasing biodiesel demand along with growing palm plantations are factors projected to boost market demand in the biodiesel sector over the forecast period.

Regional Insights

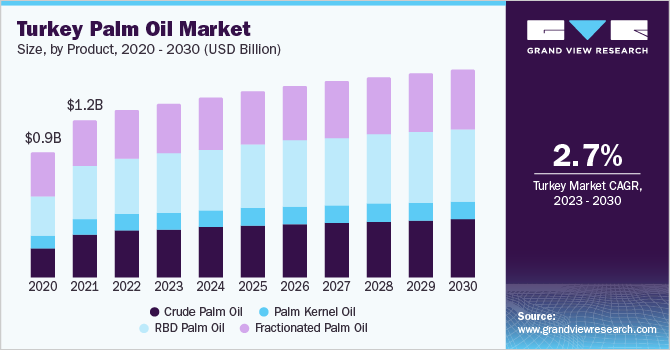

The Middle East dominated the market with a revenue share of 60.0% in 2022. The regional growth is attributed to the fact that countries such as the UAE, Turkey, and Saudi Arabia account for a major share of the exports. According to the ASEAN briefing report, Malaysia, which is the second-largest producer and exporter in the global market, exported around 2.34 million tons of palm oil to the Middle East region, with the UAE, Turkey, and Saudi Arabia accounting for 82% of the total exports. In addition, Malaysia is engaged in various campaigns to promote its products in the UAE market.

On the other hand, Africa is a major palm oil-producing region in the world. Countries such as South Africa, Nigeria, Ghana, and Egypt have widespread farmlands for the plantation of the product. According to the World Economic Forum, almost 20 African countries grow oil palm on approximately 6 million hectares of land. Additionally, Ghana, which is likely to replace the Ivory Coast in terms of product export and production, is likely to fuel the market growth in West Africa.

Nigeria is a major palm oil producer in sub-Saharan Africa, and continues to strive for self-sufficiency in terms of oil palm production. It is an important ingredient in the diet of the country’s population. The rise in consumer-oriented processed food products is likely to drive the usage of palm oil in food processing applications in Africa.

Key Companies & Market Share Insights

The market is highly competitive, with a few major players dominating the industry. Wilmar International Ltd, The Archer Daniels Midland Company (ADM), IOI Corporation Berhad, and Asian Agri are some of the key players operating in the palm oil market in the Middle East & Africa. Production capacity expansions and mergers & acquisitions are anticipated to remain key success factors for industry participants over the forecast period.

For instance, Kuala Lumpur Kepong Berhad acquired Equatorial Palm Oil plc’s 50% interest in Liberian Palm Developments Ltd. (LPD), in May 2020. Some of the notable companies in the Middle East & Africa palm oil market include:

-

ADM

-

Wilmar International Ltd

-

Sime Darby Plantation Berhad

-

IOI Corporation Berhad

-

Kuala Lumpur Kepong Berhad

-

United Plantations Berhad

-

PT Sampoerna Agro Tbk

-

Univanich Palm Oil Public Company Ltd.

-

PT. Bakrie Sumatera Plantations Tbk

-

Asian Agri

Middle East & Africa Palm Oil Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 8.36 billion

Revenue forecast in 2030

USD 9.89 billion

Growth Rate

CAGR of 2.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in kilotons, revenue in USD billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

Middle East; Africa

Country scope

Turkey; Saudi Arabia; UAE; Oman; Yemen; South Africa; Kenya; Nigeria; Ghana; Egypt

Key companies profiled

ADM; Wilmar International Ltd; Sime Darby Plantation Berhad; IOI Corporation Berhad; Kuala Lumpur Kepong Berhad; United Plantations Berhad; PT Sampoerna Agro Tbk; Univanich Palm Oil Public Company Ltd.; PT. Bakrie Sumatera Plantations Tbk; Asian Agri

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East & Africa Palm Oil Market Report Segmentation

This report forecasts revenue and volume growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the Middle East & Africa palm oil market report based on product, end-use, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Crude Palm Oil

-

RBD Palm Oil

-

Palm Kernel Oil

-

Fractionated Palm Oil

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Food & Beverage

-

Personal Care & Cosmetics

-

Biofuel & Energy

-

Pharmaceuticals

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Middle East & Africa

-

Middle East

-

Turkey

-

Saudi Arabia

-

UAE

-

Oman

-

Yemen

-

-

Africa

-

South Africa

-

Kenya

-

Nigeria

-

Ghana

-

Egypt

-

-

-

Frequently Asked Questions About This Report

b. The Middle East & Africa palm oil market size was estimated at USD 8.06 billion in 2022 and is expected to reach USD 8.36 billion in 2023.

b. The Middle East & Africa palm oil market is expected to grow at a compound annual growth rate of 2.6% from 2023 to 2030 to reach USD 9.89 billion by 2030.

b. Food & Beverage dominated the Middle East & Africa palm oil market with a share of 69.1% in 2022. This is attributable to wide utilization in the formulation of ice creams, margarine, chocolates, and cookies among others

b. Some key players operating in the Middle East & Africa palm oil market include Wilmar International Ltd, The Archer Daniels Midland Company (ADM), IOI Corporation Berhad, and Asian Agri among others

b. Key factors that are driving the Middle East & Africa palm oil market growth include helping in improving hair growth, and eye vision, lowering risks associated with cancer and cardiovascular issues among others

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."