Middle East And Africa Telehealth Market Size, Share, And Trends Analysis Report By Product (Software, Services), By Delivery Mode (Web Based, Cloud Based), By Disease Area, By End Use, By Country, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-971-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

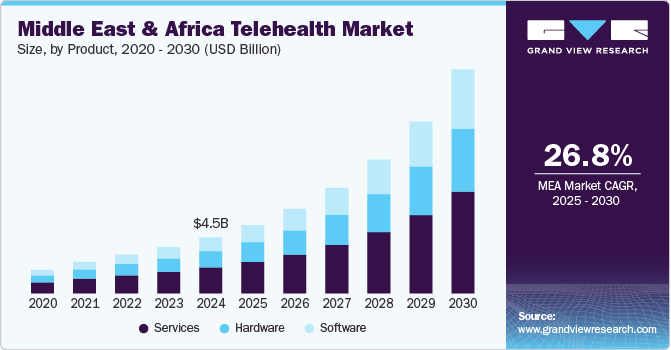

The Middle East and Africa telehealth market size was estimated at USD 4.51 billion in 2024 and is projected to grow at a CAGR of 26.8% from 2025 to 2030. Improving internet connectivity and increasing smartphone penetration are supporting the digitalization of healthcare. According to the GSMA report from 2023, the number of unique mobile subscribers in the Middle East and North Africa reached 415 million. Furthermore, smartphone adoption in the region was 79% in 2022 and is expected to rise to 90% by 2030.

Countries such as Saudi Arabia, Qatar, the UAE, Kuwait, and South Africa in the region are prospering. Advancements in healthcare systems are expected to bring digital health into action within these countries. Growing digital readiness and increasing expenditure on healthcare IT infrastructure in these countries are driving growth. For instance, Saudi Arabia is focusing on implementing multiple strategies to adopt the digitalization of healthcare, which would significantly transform care delivery & patients experience and support overall efficiency improvement. Kingdom Vision 2030 is an initiative undertaken by the government bodies of Saudi Arabia to bring transformations to the healthcare industry.

With the increasing penetration of smartphones, governments, entrepreneurs, and healthcare professionals are inclining more toward smartphones for better and healthier lifestyles. Some of the segments that could significantly contribute to the MEA digital health industry are offering self-service solutions, adopting virtual solutions wherever feasible & appropriate, automating workflow, paperless-functioning, and adopting decision intelligence systems.

With increasing adoption of internet, smart devices, and telemedicine in the field of healthcare, there has been an increase in cybersecurity issues. There have been incidents of hacking and siphoning confidential information through connected & smart devices. Owing to data security concerns related to healthcare information, government bodies, healthcare organizations, and experts are hesitating to adopt virtual care solutions on a larger and national scale. Some of the major factors negatively affecting adoption are budget & staffing issues and lack of proper cybersecurity systems, firewalls, & expertise in the field.

Market Concentration and Characteristics

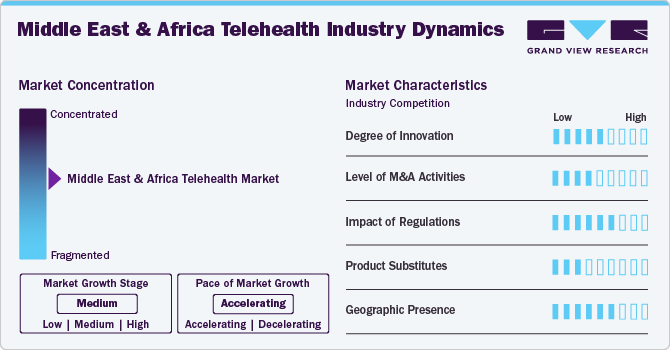

The region has seen a surge in mobile health applications, remote monitoring technologies, and virtual consultation platforms. Furthermore, governments and private sectors are investing in digital health initiatives, fostering collaborations with tech companies to enhance infrastructure and expand telehealth services. Innovations such as artificial intelligence for diagnostics, blockchain for secure patient data management, and IoT devices for real-time health monitoring are gaining traction.

The market is characterized by a moderate level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including the desire to expand the business to cater to the growing demand for Middle East and Africa telehealth.

Regulations are vital in shaping the Middle East and Africa market, impacting the growth and implementation of digital health services. As countries in the region work to modernize their healthcare systems, they are developing regulatory frameworks to ensure the safety, quality, and effectiveness of telehealth solutions. These regulations cover various aspects, including data privacy, security standards, and the licensing of healthcare providers.

Traditional in-person consultations remain a strong alternative, particularly in areas with well-established healthcare infrastructure or where trust in remote services is limited. In addition, alternative healthcare solutions such as community health workers, home-based care, and wellness apps offer patients different pathways for receiving medical advice and support.

Several market players are expanding their business by entering new geographical regions to strengthen their market position and expand their product portfolio. Rising product approvals and funding create more opportunities for market players to enter new regions.

Product Insights

The services segment dominated the market and accounted for the largest revenue share of 46.4% in 2024. This can be attributed to rapid advancements in hardware & software and an increase in the number of software upgradations. Moreover, the presence of large number of service providers is supporting segmental growth. Digital health service providers offer more accurate diagnosis, real-time monitoring of chronic ailments & effective treatment planning, better coordinated care, and improve patient & provider convenience & communication. Furthermore, as healthcare facilities lack resources and skill sets required for the deployment of digital health solutions, these services are outsourced. Either the complete process is outsourced, or a part of it in the form of a long-term contract. Services such as installations, education & training, and upgradation are all dependent on the development of these abovementioned platforms.

The software segment is anticipated to witness the fastest expansion from 2025 to 2030. Rapid implementation of electronic health records, electronic patient records, and telemedicine software is driving the segment. Moreover, rapid adoption of cloud-based technologies is supporting segment growth. Similarly, the integration of advanced AI-powered software solutions in telehealth and digital health offerings enables healthcare facilities to prioritize care based on emergencies and minimize non-urgent hospital visits. Implementing these advanced software solutions in telehealth programs could enhance patient care experience and improve quality of data for clinical decision-making.

Delivery Mode Insights

The web-based segment dominated the market and accounted for the largest revenue share of 45.0% in 2024. This is attributable to the availability of a large number of web-based telehealth platforms in the region. High usage rates of web-based platforms among providers and patients are contributing to the segment revenue. The use of web-based systems significantly reduces operational hassles owing to the processing of large volumes of data. Cost-effectiveness and seamless user interface of web-based telehealth solutions are contributing to the growth of the segment.

The cloud-based segment is anticipated to witness significant growth from 2025 to 2030 owing to the various advantages offered by cloud-based telehealth applications such as high bandwidth, true remote accessibility, easy data recovery & storage, and better data privacy & security. Furthermore, a cloud-based delivery mode offers better interoperability and integration. These applications and platforms are easier to deploy and provide users with higher efficiency & convenience. Growing IT infrastructure needs & changing business requirements and information sharing & improved patient engagement is supporting the development and growth of this segment.

Disease Area Insights

In 2024, the radiology segment had a significant revenue share of 13.0% in the market for telehealth in the Middle East and Africa. The increasing prevalence of chronic diseases and the rising demand for diagnostic imaging services are propelling the need for efficient radiology solutions. Tele-radiology allows for faster access to diagnostic results that is crucial in regions facing a shortage of radiologists. Additionally, advancements in imaging technologies, coupled with improved internet connectivity, facilitate the transmission of high-quality images for remote analysis, thus enhancing diagnostic accuracy. Furthermore, government initiatives promoting digital health and investment in healthcare infrastructure are supporting the integration of tele-radiology into existing healthcare systems.

The psychiatry segment in the Middle East and Africa telehealth market is anticipated to witness significant growth over the forecast period. The increasing awareness and acceptance of mental health issues leads to greater demand for accessible psychiatric services. Furthermore, government initiatives and investments aimed at enhancing mental health services are supporting the integration of telehealth solutions. Moreover, increasing prevalence of mental issues in the region is driving the market growth. For instance[SL2] , according to research published by ResearchGate GmbH in 2020, the occurrence of mental illness varies between 15.6% and 35.5%, with the higher percentages found in countries experiencing complex crises such as war and famine.

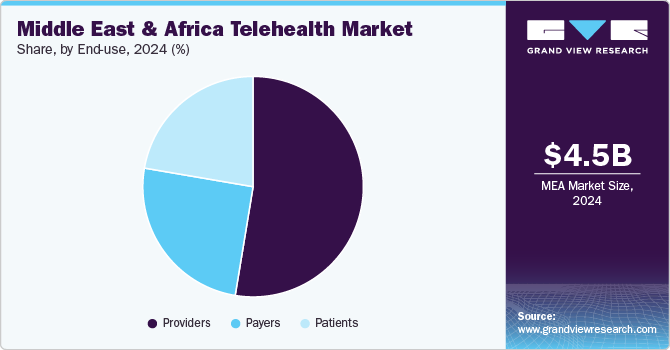

End Use Insights

The providers segment dominated the market and accounted for the largest revenue share of 52.6% in 2024. Healthcare providers are increasingly adopting telehealth platforms to reduce the burden on hospital infrastructure and staff. Moreover, the demand for quality care from the rapidly growing population is increasing. Furthermore, healthcare facilities and care providers are witnessing improvements in workflow management and clinical outcomes through seamless access of patient health information, real-time patient monitoring & reporting, and improved data-driven decision making. Virtual care services and solutions have enhanced providers’ performance and efficiency, allowing them to adopt a more value-based care approach.

The patients segment is anticipated to witness significant growth from 2025 to 2030 owing to the growing demand for personalized treatment, adoption of patient-centric care delivery systems, growing health-consciousness, increase in technology-friendly individuals, improving internet connectivity & smartphone penetration. Numerous strategies have been planned and implemented to bridge the communication & care delivery gaps between patient and provider. Middle Eastern and African countries witnessed a significant rise in active users and website visits on telehealth platforms. Furthermore, the promotion of telehealth platforms by local government bodies is driving the growth of the patients segment.

Country Insights

UAE Telehealth Market Trends

UAE telehealth market in the held the largest share of 24.8% in 2024. The region is focusing on strategies to spread awareness towards adopting and implementing telehealth and virtual care platforms amongst patients, care providers, and other industry stakeholders. For instance, the 3rd Annual MENA (Middle East and North Africa) Telehealth Conference was combined with the 26th International Society for Telemedicine and eHealth (ISfTeH) Conference in March 2022 held in Dubai.

The telehealth market in Saudi Arabia is anticipated to register the fastest growth during the forecast period owing to the government support, technological advancements, and evolving healthcare needs. The Saudi Vision 2030 initiative emphasizes the digitization of healthcare and the expansion of telehealth services. Additionally, the increasing prevalence of chronic diseases, along with a growing population and urbanization, are supplementing market growth.

Key Middle East And Africa Telehealth Market Company Insights

Key participants in the market are focusing on devising innovative business growth strategies in the form of product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions.

Key Middle East And Africa Telehealth Companies:

- Teladoc Health

- McKesson Corporation

- Altibbi

- Koninklijke Philips N.V.

- Siemens Healthineers

- Medtronic

- Cura

- Cerner Corporation

- CISCO Systems, Inc.

Recent Developments

-

In January 2024, Rudolf Riester GmbH announced the worldwide introduction of its telemedicine solution, featuring the ri-sonic E-Stethoscope along with eMurmur AI integration for detecting heart murmurs at Arab Health 2024.

-

In March 2022, Altibbi, a renowned AI-powered digital health platform in Middle East raised USD 44 million in Series B funding round and the company would utilize this funding to establish an end-to-end integrated digital primary health solution.

-

In March 2021, Philips partnered with Orbita, Inc., a provider of conversational AI-based algorithms and solutions for healthcare. The two companies under this partnership would co-develop innovative conversational virtual assistants to enhance Philip’s patient support and consumer health applications.

Middle East And Africa Telehealth Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 5.50 billion |

|

Revenue forecast in 2030 |

USD 18.05 billion |

|

Growth rate |

CAGR of 26.8% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast data |

2025 - 2030 |

|

Report updated |

November 2024 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, delivery mode, disease area, end use, country |

|

Regional scope |

Middle East And Africa |

|

Country scope |

Saudi Arabia; UAE; Kuwait; South Africa |

|

Key companies profiled |

Koninklijke Philips N.V; Siemens Healthineers; Cerner Corporation; Medtronic PLC; Cura; Altibbi; McKesson Corporation; eClinicalWorks; CISCO Systems, Inc.; Teladoc Health |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Middle East And Africa Telehealth Market Report Segmentation

This report forecasts revenue and volume growth at regional and country levels and provides an analysis on industry trends in each of the sub segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the Middle East and Africa telehealth market report based on the product, delivery mode, end use, disease area, and country:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Monitors

-

Medical Peripheral Devices

-

Blood Pressure Meters

-

Blood Glucose Meters

-

Weighing Scales

-

Pulse Oximeters

-

Peak Flow Meters

-

ECG Monitors

-

Others

-

-

-

Software

-

Standalone Software

-

Integrated Software

-

-

Services

-

Remote Patient Monitoring

-

Real-Time Interactions

-

Store and Forward

-

Others

-

-

-

Delivery Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Web-Based

-

Cloud-Based

-

On-Premises

-

-

Disease Area Outlook (Revenue, USD Million, 2018 - 2030)

-

Psychiatry

-

Substance Use

-

Radiology

-

Endocrinology

-

Dermatology

-

Gastroenterology

-

Neurological Medicine

-

ENT

-

Cardiology

-

Oncology

-

Dental

-

Gynecology

-

General Medicine

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Providers

-

Payers

-

Patients

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Saudi Arabia

-

UAE

-

Kuwait

-

South Africa

-

Frequently Asked Questions About This Report

b. UAE dominated the Middle East and Africa telehealth market with a share of 24.8% in 2024. The UAE is one of the most promising markets for digital healthcare and telehealth platforms. Factors such as government aids to innovative start-ups and significant funding by the government to promote telehealth are propelling market growth in the country.

b. Some key players operating in the Middle East and Africa telehealth market include Koninklijke Philips N.V; Siemens Healthineers; Cerner Corporation; Medtronic PLC; Cura; Altibbi; McKesson Corporation; eClinicalWorks; CISCO Systems, Inc.; Teladoc Health

b. Key factors that are driving the market growth include improving internet connectivity and increasing smartphone penetration is supporting the digitalization of healthcare.

b. The Middle East and Africa telehealth market size was estimated at USD 4.51 billion in 2024 and is expected to reach USD 5.50 billion in 2025.

b. The Middle East and Africa telehealth market is expected to grow at a compound annual growth rate of 26.8% from 2025 to 2030 to reach USD 18.05 billion by 2030.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."