- Home

- »

- Advanced Interior Materials

- »

-

Middle East Chillers Market Size, Industry Report, 2033GVR Report cover

![Middle East Chillers Market Size, Share & Trends Report]()

Middle East Chillers Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Water-Cooled, Air-Cooled), By Application (Commercial, Industrial, Residential), By Compressor Type, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-735-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Chillers Market Summary

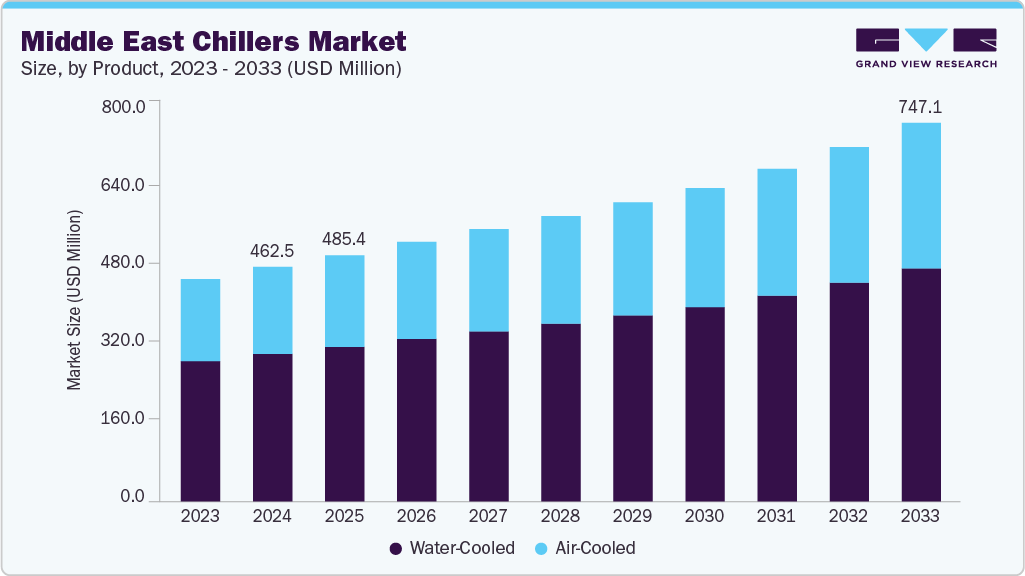

The Middle East chillers market size was estimated at USD 462.5 million in 2024 and is projected to reach USD 747.1 million by 2033, growing at a CAGR of 5.5% from 2025 to 2033. The Middle East chillers market is primarily driven by the region’s rapid infrastructure development and ongoing construction boom, particularly in commercial, residential, and hospitality sectors.

Key Market Trends & Insights

- The Saudi Arabia chillers market is expected to grow at a substantial CAGR of 5.9% from 2025 to 2033.

- By product, the air-cooled segment is expected to grow at a considerable CAGR of 6.0% from 2025 to 2033.

- By application, the commercial segment is projected to expand at a CAGR of 6.0% from 2025 to 2033.

- By compressor type, the screw chillers segment is expected to grow at a significant CAGR of 6.0% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 462.5 Million

- 2033 Projected Market Size: USD 747.1 Million

- CAGR (2025-2033): 5.5%

With large-scale projects such as smart cities, luxury hotels, shopping malls, and mixed-use developments, demand for efficient and large-capacity cooling systems continues to rise. The hot and arid climate further amplifies the reliance on central cooling solutions, making chillers a critical component in delivering year-round indoor comfort and maintaining optimal building performance. Another factor supporting market growth is the rising focus on energy efficiency and sustainability. Governments across the region are implementing green building codes and energy efficiency regulations, encouraging the adoption of modern chillers that consume less power and use eco-friendly refrigerants. Technological advancements such as magnetic bearing chillers, variable-speed compressors, and integration with smart building management systems are also helping end-users reduce operational costs while aligning with national sustainability goals, such as the UAE’s Energy Strategy 2050 and Saudi Arabia’s Vision 2030.

Market Concentration & Characteristics

The Middle East chillers market is moderately concentrated, with a mix of global HVAC leaders and dynamic regional manufacturers. International companies such as Carrier, Trane, Daikin, and Johnson Controls hold a significant share by leveraging their extensive product portfolios, advanced technologies, and strong project execution capabilities. Their ability to deliver large-scale, high-capacity solutions for mega infrastructure projects in commercial, industrial, and residential sectors reinforces their dominance. At the same time, regional players contribute by offering competitive pricing, faster response times, and tailored solutions that address the unique climatic and operational challenges of the Middle East, ensuring a balanced competitive environment.

Regulatory frameworks play a pivotal role in shaping the Middle East chillers market. Governments are increasingly implementing policies that promote energy efficiency and sustainability, including mandatory green building codes, district cooling mandates, and incentives for eco-friendly refrigerants. These regulations are closely aligned with national strategies such as the UAE Energy Strategy 2050 and Saudi Arabia’s Vision 2030, which emphasize reducing carbon emissions and improving energy use efficiency. As a result, manufacturers and developers are under growing pressure to adopt high-performance, environmentally responsible chillers that meet or exceed minimum energy performance standards.

Together, these competitive and regulatory dynamics are accelerating the shift toward technologically advanced and sustainable cooling solutions. While global leaders set the benchmark for innovation and capacity, regional suppliers ensure adaptability and accessibility in local markets. Regulatory enforcement, coupled with rising customer awareness of lifecycle costs, is further driving the market toward eco-friendly, smart chiller systems. This evolving landscape ensures steady growth while encouraging continuous product innovation and alignment with broader sustainability goals across the Middle East.

Drivers, Opportunities & Restraints

The Middle East chillers market benefits from a combination of climate-driven necessity, construction growth, and evolving regulatory frameworks. While infrastructure expansion creates a strong base of demand, the shift toward sustainable, energy-efficient cooling solutions ensures long-term opportunities for both global and regional chiller manufacturers present in the region. This dual focus on capacity and efficiency positions the market for sustained growth in the coming years.

Moreover, the market presents strong opportunities in the shift toward district cooling and smart, integrated HVAC systems. With governments and developers increasingly prioritizing sustainable urban planning, centralized cooling plants powered by high-capacity chillers are gaining momentum across cities in the UAE, Saudi Arabia, and Qatar. Furthermore, technological innovation-such as IoT-enabled chillers, AI-driven performance optimization, and low-GWP refrigerant adoption-offers manufacturers the chance to deliver differentiated, future-ready solutions that align with regional climate goals and create new growth avenues.

On the other hand, a key restraint for the Middle East chillers market is the high initial investment and long payback period associated with advanced chiller systems. Many energy-efficient models, such as magnetic bearing or absorption chillers, come with significant upfront costs, making them less accessible for smaller projects or cost-sensitive developers. In addition, fluctuating energy prices, water scarcity concerns for water-cooled chillers, and maintenance challenges in harsh desert environments can further discourage adoption, particularly where budgets are constrained.

Product Insights

The water-cooled chillers segment led the market in terms of regional revenue, accounting for 62.9% of the market share in 2024. Water-cooled chillers in the Middle East are primarily driven by their efficiency in handling large-scale cooling loads, making them well-suited for mega infrastructure projects, airports, shopping malls, and district cooling plants. Their ability to deliver consistent performance in high ambient temperature conditions-where cooling demand is intense-gives them an edge over other systems. Additionally, the expansion of district cooling networks in cities like Dubai, Riyadh, and Doha further supports their demand, as water-cooled chillers form the backbone of centralized cooling systems that help reduce peak electricity consumption and align with government energy efficiency initiatives.

Air-cooled chillers are gaining traction in the Middle East due to their lower installation costs, easier maintenance, and ability to operate independently of a constant water supply. Given the region’s water scarcity challenges, particularly in Saudi Arabia and the UAE, air-cooled solutions are preferred for projects where water use needs to be minimized. Their modular designs also make them attractive for mid-sized commercial developments, healthcare facilities, and retrofit projects. Ongoing improvements in energy efficiency and noise reduction further enhance their adoption in both urban and semi-urban applications.

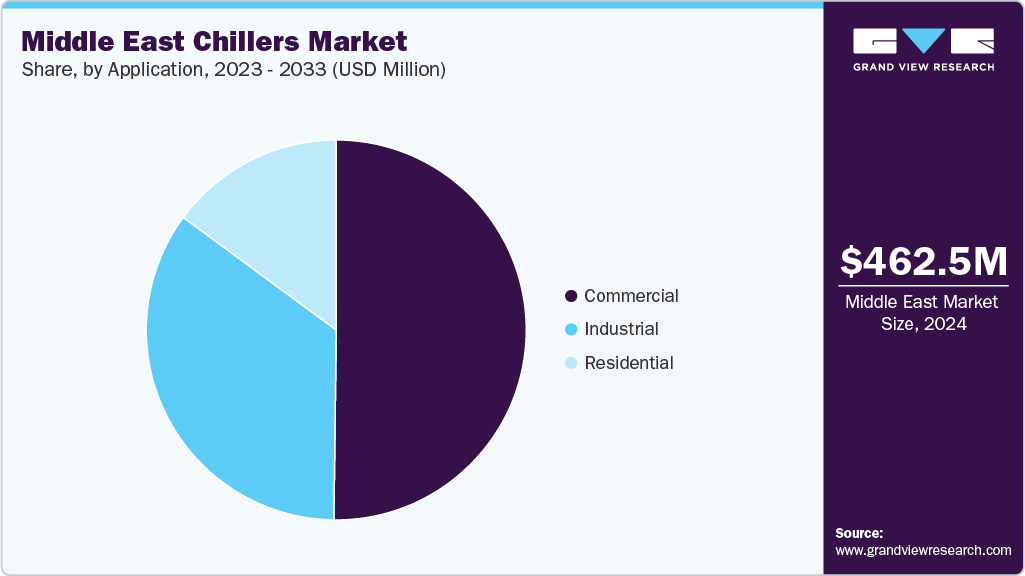

Application Insights

The commercial segment is the largest by market share, accounting for 50.2% in 2024. Mega-projects such as hotels, resorts, shopping complexes, and public infrastructure require reliable, efficient cooling to maintain indoor comfort in extreme climatic conditions. The growth of data centers in the Gulf region, accelerated by digital transformation and cloud adoption, is further boosting demand for precision cooling solutions within the commercial space. Additionally, government-backed smart city initiatives and tourism development programs provide a strong pipeline of commercial construction that sustains this segment’s growth.

Industrial applications of chillers are driven by the region’s strong petrochemical, chemical, and manufacturing base. Processes in these sectors require reliable cooling to maintain operational safety, product quality, and equipment longevity. For example, petrochemical plants use chillers to manage heat loads in processing, while food and beverage industries depend on them for cold storage and production. Pharmaceutical and medical manufacturing are also expanding, requiring precise temperature control solutions. The push toward industrial diversification in Saudi Arabia’s Vision 2030 and the UAE’s industrial strategy ensures long-term demand from this segment.

Compressor Type Insights

The screw chillers segment represented the largest share of the market in 2024 at 49.5% due to their reliability, ability to handle part-load operations, and suitability for medium-to-large scale cooling requirements. They are widely used in commercial complexes, hospitals, and industrial facilities that require continuous cooling in high-temperature conditions. Their relatively lower maintenance needs compared to centrifugal systems, combined with energy-efficient designs such as variable speed drive integration, make them a cost-effective solution for many end-users in the region.

Scroll chillers are driven by demand from small-to-medium scale applications, particularly in the commercial and residential sectors. Their compact size, quiet operation, and relatively lower upfront cost make them attractive for offices, healthcare centers, and smaller retail projects. The rise of decentralized cooling requirements, such as in villas, low-rise buildings, and smaller hospitality establishments, further supports the adoption of scroll chillers. Additionally, advancements in scroll compressor technology have improved efficiency, making these chillers more competitive in meeting sustainability and performance targets.

Country Insights

Saudi Arabia Chillers Market Trends

The Saudi Arabia chillers market dominated the regional revenue share, holding 51.5% of the market in 2024 driven largely by large-scale infrastructure development under Vision 2030. Investments in commercial spaces, mixed-use developments, airports, and industrial zones are fueling demand for high-capacity chillers. District cooling is also gaining momentum, particularly in Riyadh and other growing urban hubs, as the government pushes for sustainable solutions to reduce peak electricity consumption. Industrial diversification-especially in petrochemicals, pharmaceuticals, and food & beverage-adds another layer of demand for process cooling, making Saudi Arabia one of the fastest-expanding markets in the region.

UAE Chillers Market Trends

The UAE chillers market is projected to expand at a considerable CAGR of 5.6% over the forecast period. The country’s market remains one of the most mature and advanced chiller markets in the Middle East, anchored by its extensive use of district cooling systems, particularly in Dubai and Abu Dhabi. The government’s Energy Strategy 2050 and strict green building codes have accelerated adoption of energy-efficient and low-GWP refrigerant chillers. Rapid expansion in hospitality, tourism, and commercial real estate-alongside the surge in data center investments-further drives market growth. The country’s commitment to sustainability and its role as a hub for innovation ensures ongoing demand for smart, connected, and high-efficiency chiller systems.

Key Middle East Chillers Company Insights

Some of the key players operating in the market include Carrier and DAIKIN INDUTRIES, LTD.

-

Carrier Corporation provides heat pumps, air conditioners, boilers, furnaces, air purifiers, humidifiers, dehumidifiers, ventilators, air scrubbers, thermostats, UV lamps, energy services, and building controls to the retail, commercial, transport, and foodservice sectors. It was acquired by United Technologies Corporation in 1979; however, it was separated into a separate business in April 2020.

-

DAIKIN INDUSTRIES, LTD. is a Japanese multinational conglomerate headquartered in Osaka. The company operates through six primary business segments: air conditioning, chemicals, filters, oil hydraulics, defense systems, and medical equipment. It is a prominent company in developing and manufacturing air conditioning and refrigeration solutions, offering a wide range of products including residential and commercial HVAC systems, heat pumps, air purifiers, and fluorochemicals

Key Middle East Chillers Companies:

- Trane

- DAIKIN INDUSTRIES, LTD

- Carrier

- MITSUBISHI HEAVY INDUSTRIES, LTD

- Johnson Controls plc

- Lennox International Inc.

- Emirates Jo Trade Co. L.L.C.

- Smardt Chiller Group, Inc

- Dunham Bush

- LG Electronics

Recent Developments

-

In March 2025, Smardt Chiller Group, Inc. introduced the AeroPure AF Series, a new line of oil-free, air-cooled chillers featuring magnetically suspended compressors and low-GWP refrigerants such as R513A, R515B, and R1234ze. Available in 72 preconfigured models (capacity ranges from 211 to 2,500 kW), the series offers high energy efficiency (EER up to 16, IPLV up to 25.9), modular container-friendly design, and advanced controls for seamless integration into building or data center management systems.

-

In April 2025, Johnson Controls plc expanded the availability of its York YVAM air-cooled magnetic-bearing chillers across the Middle East. Designed specifically for data centers, these chillers offer up to 40% lower power consumption, zero water usage, ultra-low GWP refrigerants, and reliable operation in ambient temperatures up to +55 °C. They also deliver rapid recovery after power outages and operate quietly, making them suitable for hyperscale and colocation facilities.

Middle East Chillers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 485.4 million

Revenue forecast in 2033

USD 747.1 million

Growth rate

CAGR of 5.5% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, compressor type, country

Country scope

Saudi Arabia; UAE; Oman; Qatar

Key companies profiled

Trane; DAIKIN INDUSTRIES, LTD; Carrier; MITSUBISHI HEAVY INDUSTRIES, LTD; Johnson Controls plc; Lennox International Inc.; Emirates Jo Trade Co. L.L.C.; Smardt Chiller Group, Inc; LG Electronics; Dunham Bush

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Chillers Market Report Segmentation

This report forecasts revenue growth at region & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East chillers market report based on product, application, compressor type, and country:

-

Product Outlook (Revenue, USD Million; 2021 - 2033)

-

Water-Cooled

-

<50kW

-

51-100kW

-

101-500kW

-

501-1000kW

-

1001-1500kW

-

>1501kW

-

-

Air-Cooled

-

<50kW

-

51-100kW

-

101-500kW

-

501-1000kW

-

1001-1500kW

-

>1501kW

-

-

-

Application Outlook (Revenue, USD Million; 2021 - 2033)

-

Commercial

-

Corporate Offices

-

Data Centres

-

Public Buildings

-

Mercantile & Service

-

Healthcare

-

Others

-

-

Residential

-

Industrial

-

Chemicals and Petrochemicals

-

Food & Beverage

-

Metal Manufacturing & Machining (Metal Anodizing, laser, stamping, welding, etc.)

-

Medical & Pharmaceutical

-

Plastics

-

Others

-

-

-

Compressor Type Outlook (Revenue, USD Million; 2021 - 2033)

-

Screw Chillers

-

Centrifugal Chillers

-

Absorption Chillers

-

Scroll Chillers

-

Reciprocating Chillers

-

-

Country Outlook (Revenue, USD Million; 2021 - 2033)

-

Saudi Arabia

-

Oman

-

UAE

-

Qatar

-

Frequently Asked Questions About This Report

b. The Middle East chillers market size was estimated at USD 462.5 million in 2024 and is expected to be USD 485.4 million in 2025.

b. The Middle East chillers market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.5% from 2025 to 2033 to reach USD 747.1 million by 2033.

b. The Saudi Arabia chillers market held the largest regional share of the market accounting for 51.5% in 2024 driven by Vision 2030–driven infrastructure projects, commercial developments, and industrial expansion. Rising adoption of district cooling and process cooling in key sectors further supports demand.

b. Some of the key players operating in the Middle East chillers market include Trane, DAIKIN INDUSTRIES, LTD, Carrier, MITSUBISHI HEAVY INDUSTRIES, LTD, Johnson Controls plc, Lennox International Inc., Emirates Jo Trade Co. L.L.C., Smardt Chiller Group, Inc, LG Electronics and Dunham Bush

b. The Middle East chillers market is driven by rapid infrastructure and commercial development, alongside extreme climatic conditions that create high cooling demand. Growing emphasis on energy efficiency and sustainable HVAC solutions further accelerates adoption across sectors

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.