- Home

- »

- Advanced Interior Materials

- »

-

Middle East CO2 Compressor Market, Industry Report, 2033GVR Report cover

![Middle East CO2 Compressor Market Size, Share & Trends Report]()

Middle East CO2 Compressor Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Reciprocating Compressors, Centrifugal Compressors), By Application, By Type, By Power Source, By End-use, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-709-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East CO2 Compressor Market Summary

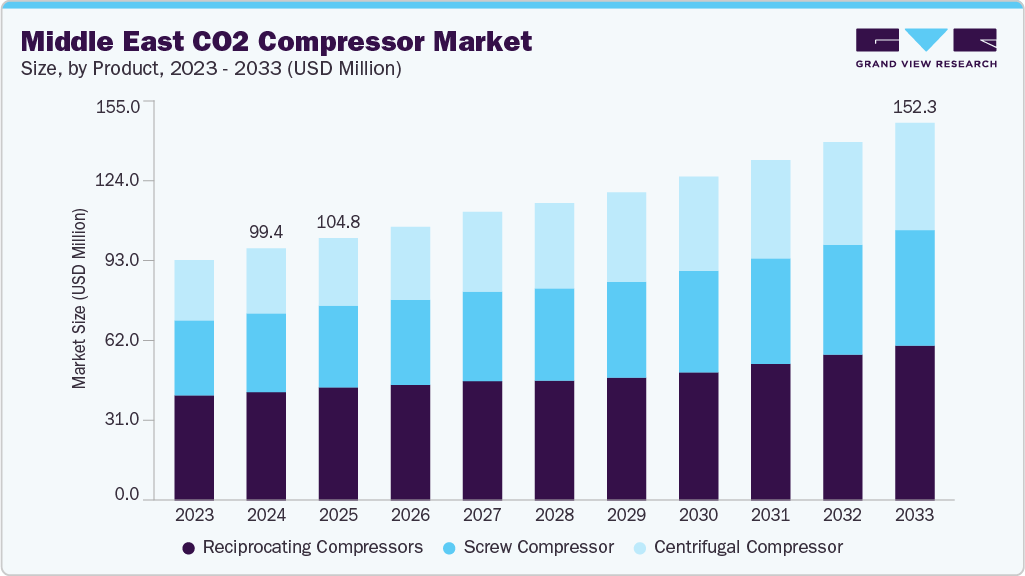

The Middle East CO2 compressor market size was valued at USD 99.4 million in 2024 and is projected to reach USD 152.3 million by 2033, growing at a CAGR of 4.8% from 2025 to 2033. The industry is driven by strong demand from the oil recovery and industrial processing sectors.

Key Market Trends & Insights

- The Saudi Arabian market is expected to grow at a substantial CAGR of 5.1% from 2025 to 2033.

- By product, centrifugal compressors are expected to grow at a considerable CAGR of 5.4% from 2025 to 2033 in terms of revenue.

- By application, the carbonating segment is expected to grow at a considerable CAGR of 5.8% from 2025 to 2033 in terms of revenue.

- By type, oil-cooled compressors are expected to grow at a considerable CAGR of 5.0% from 2025 to 2033 in terms of revenue.

- By end use, the food & beverage segment is expected to grow at a considerable CAGR of 5.5% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 99.4 Million

- 2033 Projected Market Size: USD 152.3 Million

- CAGR (2025-2033): 4.8%

Investments in high-capacity compressors, advanced cryogenic technology, and automation, along with regulatory focus on carbon management, are accelerating regional growth. Innovations such as energy-efficient variable speed drives, enhanced sealing systems, and integration with digital monitoring platforms are improving performance, reducing emissions, and supporting sustainable industrial operations. Additionally, compact modular designs, advanced cooling technologies, and AI-based predictive maintenance are increasing system reliability, lowering operational costs, and extending equipment lifespan.

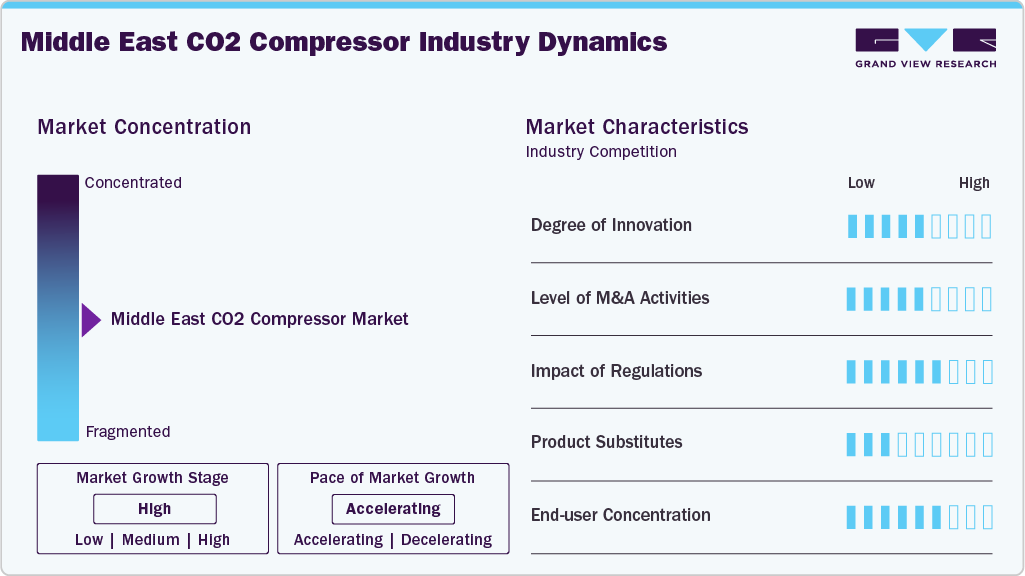

Market Concentration & Characteristics

The industry is moderately fragmented, with several global and regional players competing across industrial, oil & gas, and environmental applications. Companies like Atlas Copco, Siemens, and regional manufacturers offer diverse technologies and capacities. This structure promotes flexibility for end users while encouraging product differentiation, technological advancement, and competitive pricing across the market.

Middle East CO2 compressor market is witnessing steady innovation, focusing on energy efficiency, automation, and integration with digital monitoring systems. Companies are developing compact, modular designs and enhancing cooling technologies to suit regional industrial demands. Innovations also support carbon capture and storage initiatives, aligning with the region’s shift toward cleaner and more sustainable industrial practices.

While merger and acquisition activity in the CO2 compressor market is relatively modest, global consolidation trends influence the region. International players are expanding their footprint through strategic partnerships and acquisitions, bringing advanced technologies and operational expertise. This indirectly boosts regional competition, technology transfer, and access to cutting-edge compressor systems across various industrial sectors.

Regulations are playing a pivotal role in shaping the market by promoting energy efficiency and low-emission technologies. Government-backed carbon reduction initiatives, especially in oil-rich nations, are encouraging industries to adopt compressors compatible with carbon capture and environmentally safe refrigerants. Regulatory pressures are accelerating the shift toward compliant, high-performance, and sustainable compressor solutions.

Drivers, Opportunities & Restraints

Region’s focus on enhanced oil recovery (EOR) and industrial gas applications is significantly driving the market. As oil-producing countries invest in CO2 injection techniques to boost extraction efficiency, demand for reliable, high-pressure CO2 compressors continues to grow, supporting both energy production and environmental management goals.

Growing interest in carbon capture, utilization, and storage (CCUS) across the Middle East is significant opportunity in the market. With governments launching clean energy initiatives, industries have a chance to deploy CO2 compressors for capturing emissions. This creates a strong growth avenue for manufacturers offering advanced, energy-efficient compressor systems tailored for large-scale environmental projects.

A key challenge in the Middle East CO2 compressor market is the high cost and technical complexity of deploying advanced compressor technologies. Many regional operators face barriers related to infrastructure readiness, skilled workforce availability, and long-term maintenance. These factors can delay adoption and hinder widespread implementation, especially in smaller or cost-sensitive industrial segments.

Product Insights

Reciprocating compressors dominated the market in 2024, accounting for the highest revenue share of 42.2%due to their ability to handle high-pressure applications and variable gas volumes, making them ideal for enhanced oil recovery and industrial gas processes. Their robust performance, reliability, and ease of maintenance suit the region’s demanding operational environments, particularly in oil, gas, and petrochemical sectors, where precision and durability are essential.

The centrifugal compressor segment is expected to grow at a considerable CAGR of 5.4% from 2025 to 2033 in terms of revenue, driven by increased demand for high-capacity, continuous-operation systems. These compressors offer energy efficiency, low maintenance, and are ideal for large-scale carbon capture and industrial processing. As industries modernize and scale up operations, centrifugal compressors are gaining traction for their ability to handle high flow rates efficiently.

Application Insights

Refrigeration dominated the market in 2024, accounting for the highest revenue share at 38.5%due to growing demand for sustainable cooling solutions in food processing, cold storage, and retail. CO2 is favored as a natural refrigerant with low environmental impact, and industries are increasingly adopting CO2-based systems to meet regulatory and energy efficiency goals, making compressors essential in commercial and industrial refrigeration applications.

The carbonating segment is expected to grow at a considerable CAGR of 5.8% from 2025 to 2033 in terms of revenue, driven by expanding beverage production and rising consumer demand for carbonated drinks. As bottling plants modernize, they adopt advanced CO2 compressors to ensure precise gas control, hygiene, and efficiency. The food and beverage industry's expansion supports continued investment in high-performance carbonating solutions across the region.

Type Insights

Oil-cooled compressors dominated the market in 2024, accounting for the highest revenue share at 76.6%due to their durability, high efficiency, and ability to perform under extreme temperatures, ideal for the region’s harsh climate. These compressors offer better lubrication and cooling for heavy-duty applications, making them the preferred choice in sectors like oil and gas, where continuous, high-pressure operation is critical.

The water-cooled compressors segment is expected to grow at a considerable CAGR of 4.1% from 2025 to 2033 in terms of revenue, as industries seek energy-efficient and quieter alternatives for controlled environments. With growing adoption in food processing, medical, and large-scale industrial facilities, these systems offer consistent thermal management, especially in indoor or climate-sensitive applications, supporting performance stability and reducing energy consumption in high-capacity operations.

Power Source Insights

The electric compressors segment dominated the CO2 compressor market in 2024, holding the largest revenue share at 71.1% due to their energy efficiency, lower maintenance needs, and compatibility with industrial automation systems. Widely used in fixed-location facilities such as manufacturing plants and cold storage, electric compressors align with regional efforts to modernize infrastructure and reduce carbon footprints, making them the preferred power source across multiple industrial sectors.

The gas-powered compressors segment is expected to grow at a considerable CAGR of 4.7% from 2025 to 2033 in terms of revenue. The gas-powered compressors segment is expected to grow in the CO2 compressor market, particularly in remote or off-grid locations where electricity access is limited. Their mobility, independence from electrical infrastructure, and suitability for oilfields and outdoor industrial sites support their rising demand. As exploration and field-based operations expand, gas-powered compressors provide flexible and reliable compression solutions.

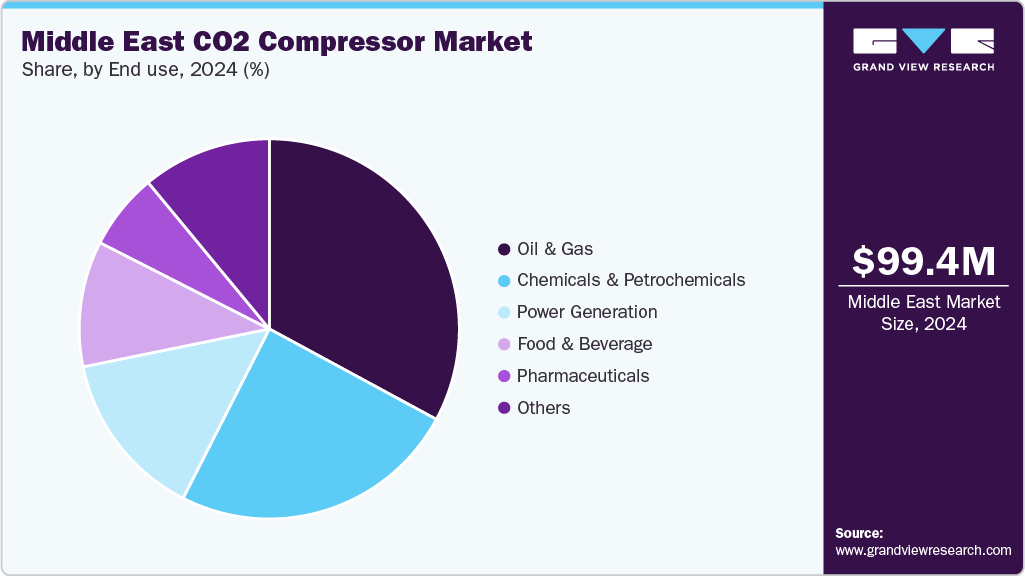

End-use Insights

The oil & gas segment dominated the CO2 compressor market in 2024, holding the largest revenue share at 32.7% due to its extensive use in enhanced oil recovery (EOR), gas reinjection, and processing operations. CO2 compressors are essential for high-pressure applications in upstream and downstream activities. The region’s heavy reliance on oil production ensures sustained demand for durable, high-performance compressor systems in this sector.

The food & beverage segment is expected to grow at a considerable CAGR of 5.5% from 2025 to 2033 in terms of revenue. The food & beverage compressors segment is expected to grow in the CO2 compressor market driven by expanding food processing, cold storage, and beverage carbonation industries. With rising consumer demand and stricter hygiene standards, manufacturers are adopting CO2 compressors for sustainable refrigeration and carbonation processes. Their efficiency and eco-friendliness make them increasingly attractive in this modernizing and diversifying industry.

Country Insights

Saudi Arabia CO2 Compressor Market Trends

Saudi Arabia CO2 compressor market dominated the global industry, accounting for a 50.5% market share in 2024, due to its massive oil and gas operations and investment in enhanced oil recovery (EOR) techniques. The country’s focus on energy efficiency, industrial expansion, and carbon management under Vision 2030 drives consistent demand for high-performance CO2 compressors across oilfields, petrochemical plants, and industrial gas processing facilities.

UAE CO2 Compressor Market Trends

The CO2 compressor market in theUAE is expected to grow at a CAGR of 4.9% from 2025 to 2033, supported by its push for industrial diversification, sustainability, and technological modernization. Growing demand in sectors like food processing, refrigeration, and clean energy is fueling the adoption of efficient compressor systems. Additionally, government-backed initiatives for carbon capture and low-emission technologies are accelerating the use of CO2 compressors across industries.

Key Middle East CO2 Compressor Companies Insights

Key players operating in the Middle East CO2 compressor market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Middle East CO2 Compressor Companies:

- Carrier

- Atlas Copco AB

- Siemens AG

- Mitsubishi Heavy Industries, Ltd.

- Danfoss

- Copeland LP

- Dorin S.p.A.

- SANDEN CORPORATION.

- Panasonic Corporation

- Pentair

Recent Developments

-

In March 2025, Carrier opened a new Experience Center in Dammam, showcasing its latest HVAC and refrigeration technologies. The center aims to provide customers with hands-on demonstrations and solutions tailored to regional climate and industrial needs, enhancing local support and engagement.

-

In January 2025, Siemens Energy expanded its Dammam plant by 35% to support major energy projects in Saudi Arabia. This expansion enhances local manufacturing capacity, reduces lead times, and supports national industrial goals. It is expected to boost the CO2 compressor market by enabling faster production and customization for carbon capture and energy applications.

Middle East CO2 Compressor Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 104.8 million

Revenue forecast in 2033

USD 152.3 million

Growth rate

CAGR of 4.8% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, power source, type, application, country

Country scope

Saudi Arabia; UAE; Qatar; Oman

Key companies profiled

Carrier; Atlas Copco AB; Siemens AG; Mitsubishi Heavy Industries Ltd.; Danfoss; Copeland LP; Dorin S.p.A.; SANDEN CORPORATION; Panasonic Corporation; Pentair

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East CO2 Compressor Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East CO2 compressor market report based on product, end-use, power source, type, application, and country.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Reciprocating Compressors

-

Screw Compressor

-

Centrifugal Compressor

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Refrigeration

-

Air Conditioning

-

Carbonating

-

Carbon Capture Application

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Oil-cooled Compressors

-

Water-cooled Compressors

-

-

Power Source Outlook (Revenue, USD Million, 2021 - 2033)

-

Electric Compressors

-

Gas-Powered Compressors

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Oil & Gas

-

Power Generation

-

Chemicals & Petrochemicals

-

Food & Beverage

-

Pharmaceuticals

-

Others

-

-

Country Outlook (Revenue, USD Million, 2021 - 2033)

-

Saudi Arabia

-

UAE

-

Qatar

-

Oman

-

Frequently Asked Questions About This Report

b. The Middle East CO2 compressor market size was estimated at USD 99.4 million in 2024 and is expected to be USD 104.8 million in 2025.

b. The Middle East CO2 compressor market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.8% from 2025 to 2033 to reach USD 152.3 million by 2033.

b. Reciprocating compressors dominated the market in 2024, accounting for the highest revenue share at 42.2% due to their ability to handle high-pressure applications and variable gas volumes, making them ideal for enhanced oil recovery and industrial gas processes. Their robust performance, reliability, and ease of maintenance suit the region’s demanding operational environments, particularly in oil, gas, and petrochemical sectors where precision and durability are essential.

b. Some of the key players operating in the Middle East CO2 compressor market include Carrier, Atlas Copco AB, Siemens AG, Mitsubishi Heavy Industries, Ltd., Danfoss, Copeland LP, Dorin S.p.A., SANDEN CORPORATION, Panasonic Corporation, Pentair

b. Key factors driving the Middle East CO2 compressor market include increasing industrialization, rising demand for carbon capture and storage, growth in oil and gas activities, government initiatives for environmental sustainability, and advancements in compressor technology that enhance efficiency and reduce emissions in various applications like refrigeration and food processing.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.