- Home

- »

- Advanced Interior Materials

- »

-

CO2 Compressor Market Size, Share, Industry Report, 2030GVR Report cover

![CO2 Compressor Market Size, Share & Trends Report]()

CO2 Compressor Market (2025 - 2030) Size, Share & Trends Analysis Report By Product Type (Reciprocating Compressors, Centrifugal Compressor), By Application (Refrigeration, Carbonating), By Type, By Power Source, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-524-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

CO2 Compressor Market Summary

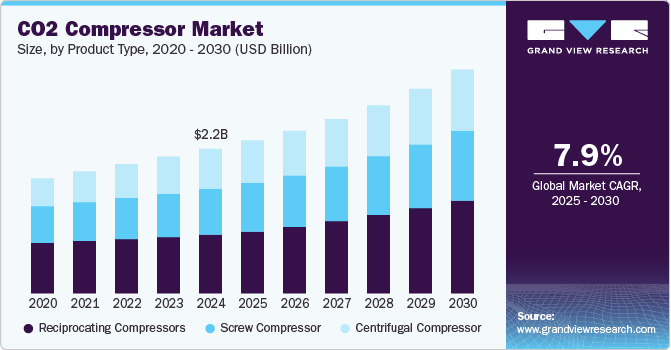

The global CO2 compressor market size was estimated at USD 2.16 billion in 2024 and is projected to reach USD 3.34 billion by 2030, growing at a CAGR of 7.9% from 2025 to 2030. The global CO2 compressor market is growing due to several key factors.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- The compressor industry in U.S. is projected to expand at a CAGR of 7.8% over the forecast period.

- By product type, the reciprocating compressors segment dominated the market, accounting for a 40.6% revenue share in 2024.

- By end use, the oil & gas segment dominated the market, accounting for a 29.8% revenue share in 2024.

- By application, the refrigeration segment dominated the market, accounting for a 40.3% revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.16 Billion

- 2030 Projected Market Size: USD 3.34 Billion

- CAGR (2025-2030): 7.9%

- North America: Largest market in 2024

Technological advancements in CO2 compressor systems, increasing demand for energy-efficient refrigeration solutions, and the growing focus on reducing carbon emissions are primary drivers.

Industries such as food and beverage, healthcare, and industrial applications are also adopting CO2 compressors for their eco-friendly and efficient cooling capabilities. Furthermore, stringent environmental regulations, along with the shift towards natural refrigerants, contribute to the market’s expansion.

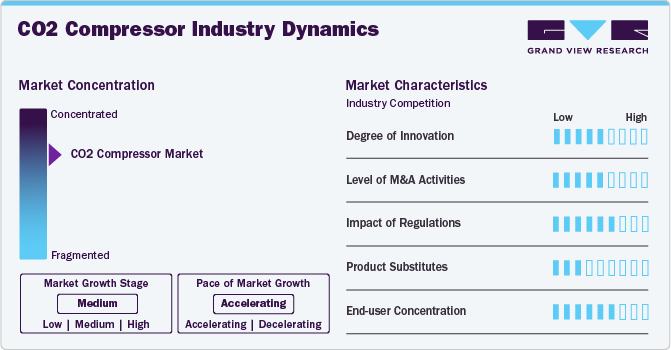

Market Concentration & Characteristics

The global CO2 compressor market is moderately fragmented, with a combination of large multinational companies and regional players vying for market share. Key manufacturers focus on developing high-performance, energy-efficient CO2 compressors for a variety of applications, including refrigeration, air conditioning, and industrial processes. Innovation in the market is driven by the growing demand for eco-friendly refrigerants, energy efficiency, and regulatory compliance, leading manufacturers to invest in more sustainable and advanced compressor technologies.

Regulatory pressures from organizations like the EU and EPA are playing a crucial role in shaping the market, with stringent standards focused on emissions reduction, energy efficiency, and the use of natural refrigerants. Compliance with these regulations is essential for manufacturers to remain competitive, as businesses strive to meet sustainability goals and reduce carbon footprints. As the demand for environmentally friendly technologies rises across industries such as food processing, pharmaceuticals, and HVAC, the need for CO2 compressors designed for energy efficiency and low emissions continues to grow.

While opportunities abound, the CO2 compressor market also faces competition from alternative refrigerant solutions, such as ammonia-based systems and synthetic refrigerants. To maintain market leadership, manufacturers must continue innovating, integrating smart technologies like IoT for real-time monitoring, and adapting to evolving regulatory landscapes. Emphasizing sustainability and energy efficiency will be key in capturing the expanding market for low-emission and high-performance compressor systems.

Drivers, Opportunities & Restraints

The growth of the CO2 compressor industry is significantly fueled by the expansion of end-use industries, particularly in sectors such as food and beverage, healthcare, pharmaceuticals, and industrial applications. As these industries continue to grow, their demand for efficient, eco-friendly, and energy-saving refrigeration and cooling systems increases, making CO2 compressors an attractive option.

Restraints to the industry include high initial installation costs and maintenance challenges associated with CO2 compressors, which can limit adoption, especially among small to medium-sized enterprises. Additionally, the lack of awareness and skilled labor for handling these systems further slows market penetration.

Opportunities in the CO2 compressor industry include the rising need for sustainable and green technologies in various industries, especially in the refrigeration and HVAC sectors. Government policies supporting the transition to low-GWP refrigerants and expanding applications in new sectors like electric vehicles and carbon capture and storage create significant growth potential.

Product Type Insights

The reciprocating compressors segment dominated the market, accounting for a 40.6% revenue share in 2024, driven by the demand for high-pressure performance and reliability. They are popular for their cost-effectiveness and ability to handle fluctuating loads, making them ideal for smaller industrial applications, including HVAC systems, refrigeration, and certain petrochemical processes. Their robust design allows them to operate efficiently in extreme conditions, contributing to their demand in sectors that prioritize performance under varying loads and operational conditions.

Centrifugal compressors are gaining popularity in applications that require high flow rates and consistent pressure, such as large-scale industrial and commercial systems. Their ability to efficiently compress gases at higher capacities and with lower energy consumption makes them ideal for sectors like petrochemicals, refrigeration, and air conditioning.

End Use Insights

The oil & gas segment dominated the market, accounting for a 29.8% revenue share in 2024. In the oil and gas industry, CO2 compressors are integral to enhancing oil recovery, transporting CO2 for injection into reservoirs, and ensuring proper pressure maintenance in pipelines. The demand for CO2 as a secondary recovery method for increasing oil production is expanding, driving the need for high-efficiency compressors. As the industry focuses on improving recovery rates and reducing carbon footprints, CO2 compressors are becoming crucial for these applications, boosting market growth.

In the food and beverage industry, CO2 compressors are crucial for processes such as carbonation, packaging, and refrigeration. The increasing demand for high-quality, fresh products with longer shelf lives is driving the need for efficient CO2 systems. CO2 compressors are widely used for controlling the temperature in food storage and distribution, as well as in carbonation for soft drinks and beer.

Application Insights

Ther refrigeration segment dominated the market, accounting for a 40.3% revenue share in 2024. As refrigeration systems shift toward more sustainable and energy-efficient solutions, the demand for CO2 as a natural refrigerant is increasing. The ability of CO2 compressors to handle these requirements while minimizing environmental impact makes them highly sought after in sectors such as food processing, retail, and pharmaceuticals, where temperature control is critical.

The increasing demand for carbonated beverages is driving the adoption of efficient CO2 compression systems. These compressors provide the necessary pressure for dissolving CO2 gas into liquids, ensuring consistent carbonation levels and product quality. As the beverage industry continues to focus on energy efficiency and sustainability, CO2 compressors are also being used to minimize energy consumption while maintaining high-performance standards, contributing to cost savings and improved environmental impact in the carbonating process.

Type Insights

The oil-cooled compressors segment dominated the market, accounting for a 73.1% revenue share in 2024. Oil-cooled compressors are favored in applications requiring consistent cooling performance, especially in industrial environments. The oil helps lubricate and cool the compressor, increasing its lifespan and reducing wear and tear. This makes them ideal for high-load industrial processes, such as refrigeration in large commercial systems and industrial gas compression, where reliability and prolonged operation are crucial to ensuring system uptime.

Water-cooled compressors are increasingly used in industries that require efficient heat exchange and cooling performance, especially in large-scale applications. The cooling water absorbed from the environment helps dissipate the heat generated during compression, improving energy efficiency. These compressors are commonly used in sectors such as manufacturing and commercial refrigeration, where high cooling capacity and stable performance are essential.

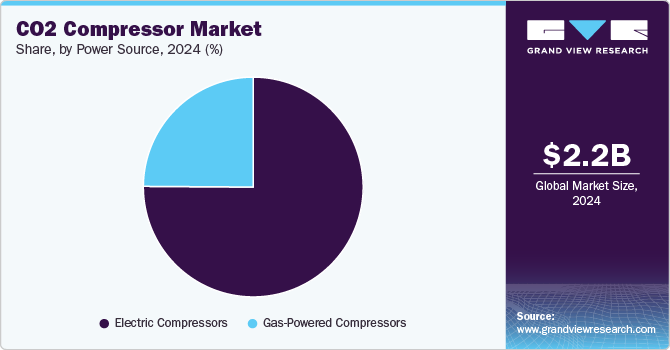

Power Source Insights

Ther electric compressors segment dominated the market, accounting for a 75.1% revenue share in 2024. Electric compressors are increasingly preferred across various industries for their efficiency, lower maintenance costs, and environmental benefits. Unlike gas-powered compressors, electric compressors rely on a stable electrical supply, making them ideal for settings where continuous operation and high performance are required. They are commonly used in applications such as refrigeration, HVAC systems, and industrial processes, where precise control and consistent power are necessary.

Gas-powered compressors are a popular choice in industries where mobility and flexibility are required, such as in remote locations or outdoor settings. They offer the advantage of being able to operate independently of the electrical grid, making them ideal for construction, mining, and offshore operations. Their ability to deliver reliable power without the need for external power sources is a key driver of their adoption in sectors where operational flexibility is crucial.

Regional Insights

The North America CO2 compressor industry is benefiting from strict environmental regulations, a shift towards sustainable refrigerants, and increasing demand from sectors like food processing and pharmaceuticals. These industries require more efficient and eco-friendly cooling systems, pushing the demand for CO2 compressors.

U.S. CO2 Compressor Market Trends

The compressor industry in U.S. is projected to expand at a CAGR of 7.8% over the forecast period. In the U.S., stringent environmental regulations and the increasing adoption of natural refrigerants in HVAC systems are major drivers for the CO2 compressor market, particularly in industries focusing on sustainability and energy efficiency.

Europe CO2 Compressor Market Trends

Europe CO2 compressor industry growth is driven by a strong emphasis on environmental sustainability, the European Union’s regulations on refrigerants, and the rising adoption of CO2-based refrigeration systems, especially in supermarkets and retail. These factors are propelling demand for more energy-efficient, eco-friendly solutions.

The CO2 compressor industry in Spain is projected to expand at a CAGR of 8.2% over the forecast period In Spain, the market is driven by the country’s increasing focus on sustainable refrigeration and HVAC solutions, especially within the food and beverage industry. Spain’s commitment to meeting European environmental standards and reducing carbon emissions boosts the demand for eco-friendly compressor technologies across commercial and industrial sectors.

Italy CO2 compressor industry is projected to expand at a CAGR of 9.4% over the forecast period due to the country’s emphasis on green technologies and energy-efficient solutions, particularly in refrigeration for food processing and storage. Italy’s strict environmental regulations and its push for reducing carbon footprints across industries make CO2 compressors an essential part of their sustainable approach to cooling systems.

Asia Pacific CO2 Compressor Market Trends

In Asia Pacific CO2 compressor industry, rapid industrialization, increasing investment in HVAC systems, and growing awareness of the need for eco-friendly refrigeration are key drivers of market growth. The region’s focus on sustainability in industrial operations and commercial sectors further boosts CO2 compressor demand.

The CO2 compressor industry in China is expected to grow at a CAGR of 9.2% over the forecast period. China’s market is experiencing significant growth due to rapid industrial expansion, increased demand for cooling in various industries, and a rising focus on environmental protection. The country is increasingly adopting sustainable refrigerant technologies to meet these needs.

India CO2 compressor industry is expected to grow at a CAGR of 8.7% over the forecast period. India is seeing increased demand for CO2 compressors as industrial applications expand and the need for energy-efficient refrigeration solutions grows. Government incentives and rising industrialization play a significant role in the market’s development.

Latin America CO2 Compressor Market Trends

The growth in CO2 compressor industry in Latin America is propelled by the expanding food and beverage sector, which drives the need for efficient refrigeration solutions. Additionally, increasing environmental regulations in the region are encouraging the adoption of more sustainable cooling technologies.

Brazil CO2 compressor industry is projected to grow at a CAGR of 7.3% over the forecast period. In Brazil, the demand for sustainable refrigeration, particularly in the food industry, is a primary driver of market growth. Additionally, government support for environmentally friendly technologies helps fuel the adoption of CO2 compressors.

Middle East & Africa CO2 Compressor Market Trends

The CO2 compressor industry in the Middle East and Africa are experiencing growth due to rising demand for cooling systems across both industrial and residential sectors. Government initiatives aimed at promoting energy-efficient solutions further stimulate the adoption of CO2 compressors in these regions.

Saudi Arabia CO2 compressor industry is projected to expand at a CAGR of 6.8% over the forecast period. Saudi Arabia’s CO2 compressor market is growing rapidly due to the country’s hot climate, which drives demand for cooling systems in various sectors. Furthermore, government initiatives promoting energy-efficient technologies are encouraging the adoption of CO2 compressors in the region.

Key CO2 Compressor Company Insights

Some key players operating in the market include Atlas Copco AB. and Siemens AG among others.

-

Atlas Copco operates through four primary business areas: Compressor Technique, Vacuum Technique, Industrial Technique, and Power Technique. This structure allows the company to deliver specialized products and services across diverse industries such as manufacturing, construction, pharmaceuticals, automotive, and electronics.

-

Siemens AG is a global technology company thatconcentrates on intelligent infrastructure for buildings and decentralized energy systems, as well as automation and digitalization in the process and manufacturing industries. The company is one of the largest industrial manufacturing entity in Europe and holds a prominent position in industrial automation and software

Key CO2 Compressor Companies:

The following are the leading companies in the CO2 compressor market. These companies collectively hold the largest market share and dictate industry trends.

- Wärtsilä

- Atlas Copco AB

- Siemens AG

- Mitsubishi Heavy Industries, Ltd.

- danfoss

- Copeland LP

- Dorin S.p.A.

- HAUG Sauer Kompressoren AG

- bei Mehrer Compression GmbH

- SANDEN CORPORATION.

- Panasonic Corporation

- Pentair

- Haier Carrier

- Bengbu AOT Compressor Co., Ltd.

- Sollant Group

Recent Developments

-

In October 2025, Dorin S.p.A. announced the upcoming launch of its CD1000 range, the "largest" transcritical CO2 compressor, expected in the second half of 2025. This 8-cylinder compressor, driven by 500 to 750HP electric motors, aims to meet the demand for megawatt capacities in industrial heat systems.

-

In July 2024, Danfoss introduced new compressor ranges, one of which is the BOCK HGX56 CO2 T for large industrial heat pumps. The BOCK HGX56 CO2 T is a 6-cylinder semi-hermetic compressor that can achieve water temperatures up to 90°C and provides an efficient alternative to ammonia and synthetic refrigerants, simplifying system design and reducing costs.

CO2 Compressor Market Report Scope

Report Attribute

Details

Market size in 2025

USD 2.28 billion

Revenue forecast in 2030

USD 3.34 billion

Growth rate

CAGR of 7.9% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Report updated

February 2025

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Product type, end use, application, power source, type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Atlas Copco AB; Siemens AG; Mitsubishi Heavy Industries, Ltd.; Danfoss; Copeland LP; Dorin S.p.A.; HAUG Sauer Kompressoren AG; Mehrer Compression GmbH; SANDEN CORPORATION; Panasonic Corporation; Pentair, Haier Carrier; Bengbu AOT Compressor Co., Ltd.; Sollant Group.

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global CO2 Compressor Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global CO2 compressor market report based on product type, end use, application, power source, type, and region:

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Reciprocating Compressors

-

Screw Compressor

-

Centrifugal Compressor

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Oil & Gas

-

Power Generation

-

Chemicals & Petrochemicals

-

Food & Beverage

-

Pharmaceuticals

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Refrigeration

-

Air Conditioning

-

Carbonating

-

Carbon Capture Application

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Oil-Cooled Compressors

-

Water-Cooled Compressors

-

-

Power Source (Revenue, USD Million, 2018 - 2030)

-

Electric Compressors

-

Gas-Powered Compressors

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. .The global CO2 compressor market size was estimated at USD 2.16 billion in 2024 and is expected to reach USD 2.28 billion in 2025.

b. .The global CO2 compressor Market, in terms of revenue, is expected to grow at a compound annual growth rate of 7.9% from 2025 to 2030 to reach USD 3.34 billion by 2030

b. .The market in North America dominated the market in 2024 accounting for 36.9% of the market share driven by the increasing adoption of environmentally friendly refrigerants and the rising demand for energy-efficient cooling systems across industries. Stringent environmental regulations in the U.S. and Canada, particularly related to reducing carbon emissions and the use of natural refrigerants, are encouraging the shift toward CO2 compressors

b. .Some of the key players operating in the CO2 Compressor Market are Atlas Copco AB, Siemens AG, Mitsubishi Heavy Industries, Ltd., Danfoss, Copeland LP, Dorin S.p.A., HAUG Sauer Kompressoren AG, Mehrer Compression GmbH, SANDEN CORPORATION, Panasonic Corporation, Pentair, Haier Carrier, Bengbu AOT Compressor Co., Ltd., and Sollant Group

b. .Key factors driving the CO2 compressor market include increasing environmental regulations pushing for natural refrigerants and the growing demand for energy-efficient, sustainable solutions across various industries like refrigeration, HVAC, and food processing. Technological advancements in compressor efficiency and integration with smart systems further boost market growth

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.