- Home

- »

- Advanced Interior Materials

- »

-

Middle East Construction Composites Market Report 2033GVR Report cover

![Middle East Construction Composites Market Size, Share & Trends Report]()

Middle East Construction Composites Market (2025 - 2033) Size, Share & Trends Analysis Report By Fiber Type (Carbon Fiber, Glass Fiber), By Resin Type (Thermoplastic, Thermoset), By Application (Industrial, Commercial, Residential), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-741-5

- Number of Report Pages: 107

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Construction Composites Market Summary

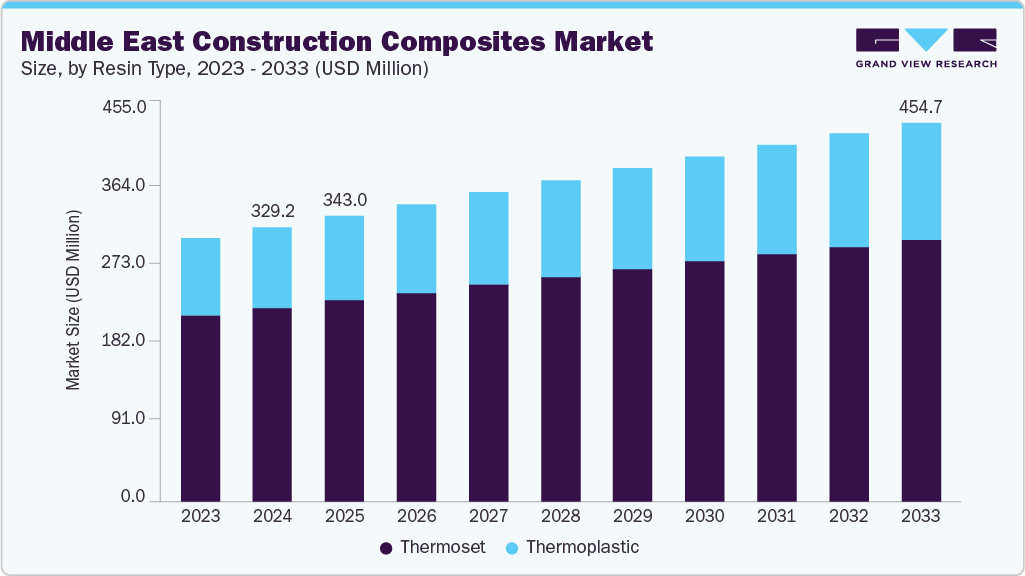

The Middle East construction composites market size was estimated at USD 329.2 million in 2024 and is projected to reach USD 454.7 million by 2033, growing at a CAGR of 3.6% from 2025 to 2033. The demand for construction composites in the Middle East is rising due to the rapid pace of urbanization, infrastructural modernization, and ambitious megaprojects under development.

Key Market Trends & Insights

- Saudi Arabia dominated the Middle East construction composites market with the largest revenue share of 32.4% in 2024.

- By fiber type, the glass fiber segment is expected to grow at the fastest CAGR of 4.1% over the forecast period.

- By resin type, the thermoplastic segment is expected to grow at the fastest CAGR of 4.1% over the forecast period.

- By application, the residential segment is expected to grow at the fastest CAGR of 3.9% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 329.2 Million

- 2033 Projected Market Size: USD 454.7 Million

- CAGR (2025-2033): 3.6%

- Saudi Arabia: Largest market in 2024

- Egypt: Fastest market in 2024

The region’s increasing investments in smart cities, luxury real estate, and transport networks have amplified the need for lightweight yet durable materials. Construction composites, with their superior strength-to-weight ratio, long service life, and corrosion resistance, are increasingly replacing traditional building materials such as steel and aluminum.Key demand drivers include the surge in construction of residential and commercial complexes, infrastructure developments, and large-scale industrial projects. The GCC region, especially Saudi Arabia and the UAE, is spearheading demand through projects like NEOM City, the Red Sea Project, and Expo-related expansions. The growing preference for modular construction and prefabricated structures is boosting composite demand, given their ease of fabrication and installation. The lightweight nature of composites reduces transportation costs and allows for innovative architectural designs, which is appealing in high-profile luxury projects.

Governments across the Middle East are heavily investing in construction as part of their long-term economic diversification strategies. Saudi Vision 2030, UAE Vision 2050, and Qatar National Vision 2030 emphasize sustainable construction practices, renewable energy integration, and infrastructure modernization. These initiatives promote the use of composites that align with energy efficiency and green building goals. Strict building codes focusing on fire safety, sustainability, and structural performance are encouraging contractors to adopt advanced materials such as fiber-reinforced plastics (FRP) and carbon composites.

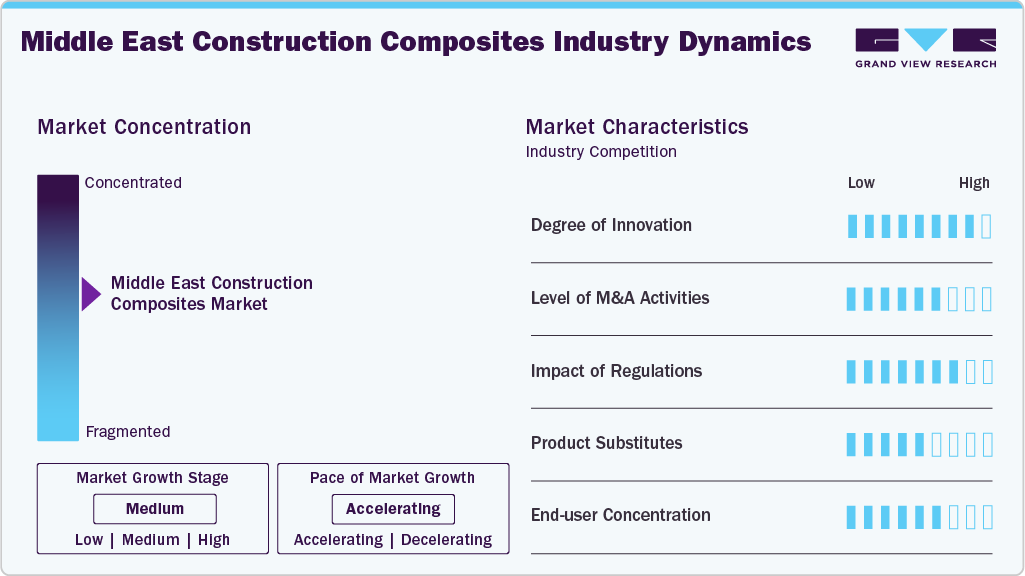

Market Concentration & Characteristics

The Middle East construction composites industry is moderately concentrated, with a few large players holding significant shares due to their technological expertise, product variety, and regional distribution networks. International giants often collaborate with local manufacturers to meet country-specific regulatory requirements and construction needs. The competition is intensifying as new regional firms enter with cost-effective alternatives, while established players differentiate through high-performance, sustainable products. The market is characterized by high entry barriers due to the capital-intensive nature of composite production and the need for advanced technology.

Although construction composites are increasingly preferred, traditional materials such as steel, aluminum, and concrete continue to pose a substitute threat, especially in cost-sensitive projects. Steel and reinforced concrete remain widely available and cheaper in bulk applications. However, the superior durability, corrosion resistance, and sustainability of composites are reducing reliance on conventional materials in high-performance projects. The growing adoption of smart and sustainable building practices is shifting the balance in favor of composites. Over time, improved affordability and wider availability are expected to mitigate the threat from substitutes.

Resin Type Insights

The thermoset segment led the market with the largest revenue market share of 70.5% in 2024, due to its established use in structural applications requiring high mechanical strength, thermal resistance, and dimensional stability. They are extensively used in industrial construction, bridges, pipelines, and large-scale infrastructure projects. Their proven performance and cost-effectiveness in delivering long-lasting solutions make them a reliable choice for contractors.

The thermoplastic segment is expected to grow at the fastest CAGR of 4.1% over the forecast period, fueled by its recyclability, ease of molding, and adaptability for modular and prefabricated construction. The rising focus on sustainable building practices and green certifications has enhanced their appeal. Their ability to be reshaped and reused aligns with evolving construction trends, making them a preferred choice for future-ready projects.

Fiber Type Insights

The carbon fiber segment led the market with the largest revenue share of 60.9% in 2024, due to its exceptional strength-to-weight ratio, high durability, and superior performance in extreme environmental conditions. They are increasingly used in high-value projects such as skyscrapers, bridges, and mega-infrastructure developments where structural reliability and long service life are crucial. Their application in luxury real estate and iconic architectural projects also reinforces their dominance.

The glass fiber segment is expected to grow at the fastest at a CAGR of 4.1% over the forecast period, driven by its cost-effectiveness, versatility, and wide applicability across residential, commercial, and industrial projects. Their lightweight and corrosion-resistant nature makes them suitable for applications in façades, roofing, and insulation, especially in large-scale housing and affordable construction projects. Growing demand for sustainable and economical building materials further accelerates their adoption.

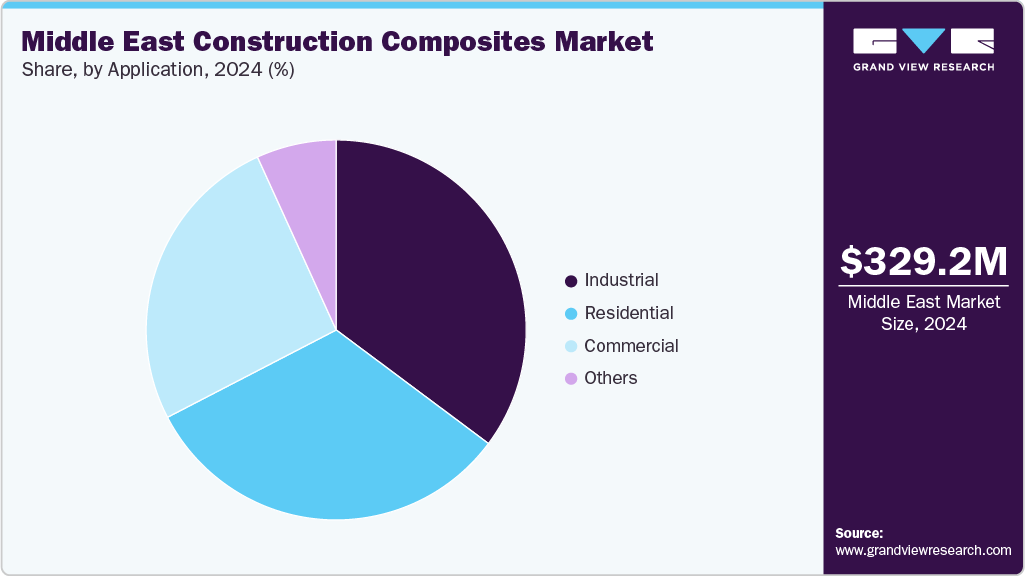

Application Insights

The industrial segment led the market with the largest revenue share of 35.2% in 2024, supported by extensive infrastructure development in oil and gas, transportation, and manufacturing sectors. Large-scale projects such as refineries, pipelines, and industrial complexes require materials with high durability, chemical resistance, and structural strength, positioning composites as a key enabler in these applications.

The residential segment is expected to grow at the fastest CAGR of 3.9% over the forecast period, driven by government housing initiatives, rapid urbanization, and rising demand for modern, sustainable living spaces. Composites are increasingly used in roofing, cladding, and interior applications due to their lightweight, energy-efficient, and aesthetic properties. The trend toward affordable housing and sustainable building practices is further pushing composite adoption in this segment.

Regional Insights

The Middle East construction composites market is thriving on account of massive investments in infrastructure, urban development, and renewable energy projects. The demand is particularly strong in the GCC nations, where economic diversification plans prioritize sustainable construction. Composite usage is growing in bridges, airports, stadiums, and high-rise projects, aligning with modern design requirements. The harsh desert climate enhances the preference for corrosion-resistant materials, while government-led sustainability mandates further fuel adoption.

Saudi Arabia dominated the Middle East construction composites market with the largest revenue share of 32.4% in 2024, driven by Vision 2030 and large-scale projects such as NEOM City, The Line, and Qiddiya. The country is focusing on sustainable and smart infrastructure, creating strong demand for high-performance composites. The construction sector’s transformation into a hub for futuristic, eco-friendly architecture is expected to sustain growth. Partnerships with international suppliers are accelerating innovation and adoption.

The UAE construction composites market is supported by its luxury real estate sector, iconic skyscrapers, and infrastructure expansion tied to tourism and Expo-related projects. Dubai and Abu Dhabi are major hubs for sustainable building practices, with increasing use of composites in façades and modular structures. Strict green building regulations and rising demand for premium architecture make UAE a frontrunner in composite adoption.

The construction composites market in Egypt composite demand is rising with government-led housing projects, new urban centers like the New Administrative Capital, and transport network upgrades. The country’s push for affordable housing and infrastructure modernization is encouraging the use of cost-effective composite solutions. With increasing foreign investments, Egypt is becoming a key growth market for regional and international suppliers.

The Qatar construction composites market focuses on stadium construction, transportation upgrades, and hospitality projects, particularly post-FIFA World Cup, continues to boost composite usage. The country is aligning its construction sector with sustainability goals under Qatar National Vision 2030. Lightweight composites are finding applications in stadiums, bridges, and metro systems.

The construction composites market in Kuwait is gradually adopting construction composites as part of its infrastructure development projects, particularly in transport and housing. Though smaller compared to Saudi Arabia and the UAE, Kuwait is expanding use in oil-and-gas-related facilities and residential complexes. Investments in sustainable building practices are expected to drive future growth.

Key Middle East Construction Composites Company Insights

Some of the key players operating in the market include Premier Composite Technologies, Saudi Composite

-

Premier Composite Technologies is a leading manufacturer of advanced composite solutions, specializing in architectural, transportation, and marine applications, and is known for supplying high-performance components to landmark construction projects.

-

Saudi Composite focuses on FRP and GRP products such as gratings, structural profiles, and panels, offering durable alternatives to steel and concrete in industrial and construction sectors.

Western Composite Industrial Company and Saad Othman Co. are some of the emerging market participants in the Middle East construction composites industry.

-

Western Composite Industrial Company is a key player in fiberglass reinforced polyester (FRP) manufacturing, providing corrosion-resistant building materials and structural components for large-scale infrastructure and industrial projects.

-

Saad Othman Co. is a diversified composite producer delivering fiberglass-based tanks, pipes, and fittings, with a strong reputation for high-quality thermoset composite solutions tailored for construction and industrial needs.

Key Middle East Construction Composites Companies:

- Premier Composite Technologies

- SFG Composites

- Western Composite Industrial Company

- Saudi Composite

- Lloyds Composite Industries LLC

- Smithline Reinforced Composites

- Saad Othman Co.

- Dura Composites

- SAMI Composites LLC

- Al Sanna Composites LLC

Recent Developments

-

In February 2025, Premier Composite Technologies collaborated with Sicomin for the Mataf Ceiling extension project at the Holy Mosque of Mecca. The ceiling spans about 216,800 m². Quadraxial-stitched glass fabric, carbon reinforcements, and Sicomin epoxy resins were used.

-

In February 2025, SFG Composites announced expansion to serve the European market by showcasing advanced SMC compression production and moulding capabilities at JEC World 2025 in Paris.

Middle East Construction Composites Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 343.0 million

Revenue forecast in 2033

USD 454.7 million

Growth rate

CAGR of 3.6% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Fiber type, resin type, application, region

Regional scope

Middle East

Country scope

Saudi Arabia; UAE; Egypt; Qatar; Kuwait

Key companies profiled

Premier Composite Technologies; SFG Composites; Western Composite Industrial Company; Saudi Composite; Lloyds Composite Industries LLC; Smithline Reinforced Composites; Saad Othman Co.; Dura Composites; SAMI Composites LLC; Al Sanna Composites LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Construction Composites Market Report Segmentation

This report forecasts revenue growth at the regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East construction composites market report based on the fiber type, resin type, application, and region:

-

Fiber Type Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Carbon Fiber

-

Glass fiber

-

-

Resin Type Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Thermoplastic

-

Thermoset

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Industrial

-

Commercial

-

Residential

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

Egypt

-

Qatar

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The Middle East construction composites market size was estimated at USD 329.2 million in 2024 and is expected to reach USD 343.0 million in 2025.

b. The Middle East construction composites market is expected to grow at a compound annual growth rate of 3.6% from 2025 to 2033 to reach USD 454.7 million by 2033.

b. The thermoset segment held the highest revenue market share of 70.5% in 2024, due to its established use in structural applications requiring high mechanical strength, thermal resistance, and dimensional stability.

b. Some of the key players operating in the construction composites market include Premier Composite Technologies, SFG Composites, Western Composite Industrial Company, Saudi Composite, Lloyds Composite Industries LLC, Smithline Reinforced Composites, Saad Othman Co., Dura Composites, SAMI Composites LLC, and Al Sanna Composites LLC

b. Key factors driving the Middle East construction composites market include the rapid pace of urbanization, ambitious infrastructure projects, and rising demand for sustainable building materials that can withstand the region’s harsh climatic conditions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.