- Home

- »

- Advanced Interior Materials

- »

-

Middle East Copper Wire Market Size, Industry Report, 2033GVR Report cover

![Middle East Copper Wire Market Size, Share & Trends Report]()

Middle East Copper Wire Market (2025 - 2033) Size, Share & Trends Analysis Report By Voltage (Low, Medium, High), By Application (Building Wire, Power Distribution, Automotive, Communication, Renewable Energy), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-714-0

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Copper Wire Market Summary

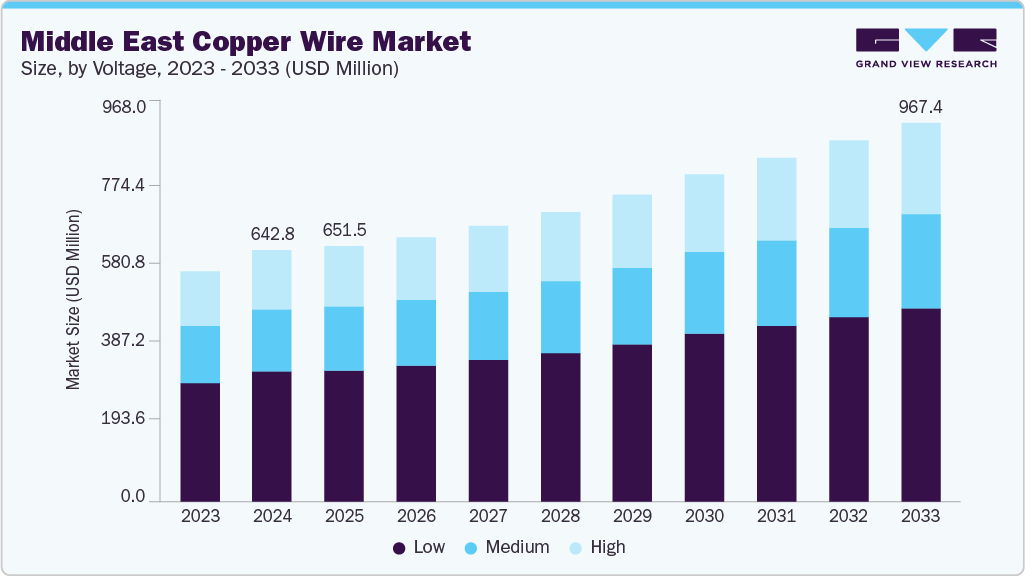

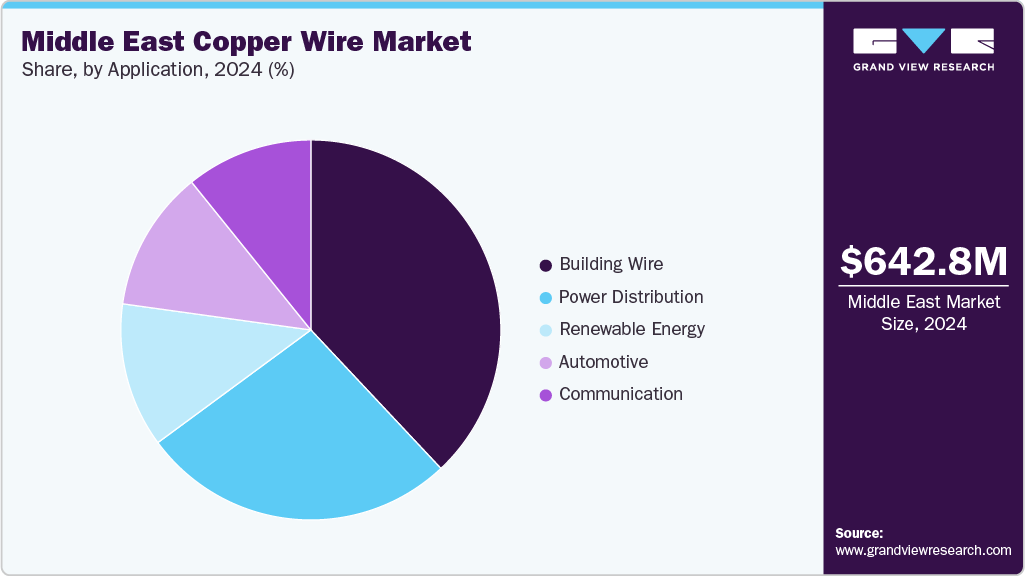

The Middle East copper wire market size was estimated at USD 642.8 million in 2024 and is projected to reach USD 967.4 million by 2033, growing at a CAGR of 5.1% from 2025 to 2033. The market is growing due to large-scale renewable energy projects, smart grid upgrades, and rapid urban infrastructure development.

Key Market Trends & Insights

- The copper wire market in the Middle East is expected to grow at a substantial CAGR of 5.1% from 2025 to 2033.

- By voltage, the low voltage segment led the market with the largest revenue share of 51.3% in 2024.

- By application, the renewable energy segment is anticipated to register at the fastest CAGR of 5.4% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 642.8 Million

- 2033 Projected Market Size: USD 967.4 Million

- CAGR (2025-2033): 5.1%

Rising solar and wind installations in Saudi Arabia, the UAE, and Egypt drive demand. The market is witnessing strong growth, supported by its central role in powering the region’s energy, infrastructure, and industrial transformation. As the backbone of electrical conductivity, copper wires are vital for power transmission, distribution systems, and wiring in both commercial and industrial applications across the GCC and wider region. Surging investments in mega infrastructure projects such as Saudi Arabia’s NEOM, the UAE’s Etihad Rail, and Qatar’s smart city developments are driving substantial demand for high-performance copper wiring in transportation networks, commercial complexes, and utility systems. Rapid urbanization, combined with government-led grid expansion and rural electrification programs, is further stimulating consumption, with Saudi Arabia and Qatar emerging as leading importers to meet domestic needs.

The regional transition toward renewable energy is a powerful demand catalyst, with large-scale solar and wind projects like Saudi Arabia’s Sakaka Solar Plant and the UAE’s Mohammed bin Rashid Al Maktoum Solar Park requiring extensive copper wiring to connect generation units to national grids. Moreover, the accelerating adoption of electric vehicles (EVs), particularly in the UAE and Saudi Arabia, is creating new growth avenues, as copper is critical in EV motors, charging stations, and battery systems. Grid modernization, 5G rollouts, and data center expansion across the region, driven by digitalization initiatives, are further boosting demand for copper wiring, positioning the Middle East as both a high-growth consumer and a strategic trading hub in the global copper wire industry.

Drivers, Opportunities & Restraints

Large-scale investments in renewable energy, infrastructure, and industrial development are fueling demand for copper wiring across the Middle East. For example, widespread grid and electrification expansion is directly driving copper requirements for transmission and integration. Meanwhile, mega projects such as Saudi Arabia’s NEOM, the UAE’s Mohammed bin Rashid Al Maktoum Solar Park, and Oman’s emerging wind farms further underscore copper’s pivotal role in new power generation and distribution frameworks.

Urbanization and smart city deployments in the region are also boosting copper usage. Qatar’s rollout of more than 300 fast EV chargers, each capable of bringing a vehicle battery to 80% in 30 minutes, demonstrates the rising infrastructure momentum and associated copper needs for chargers, connectors, and associated wiring. Similarly, the surge in data centers across the UAE, Saudi Arabia, and Bahrain-designed to support AI and cloud computing-is creating heightened demand for copper in high-performance networking and power delivery.

At the same time, Gulf governments are positioning themselves as key copper supply nodes. Abu Dhabi’s International Resources Holding initiated a copper trading unit. At the same time, Oman revived copper extraction at its Lasail mine after decades of inactivity-steps that aim to transform the region into a copper trade and processing hub.

Yet challenges remain. In Saudi Arabia, utilities have begun substituting copper with aluminum conductors in grid projects to curb costs-a marker of rising competitive pressure. In addition, ongoing volatility in global copper prices, reliance on imports, and potential delays in project execution pose tangible risks to sustained copper demand in the region.

Voltage Insights

The low voltage segment led the market with the largest revenue share of 51.0% in 2024, due to its essential role in residential, commercial, and light industrial applications. These wires, operating below 1,000 volts, are extensively used for internal building wiring, lighting systems, household appliances, and control circuits. Growing residential construction in Riyadh’s King Salman Park housing developments, new apartment complexes in Lusail City, Qatar, and mixed-use projects in Sharjah Waterfront City are fuelling demand. In parallel, refurbishment of older hotels, offices, and retail spaces in Bahrain and Oman with smart, energy-efficient electrical systems is creating new replacement demand for modern low-voltage copper wiring.

The high voltage segment is projected to see at the fastest CAGR during the forecast period, driven by regional investments in utility-scale transmission networks and industrial power supply infrastructure. High-voltage copper conductors designed for systems above 35 kV are critical in linking large power generation sites to substations and industrial clusters. Major initiatives such as Egypt’s high-voltage link to Sudan, Oman’s Duqm industrial zone grid expansion, and Kuwait’s Subiya power station transmission upgrade are increasing demand for these wires. With rising electricity needs from heavy industries, desalination plants, and cross-border power trade, the preference for copper in minimizing transmission losses over long distances is reinforcing market growth.

Application Insights

The building wire segment is expanding steadily, supported by rapid urbanization, rising residential and commercial construction, and the modernization of aging infrastructure. Copper building wires are preferred for their superior conductivity, durability, and fire resistance, making them essential for power distribution, lighting, HVAC systems, and control wiring in both new developments and refurbishment projects. Growing investments in housing, mixed-use complexes, and commercial spaces, along with stricter building safety and efficiency standards, are further increasing demand for high-quality copper wiring solutions.

The renewable energy segment is projected to register at the fastest CAGR during the forecast period, driven by the global transition toward clean energy sources. Copper’s exceptional electrical and thermal conductivity make it critical for efficient energy transmission in renewable systems. In solar PV installations, copper is extensively used in wiring, inverters, transformers, and grounding systems, while in wind turbines, it is integral to generator coils, power cables, and control systems. As renewable installations require four to six times more copper per megawatt than conventional power plants due to their decentralized nature and extensive cabling needs, ongoing investments in clean energy infrastructure are expected to boost copper wire demand significantly.

Regional Insights

The Middle East copper wire market is expanding steadily, driven by large-scale infrastructure projects, investments in renewable energy, and rapid urban growth. Demand is supported by uses in power transmission, building wiring, industrial automation, and telecommunications. Ongoing grid upgrades, cross-border interconnection initiatives, and the adoption of smart technologies are boosting consumption, while efforts to establish the region as a global copper trading and processing center are strengthening supply chains.

Saudi Arabia dominated the Middle East copper wire market with the largest revenue share of 46.4% in 2024. Saudi Arabia benefits from significant investments in renewable energy, industrial zones, and nationwide infrastructure projects under Vision 2030. Increasing solar and wind capacity, along with large residential and commercial developments, is boosting demand for both low- and high-voltage copper wiring. The country’s focus is on modernizing its transmission networks and integrating new generation capacity into the grid further fuels growth. Rising imports meet domestic needs, while local processing and manufacturing capabilities are being developed to improve supply security.

The copper wire market in UAE is anticipated to grow at a significant CAGR during the forecast period. Extensive construction activity, advanced infrastructure upgrades, and rapid adoption of renewable energy technologies support the UAE market. Demand spans from high-end commercial and residential projects to utility-scale power and industrial applications. Continuous investments in smart grids, electric mobility infrastructure, and data centers are set to sustain robust market growth in the medium term.

Key Middle East Copper Wire Company Insights

Some of the key players operating in the market include Ducab, Riyadh Cables, and others.

-

Ducab, headquartered in the UAE, is a leading manufacturer of high-quality cables and conductors, serving industries such as construction, energy, oil & gas, and transportation. The company produces a wide range of copper and aluminum wire products, including building wires, power cables, and specialty cables designed for high-performance applications. Ducab’s copper wire solutions are known for their durability, superior conductivity, and compliance with stringent international standards, making them a preferred choice in regional infrastructure and industrial projects.

-

Riyadh Cables Group, based in Saudi Arabia, is one of the largest cable manufacturers in the Middle East. It offers a comprehensive range of copper and aluminum cables for power transmission, distribution, and industrial use. The company’s copper wire portfolio includes low, medium, and high-voltage solutions engineered for reliability in harsh environments. With extensive manufacturing capacity and advanced testing facilities, Riyadh Cables Group supports large-scale infrastructure projects, renewable energy systems, and urban development initiatives across the region.

-

Oman Cables, headquartered in Oman, is a leading producer of electrical and telecommunications cables catering to domestic and international markets. The company’s copper wire range covers low, medium, and high-voltage applications, as well as specialized wiring for renewable energy and industrial automation. Known for its adherence to global quality standards and innovative manufacturing practices, Oman Cables plays a key role in supporting the GCC’s growing demand for reliable power distribution and sustainable energy solutions.

Key Middle East Copper Wire Companies:

- Ducab

- Union Copper Rod LLC

- GIC Magnet Wire FZCO

- Riyadh Cables Group

- Bahra Electric

- Jeddah Cables Company

- Saudi Cable Company (SCC)

- Saudi Wires Company Ltd.

- Oman Cables

- Elsewedy Electric

Recent Developments

-

In July 2025, Oman Cables Industry (OCI) saw Prysmian Group increase its shareholding from approximately 34.8% to around 51% through an additional investment of about $110 million. This move strengthens Prysmian’s control and integrates OCI more deeply into its global cable and conductor network.

-

In March 2024, Riyadh Cables Group underwent a major shareholder restructuring when Hikmat Saad al-Zaim transferred 10 million shares (6.67%) to Afaq Al-Hikma Co. and 20 million shares (13.33%) to Afaq Development Co., both fully owned by him. (Transaction value not publicly disclosed.)

-

In June 2024, Riyadh Cables Group experienced another shareholder portfolio change, with A.K. Almuhaidib & Sons transferring 7.4 million shares (4.93%) to its sister entity, AlMuhaidib Holding LLC, as part of a broader family business restructuring.

Middle East Copper Wire Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 651.5 million

Revenue forecast in 2033

USD 967.4 million

Growth rate

CAGR of 5.1% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative Units

Revenue in USD million/billion, Volume in Kilotons, and CAGR from 2025 to 2033

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Voltage, application

Regional scope

Middle East

Country scope

Saudi Arabia; UAE; Qatar; Oman

Key companies profiled

Ducab; Union Copper Rod LLC; GIC Magnet Wire FZCO; Riyadh Cables Group; Bahra Electric; Jeddah Cables Company; Saudi Cable Company; Saudi Wires Company Ltd.; Oman Cables; Elsewedy Electric

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Copper Wire Market Report Segmentation

This report forecasts revenue and volume growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East copper wire market report based on the voltage and application.

-

Voltage Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Low

-

Medium

-

High

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Building Wire

-

Power Distribution

-

Automotive

-

Communication

-

Renewable Energy

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Middle East

-

Saudi Arabia

-

UAE

-

Qatar

-

Oman

-

-

Frequently Asked Questions About This Report

b. The Middle East copper wire market size was estimated at USD 642.8 million in 2024 and is expected to reach USD 651.5 million in 2025.

b. The Middle East copper wire market is expected to grow at a compound annual growth rate of 5.1% from 2025 to 2033 to reach USD 967.4 million by 2033.

b. By voltage, the low voltage segment accounted for the largest market revenue share of over 51.0% in 2024.

b. Some of the key vendors in the Middle East copper wire market include Ducab, Union Copper Rod LLC, GIC Magnet Wire FZCO, Riyadh Cables Group, Bahra Electric, Jeddah Cables Company, Saudi Cable Company, Saudi Wires Company Ltd., Oman Cables, and Elsewedy Electric.

b. The main driver of growth in the Middle East copper wire market is the rapid expansion of construction, power infrastructure, and renewable energy projects, supported by urbanization, industrialization, and electrification initiatives.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.