- Home

- »

- Consumer F&B

- »

-

Middle East Egg Market Size & Share, Industry Report, 2033GVR Report cover

![Middle East Egg Market Size, Share & Trends Report]()

Middle East Egg Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Brown Eggs, White Eggs), By Production Category (Cage-Free, Organic, Pasture-Raised), By End Use Application, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-842-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Egg Market Summary

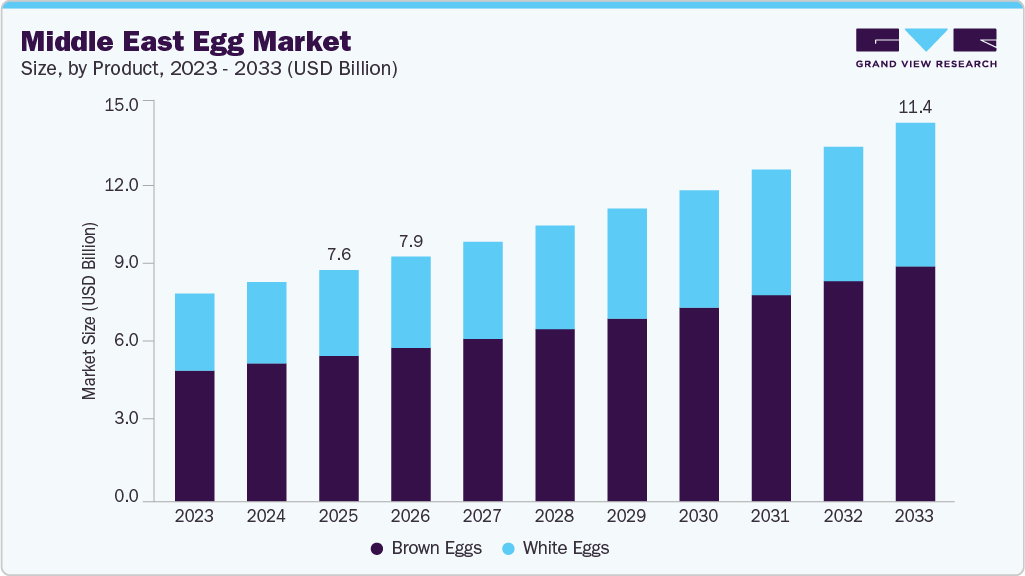

The Middle East egg market size was estimated at USD 7.57 billion in 2025 and is projected to reach USD 11.37 billion by 2033, growing at a CAGR of 5.3% from 2026 to 2033. The market growth is driven by rising consumer demand for protein-rich diets, the expansion of the food processing industry, and the increasing adoption of value-added egg products, including liquid, powdered, and pasteurized forms.

Key Market Trends & Insights

- By product, the brown eggs product segment held the largest revenue share of 62.5% in 2025.

- By production category, the pasture-raised segment dominated the market, accounting for the largest revenue share in 2025.

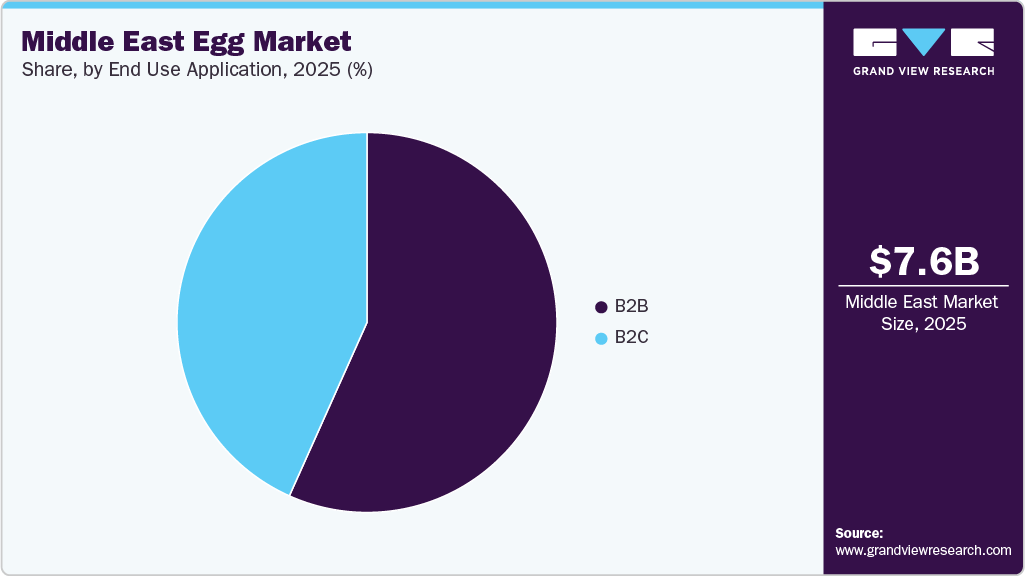

- By end use application, the B2B segment held the largest market share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 7.57 Billion

- 2033 Projected Market Size: USD 11.37 Billion

- CAGR (2026-2033): 5.3%

Growing investments by key players are also strengthening regional production capabilities. The Middle East eggs industry is witnessing a steady shift toward modernization and vertical integration across the value chain. Leading producers are investing in advanced layer-farming systems, automation, and cold-chain logistics to enhance productivity and product quality. The growing preference for fortified, organic, and omega-enriched eggs, driven by rising health consciousness and lifestyle changes, is reshaping product portfolios.

In addition, the increasing participation of women in the workforce and the rapid expansion of quick-service restaurants, bakeries, and food manufacturers are driving demand for processed egg products, including liquid, frozen, and powdered eggs. Government-backed initiatives to boost domestic production capacity and reduce import dependency are further accelerating this transition. For instance, according to the Ministry of Environment, Water, and Agriculture (MEWA), Saudi Arabia’s table egg production reached approximately 8 billion eggs in 2024. Eggs are a staple in daily meals and are widely used in the preparation of essential dishes such as pastries, pies, and various food products. These factors are positioning the Middle East as an emerging hub for sustainable and technologically advanced egg production.

Product Insights

The brown eggs segment dominated the Middle East eggs market, accounting for the largest revenue share of 62.5% in 2025. This growth is driven by rising consumer perception of their superior nutritional value and natural quality. Increasing adoption of cage-free and organic farming practices across the region has widened the availability of brown eggs, particularly in premium retail channels and health-focused consumer segments. The growing middle-class population, coupled with lifestyle-driven demand for protein-rich diets, is further propelling this trend. Producers such as Seamorgh Company and Arabian Farms are expanding their product lines of brown eggs to meet the growing demand. In addition, promotional campaigns highlighting animal welfare and sustainable production are positively influencing consumer preferences toward brown eggs.

The white eggs product segment is expected to grow at the fastest CAGR of 5.6% over the forecast period, driven by widespread consumption and affordability. White eggs are popular in foodservice and commercial settings because they look neutral and are easy to find. This makes them a good choice for bakeries, catering, and kitchens. In the Middle East, about 81% of eggs produced are white, showing a clear market preference and strong supply in the region. In addition, government efforts to enhance food security and promote self-sufficiency in countries such as Saudi Arabia and the UAE are supporting steady growth in production. Their wide retail availability through supermarkets and hypermarkets further reinforces their market dominance.

Production Category Insights

The pasture-raised segment dominated the Middle East eggs industry, accounting for the largest revenue share in 2025. Rising health awareness has led to a preference for more natural, nutritious, antibiotic- and hormone-free eggs, boosting consumer demand for pasture-raised eggs. Rapid urbanization and higher disposable incomes, especially in Gulf countries, have led to increased willingness to pay premium prices for quality and animal-welfare-friendly products. Retailers and supermarkets support this trend by positioning pasture-raised eggs as premium category products, improving visibility, expanding shelf space, and using targeted labeling and packaging. These factors have strengthened consumer trust and purchasing confidence, driving stronger sales and higher revenue for pasture-raised eggs compared to conventional options.

The organic segment is expected to grow at the fastest CAGR over the forecast period. This growth is driven by increasing awareness of health, sustainability, and clean-label nutrition. Consumers are willing to pay a premium for eggs produced without synthetic feed, hormones, or antibiotics. Demand for organic eggs is particularly surging among urban middle-income and high-income groups across the UAE, Saudi Arabia, and Qatar. Producers such as Seamorgh Company and Tanmiah Food Company are investing in production facilities and feed quality improvements to meet the evolving demand. For example, in February 2023, Tanmiah Food Company signed an MoU with European poultry producer MHP to establish a joint venture in Saudi Arabia. The joint venture is focused on building a hatchery with a capacity of 108 million eggs per year and feed mills producing 137,000 tonnes annually, supporting the Vision 2030 food security goals. Moreover, government food safety initiatives and the expansion of organic certification frameworks are further fostering growth. The rising presence of dedicated sections for organic products in modern trade outlets and e-commerce platforms is also facilitating broader market access.

End Use Application Insights

The B2B application segment dominated the Middle East eggs industry, accounting for the largest revenue share in 2025. The extensive use of eggs in bakery, confectionery, ready-to-eat meals, sauces, and mayonnaise production is contributing to the market growth. Eggs serve as essential functional ingredients, providing structure, texture, and flavor enhancement across diverse food formulations. The region’s expanding bakery and processed food industries, supported by strong demand from quick-service restaurants, hotels, and catering services, continue to propel large-scale egg utilization. Major food processors in Saudi Arabia and the UAE are increasingly adopting liquid and powdered egg formats to improve operational efficiency and ensure compliance with food safety regulations. In addition, the growth of domestic food manufacturing and government-backed initiatives to boost local processing capabilities, under programs such as Saudi Vision 2030, are expected to further strengthen the dominance of this segment.

The B2C segment is projected to grow at the fastest CAGR from 2026 to 2033. Rising per capita egg consumption and shifting dietary preferences toward protein-rich, affordable nutrition are driving sales through the B2C channel. Eggs are a key source of essential amino acids, making them a staple in Middle Eastern diets. Urbanization, rising middle-class incomes, and increased awareness of healthy eating habits have contributed to this trend. According to the Food Security Statistics Publication 2023 by the General Authority for Statistics (GASTAT), Kingdom of Saudi Arabia, the per capita egg consumption was approximately 246 eggs per year in 2024, reflecting the steady dietary reliance on eggs as a key protein source across the country.

Digital penetration is increasing and offering the convenience of doorstep delivery in urban and semi-urban areas. Companies such as Al Ain Farms and Arabian Farms strengthened their presence through company-owned e-commerce platforms and partnerships with third-party aggregators, including Carrefour Online and Noon Daily. Government support for digital transformation, such as Saudi Arabia’s E-Commerce Law (2023) and the UAE’s National Digital Economy Strategy 2035, is accelerating this shift. Though online sales currently account for a small share of the total volume, rising internet penetration and the adoption of food delivery services are expected to drive double-digit growth. These channels are particularly effective for promoting premium, fortified, and organic egg products, enabling producers to reach younger, health-conscious consumers while enhancing brand visibility and traceability.

Country Insights

The Middle East eggs industry is witnessing steady growth, driven by rising protein consumption, expanding food processing industries, and growing consumer preference for high-quality and locally produced eggs. Countries such as Saudi Arabia, the UAE, and Iran are investing heavily in poultry infrastructure to enhance self-sufficiency and reduce import dependency. Technological advancements in layer farming, biosecurity measures, and automation are improving production efficiency across the region. The demand for pasteurized, liquid, and powdered egg products is surging, particularly from the bakery, confectionery, and foodservice sectors.

Government initiatives under national food security strategies, including Saudi Vision 2030 and the UAE’s food sustainability agenda, are accelerating industry consolidation. Regional producers, such as Al Ain Farms and Seamorgh Company, are expanding their capacities and adopting value-added processing. The market is also witnessing a shift toward fortified and specialty eggs, catering to health-conscious consumers, and transitioning from traditional production toward integrated, modern, and export-capable operations.

Key Middle East Egg Company Insights

Some of the key players in the eggs market include Rahima Poultry Farms; Fakieh Group; Al Ain Farms; and Seamorgh Company.

-

Al Ain Farms is a UAE-based integrated food and beverage company offering a wide range of products, including dairy, poultry, eggs, camel milk, and juices. The company focuses on quality, freshness, and ethical production, producing nine million broilers and 160 million fresh eggs annually. Its strong local presence, diversified portfolio, and vertically integrated operations position it as a key player in the UAE’s food and protein market.

-

Seamorgh Company is an Iran-based poultry producer specializing in table eggs, parent stock, and day-old layer chicks. With over five decades of experience and 11 production units across nine provinces, it operates the region’s largest egg production chain. Its emphasis on large-scale operations, sustainable practices, and strategic partnerships with global genetics firms strengthens its position as a leading player.

Key Middle East Egg Companies:

- Rahima Poultry Farms

- Fakieh Group

- Al Ain Farms

- Seamorgh Company

- Arabian Farms

- Algharbia Farms for Poultry Co.

- Al Jazira Poultry Farm

Recent Developments

- In May 2025, Al Ain Farms was launched by merging five major UAE dairy, poultry, and egg brands, namely Al Ajban Chicken, Saha Arabian Farms, Al Jazira Poultry Farm’s Golden Eggs, Al Ain Farms, and Marmum Dairy, under one group. Backed by Ghitha Holding and Yas Holding, the Al Ain Farms aim to contribute to the UAE’s food security, industrial innovation, and self-reliance objectives.

Middle East Egg Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 7.94 billion

Revenue forecast in 2033

USD 11.37 billion

Growth rate

CAGR of 5.3% from 2026 to 2033

Base year for estimation

2025

Actuals

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, production category, end use application, country

Regional scope

Middle East

Country scope

Saudi Arabia; UAE; Oman; Qatar; Bahrain; Kuwait

Key company profiled

Rahima Poultry Farms; Fakieh Group; Al Ain Farms; Seamorgh Company; Arabian Farms; Algharbia Farms for Poultry Co.; Al Jazira Poultry Farm

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Egg Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East egg market report on the basis of product, production category, end use application, and country:

-

Product Outlook (Revenue, USD Billion, 2021 - 2033)

-

Brown Eggs

-

White Eggs

-

-

Production Category Outlook (Revenue, USD Billion, 2021 - 2033)

-

Cage-Free

-

Organic

-

Pasture-raised

-

-

End Use Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

B2B

-

Processing Industry

-

Bakery & Confectionery

-

Processed & Convenience Foods

-

Dairy & Dairy Products

-

Nutritional & Functional Food

-

-

Foodservice Industry

-

-

B2C

-

Hypermarket/Supermarket

-

Grocery Stores

-

Online

-

Company-Owned Websites

-

E-Commerce

-

-

Others (Wholesalers, etc.)

-

-

-

Country Outlook (Revenue, USD Billion, 2021 - 2033)

-

Middle East

-

Saudi Arabia

-

UAE

-

Oman

-

Qatar

-

Bahrain

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.