- Home

- »

- Advanced Interior Materials

- »

-

Middle East Explosion Proof Equipment Market Report, 2033GVR Report cover

![Middle East Explosion Proof Equipment Market Size, Share & Trends Report]()

Middle East Explosion Proof Equipment Market (2025 - 2033) Size, Share & Trends Analysis Report By Protection Method (Explosion Prevention, Explosion Containment, Explosion Segregation), By Industry (Oil & Gas, Chemical & Petrochemical, Mining, Energy & Power), By System, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-759-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Explosion Proof Equipment Market Summary

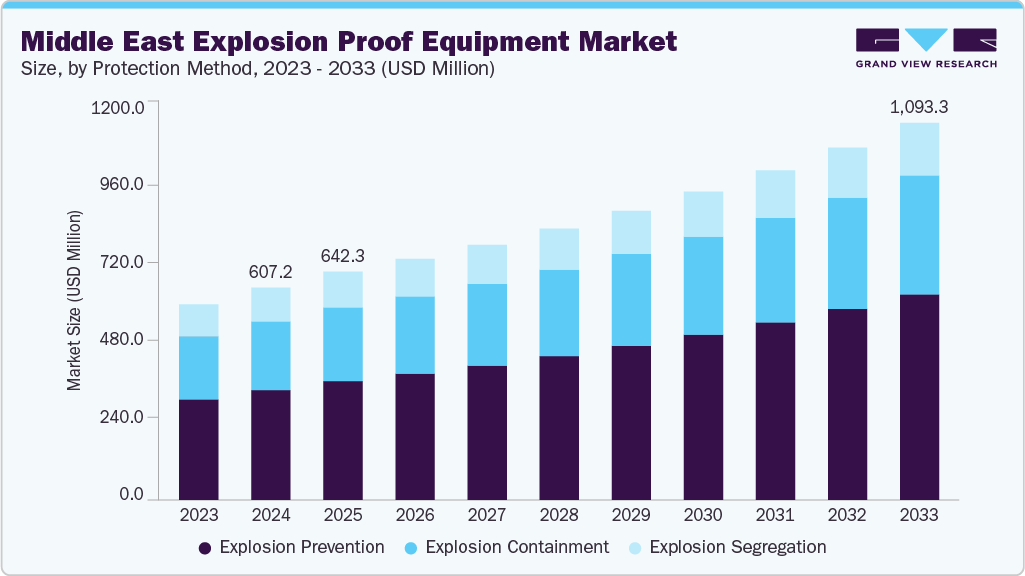

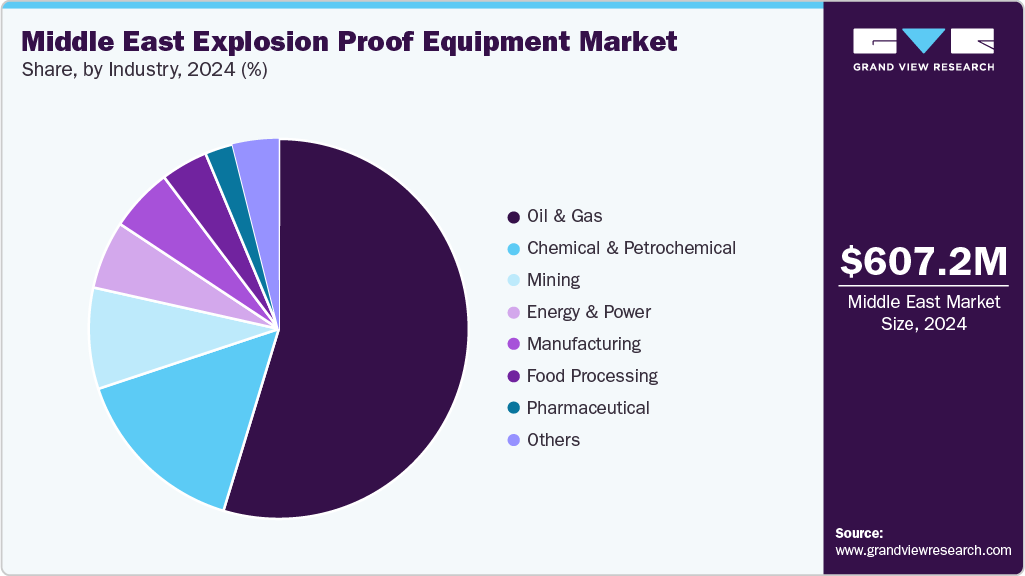

The Middle East explosion proof equipment market size was estimated at USD 607.2 million in 2024 and is projected to reach USD 1,093.3 million by 2033, growing at a CAGR of 6.9% from 2025 to 2033. The growth is attributed to increasing demand from industries such as oil and gas, petrochemicals, energy, and construction.

Key Market Trends & Insights

- The explosion proof equipment market in Saudi Arabia is expected to grow at a substantial CAGR of 7.5% from 2025 to 2033.

- By protection method, explosion prevention segment is expected to grow at a considerable CAGR of 7.5% from 2025 to 2033 in terms of revenue.

- By industry, thechemical & petrochemical segment is expected to grow at a considerable CAGR of 8.2% from 2025 to 2033 in terms of revenue.

- By system, monitoring systems segment is expected to grow at a considerable CAGR of 8.4% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 607.2 Million

- 2033 Projected Market Size: USD 1,093.3 Million

- CAGR (2025-2033): 6.9%

As these sectors expand, safety regulations are becoming stricter, driving the adoption of certified explosion-proof lighting, enclosures, motors, and control systems. Industrial facilities are prioritizing worker safety and operational continuity, especially in hazardous environments.

Technological advancements, including IoT-enabled devices and more durable materials, are improving equipment performance and reliability. In addition, growing investments in infrastructure and industrial automation across the region are fueling demand for high-quality explosion-proof solutions, making the market a key area of opportunity for manufacturers and suppliers looking to expand their presence in the Middle East.

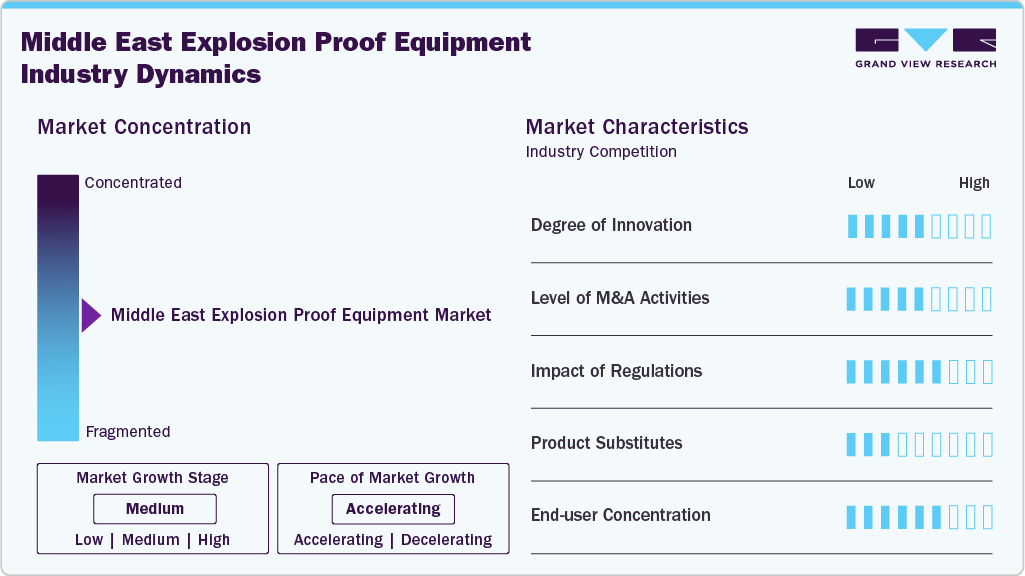

Market Concentration & Characteristics

The Middle East explosion-proof equipment market is moderately fragmented, with a mix of global and regional players competing. Major international companies dominate with advanced technologies and certified products, especially in oil and gas sectors. However, regional manufacturers and specialized firms also hold market share by offering cost-effective, localized solutions. This competitive landscape creates a balanced market structure, where innovation, compliance, and industry-specific needs drive differentiation among players.

Innovation in the Middle East explosionproof equipment market is centered on integrating IoT and real‑time monitoring to enhance safety and reliability. Manufacturers are developing energy‑efficient lighting, flameproof enclosures, and custom solutions tailored for high‑risk zones. Advanced materials that withstand extreme heat, dust ingress, and corrosive conditions also feature increasingly. Overall, innovation is incremental and driven by system‑specific demands.

M&A activity in this market is growing, with global corporations acquiring or partnering with regional firms to access local certifications and distribution networks. Deals often aim to combine technical expertise with region‑specific compliance. Consolidation helps companies scale up, gain cost efficiencies, and respond swiftly to major infrastructure and oil & gas projects demanding explosion proof equipment.

Countries enforce international standards such as ATEX, IECEx, and local certifications to ensure safety in hazardous environments. Authorities require equipment to meet zone classifications (e.g. Zone 1, Zone 2), flameproof ratings, and rigorous testing. Civil defense and safety agencies enforce compliance by driving reengineering to design and certify products carefully before market entry, frequently driving re‑engineering or upgrading older equipment.

Drivers, Opportunities & Restraints

Expansion of oil and gas infrastructure is significantly driving the market in the Middle East. As the region invests heavily in upstream and downstream operations, demand for certified, durable safety equipment rises. Harsh environments and hazardous zones necessitate reliable protection, boosting the need for explosion-proof lighting, motors, and enclosures across refineries, rigs, and processing facilities.

Growing investments in renewable energy, petrochemicals, and smart industrial zones present strong opportunities for explosion-proof equipment manufacturers. As new facilities are built, there’s increasing demand for modern, automated, and compliant safety systems. Moreover, retrofitting aging infrastructure to meet updated safety standards opens new markets for suppliers offering tailored, high-performance explosion-proof solutions adapted to diverse industrial environments.

A major challenge in the market is navigating complex, varying regulatory requirements across countries. Manufacturers must meet multiple certification standards such as IECEx, ATEX, and region-specific codes. This raises compliance costs and slows time to market. Additionally, the high upfront cost of certified equipment often deters smaller operators, affecting overall adoption in budget-sensitive or less regulated segments.

Protection Method Insights

The explosion prevention protection segment dominated the market in 2024 by accounting for a share of 52.4% due to continued reliance on heavy industrial operations in oil, gas, and petrochemicals. These sectors require robust solutions to isolate ignition sources, especially in hazardous areas. Ongoing infrastructure development and regulatory enforcement is expected to drive demand for durable, certified explosion-proof equipment across industrial zones and refineries.

The explosion containment segment is projected to grow steadily in the Middle East as industrial facilities prioritize worker safety and equipment reliability. Increased investment in offshore platforms, chemical plants, and energy projects requires enclosures capable of withstanding internal blasts. This segment benefits from stricter compliance standards and the need to modernize legacy systems with advanced containment solutions that meet international and regional safety certifications.

Industry Insights

The oil & gas segment dominated the market and accounting for revenue share of 54.7%, due to ongoing upstream and downstream expansions. New refinery projects, offshore drilling, and LNG infrastructure demand certified safety equipment. High-risk environments with flammable gases necessitate robust explosion-proof lighting, enclosures, and control systems to ensure operational safety and regulatory compliance.

The chemical & petrochemical segment is projected to grow notably in the Middle East, with rapid investment, especially in Saudi Arabia and the UAE. This expansion fuels demand for explosion-proof equipment to manage volatile substances and ensure plant safety. Complex processing environments require flameproof motors, switches, and monitoring systems. As production scales, regulatory pressure likely to push manufacturers to upgrade and standardize safety across new and existing facilities.

System Insights

The junction boxes & enclosures system segment dominated the market in 2024 by accounting for a share of 26.9% due to their critical role in protecting electrical components in explosive environments. Expanding oil, gas, and industrial projects require durable, certified housings to prevent ignition. Demand for corrosion-resistant materials such as stainless steel and aluminum is rising, especially in offshore, desert, and chemical plant applications.

Monitoring systems segment is growing rapidly in the Middle East explosion proof equipment market, as industries prioritize real-time hazard detection and operational safety. Integration of IoT-based sensors and explosion-proof surveillance systems is increasing in oil refineries, gas plants, and chemical facilities. These systems help detect gas leaks, pressure anomalies, and fire risks early, supporting predictive maintenance and regulatory compliance across high-risk industrial zones.

Country Insights

Saudi Arabia explosion proof equipment market dominated the region with a revenue share of 37.2% in 2024, due to heavy investment in oil & gas infrastructure and “Vision 2030” industrial goals. Strict industrial safety regulations and global standards adoption push demand for certified safety equipment in high‑risk zones. Simultaneously, rising petrochemical and energy projects, and expansion of large‑scale construction, stimulate opportunities for explosion prevention and containment systems across sectors.

The explosion proof equipment market in the UAE is expected to grow at a CAGR of 7.2%from 2025 to 2033, driven by substantial investments in industrial infrastructure and stringent safety regulations. The government's commitment to enhancing occupational safety standards and the expansion of sectors such as oil and gas, chemicals, and manufacturing are key factors contributing to this growth. In addition, the adoption of advanced technologies and compliance with international safety standards further bolster the demand for explosion-proof equipment in the region.

Key Middle East Explosion Proof Equipment Company Insights

Some of the key players operating in the market include Siemens, Honeywell International Plc., Rockwell Automation Inc.

-

Honeywell International Inc. is a multinational company that operates in a wide range of industries, including building technologies, aerospace, performance materials, and safety and productivity solutions. The company designs and manufactures diverse solutions, such as advanced building control systems, smart home technology, aerospace products, industrial automation systems, and materials for the healthcare and energy sectors.

-

ABB (Asea Brown Boveri) is a global player in electrification, automation, and digitalization, providing innovative solutions across industries such as energy, transportation, manufacturing, and utilities. The company offers a wide range of products and services, including electrical equipment, robotics, industrial automation, and digital solutions to improve efficiency, sustainability, and safety.

Key Middle East Explosion Proof Equipment Companies:

- Siemens

- Honeywell International Plc.

- Rockwell Automation Inc.

- ABB

- Eaton Corporation

- Emerson Electric Co.

- Warom Technology Inc.

- WorkSite Lighting

- Federal Signal Corporation

- Pepperl+Fuchs SE

Recent Developments

-

In May 2025, Honeywell launched a new gas detector production line at Abu Dhabi’s Masdar Innovation Centre. This facility enhances local manufacturing capabilities, supporting advanced safety solutions for the Middle East’s industrial sectors. The move strengthens Honeywell’s commitment to innovation and regional market growth in environmental and industrial safety technologies.

-

In March 2024,Emerson Electric Co. introduced the Rosemount SAM42 Acoustic Particle Monitor, designed to measure entrained sand in oil and gas well outputs. This new product includes explosion-proof protection and features onboard data processing capabilities.

Middle East Explosion Proof Equipment Market Report Scope

Report Attribute

Details

Market size in 2025

USD 642.3 million

Revenue forecast in 2033

USD 1,093.3 million

Growth rate

CAGR of 6.9% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Protection method, industry, system, region

Country scope

Saudi Arabia; UAE; Oman; Qatar; Kuwait; Israel

Key companies profiled

Siemens; Honeywell International Plc.; Rockwell Automation Inc.; ABB; Eaton Corporation; Emerson Electric Co.; Warom Technology Inc.; WorkSite Lighting; Federal Signal Corporation; Pepperl+Fuchs SE

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Explosion Proof Equipment Market Report Segmentation

This report forecasts revenue growth at a country level and analyzes industry trends in each of the sub-segments from 2021 - 2033. For this study, Grand View Research has segmented the Middle East explosion proof equipment market based on protection method, industry, system, and country.

-

Protection Method Outlook (Revenue, USD Million, 2021 - 2033)

-

Explosion Prevention

-

Explosion Containment

-

Explosion Segregation

-

-

Industry Outlook (Revenue, USD Million, 2021 - 2033)

-

Oil & Gas

-

Chemical & Petrochemical

-

Mining

-

Energy & Power

-

Manufacturing

-

Food Processing

-

Pharmaceutical

-

Others

-

-

System Outlook (Revenue, USD Million, 2021 - 2033)

-

Junction Boxes & Enclosures

-

Lighting Systems

-

Monitoring Systems

-

Explosion-Proof Cameras

-

Explosion-Proof Sensors

-

Others

-

-

Communication & Networking Systems

-

Access Points & Routers

-

Tablets & Smartphones

-

Networking Equipment

-

Explosion-Proof Servers

-

Others

-

-

Signaling Devices

-

Automation Systems

-

Cable Glands

-

HVAC Systems

-

Others

-

-

Country Outlook (Revenue, USD Million, 2021 - 2033)

-

Saudi Arabia

-

UAE

-

Oman

-

Qatar

-

Israel

-

Kuwait

-

Frequently Asked Questions About This Report

b. The Middle East explosion proof equipment market size was estimated at USD 607.2 million in 2024 and is expected to reach USD 642.3 million in 2025.

b. The Middle East explosion proof equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 6.9% from 2025 to 2033, reaching USD 1,093.3 million by 2033.

b. The explosion prevention protection segment dominated the market in 2024 by accounting for a share of 52.4% due to continued reliance on heavy industrial operations in oil, gas, and petrochemicals. These sectors require robust solutions to isolate ignition sources, especially in hazardous areas.

b. Some of the key players operating in the Middle East explosion proof equipment market include Siemens, Honeywell International Plc., Rockwell Automation Inc., ABB, Eaton Corporation, Emerson Electric Co., Warom Technology Inc., WorkSite Lighting, Federal Signal Corporation, Pepperl+Fuchs SE.

b. Key factors driving the Middle East explosion-proof equipment market include rapid industrial expansion, strict safety regulations, growing oil & gas activities, and increased investments in petrochemicals, manufacturing, and infrastructure creating strong demand for certified equipment to ensure safety in hazardous environments.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.