- Home

- »

- Conventional Energy

- »

-

Middle East Gas Pipeline Infrastructure Market Report, 2033GVR Report cover

![Middle East Gas Pipeline Infrastructure Market Size, Share & Trends Report]()

Middle East Gas Pipeline Infrastructure Market (2025 - 2033) Size, Share & Trends Analysis Report By Operation (Gathering Pipeline, Transmission Pipeline, Distribution Pipeline), By Application, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-731-6

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Gas Pipeline Infrastructure Market Summary

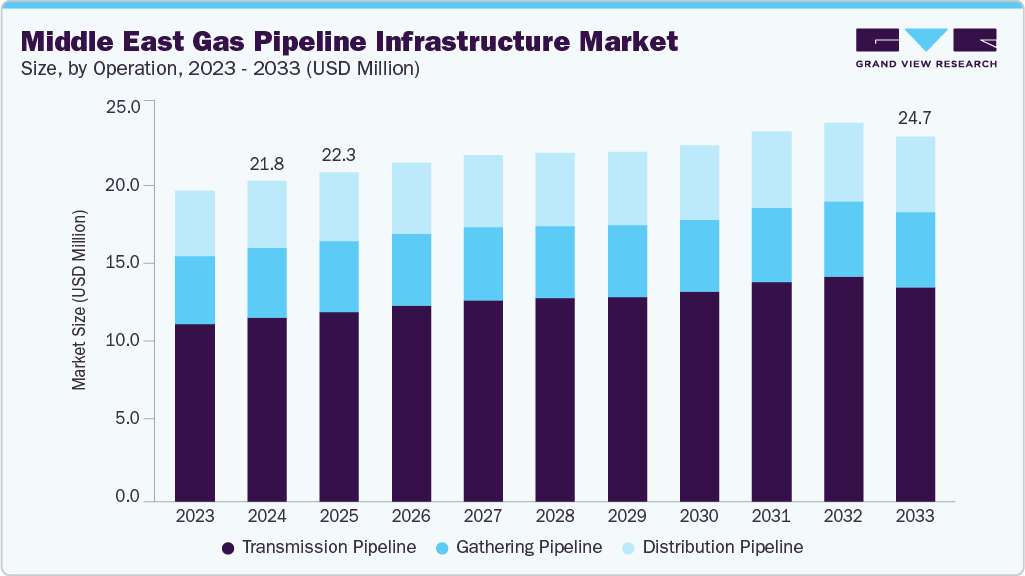

The Middle East gas pipeline infrastructure market size was estimated at USD 21.75 million in 2024 and is projected to reach USD 24.70 million by 2033, growing at a CAGR of 1.3% from 2025 to 2033. Pipeline development across the region spans large-scale transmission, gathering, and distribution systems, enabling cross-border energy trade and supporting industrial, power generation, and residential sectors.

Key Market Trends & Insights

- Saudi Arabia held the largest share of 32% in the Middle East market in 2024.

- The gas pipeline infrastructure market in the Middle East is expected to grow significantly over the forecast period.

- By operation, the transmission pipeline segment held the largest market share of 57.17% in 2024.

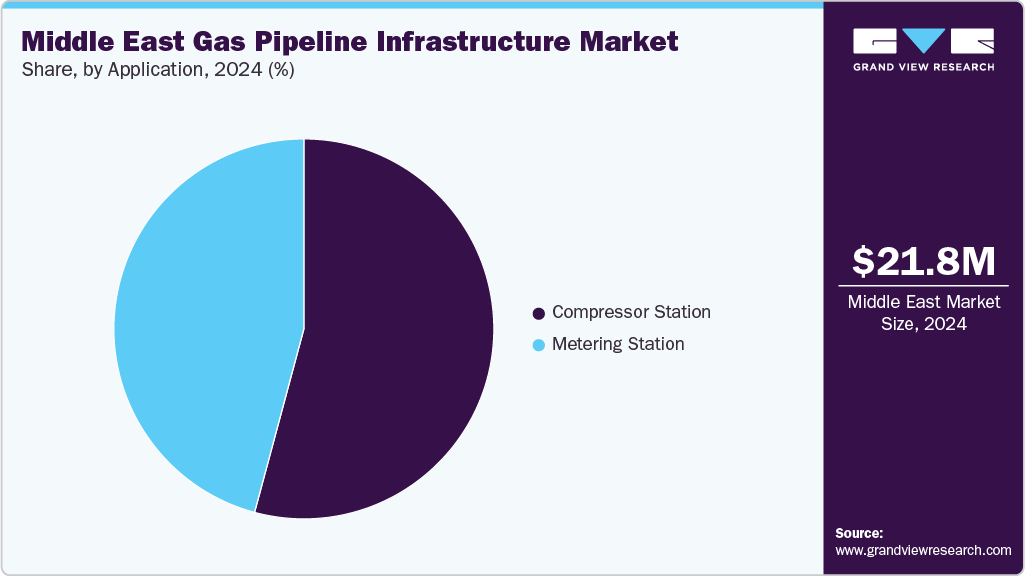

- Based on applications, the compressor station segment accounted for the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 21.75 Million

- 2033 Projected Market Size: USD 24.70 Million

- CAGR (2025-2033): 1.3%

- Saudi Arabia: Largest market in 2024

National strategies such as Saudi Vision 2030, the UAE’s Energy Strategy 2050, and Qatar’s LNG expansion roadmap are accelerating investments in gas infrastructure to diversify energy portfolios, enhance domestic supply reliability, and strengthen regional export capabilities. Countries such as Saudi Arabia, the UAE, Qatar, Iran, and Iraq increasingly prioritize pipeline projects to serve industrial hubs, petrochemical complexes, and export corridors, enabling cross-border integration and improved energy security.

Growth in the market is driven by rising natural gas demand as a transition fuel, large-scale upstream developments, and strong government support for LNG and pipeline connectivity projects. Technological advancements in pipeline monitoring, digital twin solutions, and corrosion-resistant materials improve operational efficiency and safety. Integrated networks connecting offshore fields, onshore processing facilities, and industrial zones are becoming critical to meeting growing regional consumption while supporting LNG export strategies. Cross-border initiatives such as the GCC interconnection network and the Eastern Mediterranean Gas Forum (EMGF) pipeline plans are expected to strengthen energy cooperation and open new trade opportunities. With leading companies such as Saudi Aramco, ADNOC, QatarEnergy, and Israel Natural Gas Lines (INGL) spearheading large-scale deployments, the Middle East gas pipeline infrastructure industry is set for robust and sustained growth over the coming decade.

Drivers, Opportunities & Restraints

The Middle East gas pipeline infrastructure industry is driven by rising natural gas demand as a transition fuel, large-scale upstream developments, and national diversification strategies across the GCC, Levant, and North Africa. Countries such as Saudi Arabia, Qatar, and the UAE invest heavily in expanding transmission and distribution pipelines to support LNG export growth, industrial zones, and power generation. Strategic projects like Saudi Arabia’s Jafurah unconventional gas development and Qatar’s North Field expansion underline the region’s focus on maximizing natural gas reserves for domestic use and international trade. In addition, the push for cleaner energy aligned with decarbonization goals positions natural gas as a key enabler of energy security while reducing reliance on oil in the power sector.

Opportunities in the market include cross-border pipeline projects to strengthen regional energy cooperation, integration of pipelines with LNG export terminals, and the development of digital monitoring solutions to enhance operational efficiency and safety. The rise of hydrogen blending in pipelines, expansion of petrochemical feedstock supply, and increasing foreign partnerships in infrastructure development open new avenues for growth. However, the market faces restraints such as high capital requirements for new pipeline projects, complex geopolitics surrounding cross-border agreements, and the risk of stranded assets due to long-term decarbonization policies. Technical challenges in building pipelines across desert terrains and offshore routes, as well as regulatory discrepancies among countries, also pose barriers to seamless deployment. Despite these hurdles, ongoing investment momentum and strong national commitments continue to position the Middle East as a global hub for gas pipeline infrastructure.

Operation Insights

Transmission pipeline segment held the largest revenue share of over 57.17% in 2024. The transmission pipeline segment accounted for a 57.17% share in 2024, reflecting its critical role in transporting natural gas over long distances and linking production fields with major demand centers. With vast proven reserves in countries such as Saudi Arabia, Iran, Qatar, and Iraq, transmission pipelines form the backbone of regional and cross-border gas trade, ensuring reliable energy delivery to domestic consumers and export markets. Landmark projects such as the Dolphin Gas Project, the Arab Gas Pipeline, and Saudi Arabia’s network expansions illustrate the segment’s importance in connecting upstream production with industrial clusters, power plants, and LNG terminals. As regional economies accelerate energy diversification and gas-based power generation, transmission pipelines provide the scale and efficiency needed to sustain rising demand while supporting cross-border energy security initiatives.

Growth in this segment is further supported by ongoing investments in pipeline modernization, capacity expansion, and advanced monitoring technologies that enhance operational safety and efficiency. Digital pipeline management, leak detection systems, and SCADA (Supervisory Control and Data Acquisition) integration are increasingly deployed to strengthen network reliability. Moreover, with ambitious infrastructure projects in the UAE, Iran, and Kuwait, alongside Iraq’s plans to expand gas gathering and export networks, transmission pipelines remain central to meeting the Middle East’s energy needs. While gathering pipelines support upstream development and distribution networks expand to end-users, the transmission pipeline infrastructure underpins regional energy trade, positioning the segment as a cornerstone of the Middle East’s gas value chain throughout the forecast period.

Application Insights

Compressor Station held the largest revenue share of over 59.98% in 2024. The compressor station segment accounted for the largest share of 59.98% in 2024, underscoring its central role in maintaining pressure and ensuring the efficient transportation of natural gas across vast regional networks. Given the extensive cross-border and domestic transmission systems in Saudi Arabia, Iran, Qatar, and the UAE, compressor stations enable uninterrupted, long-distance gas flow from upstream production sites to industrial hubs, LNG terminals, and end use markets. Strategic projects such as expansions of the Dolphin Gas Pipeline, Saudi Aramco’s cross-country transmission system, and Iran’s gas export corridors highlight the critical reliance on compressor stations to sustain throughput capacity and meet the region’s surging energy demand. With the Middle East emerging as a global hub for natural gas supply and trade, the robustness of compressor infrastructure forms the backbone of operational reliability and export competitiveness.

Ongoing investments in modernization, digitalization, and energy-efficient compressor technologies further reinforce the segment’s growth. Governments and operators are adopting advanced turbine and electric-driven compressors, real-time monitoring platforms, and predictive maintenance systems to improve operational efficiency and reduce emissions. Furthermore, the push toward integrating hydrogen and other low-carbon gases into existing infrastructure is prompting the development of flexible compressor stations capable of handling diverse fuel blends. Countries like Qatar and the UAE also invest in state-of-the-art stations to strengthen LNG supply chains and ensure stable feedstock availability for downstream petrochemical industries. As the Middle East continues to expand its natural gas trade while aligning with sustainability objectives, compressor stations will remain the cornerstone of application-driven demand in the regional gas pipeline infrastructure market over the forecast period.

Country Insights

Saudi Arabia Gas Pipeline Infrastructure Market Trends

The Saudi Arabia gas pipeline infrastructure industry held the largest revenue share of 32% in the Middle East market in 2024, underpinned by its dominant role as the region's leading natural gas producer and exporter. The Kingdom is expanding its transmission and distribution pipeline network to support rising domestic demand, industrial diversification, and strategic export initiatives under Vision 2030. Key projects such as the Master Gas System (MGS) expansions and the integration of gas supply into major industrial hubs, including NEOM and Jubail, reinforce Saudi Arabia's leadership. Strong backing from Saudi Aramco, combined with state-driven investments in infrastructure modernization and digital monitoring systems, ensures continued capacity growth and operational efficiency.

Saudi Arabia's geographic advantage and large-scale production capacity allow it to serve both domestic industries and international markets efficiently. The Kingdom also invests in advanced compressor stations, safety systems, and digital pipeline management technologies to minimize downtime and enhance resilience. With substantial capital allocation and clear regulatory frameworks, Saudi Arabia is expected to maintain its position in the regional gas pipeline infrastructure market throughout the forecast period.

Iran Gas Pipeline Infrastructure Market Trends

The Iran gas pipeline infrastructure industry represents one of the world's largest natural gas reserve holders and a vital contributor to the Middle East landscape. The country has an extensive transmission and distribution pipeline network, anchored by its giant South Pars gas field, which fuels domestic consumption and cross-border exports. Despite facing geopolitical and sanction-related constraints, Iran continues to expand its pipeline infrastructure to meet rapidly growing domestic power generation and industrial demands. Projects connecting remote reserves to central consumption hubs are bolstering national energy security and reducing supply bottlenecks.

Cross-border pipeline initiatives, particularly with neighboring Iraq, Turkey, and Pakistan, underscore Iran's ambition to remain a regional gas hub. Although foreign investment limitations present challenges, domestic players and government-led programs are driving incremental capacity additions. As Iran continues leveraging its massive reserves, it remains a critical pillar of the Middle East's gas pipeline infrastructure industry.

Iraq Gas Pipeline Infrastructure Market Trends

The Iraq gas pipeline infrastructure industry is gradually strengthening its position as the country expands its transmission and distribution networks to support growing electricity generation and industrial requirements. Historically reliant on associated gas flaring, the country has made significant strides in capturing and processing natural gas from its oilfields to reduce wastage and enhance supply availability. International collaborations, particularly with U.S. and Gulf-based companies, facilitate infrastructure upgrades and the construction of new pipelines and compressor stations.

Iraq's growing demand for power and reliance on gas imports from Iran highlight the urgency of expanding its domestic pipeline capacity. Government programs to reduce flaring, diversify supply routes, and integrate gas infrastructure into industrial clusters are accelerating development. While security and regulatory challenges persist, Iraq's improving infrastructure framework is expected to support steady growth in the market.

UAE Gas Pipeline Infrastructure Market Trends

The UAE gas pipeline infrastructure industry is growing on the back of advanced energy infrastructure and a strategic push toward gas self-sufficiency. Major projects such as the expansion of the Dolphin Gas Project and ADNOC's extensive pipeline modernization initiatives underscore the UAE's role as a reliable regional supplier. In particular, Abu Dhabi invests heavily in smart pipeline technologies, advanced compressor stations, and integrated monitoring systems to enhance reliability and efficiency.

Beyond domestic needs, the UAE's interconnected gas pipeline networks with neighboring Gulf countries strengthen its role in cross-border supply security. The government's focus on clean energy transition also includes investments in hydrogen-ready pipelines, ensuring long-term infrastructure adaptability. With strong regulatory frameworks, open investment policies, and advanced engineering capabilities, the UAE is expected to remain a growth leader in the regional market.

Qatar Gas Pipeline Infrastructure Market Trends

The Qatar gas pipeline infrastructure industry is closely tied to its global leadership in LNG exports and vast natural gas reserves in the North Field. While LNG dominates its export strategy, the country maintains an extensive domestic pipeline system to support power generation, water desalination, and industrial clusters. Key expansions are underway to link new processing facilities with industrial and urban demand centers, while advanced compressor stations ensure efficient transmission.

Qatar's strategic investment in pipeline safety, digital monitoring, and integration with LNG facilities strengthens its infrastructure reliability. Further, Qatar National Vision 2030 initiatives emphasize modernizing energy infrastructure and reducing carbon emissions through integration with carbon capture and hydrogen technologies. These efforts and steady demand growth from domestic and international markets position Qatar as a vital contributor to the Middle East market growth.

Key Middle East Gas Pipeline Infrastructure Company Insights

Some of the key players operating in the Middle East market include Saudi Aramco, QatarEnergy, ADNOC, and National Iranian Gas Company, among others. These companies are actively engaged in developing, expanding, and maintaining extensive pipeline networks, enabling efficient natural gas transmission and distribution across domestic and cross-border markets.

Key Middle East Gas Pipeline Infrastructure Companies:

- China Petroleum Pipeline Engineering Co.

- Iranian Offshore Engineering and Construction Company

- JGC

- Larsen & Toubro

- National Petroleum Construction Company

- NMDC Energy

- Orient Pipeline Company

- Petrofac

- Saipem

- Technip Energies

- UCC Holding

Recent Developments

- In March 2025, Saudi Aramco inaugurated the expansion of its 500-kilometer gas transmission pipeline network in the Eastern Province, designed to connect key upstream fields with industrial zones and power generation facilities. The project incorporates advanced pipeline monitoring systems, corrosion-resistant materials, and smart compressor stations to ensure safe and efficient gas transport.

Middle East Gas Pipeline Infrastructure Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 22.34 million

Revenue forecast in 2033

USD 24.70 million

Growth rate

CAGR of 1.3% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative Units

Volume in Thousand Kilometers, Revenue in USD million, and CAGR from 2025 to 2033

Report coverage

Revenue & volume forecast, competitive landscape, growth factors, and trends

Segments covered

Operation, application, country

Country scope

UAE; Saudi Arabia; Iraq; Iran; Qatar

Key companies profiled

China Petroleum Pipeline Engineering Co.; Iranian Offshore Engineering and Construction Company; JGC; Larsen & Toubro; INational Petroleum Construction Company; NMDC Energy; Orient Pipeline Company; Petrofac; Saipem; Technip Energies; UCC Holding

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Gas Pipeline Infrastructure Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East gas pipeline infrastructure market report on the basis of operation, application and country:

-

Operation Outlook (Volume, Thousand Kilometers; Revenue, USD Million, 2021 - 2033)

-

Gathering Pipeline

-

Transmission Pipeline

-

Distribution Pipeline

-

-

Application Outlook (Volume, Thousand Kilometers; Revenue, USD Million, 2021 - 2033)

-

Compressor Station

-

Metering Station

-

-

Country Outlook (Volume, Thousand Kilometers; Revenue, USD Million, 2021 - 2033)

-

Middle East

-

UAE

-

Saudi Arabia

-

Iraq

-

Iran

-

Qatar

-

-

Frequently Asked Questions About This Report

b. The Middle East gas pipeline infrastructure market size was estimated at USD 21.75 million in 2024 and is expected to reach USD 22.34 million in 2025.

b. The Middle East gas pipeline infrastructure market is expected to grow at a compound annual growth rate of 1.3% from 2025 to 2033 to reach USD 24.70 million by 2033.

b. Based on the operation segment, Transmission Pipelines held the largest revenue share of 57.17% in the Middle East gas pipeline infrastructure market in 2024.

b. Some of the key vendors operating in the Middle East gas pipeline infrastructure market include China Petroleum Pipeline Engineering Co.,Iranian Offshore Engineering and Construction Company, JGC, Larsen & Toubro, National Petroleum Construction Company, NMDC Energy, Orient Pipeline Company, Petrofac, Saipem, Technip Energies, UCC Holding etc.

b. The key factors driving the Middle East gas pipeline infrastructure market include the region’s abundant natural gas reserves, ambitious energy diversification programs, and growing demand for secure and reliable energy transportation.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.