- Home

- »

- Clinical Diagnostics

- »

-

Middle East In Vitro Diagnostics Market Size Report, 2033GVR Report cover

![Middle East In Vitro Diagnostics Market Size, Share & Trends Report]()

Middle East In Vitro Diagnostics Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Instruments, Reagents), By Test Location, By End-use (Hospitals, Laboratory), By Application, By Technology, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-705-2

- Number of Report Pages: 320

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East In Vitro Diagnostics Market Summary

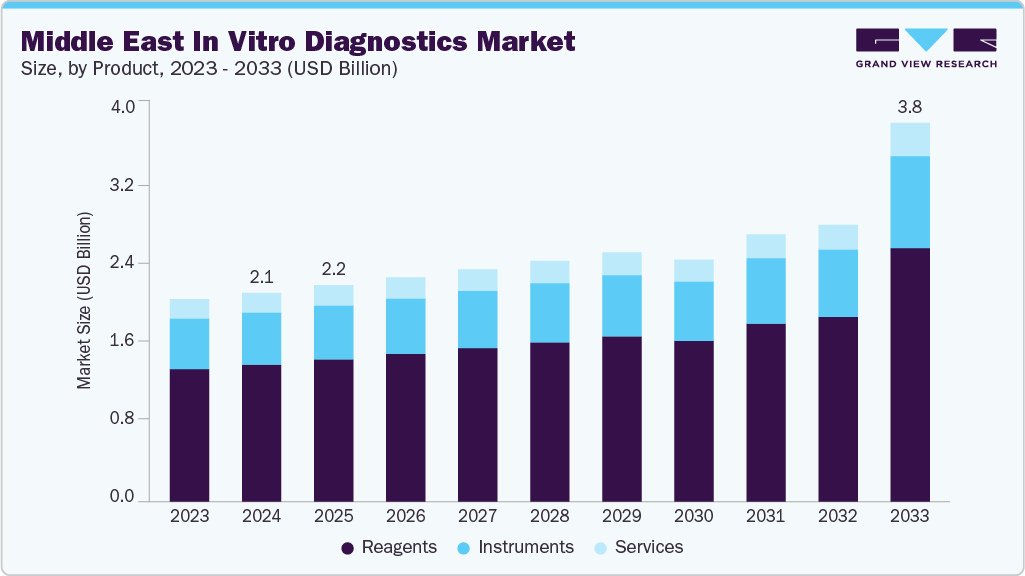

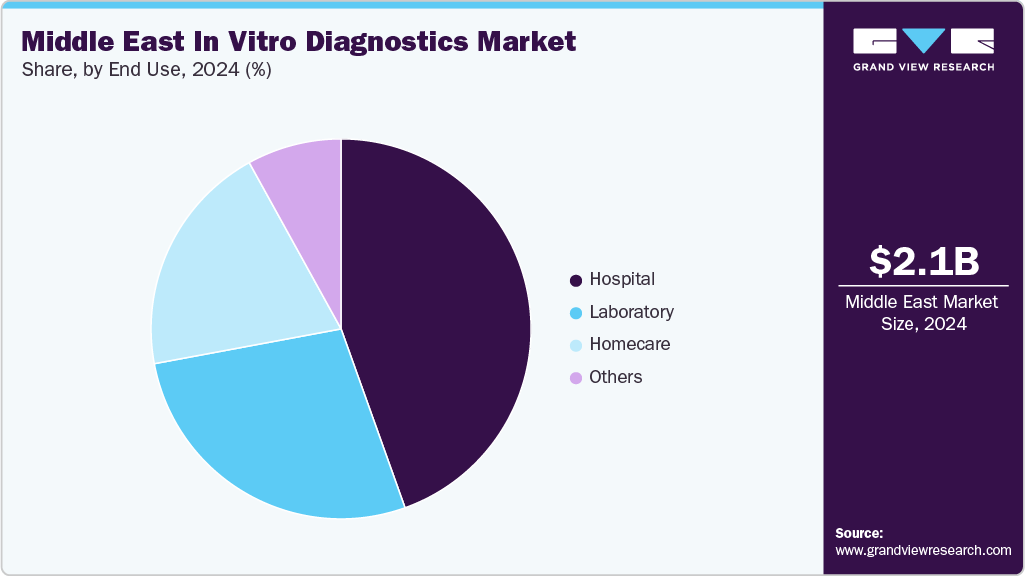

The Middle East in vitro diagnostics market size was estimated at USD 2,093.7 million in 2024 and is projected to reach USD 3,797.5 million by 2033, growing at a CAGR of 7.25% from 2025 to 2033. The market is driven by a combination of rising disease prevalence, expanding healthcare infrastructure, and increased investments in early disease detection.

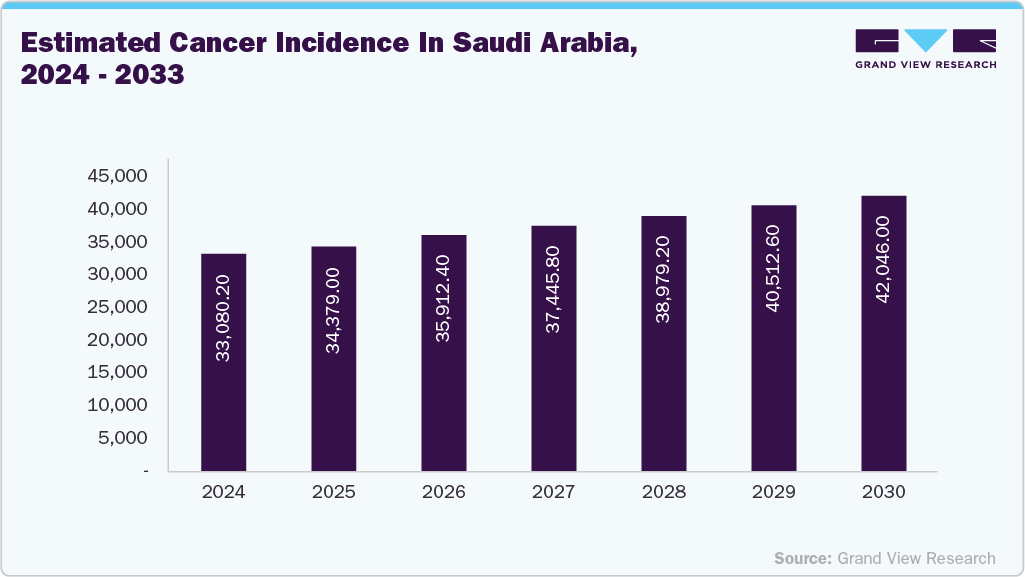

Chronic diseases such as diabetes, cardiovascular disorders, and cancer are on the rise in the region, prompting governments and healthcare providers to prioritize advanced diagnostic testing to improve patient outcomes. According to the World Health Organization (WHO), cancer incidence in the Middle East is expected to double by 2033, with 9 out of 22 countries in the region lacking optimal operational facilities to manage cancer effectively. This unmet need for early diagnosis and treatment, coupled with economic development in emerging markets like Qatar, is creating substantial opportunities for the IVD market.

The Saudi Arabia in vitro diagnostics market is experiencing robust growth, fueled by the increasing prevalence of both communicable and noncommunicable diseases (NCDs), as well as rising awareness and government initiatives to improve healthcare outcomes. The country faces a growing burden of NCDs, such as cardiovascular diseases (CVDs) and diabetes, largely attributed to sedentary lifestyles. In addition, cancers such as lung, colorectal, stomach, breast, and prostate are major causes of cancer-related deaths. According to ScienceDirect, the prevalence of CVDs in Saudi Arabia is projected to reach 479,500 cases by 2035, while over 31,000 new cancer cases were anticipated to be diagnosed in 2023.

Cancer Incidence

The Middle East offers considerable opportunities for both global and regional IVD manufacturers, particularly in high-growth segments such as molecular diagnostics, point-of-care testing (POCT), and infectious disease testing. The COVID-19 pandemic significantly boosted the adoption of molecular and rapid diagnostics in the region, leaving behind an expanded testing infrastructure that can now be leveraged for other applications such as tuberculosis, hepatitis, and sexually transmitted infections. Emerging healthcare hubs like Dubai and Riyadh are positioning themselves as regional centers for medical innovation, attracting partnerships with leading global players. Moreover, ongoing government initiatives, such as Vision 2033 in Saudi Arabia and the UAE’s National Strategy for Advanced Science, are encouraging greater localization of manufacturing and technology transfer, creating a favorable environment for market expansion.

Technological innovation is reshaping the Middle East IVD landscape, with advancements in automation, digital pathology, and next-generation sequencing (NGS) transforming laboratory workflows and diagnostic capabilities. Integration of artificial intelligence (AI) and data analytics into diagnostic platforms is enhancing test accuracy, reducing turnaround times, and enabling personalized medicine approaches. The rising adoption of cloud-based laboratory information systems is also improving interoperability across healthcare networks, supporting more efficient patient management. Furthermore, the increasing availability of compact, user-friendly POCT devices is expanding diagnostic access in remote and resource-limited areas, addressing a critical gap in healthcare delivery. Together, these advancements are positioning the Middle East in vitro diagnostics industry as a dynamic and technology-driven segment with strong growth potential over the next decade.

In February 2025, Medlab Middle East 2025 proved a hotspot for new IVD product introductions and showcases EDAN unveiled its H90 Series hematology analyzers, featuring advanced 3D fluorescence tech and RFID reagent traceability for workflow efficiency. Fapon presented a comprehensive suite of IVD tech chemiluminescence immunoassay (CLIA), biochemistry, PCR, NGS, lateral flow, and fluorescence immunoassays highlighting regional breadth.

In May 2024, the Genomics Day Symposium, organized by Advanced Technology Company (ATC), Illumina, and the Kuwait Medical Genetics Center (KMG), showcased advancements in genetic testing and personalized medicine. This initiative highlights Kuwait’s commitment to genomic research and cutting-edge diagnostic solutions, positioning the country as a leader in innovative healthcare technologies.

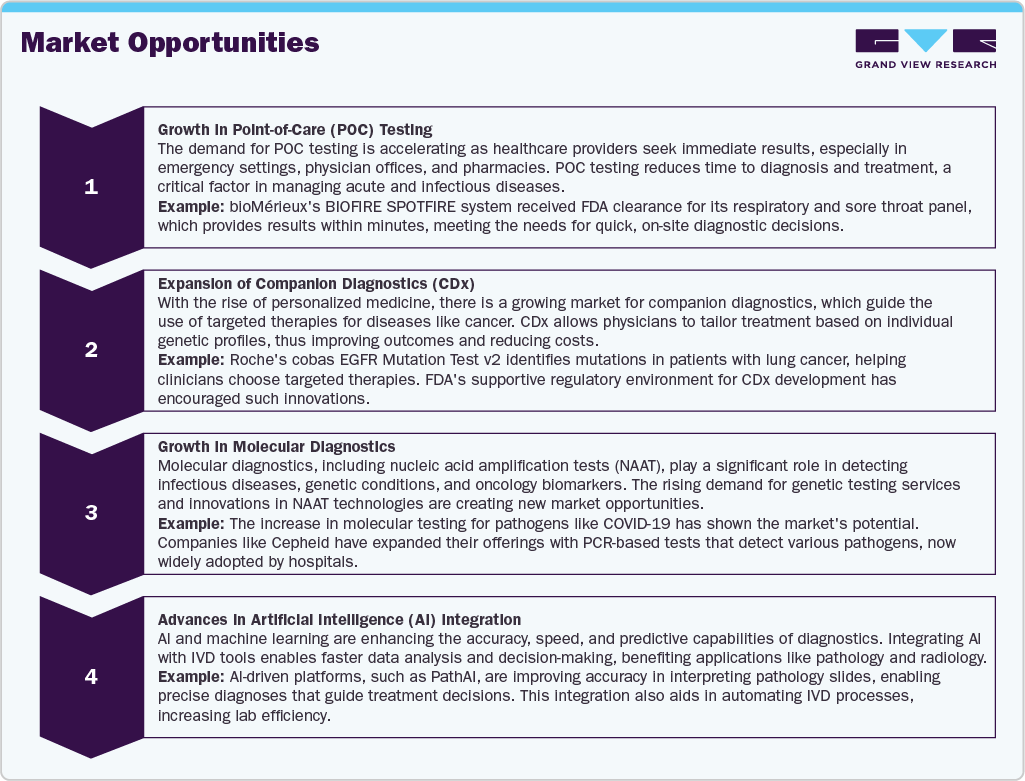

Market Opportunities

The Middle East in vitro diagnostics industry is experiencing substantial growth and offers multiple opportunities, driven by technological advancements, an increasing emphasis on personalized medicine, and a demand for rapid diagnostics. Here is a detailed opportunity analysis for IVD along with examples:

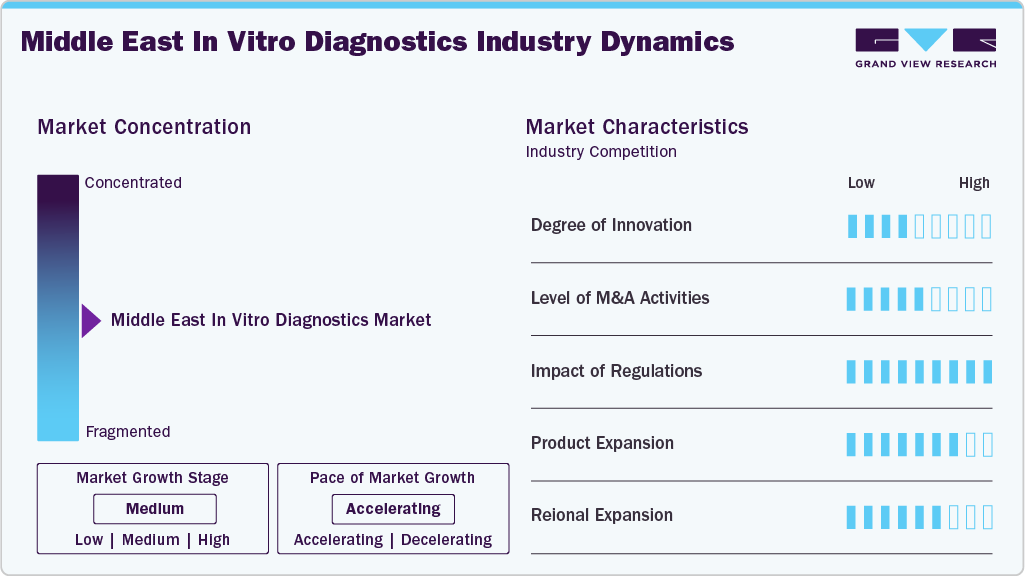

Market Concentration & Characteristics

The Middle East in vitro diagnostics industry demonstrates a high degree of innovation, driven by advancements in molecular diagnostics, next-generation sequencing (NGS), and point-of-care testing. Continuous R&D efforts focus on improving test accuracy, speed, and ease of use, particularly in personalized medicine and early disease detection. Emerging technologies like AI and machine learning are also being integrated into diagnostic platforms, enabling predictive analytics and enhanced data interpretation. Roche Diagnostics is strategically embedded in this journey as an innovation enabler, aligning with national priorities by introducing AI-powered digital pathology, workflow automation, and decentralized diagnostics-especially point-of-care testing in remote or underserved areas

The Middle East in vitro diagnostics industry experiences a high level of mergers and acquisitions (M&A), as companies pursue strategic partnerships and acquisitions to expand product portfolios, enter new market segments, and strengthen their global presence. Large players often acquire smaller, innovative firms to integrate advanced technologies, such as molecular diagnostics and digital health solutions, into their offerings. M&A activities also help companies consolidate market share, diversify geographically, and enhance their competitive positioning.

Countries like Saudi Arabia and the UAE are rapidly advancing regulatory modernization through digital systems, risk-based classifications, and AI regulations. In KSA, the SFDA employs a robust classification system (A to D) aligned with global counterparts, and is among the few worldwide to have published guidance for AI/ML-based medical devices including diagnostic tools that leverage image analysis, biosensors, and adaptive learning algorithms. Manufacturers must demonstrate clinical validity, analytical performance, and evidence of safety-often via literature, trials, or established guidelines

Product expansion in the Middle East in vitro diagnostics industry is at a high level, driven by the growing demand for comprehensive diagnostic solutions across multiple disease areas. Manufacturers are consistently developing new assays, expanding test menus, and integrating multiplex testing capabilities to meet evolving clinical needs. The rise of personalized medicine has further accelerated product diversification, with a focus on companion diagnostics and biomarker-based tests. In addition, companies are expanding into emerging sectors like liquid biopsy, microbiome analysis, and infectious disease testing, broadening their portfolios to capture new market opportunities and address unmet clinical needs.

The Middle East in vitro diagnostics industry is increasingly shaped by aggressive regional expansion strategies from both multinational and local players. Global diagnostics leaders such as Roche, Abbott, Siemens Healthineers, BD, bioMérieux, and QIAGEN are strengthening their footprint through new regional offices, dedicated training centers, and direct distribution partnerships across GCC countries and beyond. Many have shifted from a country-specific approach to hub-and-spoke models, with key hubs in Dubai (UAE) and Riyadh (Saudi Arabia) serving as operational, logistics, and service centers for the broader Middle East, North Africa, and sometimes South Asia. This consolidation improves supply-chain efficiency and enables faster deployment of new diagnostic technologies in multiple markets simultaneously.

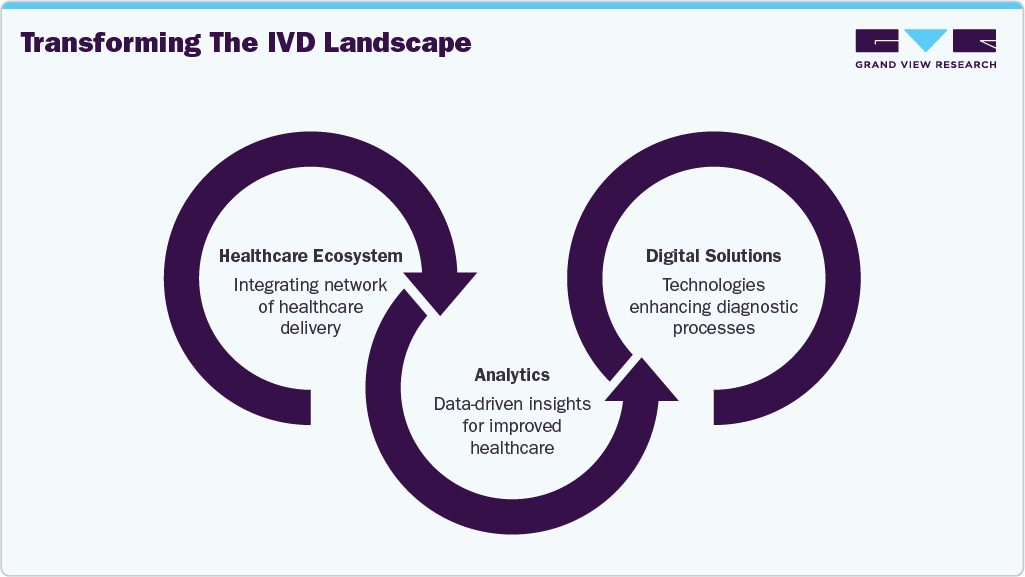

The Evolving Role of Middle East In Vitro Diagnostics in Healthcare Delivery

The Middle East in vitro diagnostics (IVD) industry is transitioning from its traditional role as a back-office, pay-for-service function to a central stakeholder within the healthcare delivery ecosystem. This shift is driven by three key trends, creating significant opportunities for digital solutions and analytics to reshape the IVD landscape.

Enhancing Diagnostic Tests: Healthcare systems are increasingly seeking improvements in diagnostic capabilities. One major expectation is for diagnostics to provide meaningful metrics that support outcome-based healthcare. Rather than delivering isolated results-such as a high hemoglobin A1c level-tests are now expected to link these findings to patient outcomes (e.g., a reduction in HbA1c correlating with a lower risk of complications). Another critical development is the transformation of test results into actionable insights. By incorporating local context, patient history, and trend analysis, diagnostic tools can offer clinicians deeper, more personalized insights, enhancing their decision-making process.

Revolutionizing Care Delivery: As a cornerstone of clinical decision-making, diagnostics plays a vital role in shaping the future of care delivery. Three significant shifts are influencing this evolution. First, the rise of new care models, including home-based and virtual care, demands innovative diagnostic workflows and tests that support remote care without compromising accuracy or quality. Second, the growing emphasis on preventive care highlights the need for advanced screening tools. Cost-effective, high-accuracy tests, such as molecular colon-cancer screenings enhanced by algorithms, can enable earlier detection and better outcomes. Finally, the move toward personalized medicine is reshaping how treatments are selected. IVD companies must develop new diagnostic panels that help clinicians tailor therapies to individual patients, improving efficacy and patient outcomes.

Expanding Diagnostics Role in Healthcare: The scope of diagnostics is broadening beyond traditional disease detection, creating new value for both the healthcare system and IVD companies. A clear example of this expanded remit is the role diagnostics can play in pandemic preparedness and response, serving as a frontline defense against future global health threats. In addition, diagnostics are becoming integral to drug development, enhancing efficiency and precision. Companion diagnostics, for example, help identify patients most likely to benefit from specific treatments or those at risk of adverse effects, enabling more targeted and effective therapies.

AccuBioTech at Medlab Middle East 2025: Rapid IVD Innovations

At the Medlab Middle East 2025 exhibition (February 3-6, 2025, in Dubai), AccuBioTech showcased a robust lineup of rapid IVD testing products, highlighting their focus on speed, accessibility, and public health applicability. Their offerings, based on advanced immunochromatography technology, included:

-

Infectious Disease Tests for pathogens such as Dengue, HAV, HBsAg, HCV, HIV, H. pylori, and Syphilis.

-

Multi-Drug Detection tests designed for quick screening of drug abuse.

-

Additional products covering fertility, cardiac markers, inflammation, urine analysis, and tumor markers.

These innovations received strong attention for their high sensitivity, rapid turnaround, and operational simplicity, positioning AccuBioTech as a contributor to accelerated diagnostics in the region

Pricing Analysis

In the Middle East, IVD product pricing is influenced not only by product type and technical complexity but also by import dependency, local distributor markups, government tendering policies, and currency fluctuations. GCC countries such as Saudi Arabia, UAE, and Qatar tend to have higher average selling prices due to reliance on premium brands, strict regulatory compliance costs, and higher operational overheads. Conversely, markets such as Egypt, Jordan, and Lebanon often experience more competitive pricing, with a stronger presence of mid-tier brands and cost-sensitive procurement.

Large hospitals and government facilities frequently purchase instruments via tenders or long-term supply agreements, often bundling them with reagent rental contracts-where the analyzer is provided at a subsidized rate in exchange for a minimum volume commitment for reagents. Reagents and consumables in the Middle East are typically priced 15-30% above equivalent European market prices due to import duties (5-15% in most GCC countries) and logistics costs, but bulk procurement under national health programs can negotiate discounts of up to 20%.:

Product Type

Category

Price Range (USD)

Pricing Notes

Instruments

Clinical Chemistry Analyzers

USD 18,000 - USD 220,000

Higher range in GCC; reagent rental models common in public hospitals.

Immunoassay Analyzers

USD 22,500 - USD 270,000

Premium systems favored for multiplex testing in UAE/KSA..

Molecular Diagnostics Platforms

USD 60,000 - USD 550,000

PCR & NGS platforms attract high markups; KSA tenders pay premium for localization-ready units.

Hematology Analyzers

USD 5,000 - USD 360,000

Costs depend on throughput and parameters analyzed.

Reagents

Clinical Chemistry Reagents

USD 1 - USD 20 per test

High-volume, lower-margin consumables.

Immunoassay Reagents

USD 5 - USD 100+ per test

Priced higher due to assay complexity and specificity.

Molecular Diagnostic Reagents

USD 20 - USD 100+ per test

High pricing reflects complex assays (e.g., PCR, NGS).

Hematology Reagents

USD 0.50 - USD 5 per test

Lower-cost consumables for routine blood analysis.

Product Insights

The reagents segment led the market with the largest revenue share of 65.60% in 2024, driven by high demand for consumables across chronic disease monitoring, infectious disease surveillance, and preventive screening in hospitals and centralized labs. Meanwhile, instruments secured the second-largest share, driven by significant investments in automated analyzers and molecular platforms under national healthcare transformation strategies, especially in Saudi Arabia and the UAE, where Vision 2033 and similar initiatives continue to fund modernization and expansion of diagnostic laboratories.

The instruments segment is anticipated to grow at the fastest CAGR during the forecast period. The growth of the segment is fueled by the adoption of advanced, automated analyzers and integrated platforms that enhance testing efficiency. Laboratories are shifting toward high-throughput systems that can process large volumes of samples with minimal manual intervention, improving accuracy while reducing operational costs over time. Modern IVD instruments now offer multi-parameter testing, connectivity with laboratory information systems, and enhanced user interfaces, making them more attractive for both large hospitals and independent diagnostic centers. Growth is also fueled by the increasing prevalence of diseases requiring complex diagnostics, such as oncology and genetic disorders, which demand sophisticated molecular and immunoassay analyzers.

Technology Insights

The immunoassay segment accounted for the largest market revenue share in 2024. Owing to its versatility, sensitivity, and ability to detect a wide range of biomarkers. This technology is deeply embedded in clinical workflows for infectious disease testing, hormone level monitoring, oncology markers, and cardiac risk assessment. In the Middle East, the rising burden of non-communicable diseases, such as diabetes and cardiovascular disorders, has intensified the use of immunoassays for both diagnosis and ongoing patient monitoring. The method’s adaptability allows laboratories to run both qualitative and quantitative tests, making it suitable for centralized labs and point-of-care settings alike.

The coagulation segment is expected to grow at the fastest CAGR over the forecast period, driven by increasing awareness and diagnosis of bleeding disorders, thrombosis, and cardiovascular conditions. The region’s aging population, combined with the rising prevalence of lifestyle-related diseases, has led to a surge in anticoagulant therapy monitoring, creating a higher demand for coagulation testing. Hospitals and specialized clinics are investing in advanced coagulation analyzers that offer rapid turnaround times, minimal sample requirements, and improved data integration with patient records. Modern coagulation platforms now incorporate multiple testing parameters, such as prothrombin time (PT), activated partial thromboplastin time (aPTT), fibrinogen levels, and D-dimer assays, enabling a comprehensive coagulation profile in a single run. Moreover, trauma centers and emergency departments are increasingly relying on point-of-care coagulation testing for faster treatment decisions in critical cases.

Application Insights

The infectious diseases segment accounted for the largest market revenue share in 2024. The region continues to experience a high demand for diagnostic testing for viral, bacterial, and parasitic infections, including respiratory illnesses, HIV, hepatitis, and tuberculosis. Public health initiatives in countries such as Saudi Arabia and the UAE are prioritizing mass screening programs and early detection efforts, leading to increased procurement of rapid tests, molecular assays, and immunoassay-based kits. Recent improvements in molecular diagnostics, particularly PCR-based platforms, have significantly enhanced the speed and accuracy of infectious disease testing, enabling results within hours rather than days.

The oncology segment is anticipated to grow at the fastest CAGR over the forecast period. The prevalence of breast, colorectal, and prostate cancers has been climbing steadily in the region, largely due to lifestyle changes, aging populations, and better screening programs. This has driven healthcare systems to expand diagnostic capabilities, particularly in molecular oncology testing, tumor marker detection, and companion diagnostics for targeted therapies. Next-generation sequencing (NGS) and liquid biopsy technologies are gaining momentum, allowing for non-invasive cancer detection and real-time monitoring of disease progression. Major cancer centers in the UAE, Saudi Arabia, and Qatar are integrating these technologies into routine clinical practice, supporting precision medicine approaches tailored to individual patients.

Test Location Insights

The point-of-care segment accounted for the largest market revenue share in 2024. POC diagnostics deliver timely results at or near the site of patient care, which is especially valuable in emergency departments, outpatient clinics, primary care centers, and mobile screening units. The ability to obtain rapid actionable information shortens decision cycles for triage, antibiotic stewardship, and acute care management, reducing both length of stay and downstream resource use.

The homecare segment is expected to grow at the fastest CAGR during the forecast period. The Middle East in vitro diagnostics industry has seen a marked increase in the adoption of homecare testing, driven by the need for accessible and reliable testing solutions. Advances in user-friendly device design, simplified sample collection methods, and robust remote monitoring platforms have enabled reliable testing outside clinical facilities-for chronic disease monitoring, therapeutic drug management, and screening applications. The growth of homecare is underpinned by demographic trends (aging populations and rising chronic disease prevalence), patient preference for less disruptive care, and public policies encouraging distributed healthcare delivery to manage system capacity.

End Use Insight

The hospitals segment accounted for the largest market revenue share in 2024. Hospitals commonly enter into long-term supply contracts, reagent rental agreements, and service arrangements with suppliers, creating predictable revenue streams for manufacturers and distributors. The concentration of testing volumes and complex case mixes in hospitals also makes them focal points for introducing new diagnostic technologies and pilot programs such as advanced molecular testing and digital pathology due to available resources and specialist expertise.

The homecare segment is expected to grow at the fastest CAGR over the forecast period. These centers offer focused laboratory services with flexible hours, fast turnaround, and convenient locations that attract both routine and specialty testing volumes from ambulatory patients and employer health programs. They respond quickly to market needs, deploying niche assays, wellness panels, and preventive-screening packages that may not be sustainable for larger hospital systems on a per-test basis.

Key Middle East In Vitro Diagnostics Company Insights

Some of the key players operating in the Middle East in vitro diagnostics industry include Abbott, bioMérieux, F. Hoffmann-La Roche Ltd., Siemens Healthineers AG, Thermo Fisher Scientific, Inc., Bio-Rad Laboratories, Inc., among others. Mature players heavily invest in state-of-the-art technology and infrastructure, allowing them to process & analyze a large volume of data efficiently. Market players in the IVD market are adopting various market strategies such as new product launches, mergers & acquisitions, and partnerships to strengthen their product portfolios, offer diverse technologically advanced & innovative products, expand their product portfolios, and improve competency.

ARUP Laboratories, RayBiotech, Inc., Randox Laboratories Ltd., Everlywell, Orreco, and Biostarks are some of the emerging market participants in the Middle East in vitro diagnostics industry. Emerging players put greater focus on gaining market penetration through product differentiation. These companies are actively involved in developing novel and accurate IVD testing products to improve overall health services. Moreover, these companies are collaborating with research institutes, government bodies, and global leaders to increase the range of their products in potential markets.

Key Middle East In Vitro Diagnostics Companies:

- Abbott

- Bio-Rad Laboratories, Inc

- Siemens Healthineers AG

- BIOMÉRIEUX

- BD

- QIAGEN

- Quidel Corporation

- F. Hoffmann-La Roche Ltd.

- Danaher

- Quest Diagnostics Incorporated

- Agilent Technologies, Inc.

Recent Developments

-

In February 2025, ABL Diagnostics will manufacture and commercialize a full range of UltraGene PCR tests acquired from its parent company, Advanced Biological Laboratories. These tests cover over 100 pathogens, supporting infectious disease diagnostics across multiple conditions. The company aims to integrate PCR with its DeepChek sequencing products, expanding its presence in precision medicine.

-

In September 2024, Nanostics Inc., a precision health company, partnered with OncoHelix, a precision diagnostics provider, to introduce ClarityDX Prostate, a diagnostic tool for detecting aggressive prostate cancer, to the Middle East and North Africa (MENA) region. OncoHelix operates a state-of-the-art facility, OncoHelix-coLAB, in Abu Dhabi, in collaboration with Burjeel Holdings. This partnership aims to improve patient diagnostics and treatment outcomes by bringing advanced molecular diagnostics to the region.

-

In May 2024, Biocartis, a Belgium-based company, expanded its collaboration with Merck Serono Middle East and Merck Saudi Ltd. to improve patient access to RAS biomarker testing across the Middle East and North Africa (MEA) region. This partnership focuses on enhancing the availability of the Idylla KRAS Mutation Test and Idylla NRAS-BRAF Mutation Test, which are part of the Idylla platform. These tests provide rapid and reliable results from tumor tissue samples, making them suitable for healthcare settings with limited access to advanced diagnostics.

-

In March 2023, Mylab Discovery Solutions, an Indian biotech firm, formed an exclusive partnership with AstraGene LLC, the UAE's first molecular diagnostics manufacturing company. This collaboration focuses on co-developing automated molecular diagnostic solutions for the UAE and Kuwait, including reagents, diagnostic kits, and fully automated devices.

Middle East In Vitro Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2,169.1 million

Revenue forecast in 2033

USD 3,797.5 million

Growth rate

CAGR of 7.25% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, Volume (number of units installed and reagents sold), and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Products, technology, application, test location, end use, region

Regional scope

MEA

Country scope

Saudi Arabia; UAE; Kuwait; Qatar; Oman

Key companies profiled

Abbott; Bio-Rad Laboratories, Inc.; Siemens Healthineers AG; BIOMÉRIEUX; BD; QIAGEN; Quidel Corporation; F. Hoffmann-La Roche Ltd.; Danaher; Randax Laboratories Incorporated; Agilent Technologies, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East In Vitro Diagnostics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East in vitro diagnostics market report based on products, technology, application, test location, end use, and region.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Instruments

-

Reagents

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Immunoassay

-

Instruments

-

Reagents

-

Others

-

-

Hematology

-

Instruments

-

Reagents

-

Others

-

-

Clinical Chemistry

-

Instruments

-

Reagents

-

Others

-

-

Molecular Diagnostics

-

Instruments

-

Reagents

-

Others

-

-

Coagulation

-

Instruments

-

Reagents

-

Others

-

-

Microbiology

-

Instruments

-

Reagents

-

Others

-

-

Others

-

Instruments

-

Reagents

-

Others

-

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Infectious Diseases

-

Diabetes

-

Oncology

-

Cardiology

-

Nephrology

-

Autoimmune Diseases

-

Drug Testing

-

Other applications

-

-

Test Location Outlook (Revenue, USD Million, 2021 - 2033)

-

Point of Care

-

Home-care

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Laboratory

-

Home Care

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

Kuwait

-

Qatar

-

Oman

-

-

Frequently Asked Questions About This Report

b. The Middle East in vitro diagnostics market size was estimated at USD 2,093.7 million in 2024 and is expected to reach USD 2,169.1 million in 2025.

b. The Middle East in vitro diagnostics market is expected to grow at a compound annual growth rate of 7.25% from 2025 to 2033 to reach USD 3,797.5 million by 2033

b. On the basis of product, reagents accounted for the largest market share of 65.60% in 2024, driven by high demand for consumables across chronic disease monitoring, infectious disease surveillance, and preventive screening in hospitals and centralized labs.

b. Some key players operating in the Middle East in vitro diagnostics market include Abbott, Bio-Rad Laboratories, Inc, Siemens Healthineers AG, BIOMÉRIEUX, BD, QIAGEN, Quidel Corporation, F. Hoffmann-La Roche Ltd., Danaher, Randax Laboratories Incorporated, Agilent Technologies, Inc

b. Key factors that are driving include combination of rising disease prevalence, expanding healthcare infrastructure, and increased investments in early disease detection. Chronic diseases such as diabetes, cardiovascular disorders, and cancer are on the rise in the region, prompting governments and healthcare providers to prioritize advanced diagnostic testing to improve patient outcomes.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.